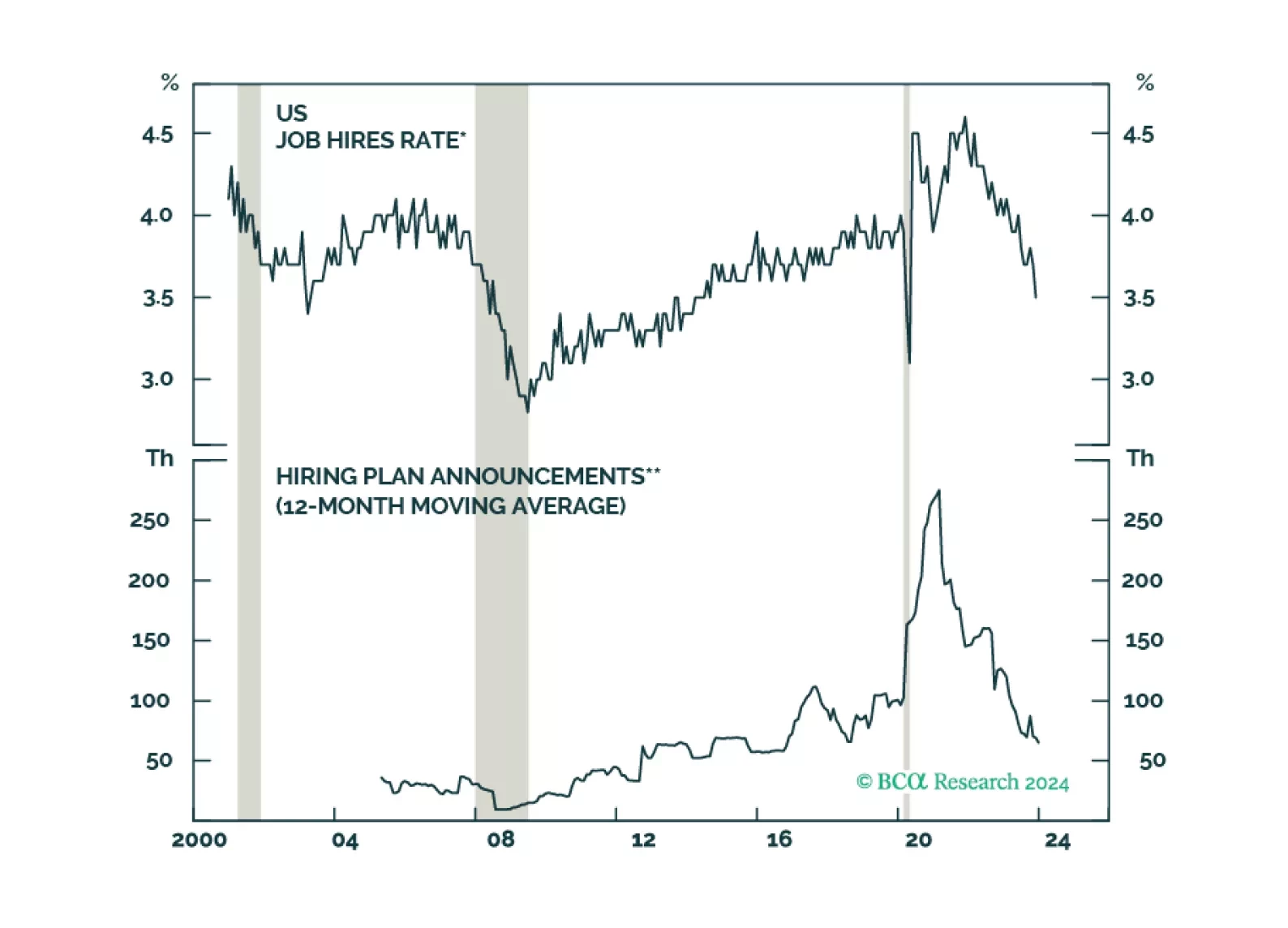

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

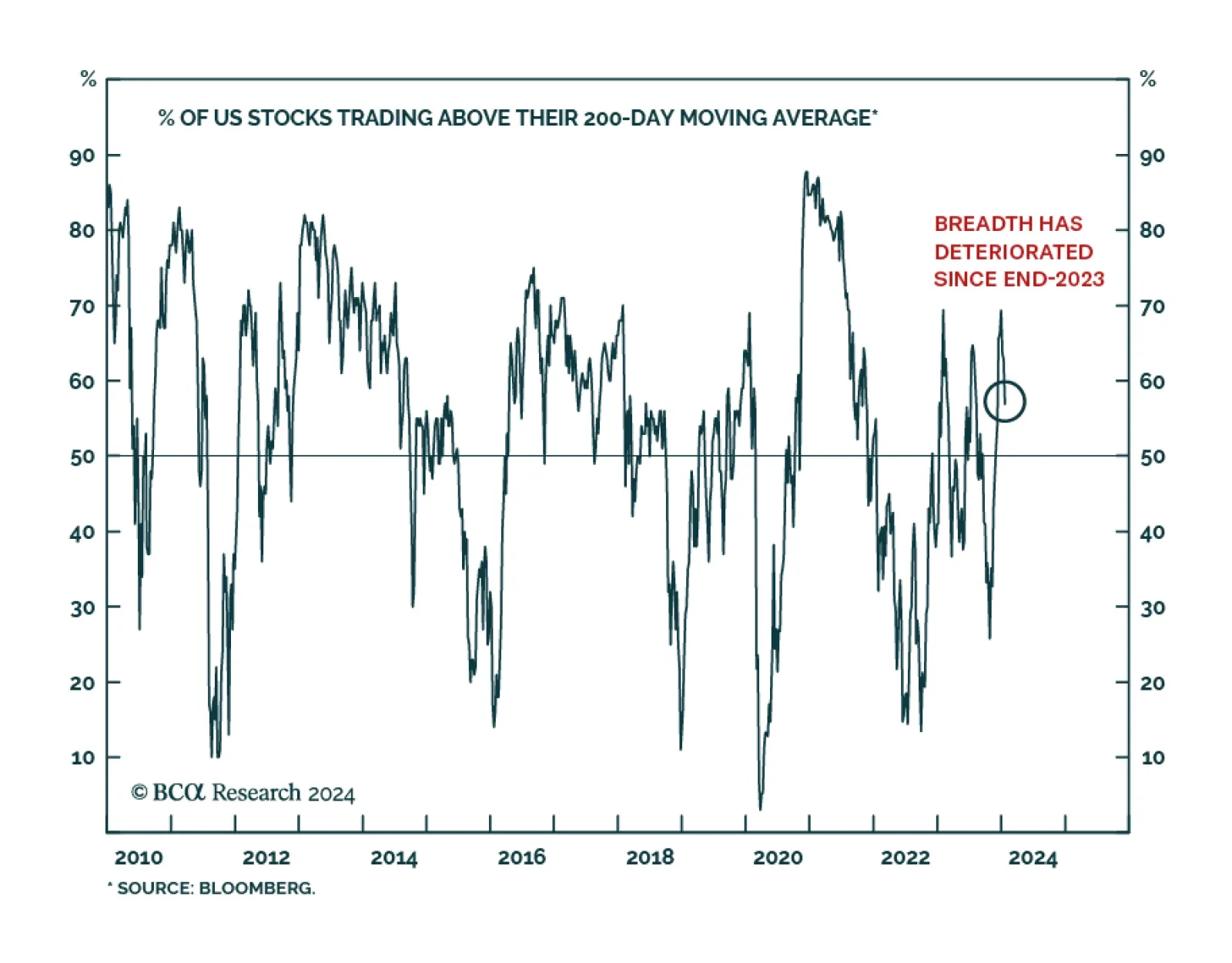

After having traded sideways for the past month, US equities ended the week on a high note with the S&P 500 closing at fresh record high on Friday. Last year’s winners are once again driving the rally. Information…

