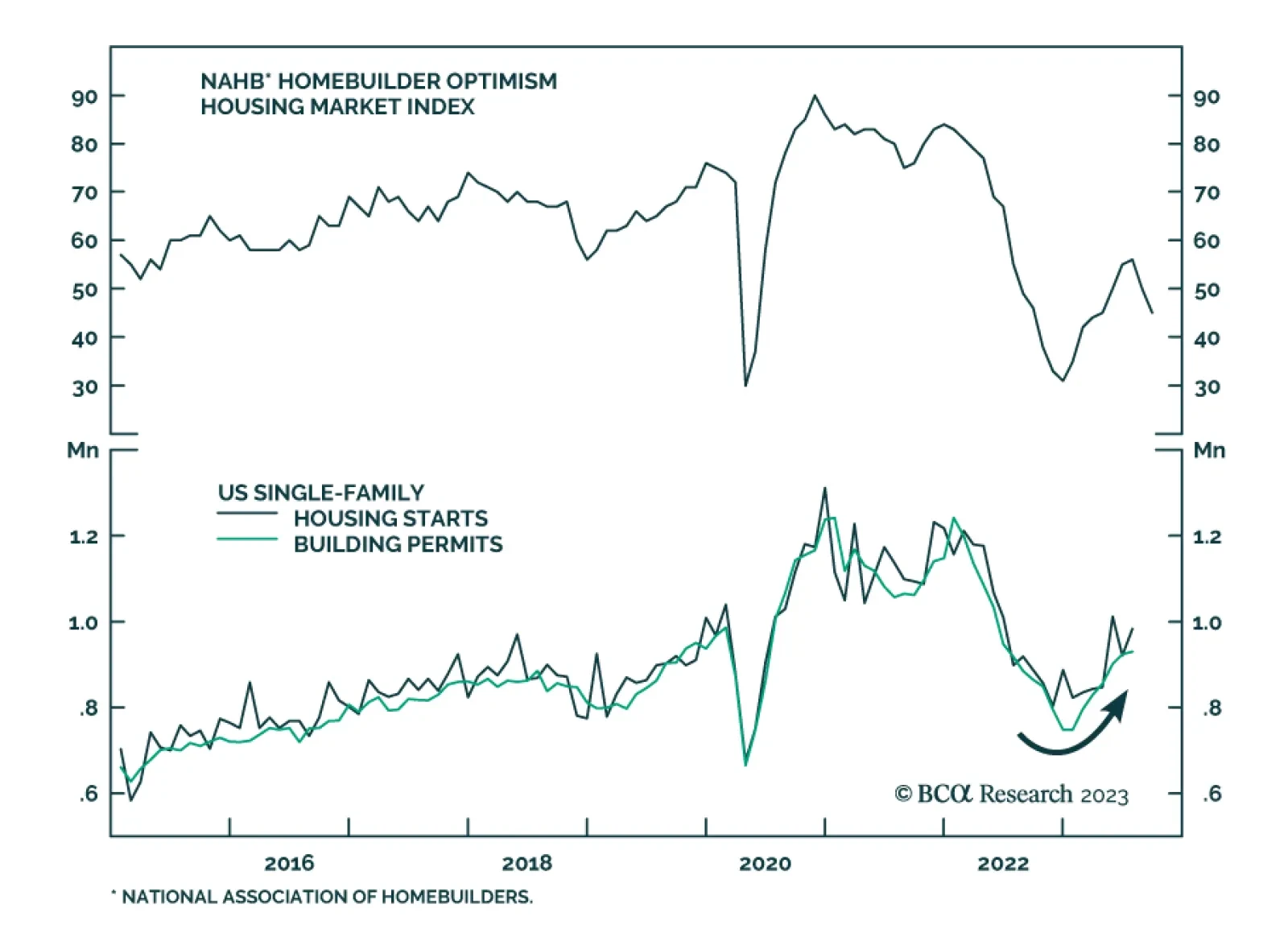

After a steady rebound in the first half of the year, the US NAHB Housing Market Index’s 5-point decline to 45 in September was a disappointment to consensus estimates of a 1-point decrease. It marks the second consecutive…

