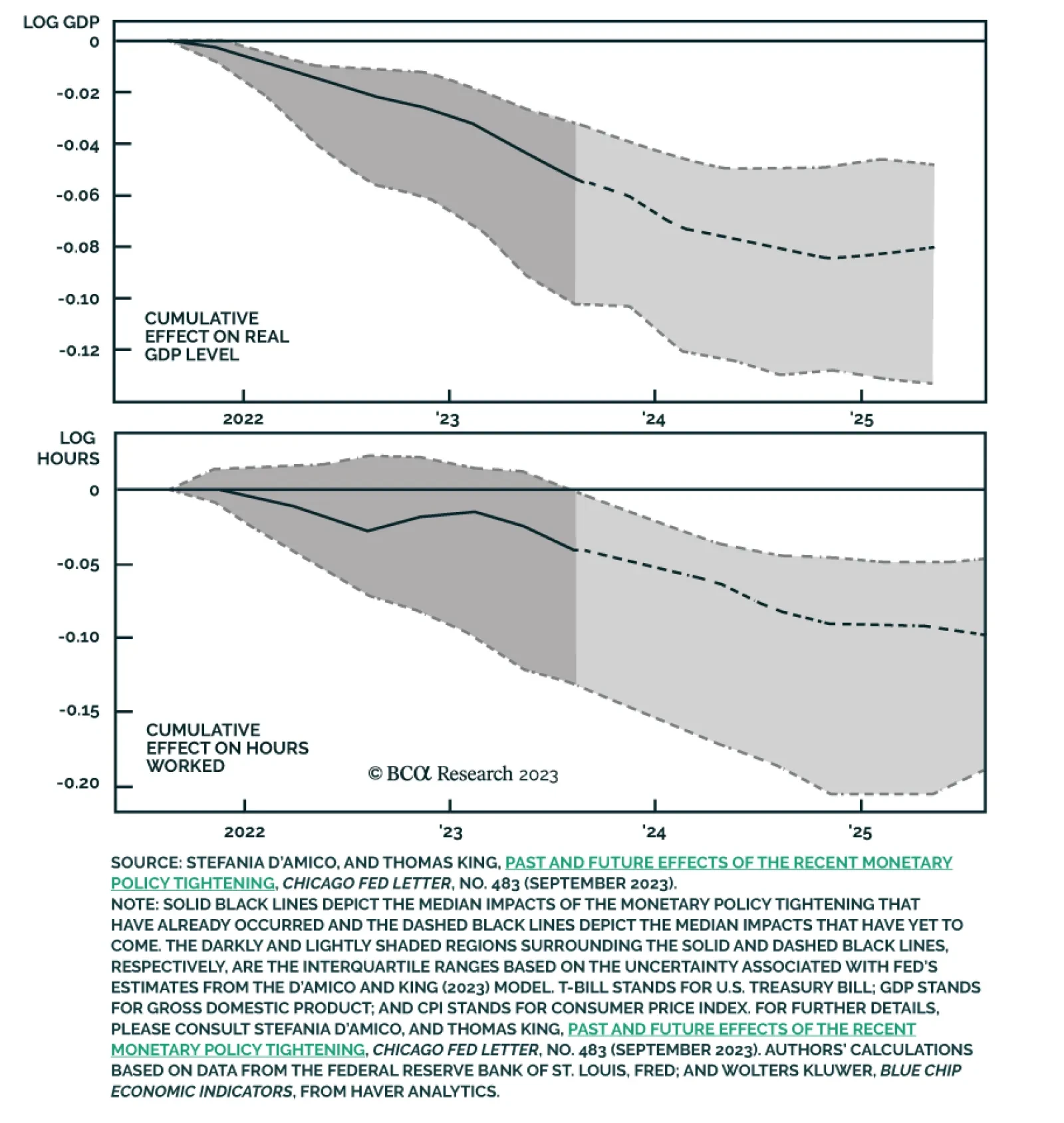

According to BCA Research's Global Investment Strategy service, the global economy will stay buoyant over the next few quarters but will then sour as the lagged effects of higher interest rates and tighter bank lending…

