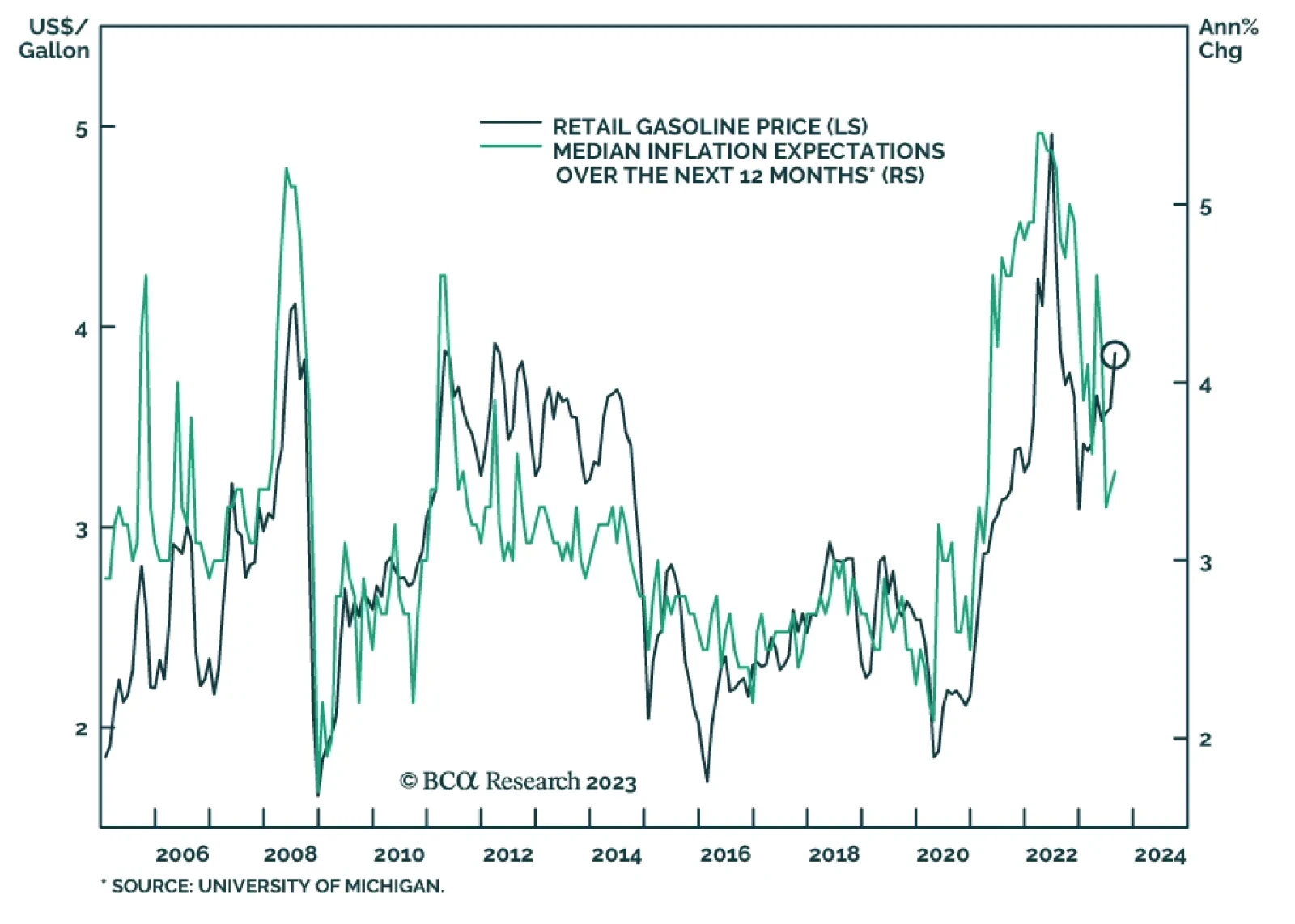

The final release of the University of Michigan’s gauge of US consumer inflation expectations unexpectedly rose in August. It shows 1-year ahead inflation expectations increased by a tenth of a percentage point to 3.5% (an…

