Stocks should continue to rally in the near term, but investors should prepare to turn more defensive towards the end of the year in advance of a recession in 2024.

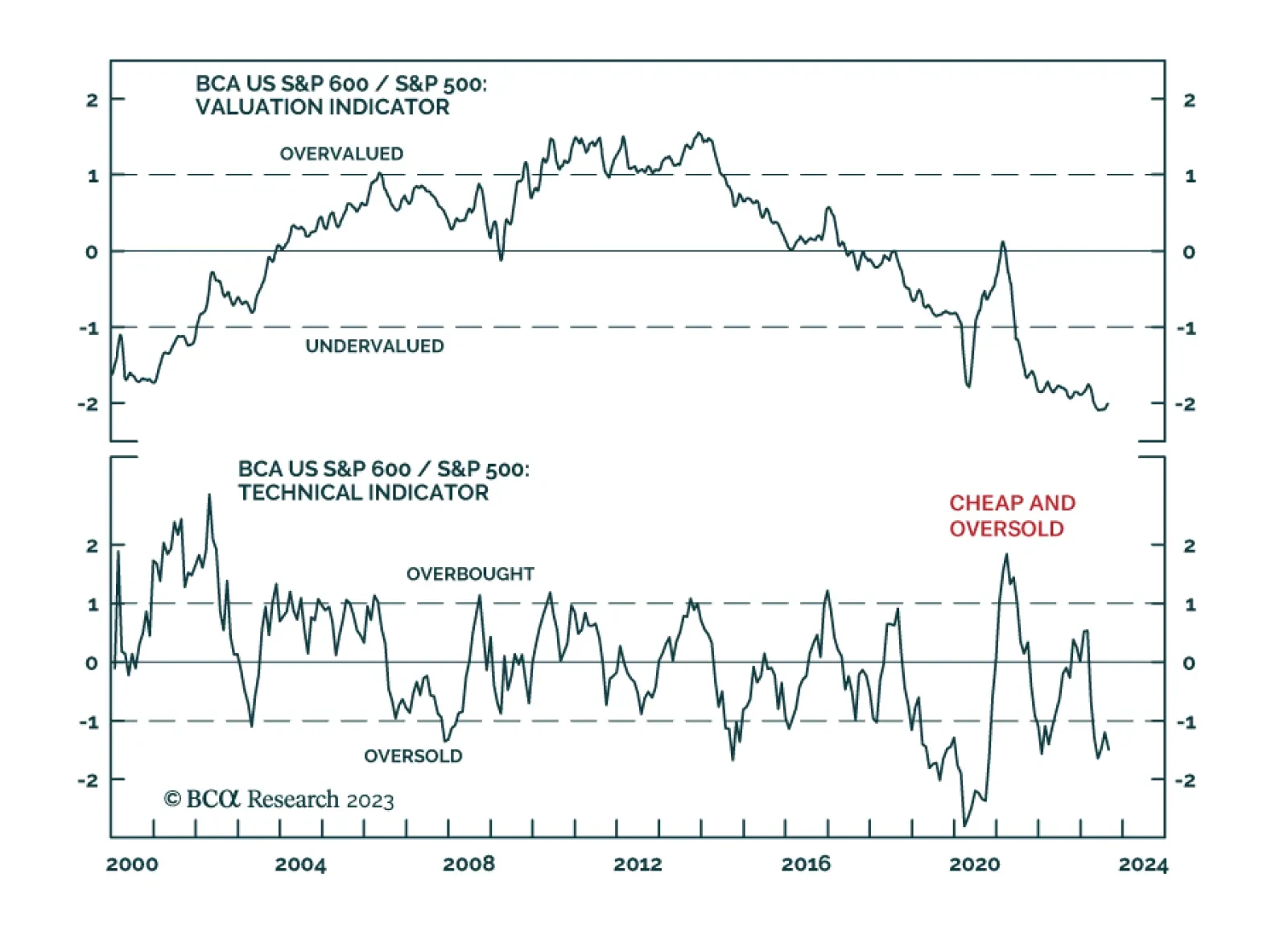

After having sold off in the first five months of the year, the performance of small-cap stocks improved in June and July with the S&P 600 index gaining 13.9% in those two months. A broadening of the US equity rally –…

