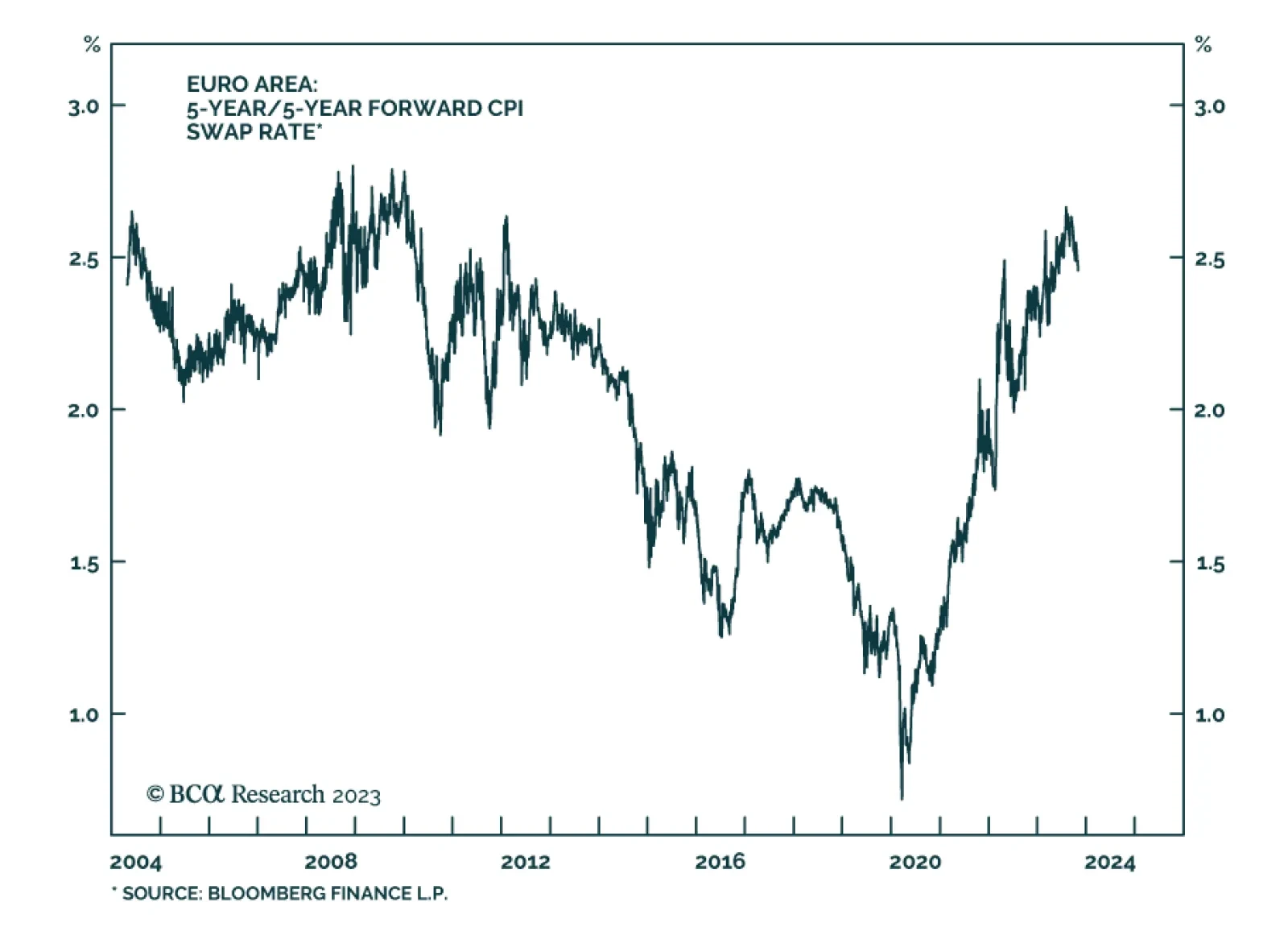

According to BCA Research’s European Investment Strategy service, German yields will fall toward 2% as market-based inflation expectations dip. For now, the deceleration in Eurozone core CPI can be attributed to the…