US durable goods orders delivered a negative surprise on Thursday. The 5.2% m/m decline in new orders for manufactured durable goods came in below expectations of a 4.0% m/m decrease and marks the biggest monthly drop since April…

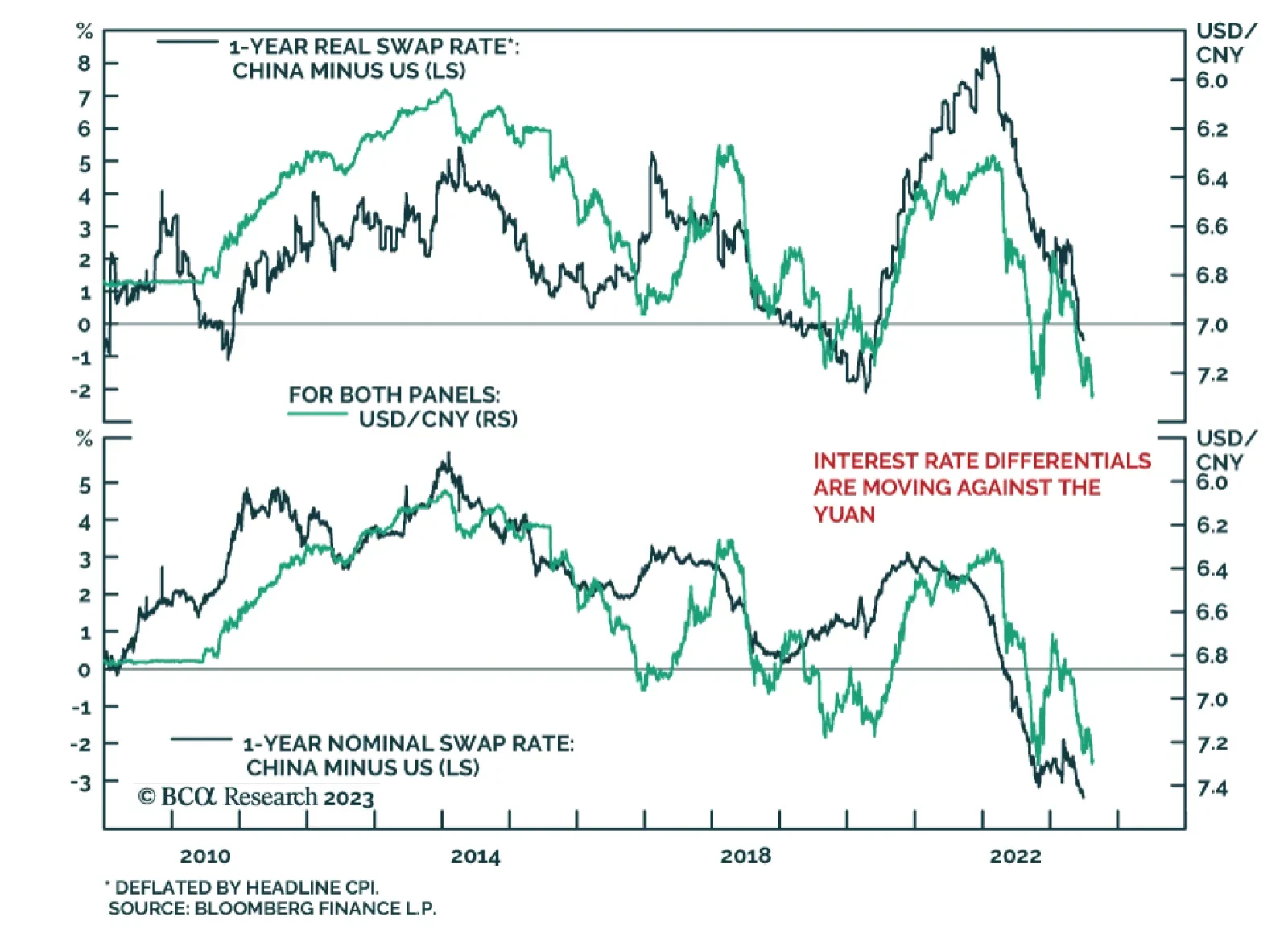

Chinese authorities have recently ratcheted up support for the currency. The PBoC continues to set its daily yuan fixing at a stronger-than-expected rate, with the yuan midpoint (a reference for trading that caps the range…