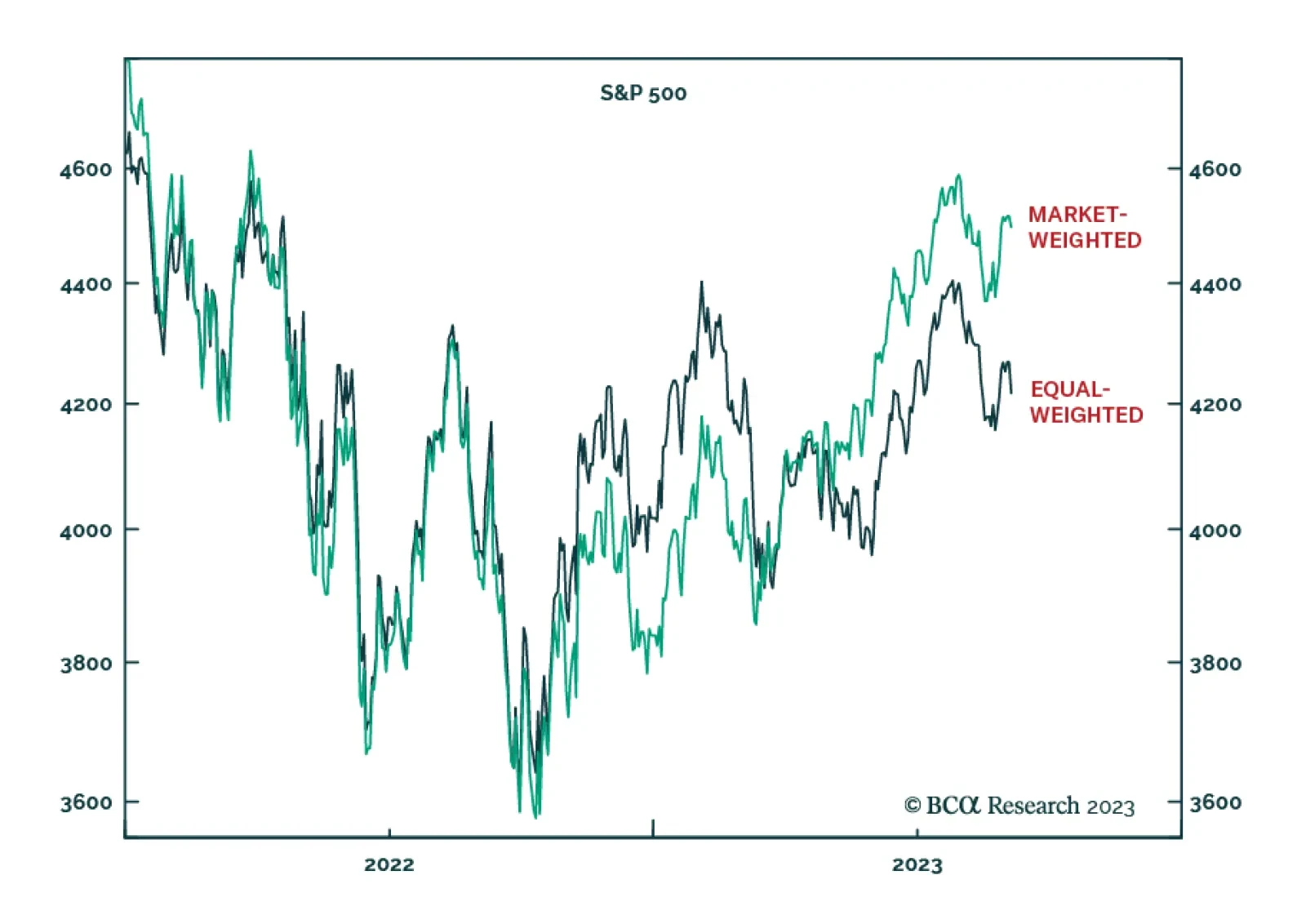

While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…

In this report, we review our European fixed income strategy recommendations ahead of tomorrow’s critical ECB meeting