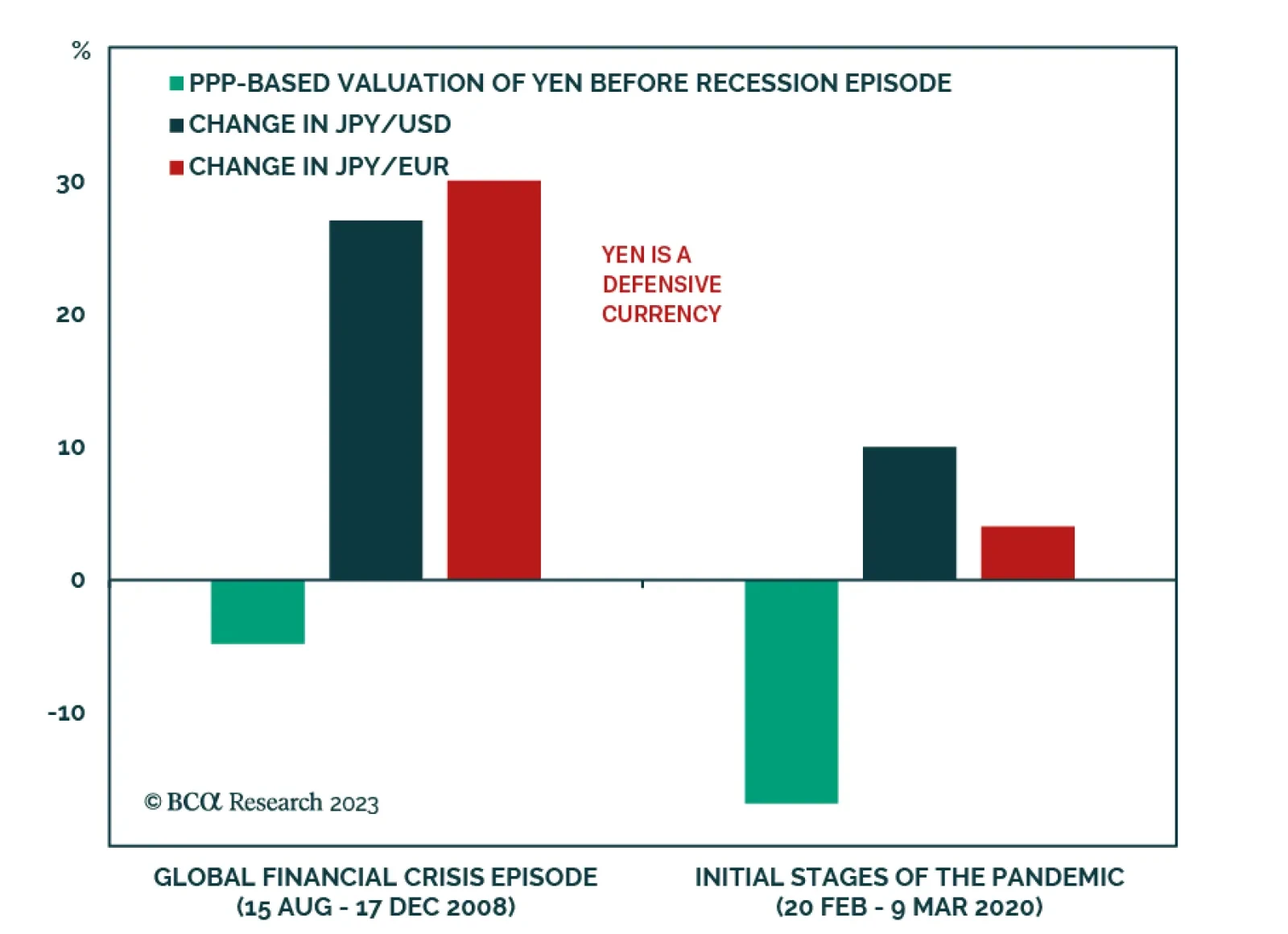

Last week the Bank of Japan (BoJ) announced further relaxations to its yield curve control (YCC) program. Despite this, the yen has shown no signs of life. Since the BOJ's decision was announced, the yen is the worst…