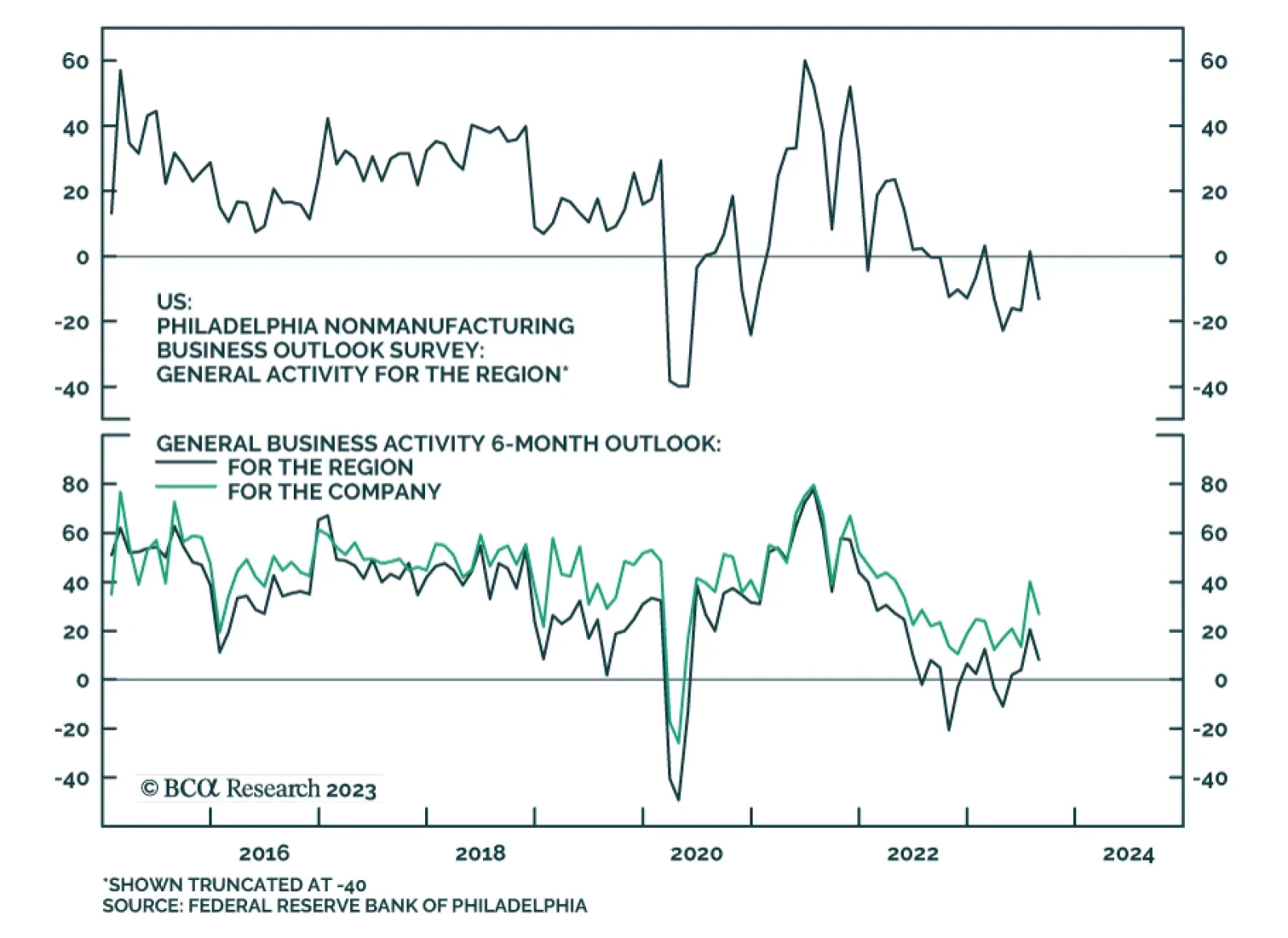

Results of the Philadelphia Fed’s August Nonmanufacturing Business Outlook Survey sent a negative signal on Tuesday. The diffusion index for firms’ assessment of general business activity across the region relapsed…

