In a Tuesday morning television interview, Fed Governor Christopher Waller signaled that the Fed will not lift rates when it meets later this month. Specifically, Waller echoed language used by Chair Powell at the Jackson Hole…

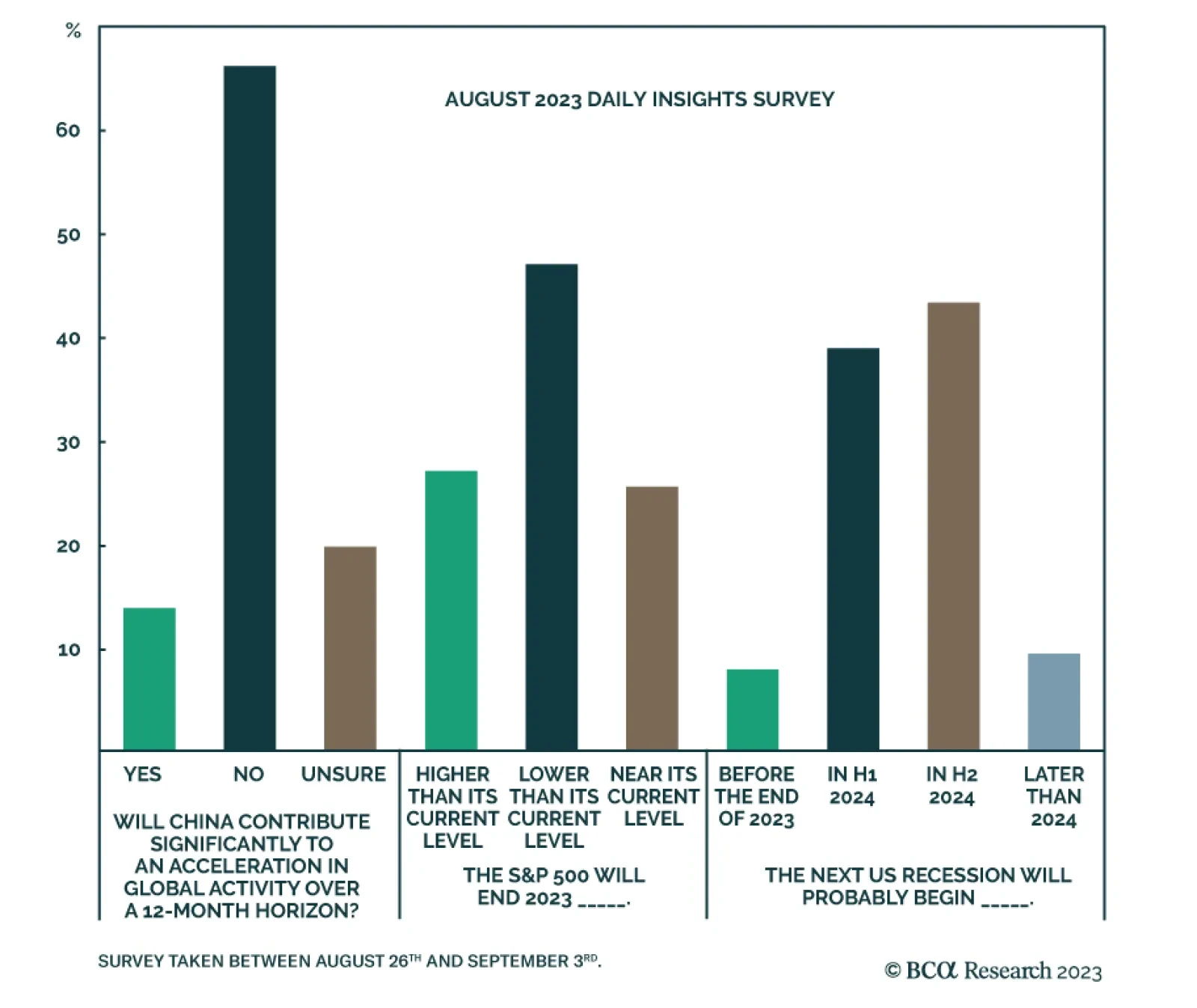

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for the US economy, US stocks, and China’s contribution to global growth. On the outlook for the US economy…

