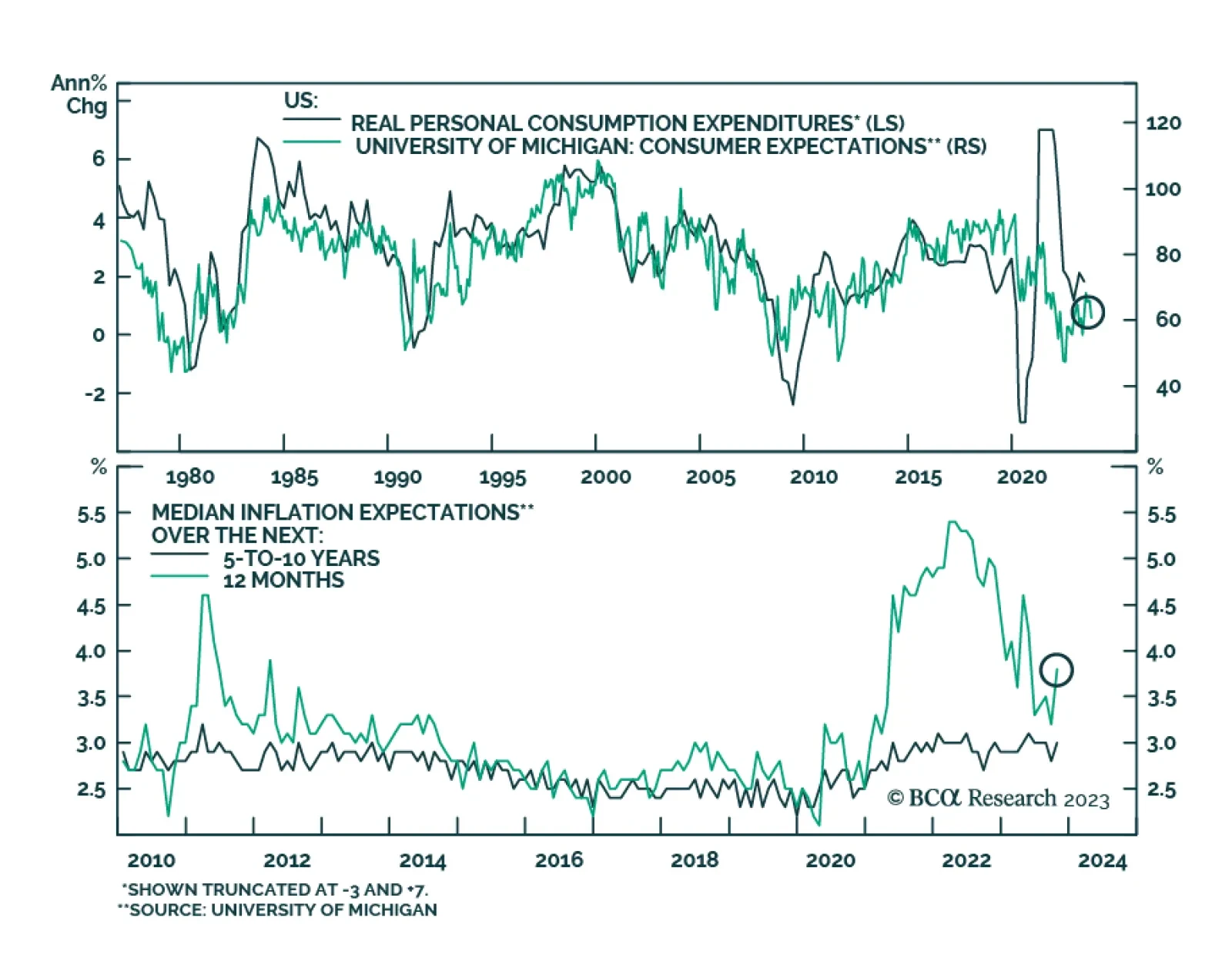

The preliminary release of the University of Michigan’s Consumer Sentiment survey delivered a negative surprise on Friday. A bigger-than-anticipated drop pushed the headline sentiment index down to a five-month low of 63.…