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

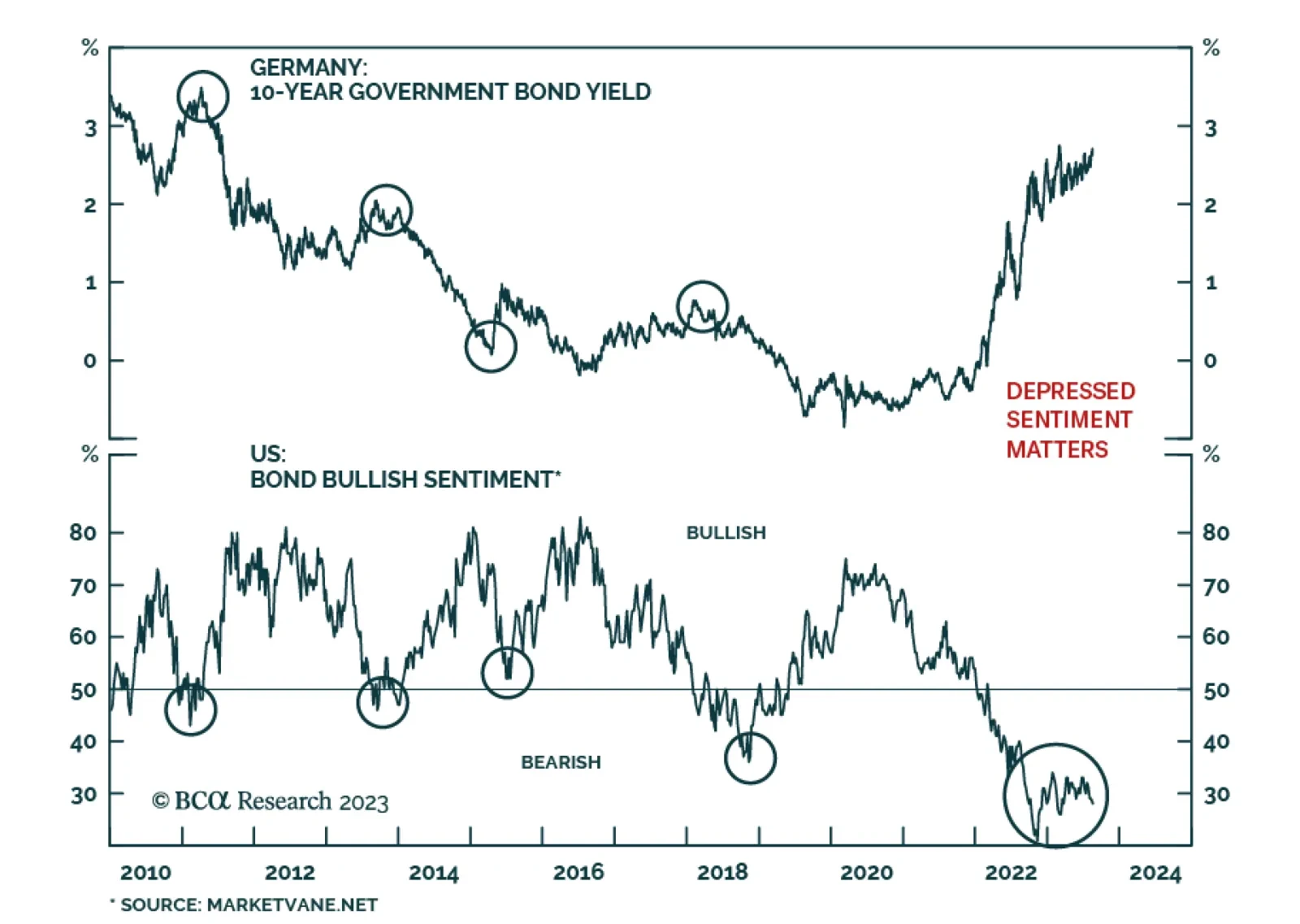

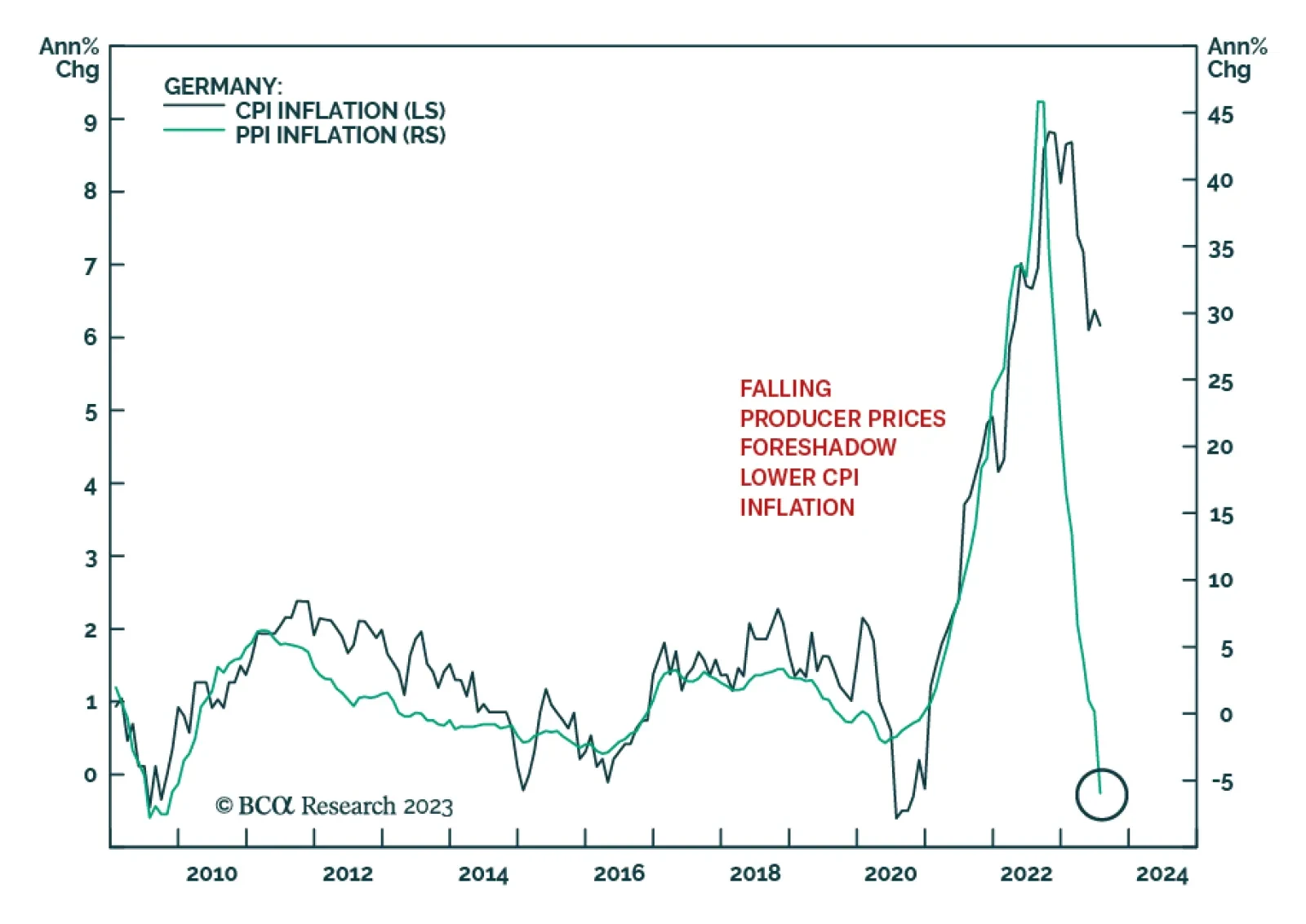

According to BCA Research’s European Investment Strategy service, German yields are unlikely to experience a decisive break out that would carry them to 3%. Five economic forces suggest that German yields are unlikely to…

