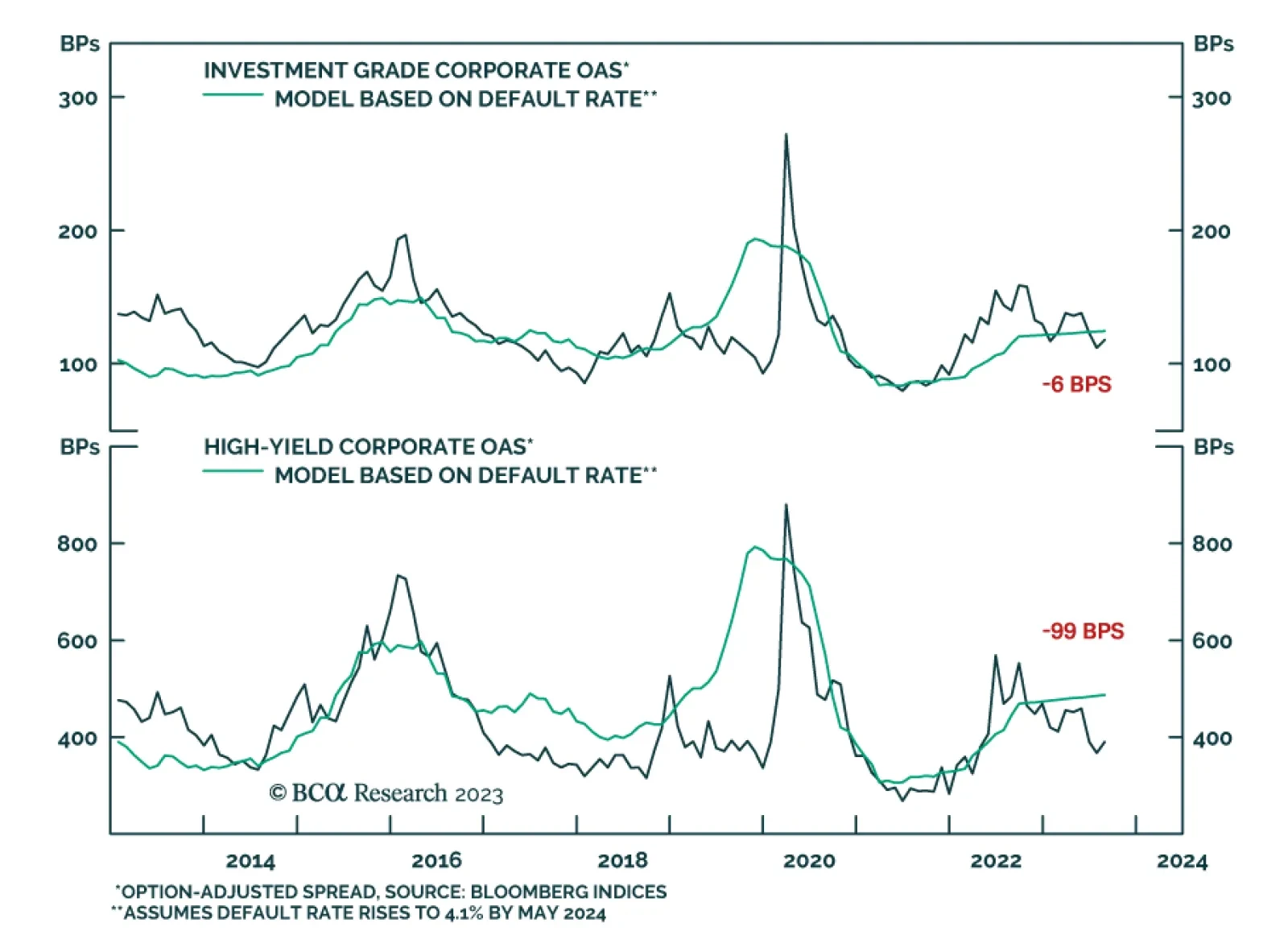

BCA Research’s US Bond Strategy service cautions against turning bullish on corporate bonds. Corporate bonds have delivered strong excess returns versus duration-matched Treasuries during the past two months. Yet the…

