Canadian government bond yields jumped on Tuesday, with the 10-year yield rising by nearly 14 basis points. While most other major DM government bonds also sold off, the move in Canadian yields was relatively more pronounced.…

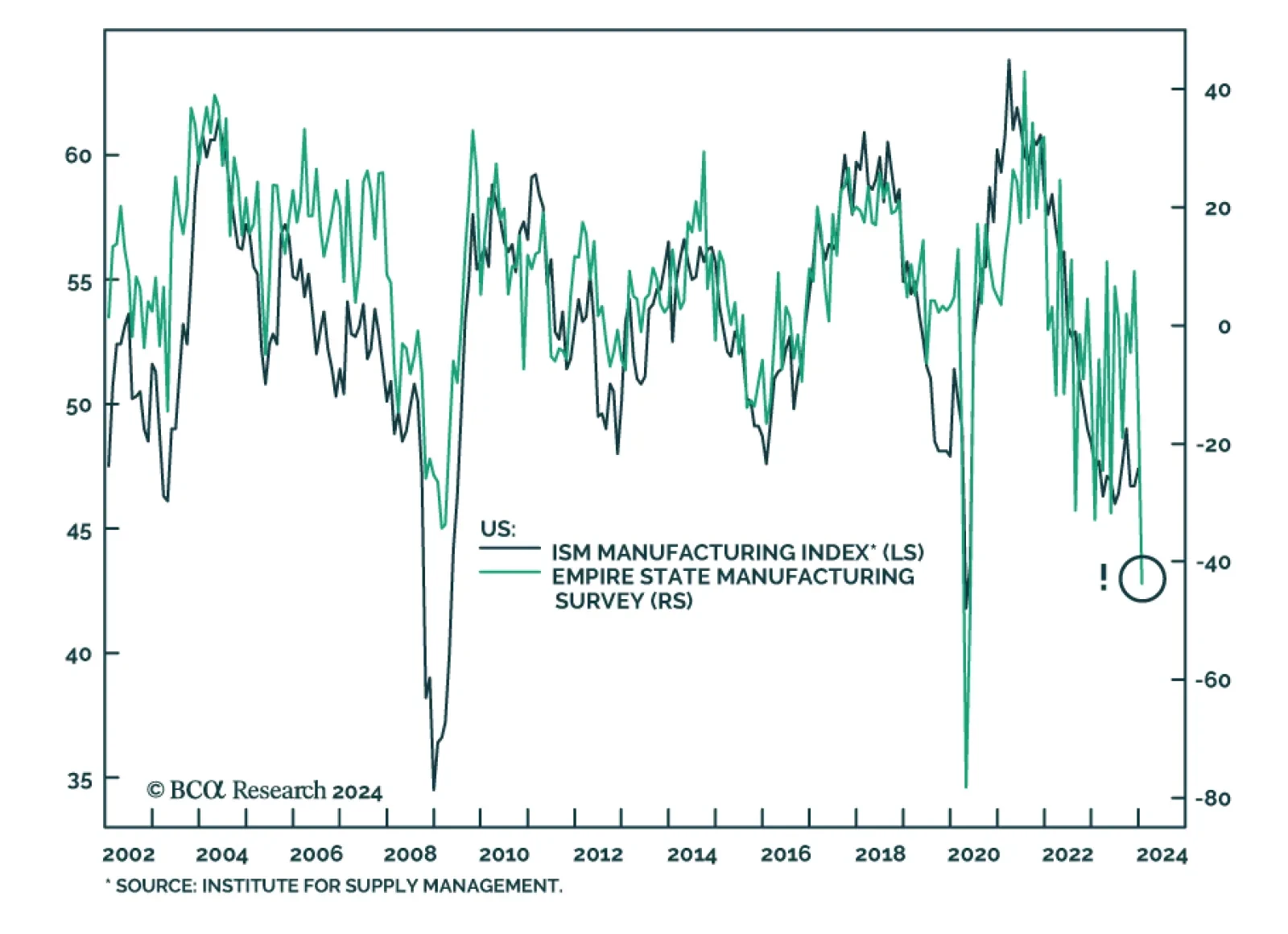

The New York Fed’s Empire State Survey delivered a somber signal about US manufacturing conditions. The headline general business conditions index plunged from -14.5 to -43.7 in December, disappointing expectations of an…

