Recession-Hard/Soft Landing

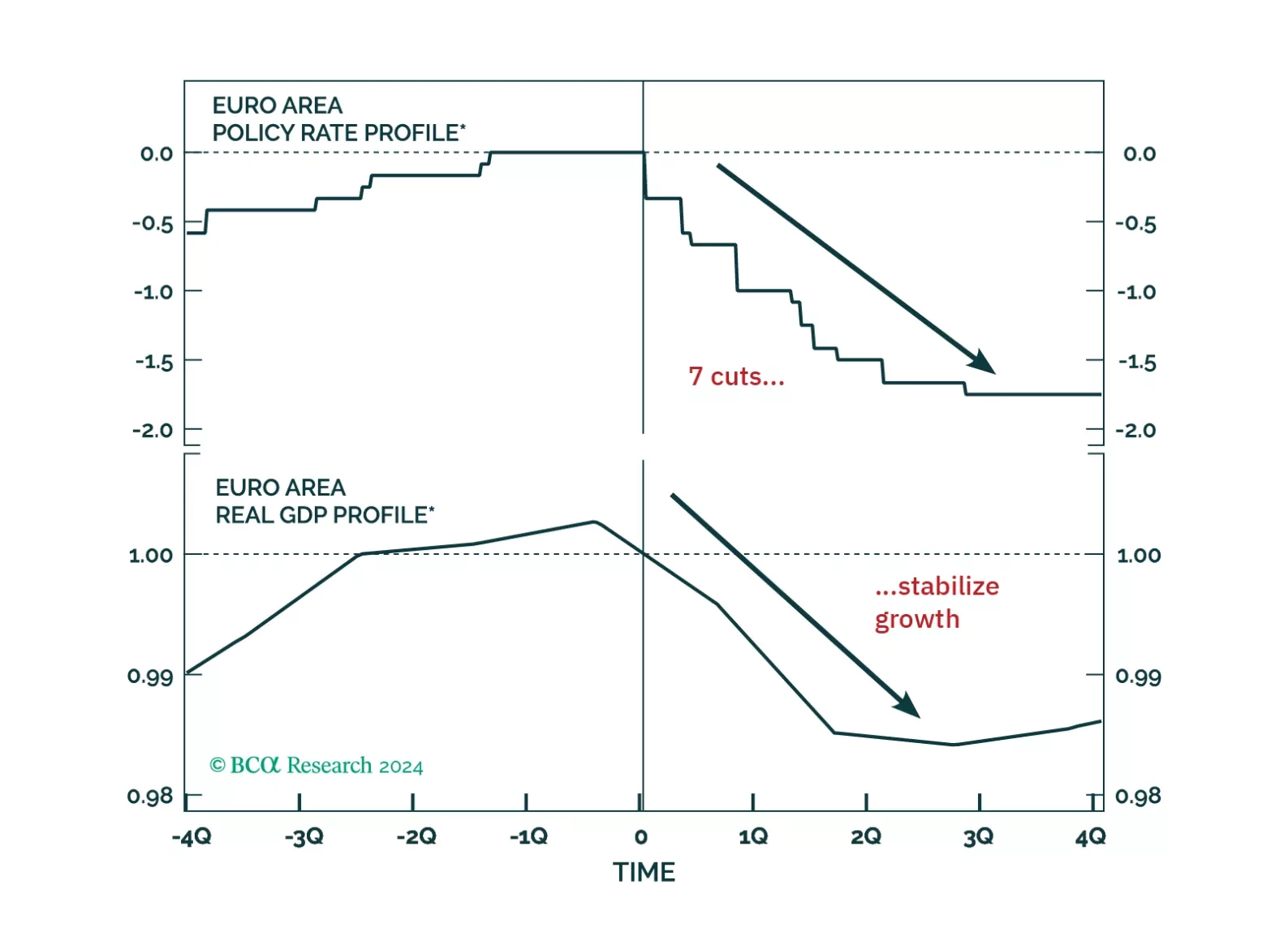

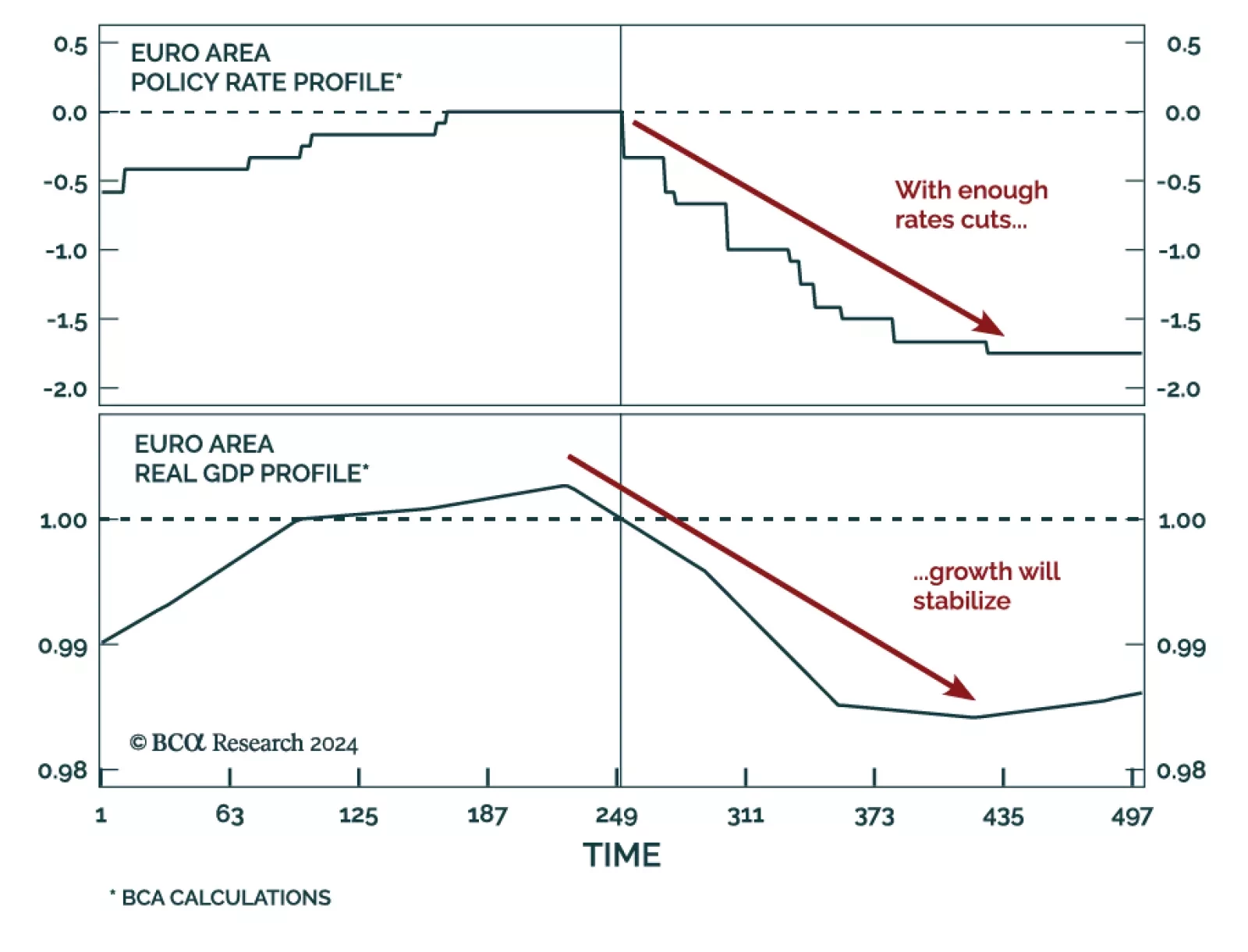

Key Views 2025: The Year Of Change For Europe…

