In Section I, we discuss the implications and potential risks of the Fed’s recent pivot. The near-term implications of the Fed's dovish pivot are likely to continue to be bullish for risky asset prices, and a new high in global stock…

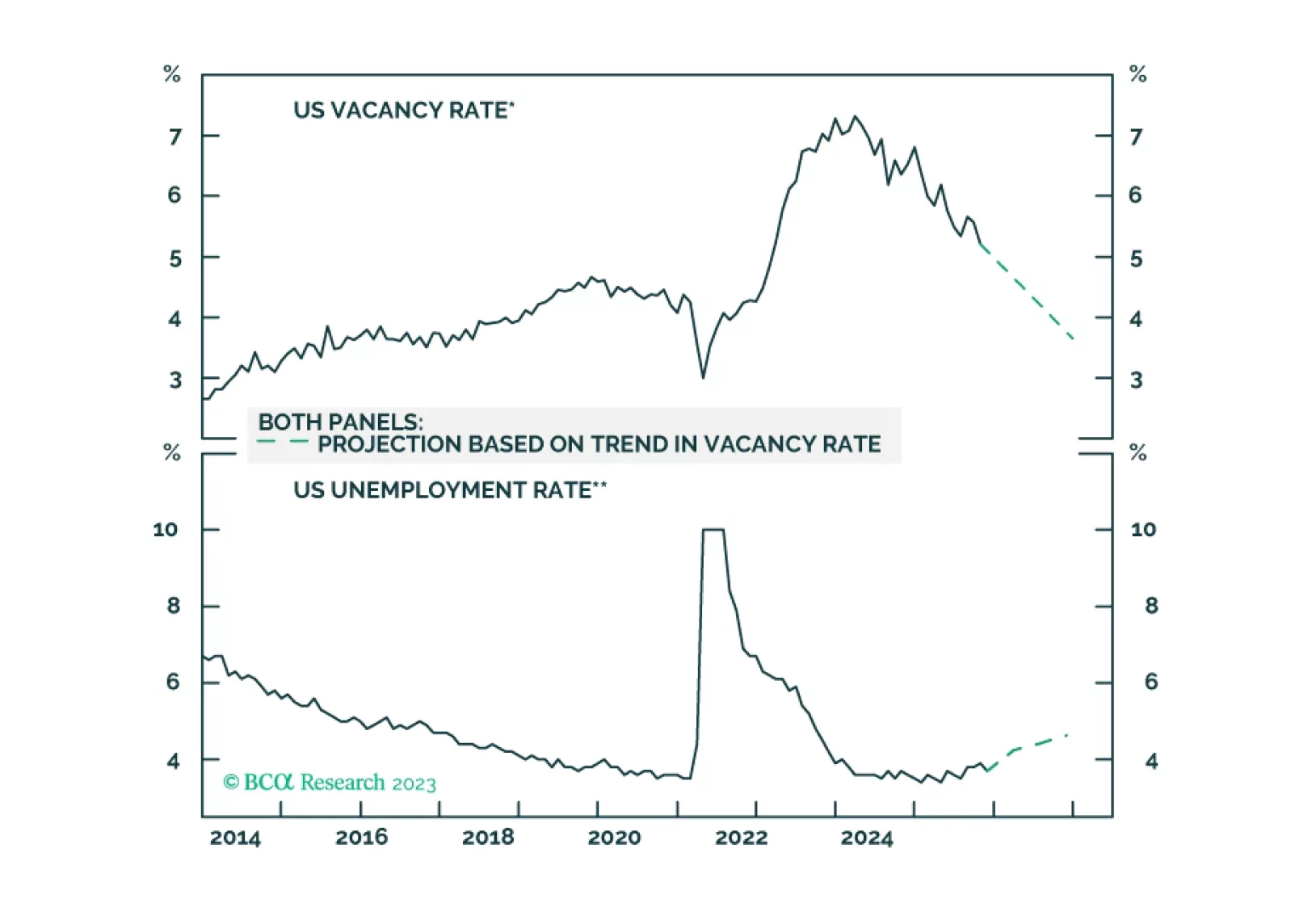

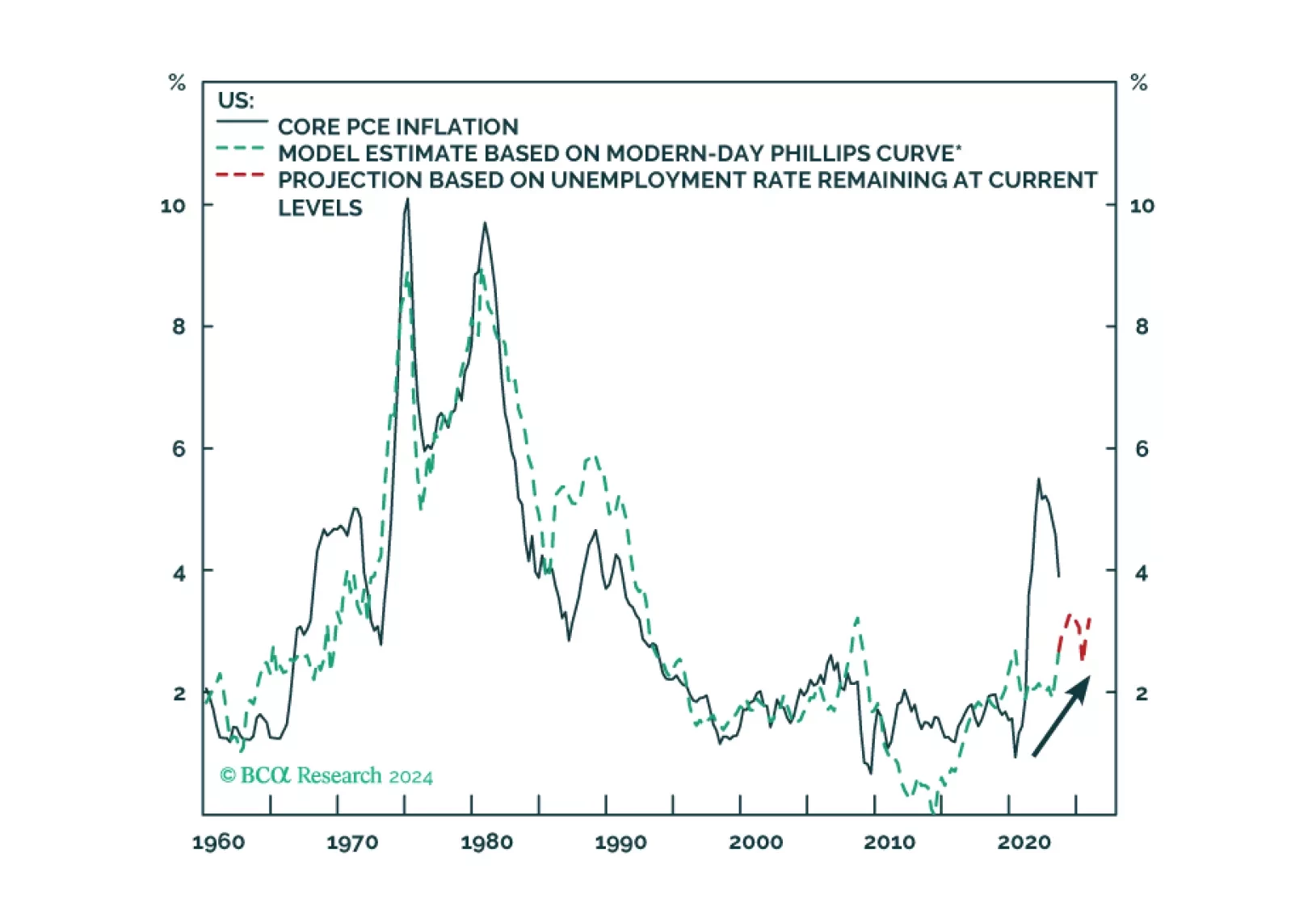

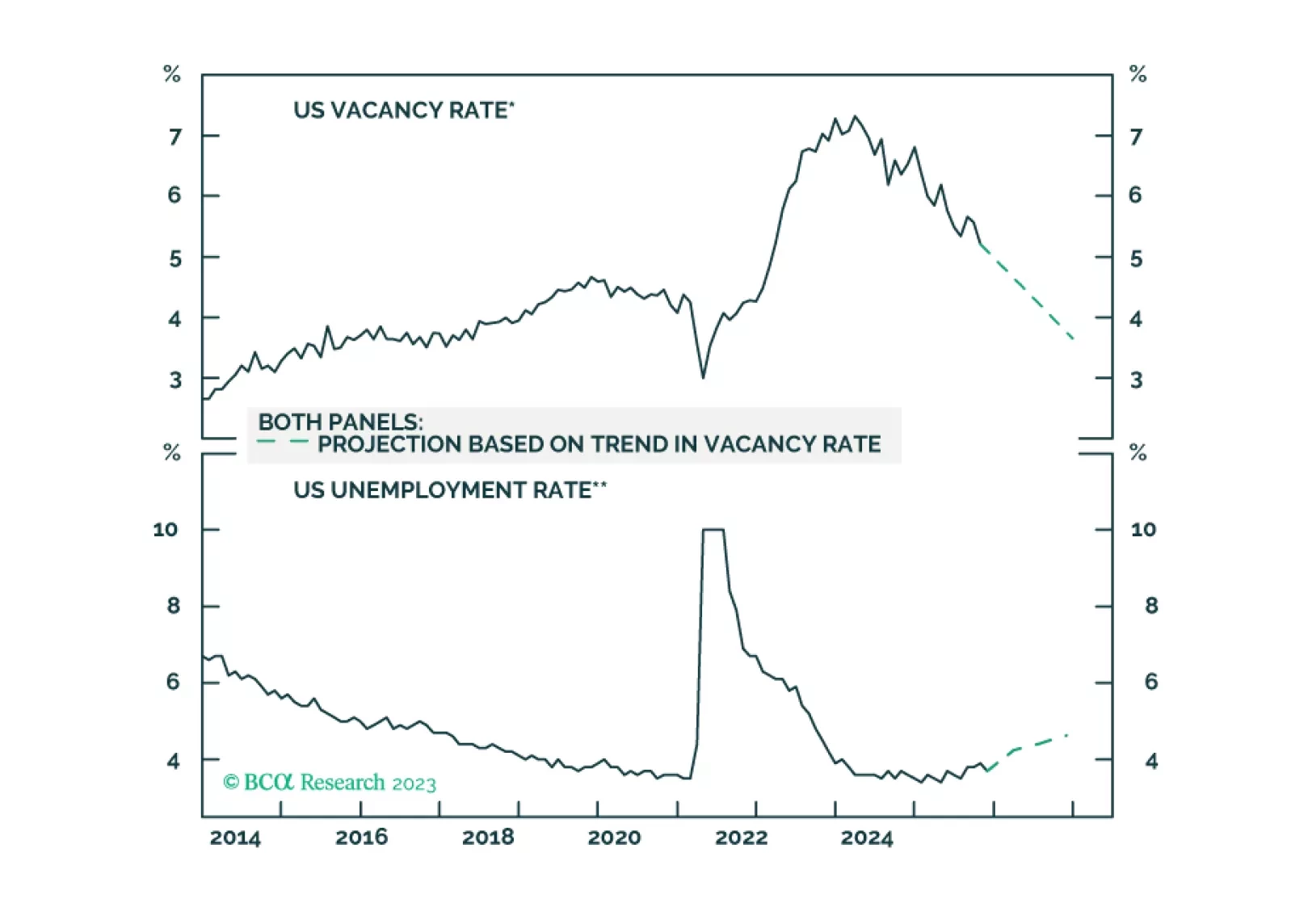