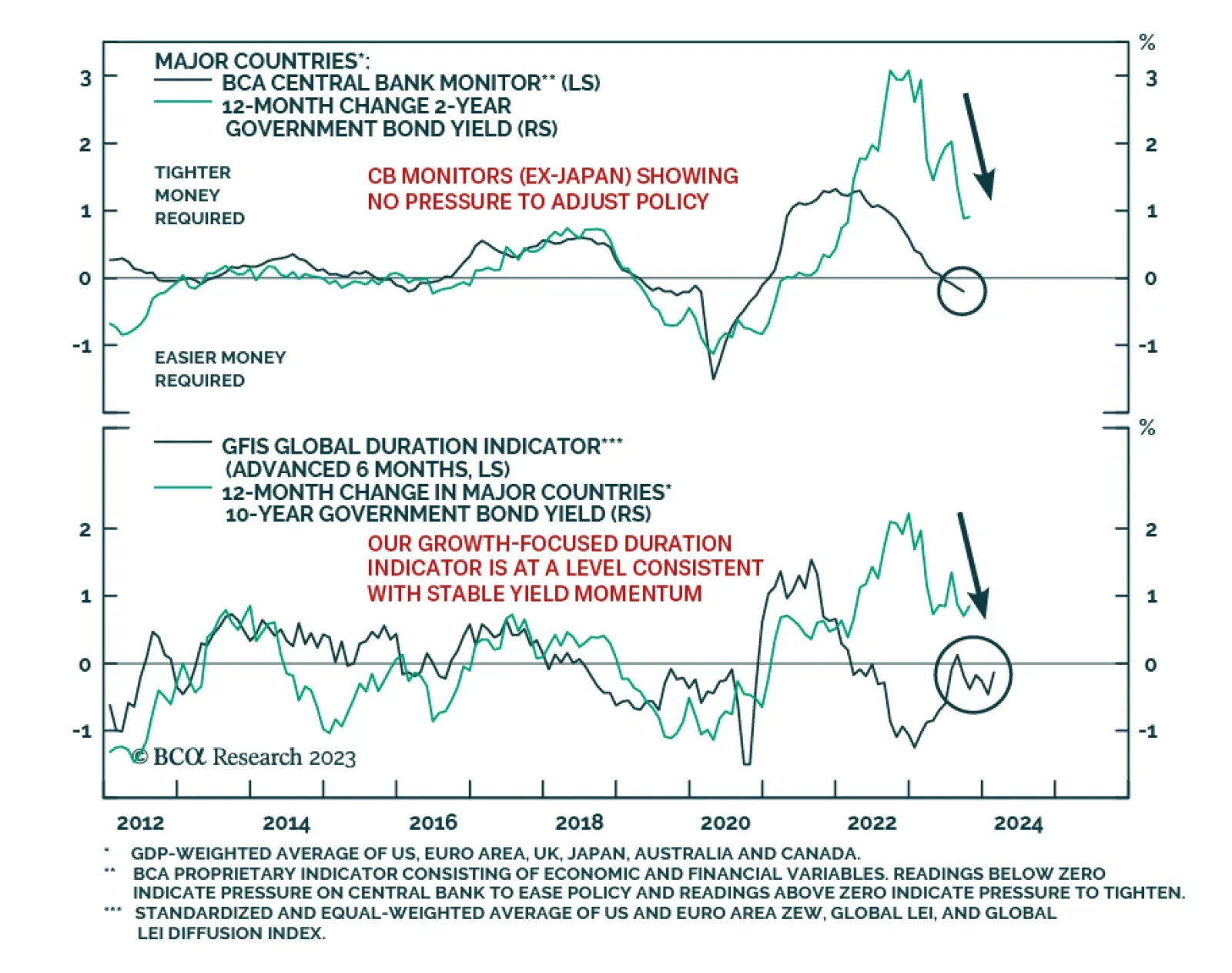

BCA Research’s Global Fixed Income Strategy service is maintaining a tactical neutral duration stance to begin Q4. The team believes the risk/reward on US Treasuries has improved substantially after latest backup in…

