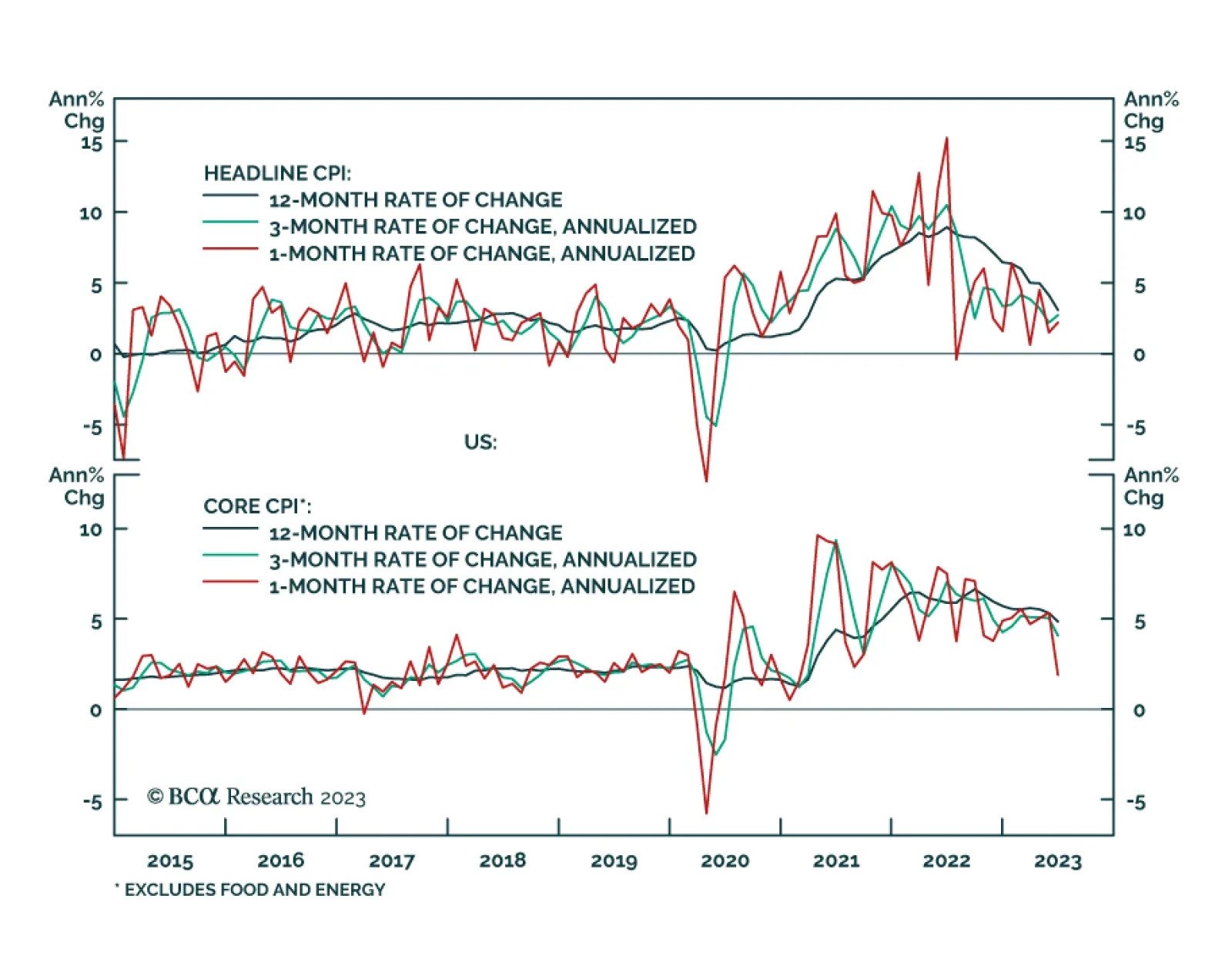

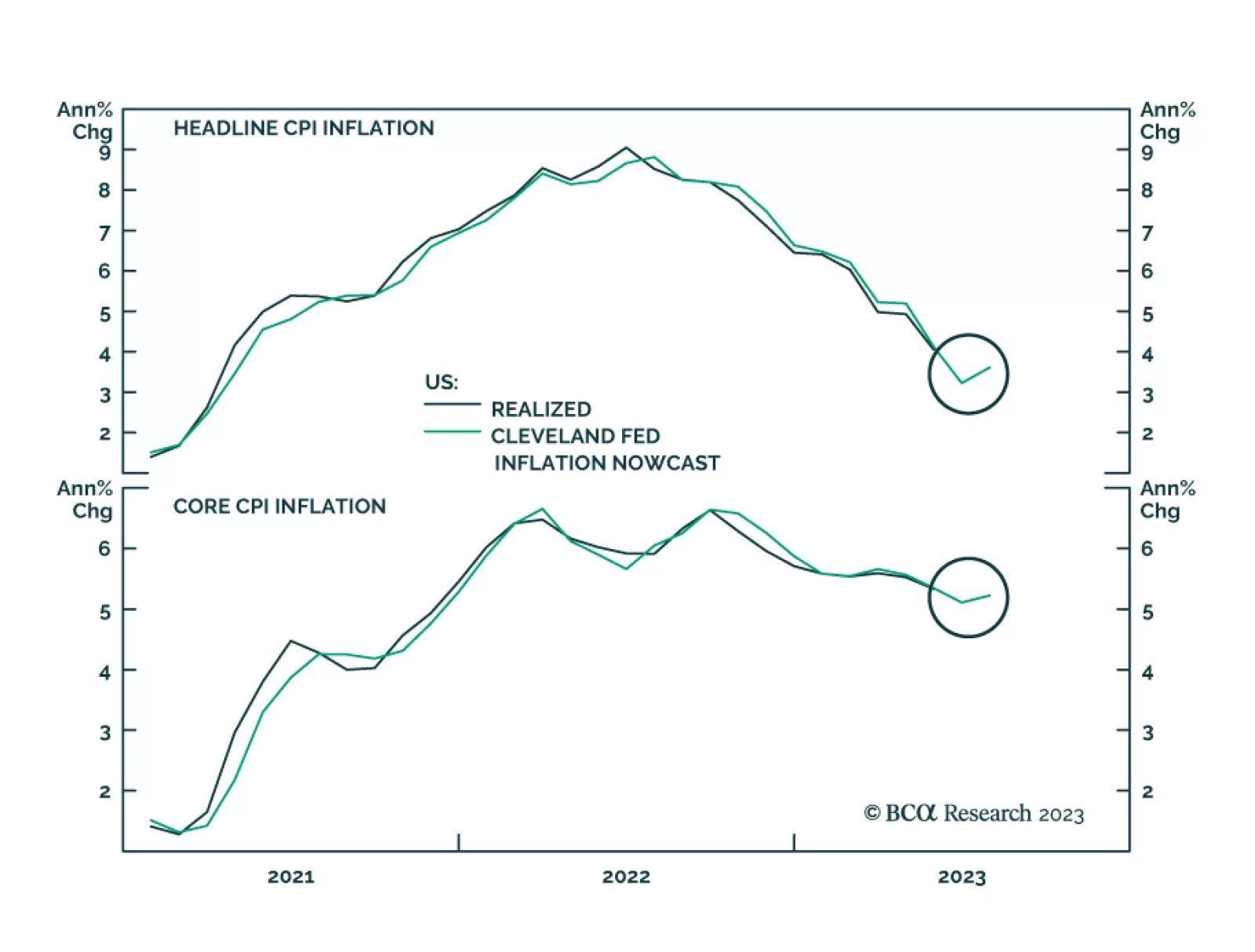

The June US CPI release showed inflationary pressures cooled last month. The headline index moderated from 4.0% y/y to 3.0% y/y – slightly below expectations of 3.1% y/y. Similarly, core CPI growth eased from 5.3% y/y to 4.…