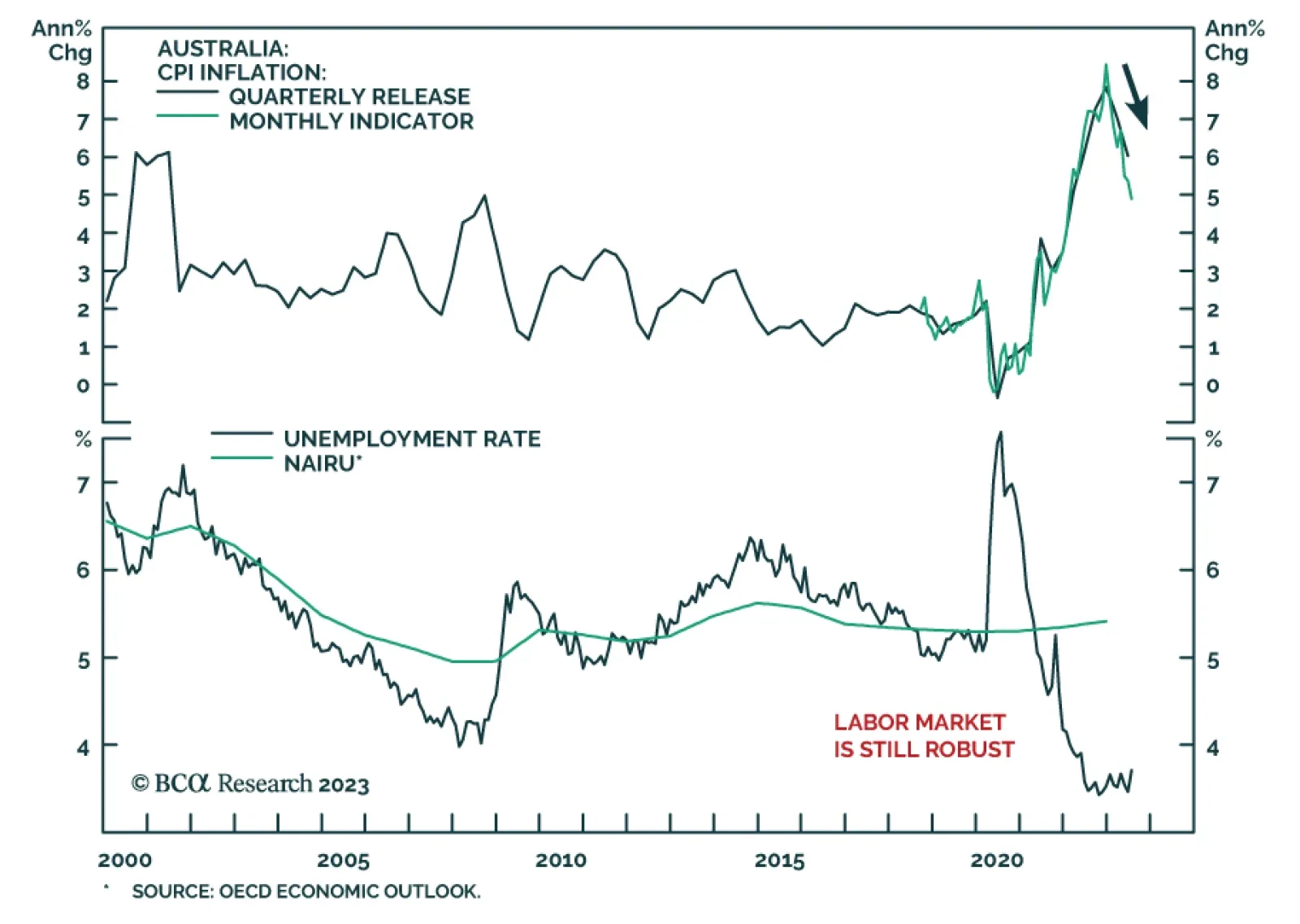

The AUD was the worst performing currency on Tuesday after the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% for the third consecutive month. In particular, outgoing Governor Philip Lowe underscored that…