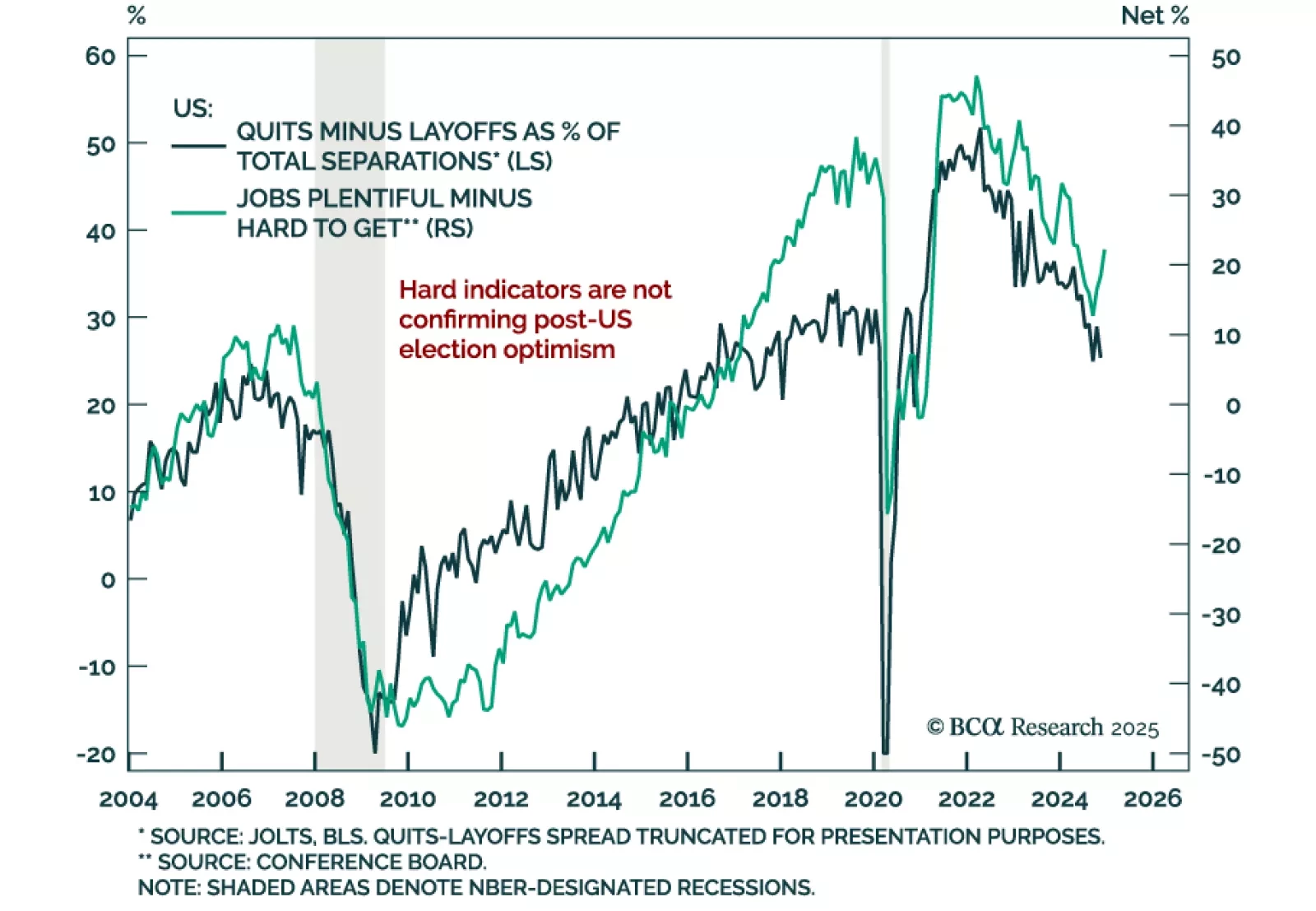

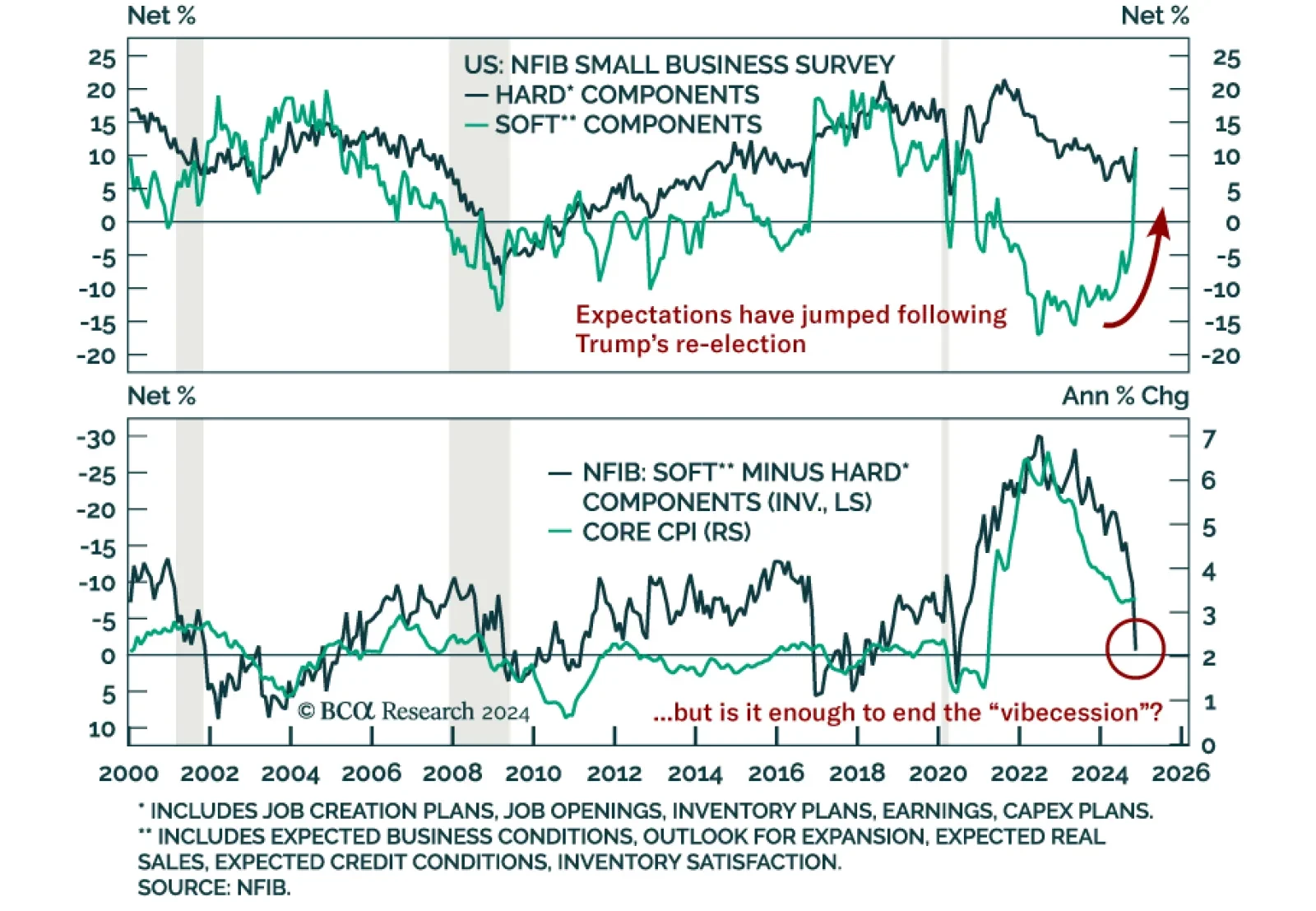

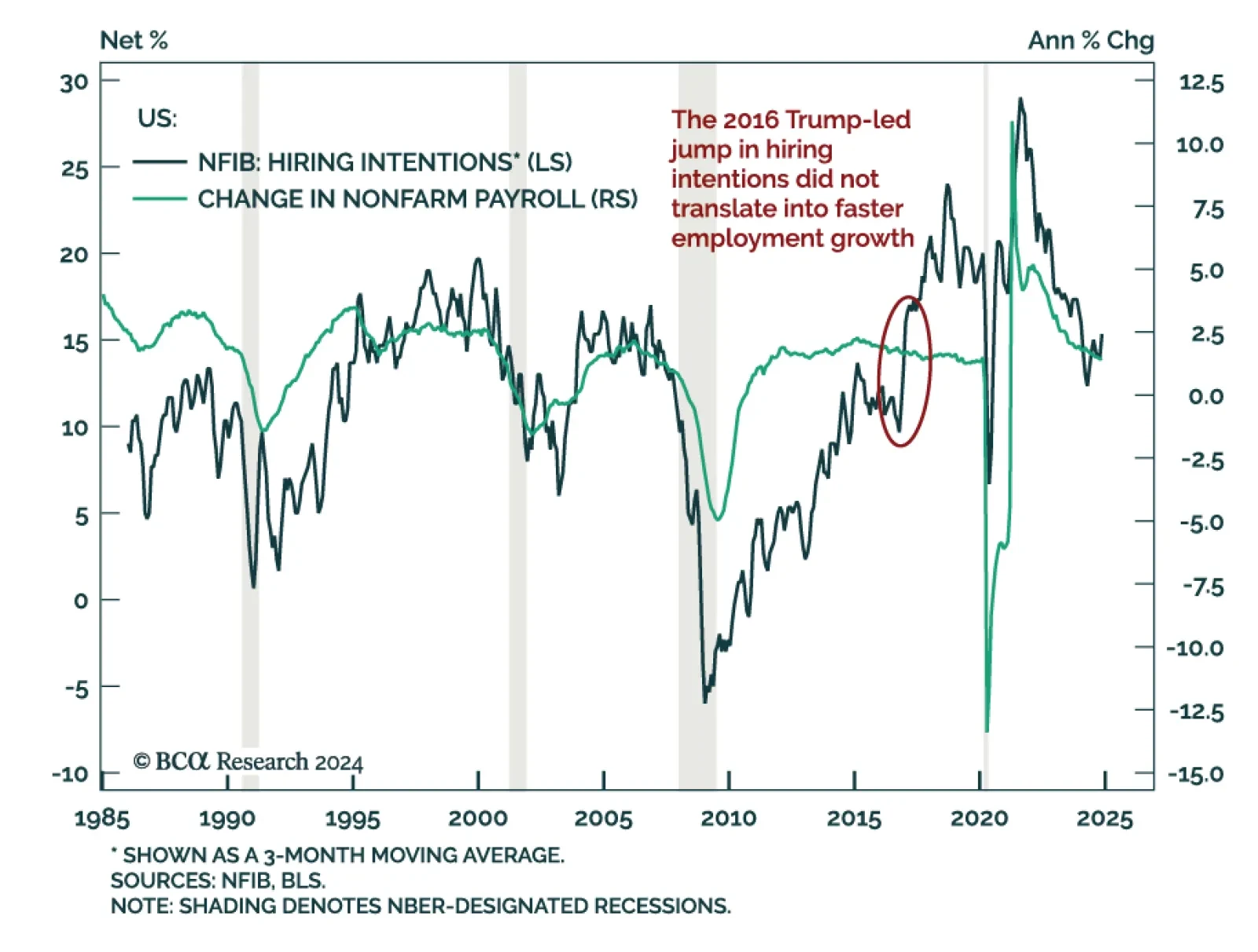

Did Trump End The “Vibecession…

For our last publication of the year, we explore five key themes that will dominate the European macro landscape and markets next year. While the start of 2025 will be challenging for European assets, the latter part will offer some much-needed relief.