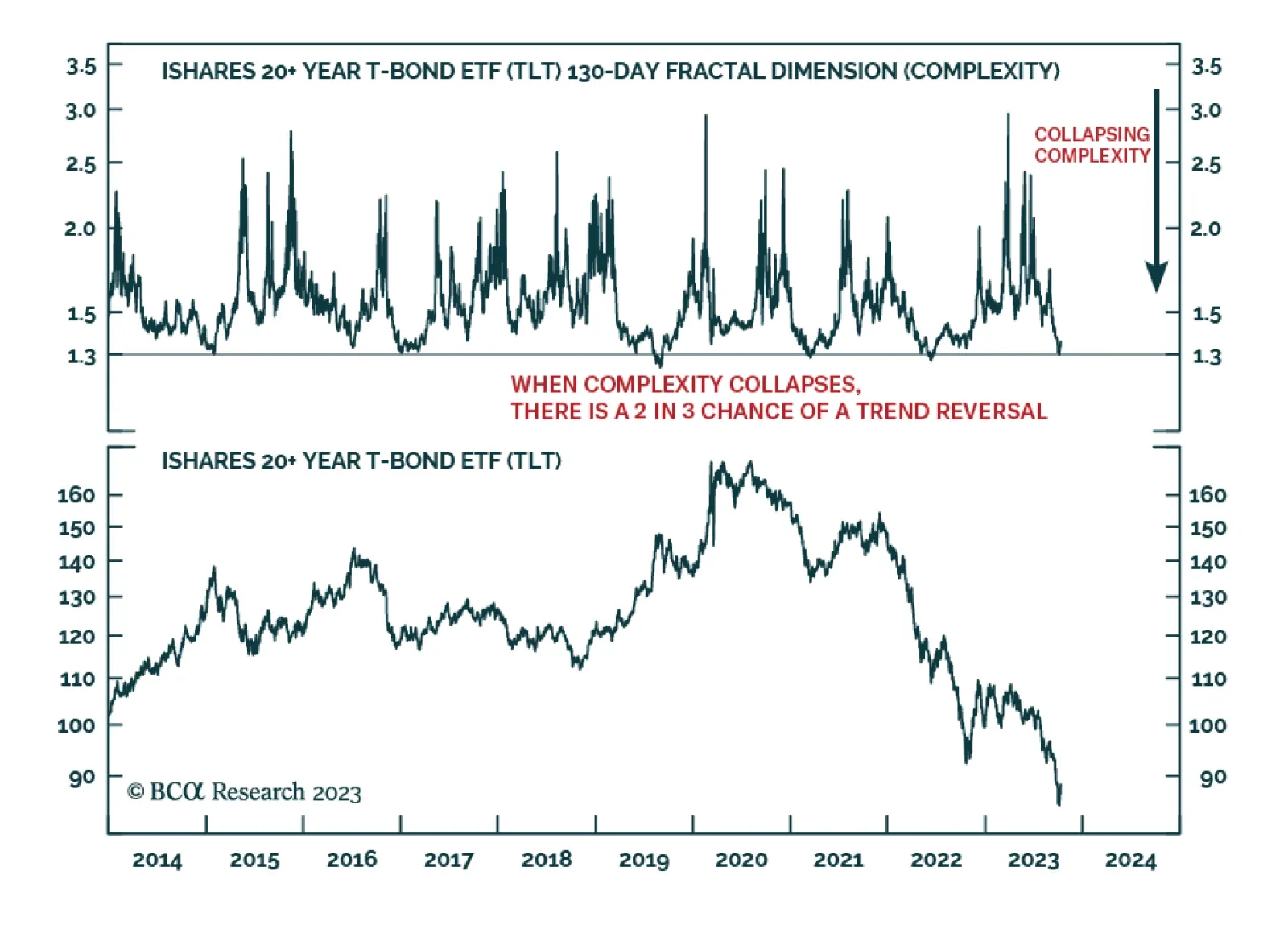

According to BCA Research’s Counterpoint service, the sharp sell-off in long duration bonds (ticker TLT) has reached the collapsed 130-day complexity that has preceded several turning-points in the last few years. This…