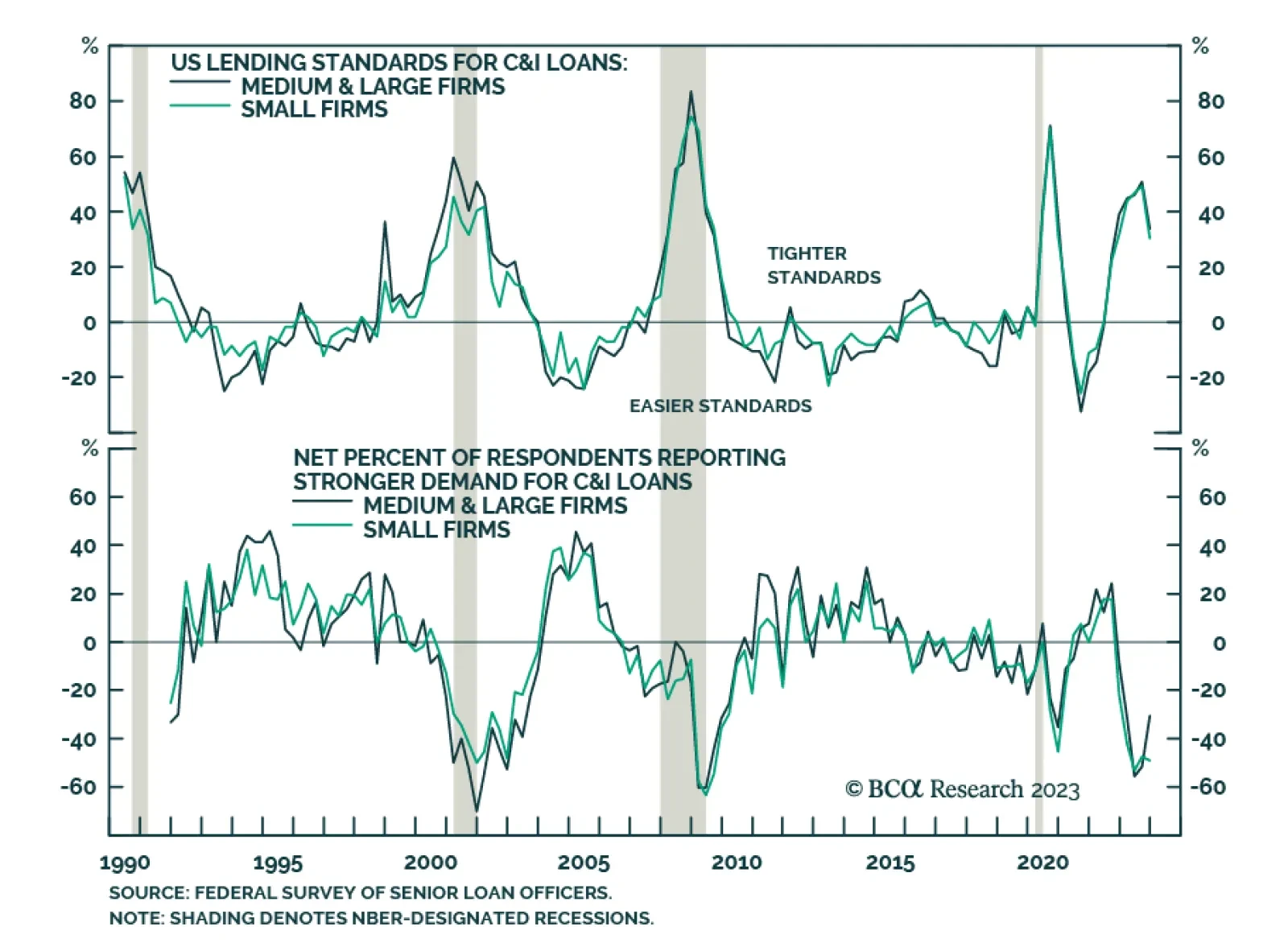

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continued to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE)…

