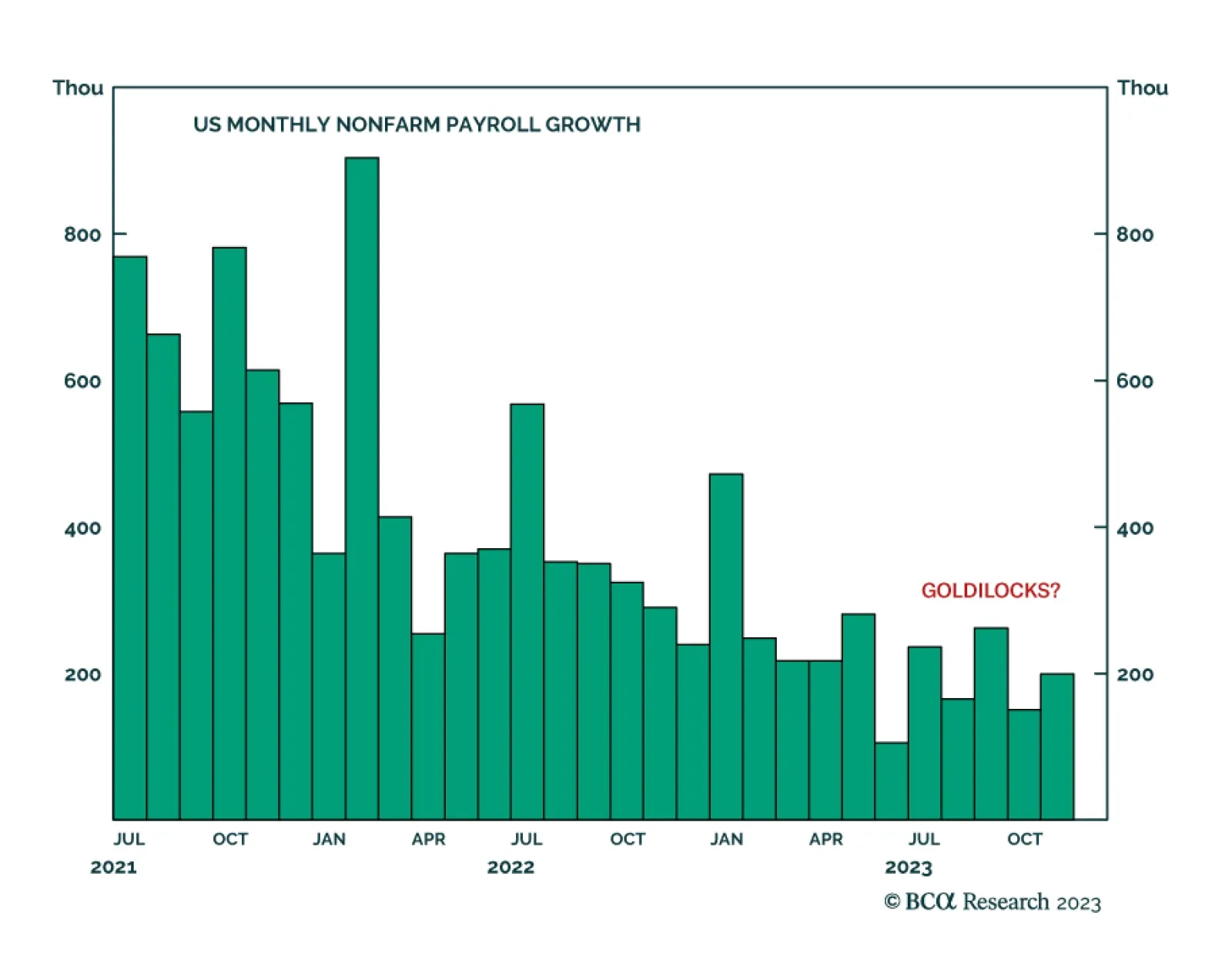

The US employment report delivered a positive surprise on Friday. Nonfarm payroll growth accelerated from 150 thousand to 199 thousand in November, beating expectations of 185 thousand. Importantly, the favorable result was…