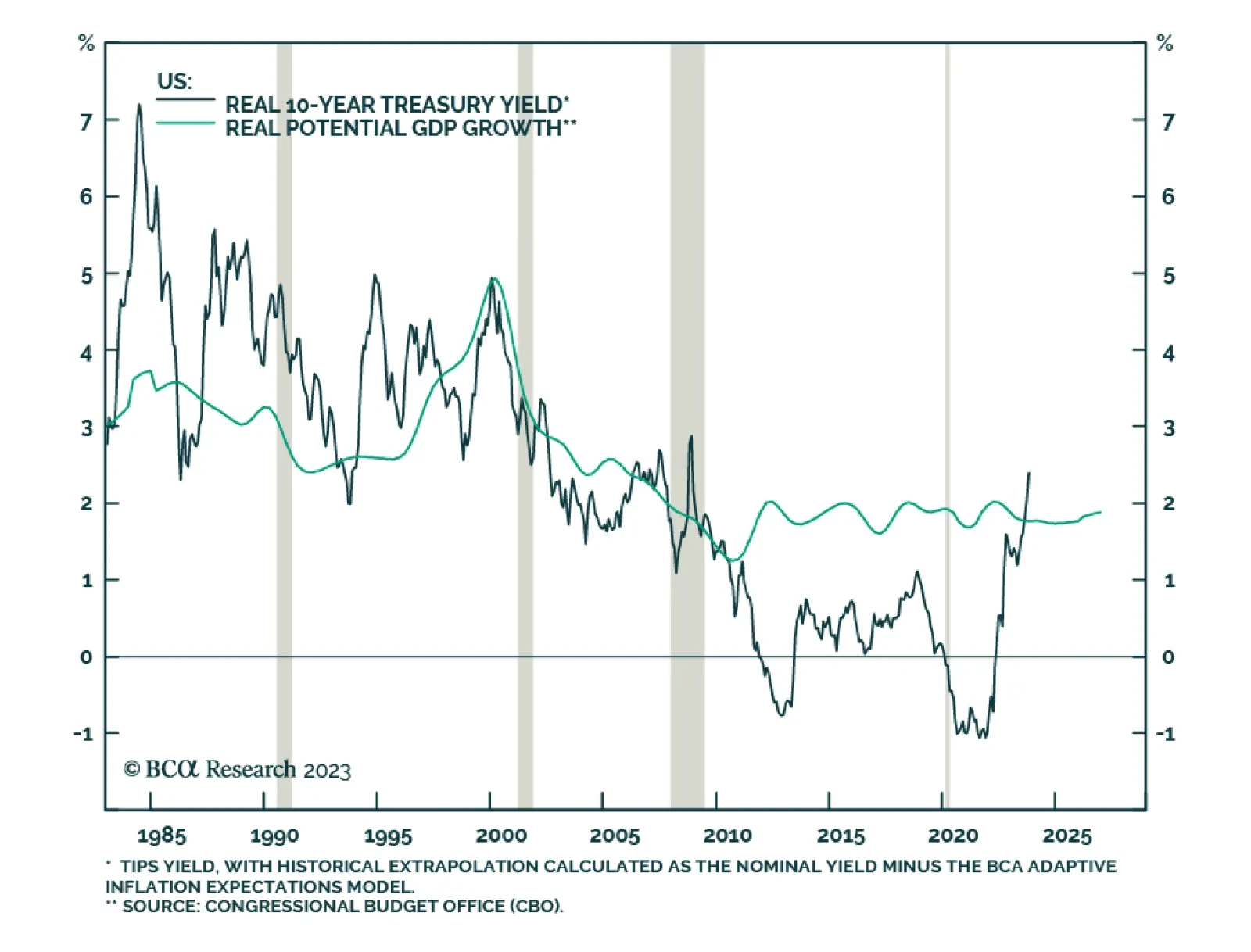

The last few weeks saw a repricing of nominal yields to levels not breached since before the Great Financial Crisis. Breaking down the US 10-year Treasury yield into real and inflation expectations components reveals the selloff…

