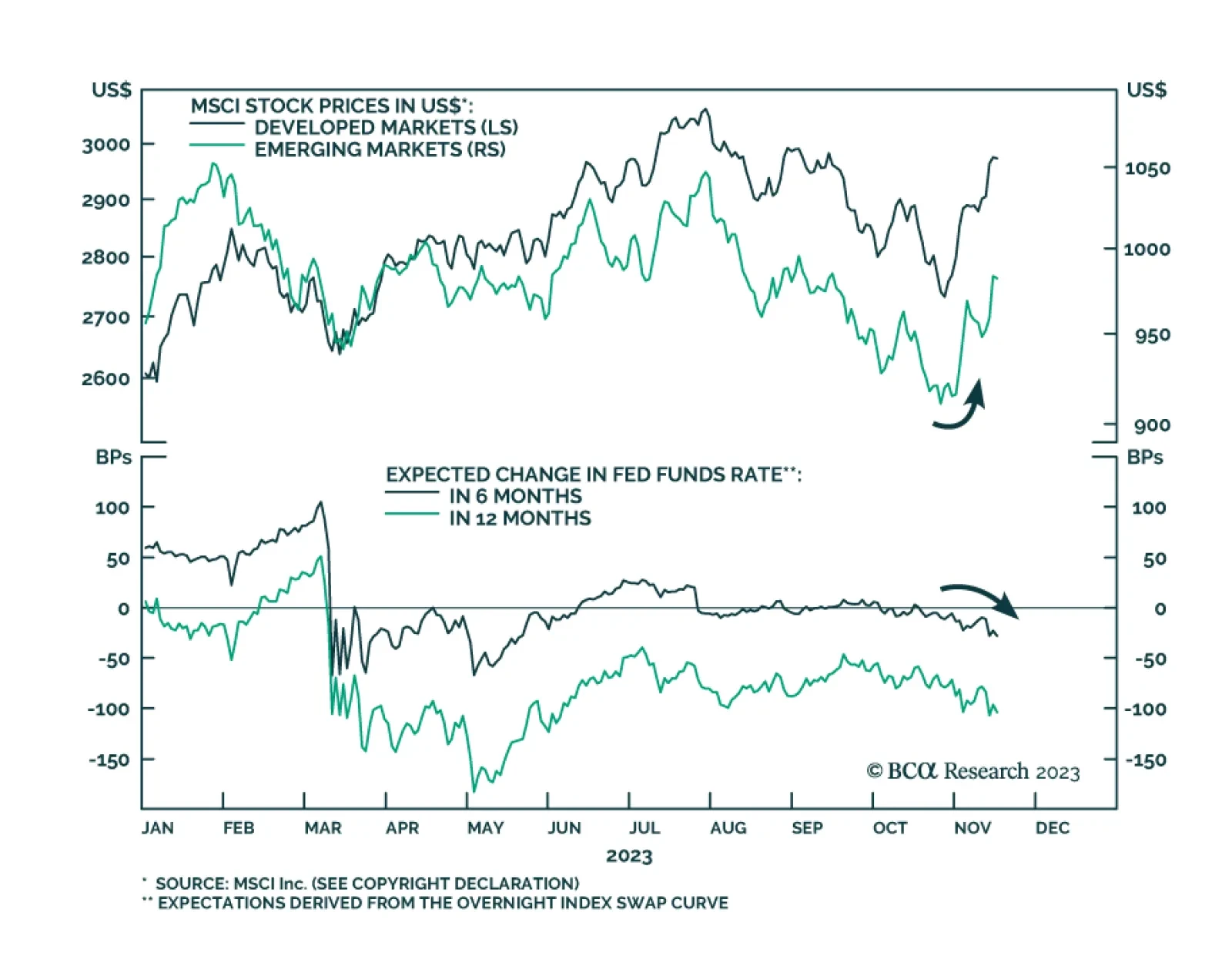

Global market sentiment has improved notably since late-October. In the equity space, DM and EM stocks have gained 8.5% and 7.8% respectively since October 26. Regarding currencies, the counter-cyclical DXY index has lost 2.2% so…

