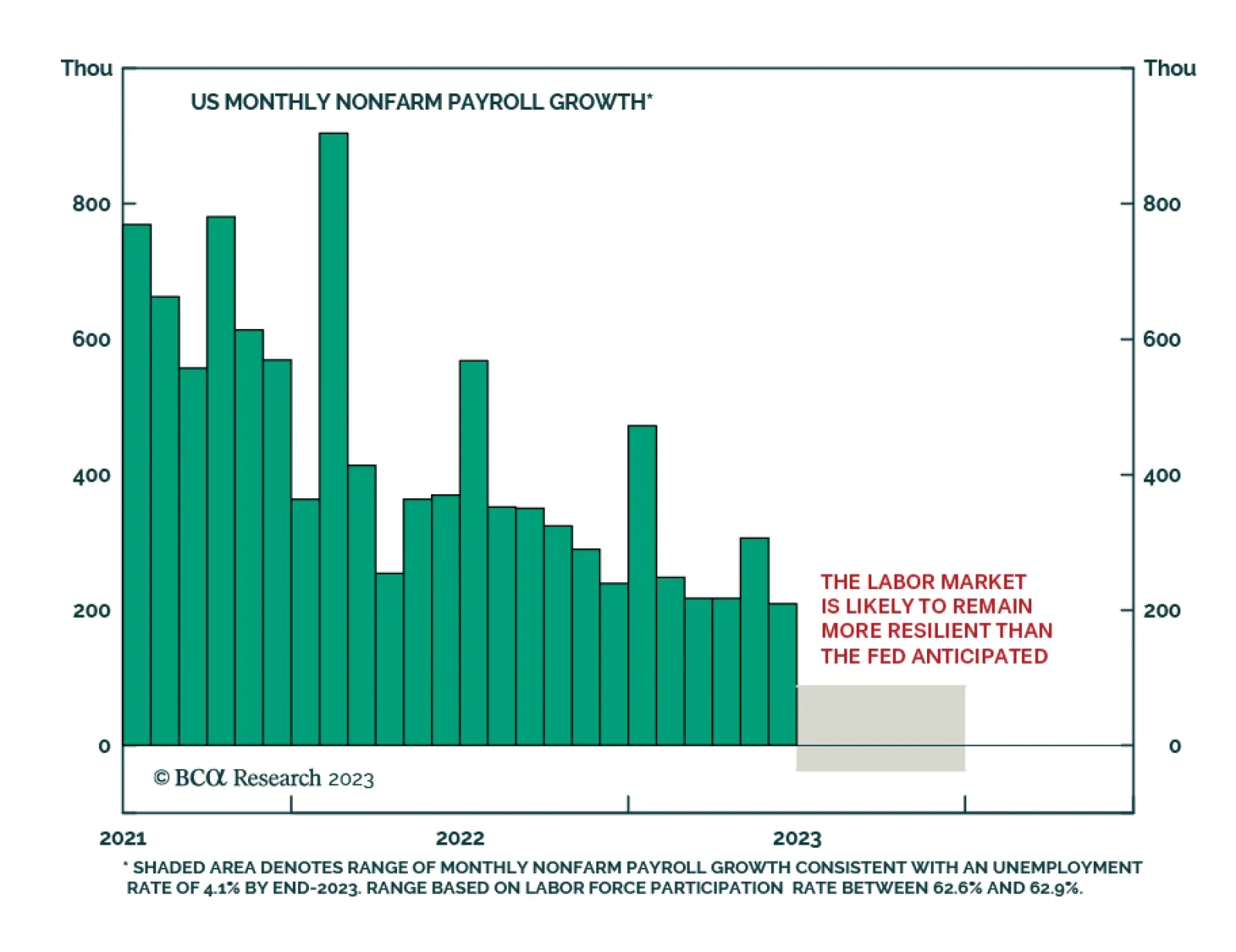

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…

The July FOMC meeting proceeded pretty much as expected. The Fed hiked by 25 basis points, bringing the target range for the funds rate up to 5.25%-5.50%. The forward rate guidance included in the post-meeting statement was also…