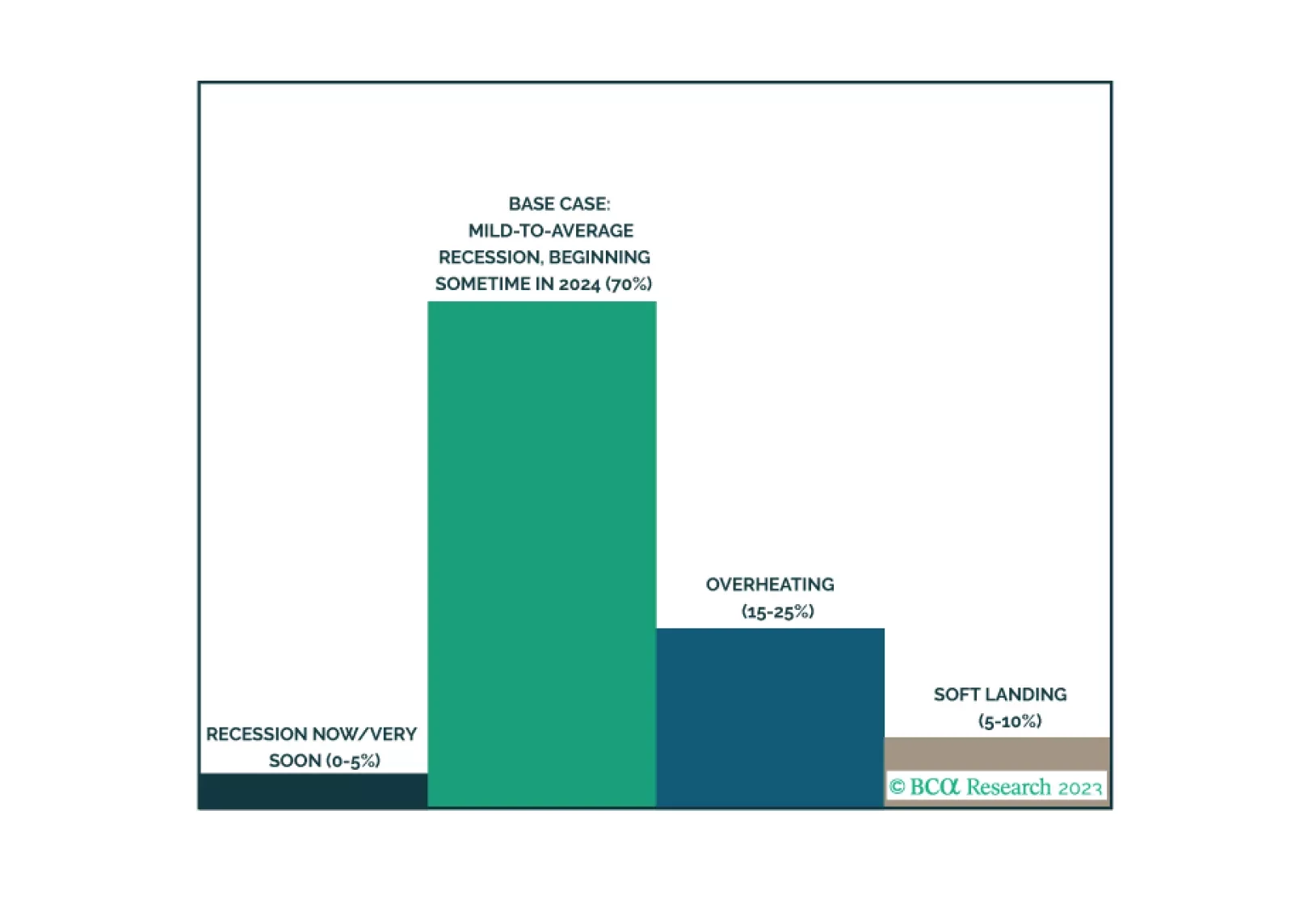

Our last publication of 2023 is an illustrated guide to our view that the economy will enter a recession around midyear. We expect equities will underperform Treasuries