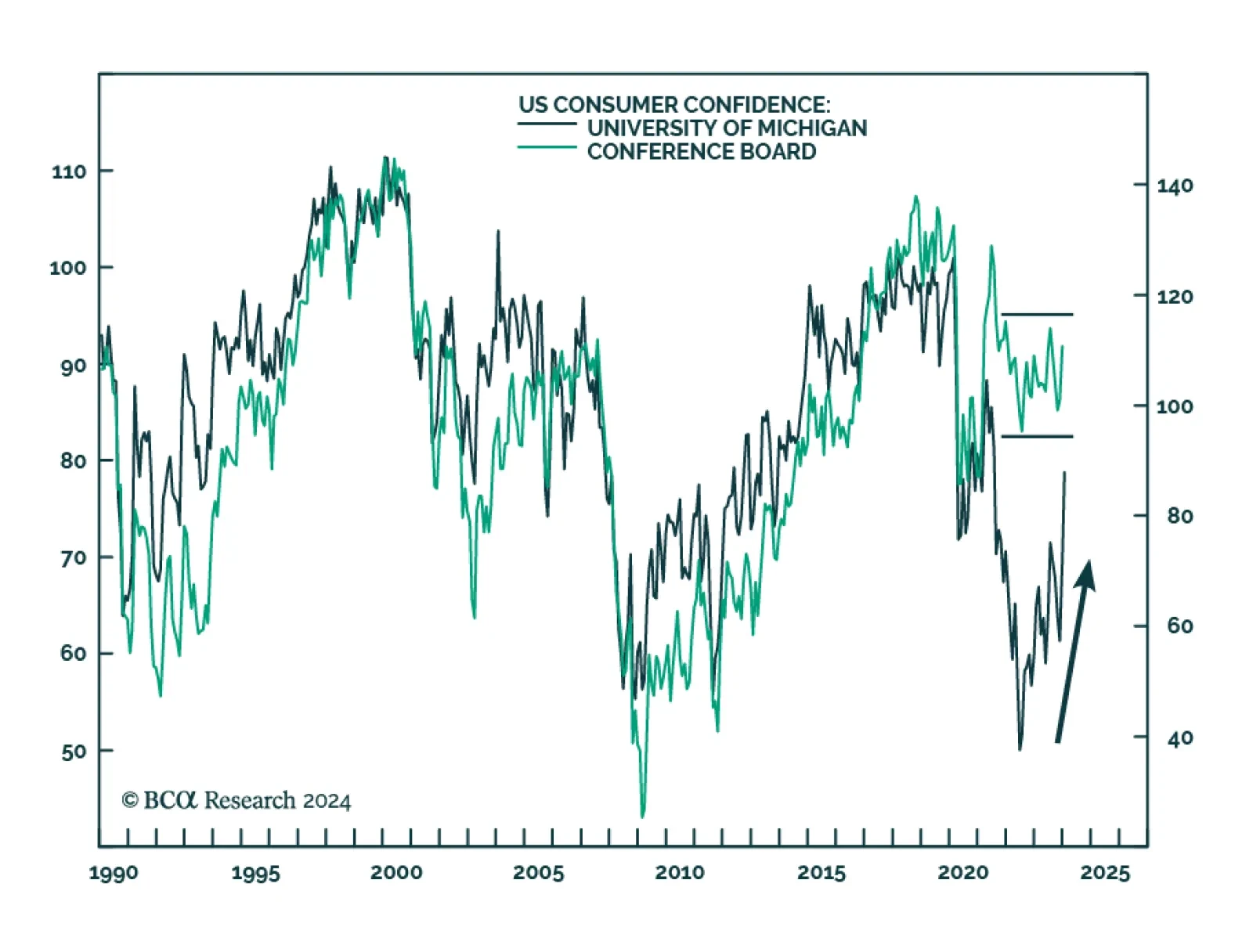

The preliminary release of the University of Michigan’s Survey of Consumers delivered a positive surprise on Friday. The headline index jumped from 69.7 to a 30-month high of 78.8, beating expectations of a slight increase…

