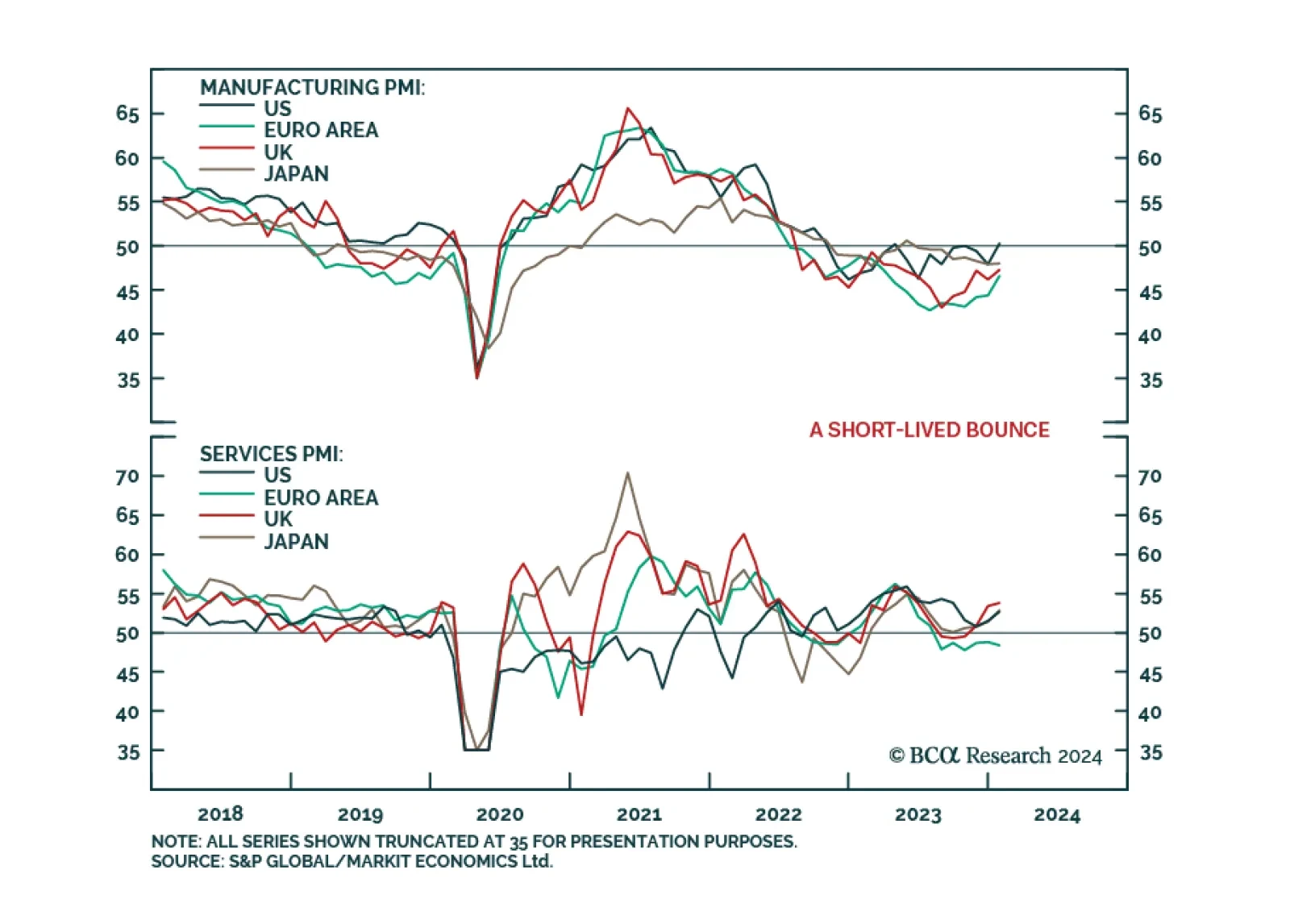

Flash PMIs sent a generally positive update on economic activity across major DM economies in January – particularly in the case of manufacturing. In the US, the composite index rose to a 7-month high of 52.3, beating…