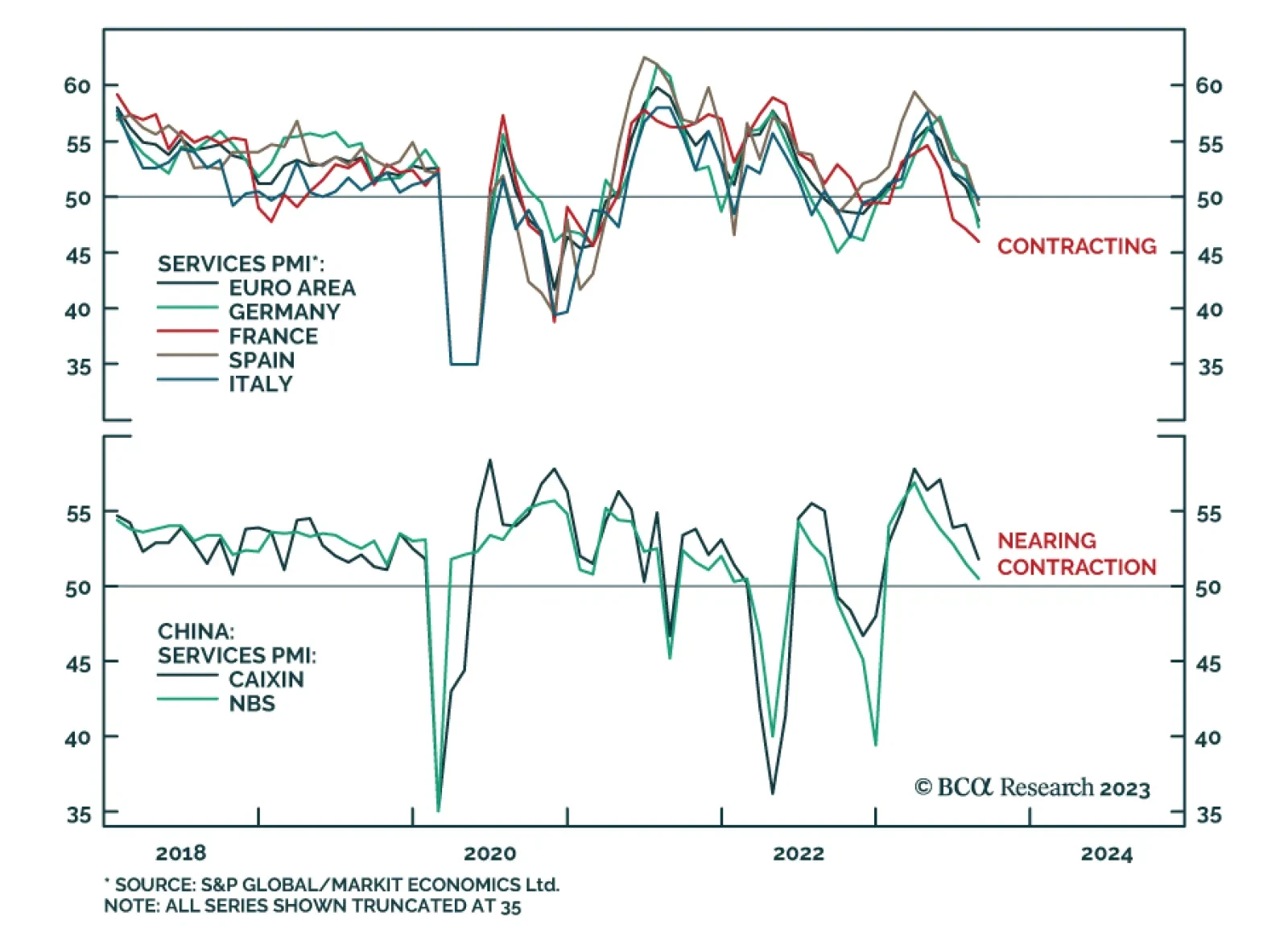

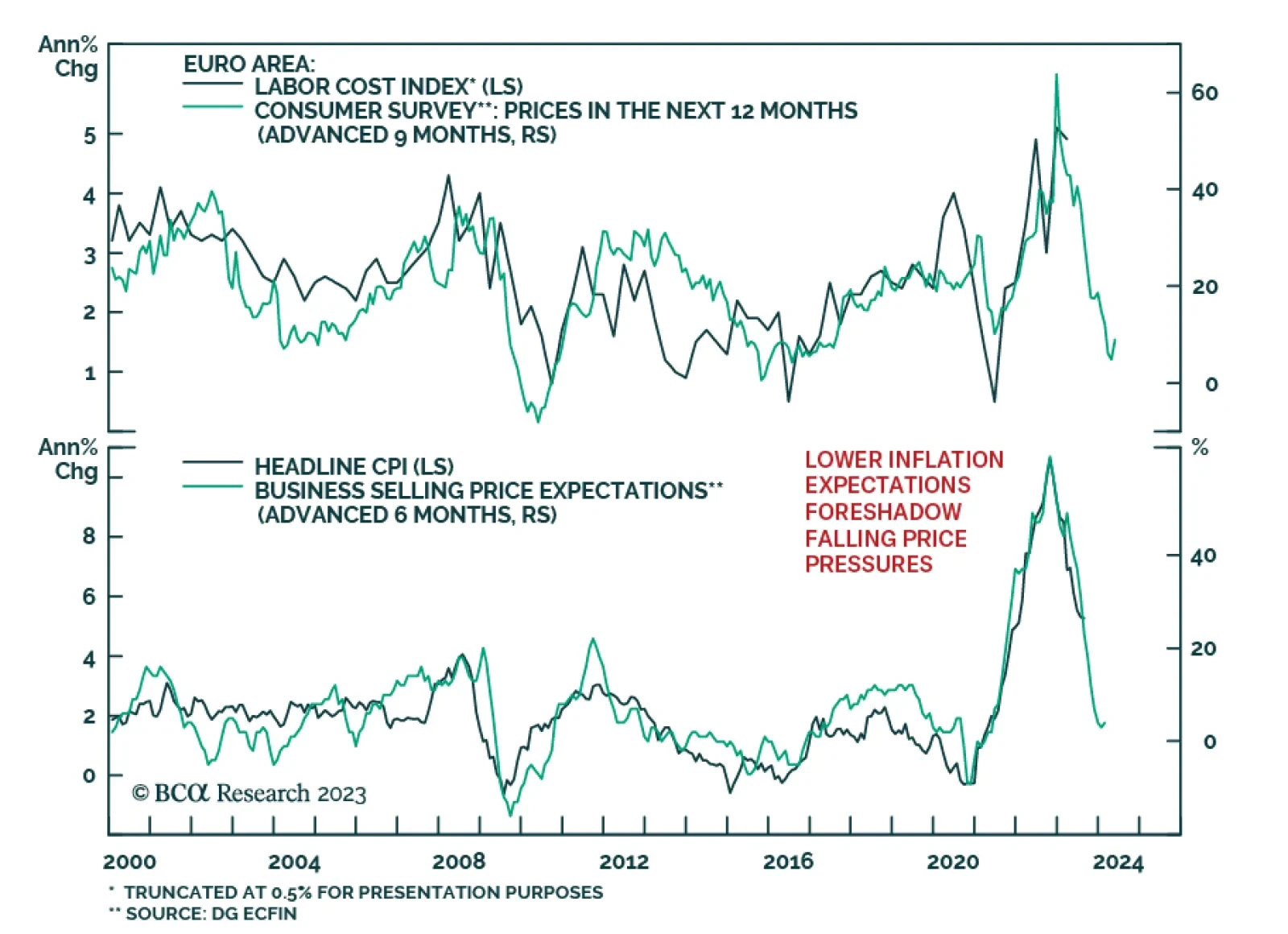

The final PMIs for August delivered a pessimistic update on service sector conditions in the Euro Area and China. The Eurozone services index was unexpectedly revised down from 48.3 to 47.9 – indicating a more pronounced…