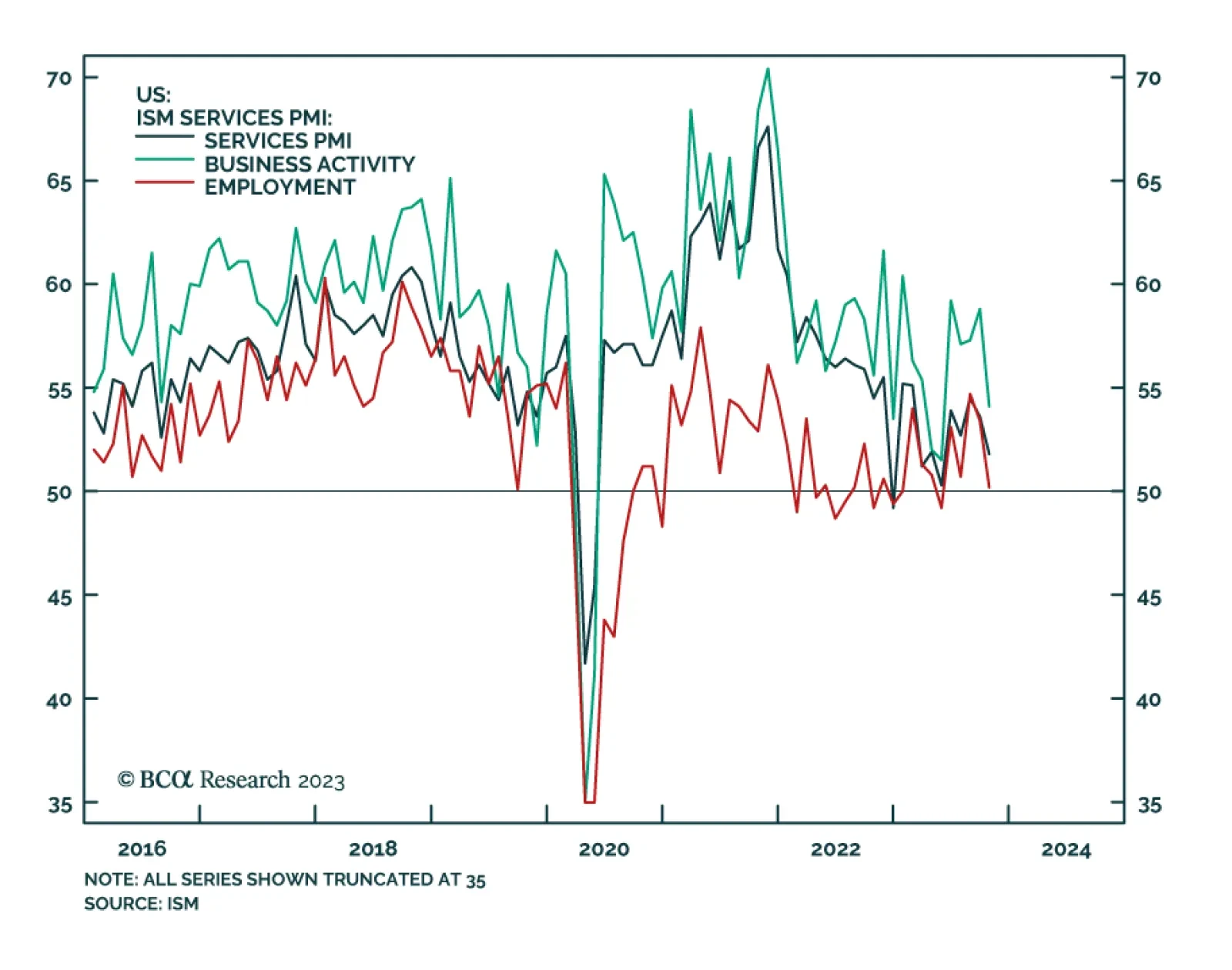

The US ISM PMI delivered a disappointing signal about service sector activity in October. The headline index fell from 53.6 to 51.8 – marking a sharp slowdown in activity and falling below expectations of a much more muted…

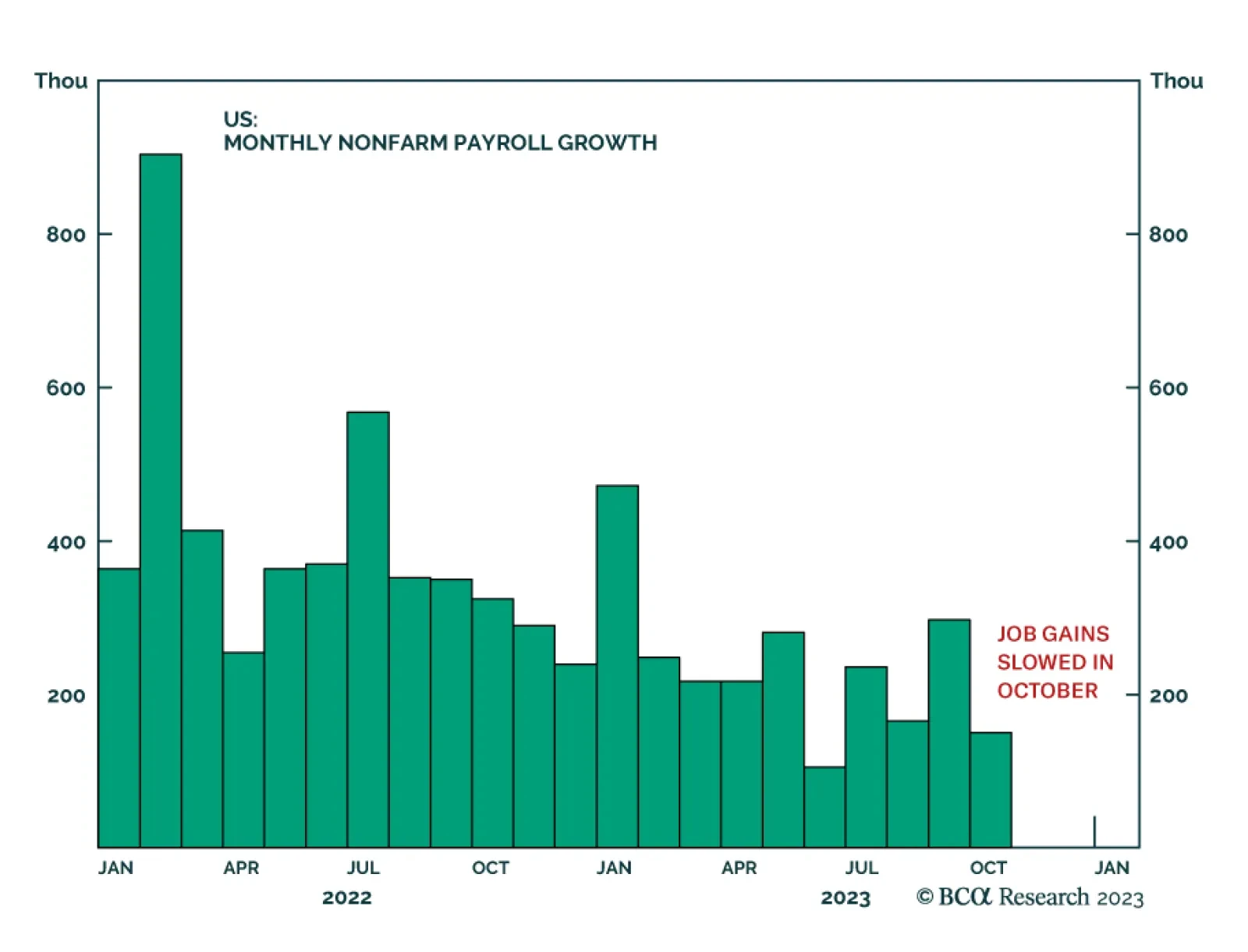

The US Nonfarm Payroll report indicates that labor market conditions cooled in October. The 150 thousand increase in payroll employment fell below expectations of 180 thousand and marks a slowdown from the 297 thousand increase…

