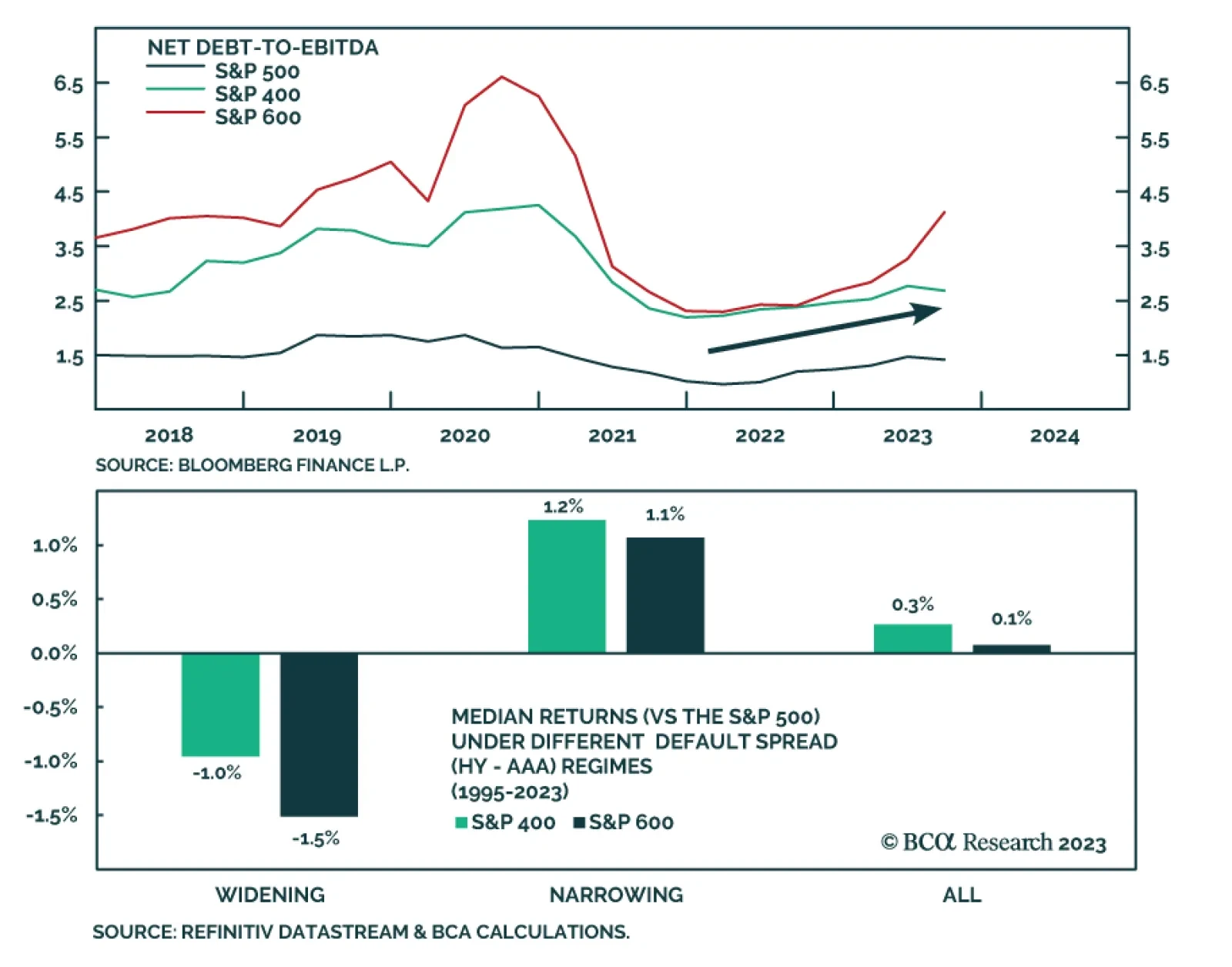

According to BCA Research's US Equity Strategy service, mid-caps underperform when spreads widen, although less so than Small as they are more financially robust and have better credit ratings. Small is the most leveraged…