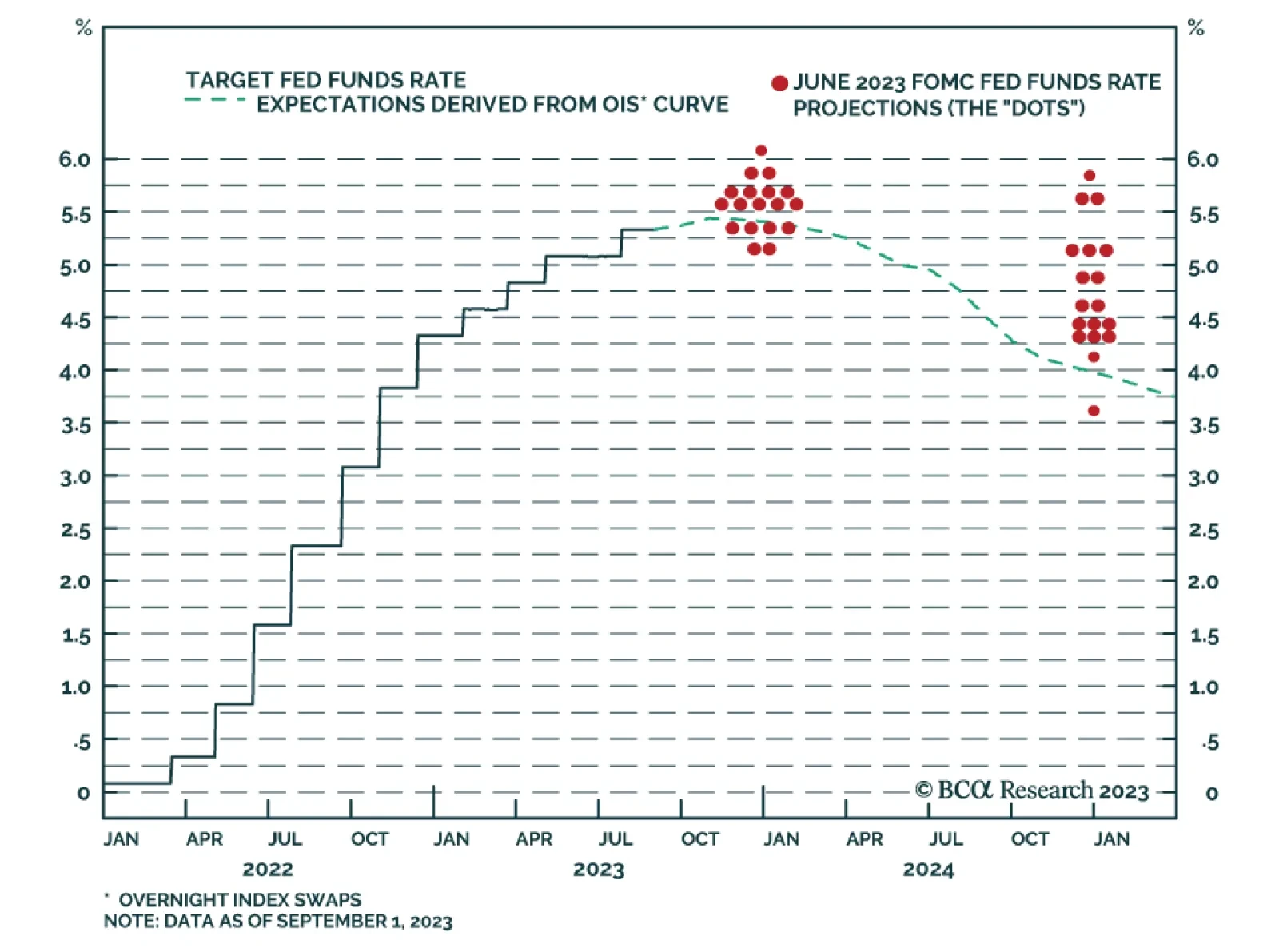

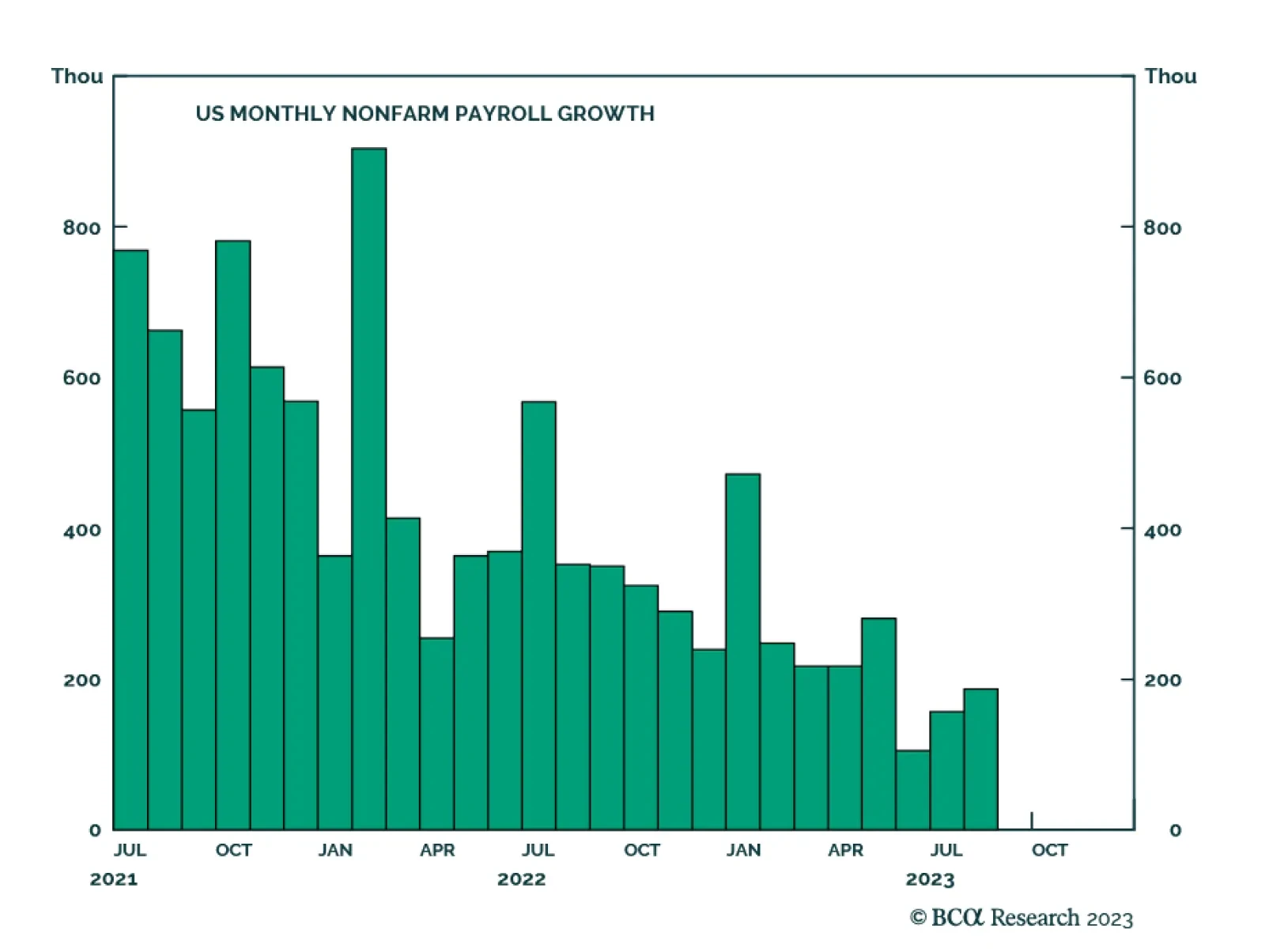

Friday’s US employment report suggests that the softening of the labor market is continuing at a steady pace. Although nonfarm payroll employment in June and July was revised down by 110 thousand, the 187 thousand increase…

