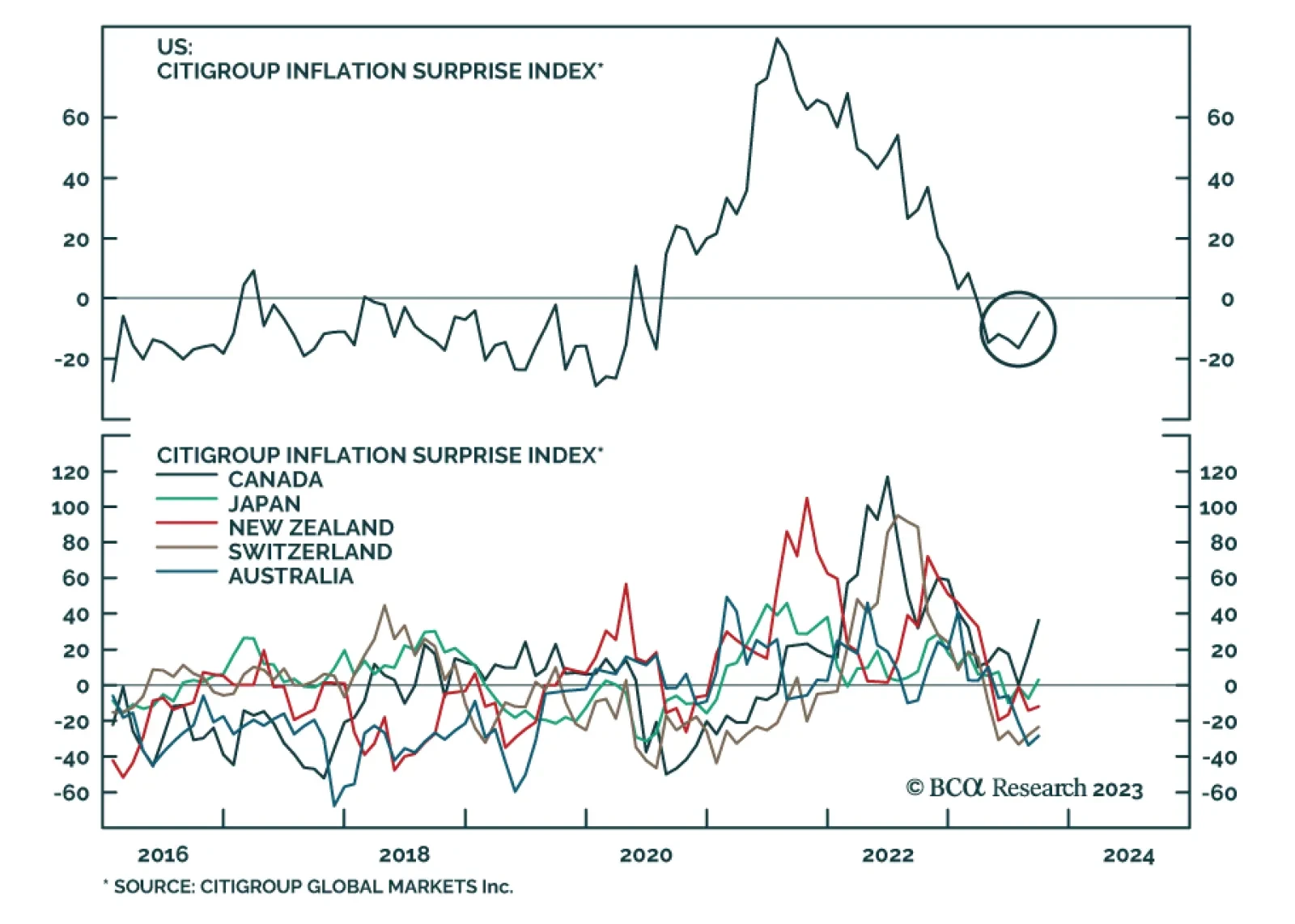

The Citi US Inflation Surprise Index has risen over the past two months after having bottomed at a three-year low in July. The good news is that the level of the index remains negative after having first fallen below zero in…