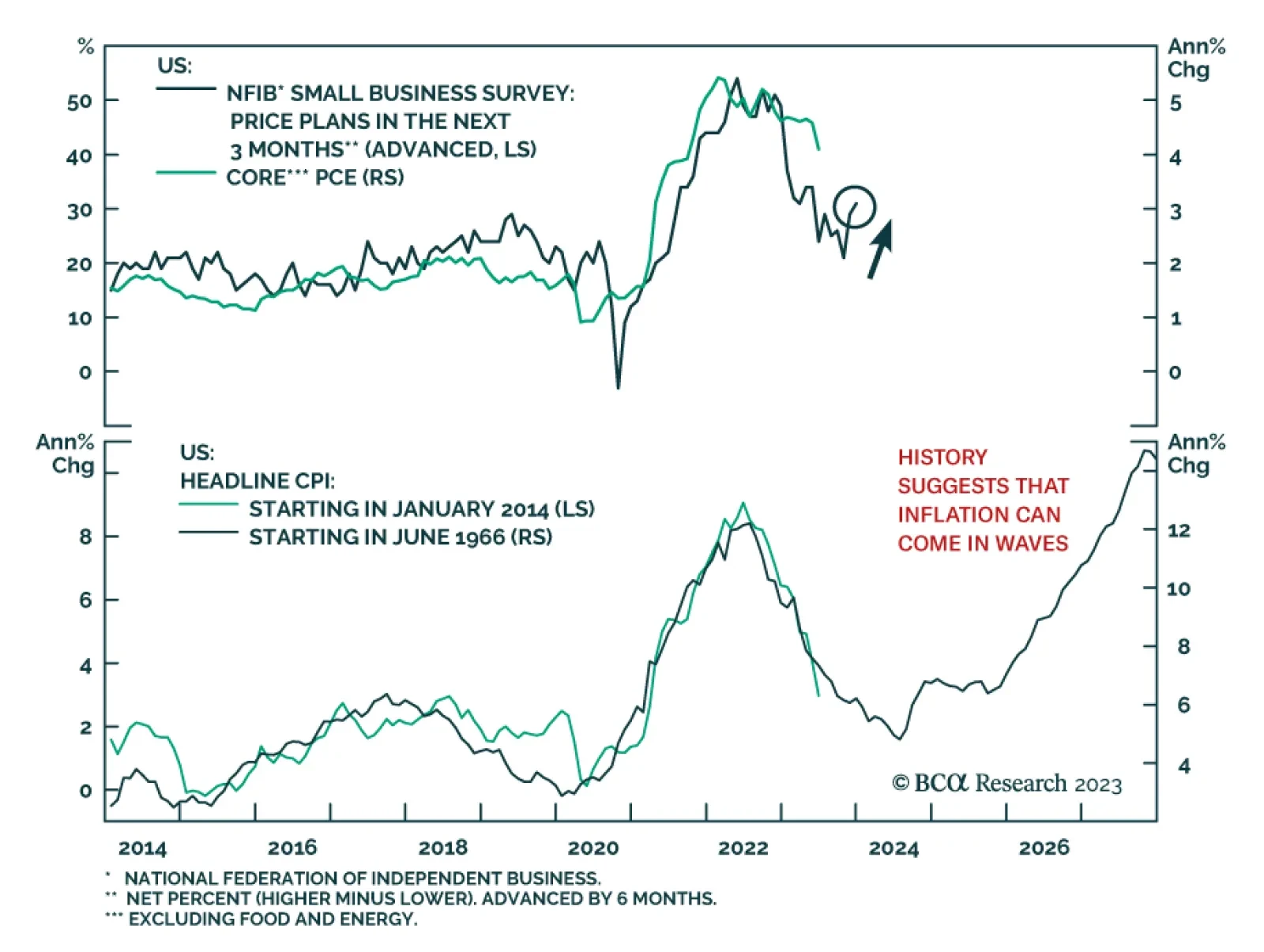

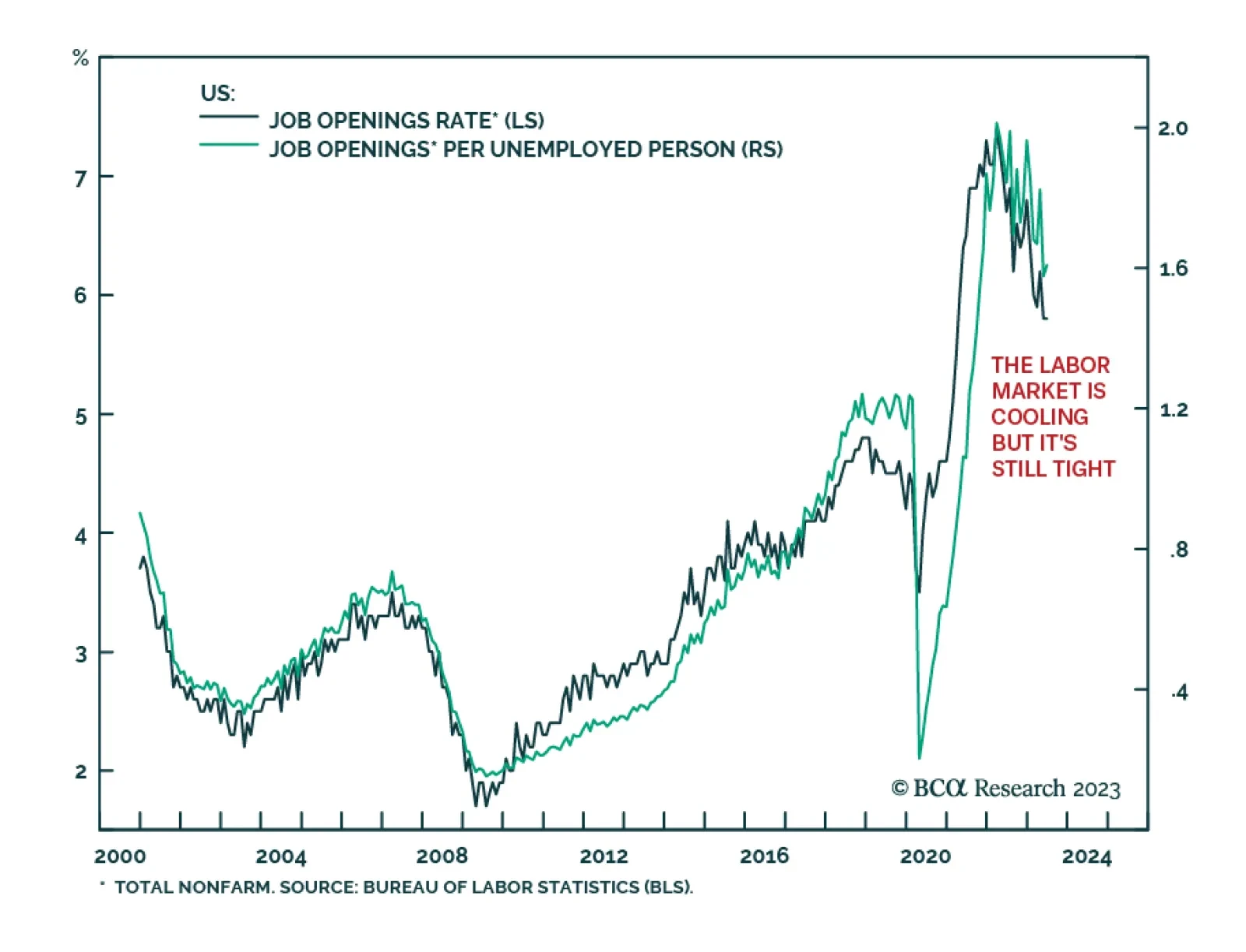

Core inflation in the US should drift lower in the coming months. However, it is too early to conclude that the US is completely out of the woods when it comes to inflation. Given that the US job market remains tight, and the…