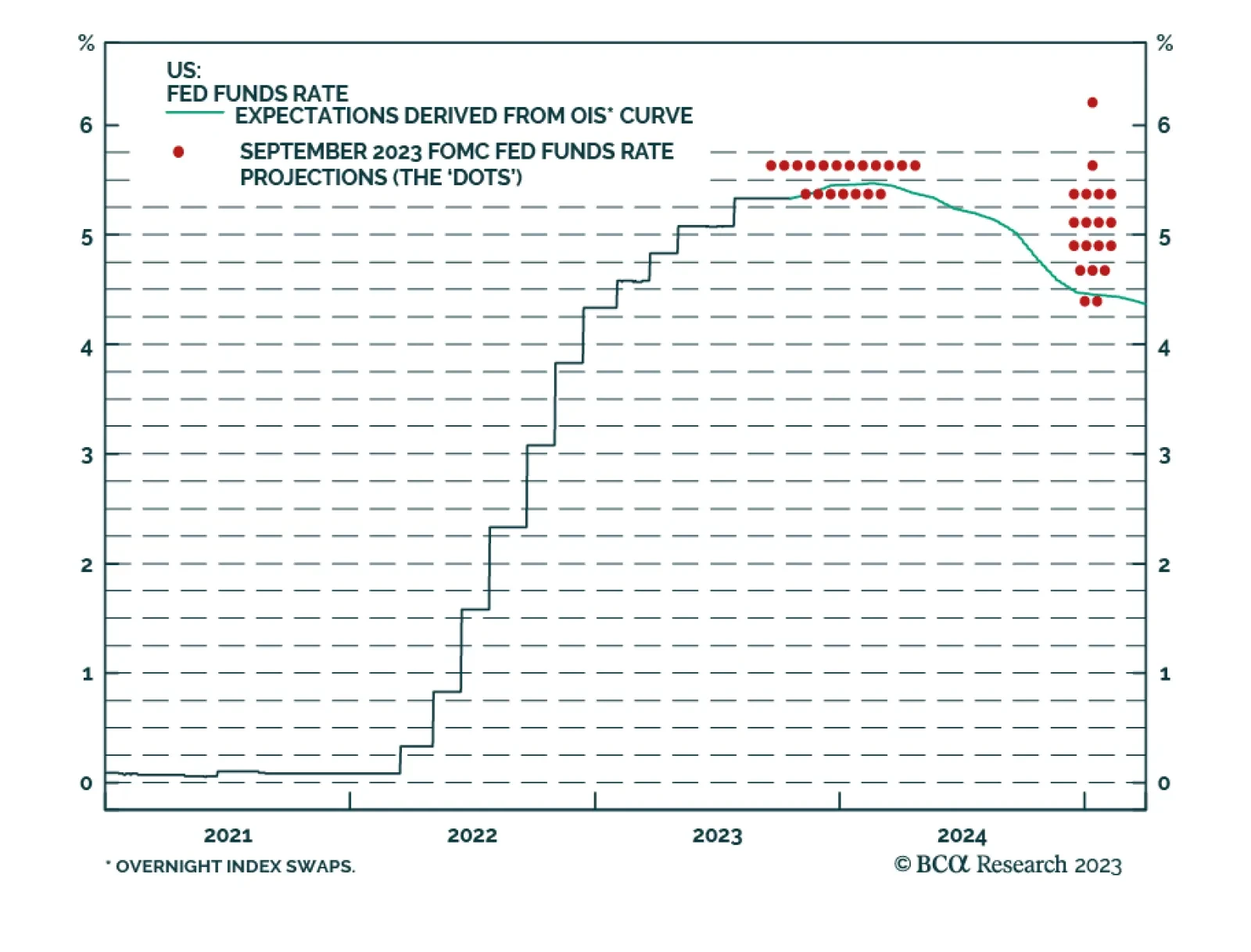

Fed Chair Jay Powell's speech at the Economic Club of New York on Thursday corroborates the signal from other recent Fedspeak that policymakers may not need to hike rates again. He highlighted that although inflation is…

