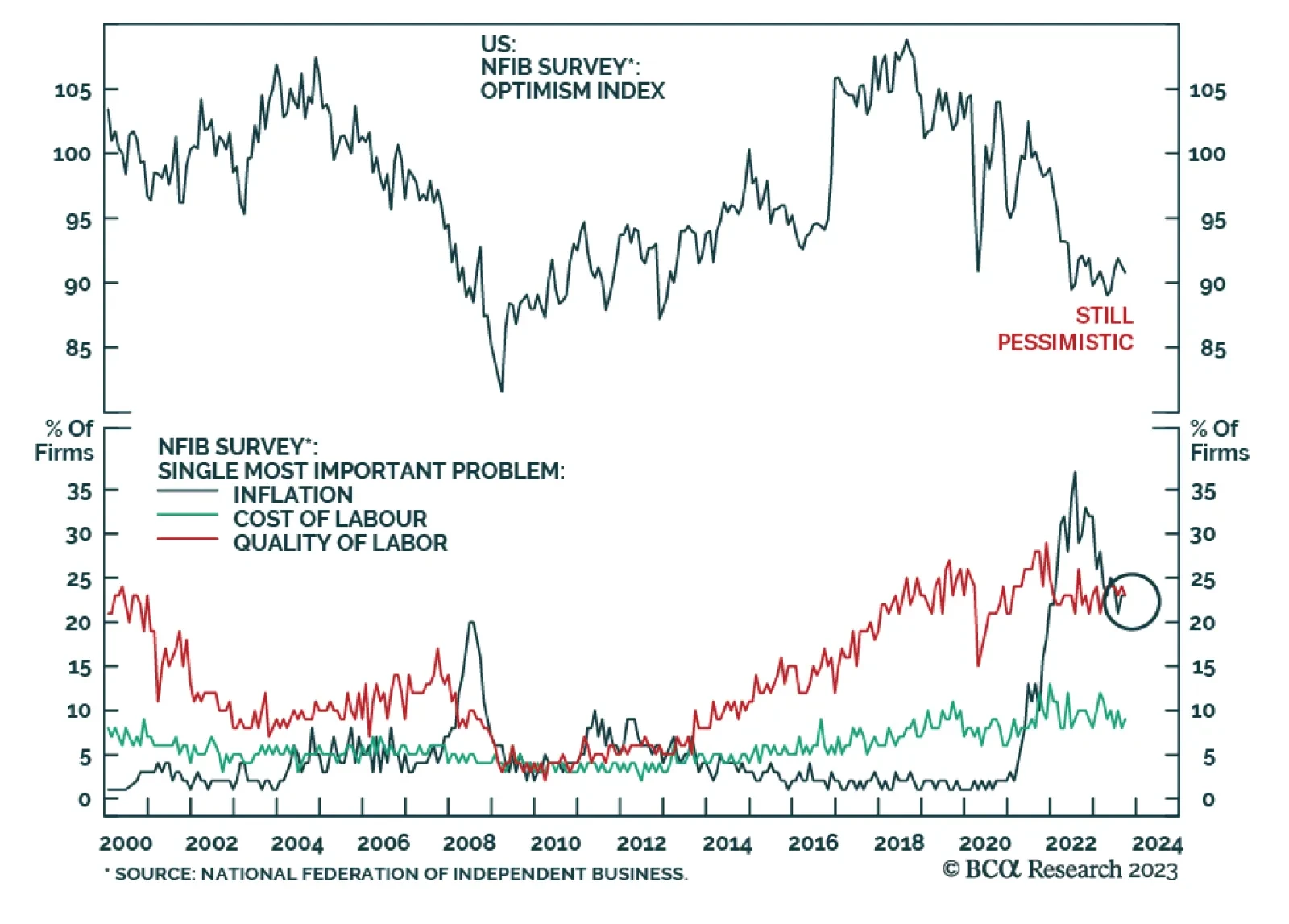

US small business optimism deteriorated for the second consecutive month in September. The NFIB index weakened by 0.5 points to 90.8, slightly below expectations of a more muted decline to 91.0. The latest move brings the index…