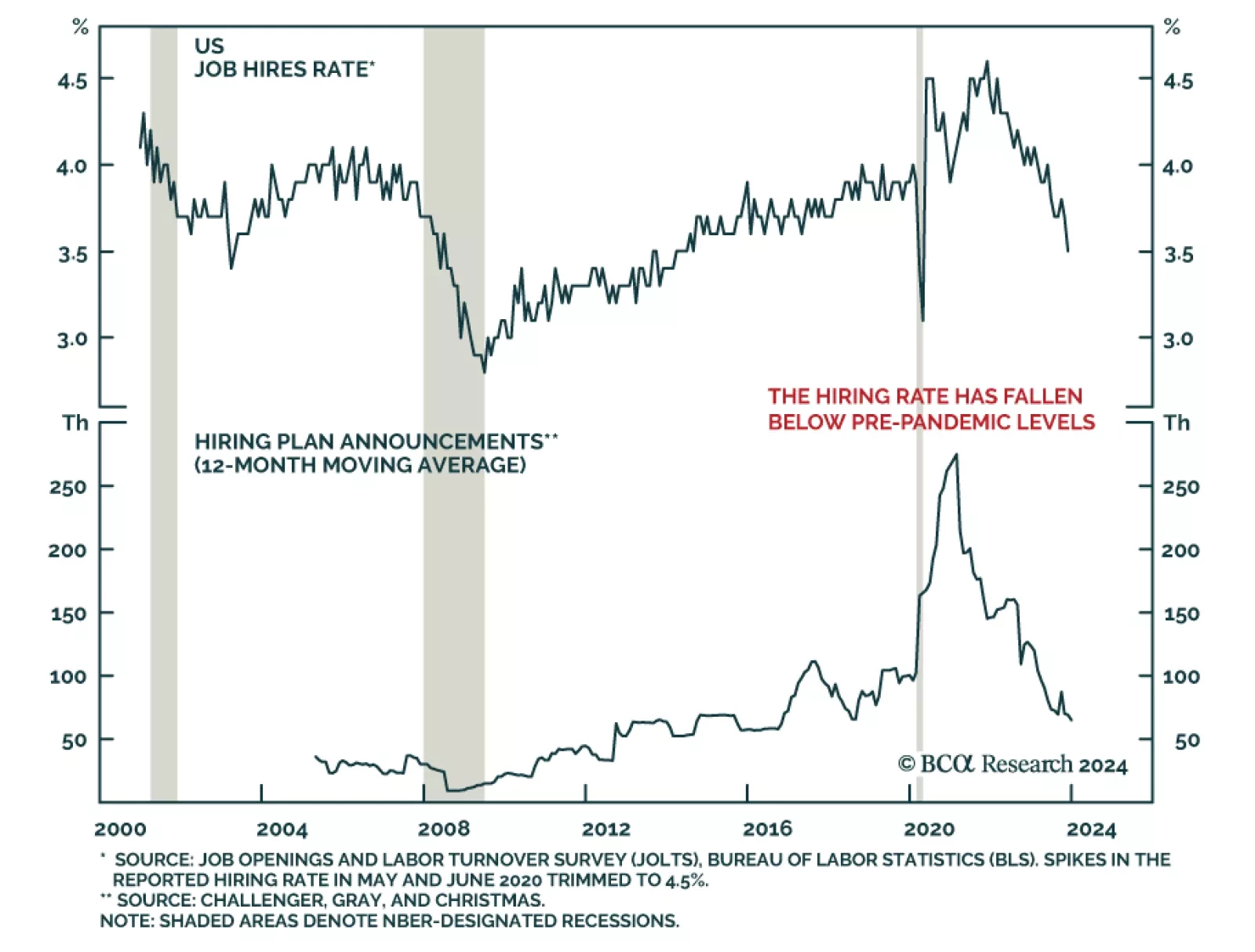

According to BCA Research’s Global Investment Strategy service, labor demand can fall even in a full-employment economy. Investors often focus on the unemployment rate as a gauge of how strong the labor market is. The…