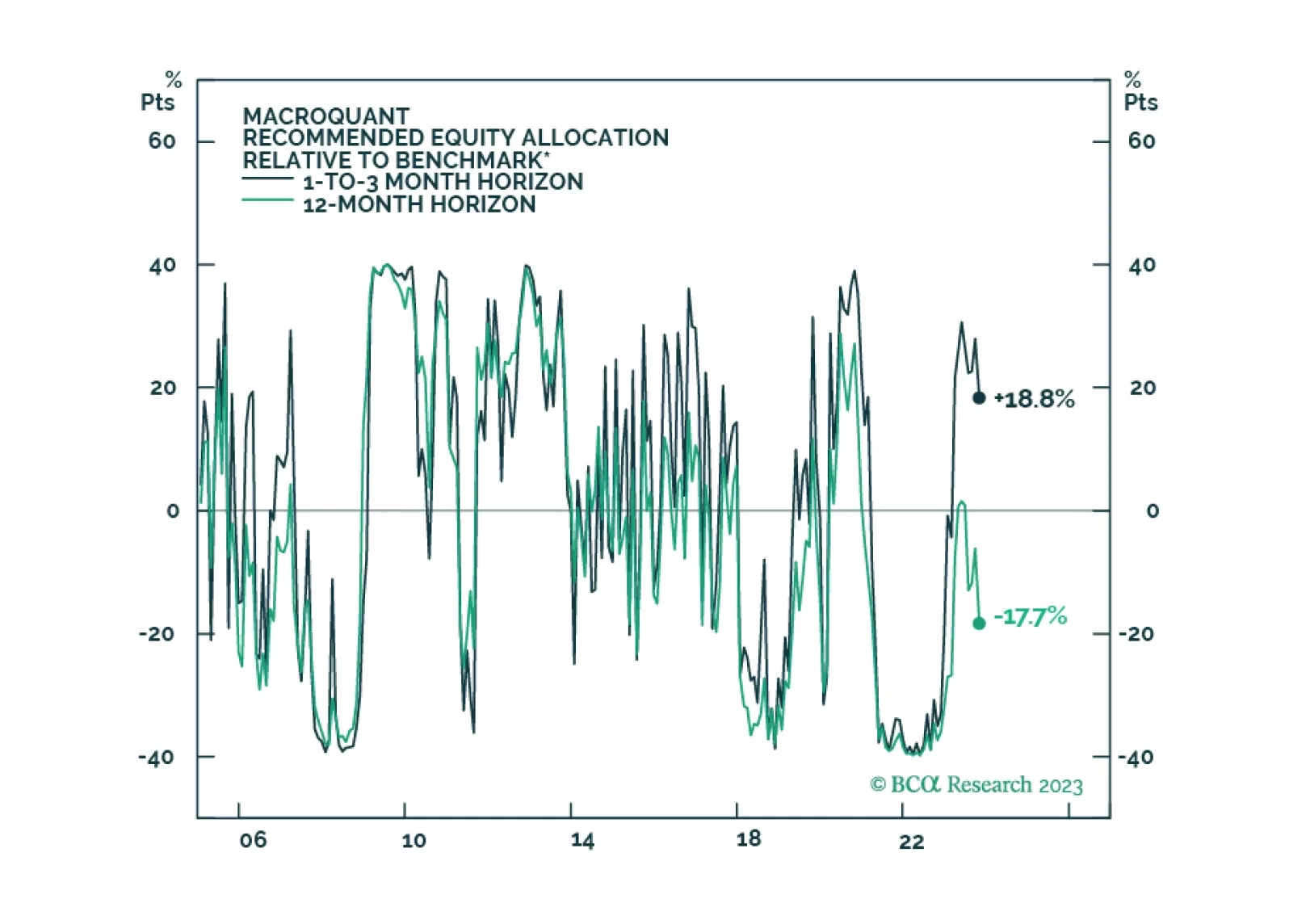

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.