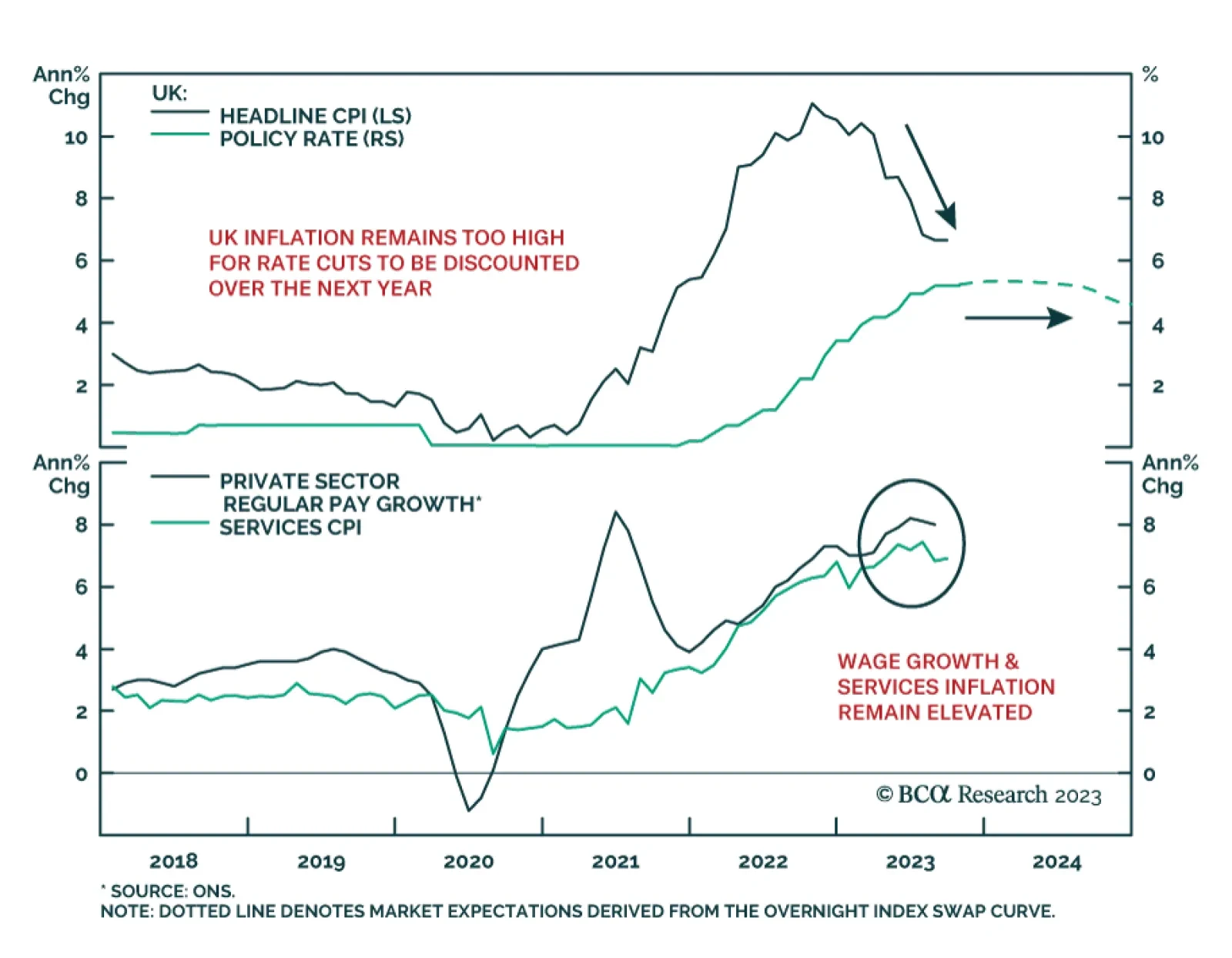

The data releases this week in the UK were disappointing for those that have been looking for a major downshift in UK inflation – most importantly, the Bank of England (BoE). The CPI report for September came in above…

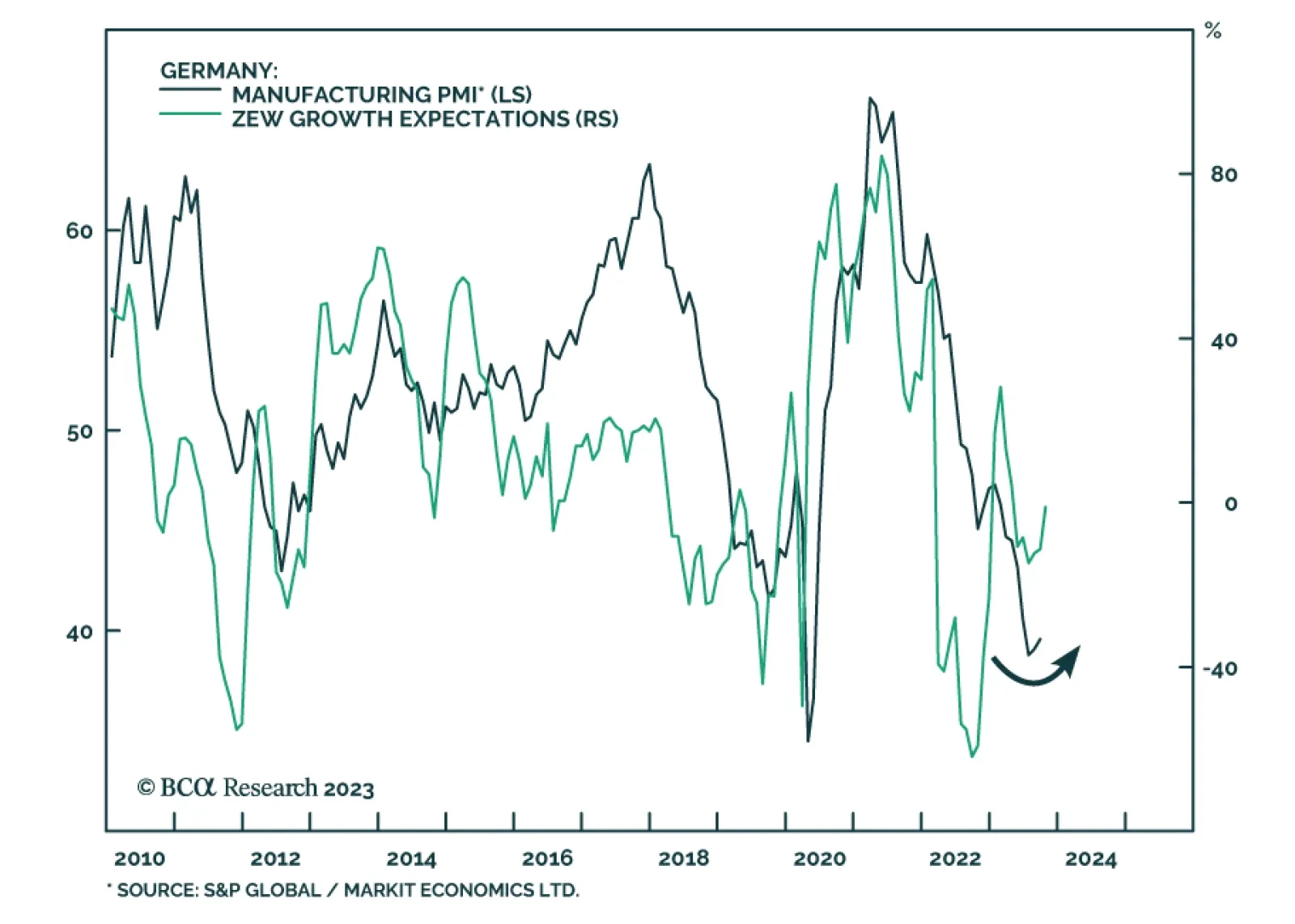

The ZEW survey of investor sentiment sent an optimistic signal on Tuesday. German sentiment rebounded sharply from -11.4 to -1.1 in October – its highest level since April. Lower inflation expectations and a sharp increase…