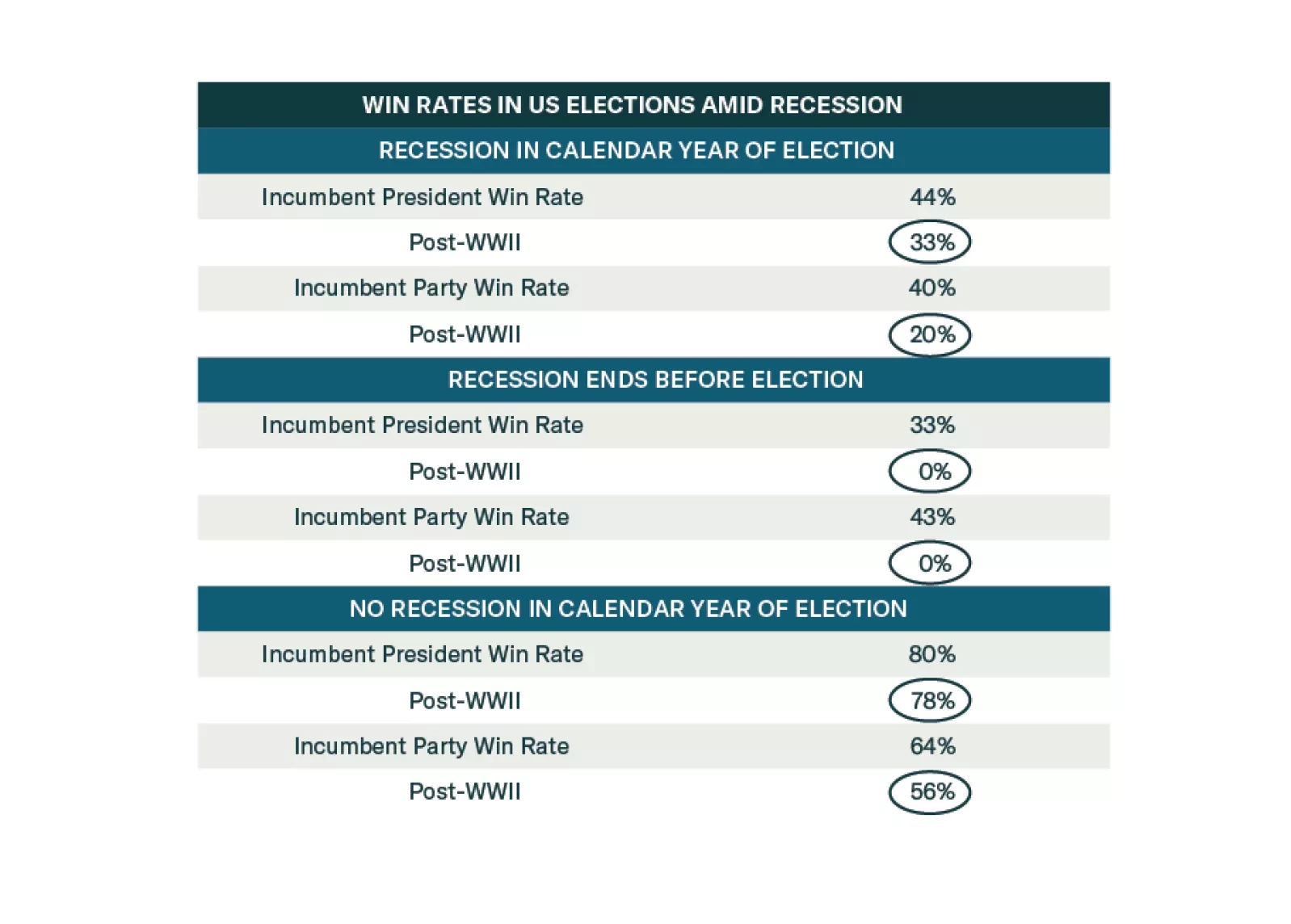

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

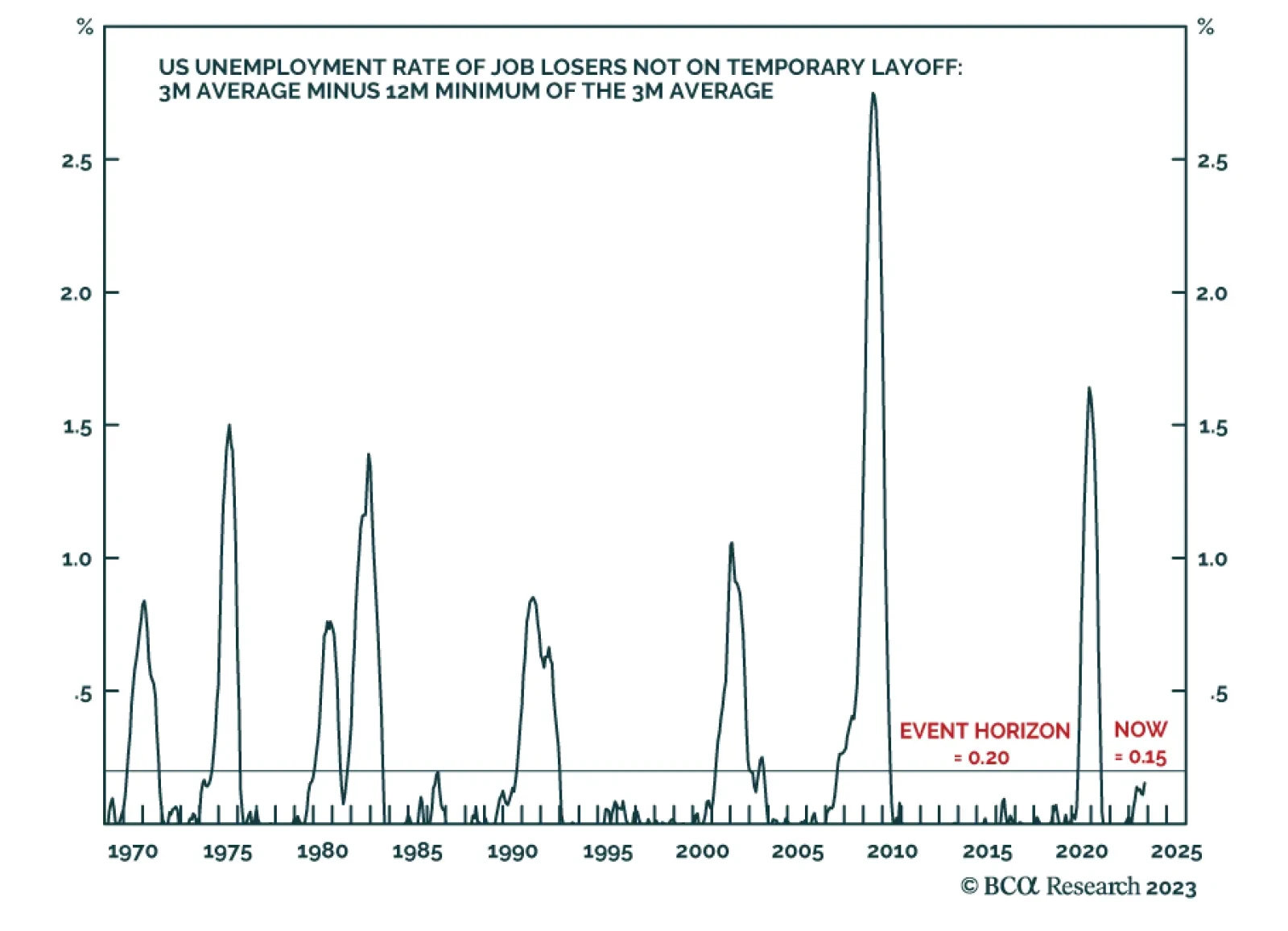

The ‘Joshi rule’ real-time recession indicator signals the start of a US recession when the three-month moving average of the unemployment rate of ‘job losers not on temporary layoff’ rises by 0.20 percent…