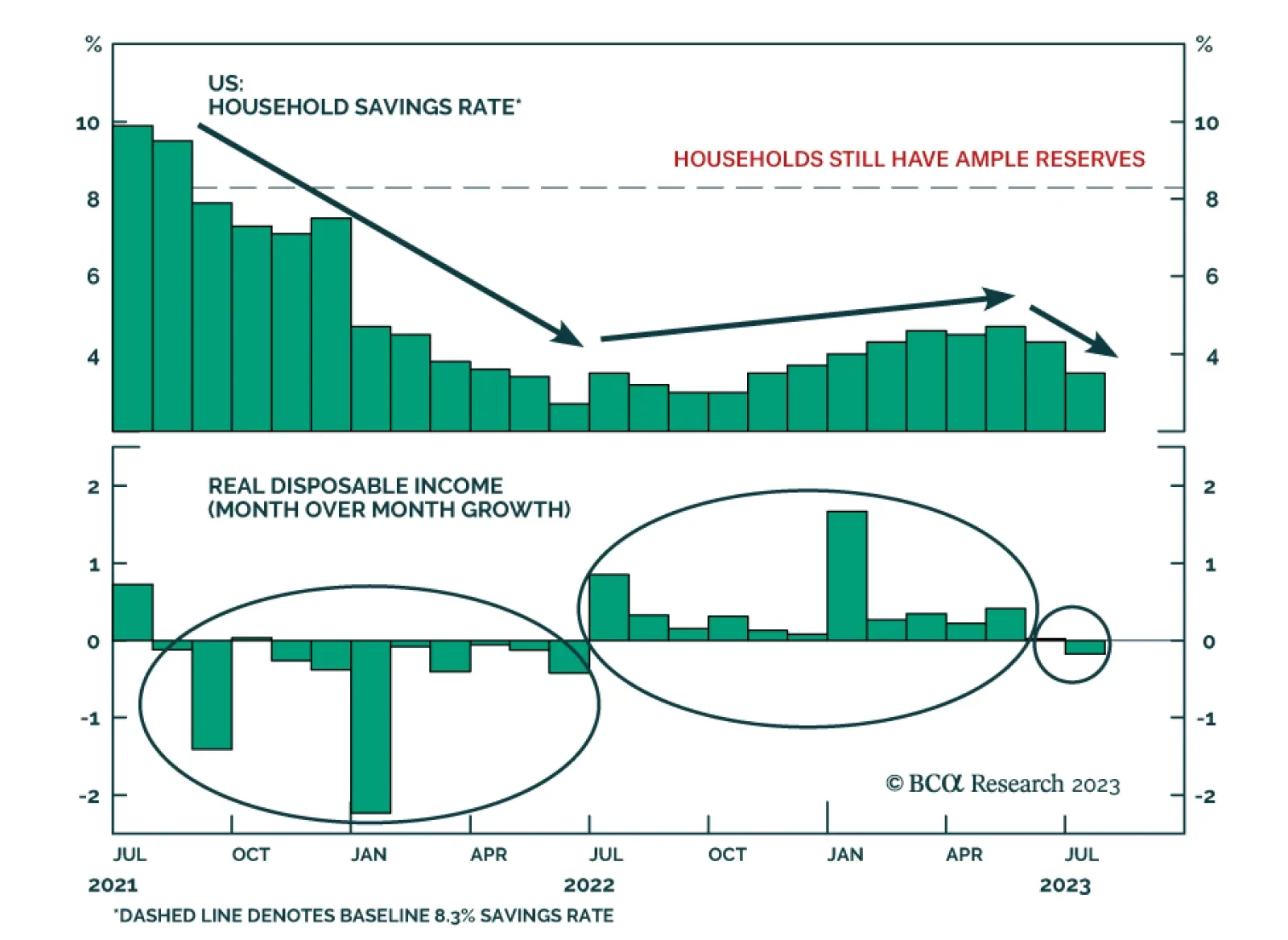

Our colleagues at BCA’s US Investment Strategy service have been excess savings bulls since cash began silting up on household balance sheets as transfer payments flowed from the Capitol to Main Street while High Street…