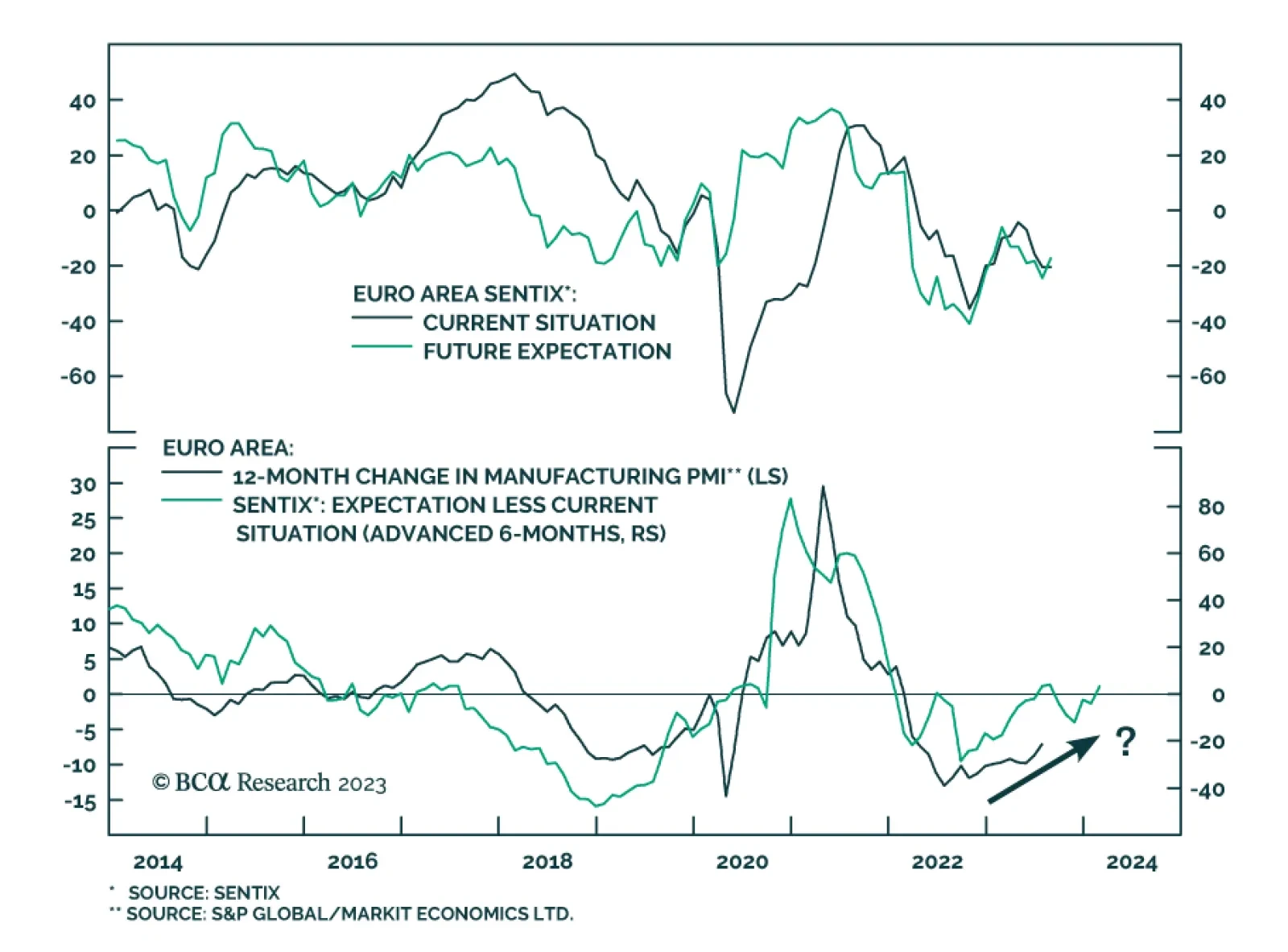

The Sentix Economic Index for the Eurozone sent a positive signal on Monday. It unexpectedly increased from -22.5 to -18.9 in August, surprising expectations of a further deterioration to -24.5. This marks the index’s first…