and cash over much of 2024, but we are waiting to turn…

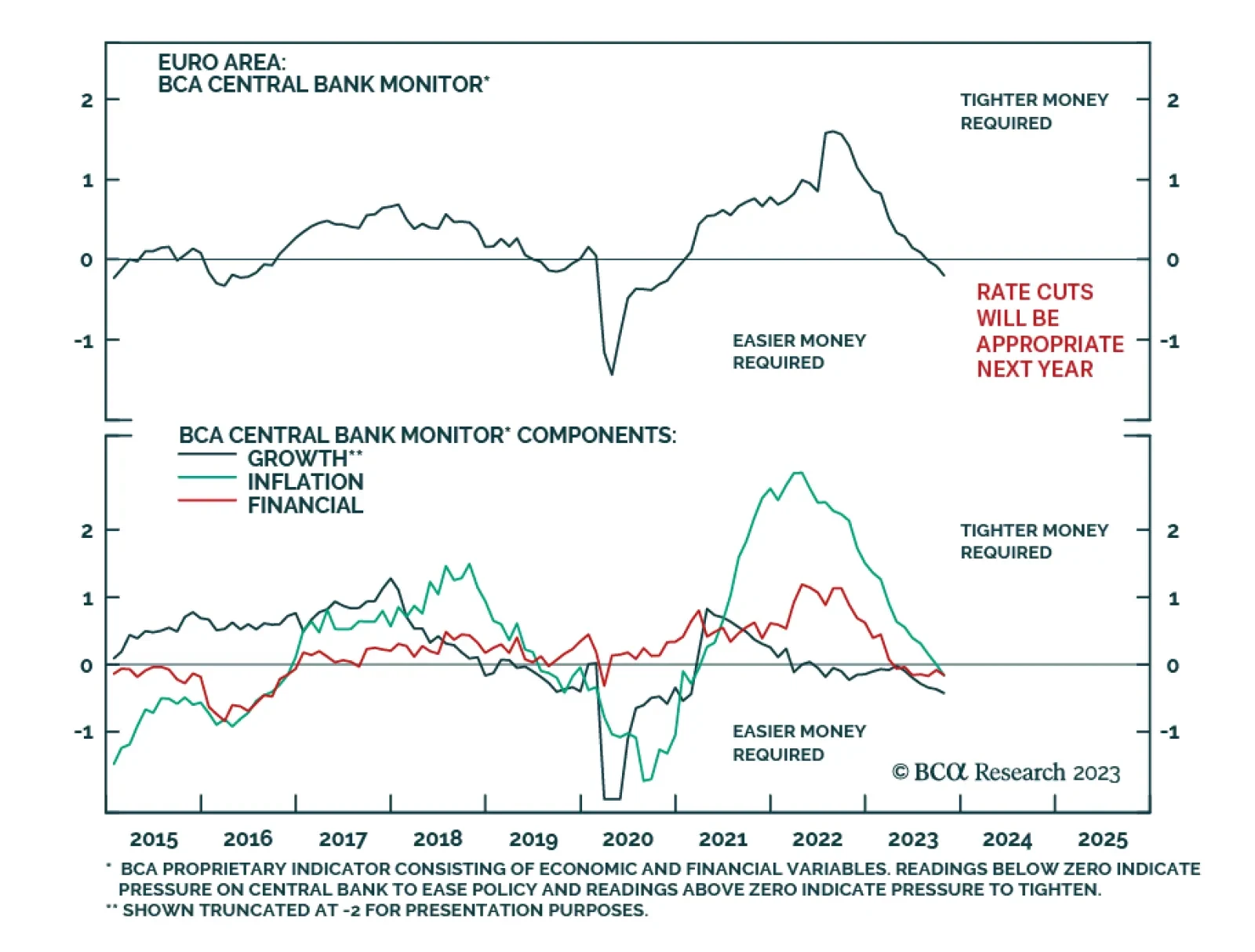

As expected, the ECB kept its policy rate unchanged on Thursday. In the updated macroeconomic