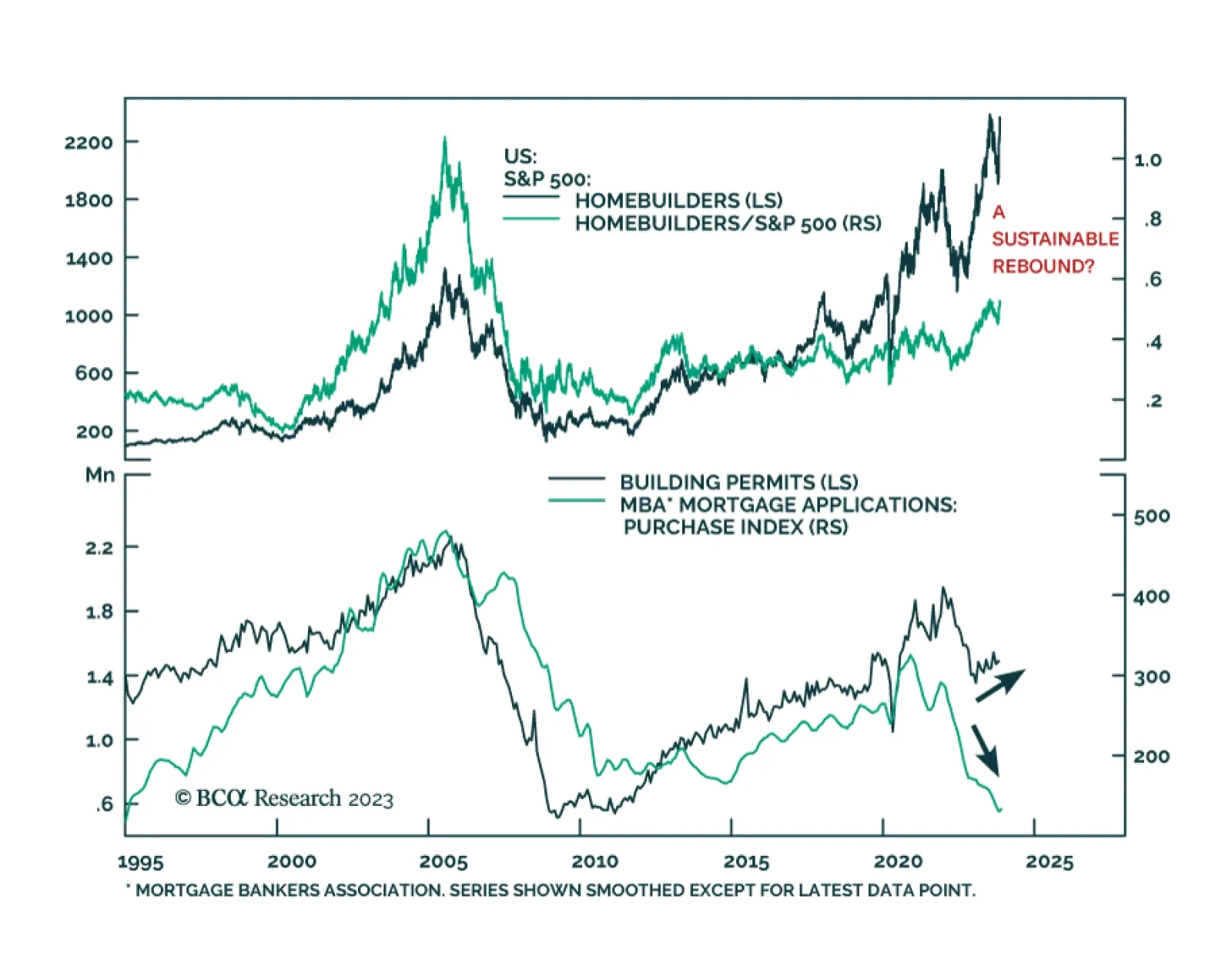

Recent data releases have painted a mixed picture of US housing market dynamics. On the one hand, housing starts and building permits unexpectedly increased on a month-on-month basis in October. After falling in 2022, housing…