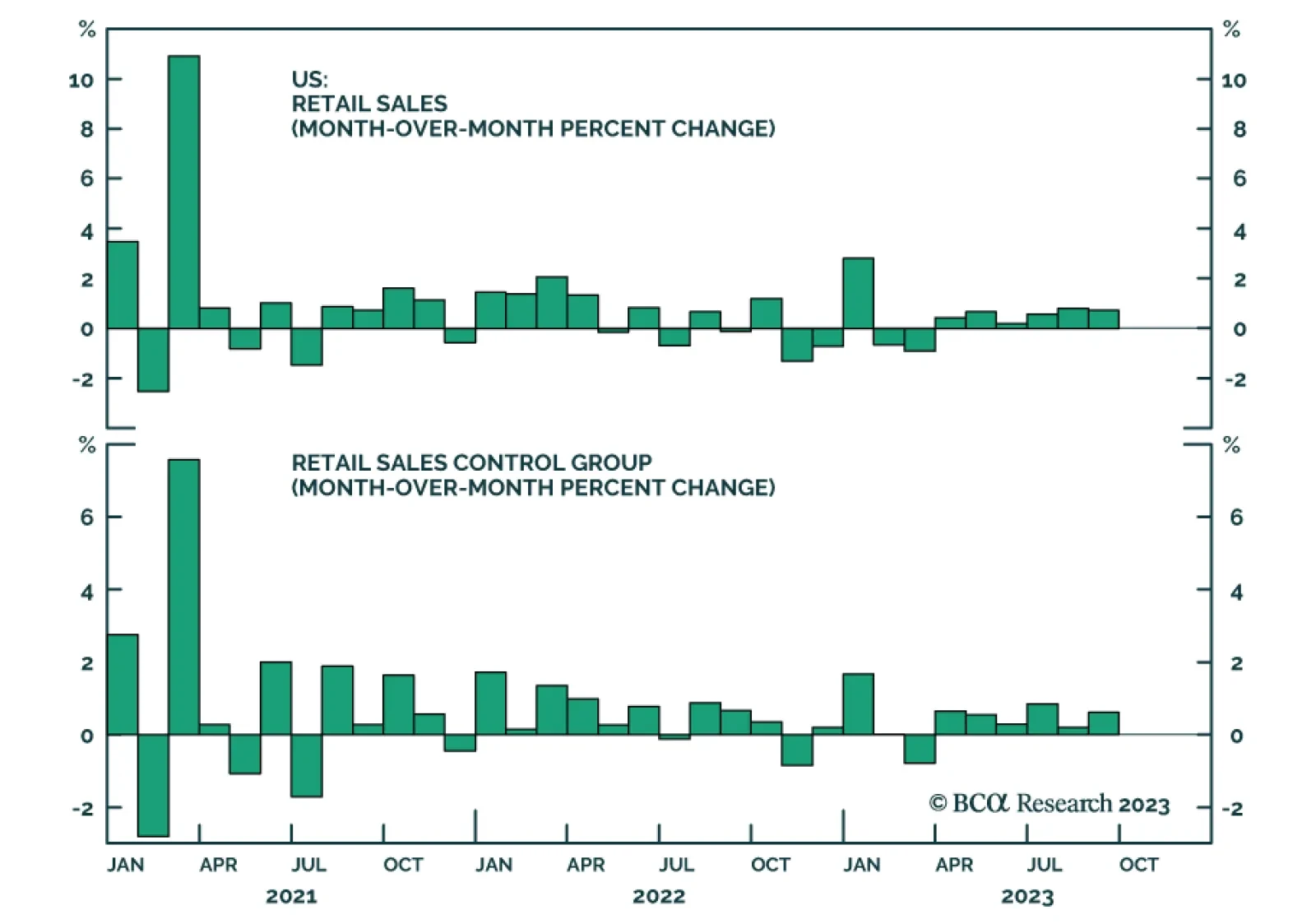

The US retail sales report delivered a sanguine update on US consumption. Overall spending increased by 0.7% m/m in September – above expectations of a 0.3% m/m rise and following an upwardly revised 0.8% m/m in August. The…