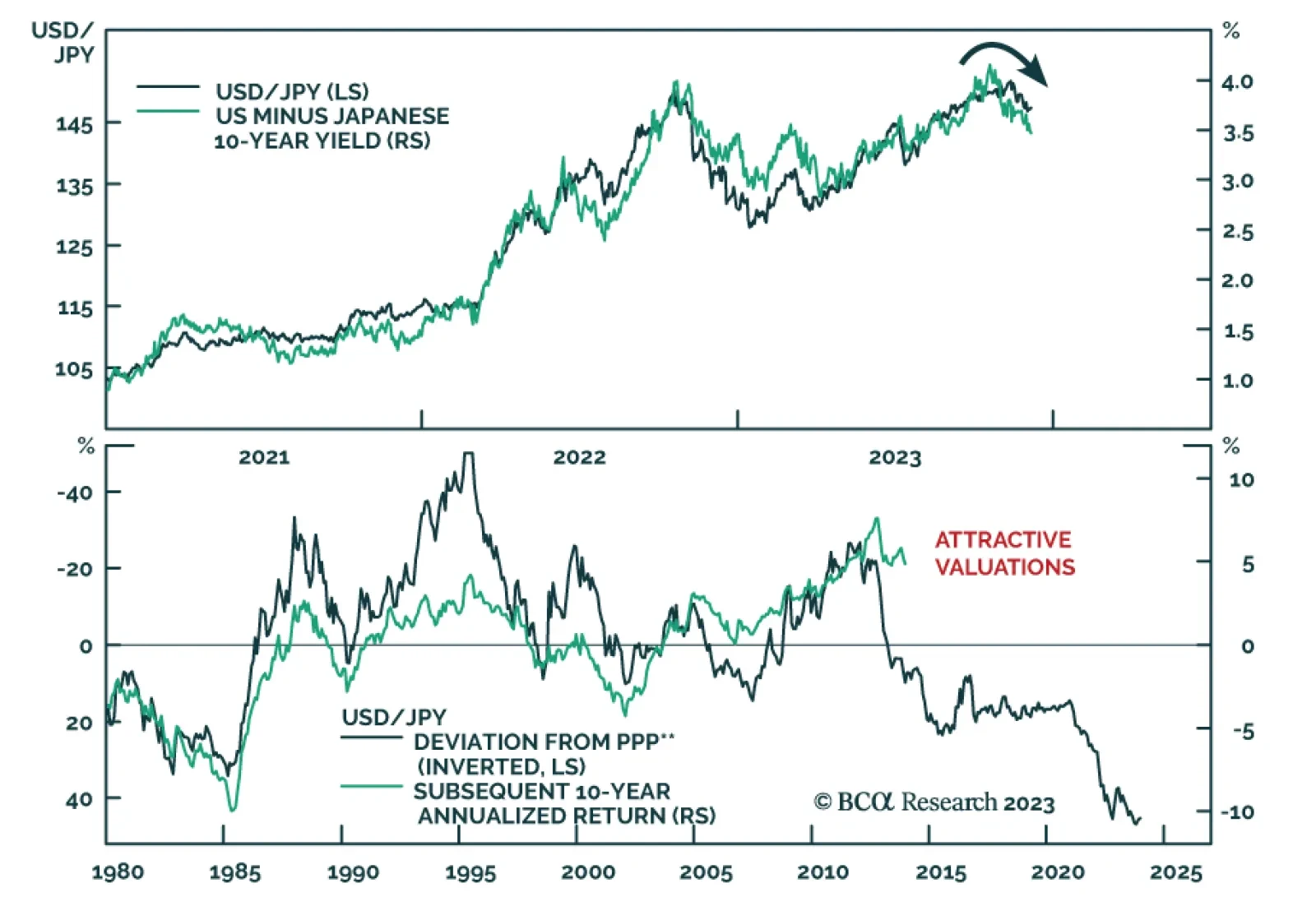

The Japanese yen strengthened considerably on Thursday after comments by Bank of Japan (BoJ) Governor Kazuo Ueda caused investors to bring forward their expectation of the timing of the end of negative rates. In particular, Ueda…