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

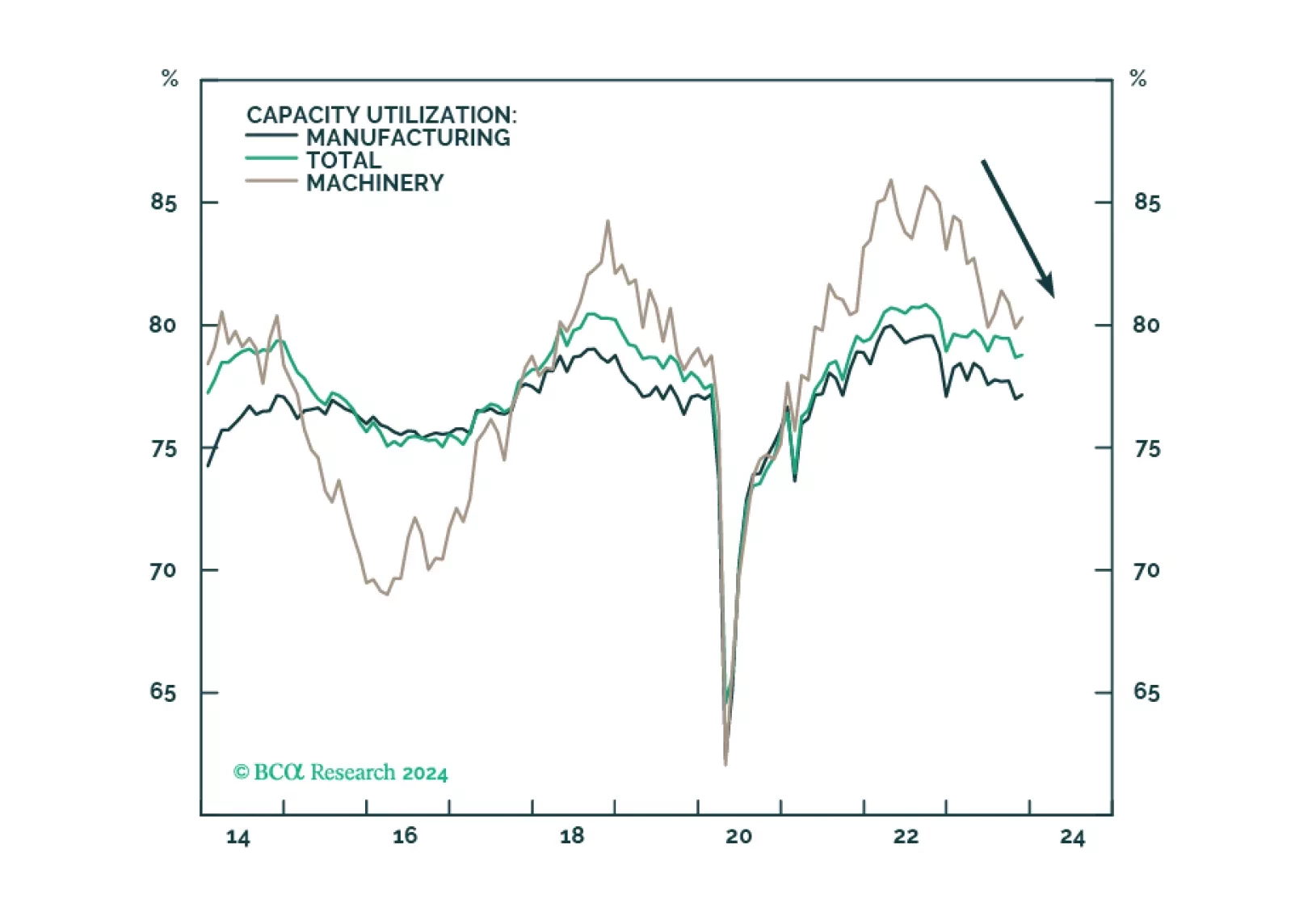

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

According to BCA Research’s European Investment Strategy service, investors should not chase European equities higher from current levels. The soft-landing narrative has captured the minds of investors. The expectations…