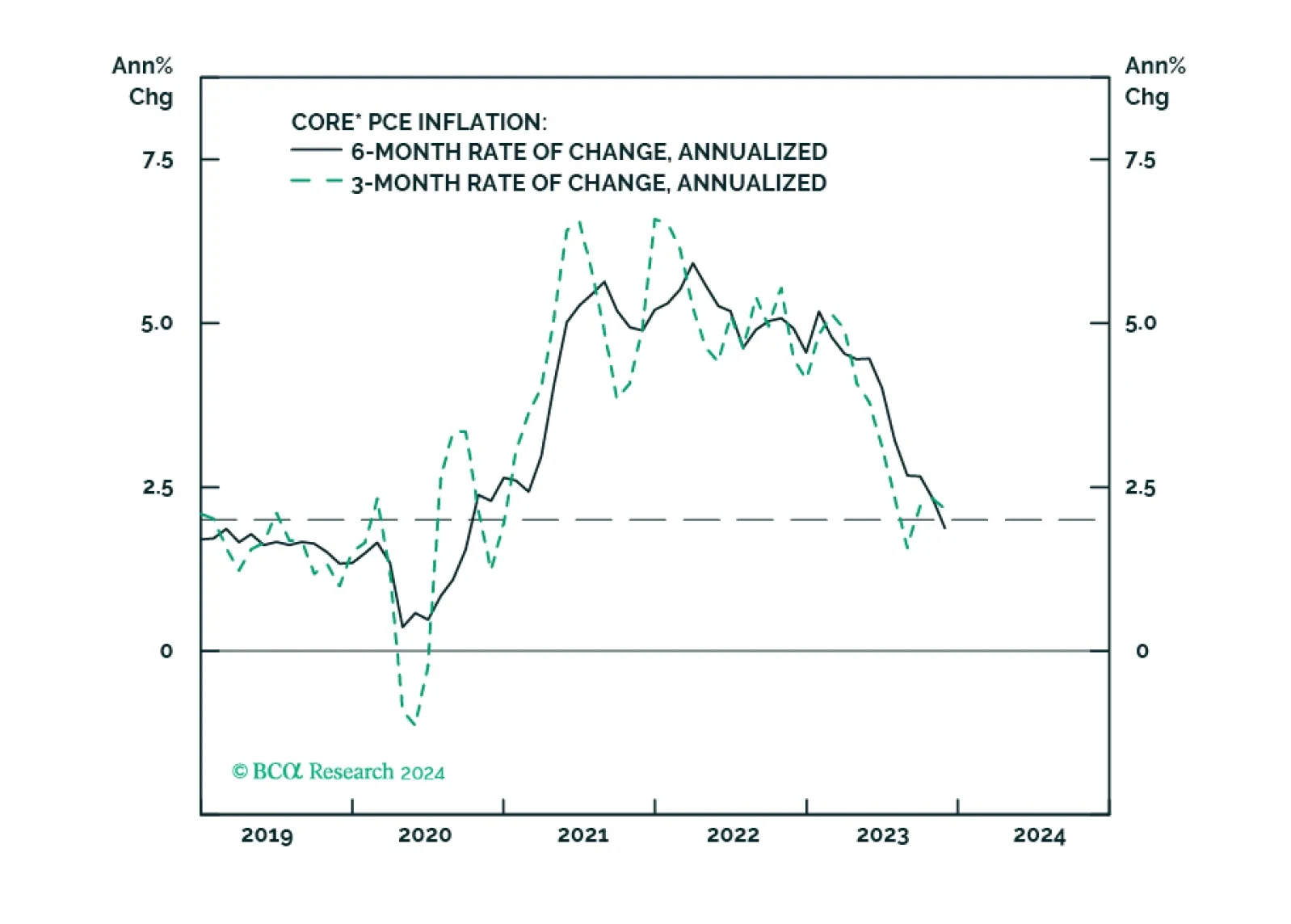

An update to our outlooks for the Fed’s interest rate and balance sheet policies following this week’s remarks from Fed Governor Waller.

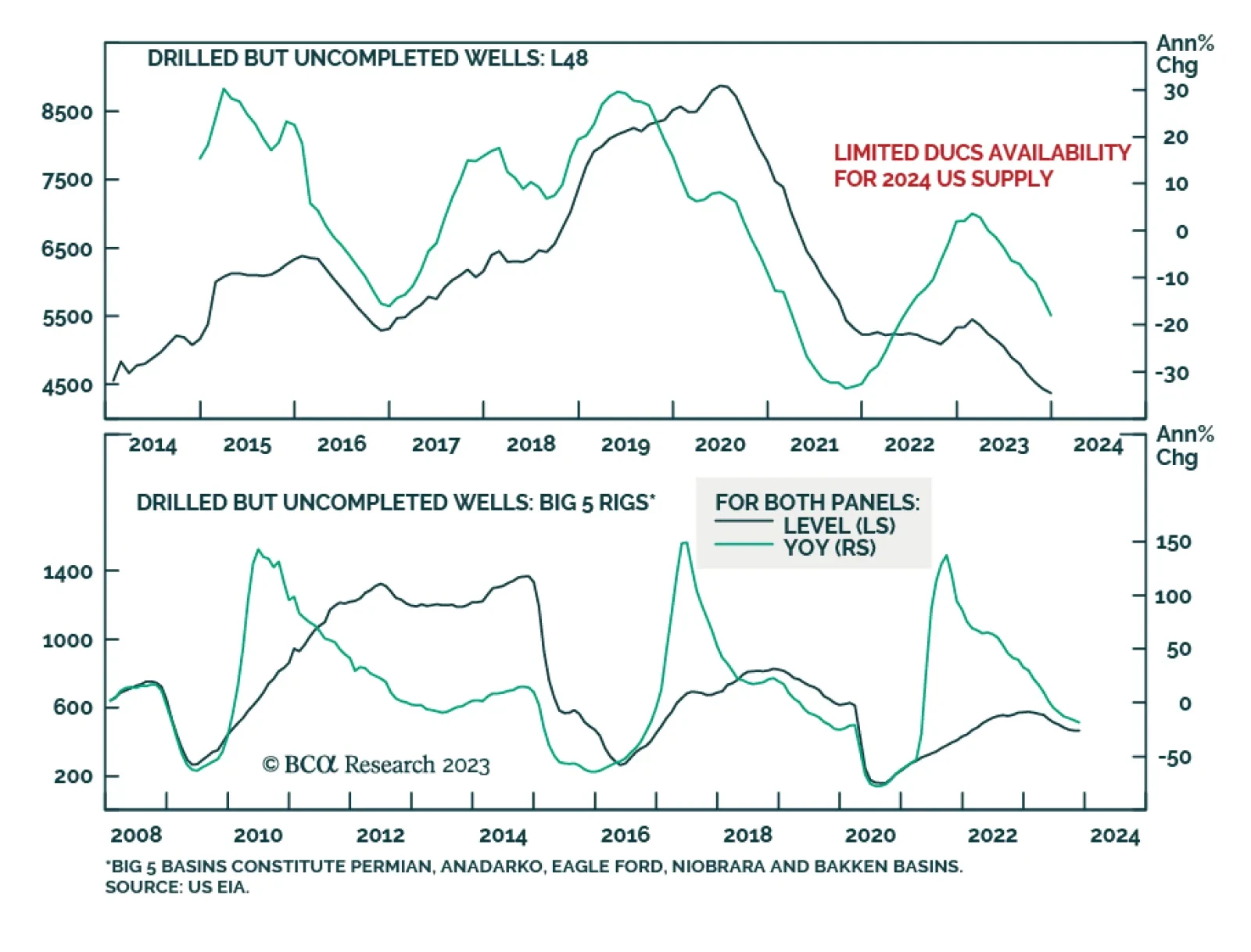

The 1mm b/d surge in US crude oil production last year was the result of a flood of low-cost drilled-but-uncompleted (DUCs) shale-oil wells coming online, mostly in 2H23 in the Permian Basin, which our colleagues in BCA's…