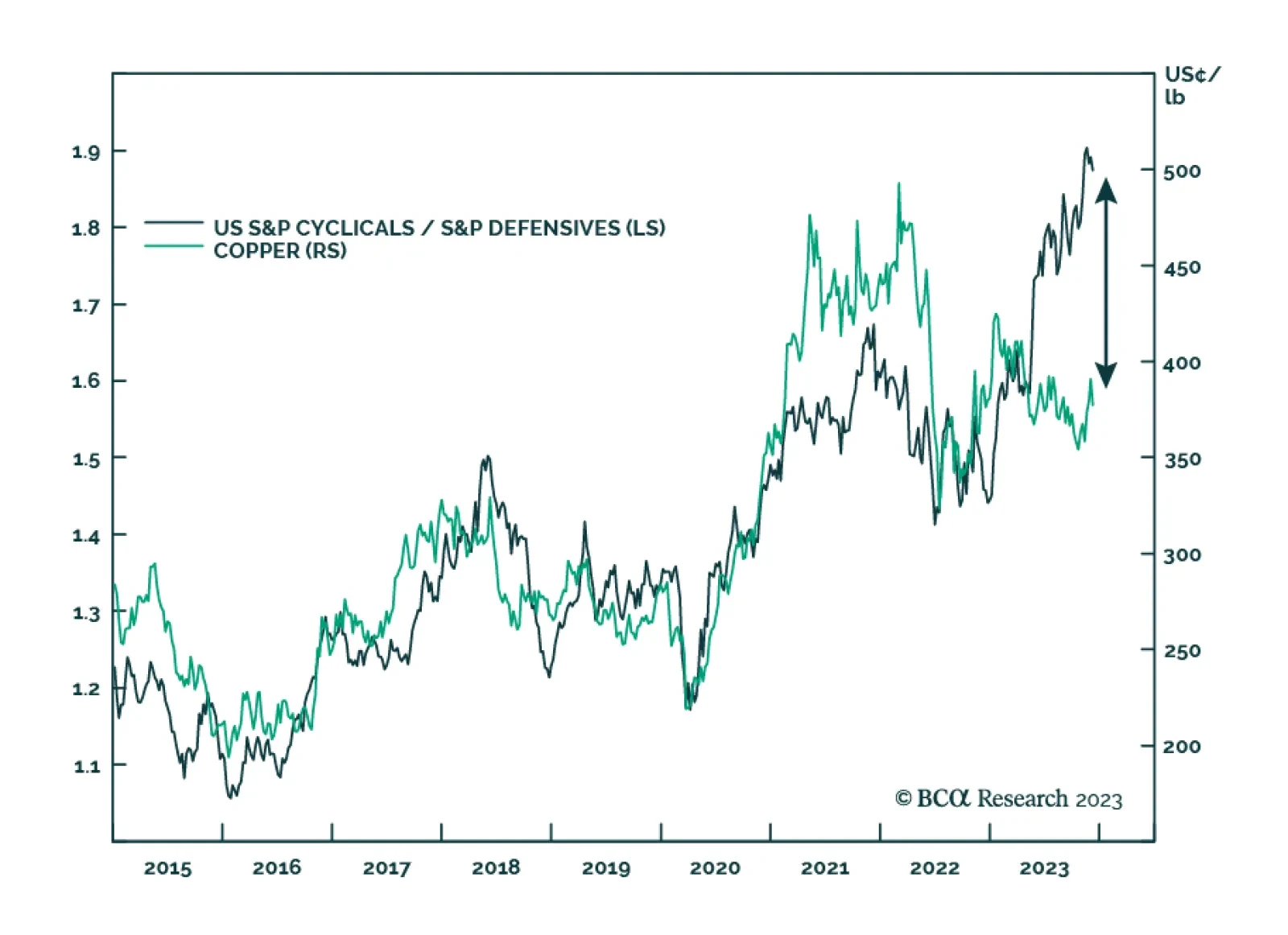

Copper benefited from the recent improvement in global risk sentiment, participating in the broad-based rally in November. To the extent that the red metal has vast applications across many economic sectors, it is…