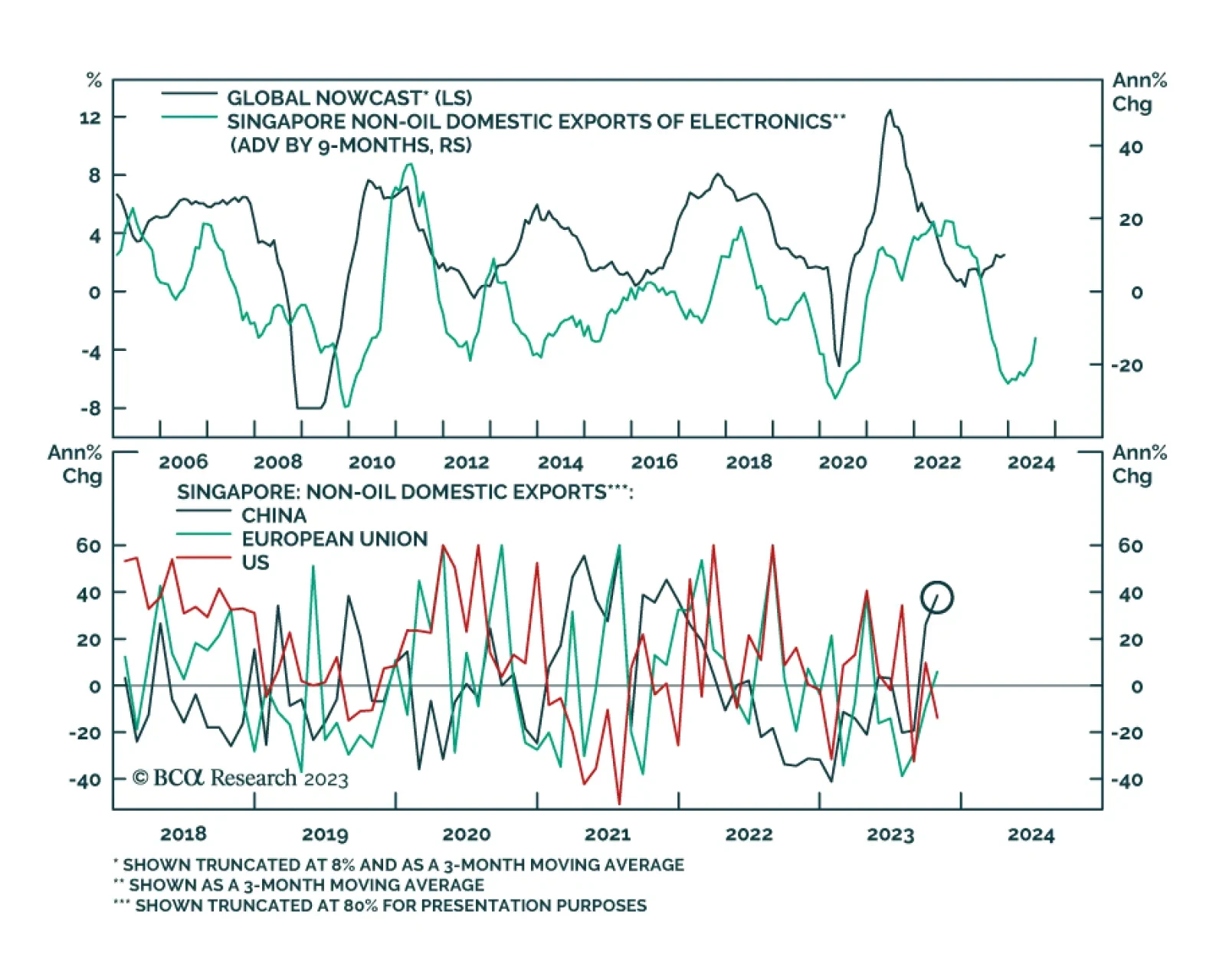

Singapore is a small open economy that is highly sensitive to fluctuations in the global manufacturing activity. As such, Singapore’s non-oil domestic exports (NODX) are a bellwether for global growth. Singapore’s…