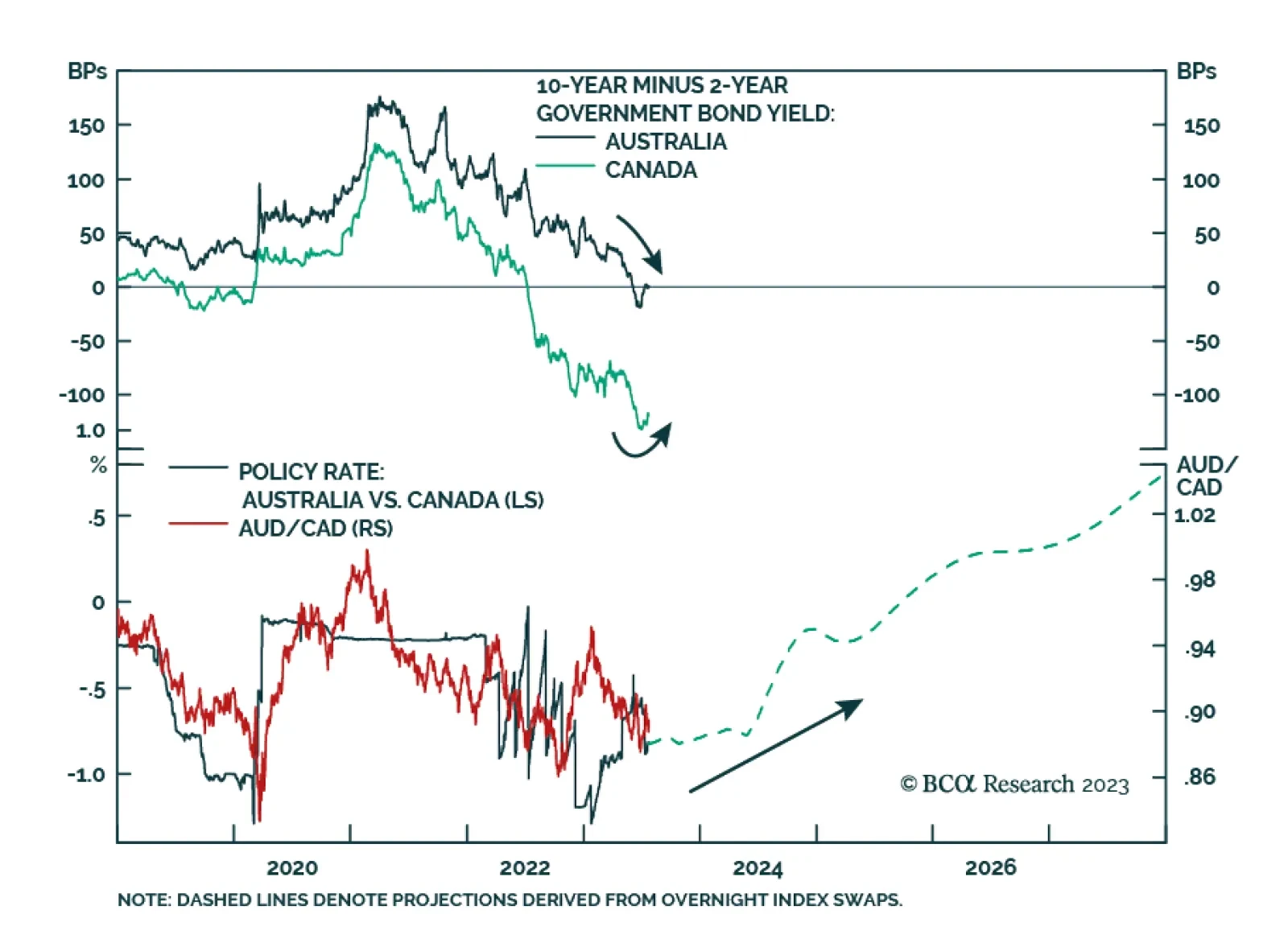

Australia’s June monthly CPI release shows inflationary pressures continue to moderate. Headline CPI inflation receded to 5.4% y/y -- in line with expectations – following a downwardly revised 5.5% y/y in May. To the…