projections, the central bank revised down its inflation and growth forecasts for next year. It now expects inflation to ease to 2.7…

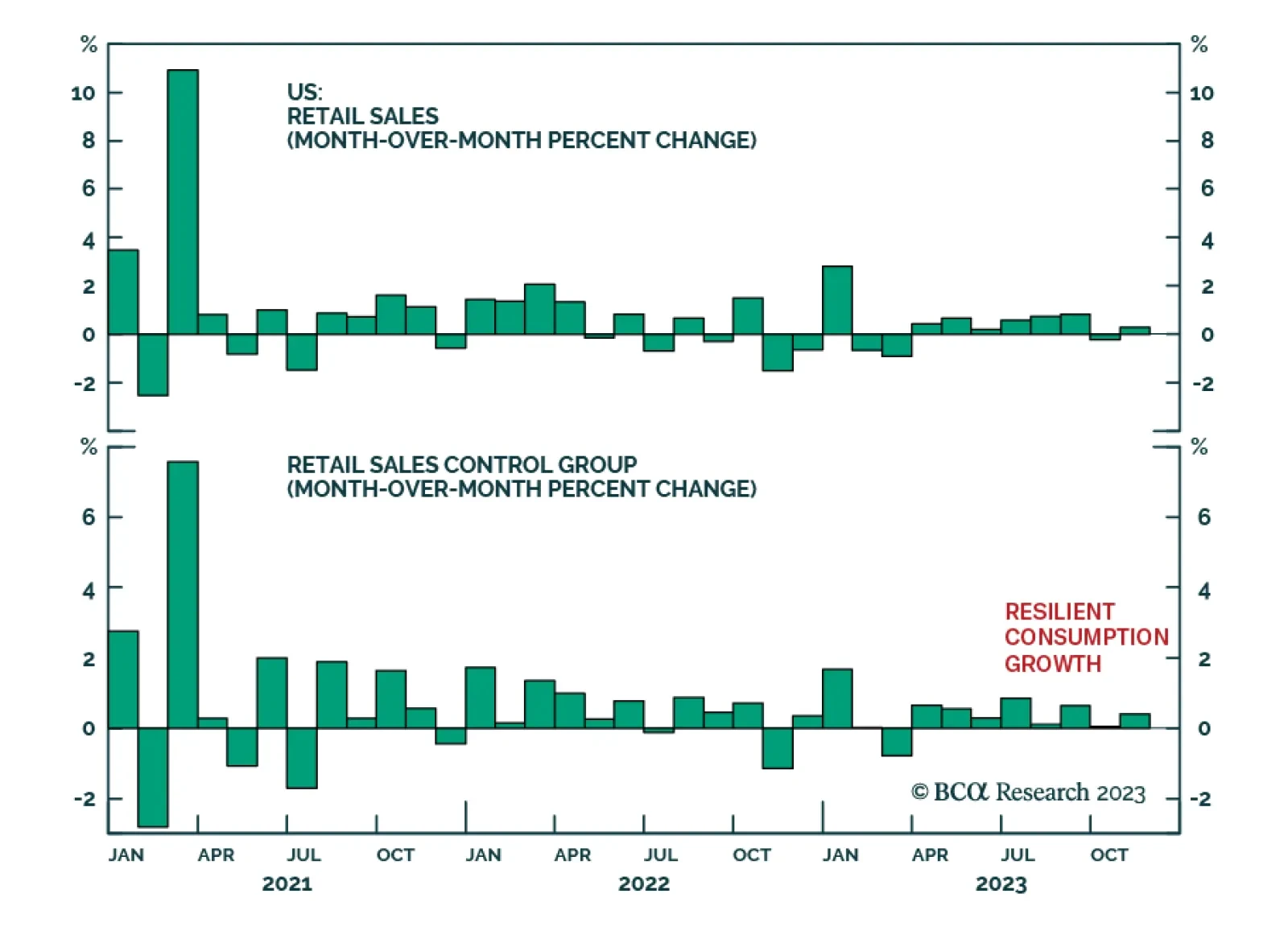