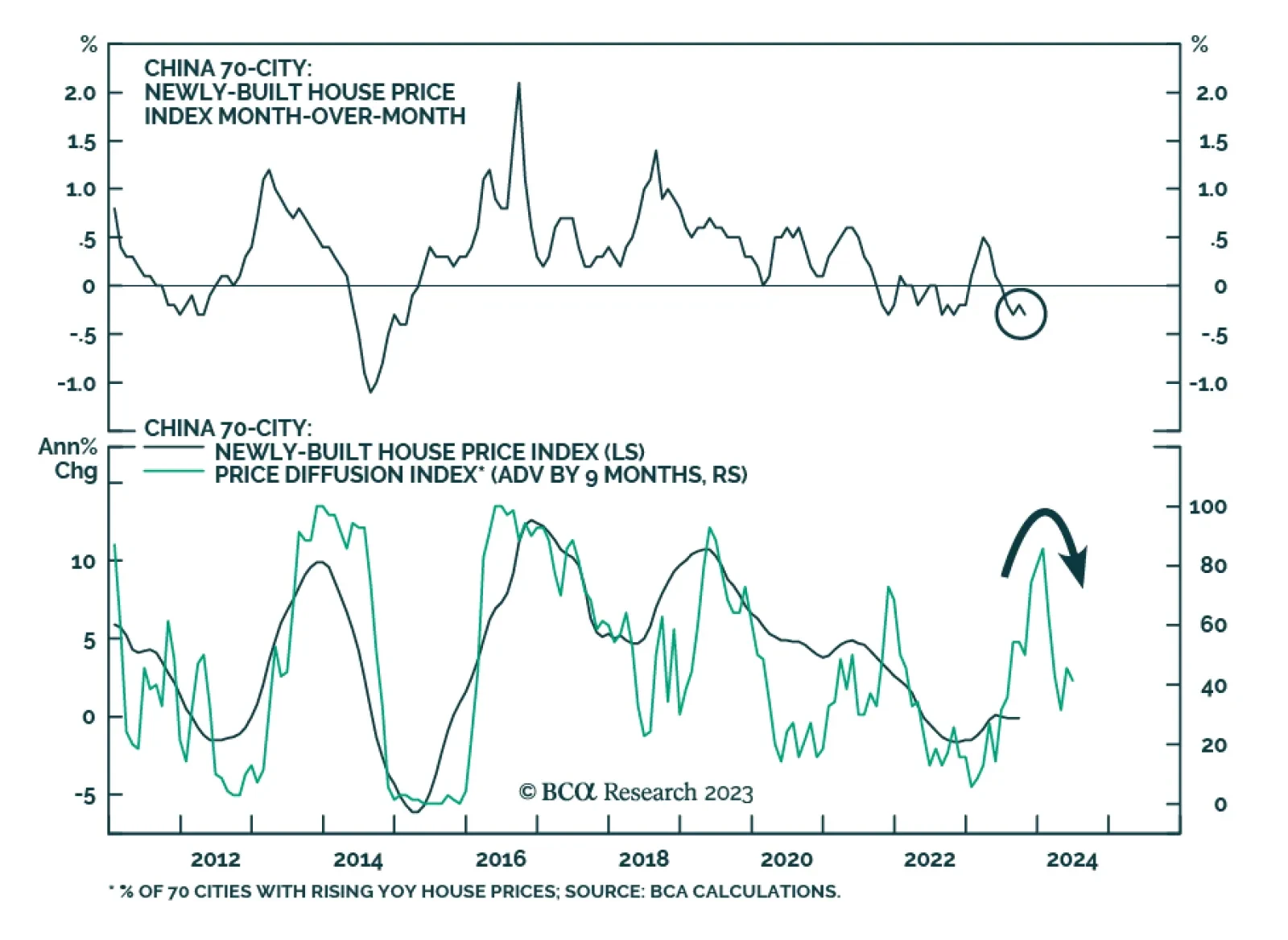

The latest house price data indicate that China's housing market remains weak. The prices of newly built homes across 70 medium and large Chinese cities declined by 0.4% m/m in October – a faster pace of decline than…

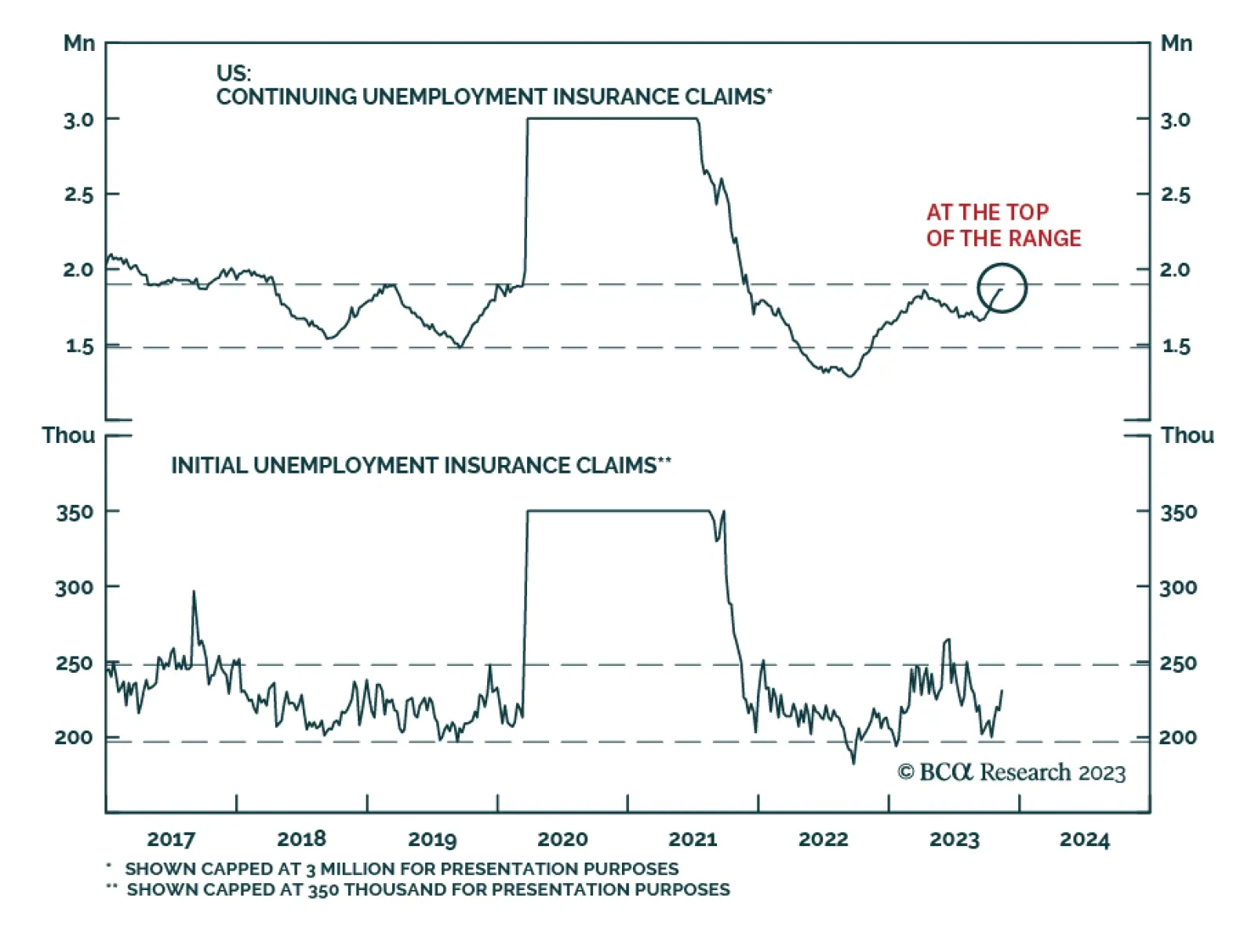

US jobless claims have been trending higher in recent weeks, confirming that labor market conditions are deteriorating. Initial claims came in slightly above consensus estimates on Thursday, increasing by 231 thousand versus…