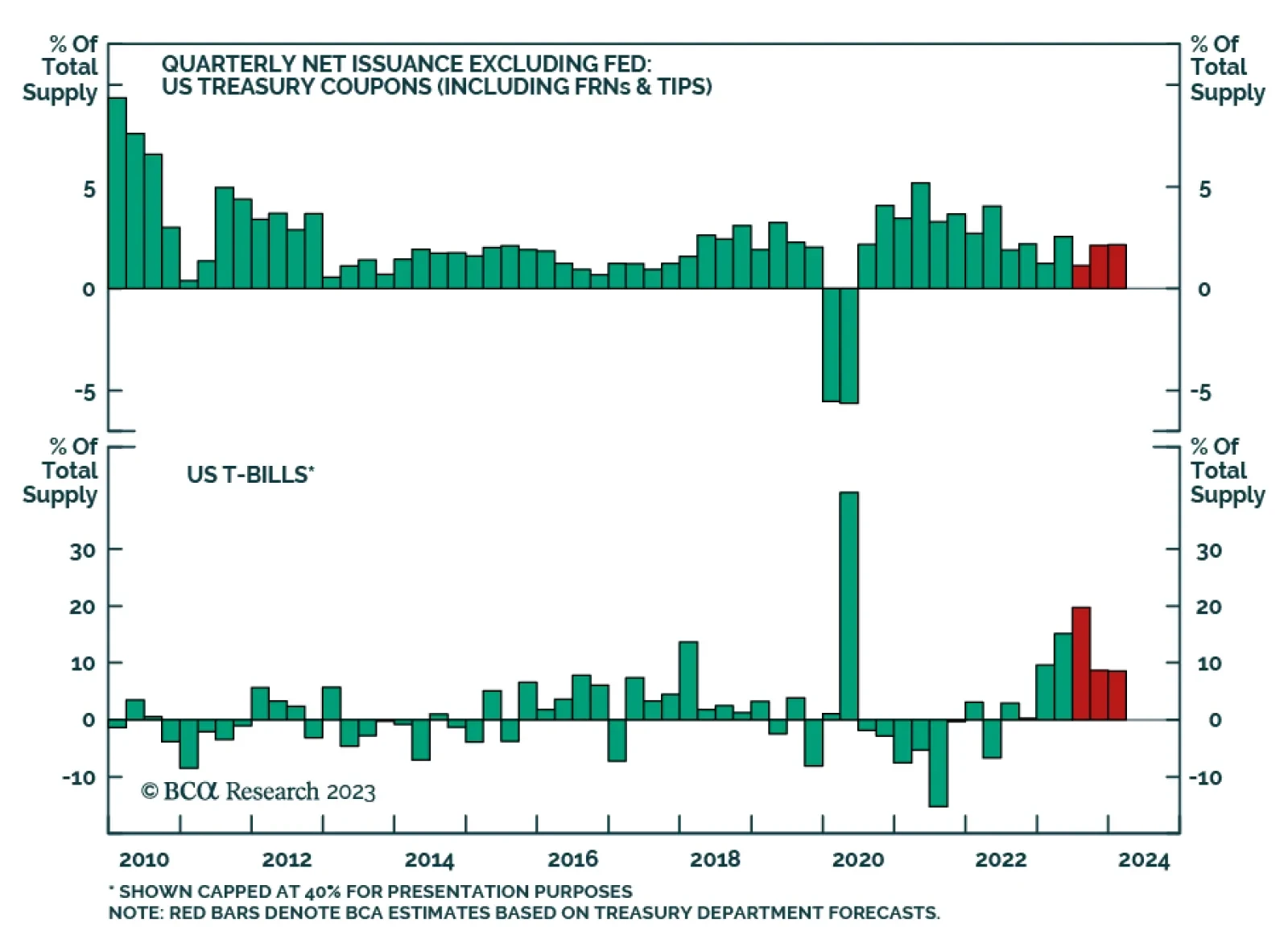

According to BCA Research’s US Bond Strategy service, while economic growth will be a much more important driver of Treasury yields going forward than supply, the Treasury department did make several announcements on…