Households’ excess pandemic savings will eventually run out, but we continue to disagree with the widespread view that they’re already gone or entirely in the hands of the wealthy. Consumers’ demise continues to be greatly…

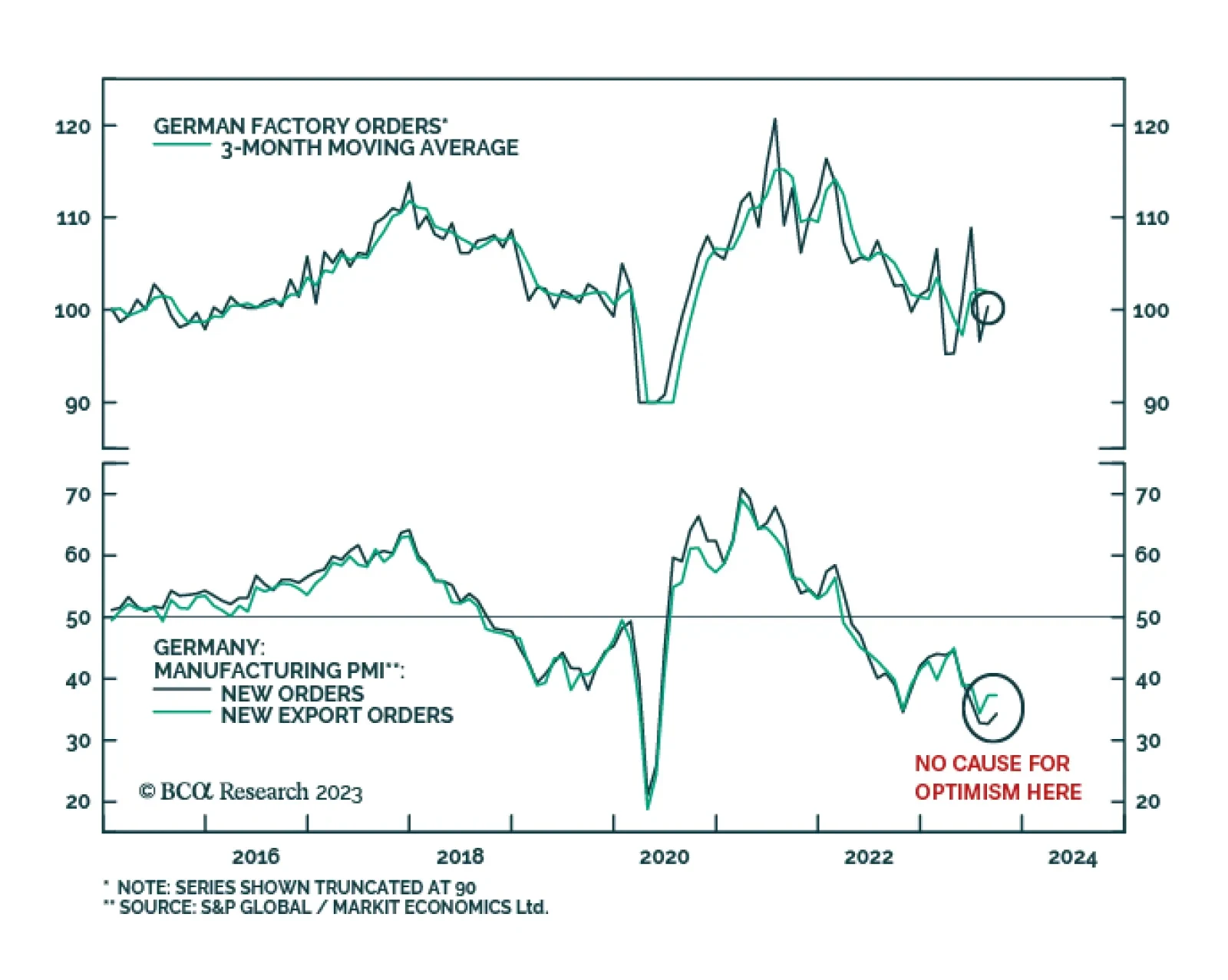

August brought some respite for German factories struggling with poor demand this year. After falling by 11.3% m/m in the prior month, German factory orders rebounded by 3.9% m/m in August – beating expectations of a 1.5% m…