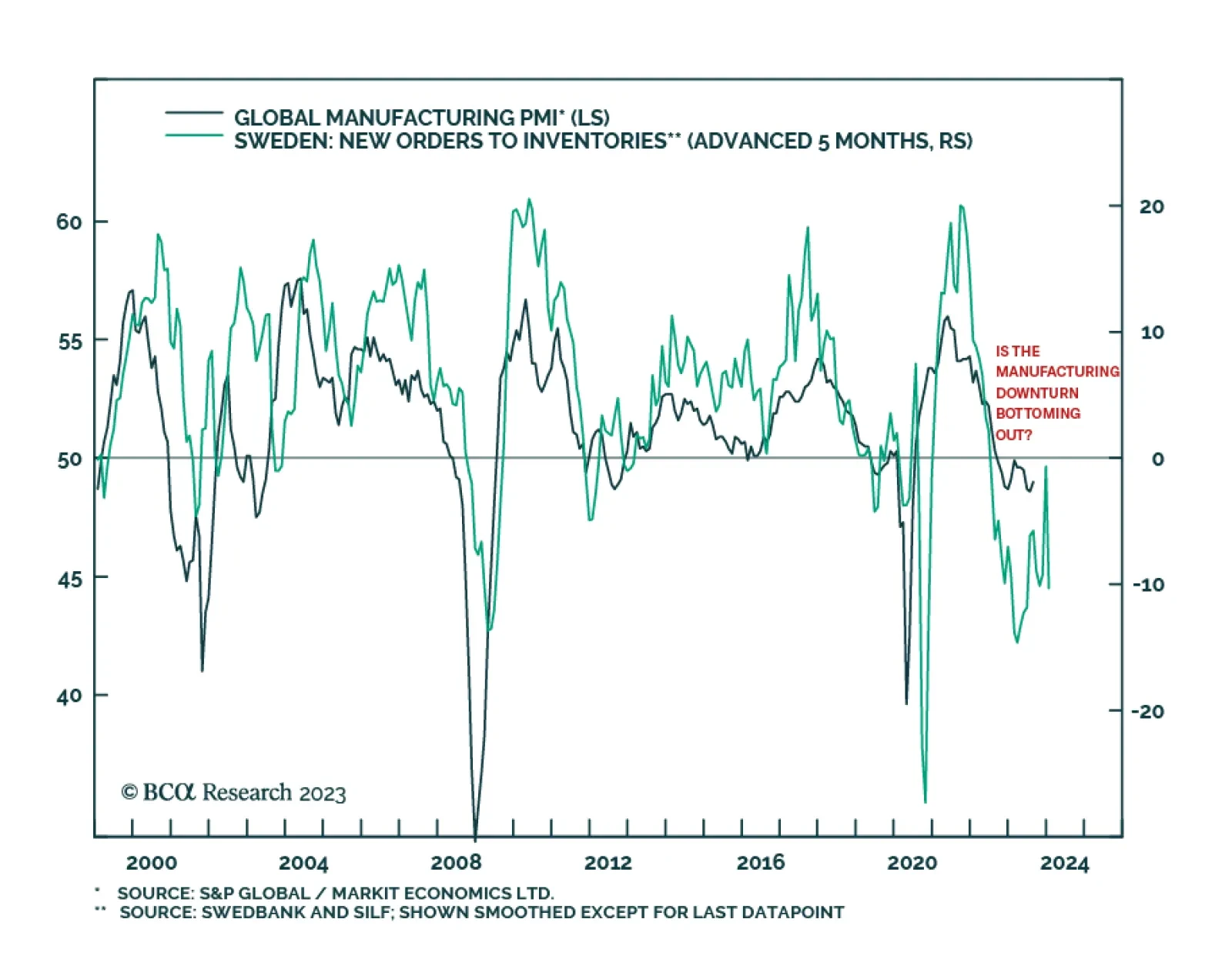

The Global Manufacturing PMI suggests that although the global manufacturing downturn remains intact, the pace of deterioration slowed in August. The