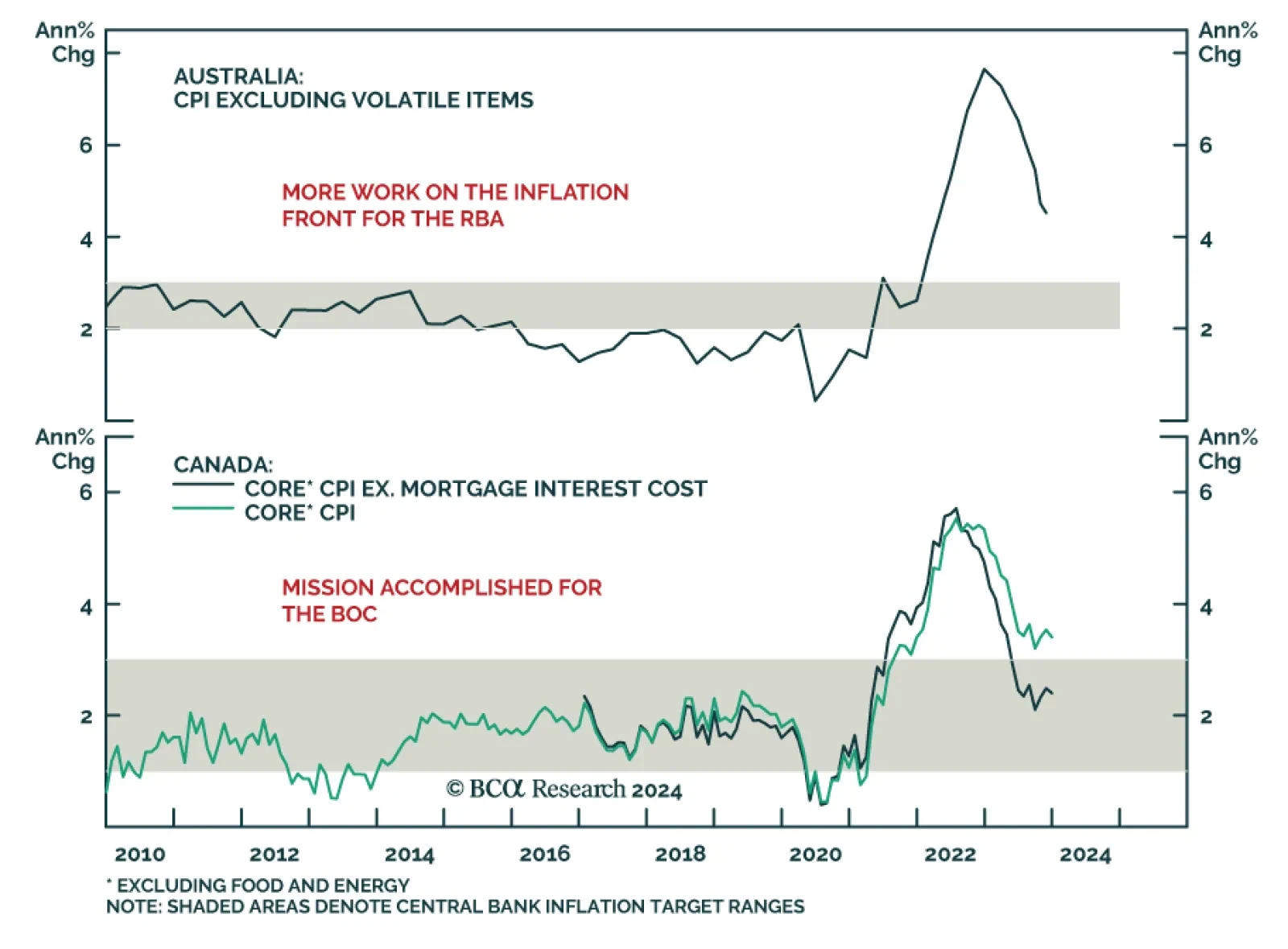

Ahead of today’s Bank of Canada (BoC) meeting and the Reserve Bank of Australia (RBA) meeting on February 6th, our Global Fixed Income Strategists compared the monetary policy outlooks for both central banks. In Canada,…