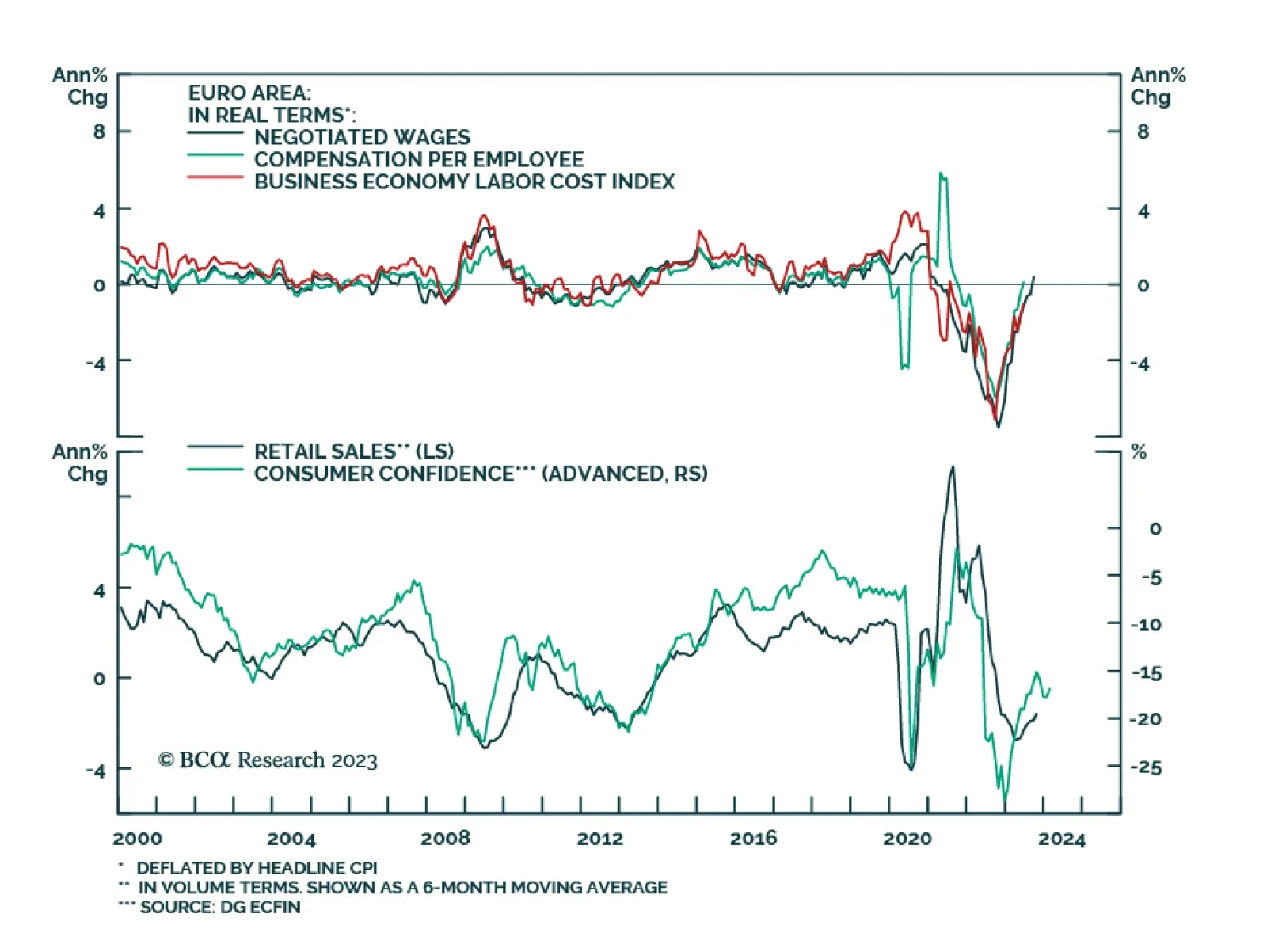

Retail sales volumes grew on a sequential basis for the first time in three months in October, rising by 0.1% m/m following an upwardly revised 0.1% m/m decline. On an annual basis, the pace of decline slowed from -2.9% y/y to -1…