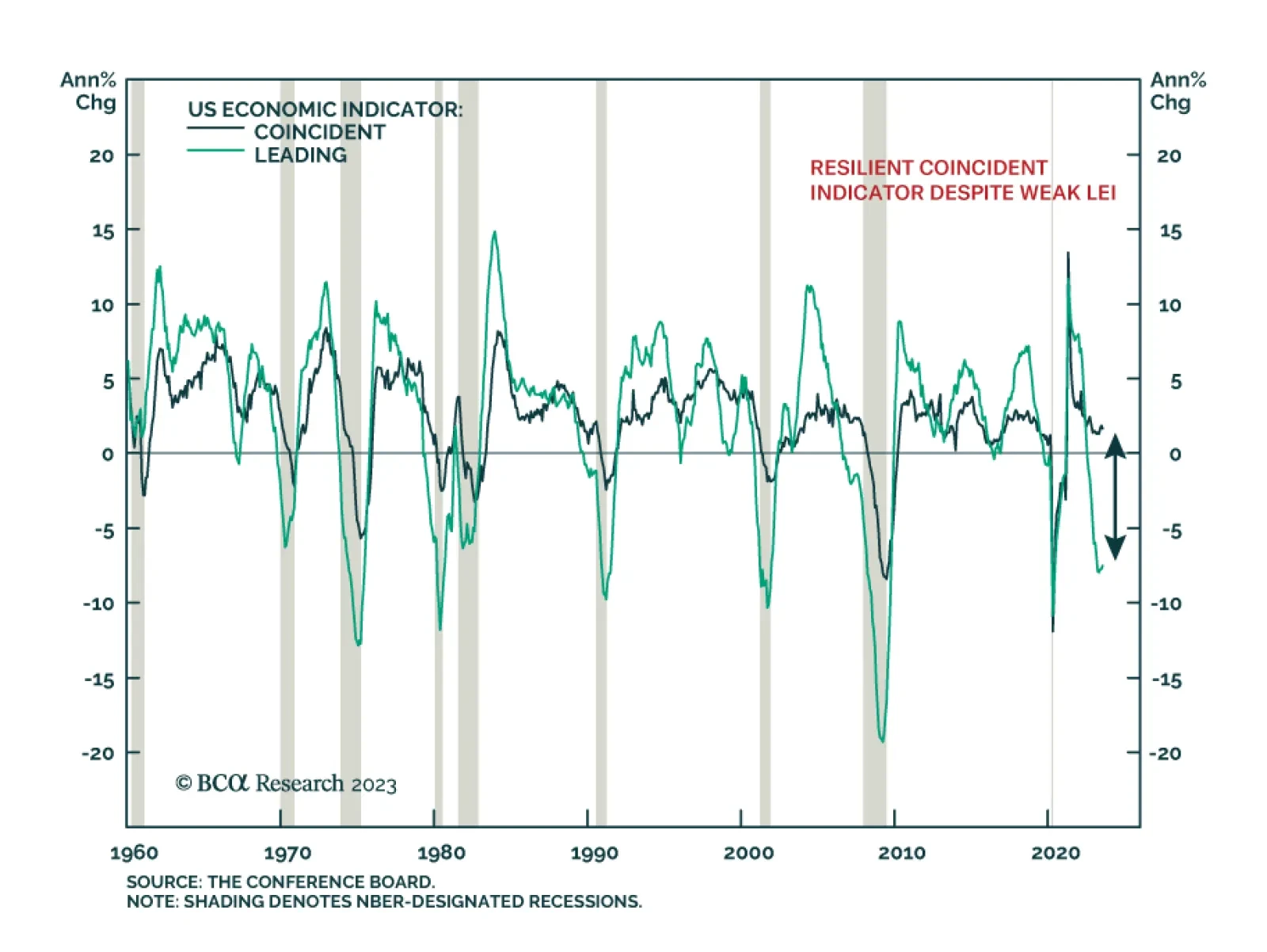

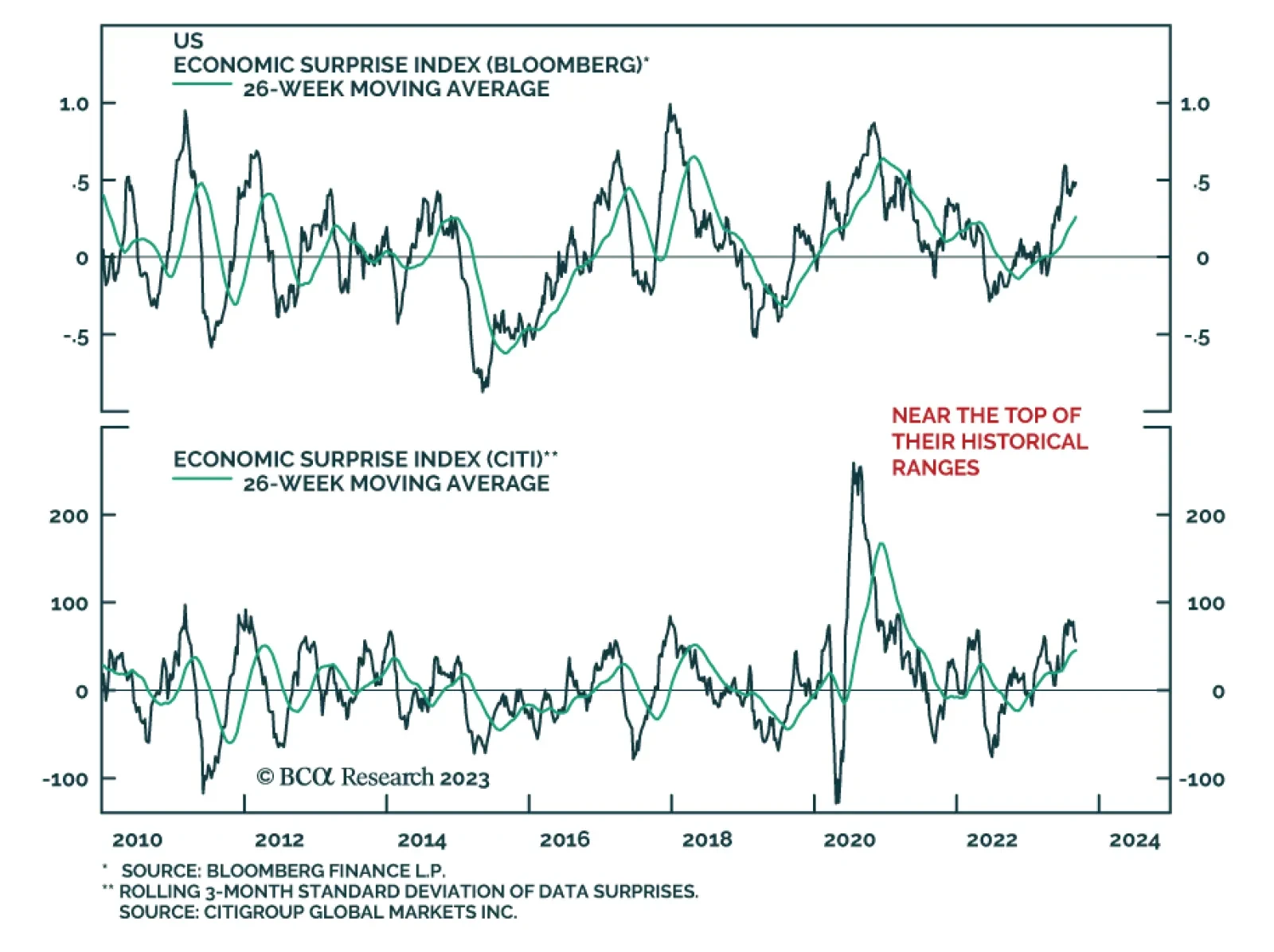

Consensus expectations for the US economy were bleak at the start of the year. In hindsight, this pessimism was excessive: real GDP expanded in the first two quarters of the year (see Country Focus). Similarly, the US Conference…