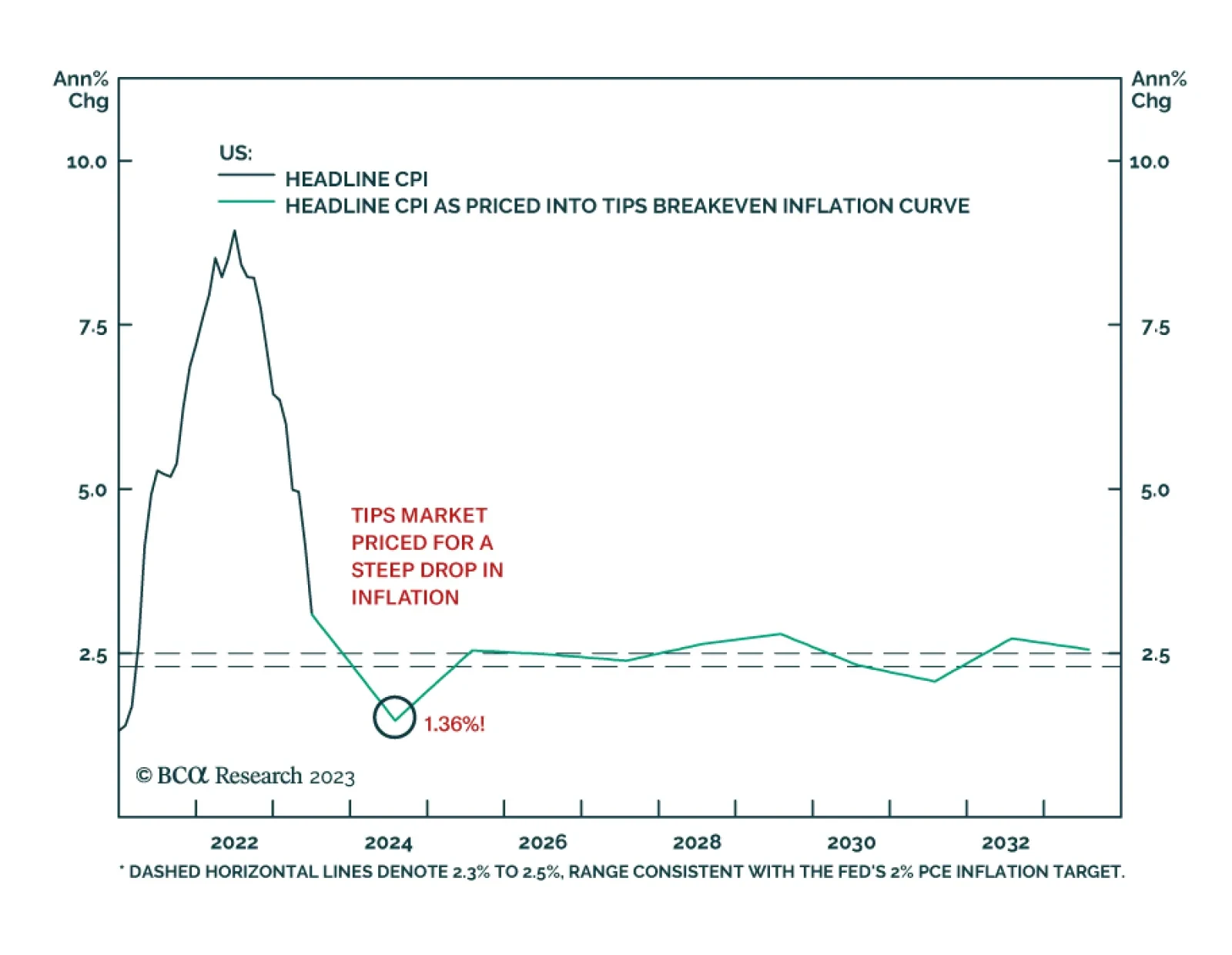

According to BCA Research’s US Bond Strategy service, inflation will fall during the next 12 months, but not by as much as markets expect. Investors should take advantage of this valuation opportunity by entering 2-year/10-…