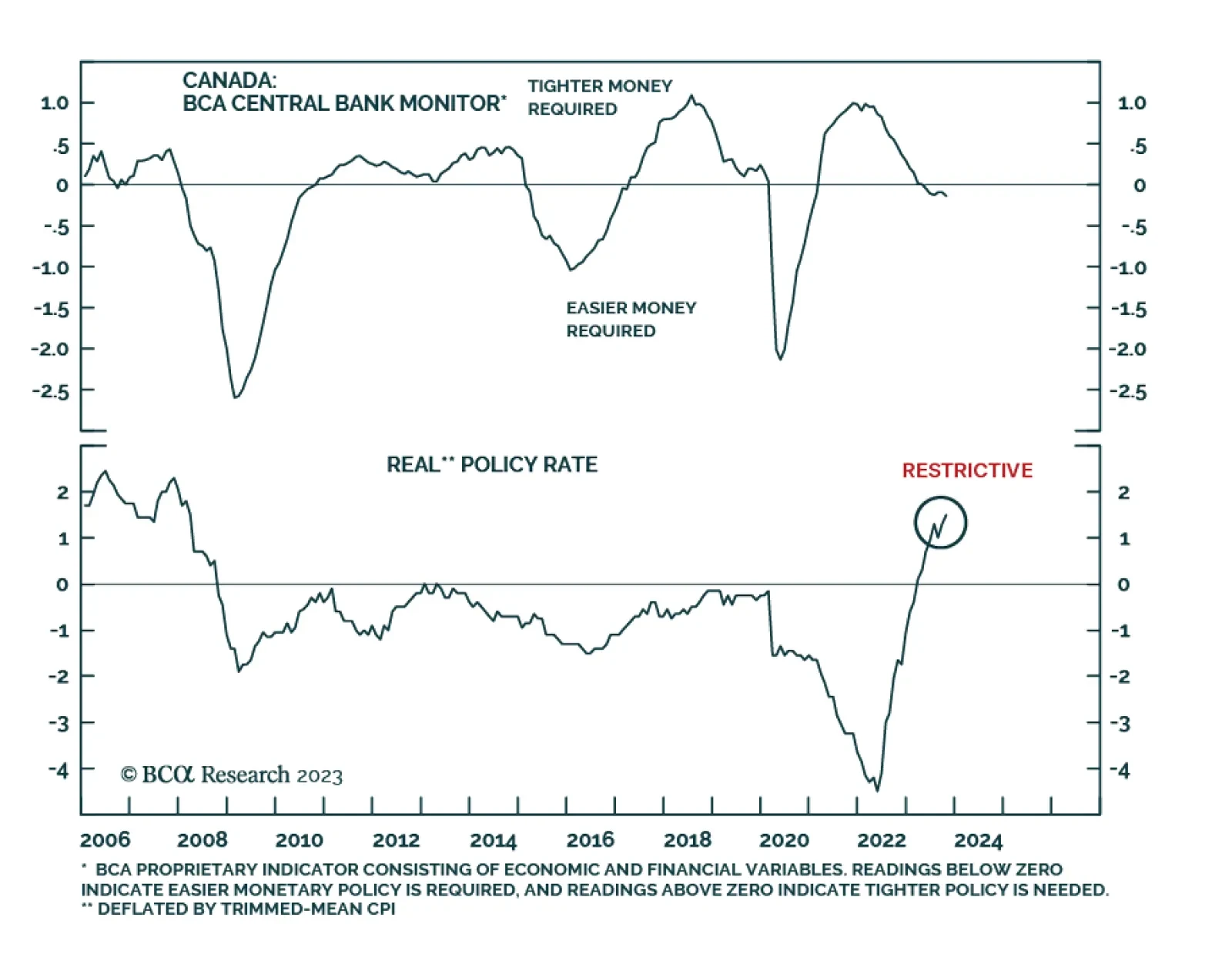

The BoC kept its policy rate steady at 5% for the fourth consecutive meeting on Wednesday, in line with expectations. In its press release, the BoC maintained that it is ready to keep hiking if deemed necessary. That said, the…