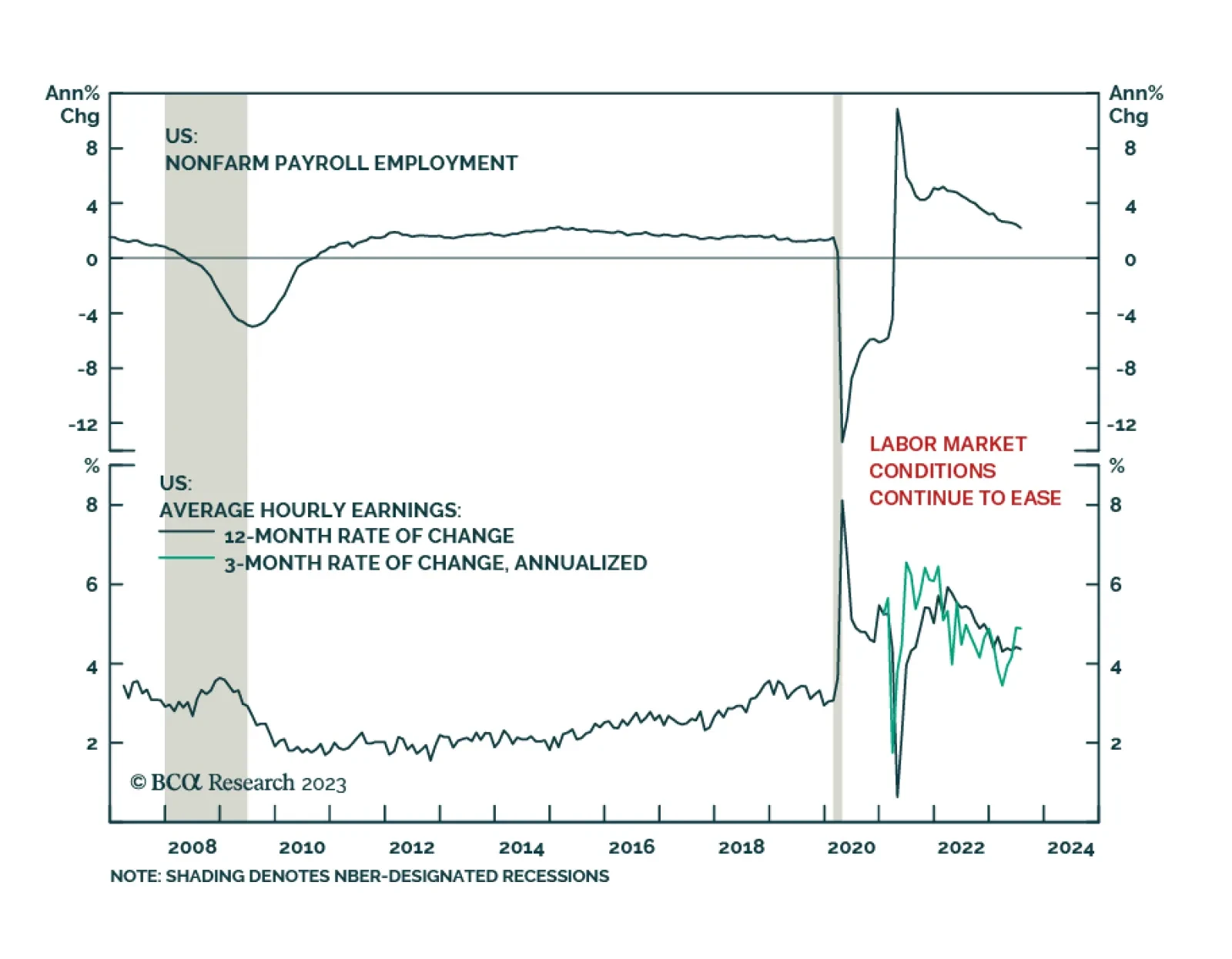

Nonfarm payroll employment increased by less than anticipated in July, rising by 187 thousand versus expectations of 200 thousand. In addition, the June increase was revised down from 209 thousand to 185 thousand. Similarly,…