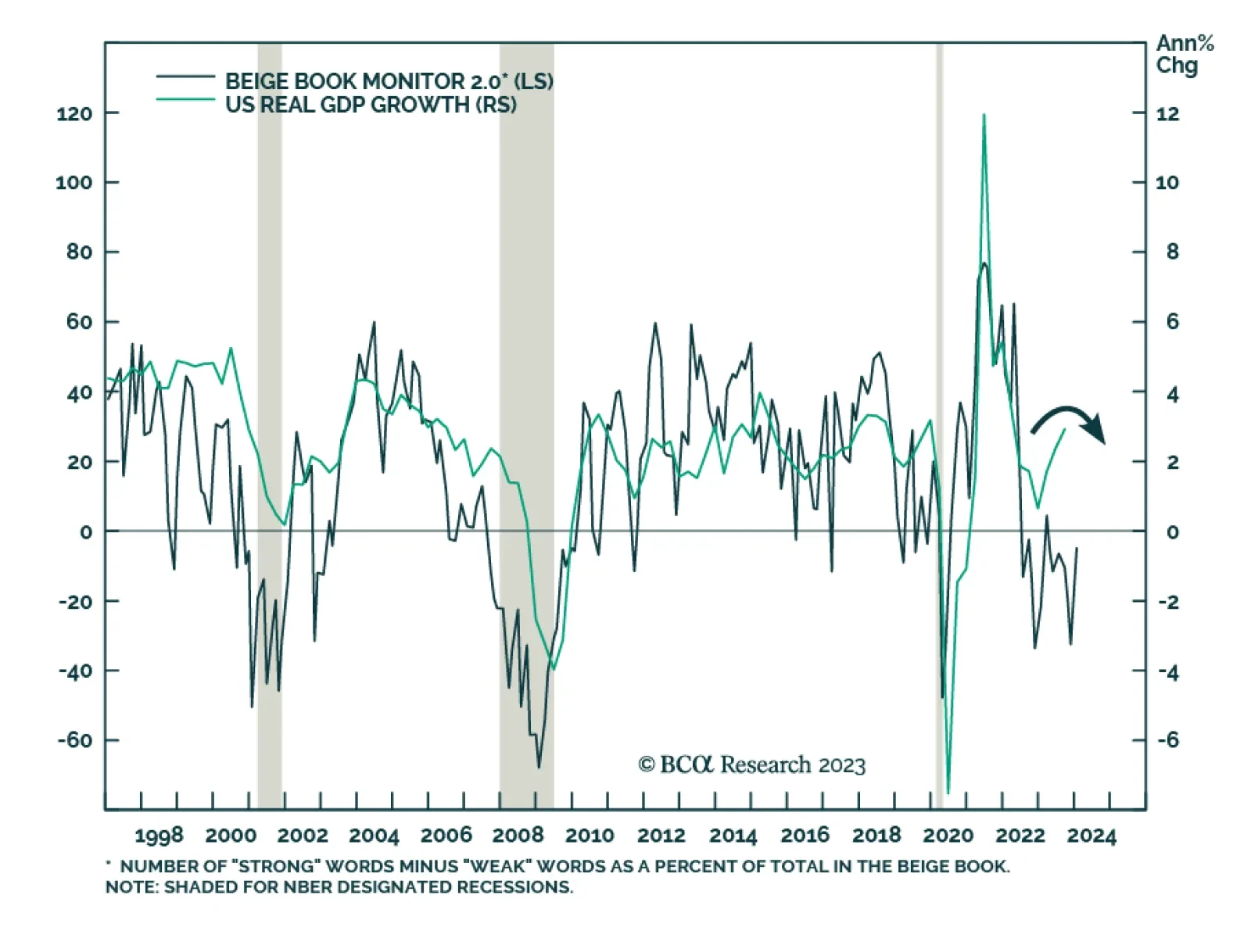

The Fed’s latest Beige Book delivered a lukewarm message on the US economy. Growth, employment, and prices were all relatively stable since the previous release in late-November. Eight districts reported little or no change…