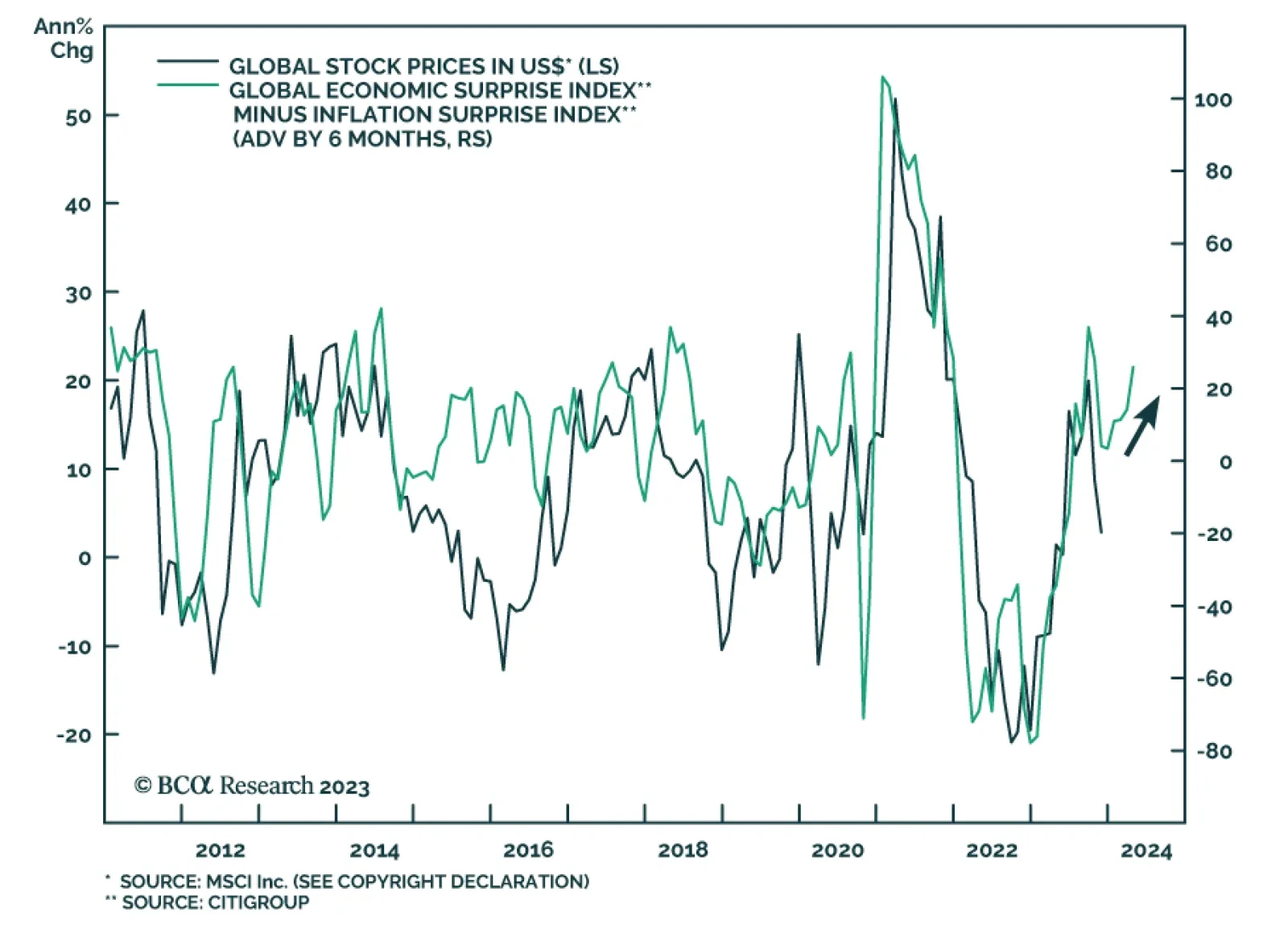

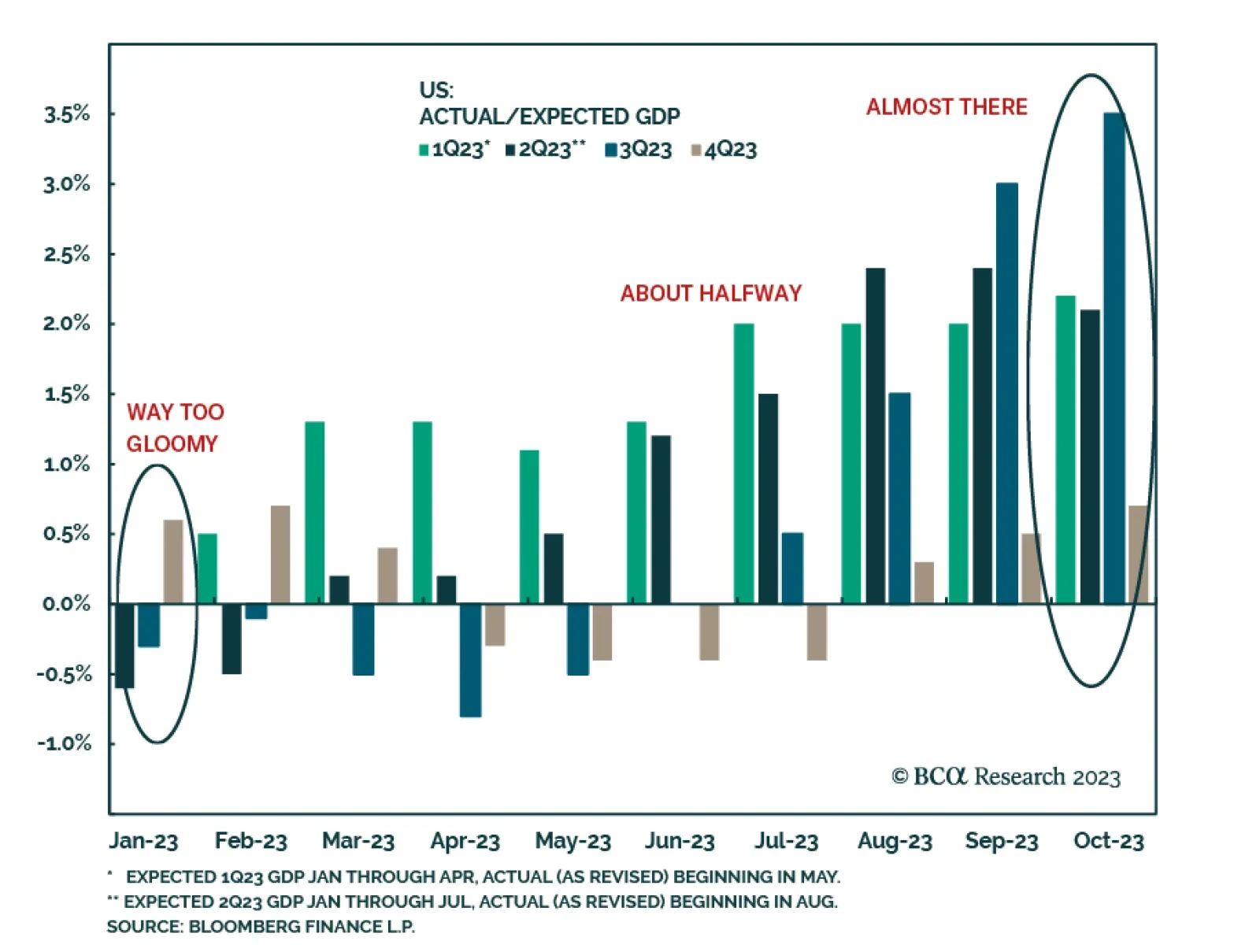

After dipping into negative territory between June and early August, the Global Economic Surprise Index has since rebounded, signalling an improvement in economic momentum. Initially, this rebound was isolated to the US. However…