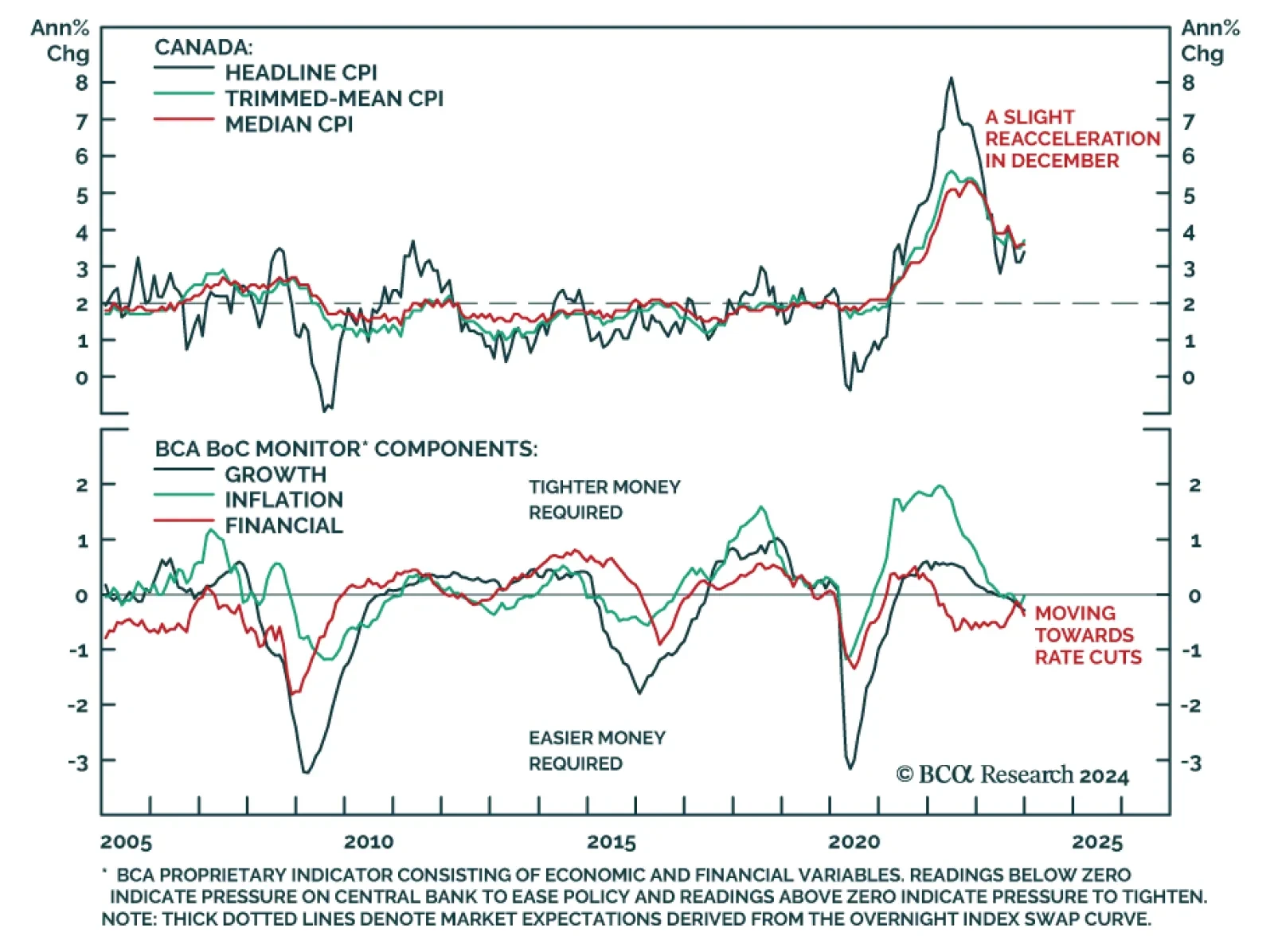

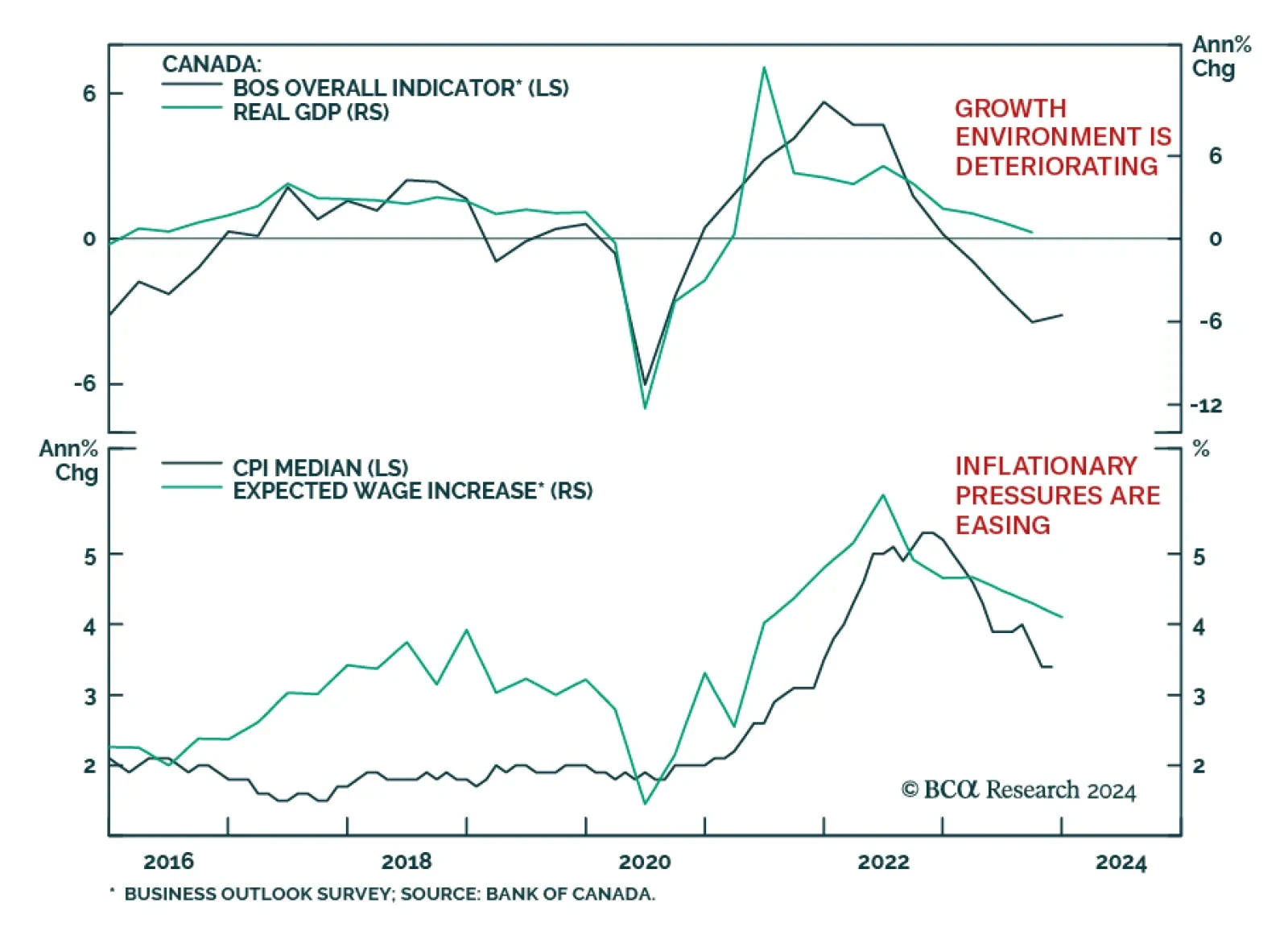

Canada’s Business Outlook Survey (BOS) indicator increased slightly in Q4, suggesting that sentiment stabilized at the end of 2023. In particular, easing inflationary pressures amid weaker demand and greater competition…