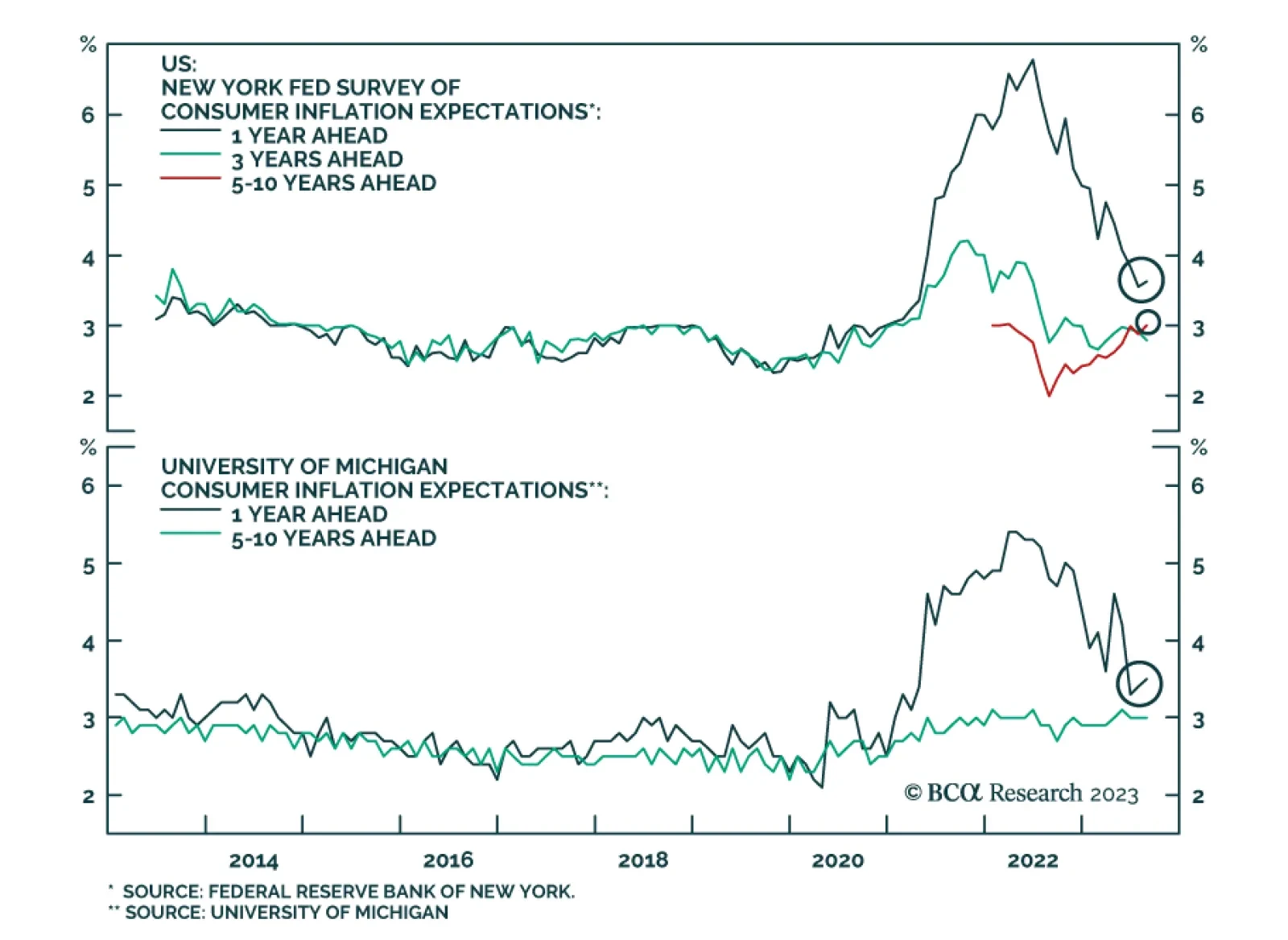

The New York Fed’s latest consumer expectations survey shows household sentiment deteriorated in August. Job loss expectations jumped, with the average perceived likelihood of losing one’s job over the coming year…