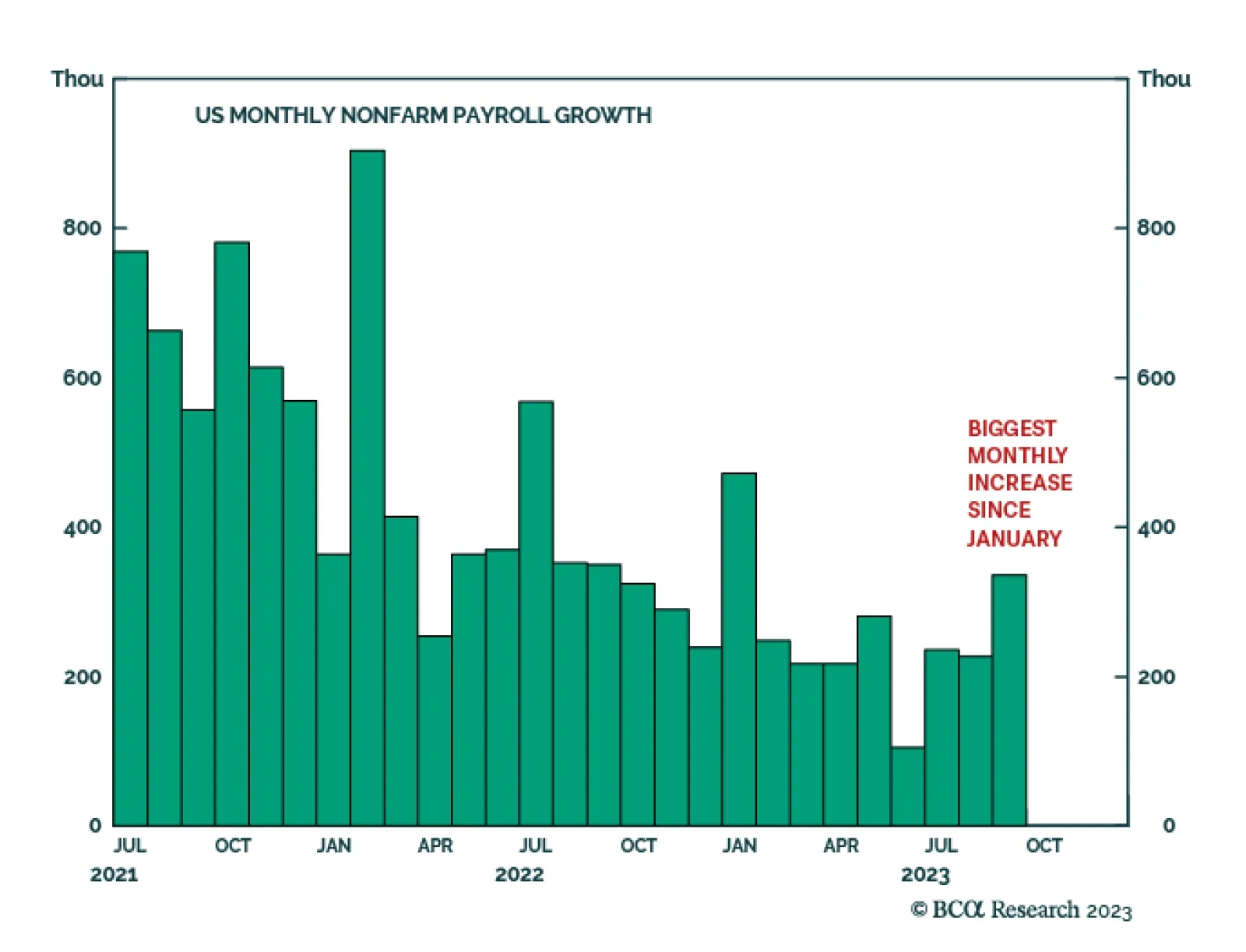

The US Nonfarm Payroll report delivered a strong positive surprise about employment growth in September. Job gains accelerated from 187 thousand to 336 thousand – significantly above expectations of a slight decline to 170…

The Fed’s ‘Sahm rule’ real-time recession indicator signals a US recession when the three-month moving average of the unemployment rate rises by 0.50 percent from its low during the previous 12 months. But…