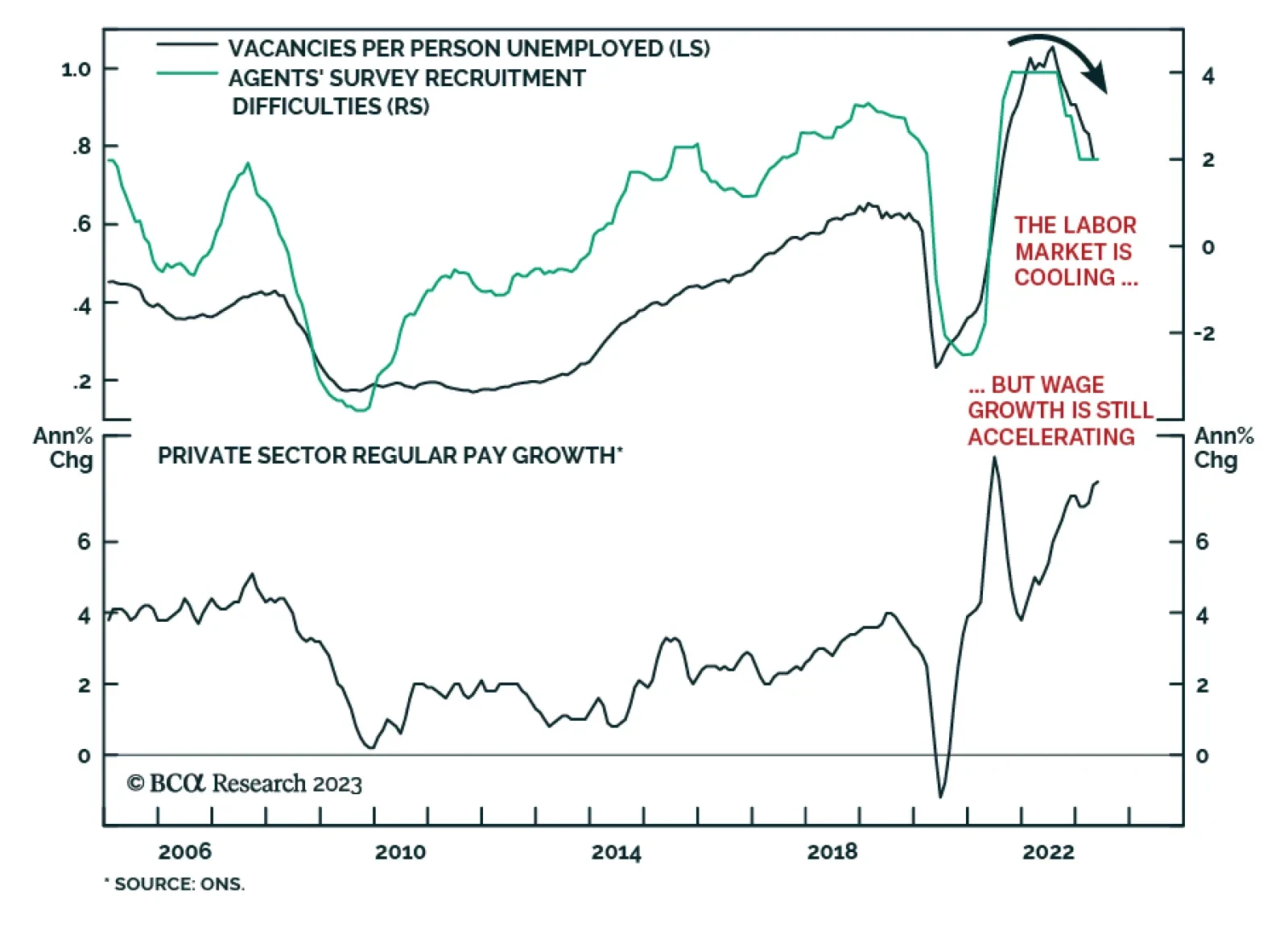

As expected, the Bank of England delivered another 25 basis point rate increase at its Thursday meeting, lifting the policy rate to 5.25%. Going forward, Bailey – not unlike his counterparts at the Fed and ECB –…