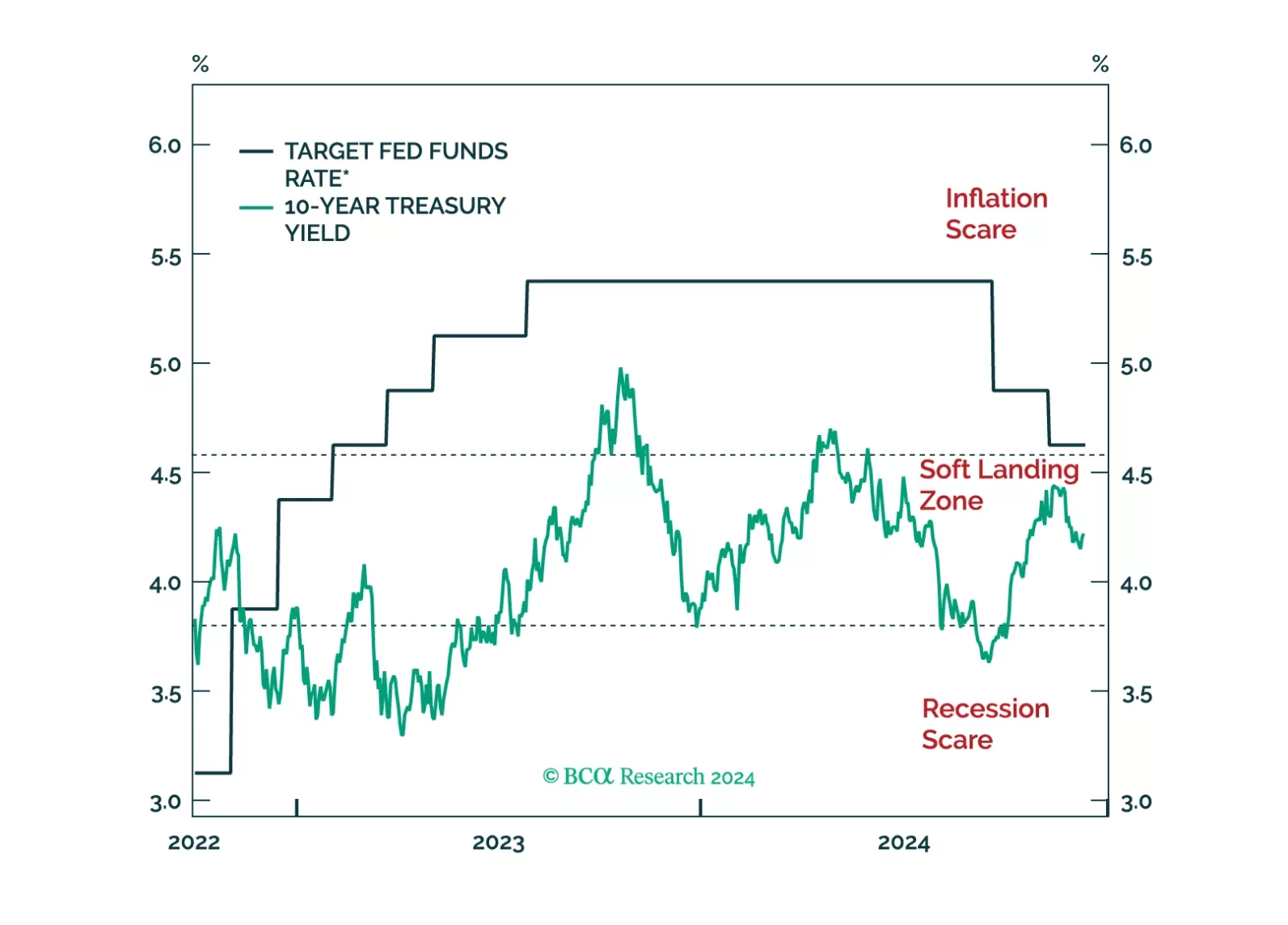

We offer 5 key investment views for US fixed income markets in 2025.

- Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026.