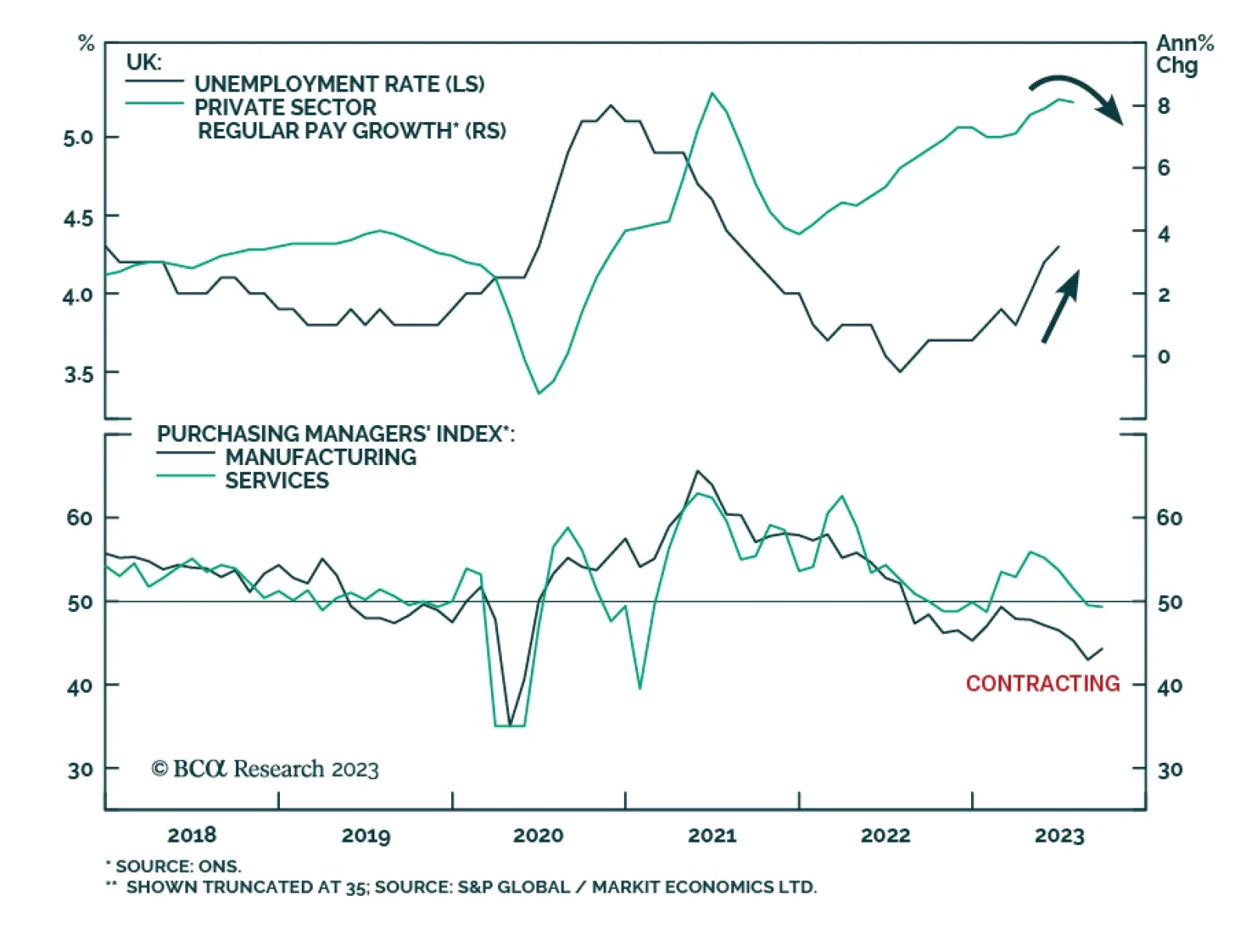

The results of the Bank of England’s latest monthly Decision Maker Panel survey reduces pressure on policymakers to tighten further. Business expectations regarding output price inflation over the coming year fell from 5…