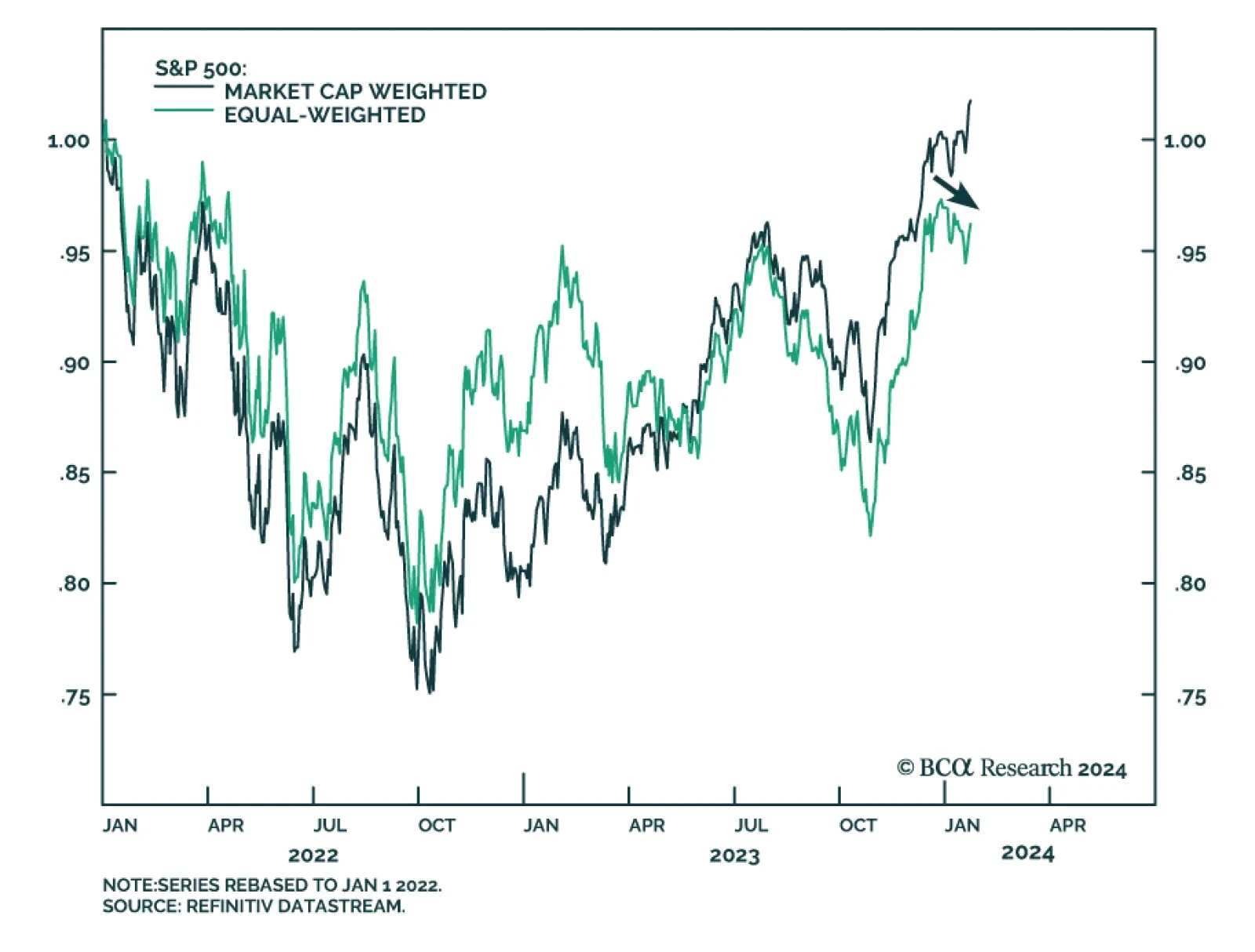

The S&P 500 notched a fresh record high on Tuesday for the third session in a row, bringing its year-to-date gains to 2.0%. Yet as we highlighted in a recent Insight, the lack of a broad-based rally across all S&P 500…