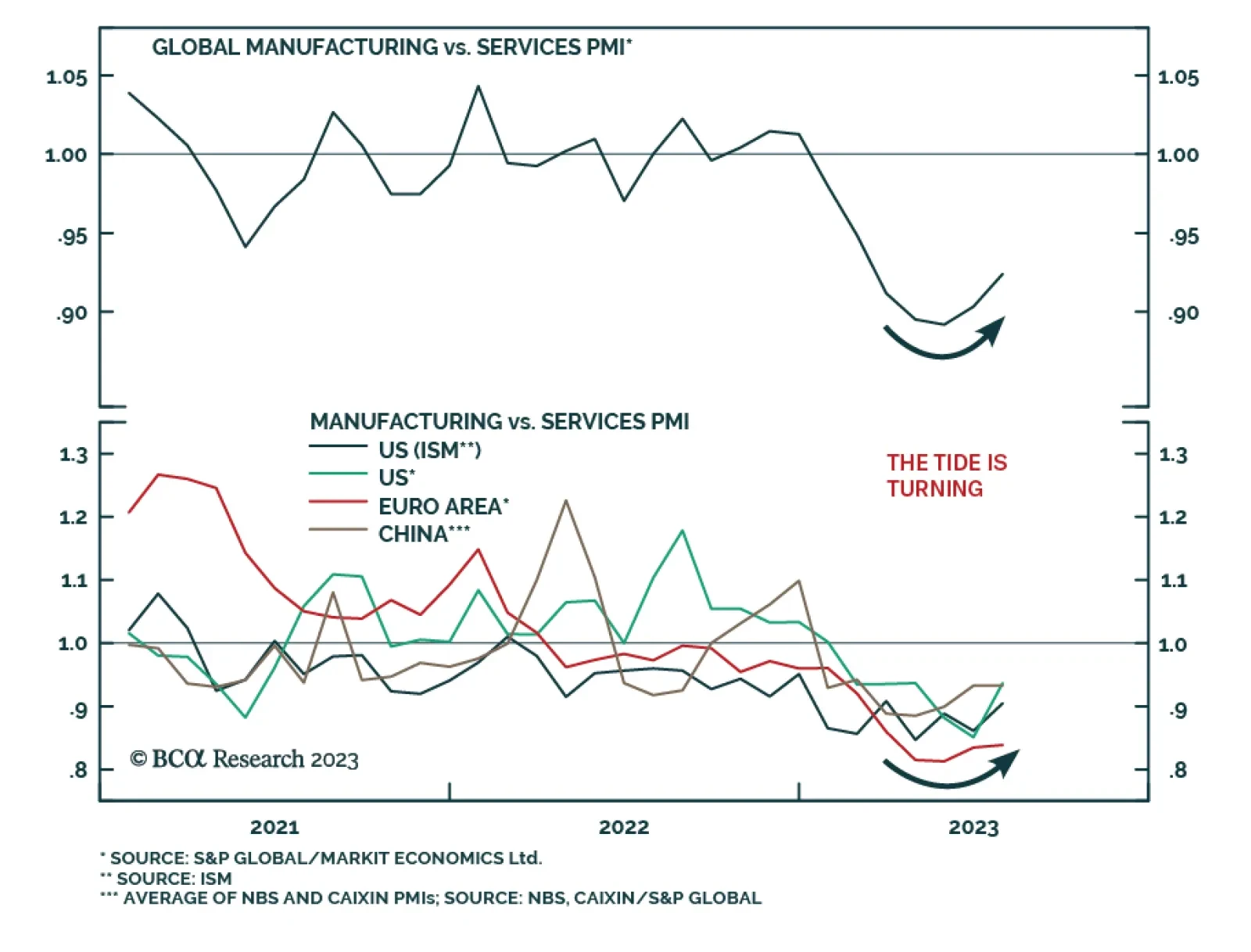

The first half of the year was characterized by a two-speed economy. Manufacturing bore the brunt of the weakness while the services sector remained resilient. However, the global composite PMI corroborates the signal from DM…