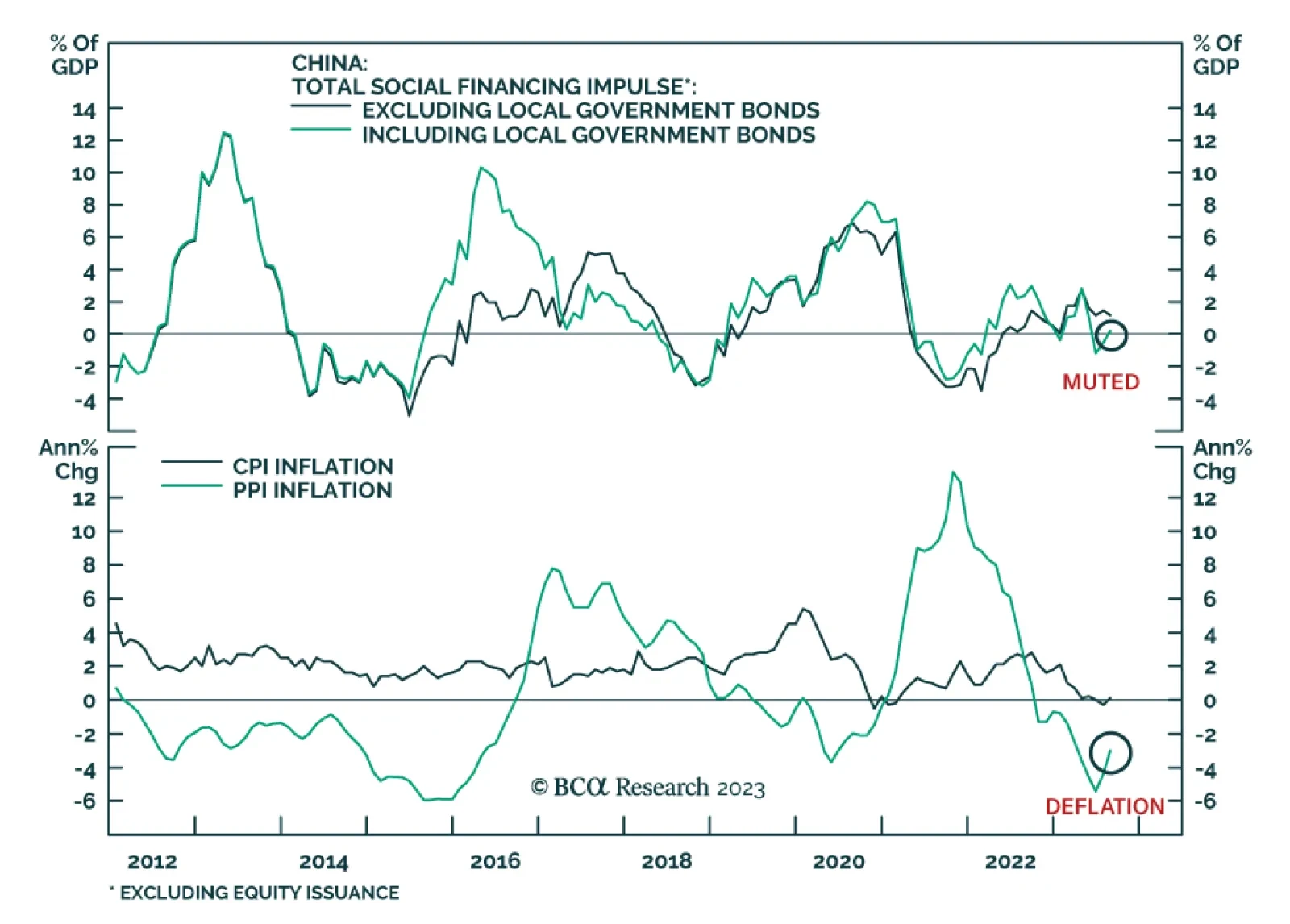

Recent Chinese economic data show some signs of stabilization. China’s credit expansion surprised to the upside in August. Aggregate social financing totaled CNY3.12 trillion – above expectations of CNY2.69…