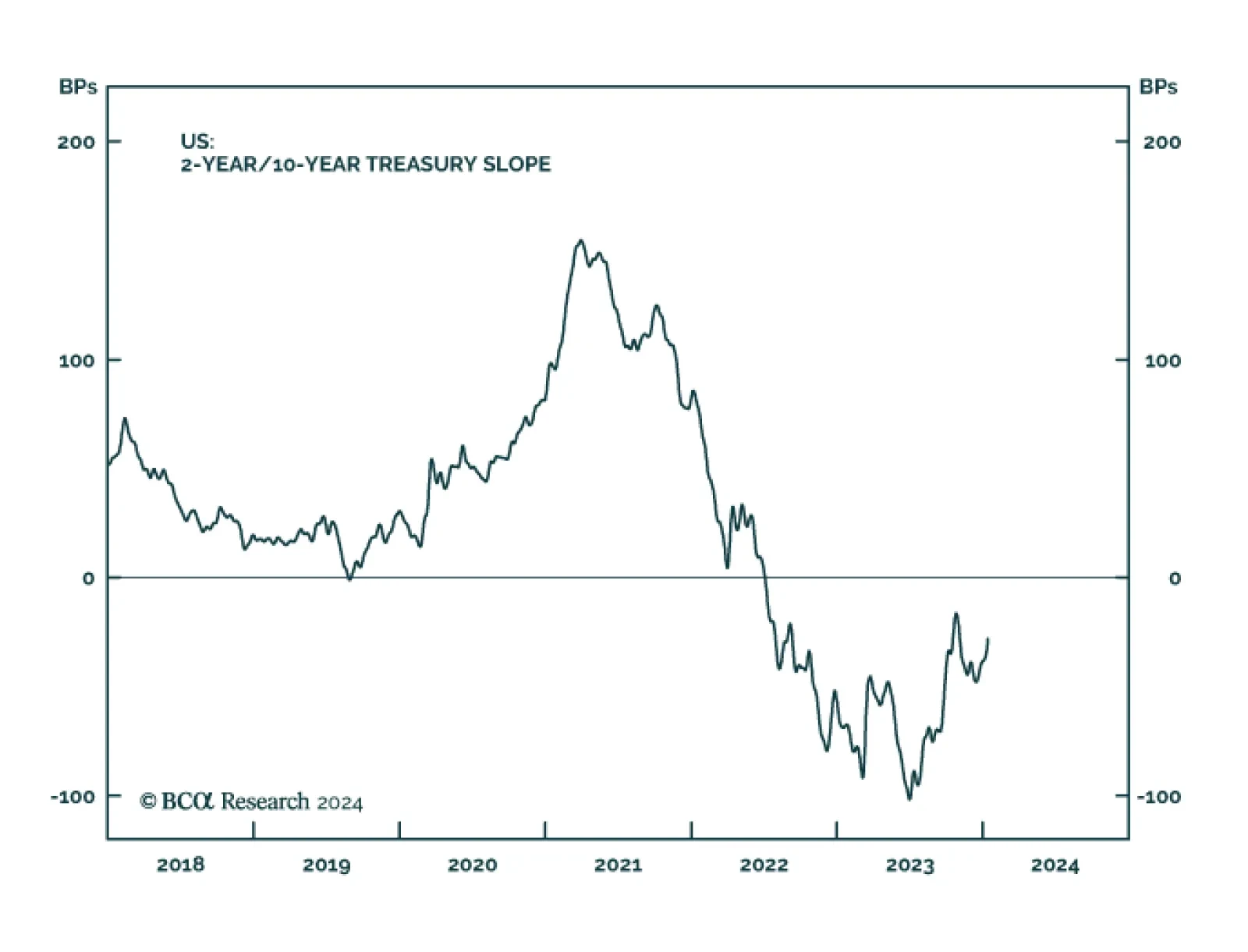

The Treasury curve bull steepened meaningfully on Friday with the 2-year yield falling by nearly 11 basis points versus the 3 basis point decline in the 10-year yield. A softer than anticipated US PPI release prompted this move.…