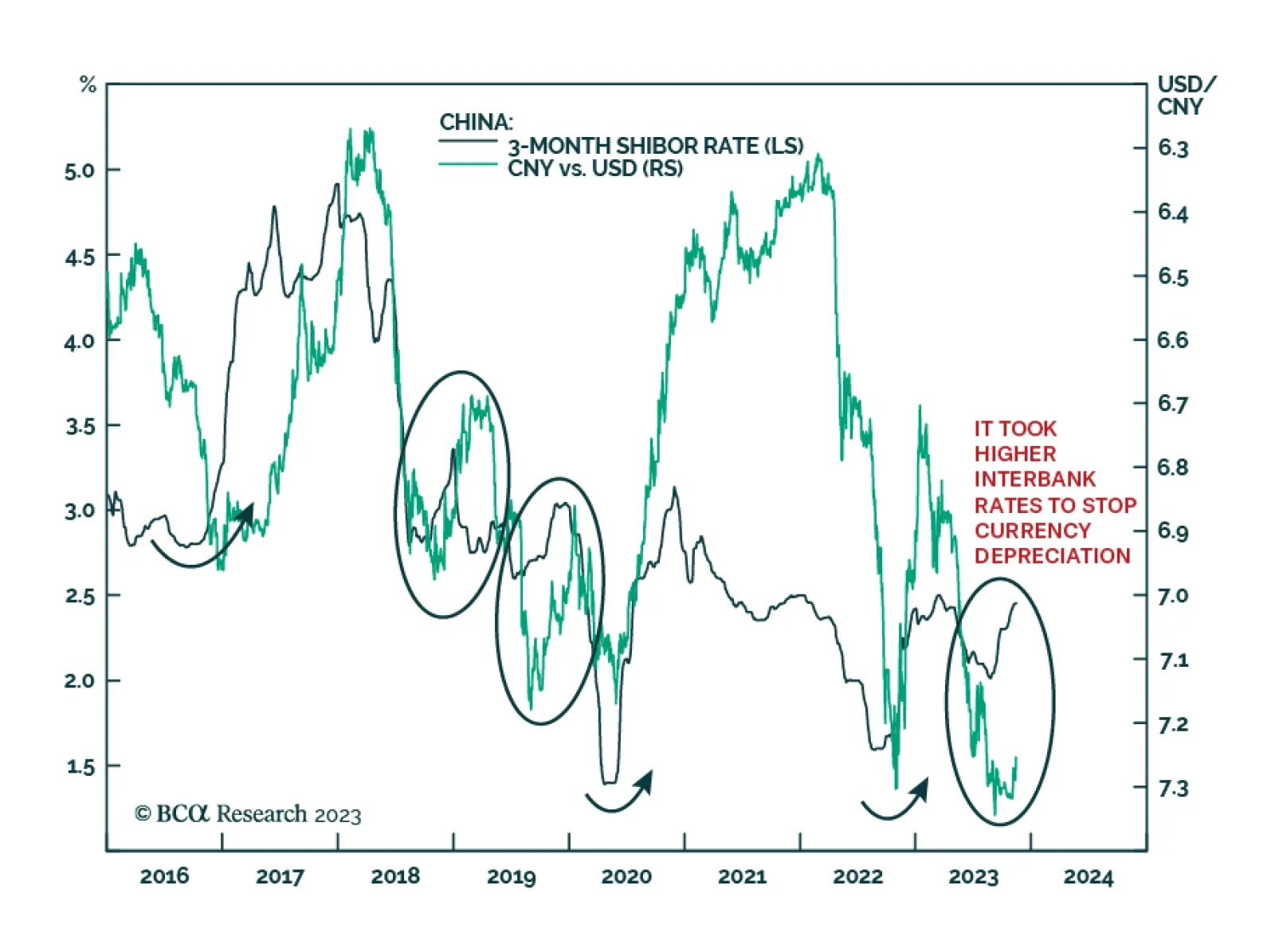

According to BCA Research’s China Investment Strategy service, Chinese policymakers are facing the Impossible Trinity. When faced with rapid currency depreciation in August-September, the PBoC deliberately tightened…