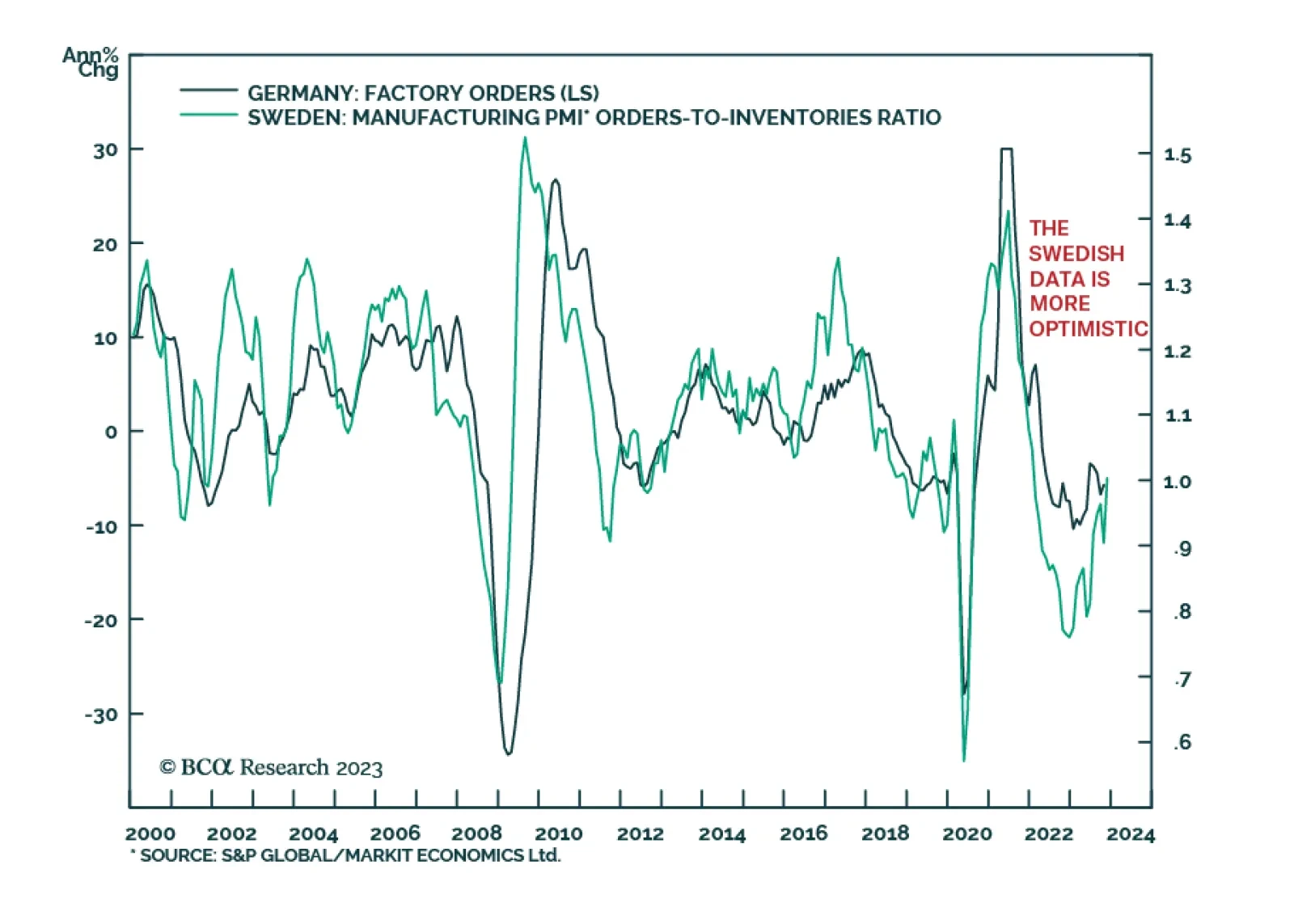

German factory orders sent a disappointing signal on Wednesday. New orders at German factories unexpectedly declined by 3.7% m/m in October, disappointing expectations of a 0.2% m/m rise following two consecutive months of…