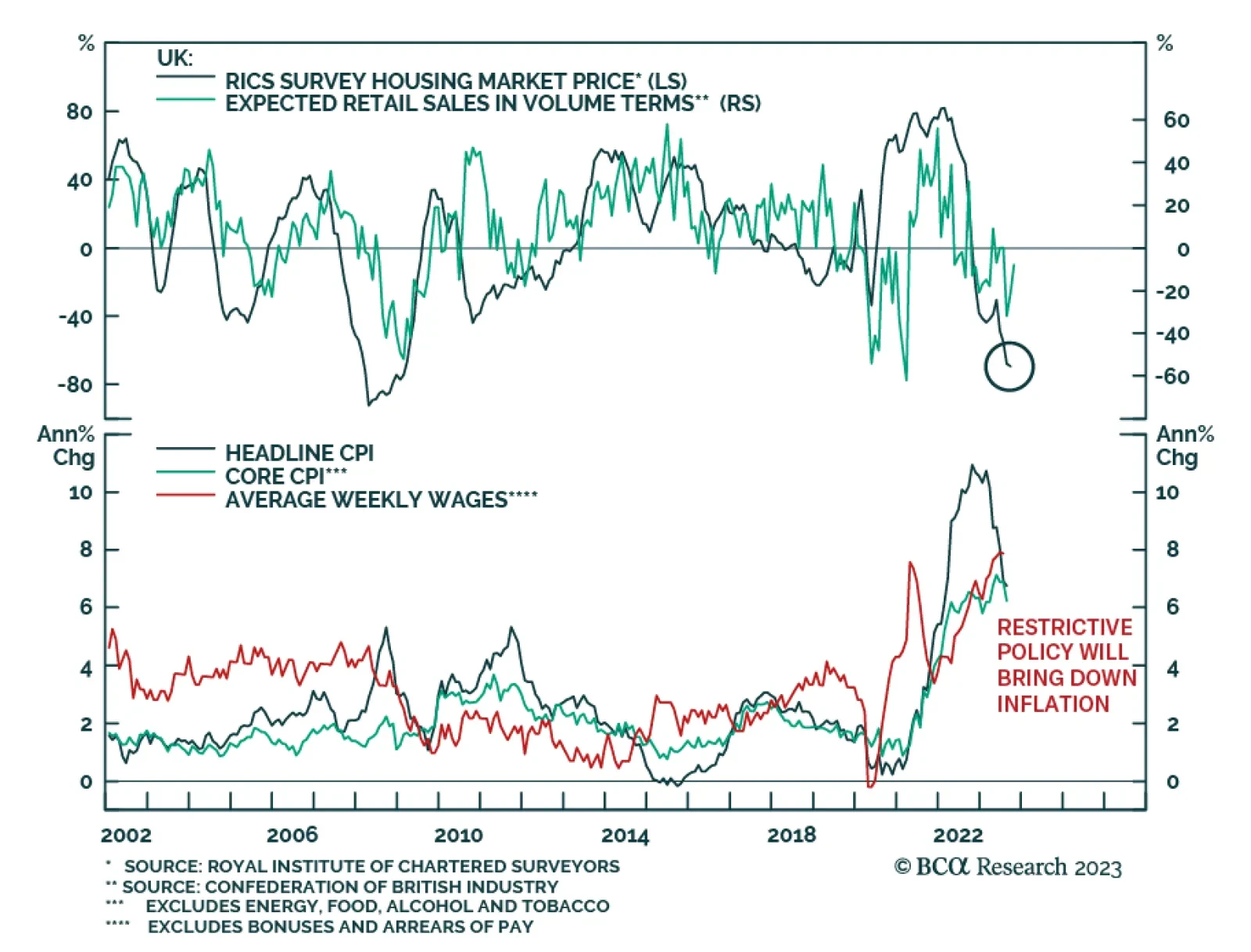

As expected, the UK economy bounced back in August with GDP expanding by 0.2% m/m following a 0.6% m/m decline in July. Yet to the extent that this improvement largely reflects a rebound after strikes weighed down on activity in…