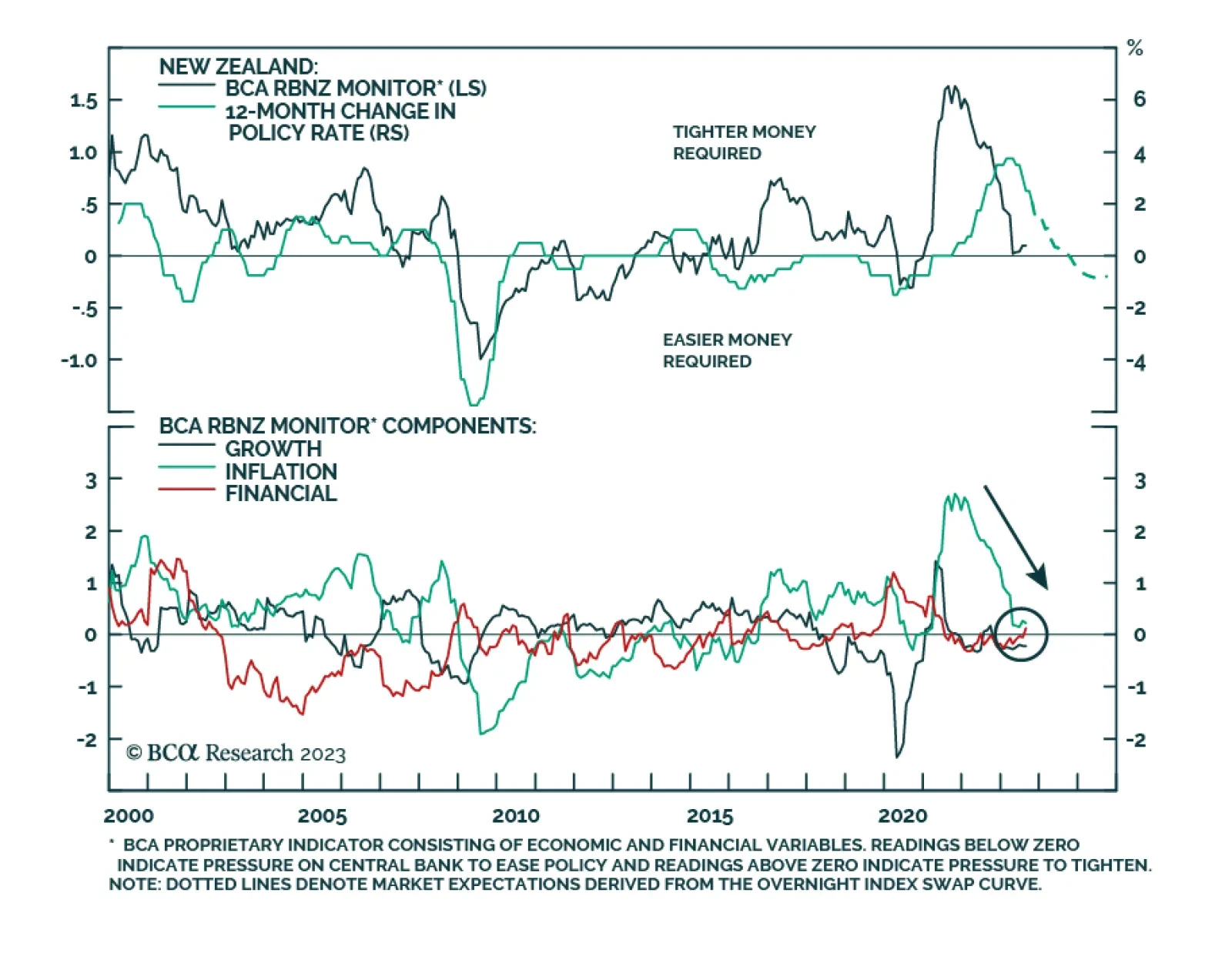

As expected, the Reserve Bank of New Zealand held the official cash rate at 5.5% on Wednesday, keeping policy unchanged for the third consecutive meeting. The press release underscored that while monetary policy is weighing on…