headline PMI index ticked up by 0.4 points to 49. In particular, the Output,…

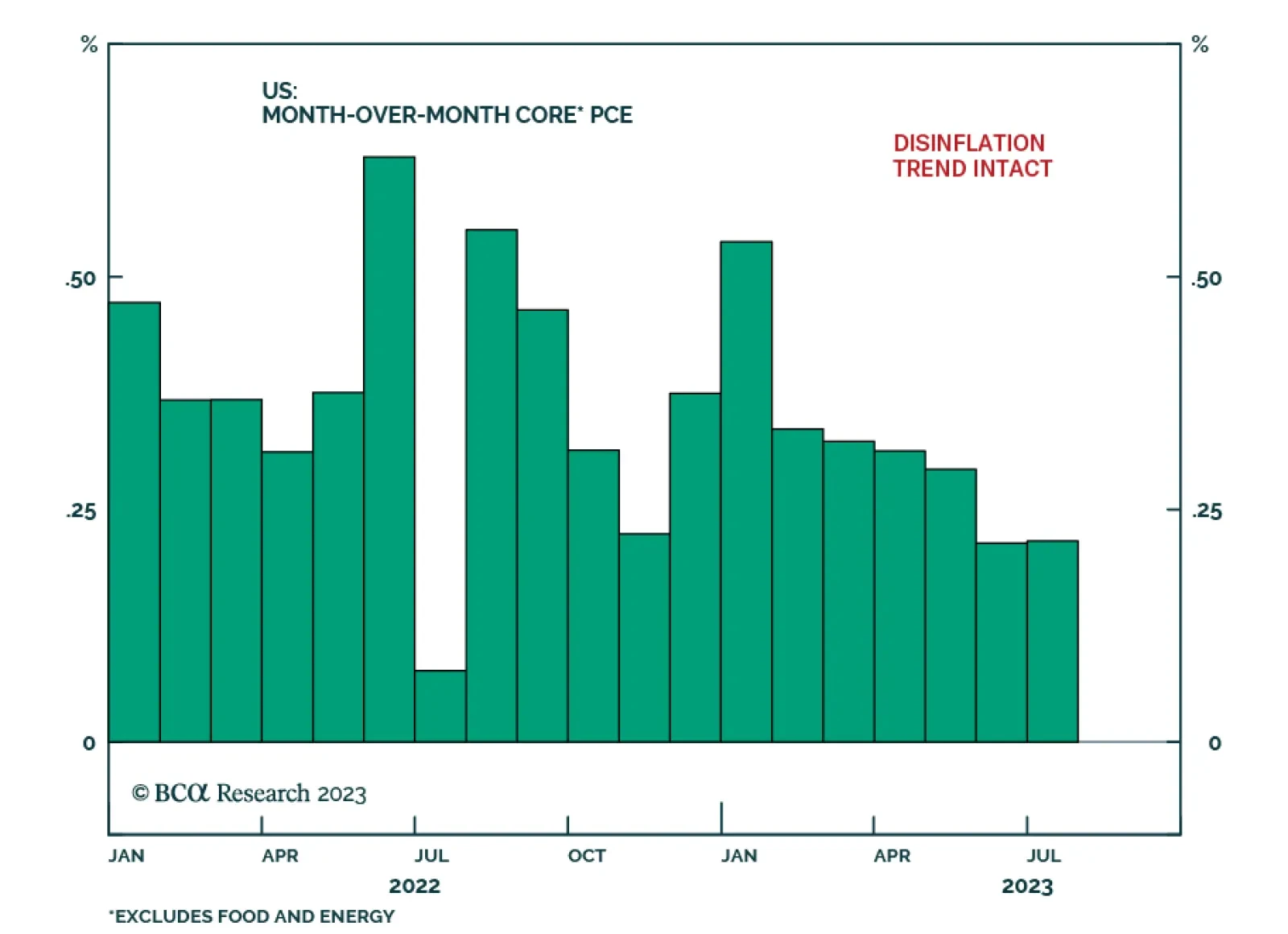

US bond investment takeaways from this week’s PCE and employment releases.