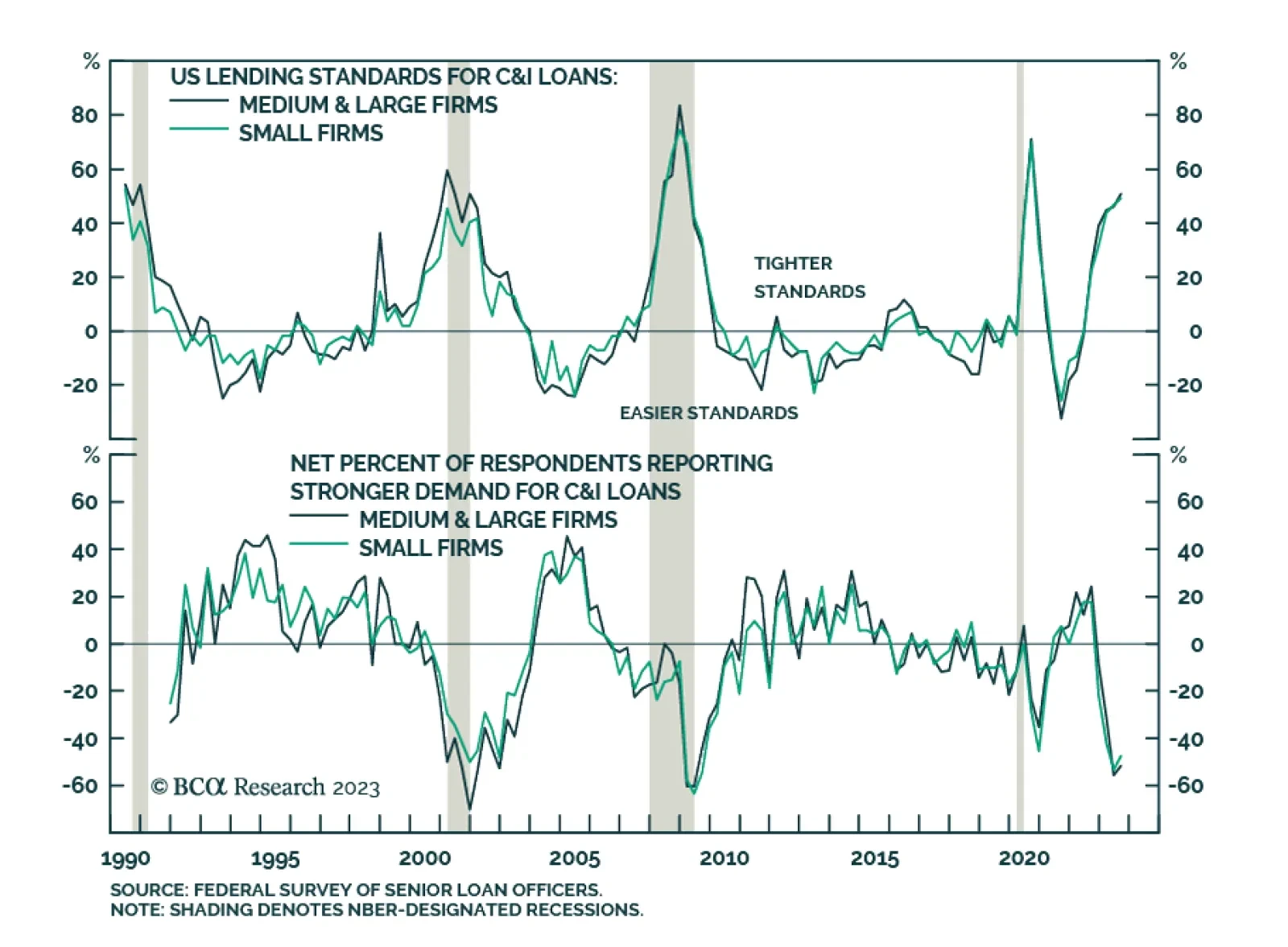

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continue to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE),…

The ADP Jobs Report delivered a better-than-anticipated signal about the US labor market on Wednesday. The 324 thousand increase in private employment in July beat expectations of a 190 thousand rise and marks the second highest…

Collapsed complexity, plus the unwinding of favourable base effects and favourable seasonal adjustments to the inflation and jobs numbers, all pose a danger to the Goldilocks market.