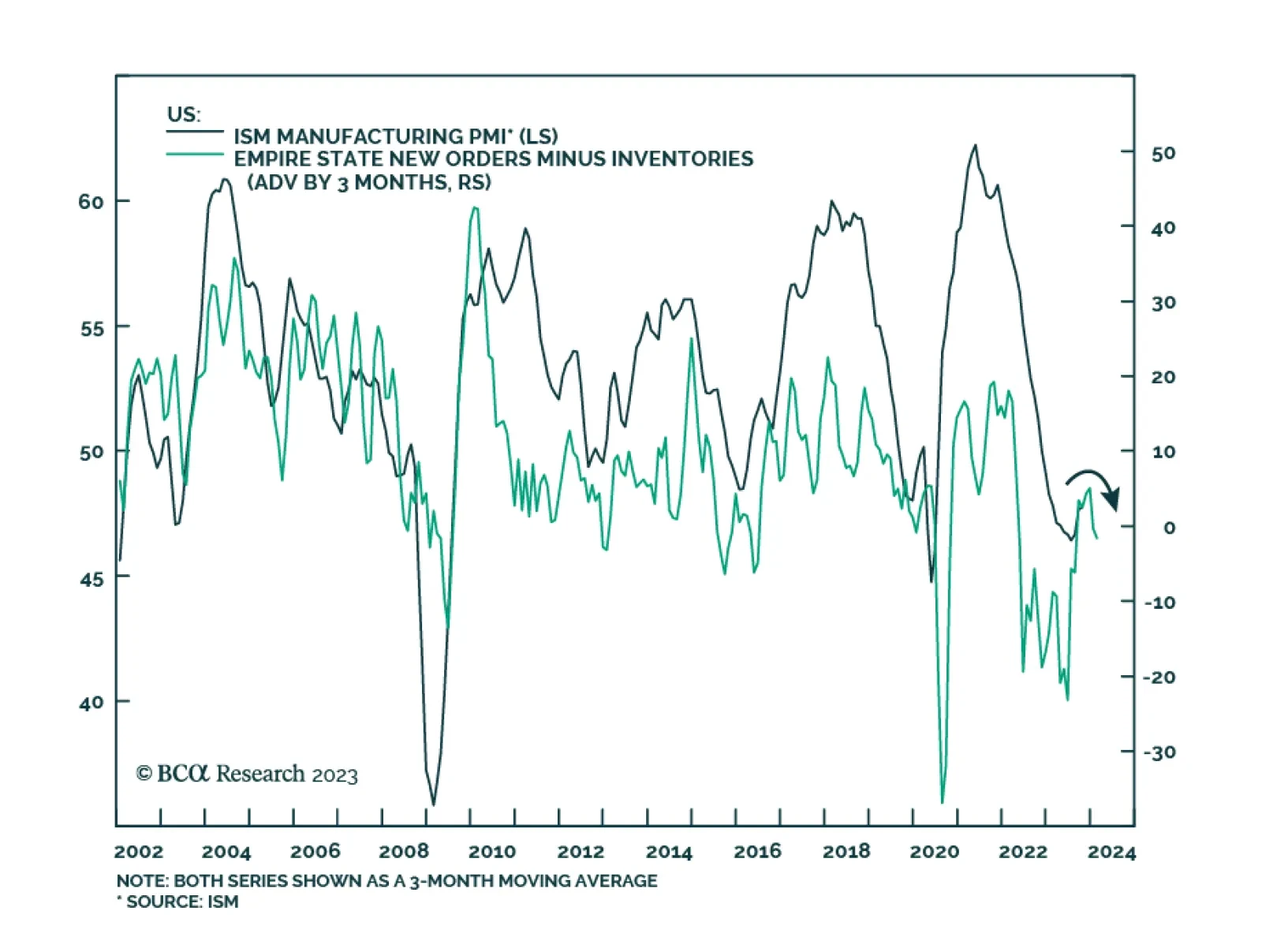

The New York Fed's Empire Manufacturing Index unexpectedly returned to positive territory in November, climbing 14 points to its highest level since April. The headline index suggests that manufacturing activity is…