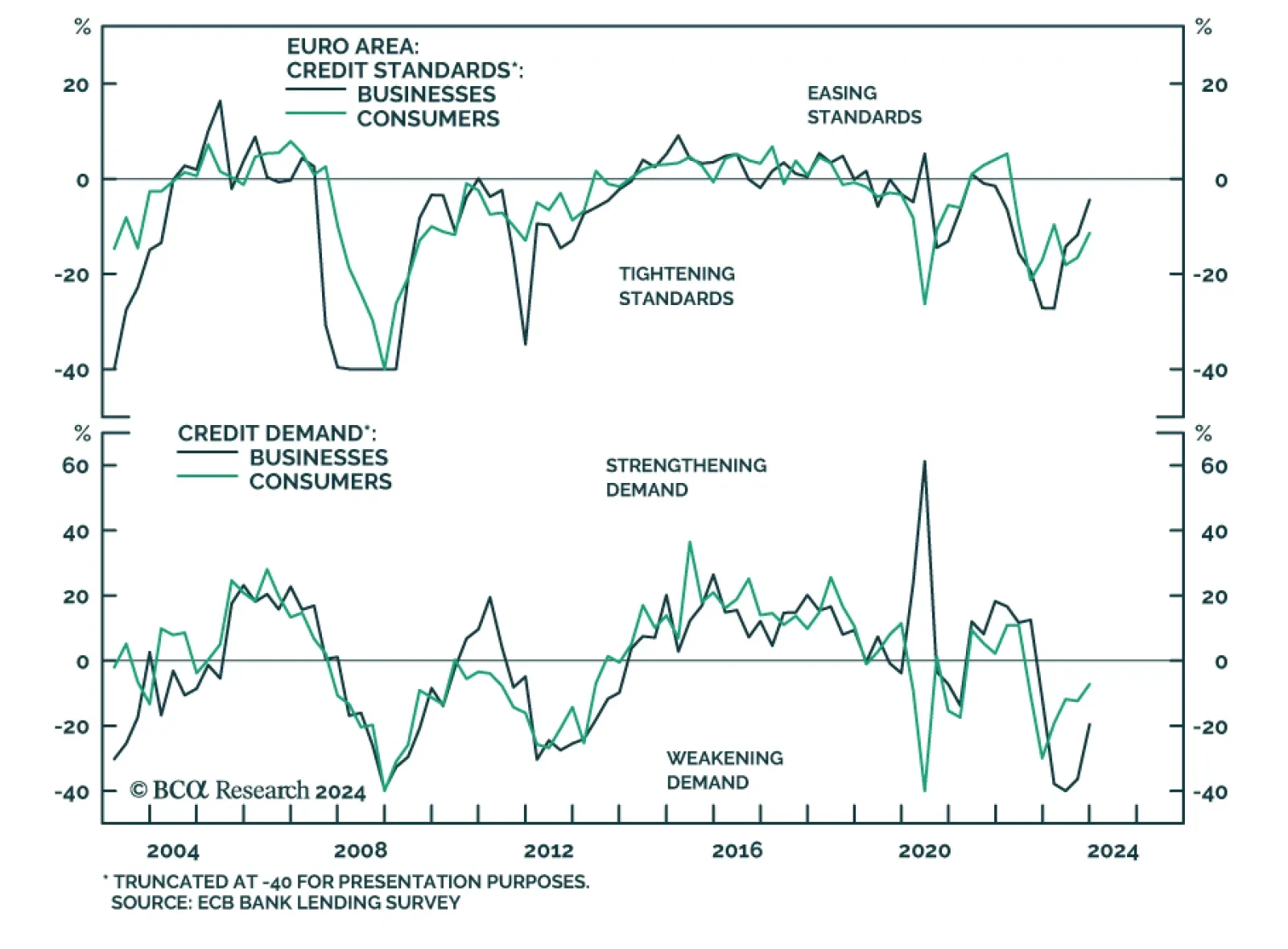

Results of the ECB’s quarterly Bank Lending Survey suggest that the tight monetary policy stance is still weighing on the Eurozone economy. Banks tightened credit standards for businesses and consumers further in Q4…