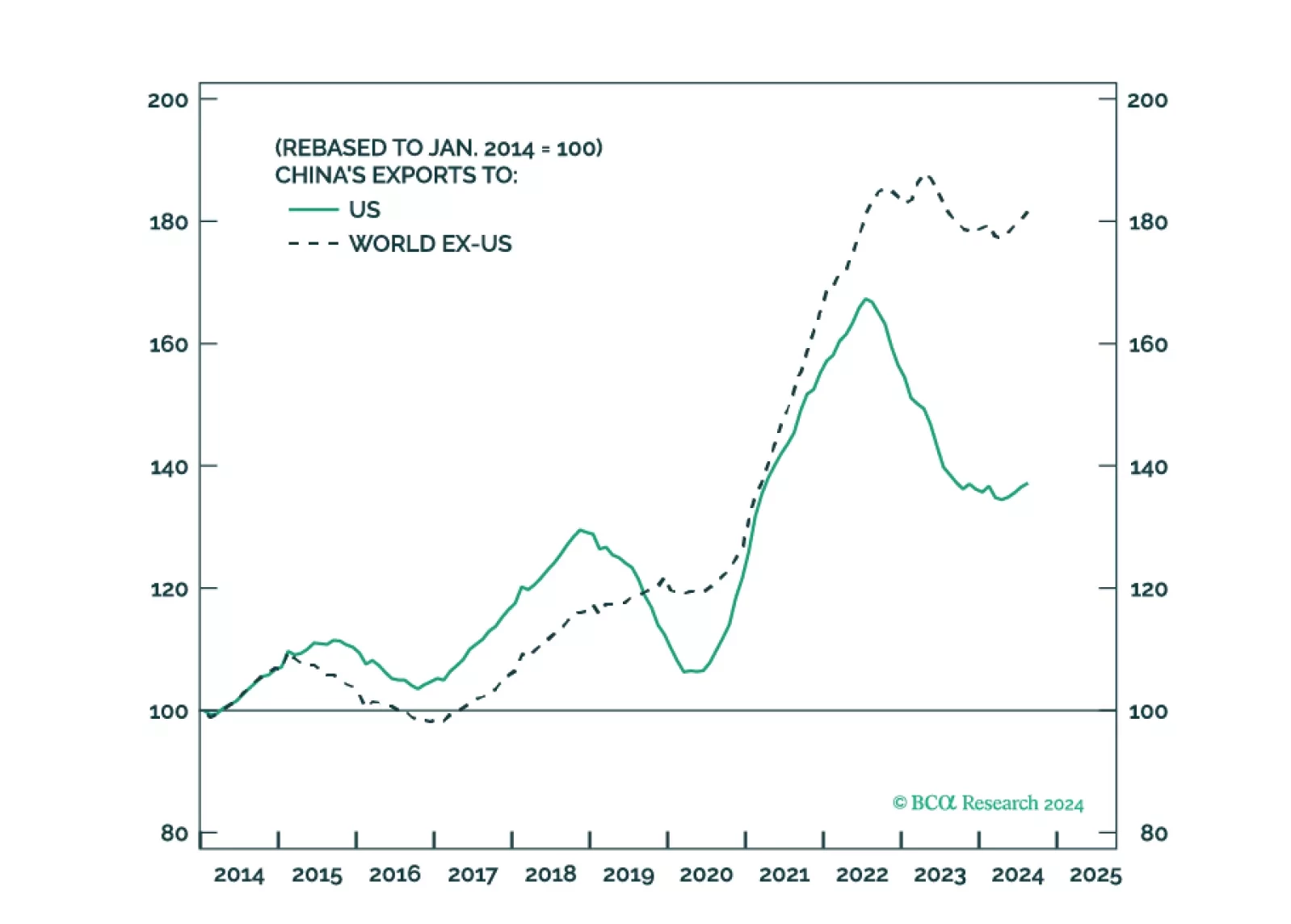

- Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.

- China will retaliate against Trump and stimulate its domestic economy, while pursuing stronger trade ties with other countries. Europe will also retaliate.

- Geopolitical risk will shift from Ukraine-Russia to Israel-Iran, where the conflict will continue to escalate until a crisis point is reached within 2025.