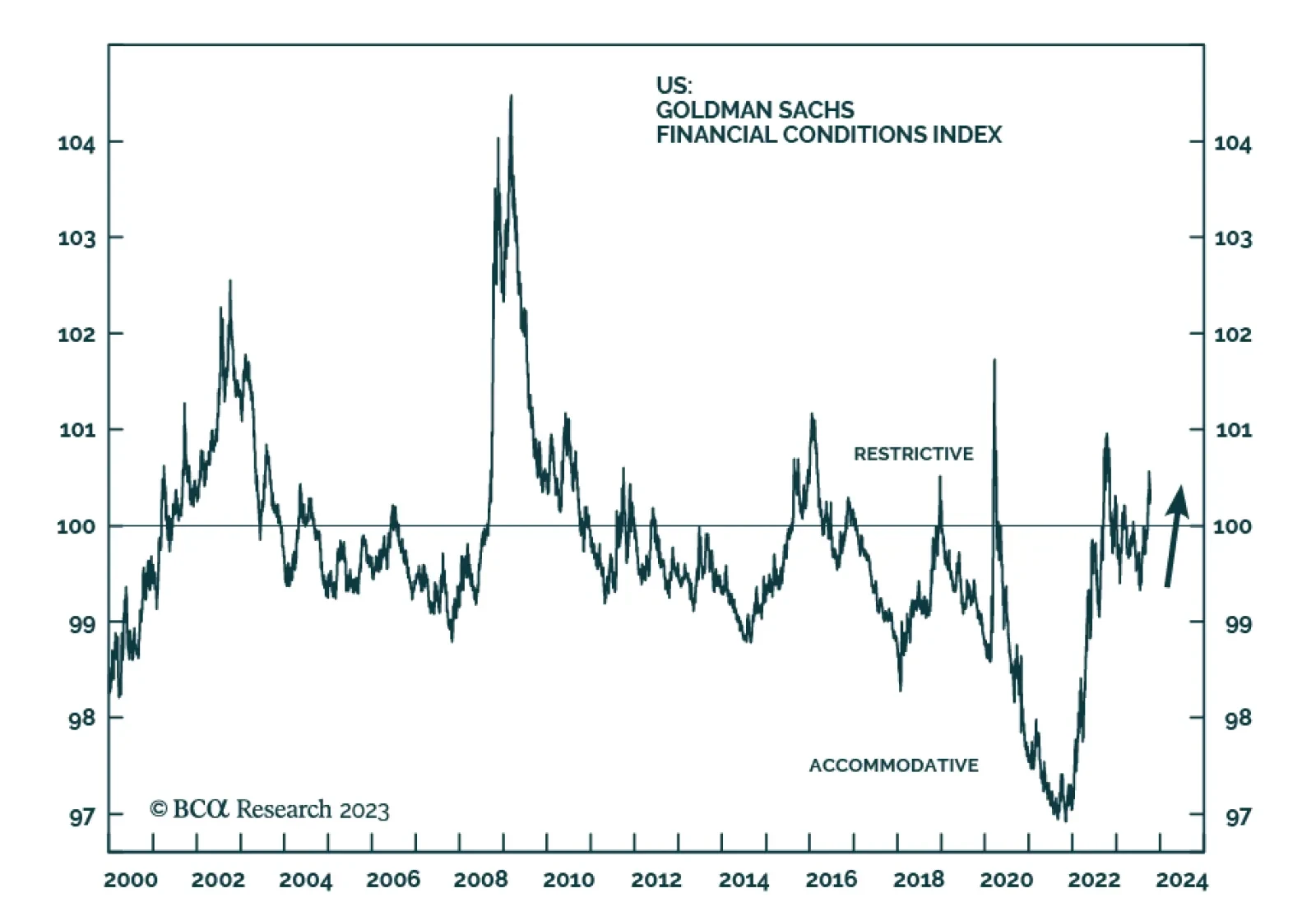

US financial conditions have tightened meaningfully in Q3. While the Goldman Sachs index remains below where it was a year ago, it crossed above the 100 line in late September into restrictive levels after spending most of the…