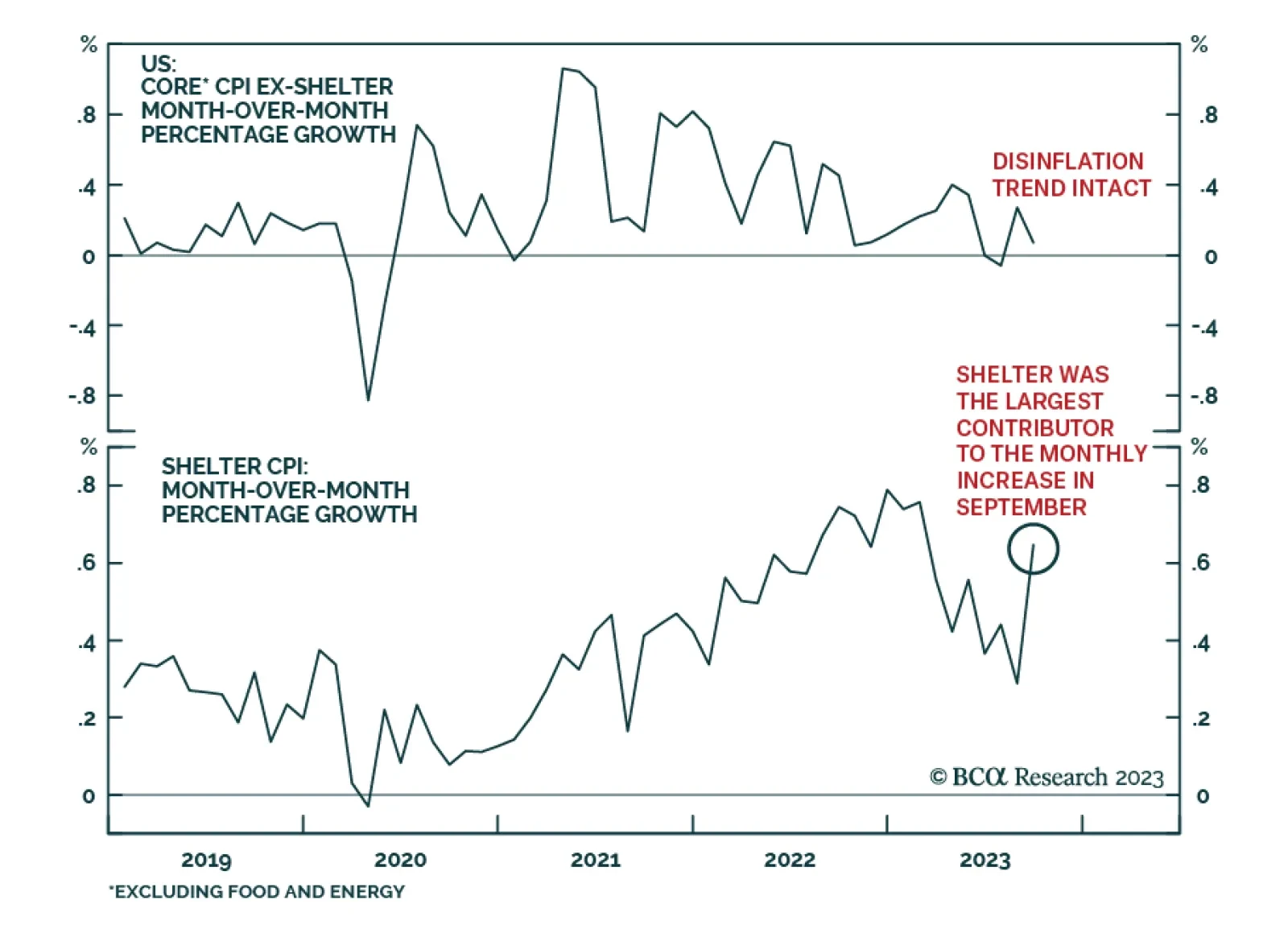

The US CPI report shows inflation was higher than anticipated in September. Although the headline index decelerated from 0.6% m/m to 0.4% m/m, it is above expectations of 0.3% m/m. The annual rate of change remains at 3.7% y/y…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