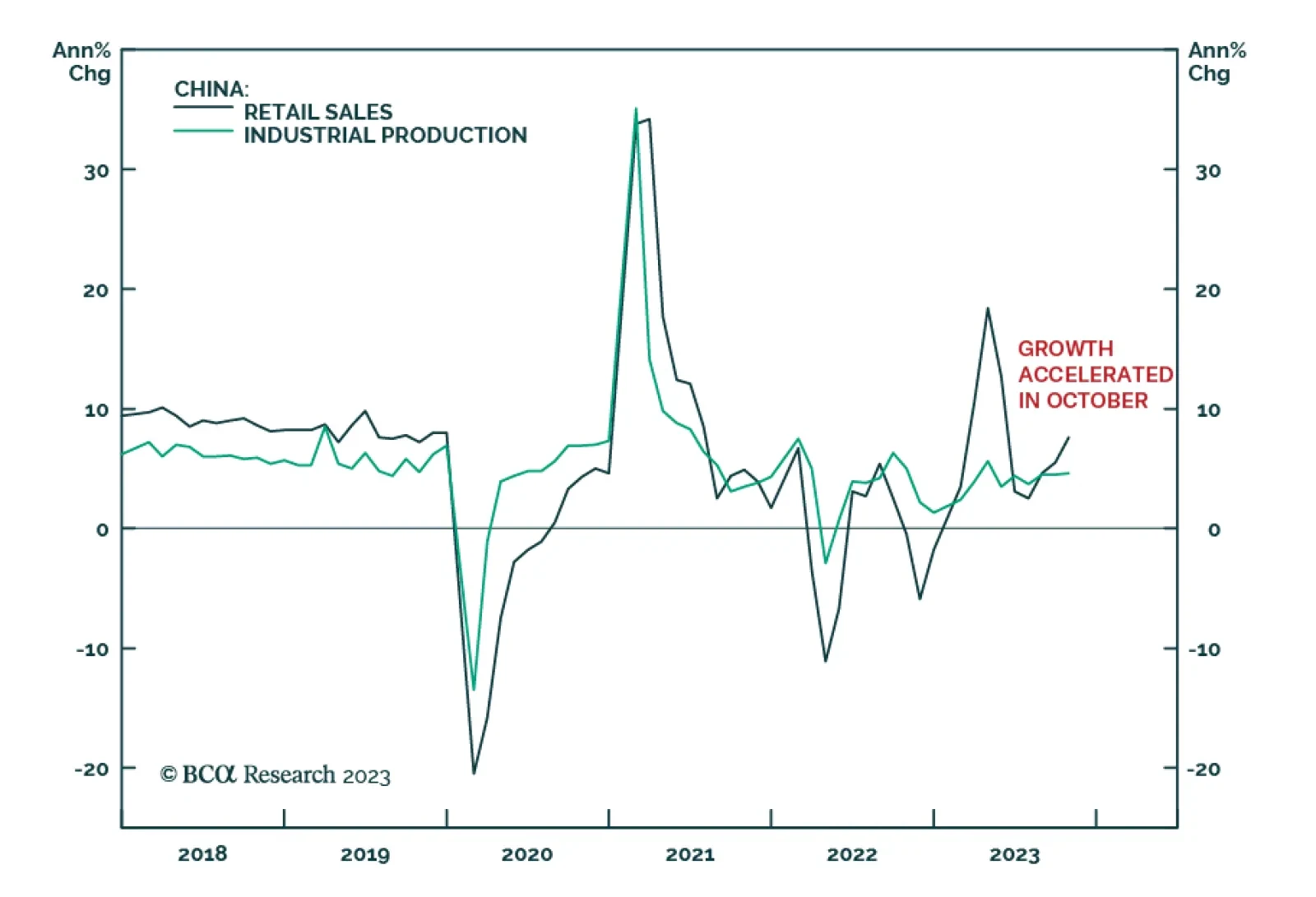

On the surface, the acceleration in Chinese retail sales and industrial production growth in October suggests that the economy is holding up. Retail sales expanded by 7.6% y/y last month – beating expectations of 7.0% y/y…