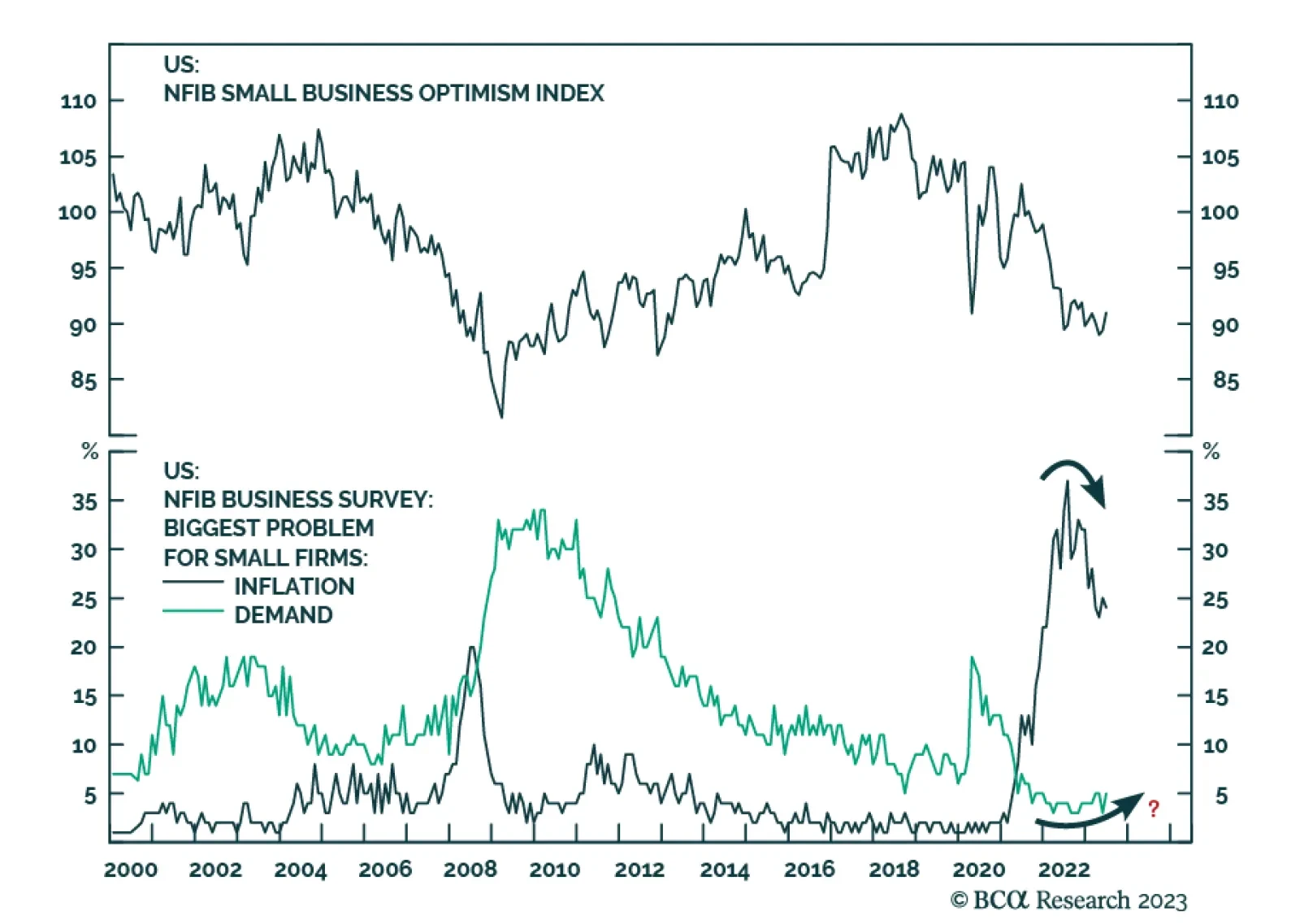

The NFIB survey provided a slightly positive signal about the US economy in June. Small business optimism improved from 89.4 to a 7-month high of 91.0 – beating expectations of a more muted increase to 89.9. Details of…