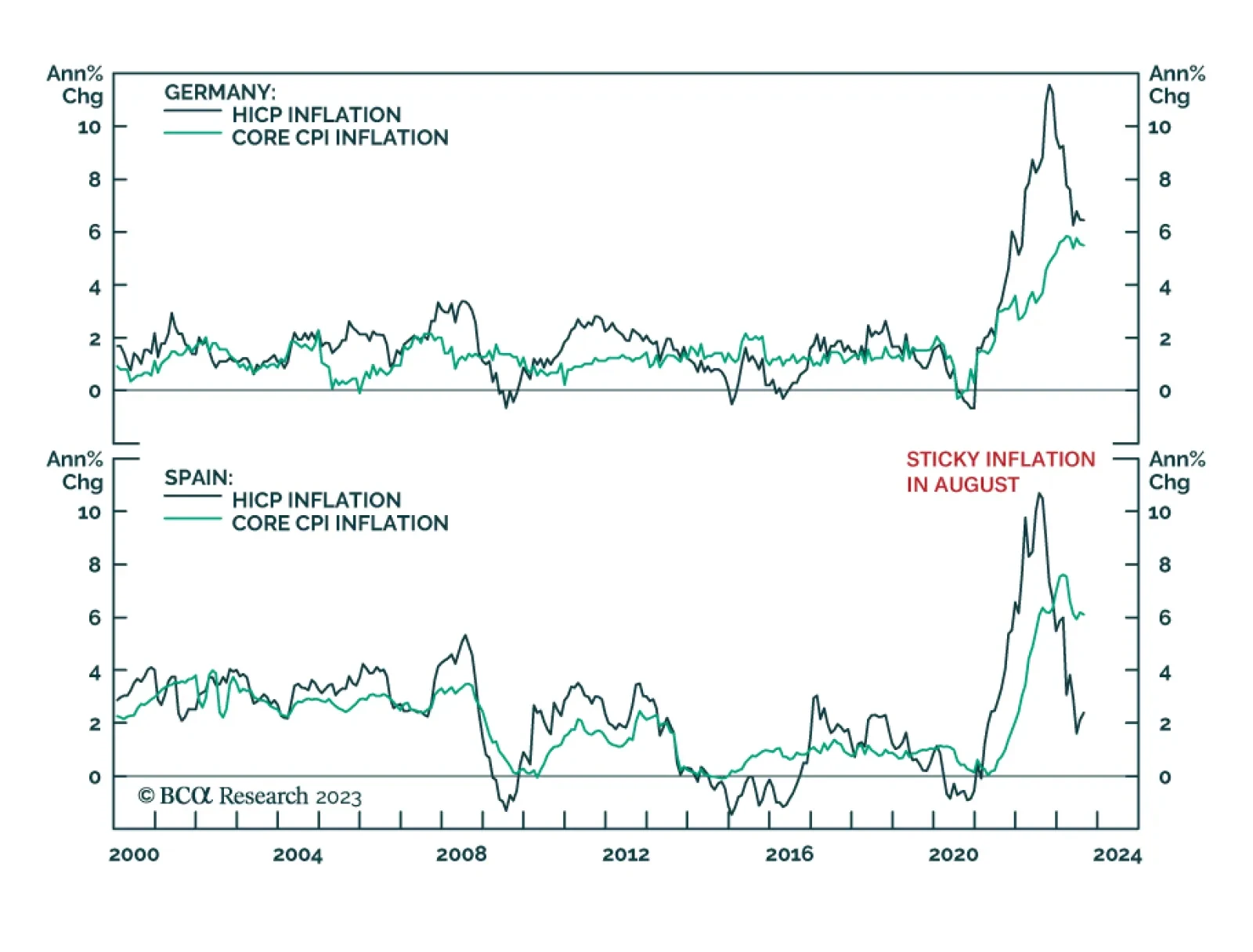

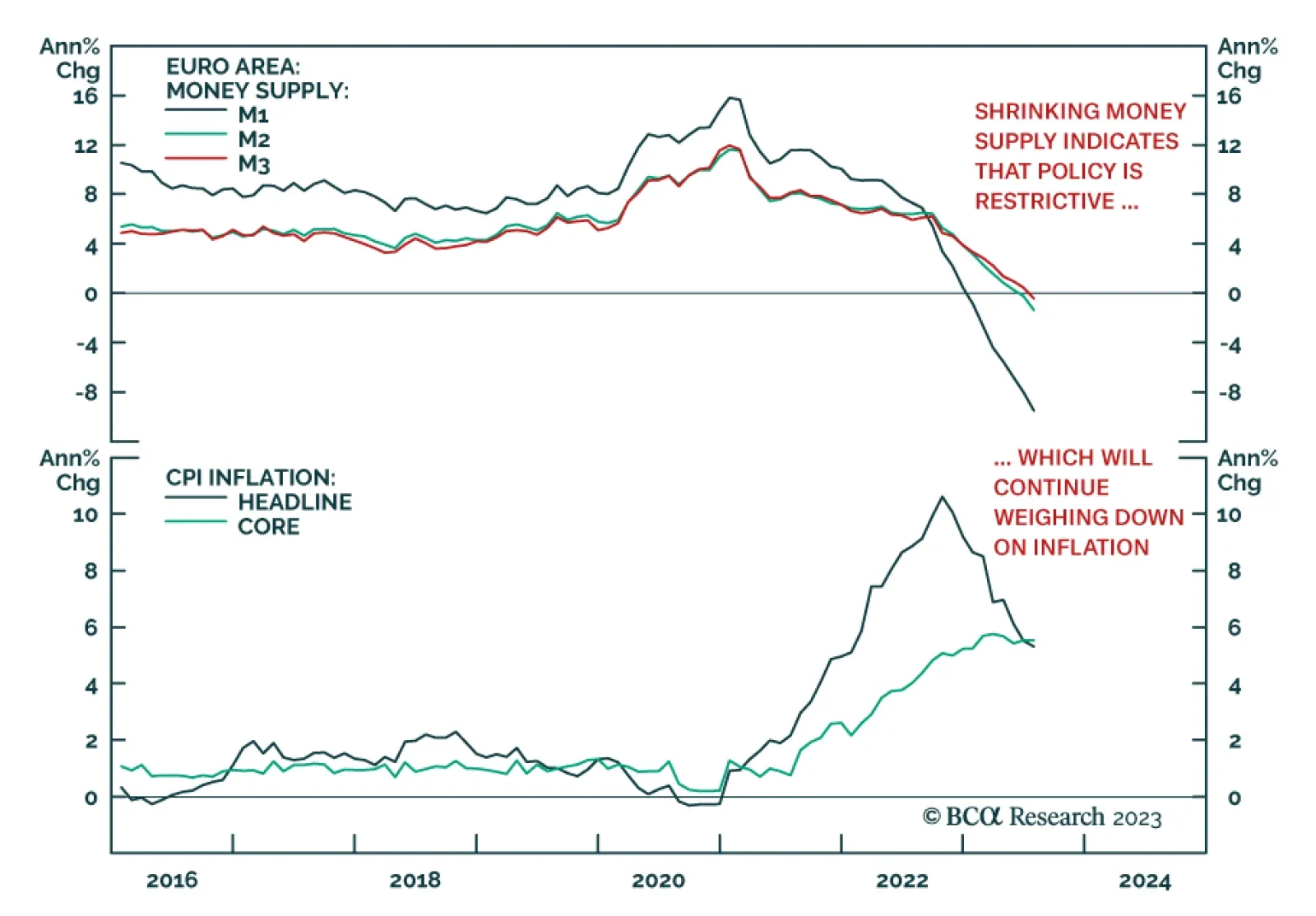

Euro Area inflation data surprised to the upside on Wednesday. According to preliminary data, although Germany’s harmonized headline CPI inflation rate fell from 6.5% y/y to 6.4% y/y in August, it nevertheless came in…

On the surface, the latest uptick in the General Business Activity Index of the Dallas Fed’s Manufacturing Survey suggests that manufacturing activity is no longer deteriorating at an accelerating pace. The indicator rose…