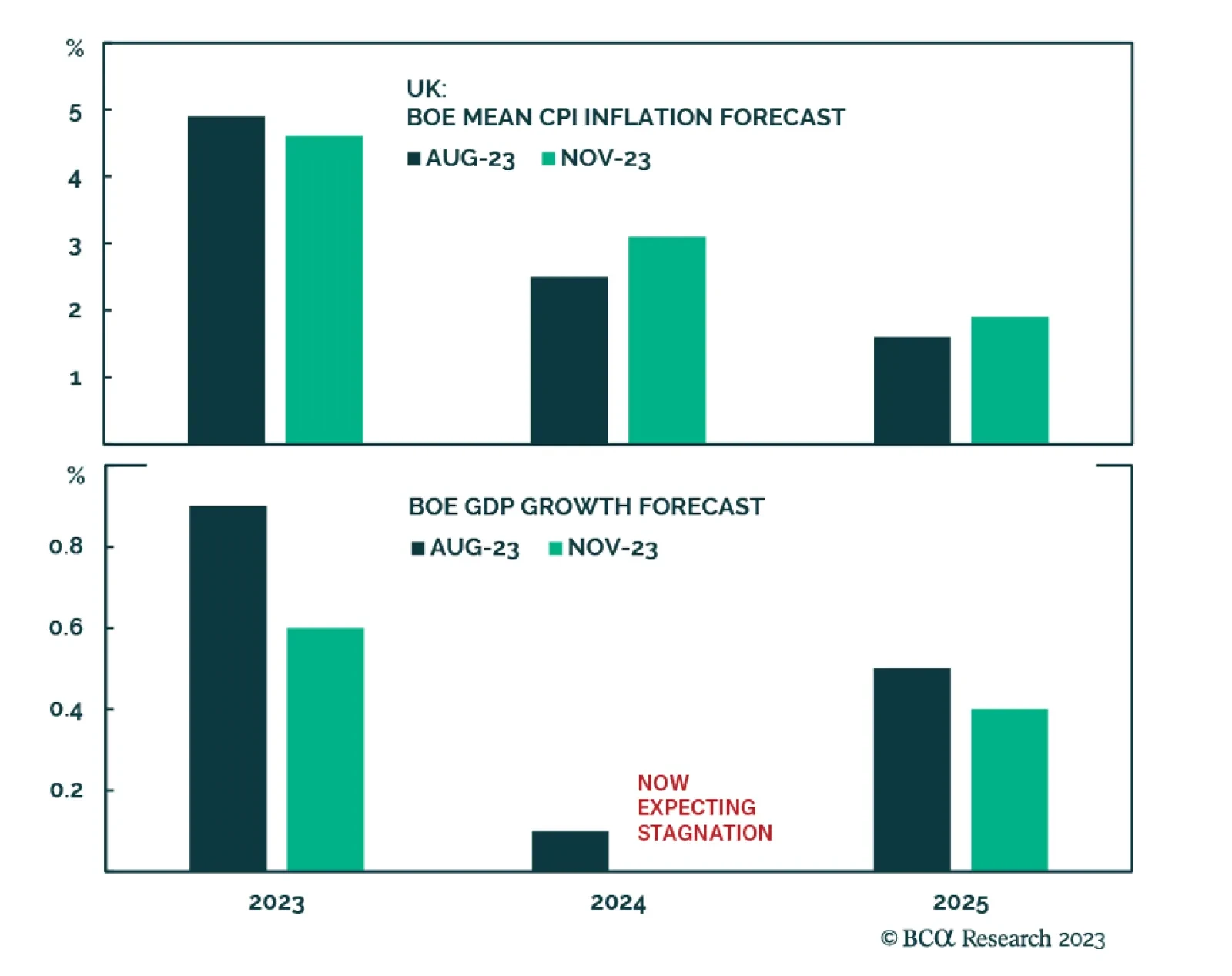

As expected, the Bank of England kept its bank rate unchanged at 5.25% at Thursday's MPC meeting with six members voting in favor of the decision and the remaining three preferring a 25bps rate increase. Governor Andrew…