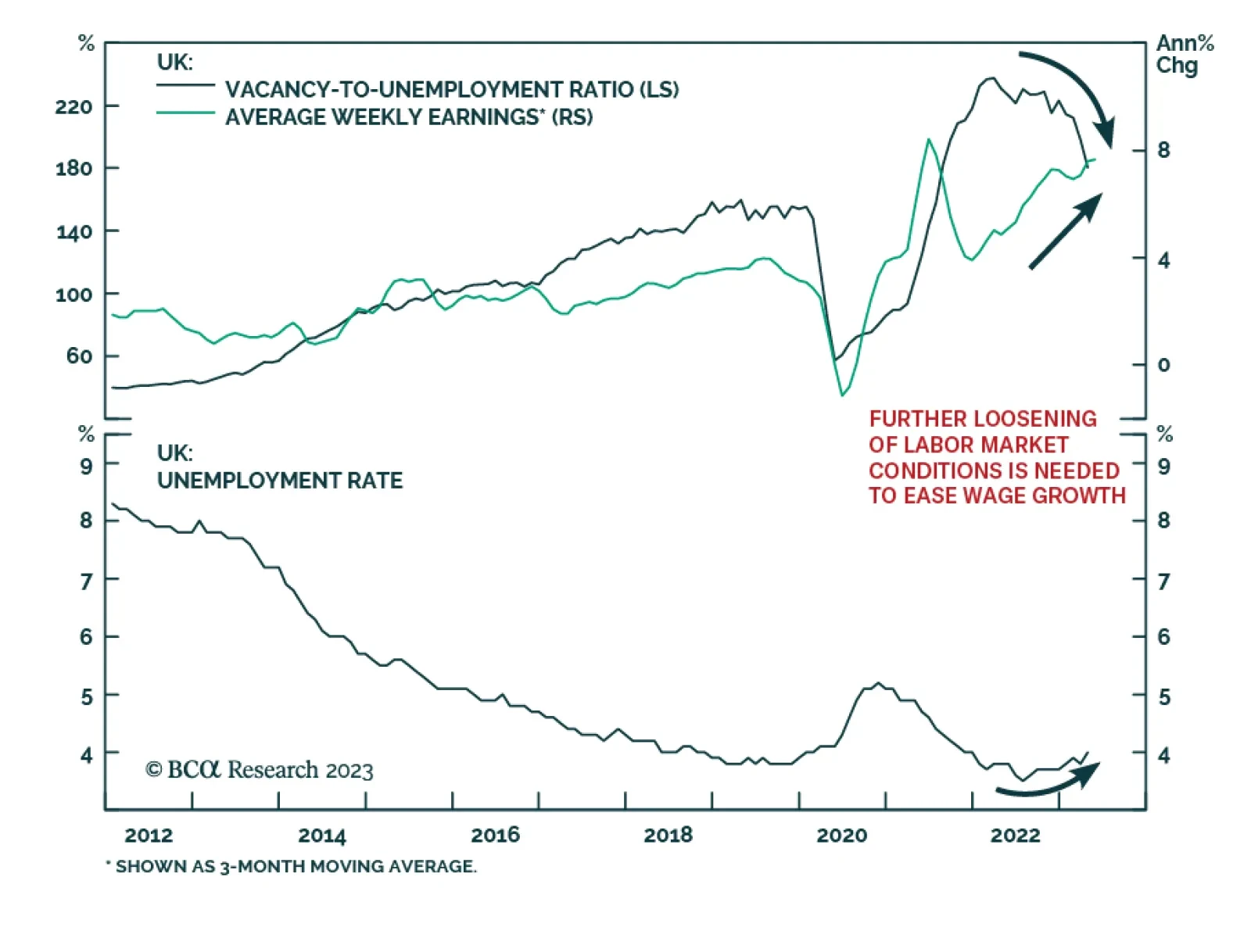

Hot UK wage data focused investors’ attention on the Bank of England’s battle against sticky inflationary pressures on Tuesday. The 7.3% y/y increase in weekly earnings (excluding bonuses) in the three months to May…