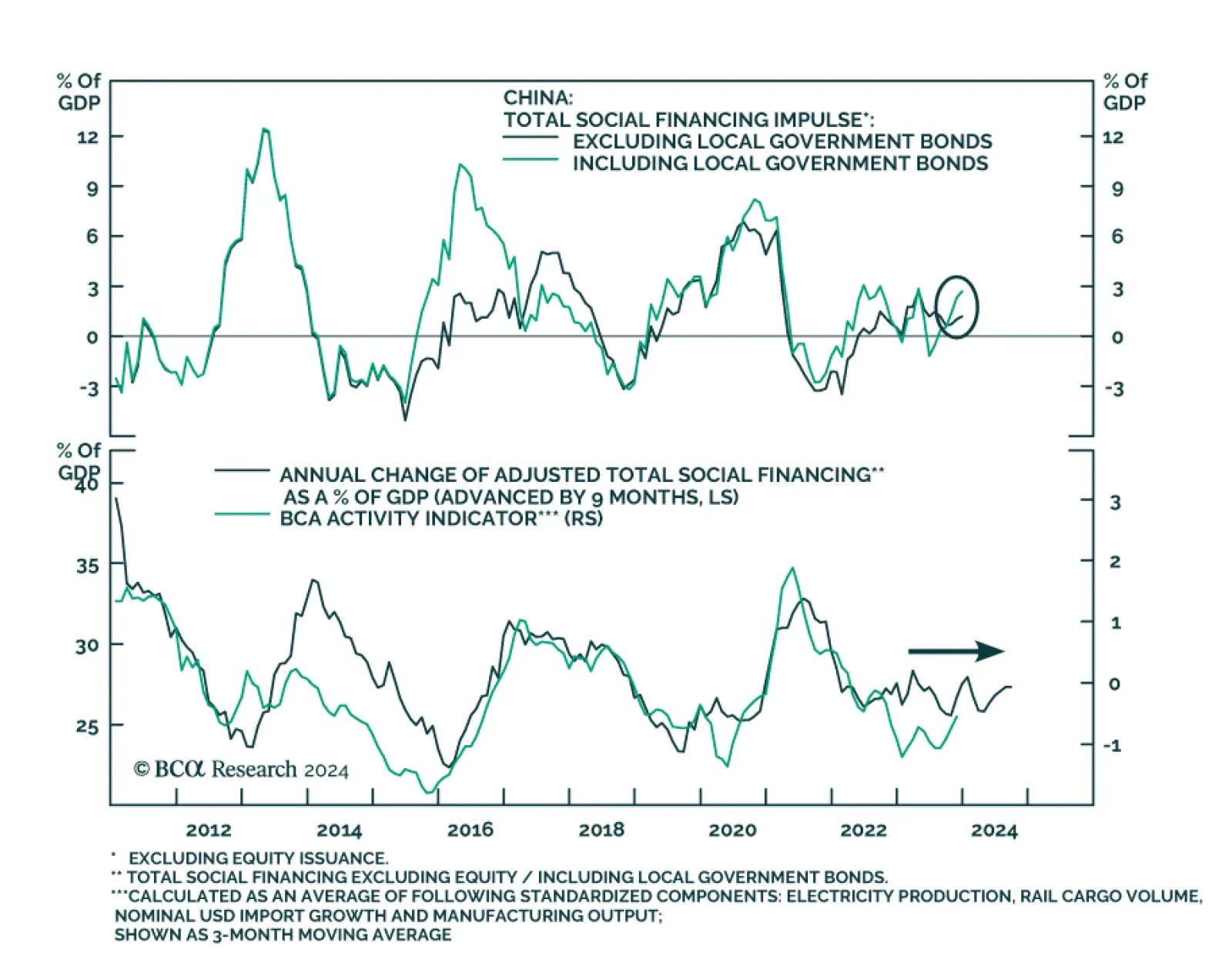

Chinese credit dynamics remain muted with the expansion in total social financing easing from 2.45 trillion yuan to 1.94 trillion yuan in December, below expectations of a tamer slowdown to 2.16 trillion yuan. Loan growth also…