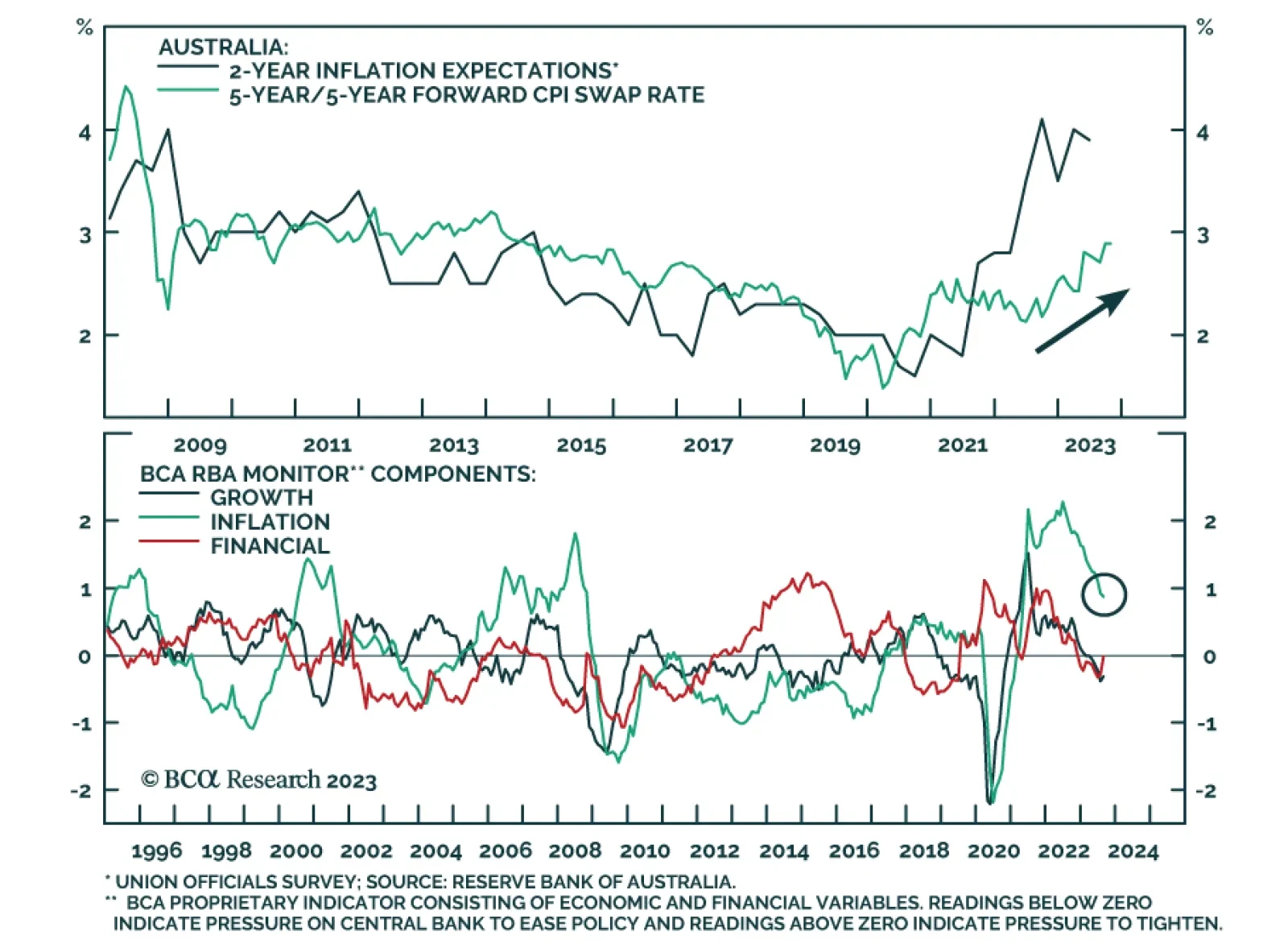

The Australian dollar was among the worst performing major currencies on Tuesday after the Reserve Bank of Australia held the cash rate at 4.1% for the fourth consecutive month. In her post meeting statement, newly appointed…