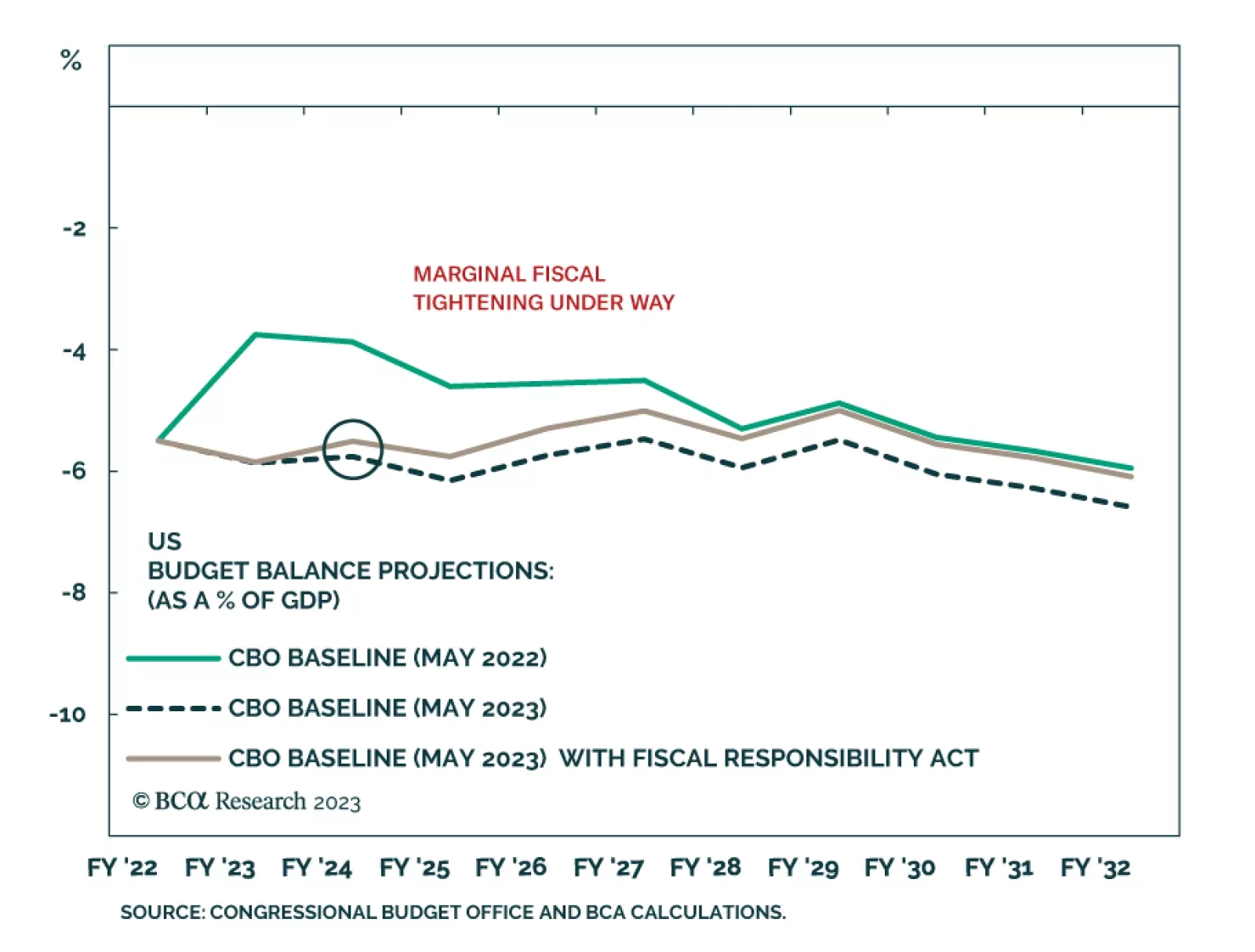

According to BCA Research’s US Political Strategy service, US fiscal policy is marginally negative for the economy and marginally increases the odds of recession in 2023-24. It is not a positive catalyst for equities in the…