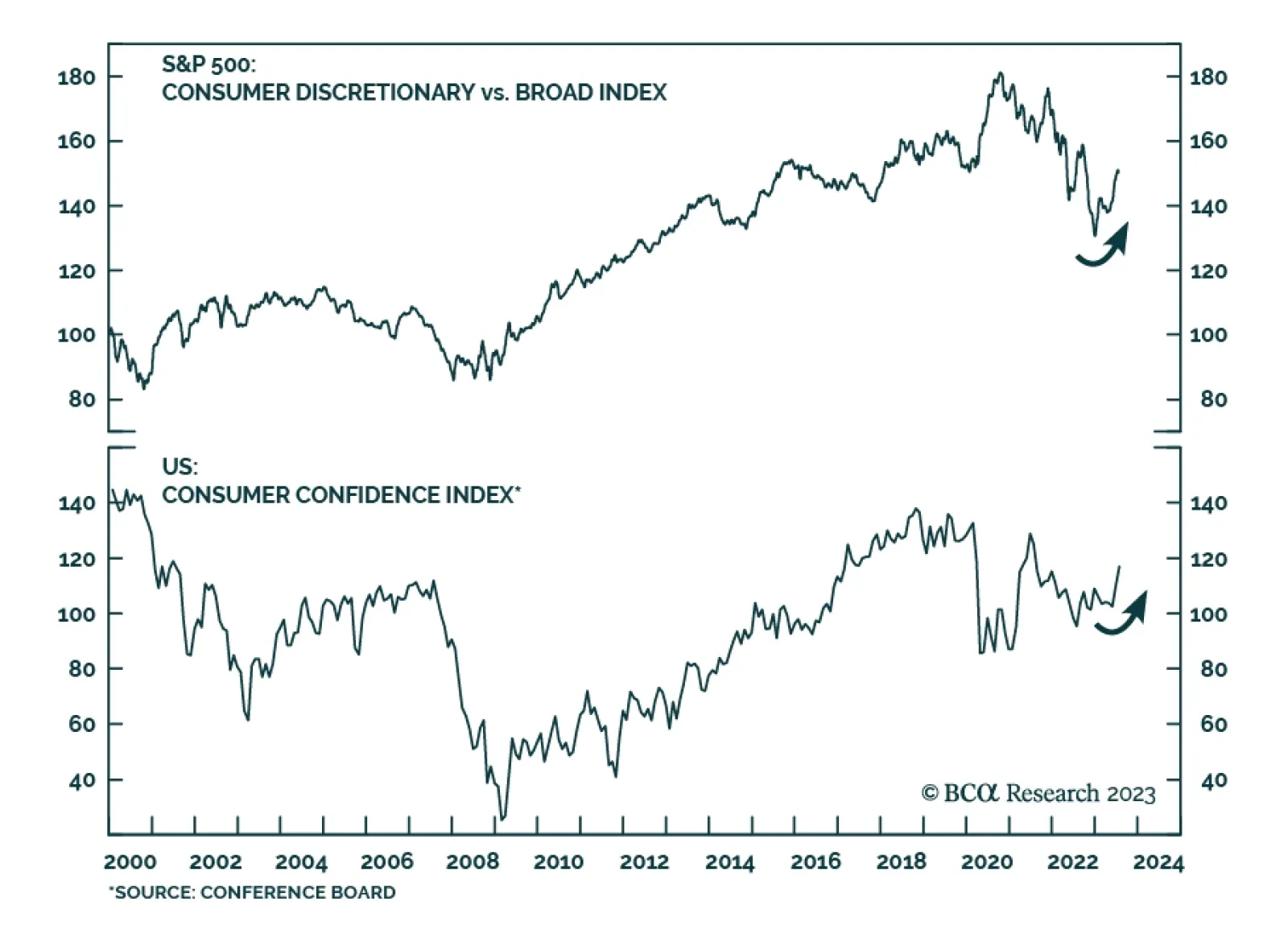

The US Consumer Discretionary sector has been one of the top winners since the equity rally broadened two months ago. Its 13% gain since the end of May outpaces the S&P 500’s rally by 3.8 percentage points This…