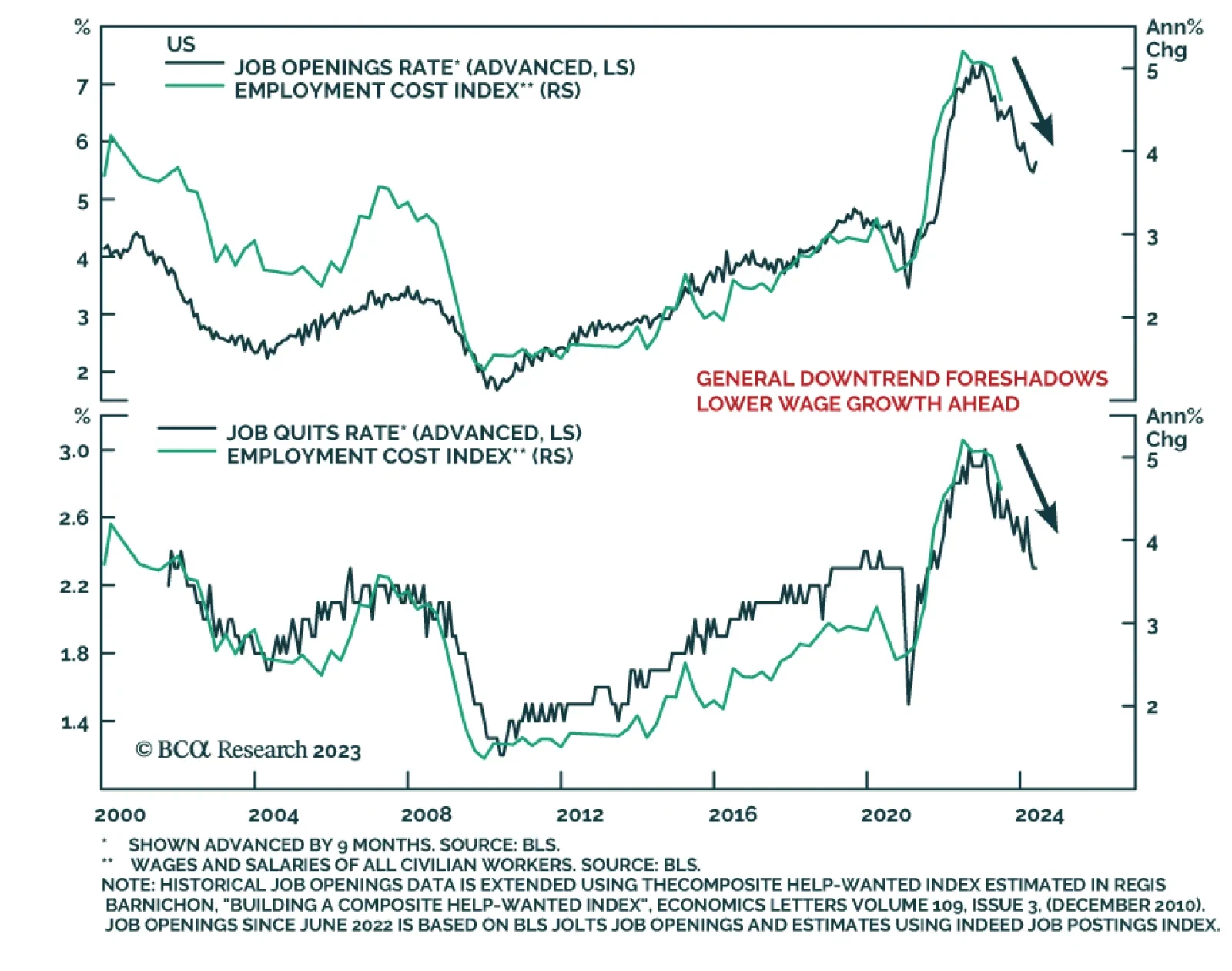

The US JOLTS report sent a chill through financial markets on Tuesday. The bigger-than-expected number of job openings in August fueled investors’ concern that the Fed will be forced to maintain a hawkish stance for longer…