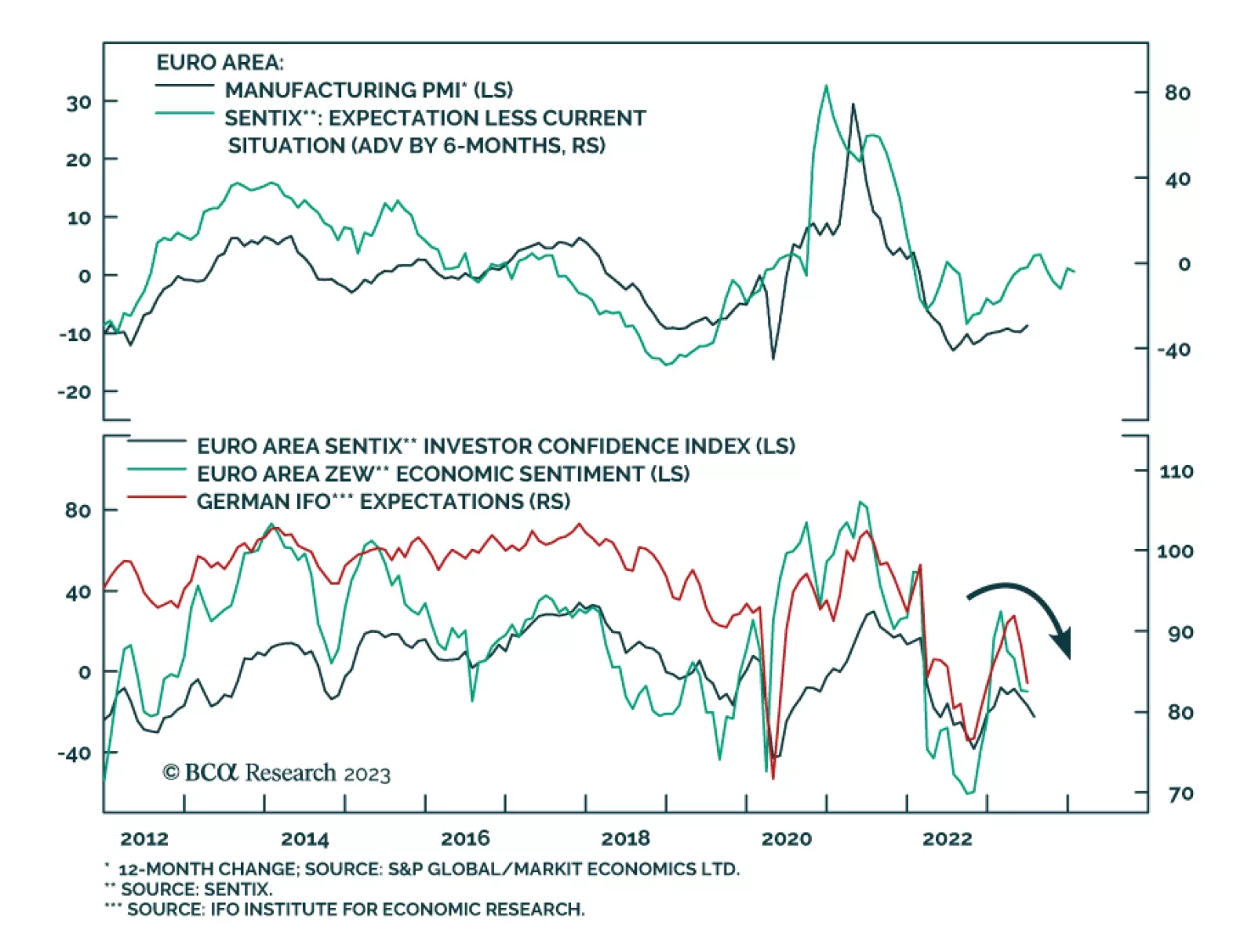

On Monday, the Eurozone Sentix sent a pessimistic signal about investor confidence in the Eurozone economy. The headline index dropped from -17.0 to -22.5 in July, significantly below expectations of a more muted deterioration to…