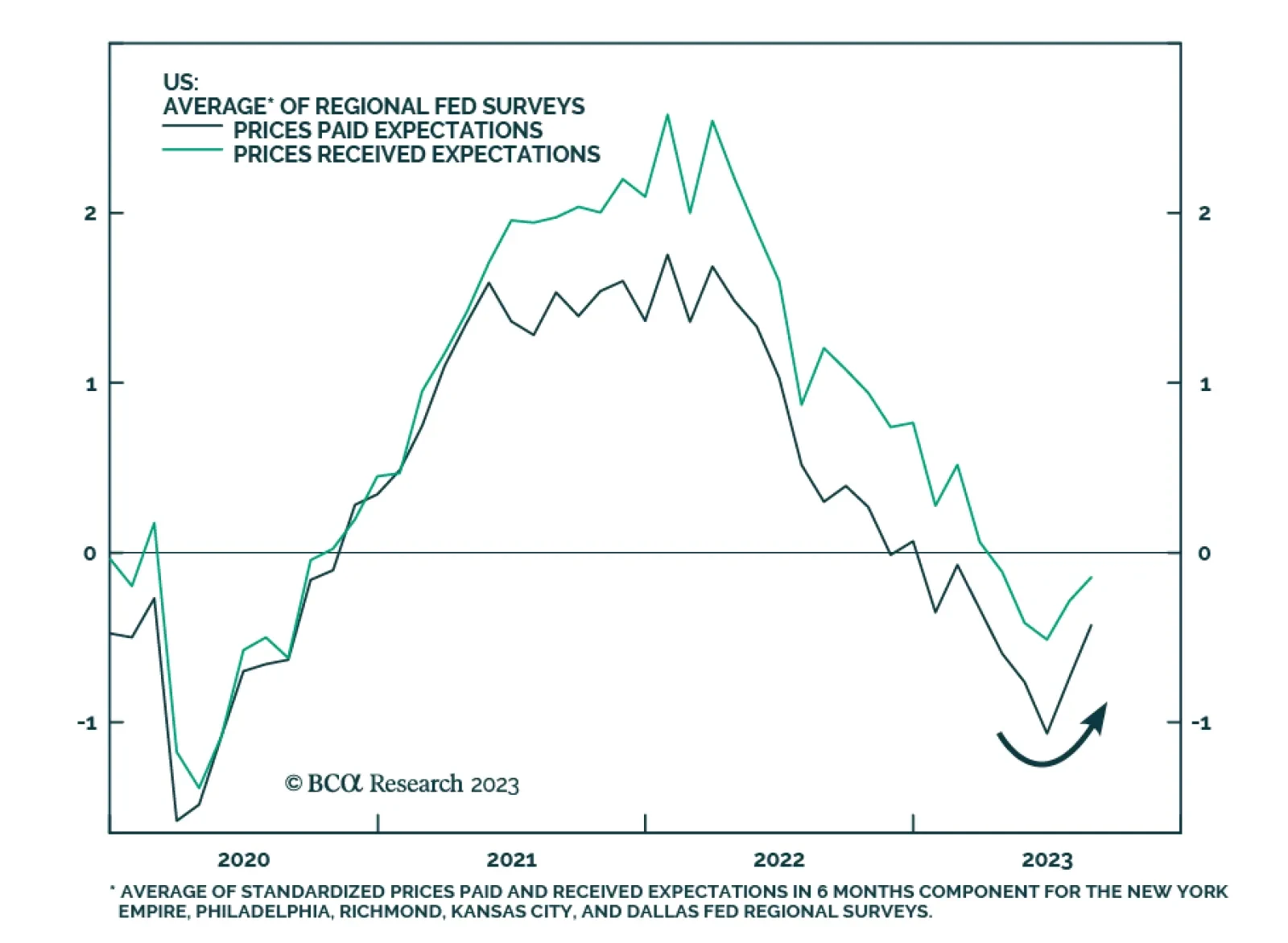

In an Insight last month, we noted that the Global Investment Strategy service increased its subjective odds for the resurgence of US inflation later this year or early next year from 20% to 30%. Here are some of the data points…