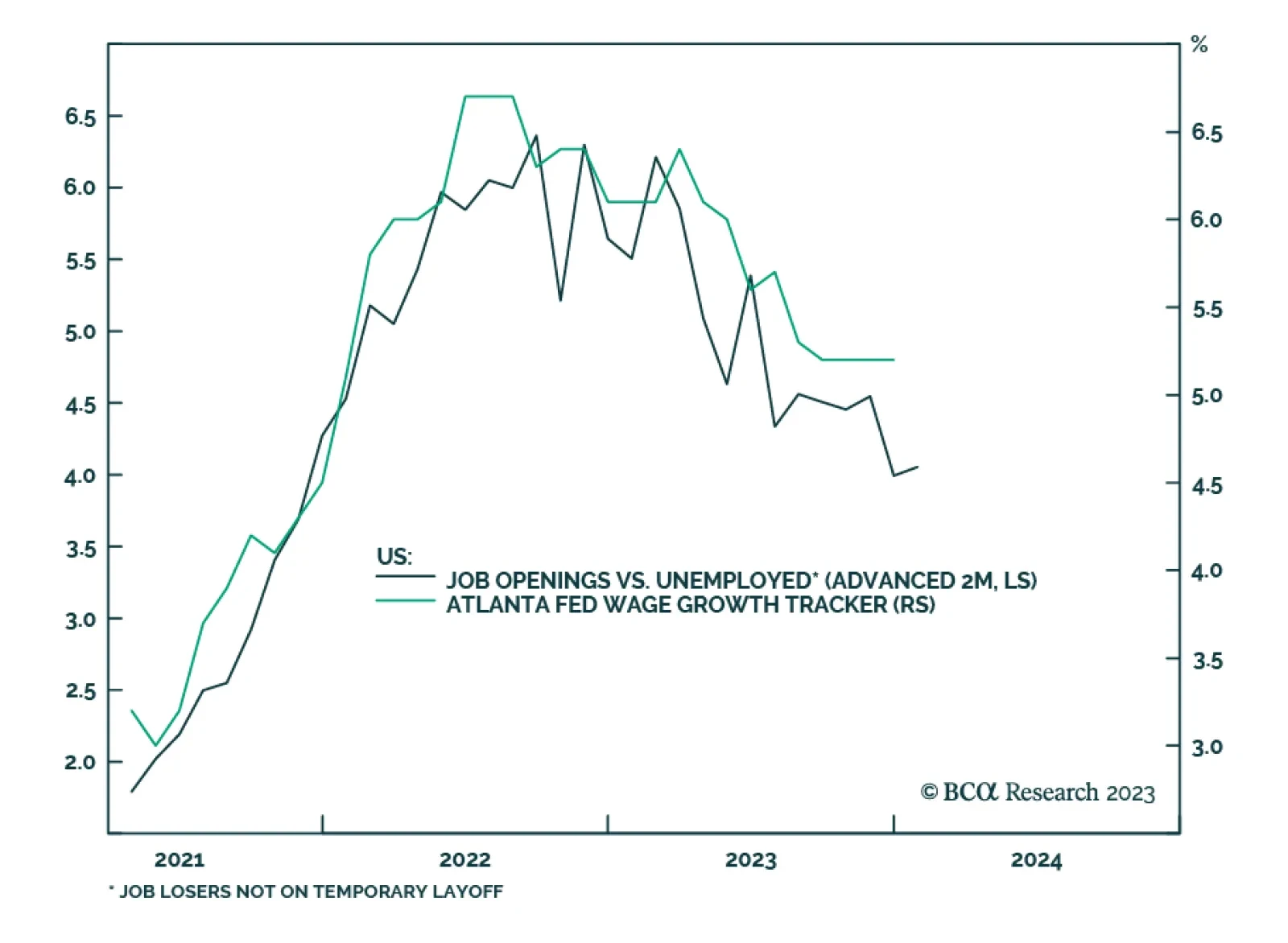

The best leading indicator for post-pandemic US wage inflation is the ratio of job vacancies to ‘bad’ unemployment (V/U), where bad unemployment refers to ‘job losers not on temporary layoff’. This…