NFIB: Fade Post-Election Euphoria…

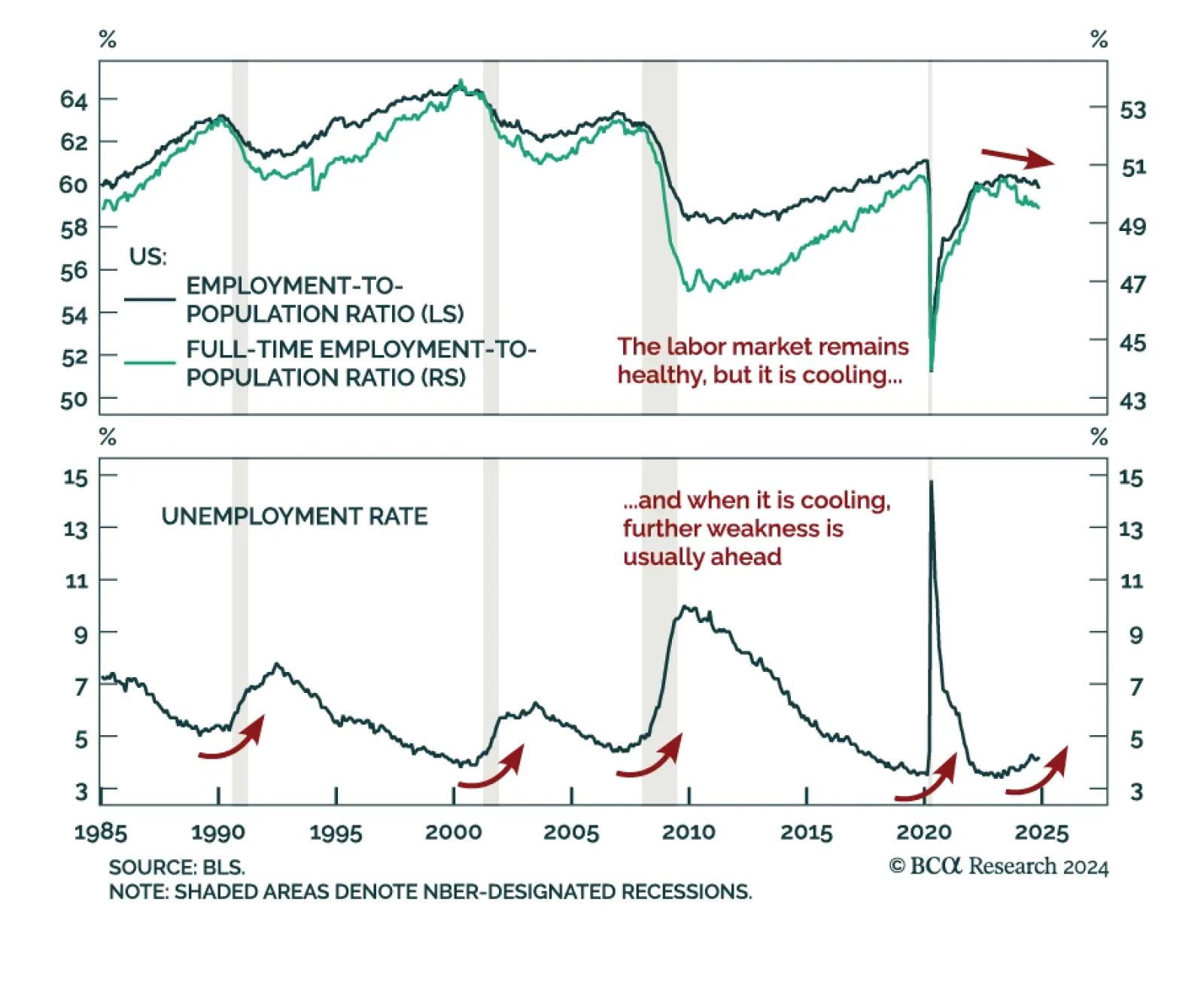

Markets Find Relief In Mixed Jobs Report…