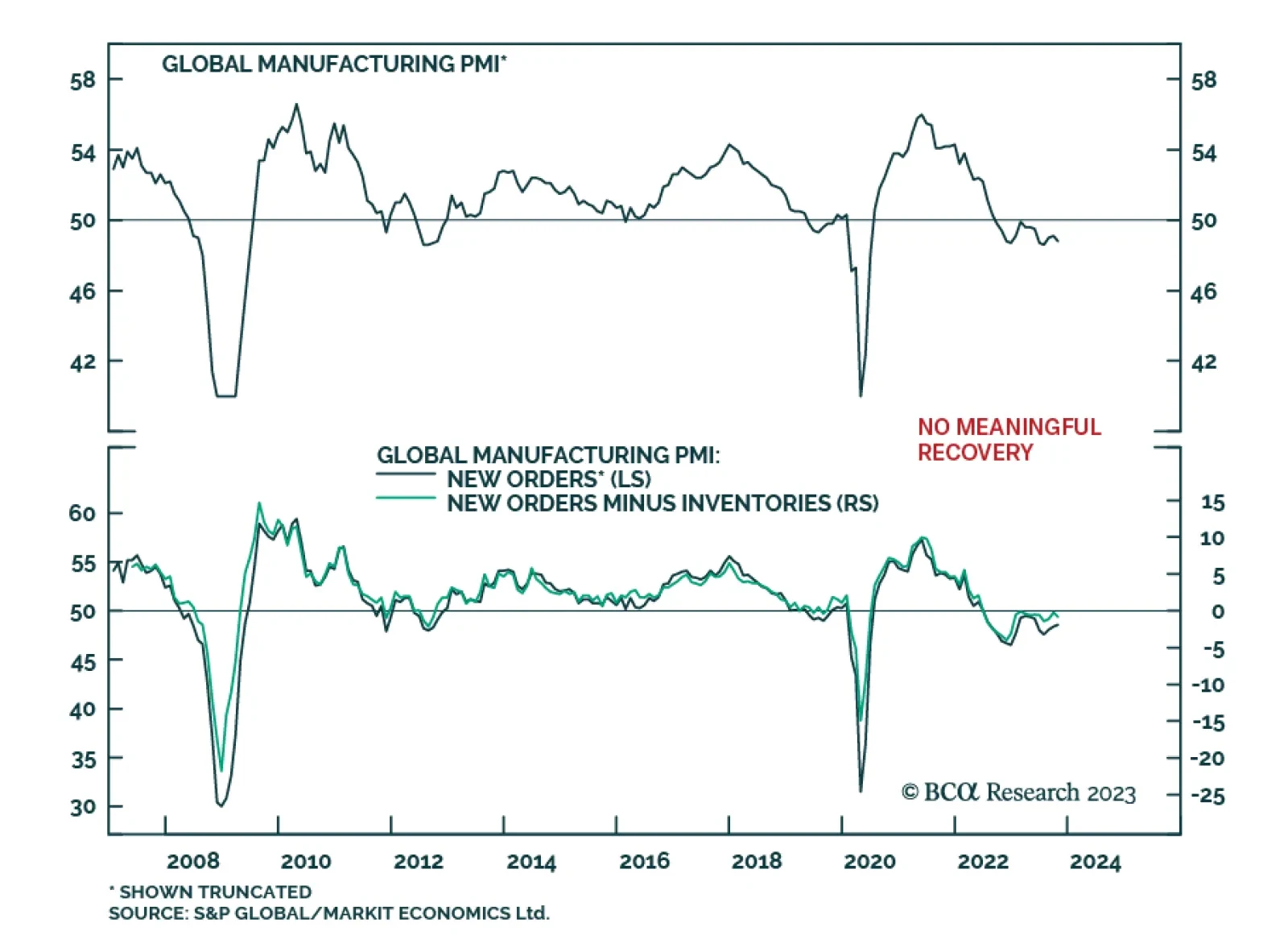

The October update of the Global Manufacturing PMI sent a pessimistic signal about the industrial cycle. The headline index declined from 49.2 to 48.8, indicating a faster pace of deterioration. In particular, the Output,…

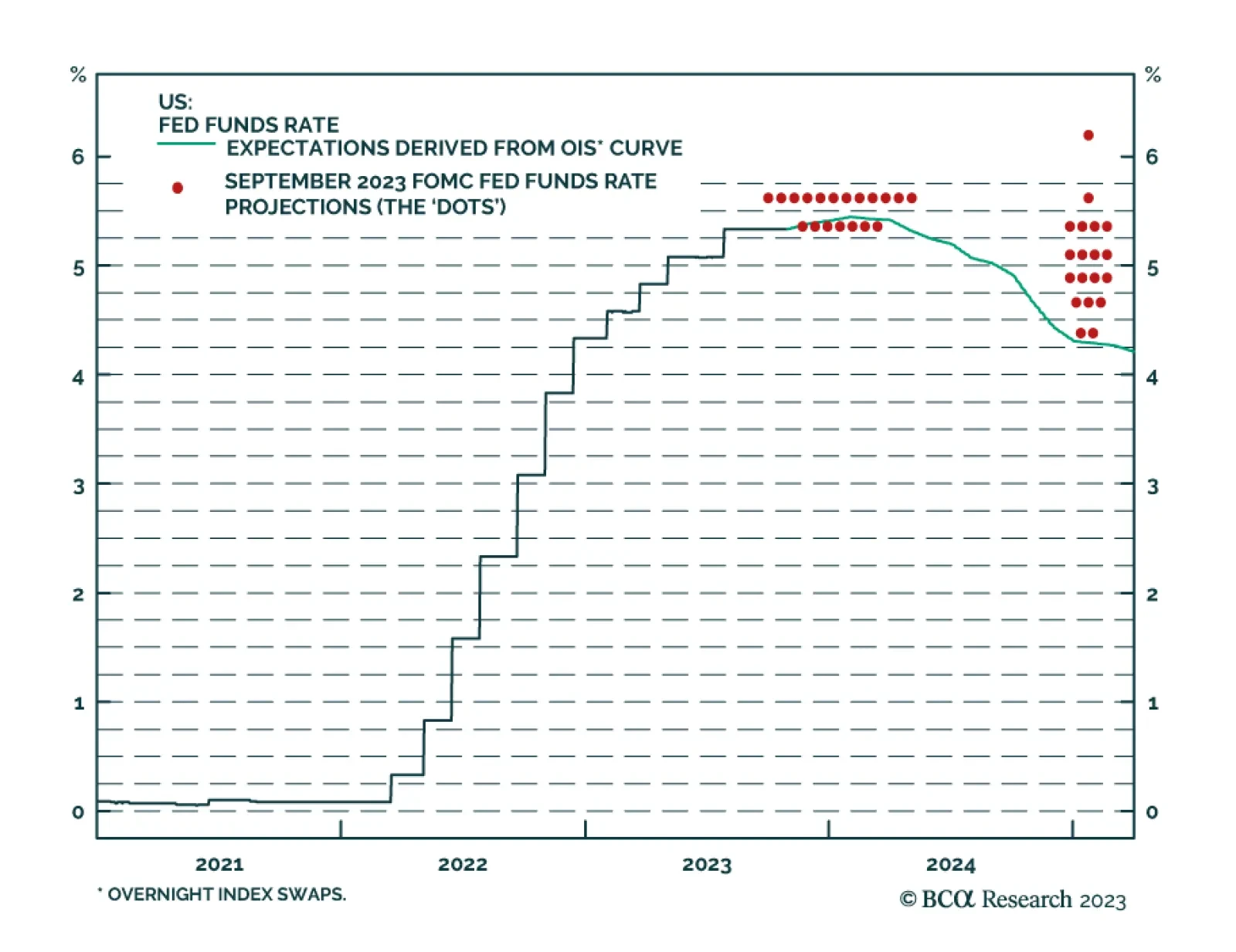

As expected, the Fed stood pat at its Wednesday meeting, maintaining the target for the fed funds rate at 5.25-5.50%. The minimal changes made to the Fed Statement were to emphasize the strong pace of economic activity in Q3, to…