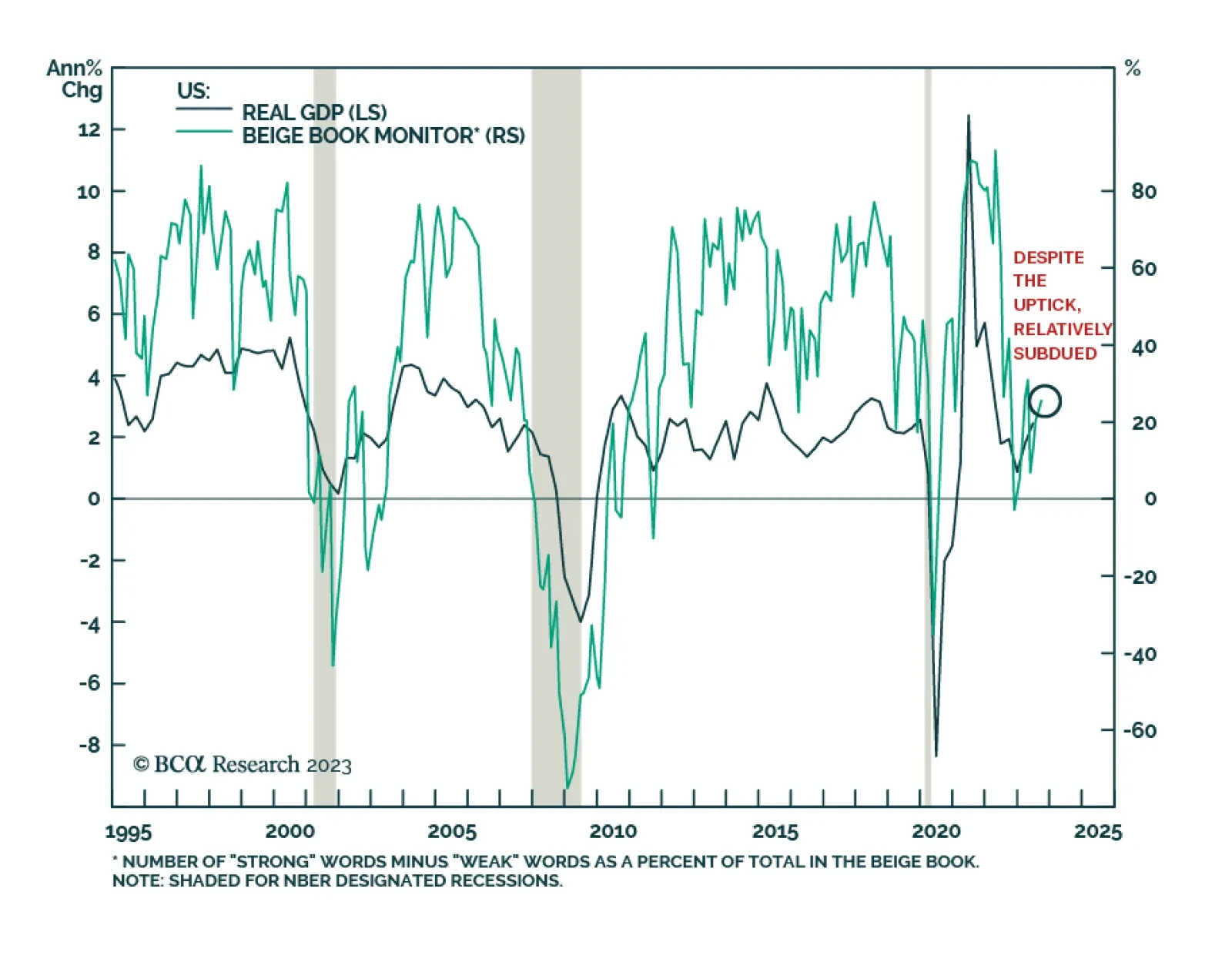

Overall, the Fed’s latest Beige Book provided a pessimistic assessment of the US economy. Although the report characterized tourism spending as “stronger than expected,” it also noted that pent-up demand for…