US JOLTS: No Clear Direction…

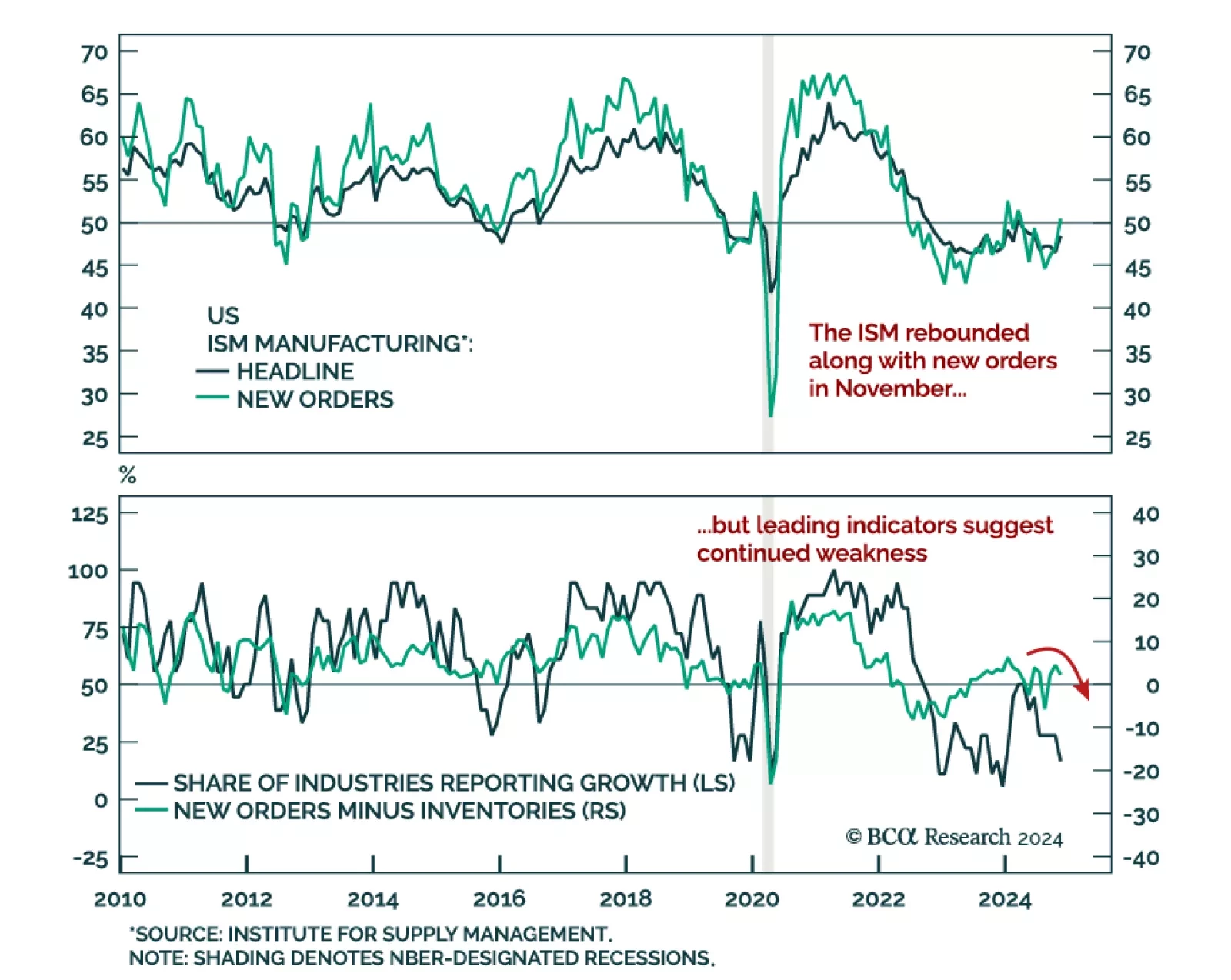

ISM Manufacturing: More Than Meets The Eye…