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ outlook for oil prices, Fed policy, and the global economy. On the outlook for crude oil, a larger share of respondents…

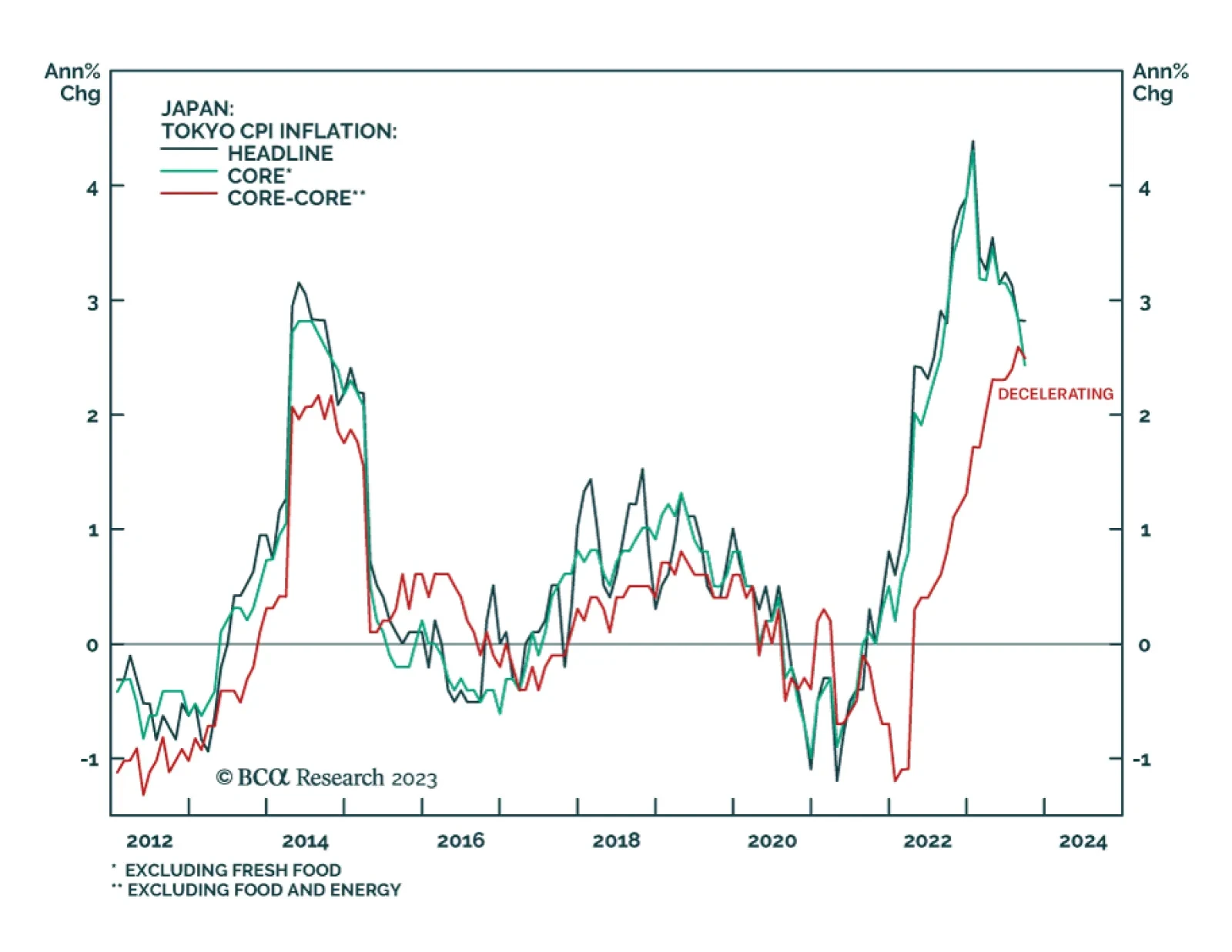

The BoJ remains an outlier among global DM central banks. While many of its peers are now debating whether to end their rate tightening cycles, the Japanese central bank has not even started raising interest rates yet.…