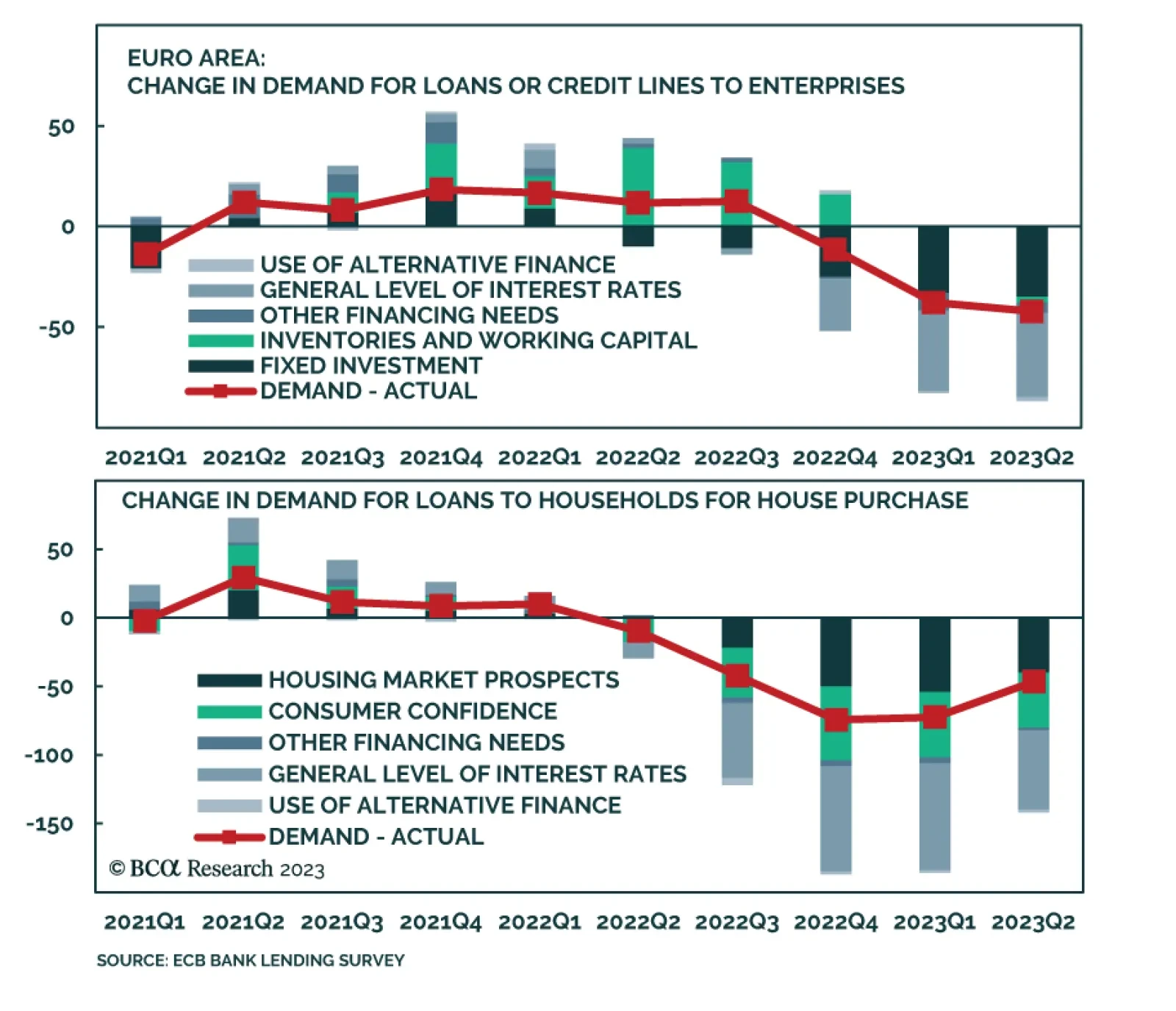

Results of the ECB’s bank lending survey (BLS) show the impact of the central bank’s aggressive tightening cycle on the region’s economy. Uncertainty about the economic outlook, borrower-specific dynamics,…