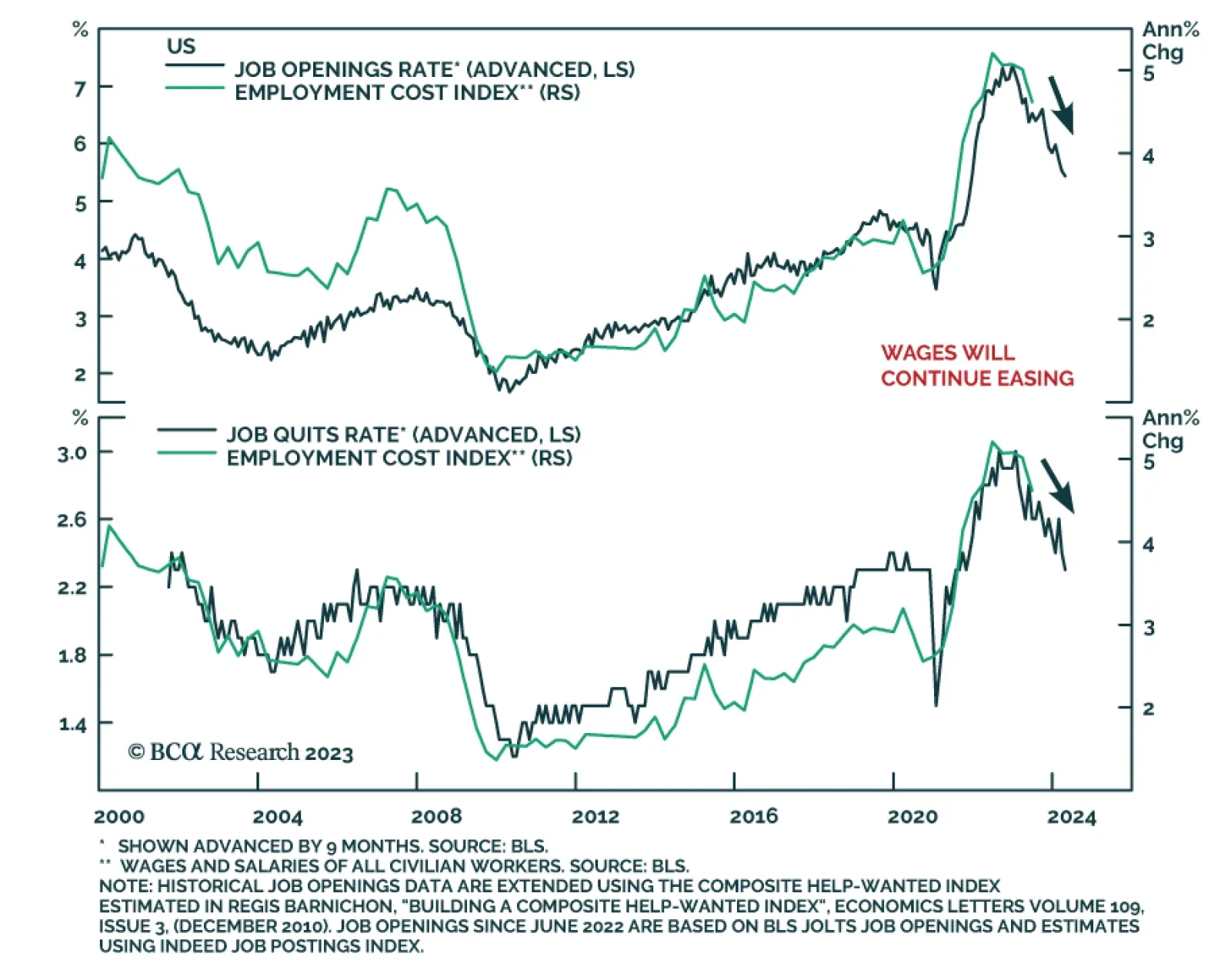

On Tuesday, the Job Openings and Labor Turnover Survey (JOLTS) indicated that the US labor market continues to cool. It showed job openings fell to 8.827 million in July following a downwardly revised 9.165 million in June (down…

Eurozone money supply data reflect the impact of the ECB’s aggressive tightening campaign on the region’s economy. Data released on Monday showed the July M3 measure of broad money (the sum of M2, repurchase…

The ongoing profit contraction among Chinese industrial firms underscores that deflationary headwinds dominate the domestic economy. Although the annual pace of decline of industrial profits slowed from 8.3% y/y in June to 6.7% y…