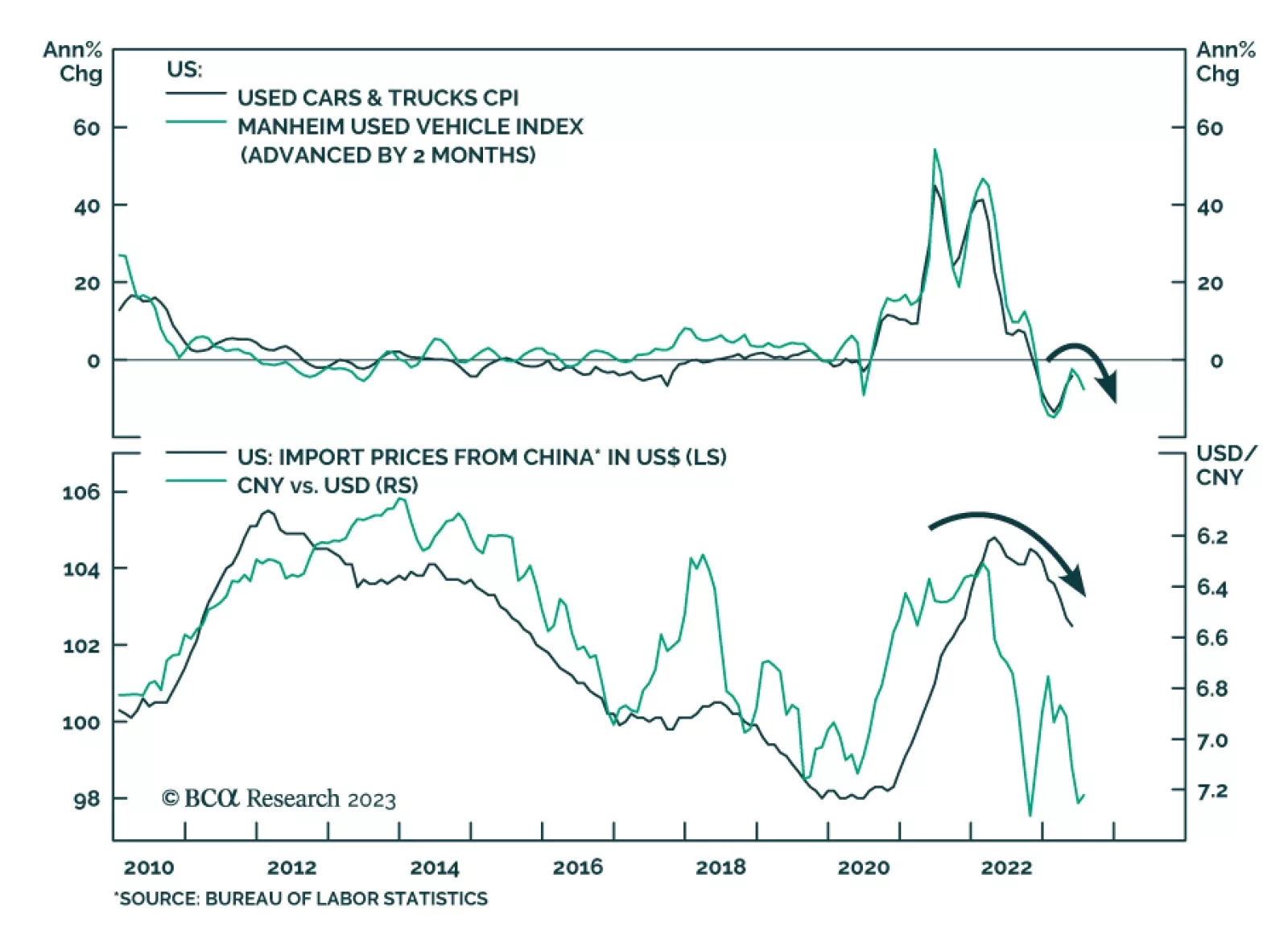

The latest update of the Manheim Used Vehicle Price Index provides a positive signal for US goods inflation. It shows used car prices fell by -4.2% m/m (-10.1% y/y) in June – its third consecutive monthly decline following…