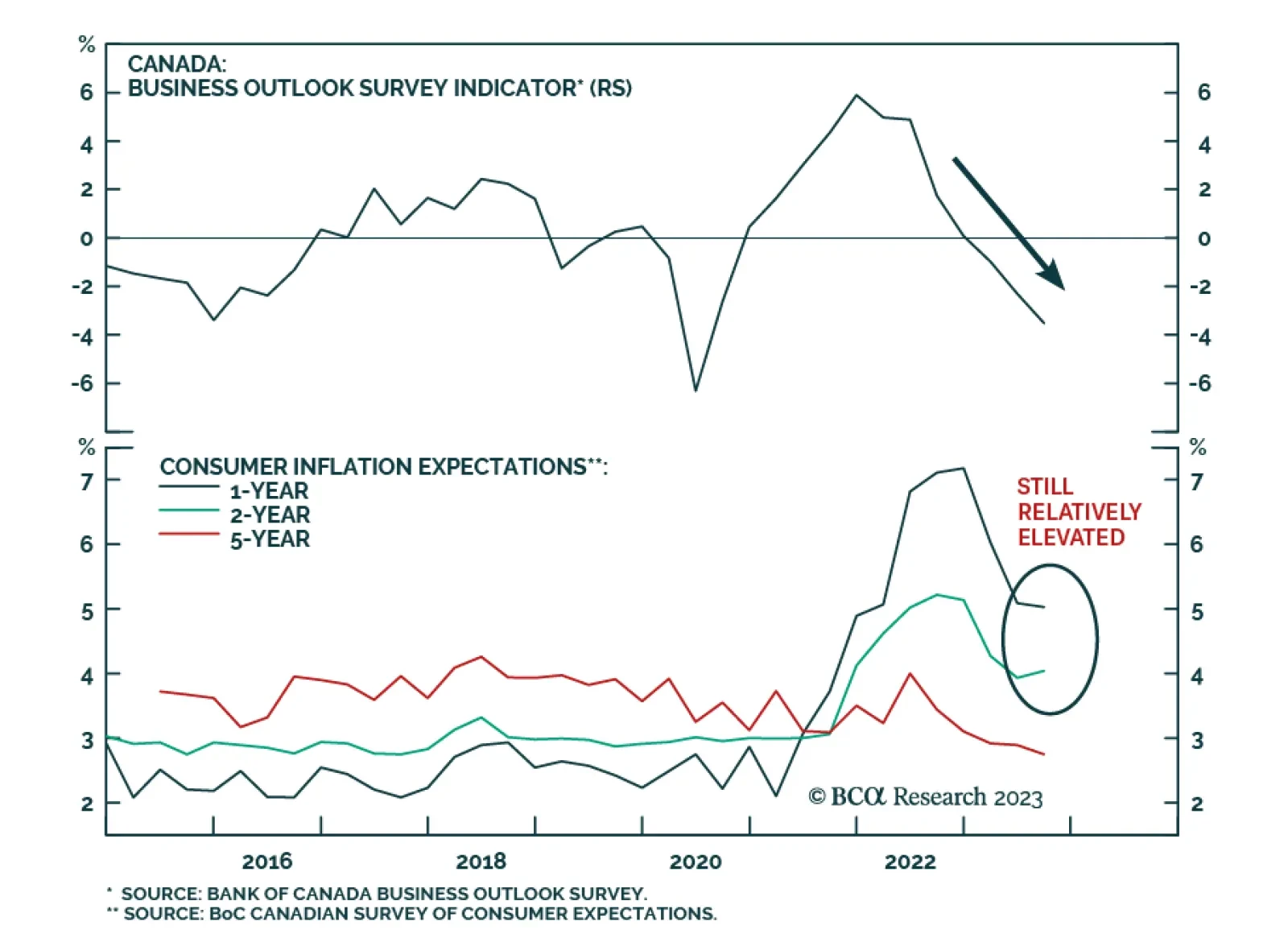

Results of the Banks of Canada’s Q3 business and consumer surveys reveal that the aggressive tightening cycle is dampening economic agents’ sentiment. Putting aside the sharp decline at the onset of the pandemic in Q2…