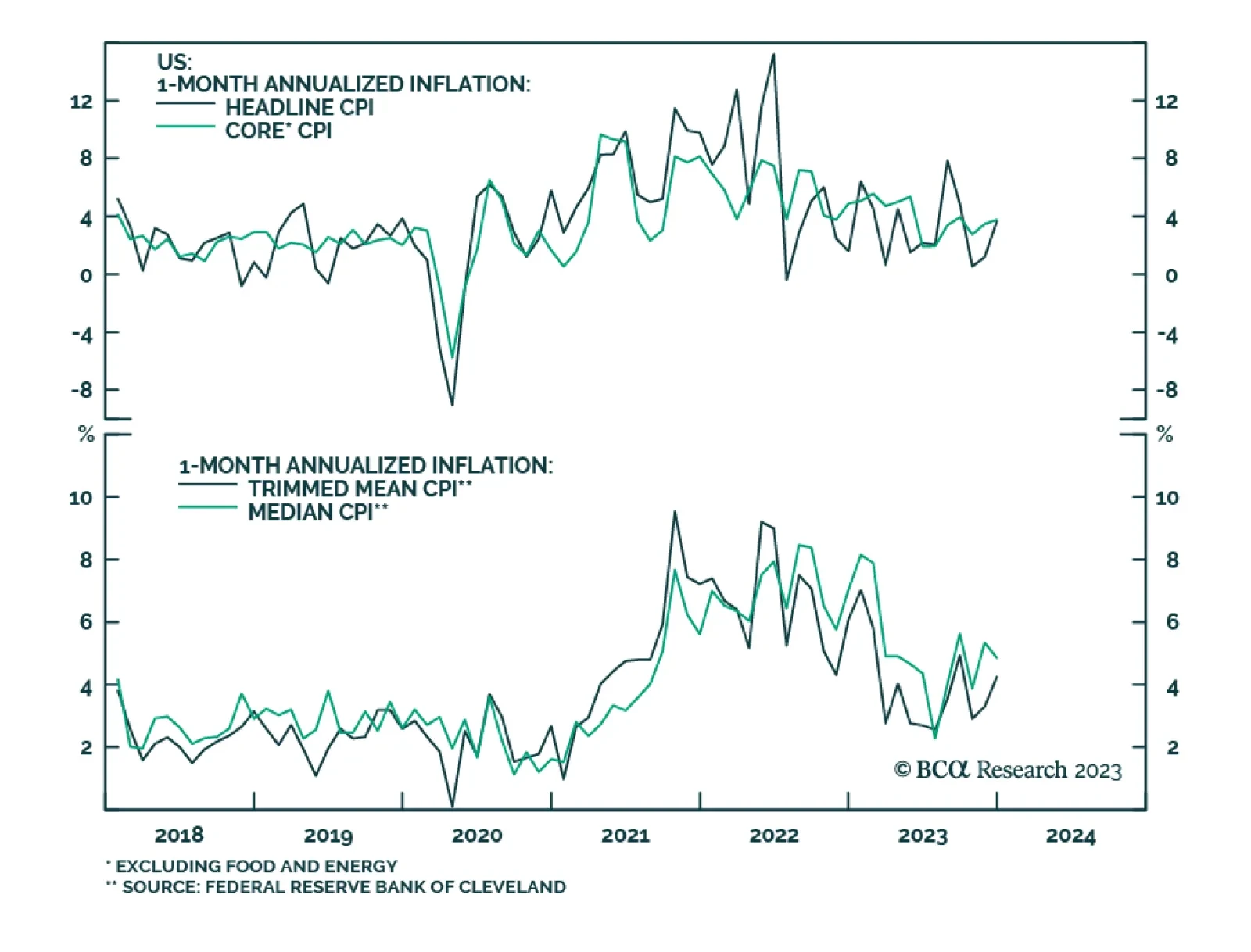

US CPI inflation for December came in slightly hotter than anticipated. Headline inflation accelerated from 0.1% to 0.3% on a month-over-month basis and rose from 3.1% to 3.4% on a year-over-year basis. Both the monthly and…