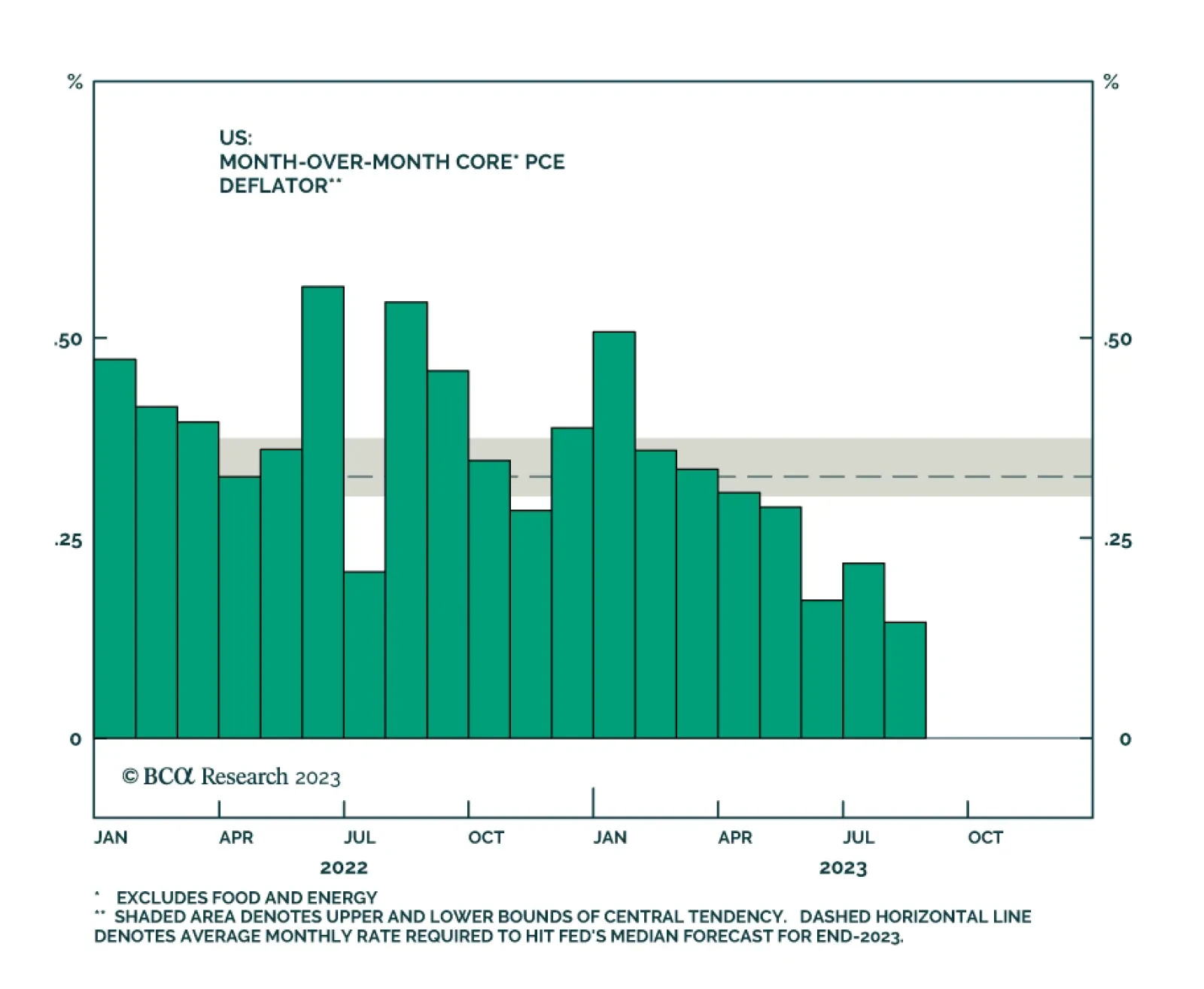

The US Personal Income and Outlays report for August sent a positive signal about the disinflationary trend. The core PCE deflator – the Fed’s preferred inflation gauge – slowed to a 33-month low of 0.1% m/m…