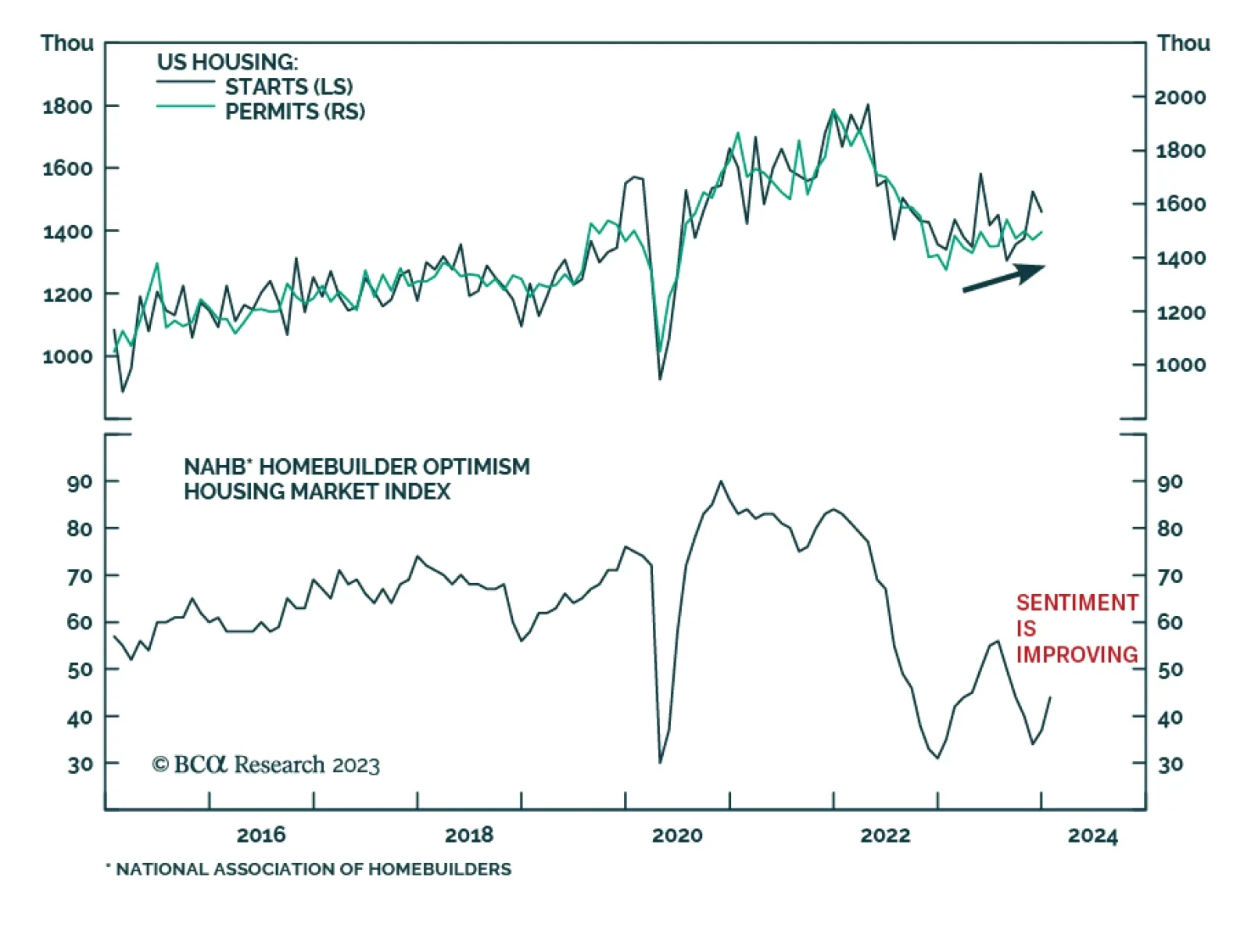

Recent data suggest that the US housing market is resilient. In particular, a strong rebound in homebuilder sentiment is sending a positive signal. The NAHB Housing Market Index jumped from 37 to 44 in January – handily…