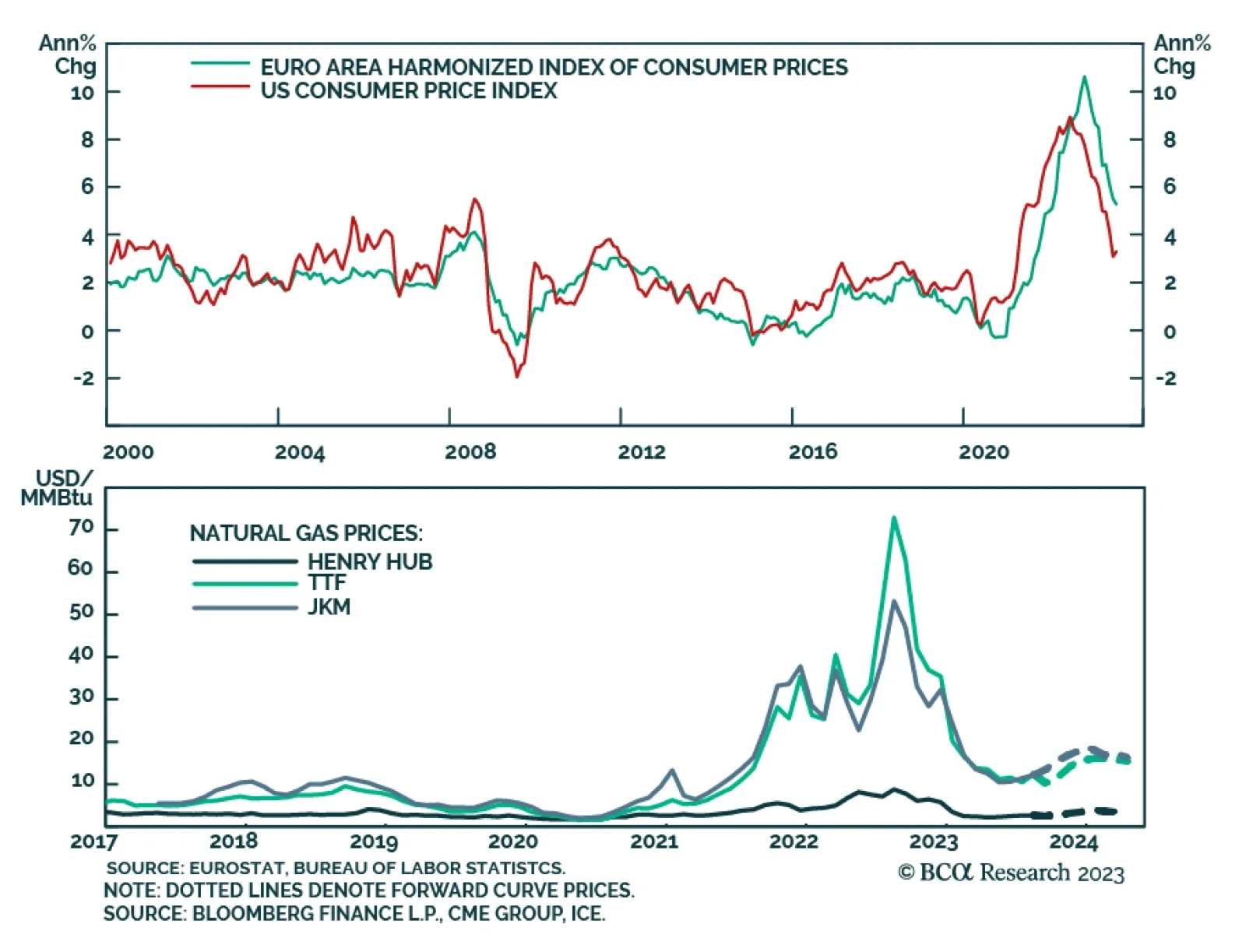

According to BCA Research’s Commodity & Energy Strategy service, current monetary policy settings at the Fed and ECB risk pushing commodity and energy prices lower. Lower prices and higher rates will suppress capex and…

Eurozone headline inflation surprised to the upside in August, confirming the signal from the preliminary German and Spanish releases. The year-on-year gauge was unchanged at 5.3% – surprising expectations of a deceleration…

The US Personal Income and Outlays report shows consumption remained resilient in July. Although personal income growth decelerated from 0.3% m/m to 0.2% m/m, spending accelerated from an upwardly revised 0.6% m/m to 0.8% m/m…