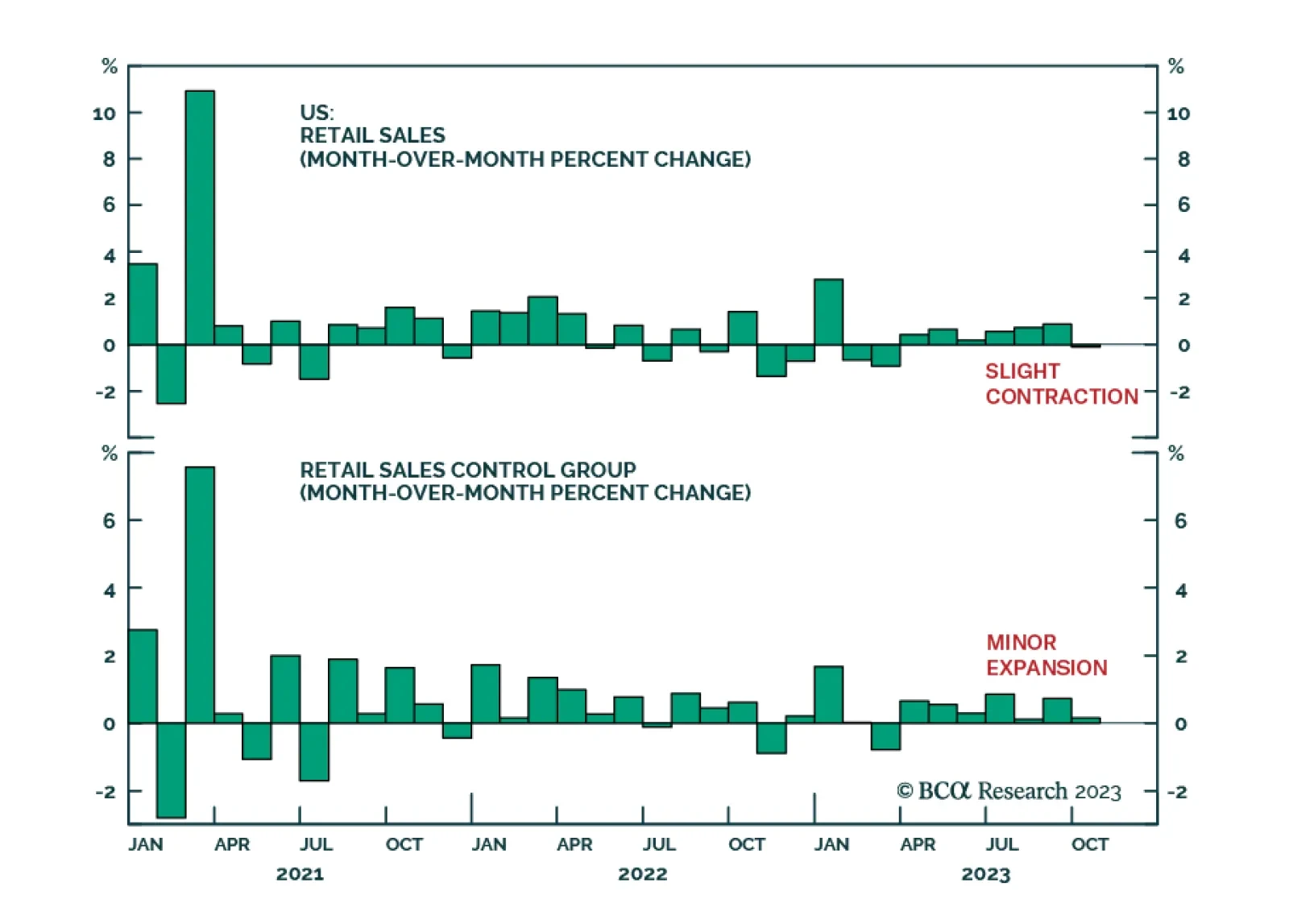

The US retail sales release delivered a mixed signal about US consumption. Although the headline figure contracted by 0.1% m/m in October, it was better than expectations of a 0.3% m/m decline. Moreover, the September increase…

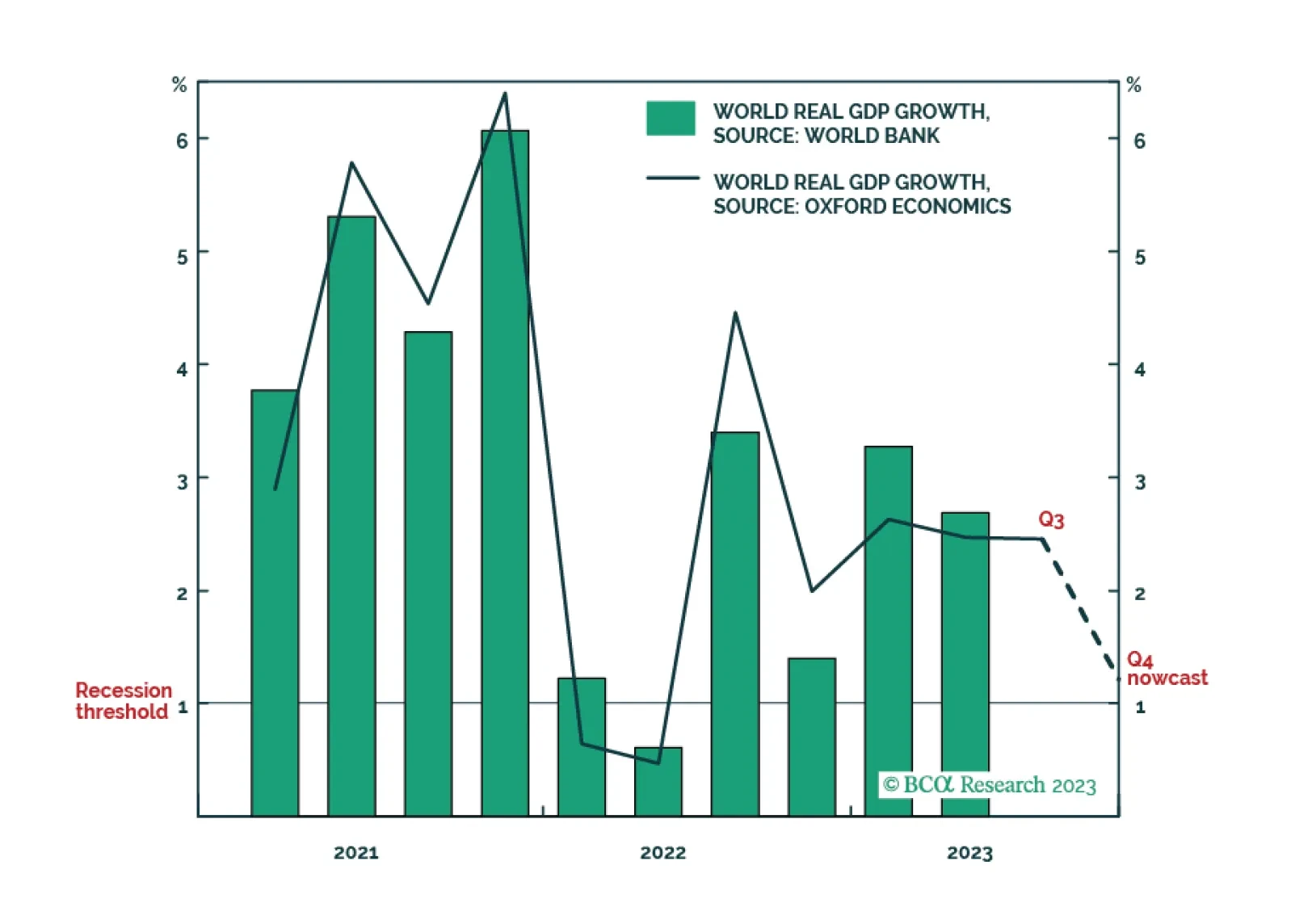

The latest ‘nowcast’ for world economic growth in the fourth quarter has plunged to just 1.2 percent, marking the cusp of another world recession. One important implication is that expectations for oil demand growth and industrial…