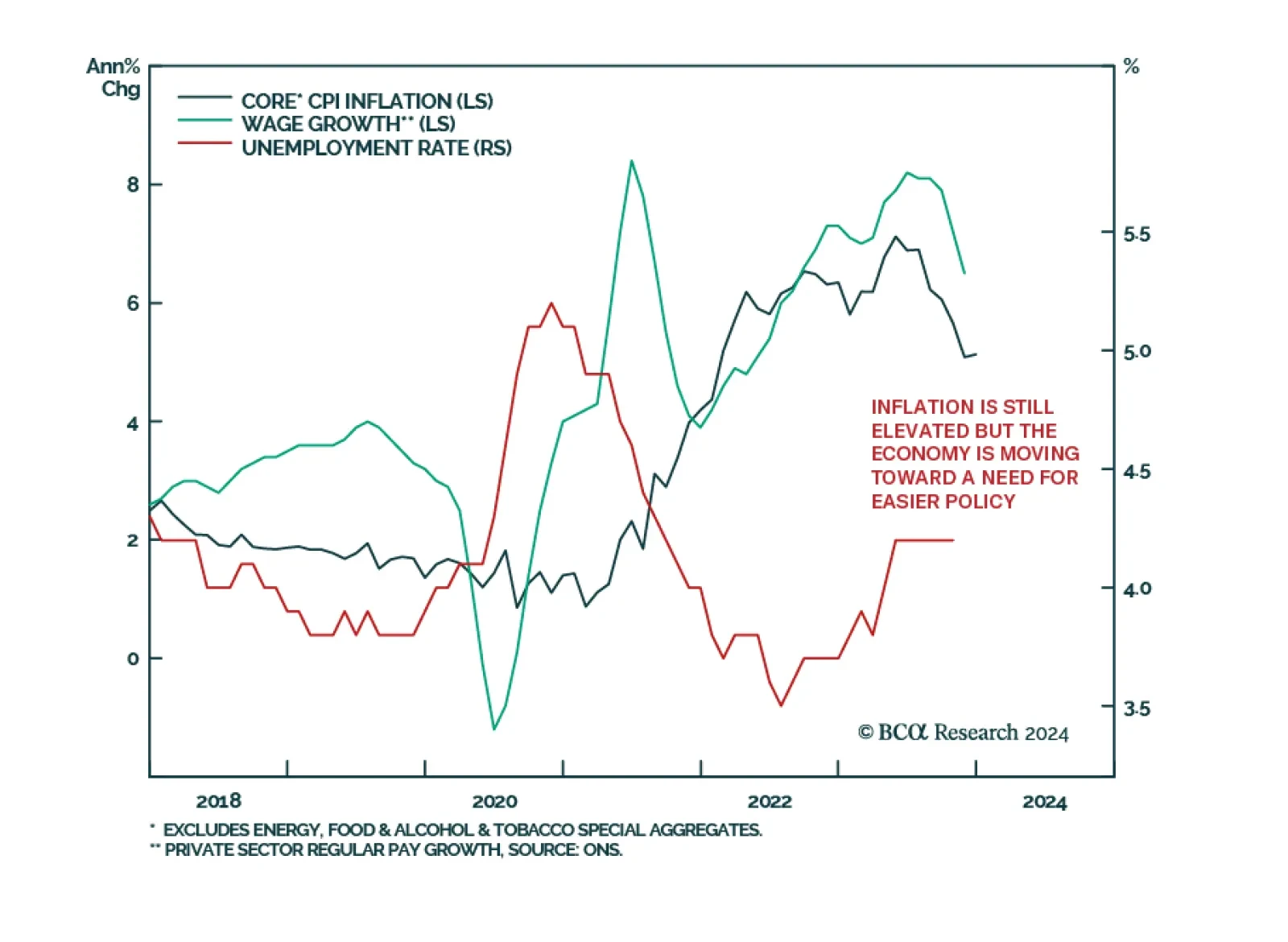

The British pound was the best performing G10 currency on Wednesday as UK gilts sold off meaningfully with the 10-year yield ending the day nearly 19 basis points higher. An unexpected acceleration in CPI inflation in December…