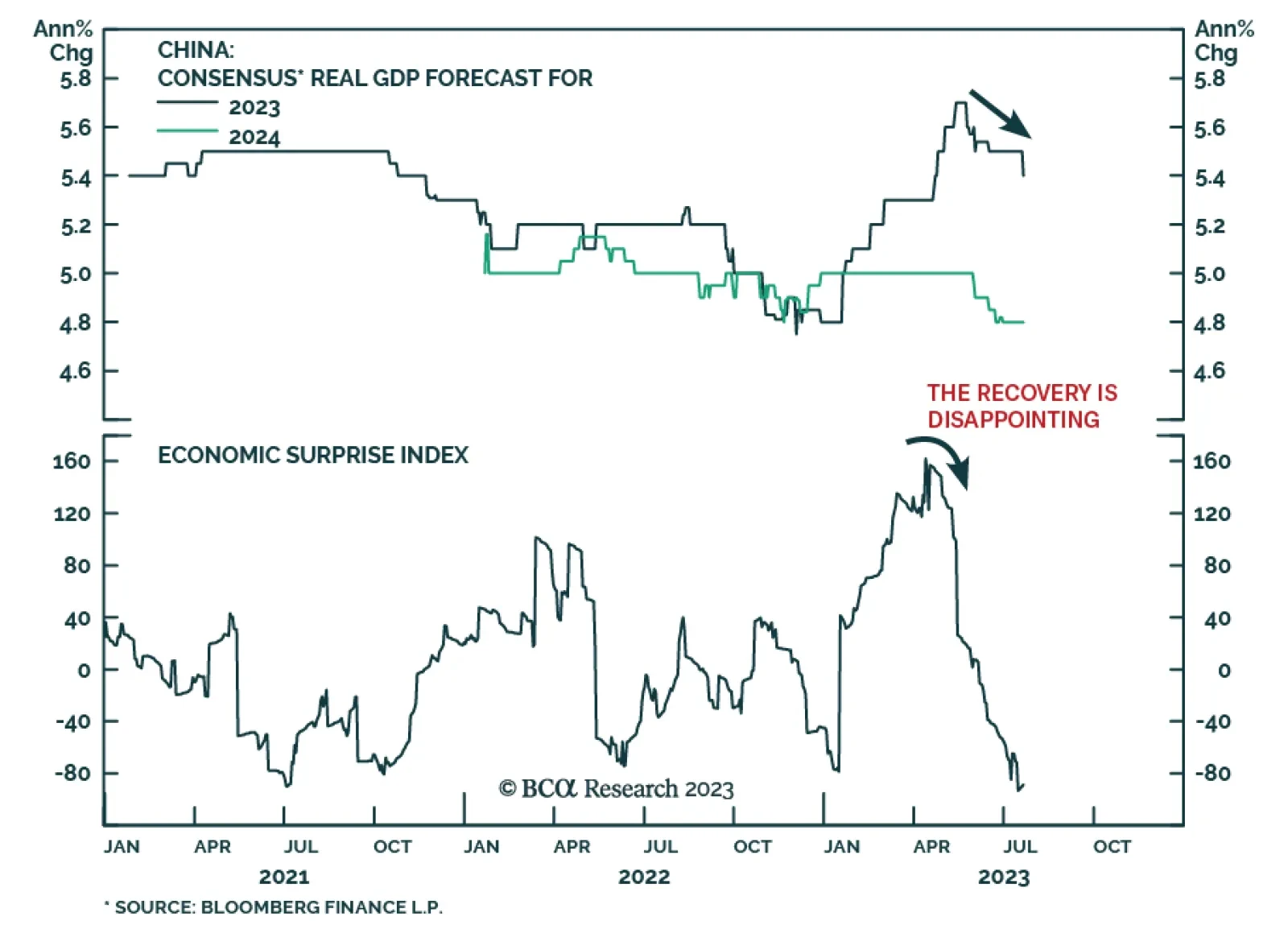

Over the past two months, copper has rallied alongside risk assets and now stands 9% above its late-May trough. Here, the outlook for China’s economy – which accounts for over half of global refined copper usage…