The November US retail sales release for November delivered a positive signal about consumer spending. Overall retail sales unexpectedly increased by 0.3% m/m, surprising expectations of a 0.1% m/m decline. The details of the…

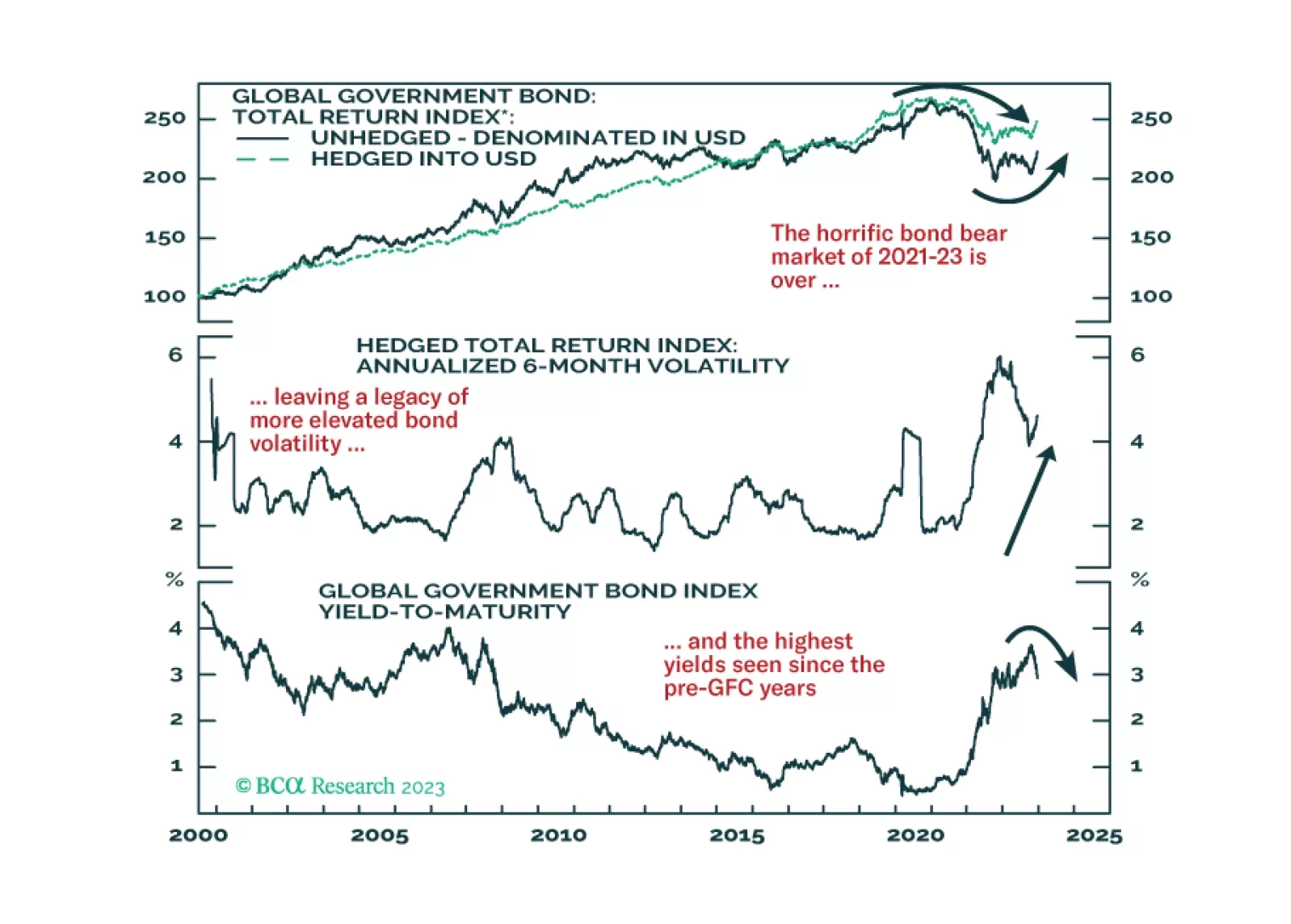

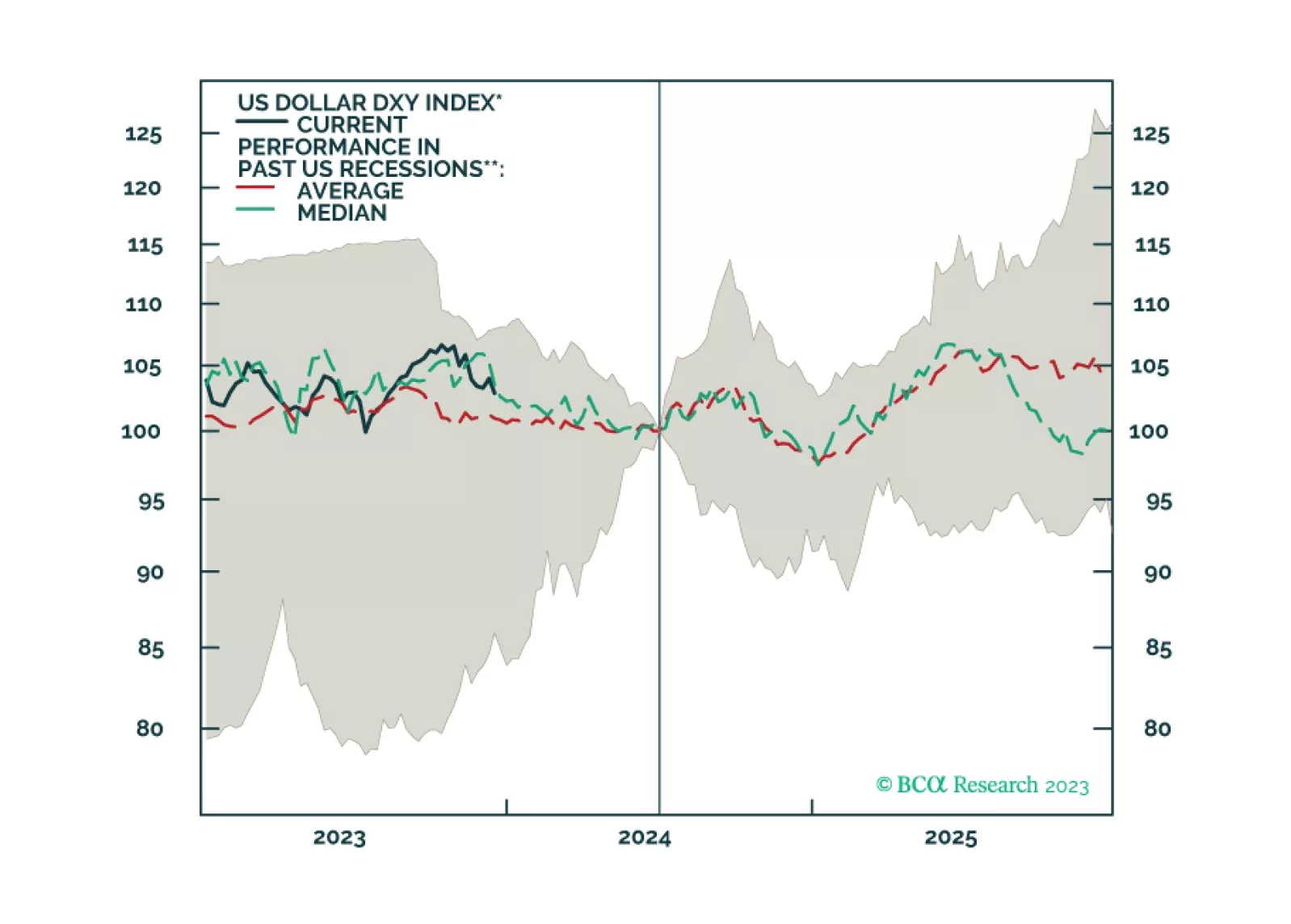

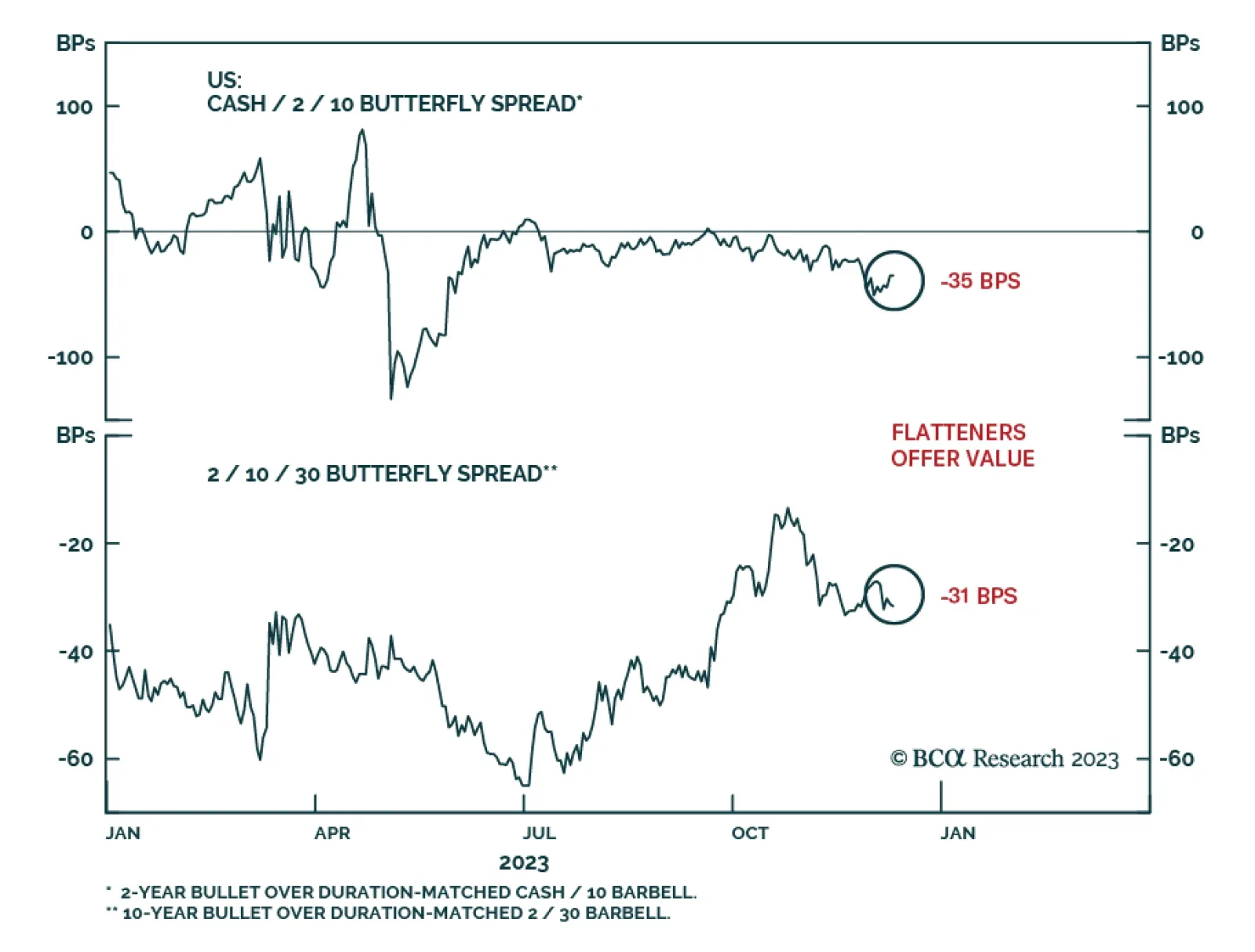

According to BCA Research’s US Bond Strategy service, Treasury curve steepeners will pay off handsomely once the next recession hits. However, curve flatteners (aka barbelled Treasury portfolios) offer better value for the…