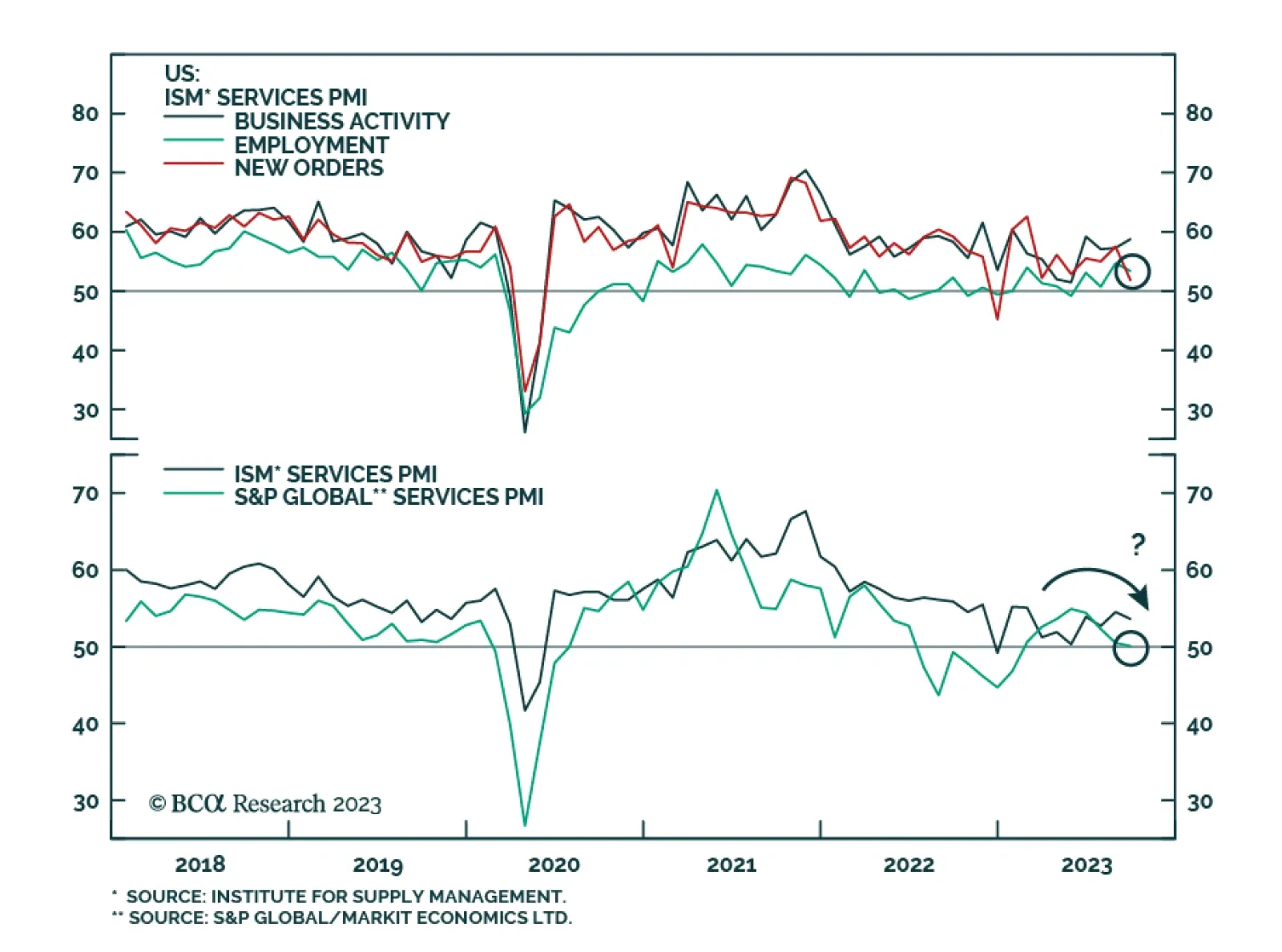

As expected, the US ISM PMI showed service sector activity slowing in September. The Services ISM declined from 54.5 to 53.6, broadly in line with expectations of 53.5. Although the level of the headline index indicates that…

There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

We unveil the ‘Joshi rule’ real-time recession indicator as a much better version of the Federal Reserve’s own ‘Sahm rule’. And we identify what would trigger these recession indicators in this week’s and future US jobs reports. Plus…