The Q3 earnings season will shift into high gear this Friday as banks report their financial results for the quarter. Among the trends that we’ll be watching for is insight on the outlook for profit margins. As our US…

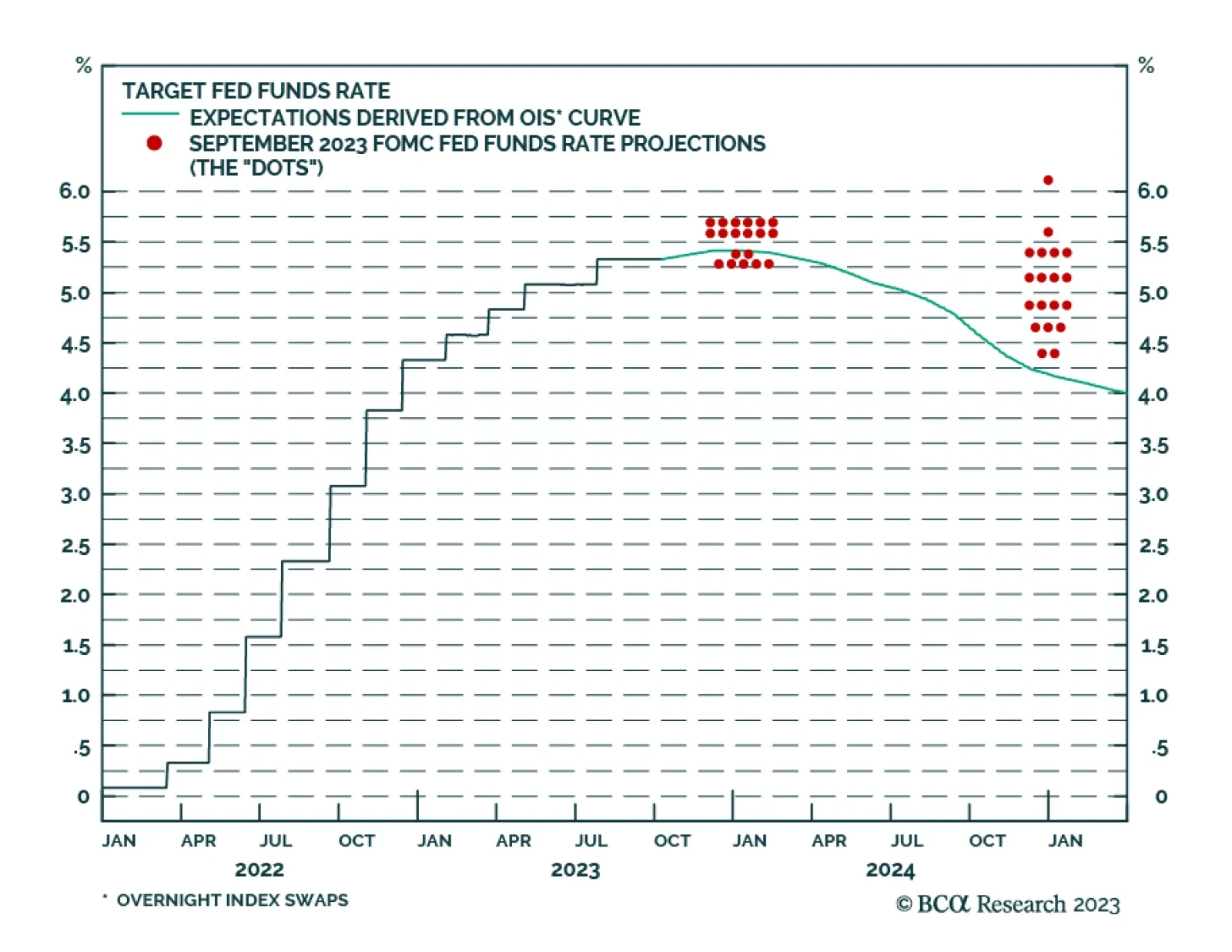

The minutes of the September FOMC meeting confirmed that the Fed intends to maintain restrictive monetary policy for longer. Although inflation has been moderating, participants continue to view it as unacceptably high and…