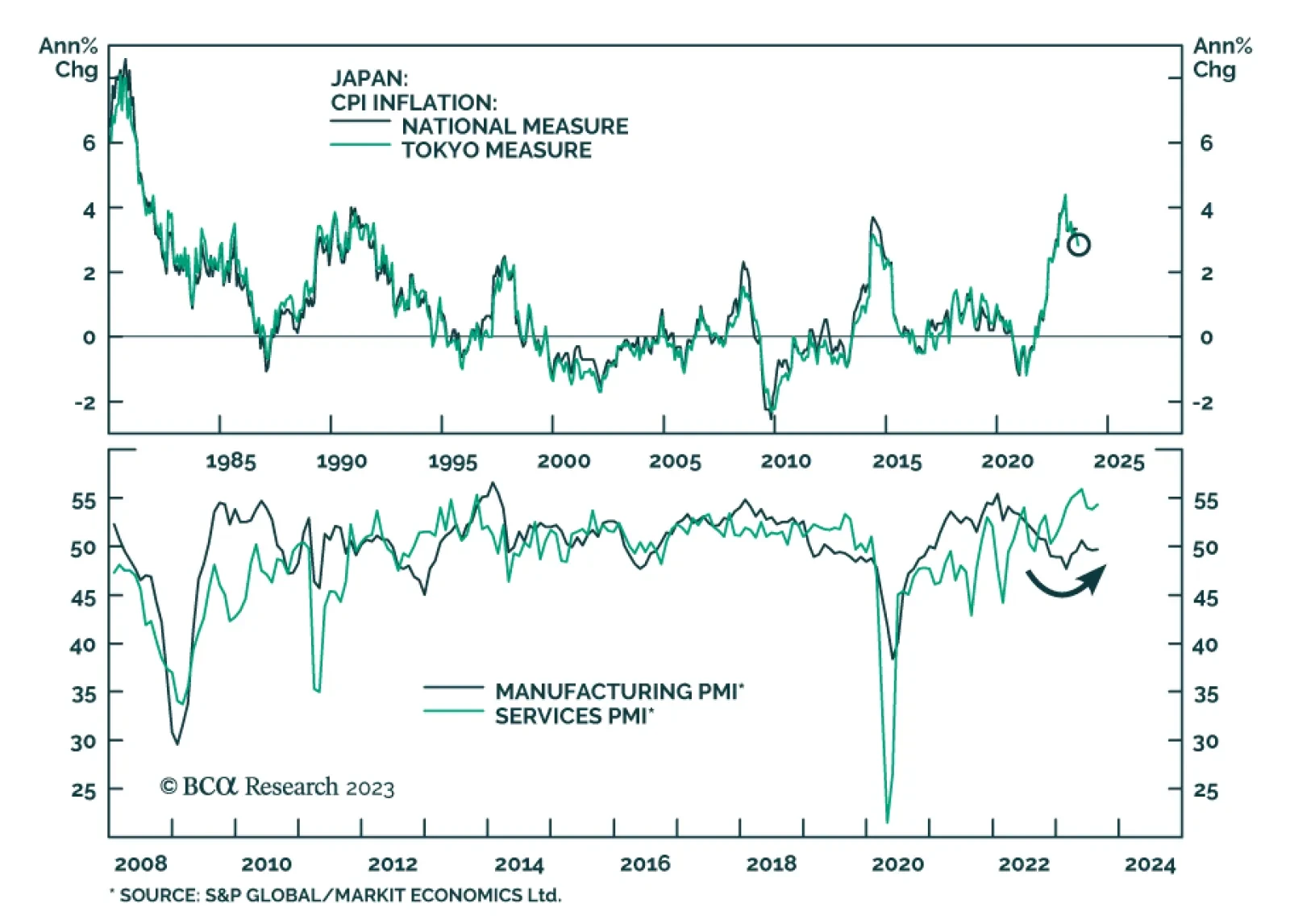

Tokyo’s headline CPI inflation fell below expectations in August, easing from 3.2% y/y to 2.9% y/y – slightly below anticipations of 3.0% y/y and the first dip below 3% in nearly one year. Similarly, the slowdown in…