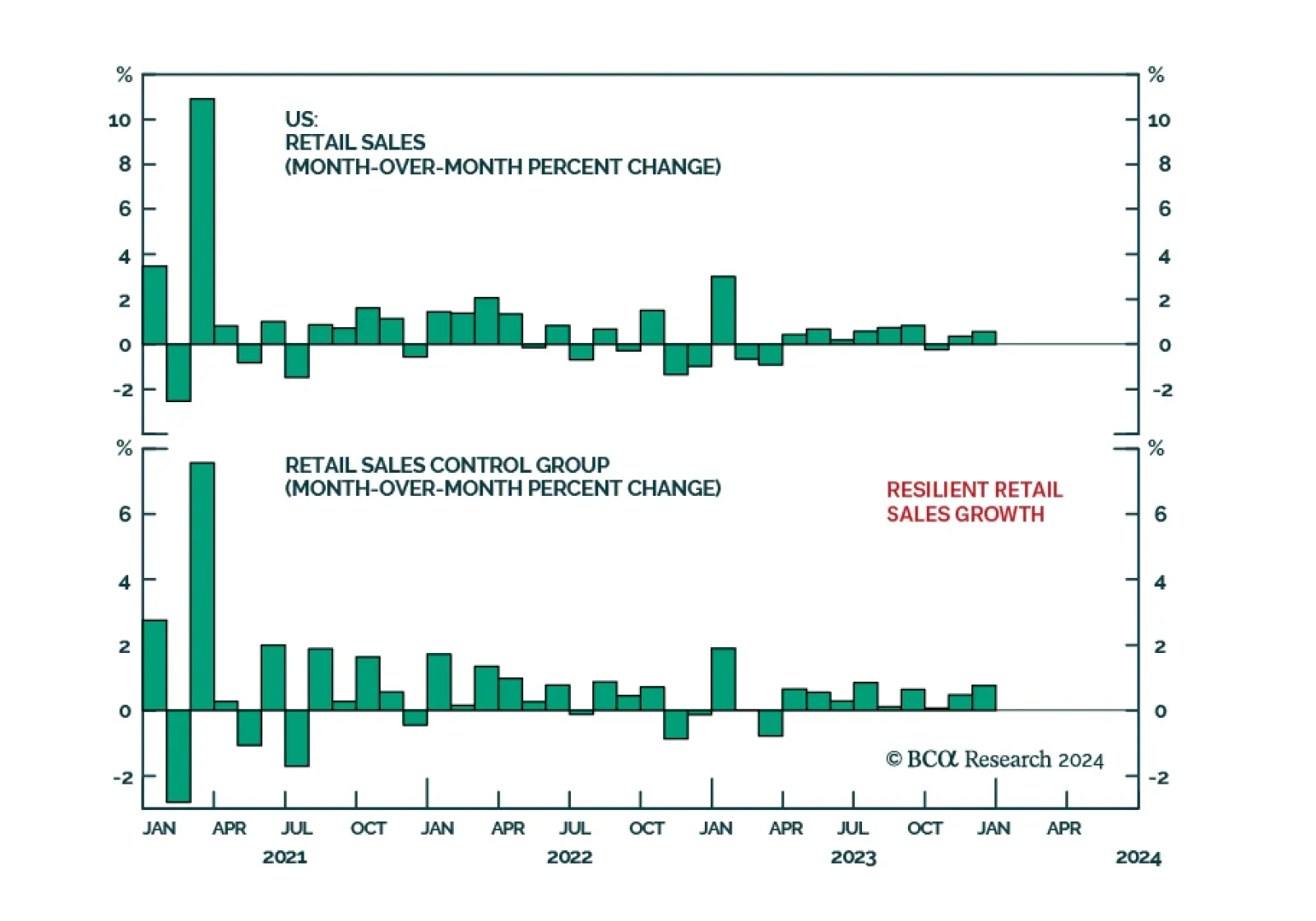

The US retail sales release delivered a positive signal about the US economy in December. The 0.6% m/m increase in overall retail sales beat expectations of a more muted acceleration from 0.3% m/m to 0.4% m/m. Importantly, the…