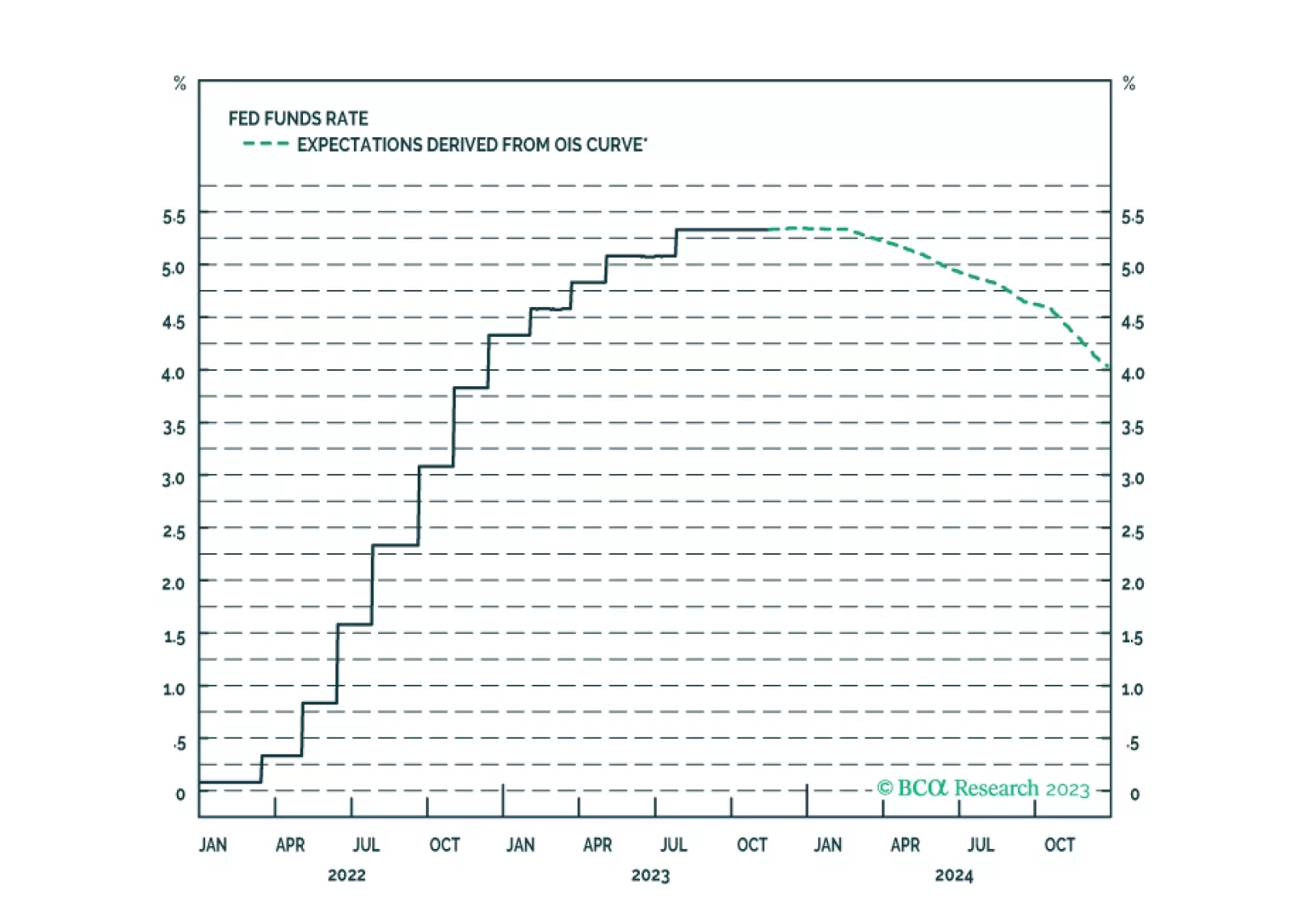

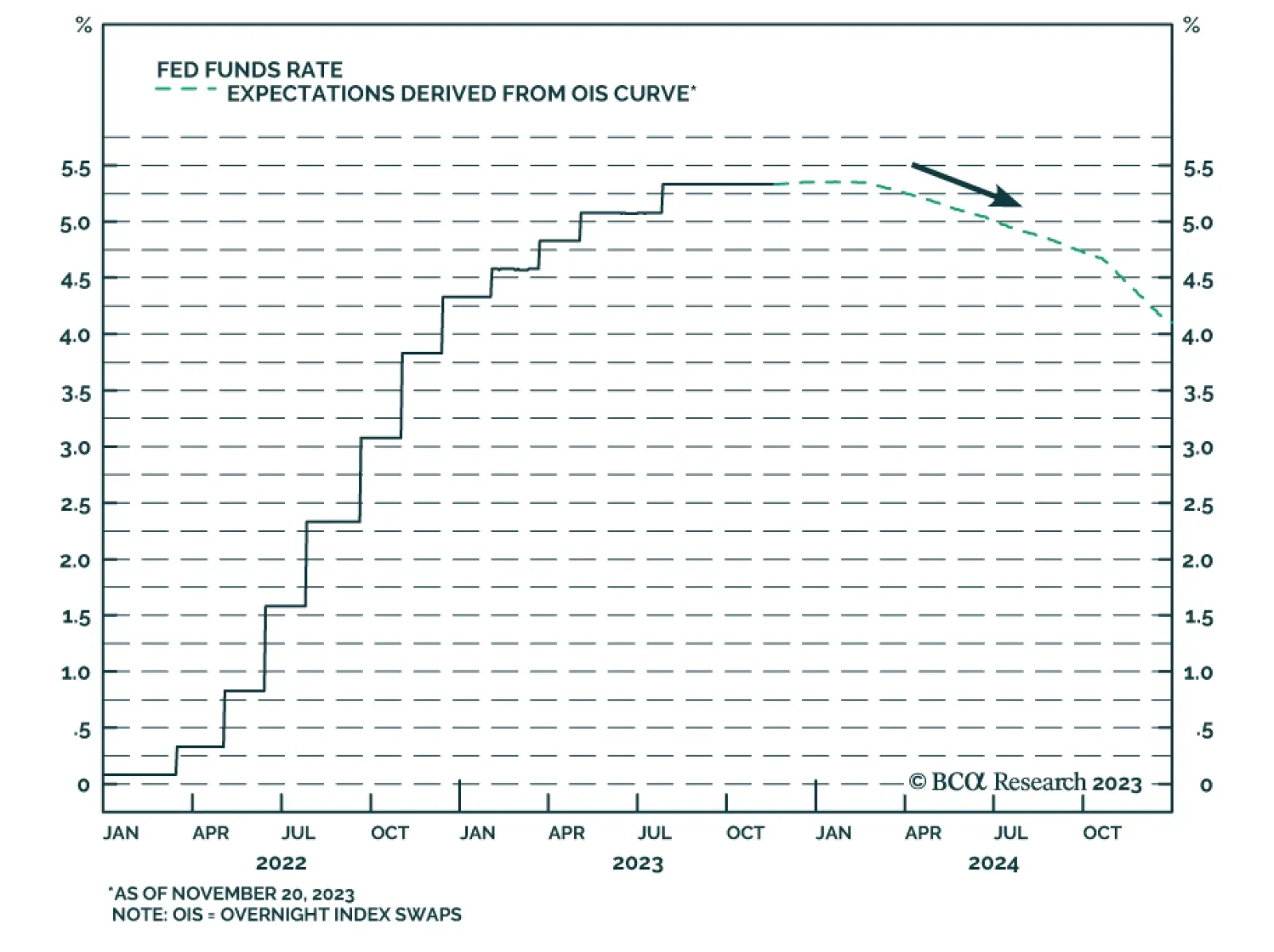

The minutes of the Fed's latest FOMC meeting revealed that there is a consensus among policymakers to proceed carefully. Another rate increase is appropriate only if "incoming inflation indicated that progress toward the…

The soft-landing narrative is gaining momentum, pushing equities higher and potentially offering investors a better entry point to position against it. Financial markets appear to have been surprised by the comforting…