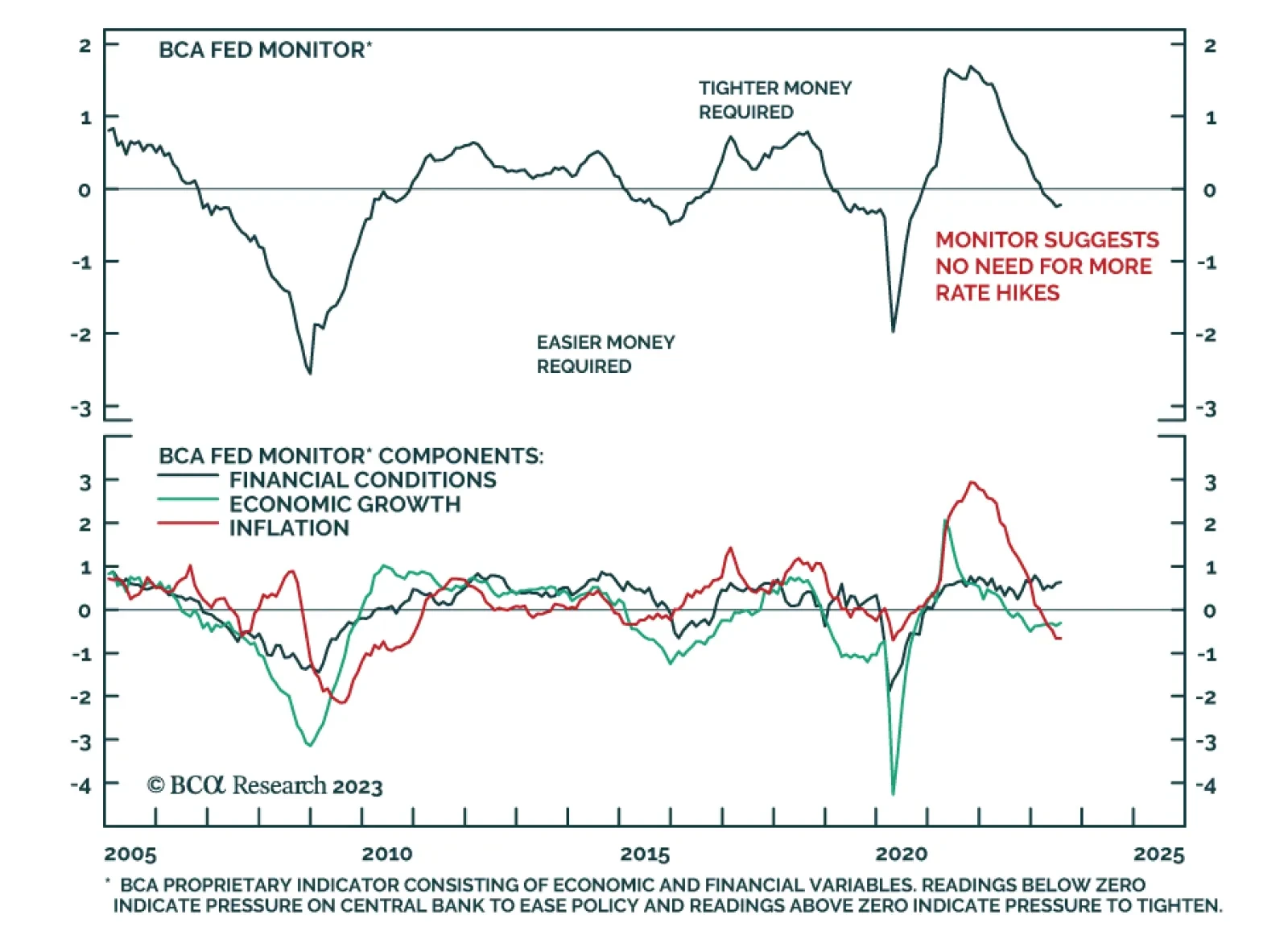

The Treasury market’s reaction to Fed Chair Jermone Powell’s Jackson Hole speech was relatively tame on Friday. Although there was some volatility during the speech, the 10-year yield ended the day broadly unchanged.…