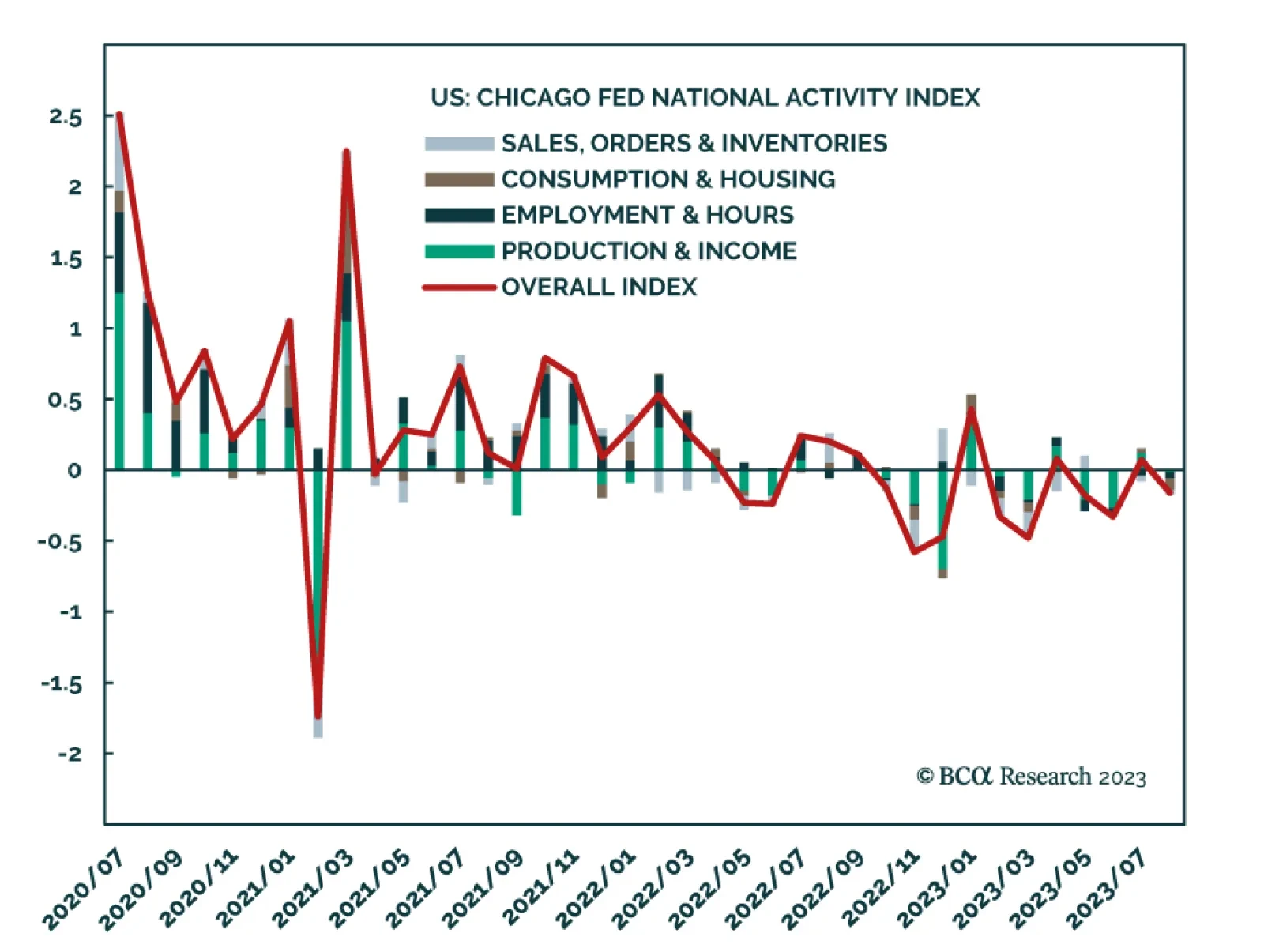

In a recent Insight we highlighted that the GDP tracking indicators produced by regional Fed banks are sending different signals about economic conditions in the US. While the Atlanta Fed’s GDPNow model suggests Q3 growth…