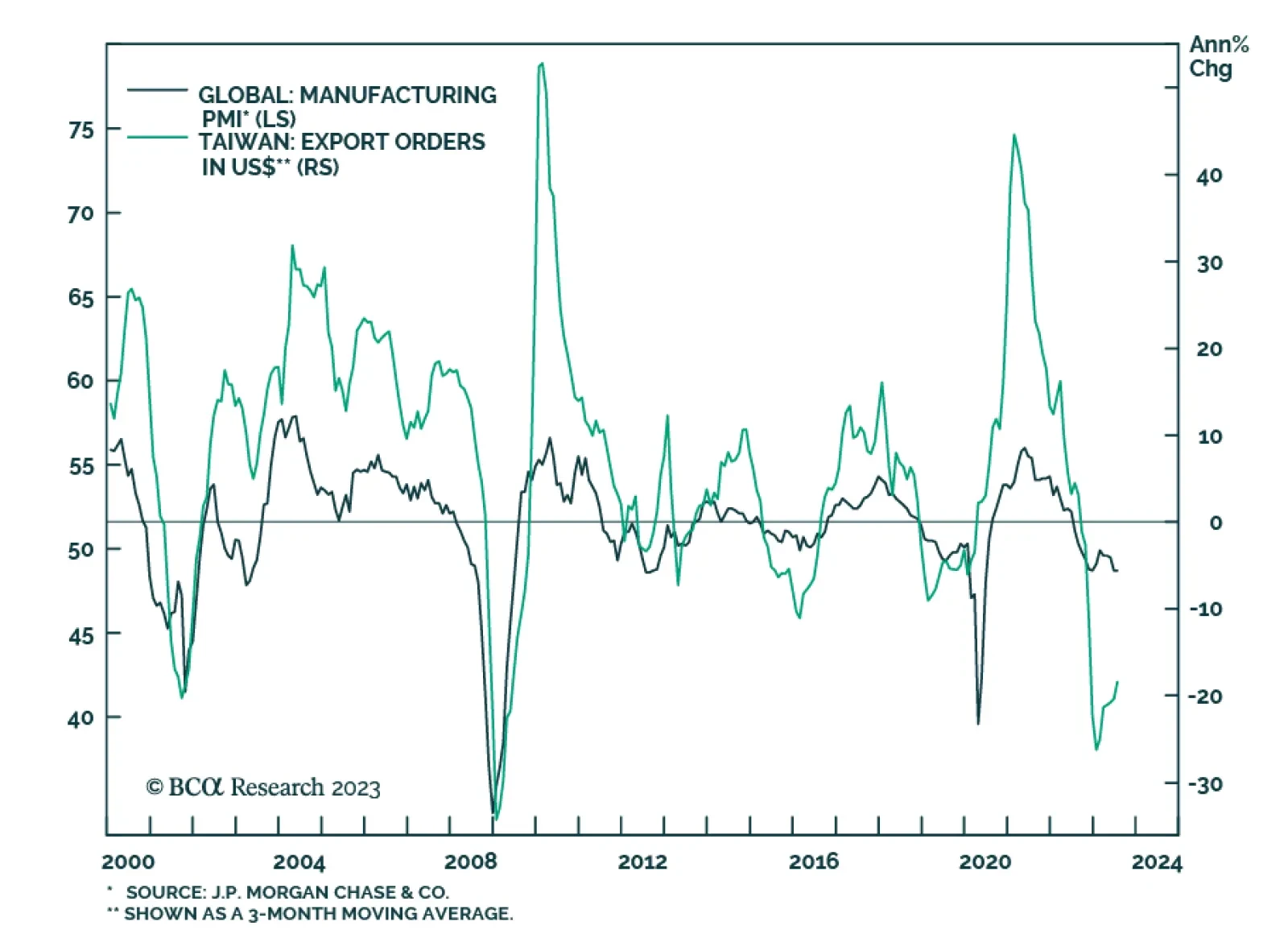

To the extent that Taiwanese export orders are a bellwether for global trade dynamics, the latest update for July provides a less pessimistic signal about the manufacturing cycle. It shows the pace of decline slowed sharply from…

German producer prices indicate that inflationary pressures continue to moderate. The producer price index’s 6.0% y/y drop in July is more pronounced than the anticipated 5.1% y/y decline and marks the first annual decrease…