According to BCA Research’s Counterpoint service, Goldilocks is just a fairy tale. In the near-term, this will be negative for stocks, neutral for bonds, and positive for the dollar. The Fed can win the war against…

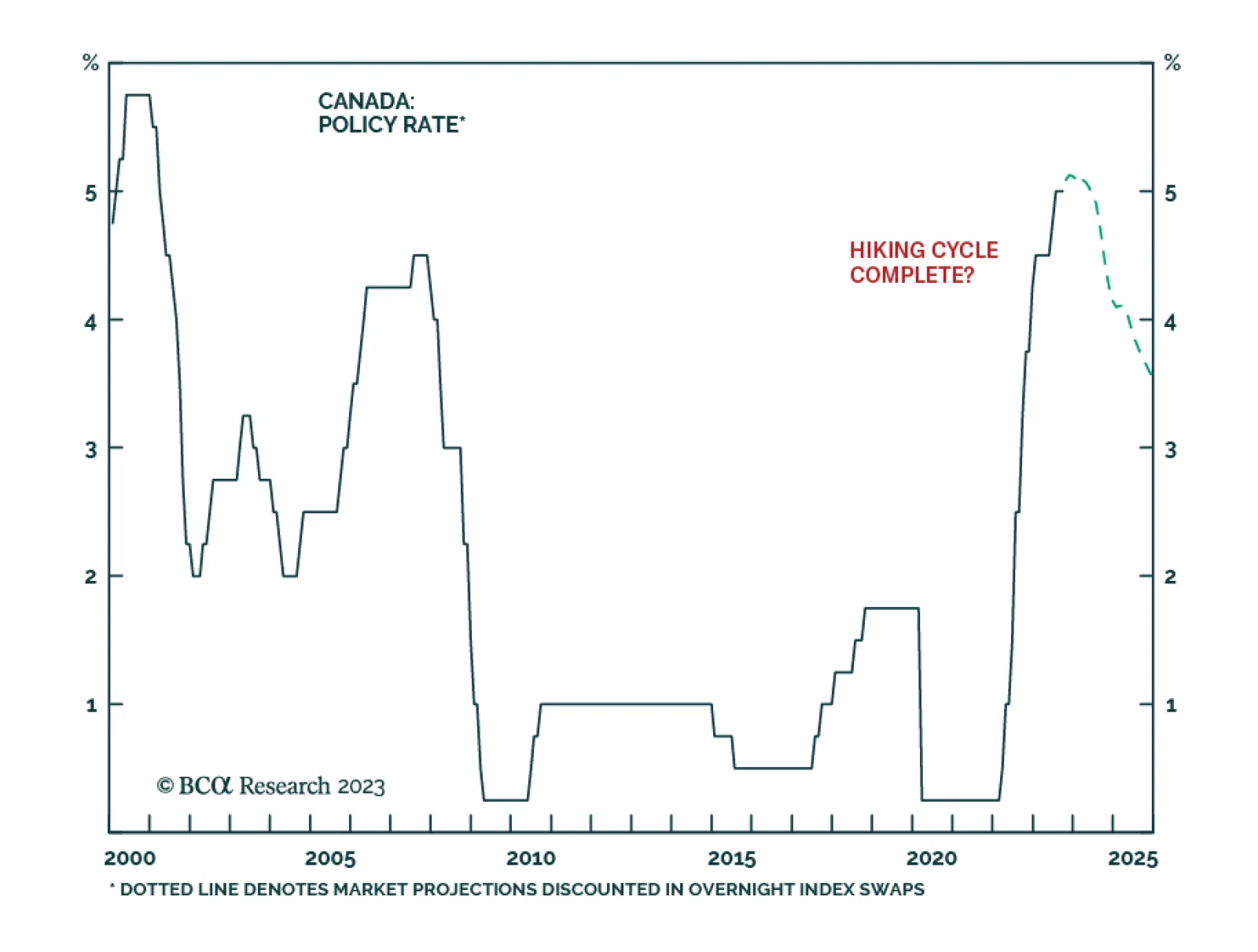

As expected, the Bank of Canada kept its policy rate unchanged at 5% on Wednesday. In particular, the central bank highlighted that domestic economic growth deteriorated. Indeed, last week’s GDP release showed the…