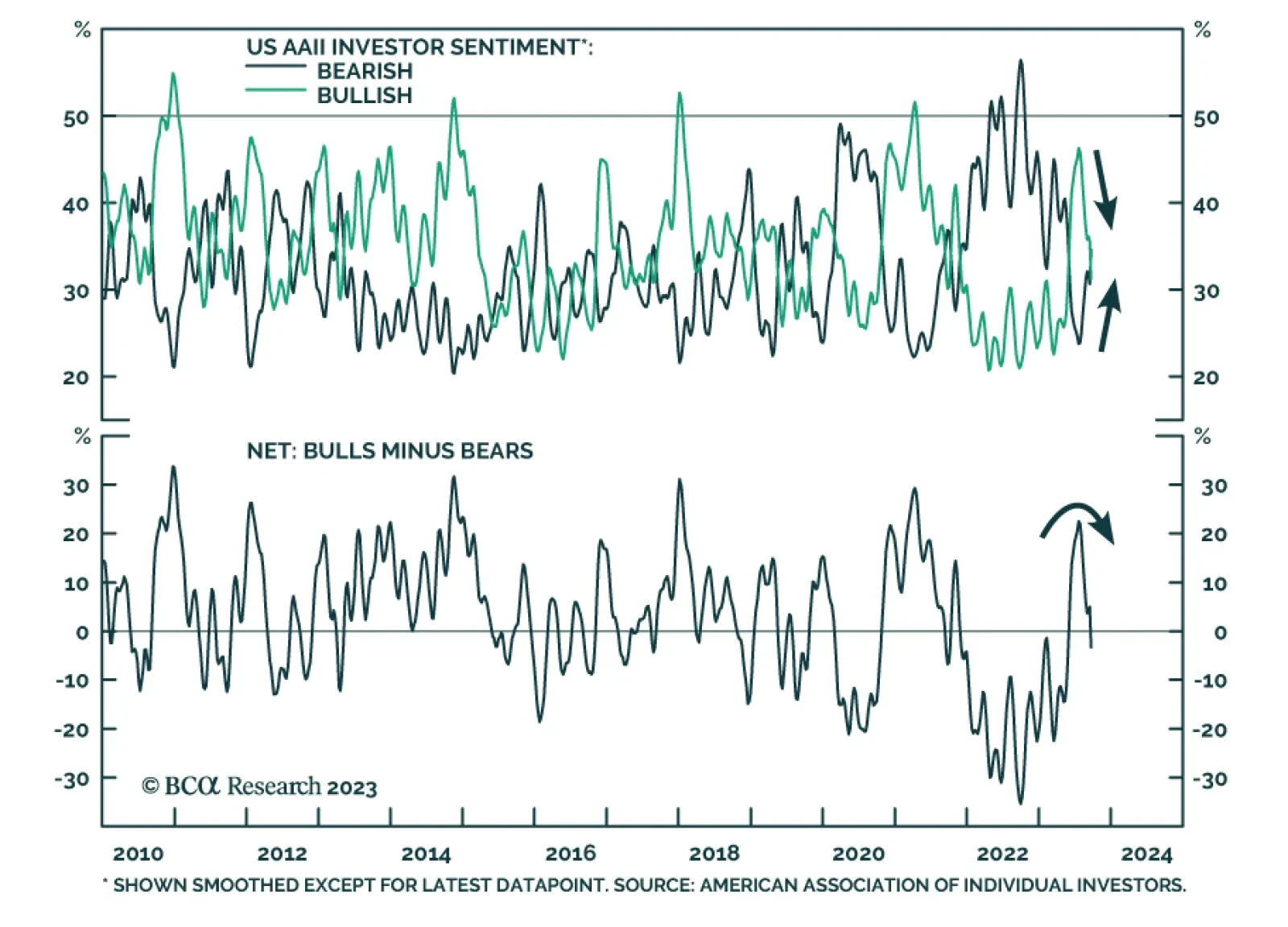

Investor sentiment has turned less optimistic. According to the latest AAII survey, the share of respondents with a bullish outlook has collapsed to 31.3% from its peak of 51.4% two months ago. It is now back down below its…