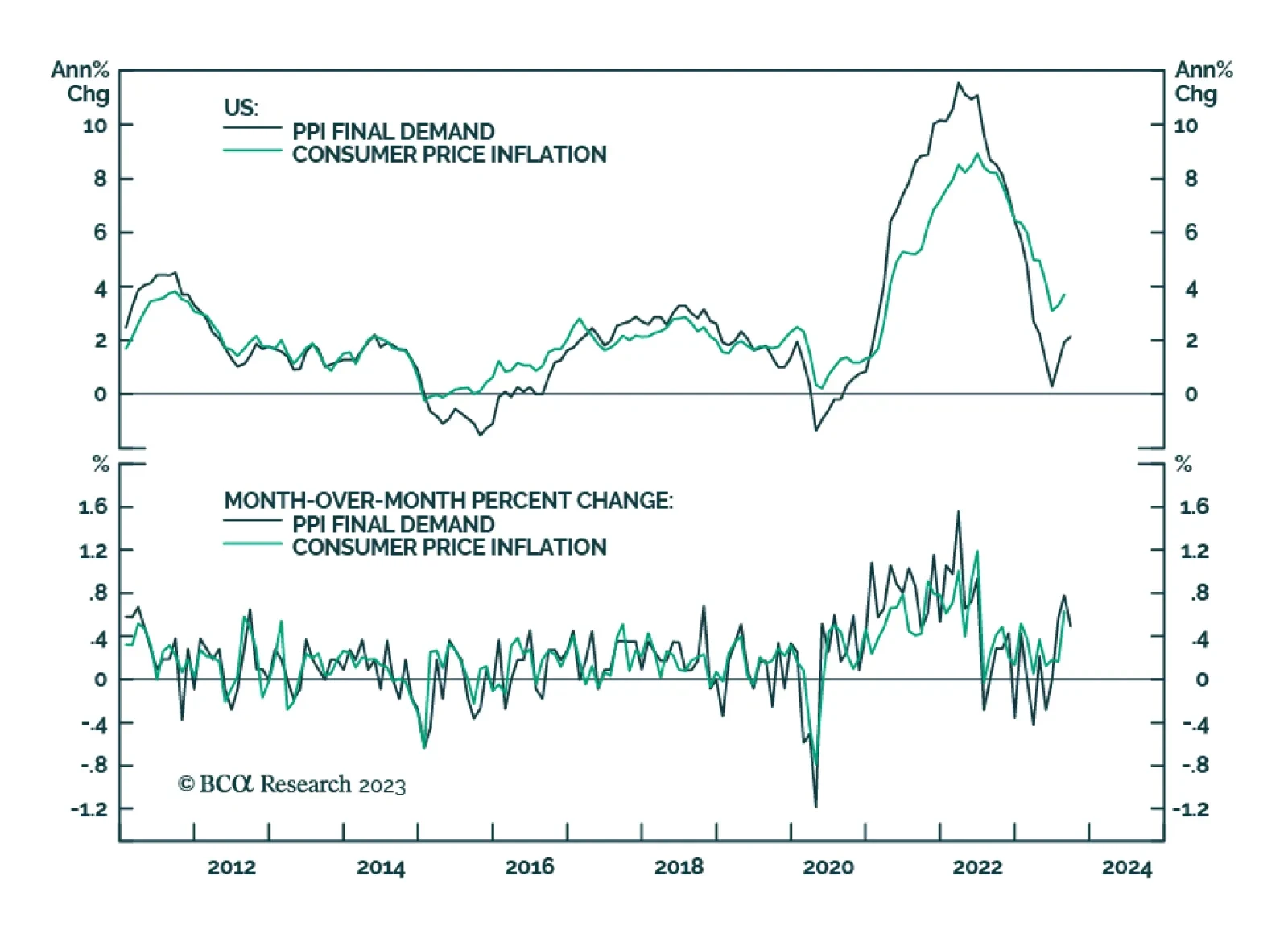

The US PPI report came in hotter-than-anticipated in September. Although the headline index decelerated from 0.7% m/m to 0.5% m/m, it remains above expectations of a more pronounced moderation to 0.3% m/m. In particular, a 3.3% m…