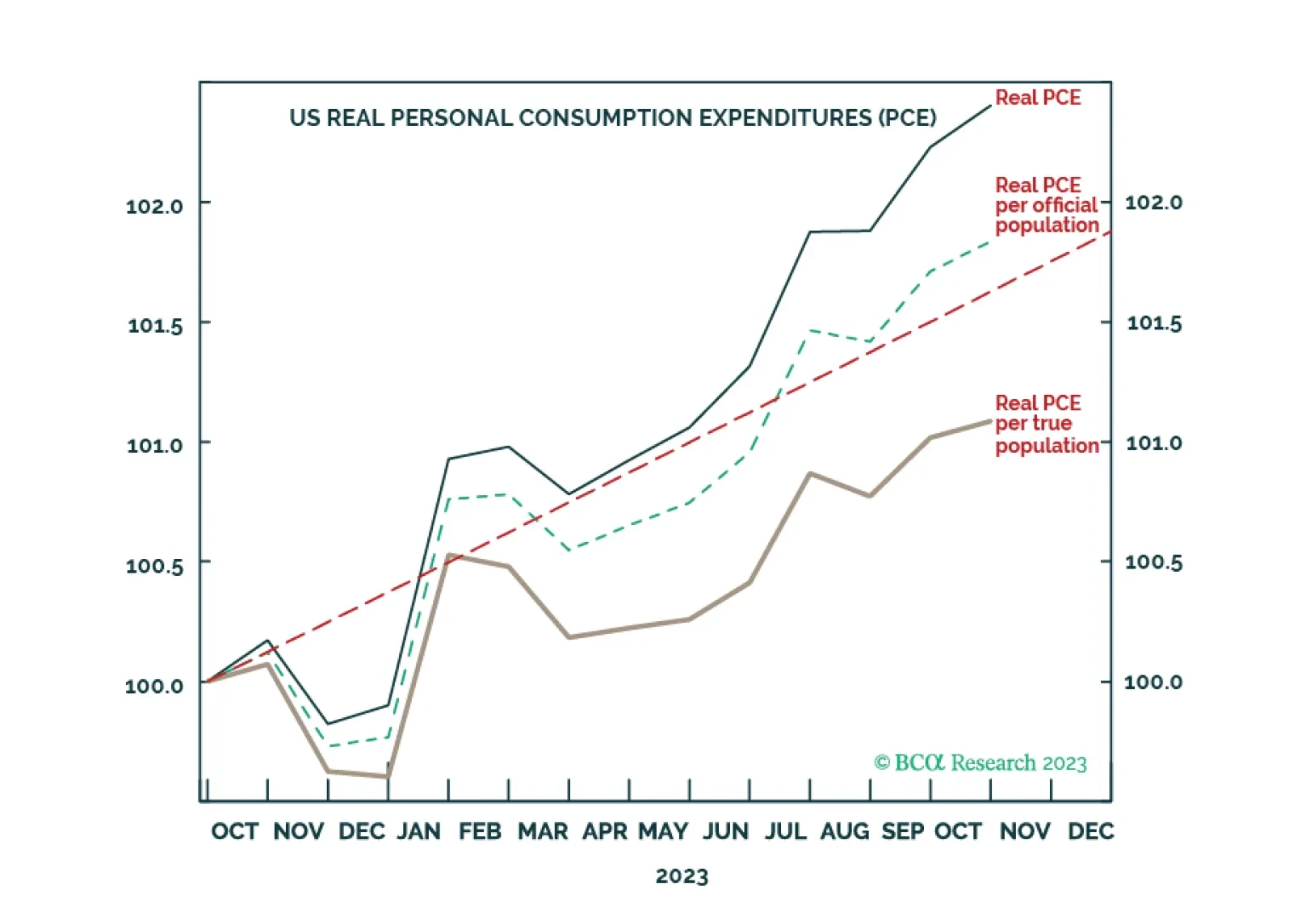

Illegal immigration into the US has skyrocketed to record levels. Correctly accounting for this, US real consumption growth on a per head basis is already fragile. Meanwhile, the real bond yield is only now approaching the pain point…

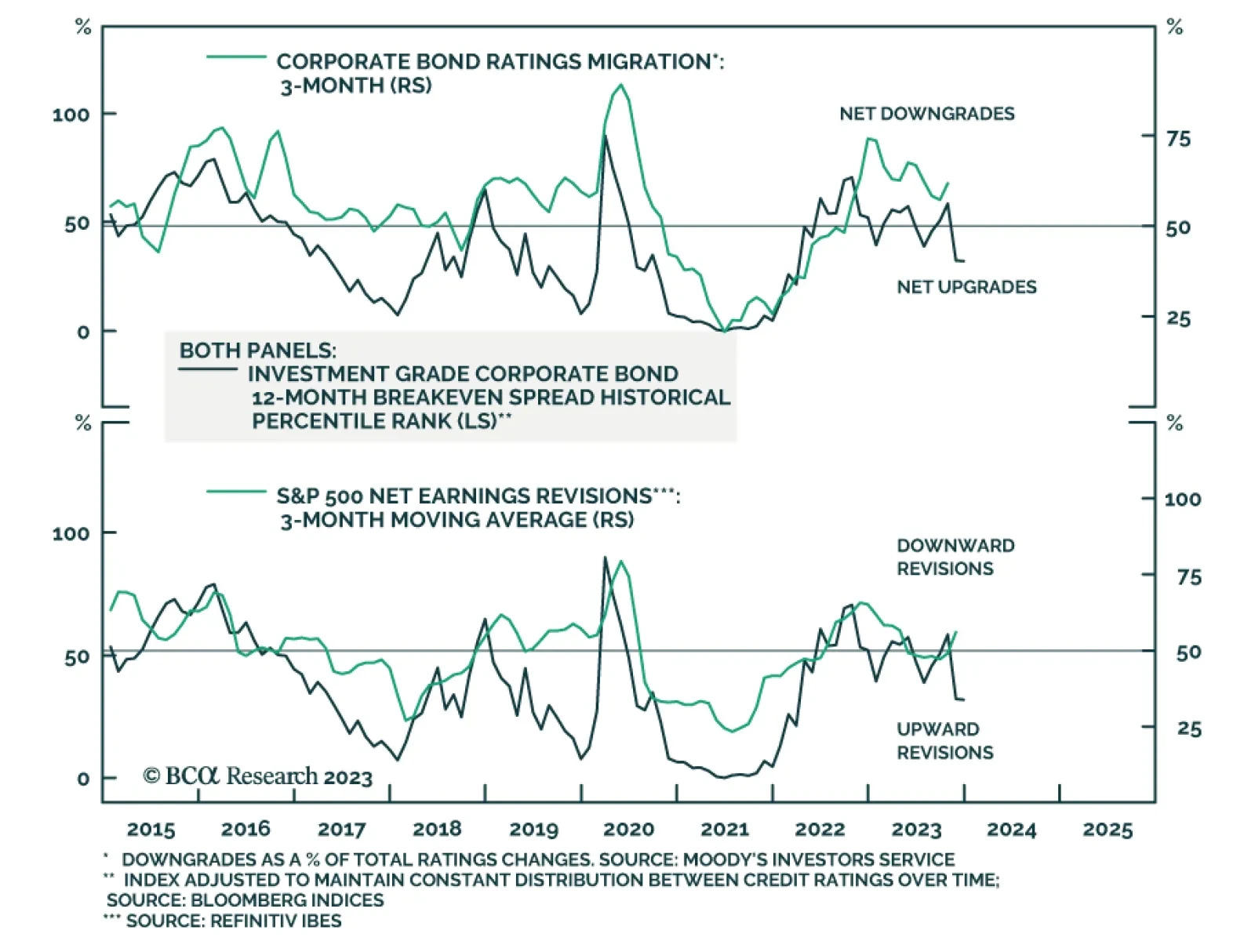

According to BCA Research’s US Bond Strategy service, US corporate bond spreads are far too tight. The soft landing narrative took hold of markets in November as the overnight index swap (OIS) curve moved to price in 159…