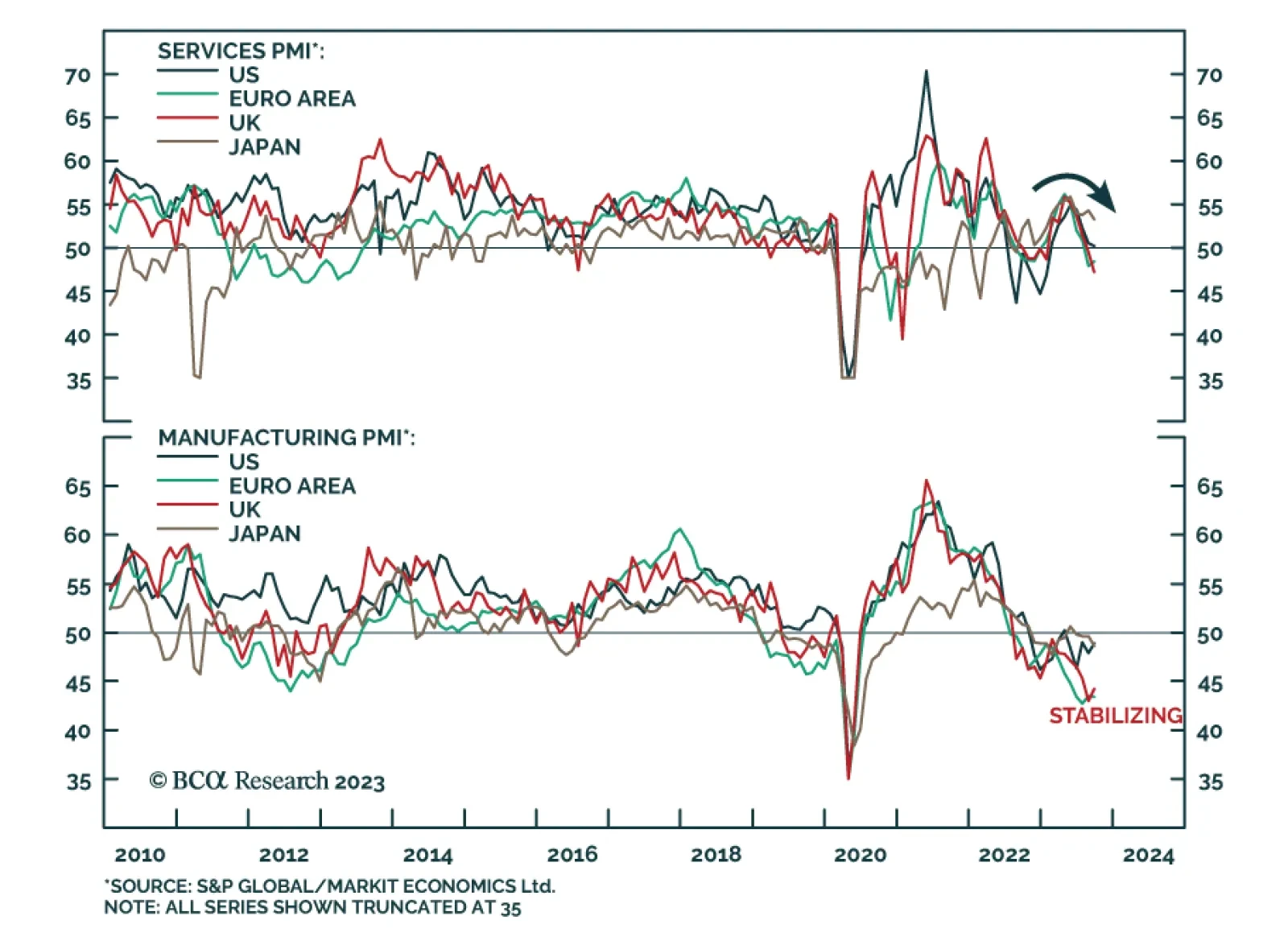

Flash PMIs suggests that the tailwind to services from pent-up demand during the pandemic is easing and that although the global manufacturing downturn is bottoming, it is not meaningfully reaccelerating. In the case of the US…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.