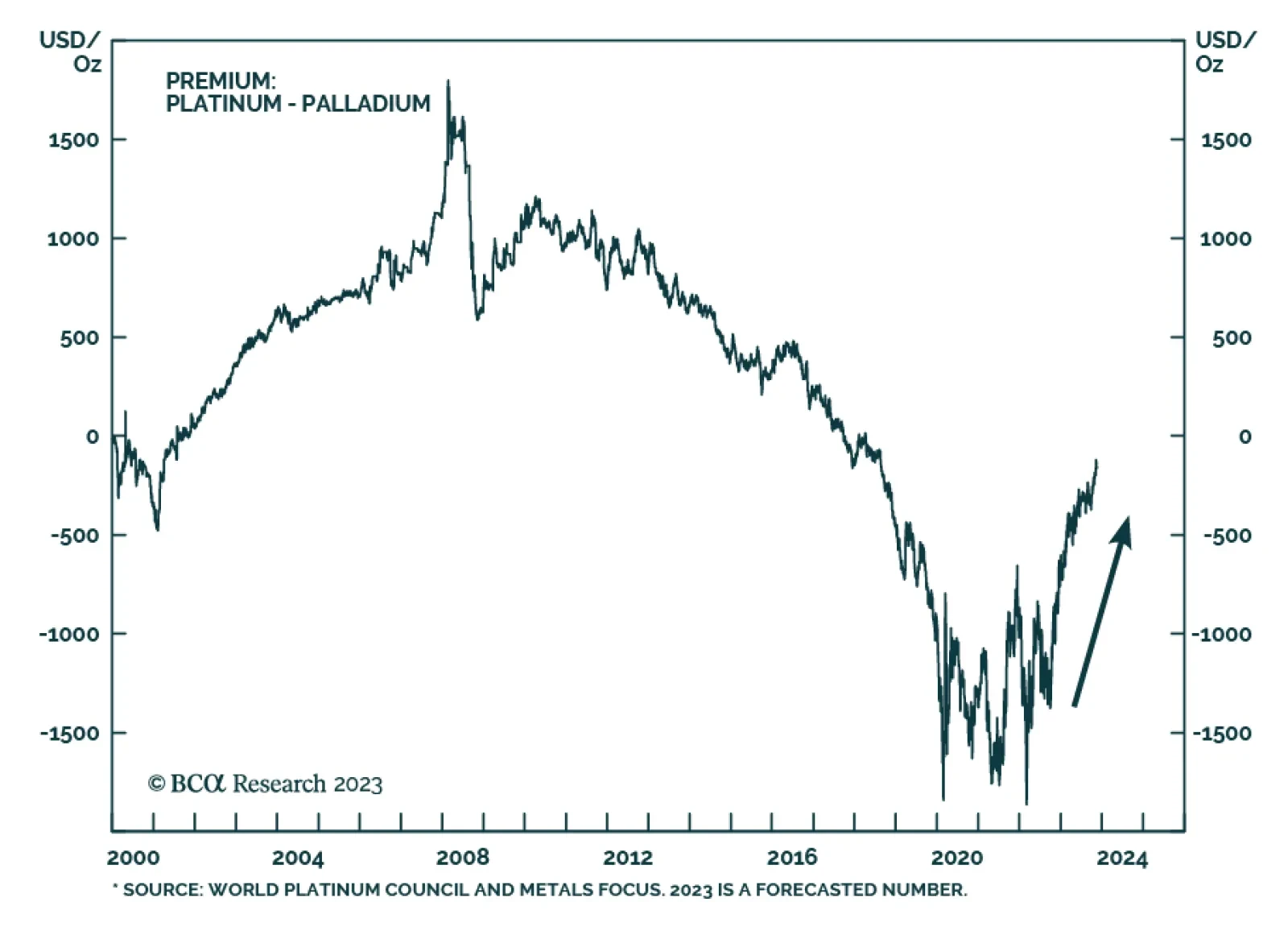

As we anticipated in an Insight we published in May, palladium continues to underperform platinum. Last week, platinum's discount to palladium shrunk to its smallest since August 2018. While the prices of both metals have…