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…

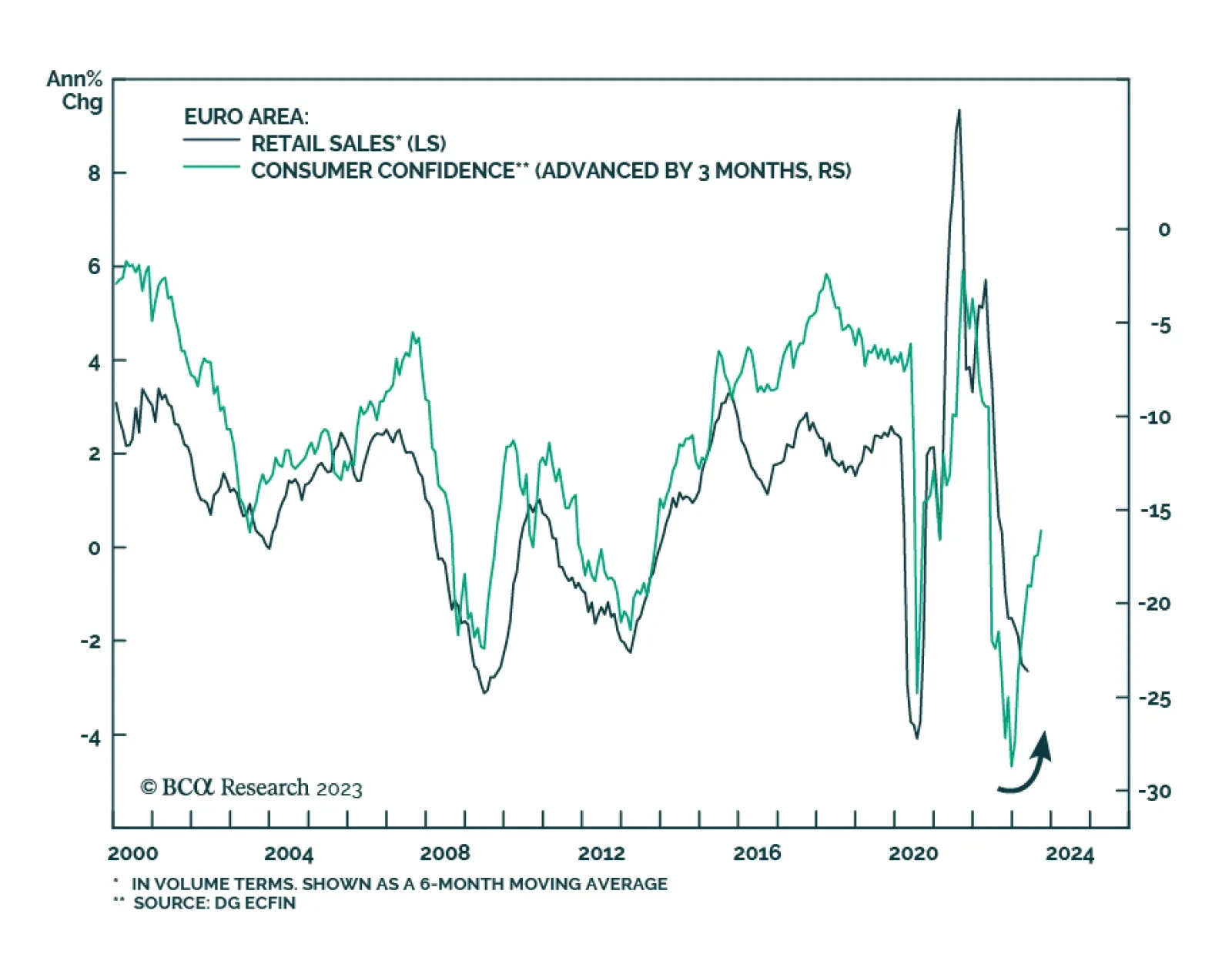

Euro Area consumer confidence has been steadily recovering since it bottomed in September. Most recently, the -15.1 flash estimate for July surprised to the upside and marks its highest reading since February 2022 – ahead…