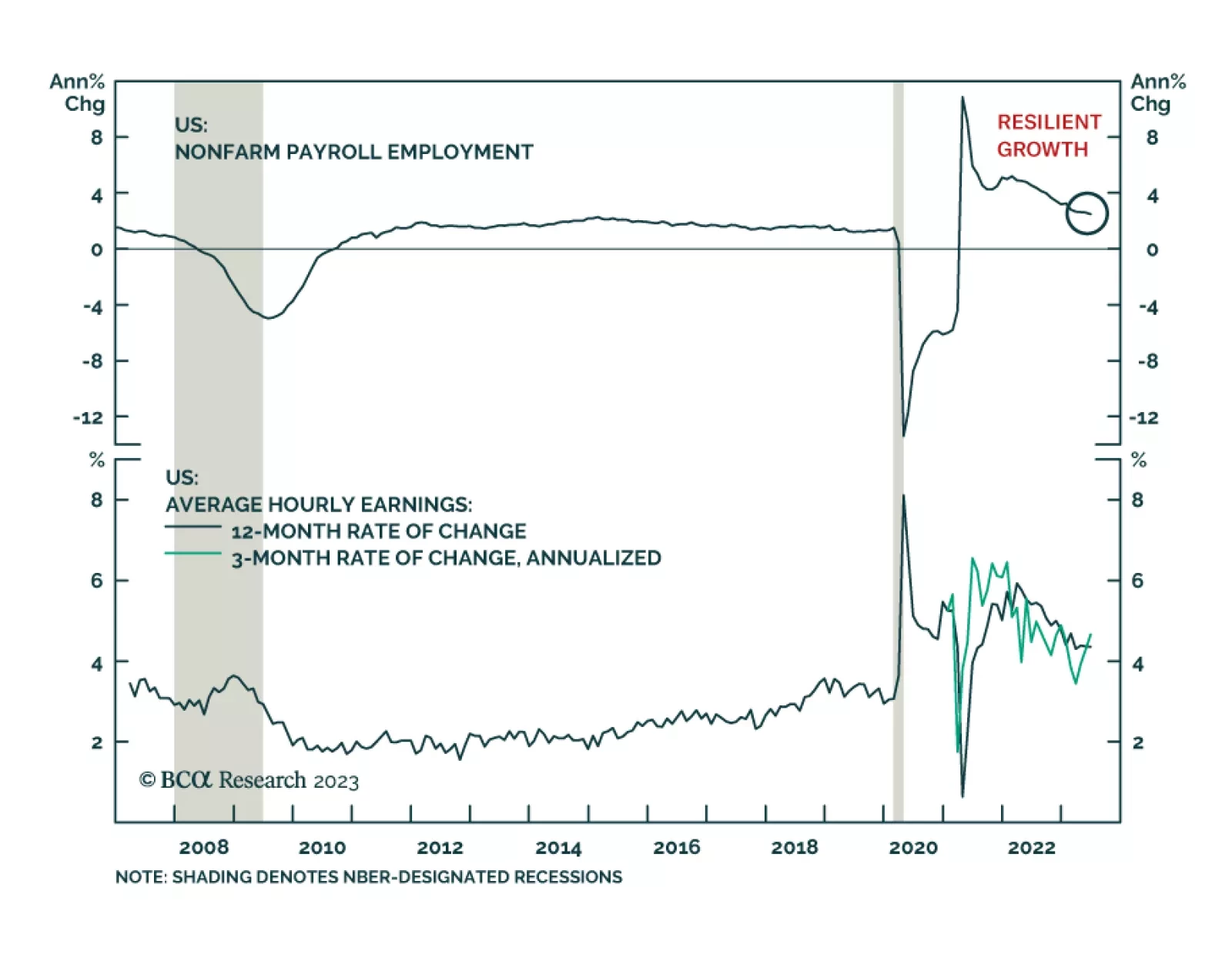

Last week’s labor market data signal that US employment conditions remain strong – solidifying the case for a 25 bps rate hike at the Fed’s next meeting later this month (see The Numbers). Yet in order for…

On the surface, the lower-than-anticipated job gains suggest that US labor market conditions softened last month. Friday’s jobs report revealed that the increase in nonfarm payrolls slowed from a downwardly revised 306…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

In this short weekly report, we review some of the most common questions clients asked us in the last few weeks.