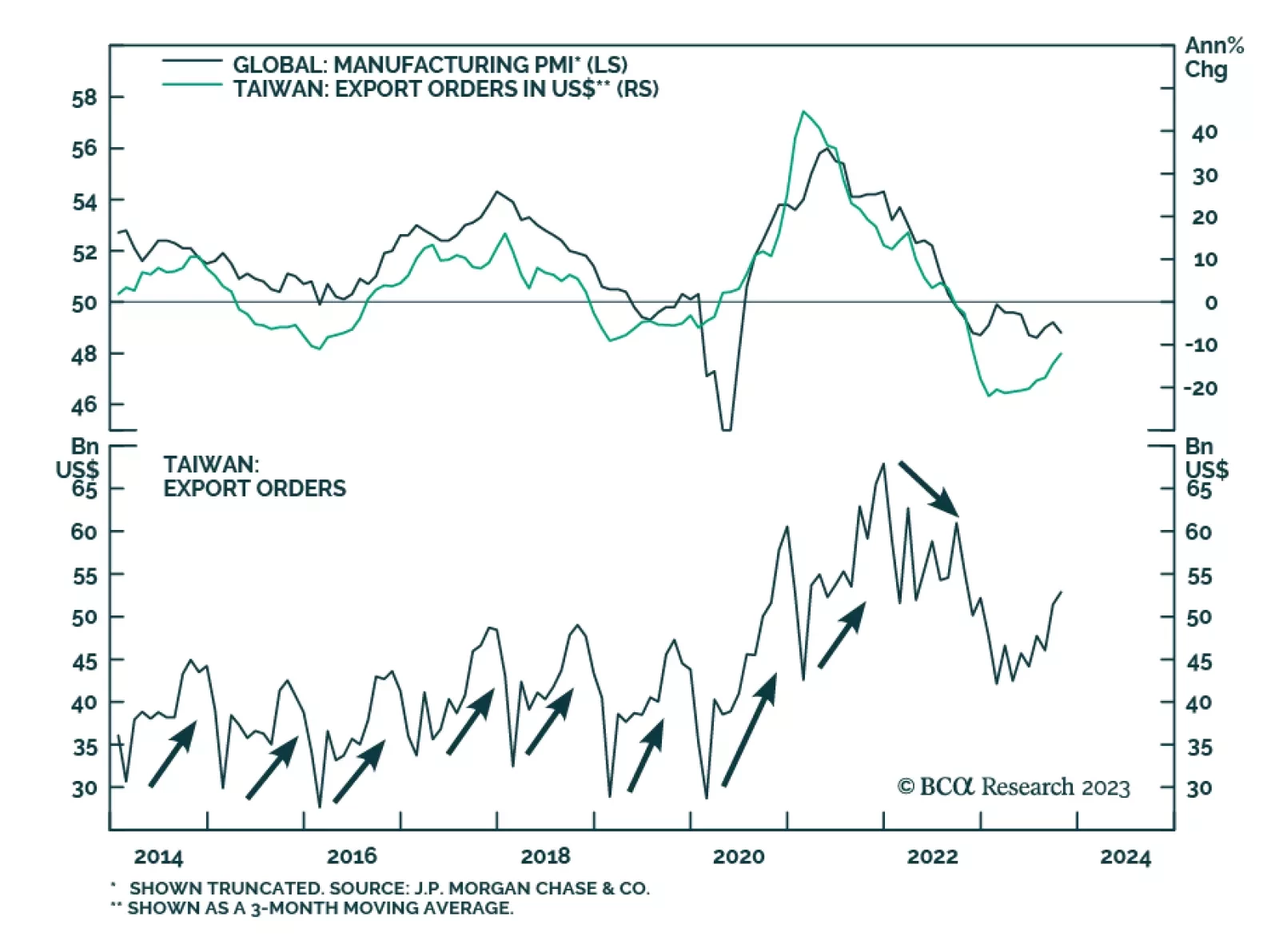

To the extent that Taiwanese export orders act as a bellwether for global trade dynamics, we often monitor the release to gain a sense of the state of the manufacturing cycle. On this front, the October update provided a positive…