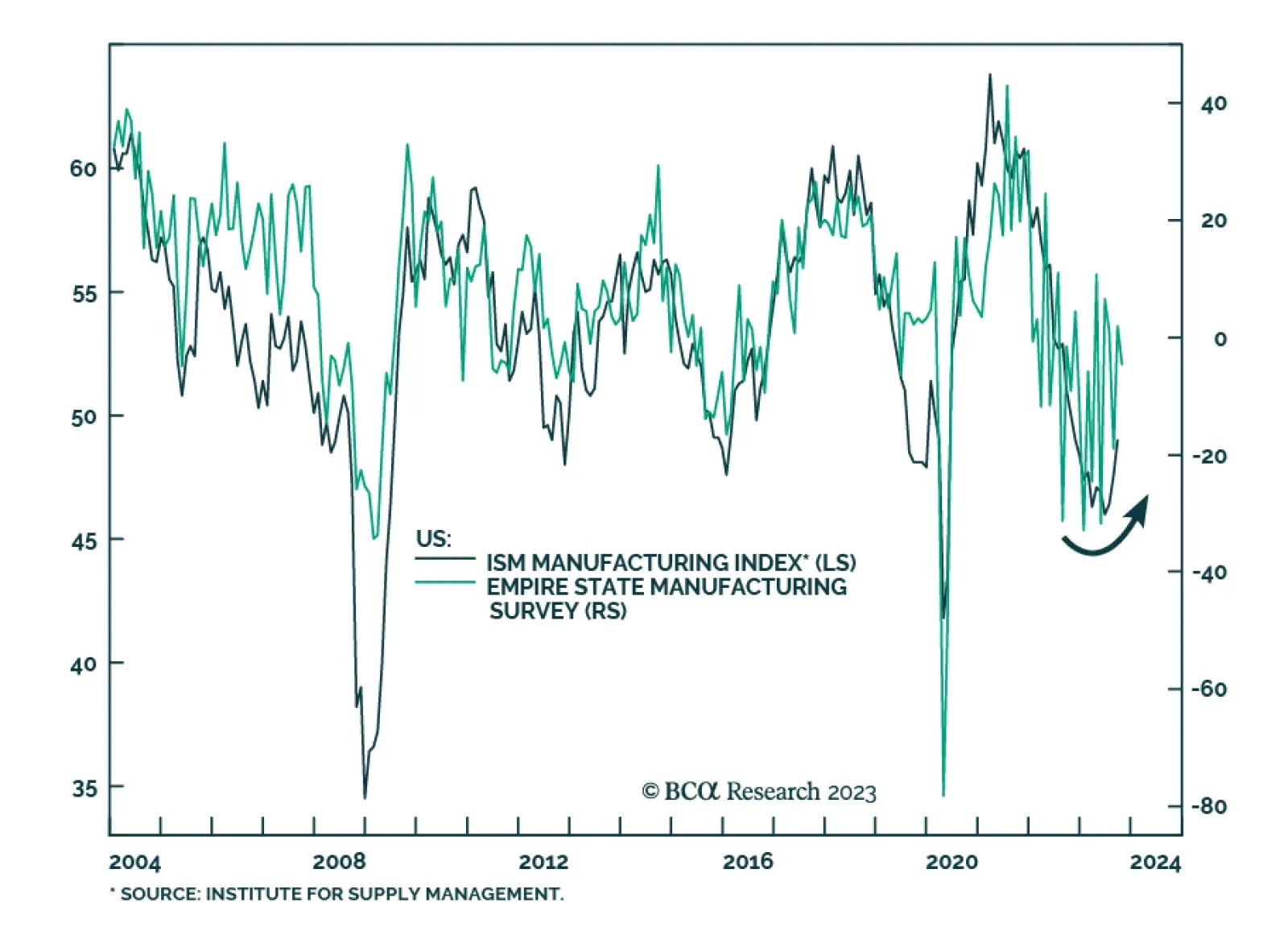

As expected, the New York Fed’s Empire State Survey sent a pessimistic signal about manufacturing conditions in October. The general business conditions index weakened from 1.9 to -4.6, albeit better than expectations of a…

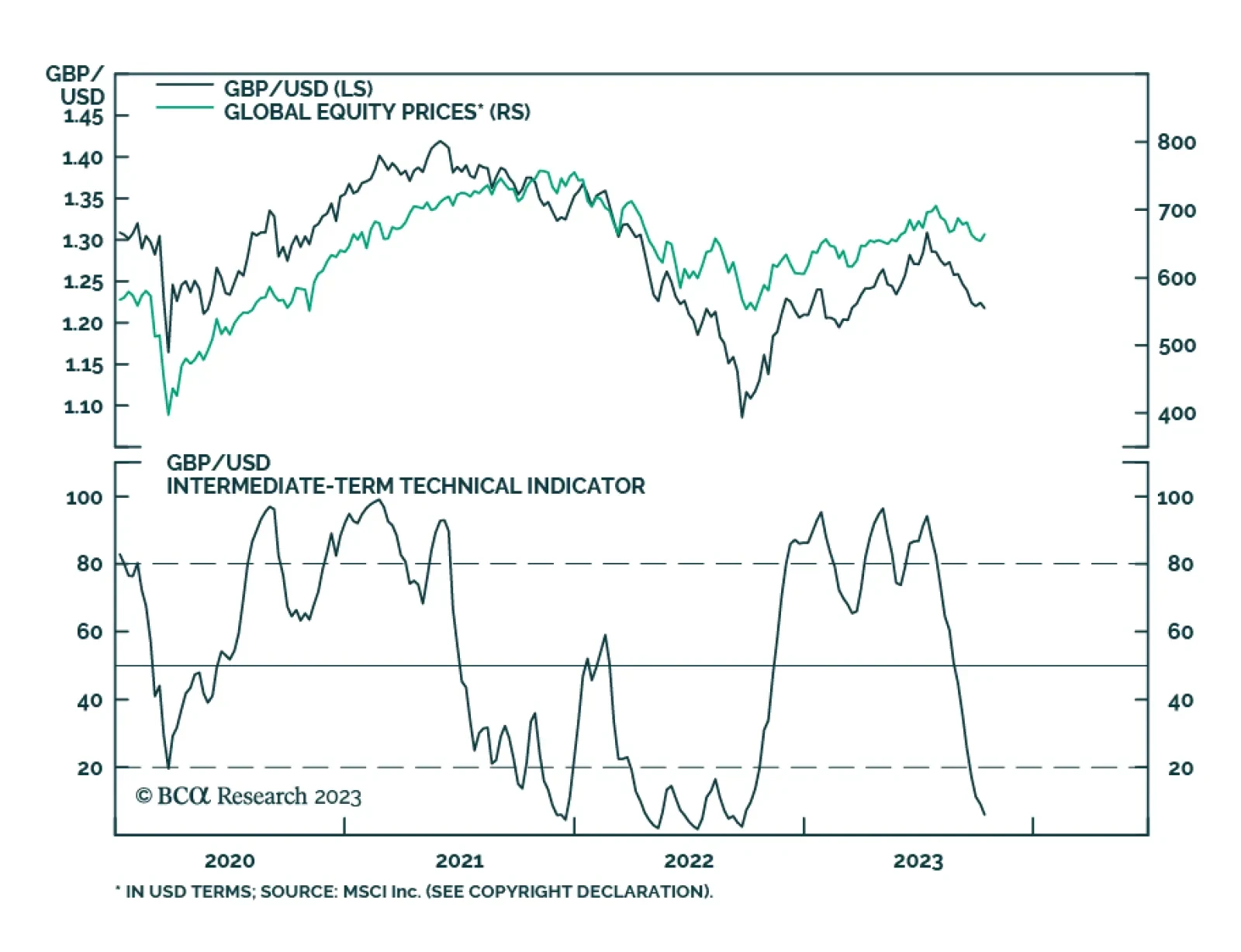

Back in May, our foreign exchange team suggested the risk to sterling was to the downside. Indeed, GBP/USD is down 8% from its recent peak. While dollar strength largely explains this move in GBP/USD, there have been other…