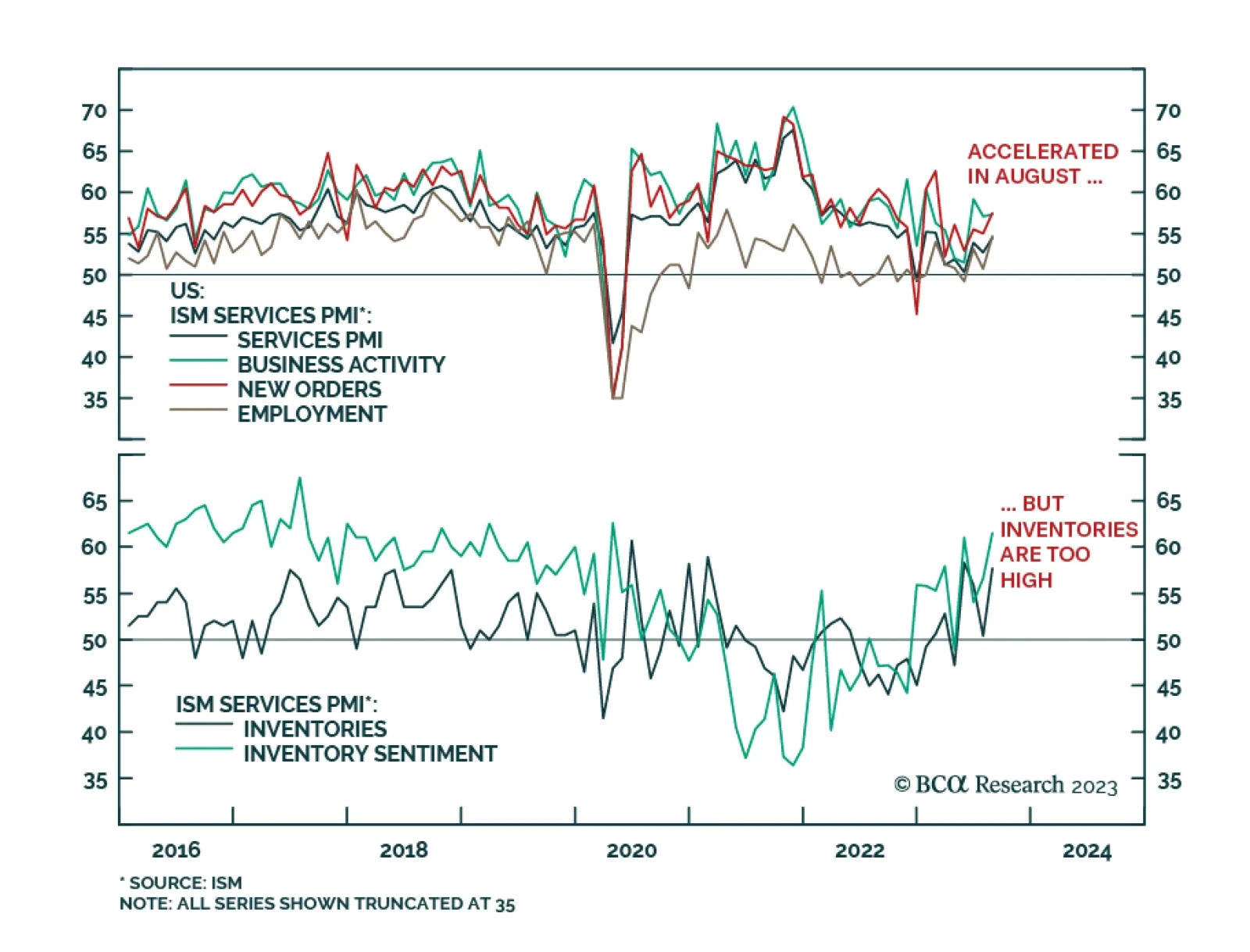

The US ISM delivered a positive signal about service sector activity in August. The headline index unexpectedly jumped by 1.8 points to a six-month high of 54.5, surprising expectations of a 0.2-point decline to 52.5. Importantly…