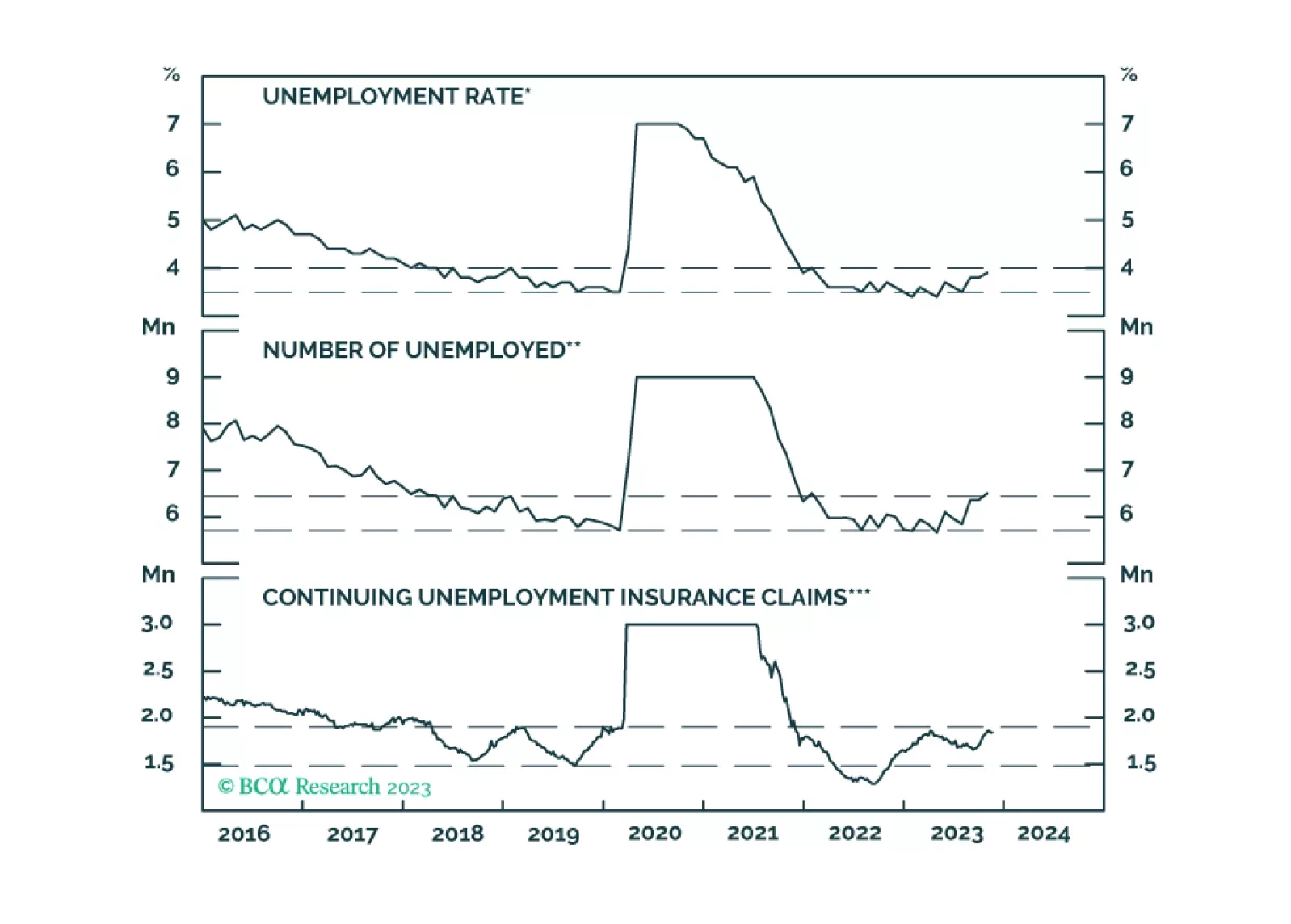

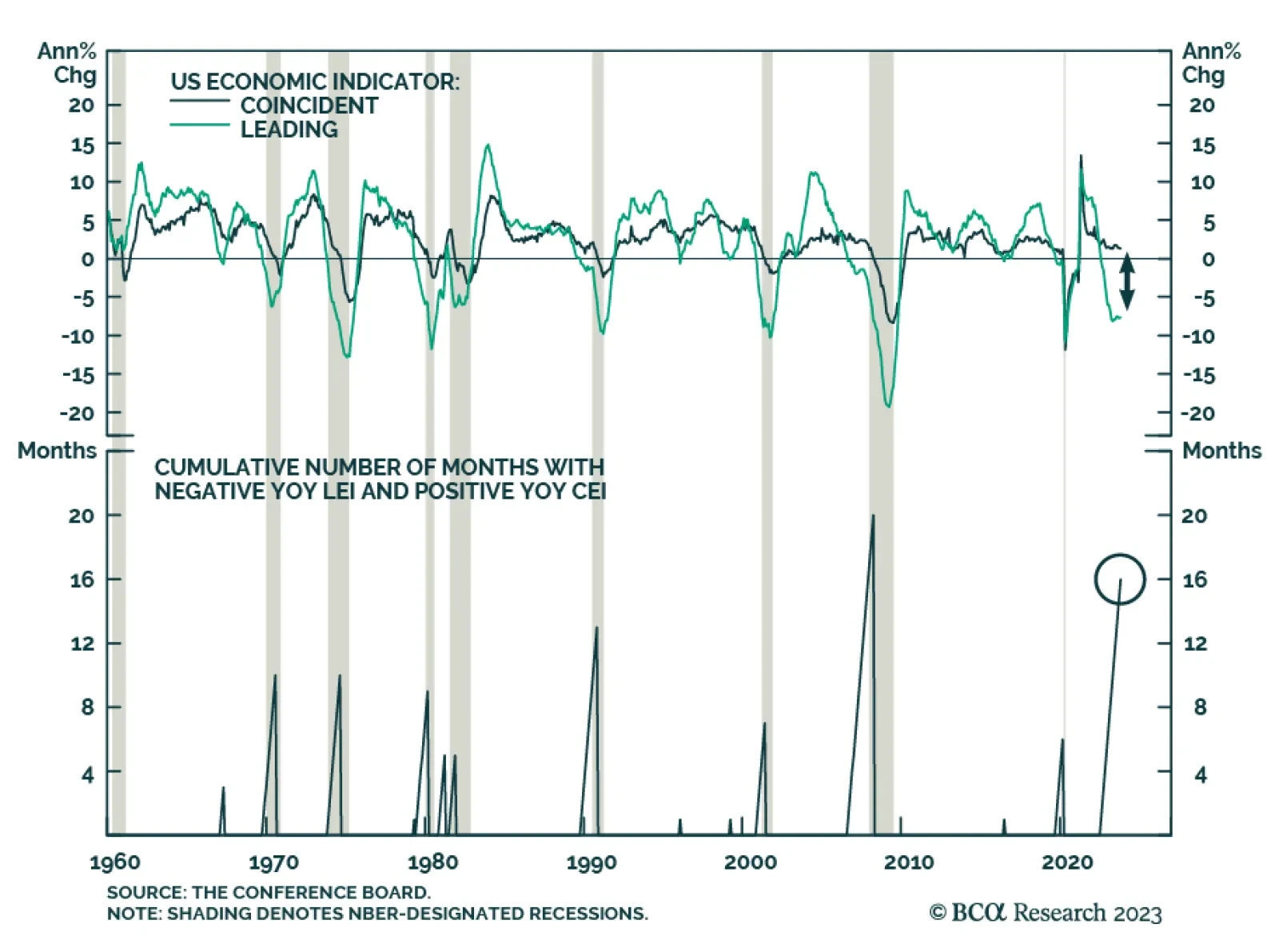

The US Conference Board's Leading Economic Indicator (LEI) continues to send a poor signal about the economic outlook. The monthly pace of contraction quickened to -0.8% m/m in October from -0.7% m/m in September. In terms…

The soft-landing narrative has gotten nowhere at BCA but appears to be making some headway with broker-dealers and investors. We are preparing to lean against it once it pushes equity prices a little higher.

BCA Research's US Bond Strategy service continues to recommend a neutral allocation to TIPS for now, but with a bias to turn underweight. The team calculates a forecasted range for headline CPI inflation of 0.9% to 2.9%…