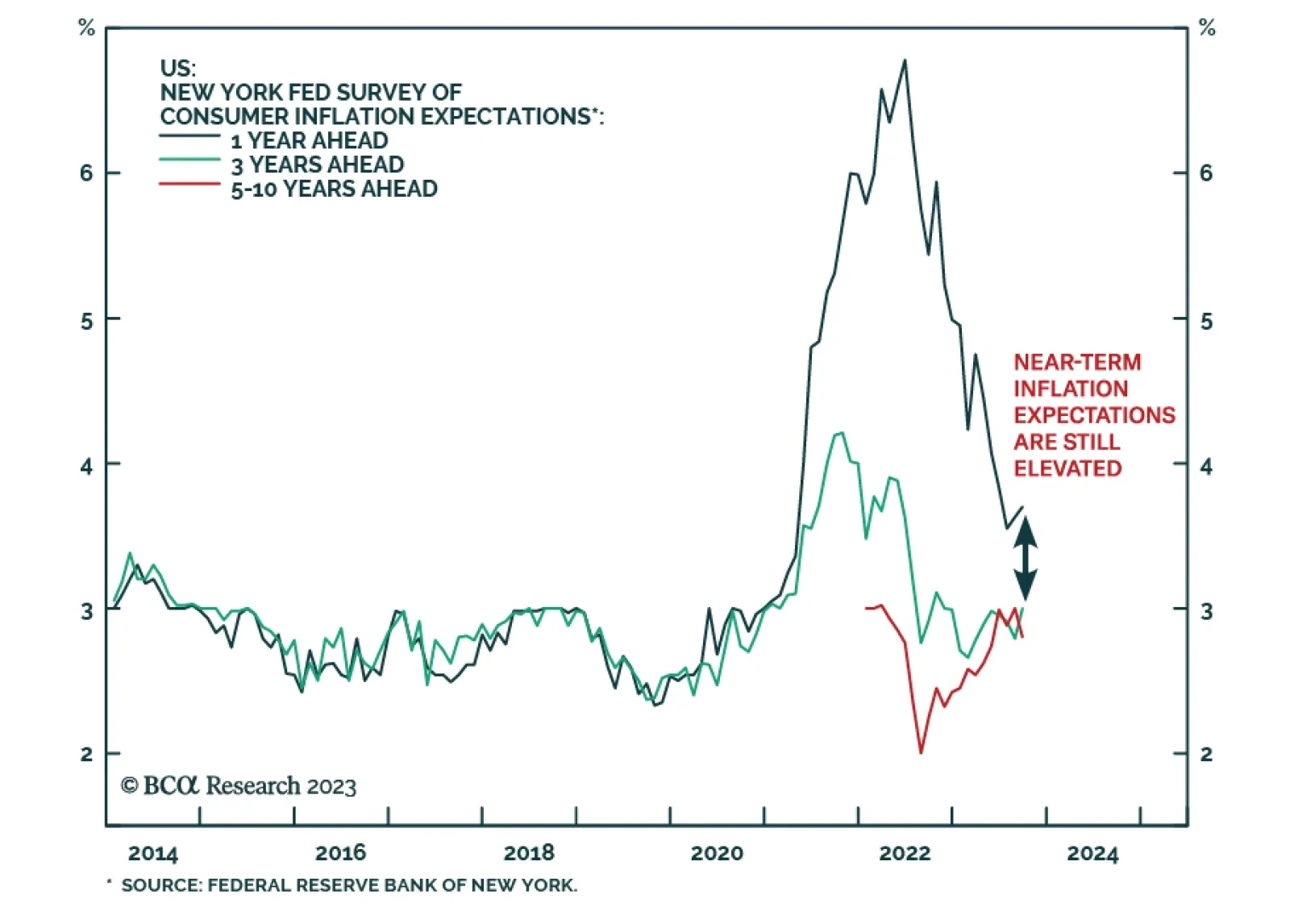

Results of the New York Fed’s survey show American consumers’ near-term inflation outlook ticked up in September. Respondents’ one-year ahead inflation expectations rose from 3.6% to 3.7%, and the three-year…