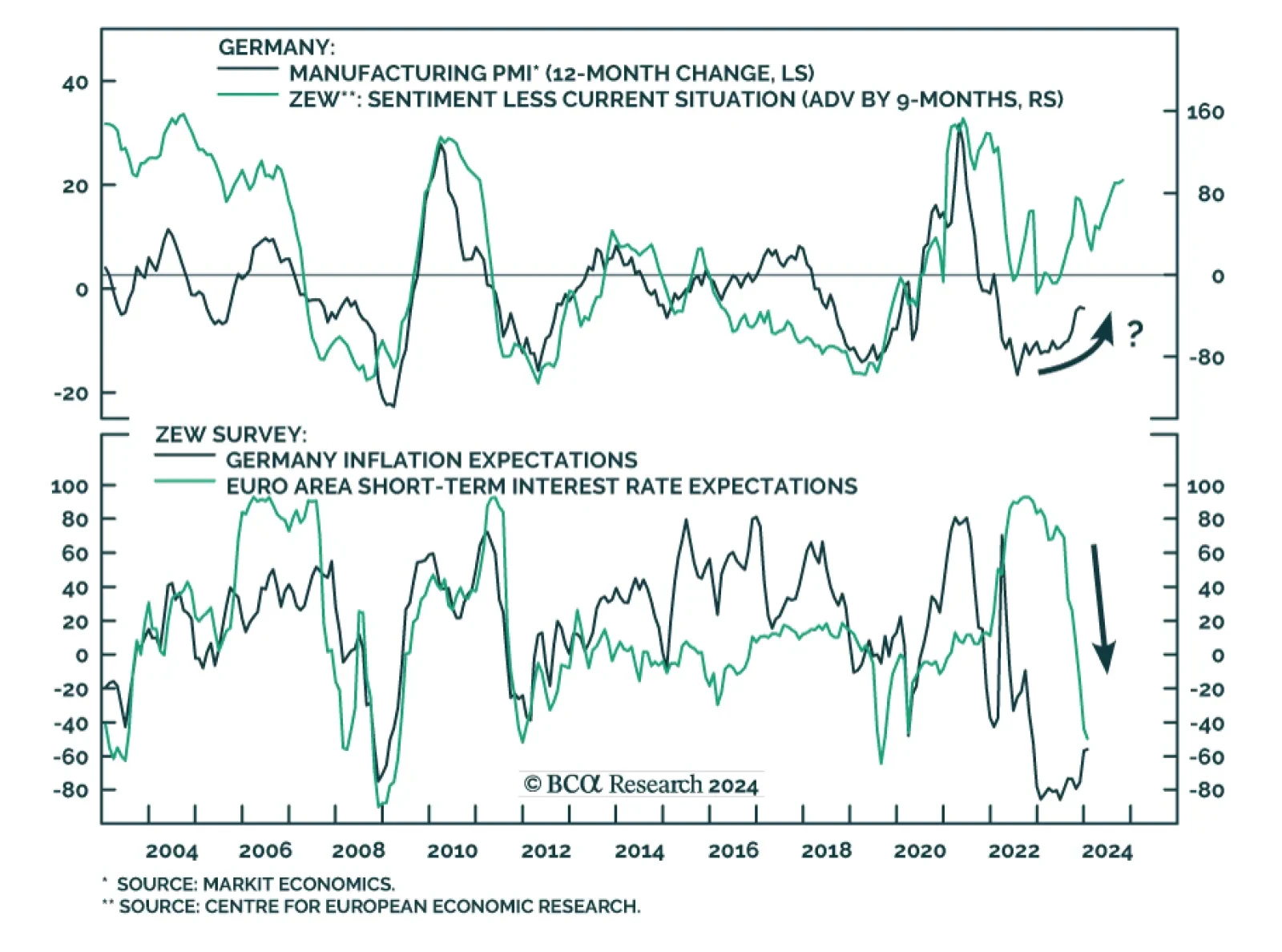

Results of the ZEW survey sent a slightly positive signal on German investor sentiment. The economic expectations indicator rose to an 11-month high in January – beating consensus estimates of a decline. This increased…