BCA Research’s European Investment Strategy service concludes that investors should go long German curve steepeners. Last week at Davos, European Central Bank (ECB) President Christine Lagarde leaned heavily against the…

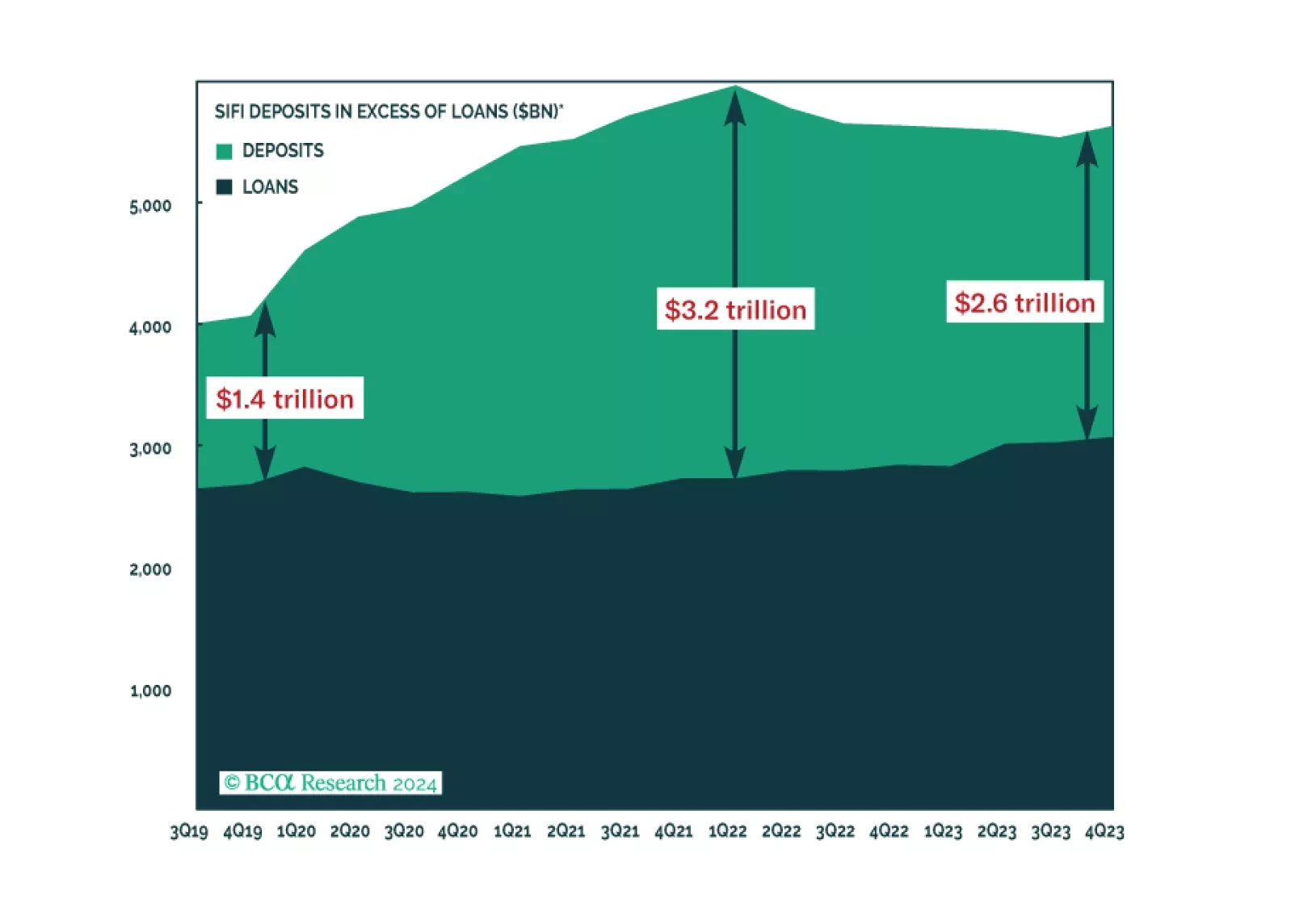

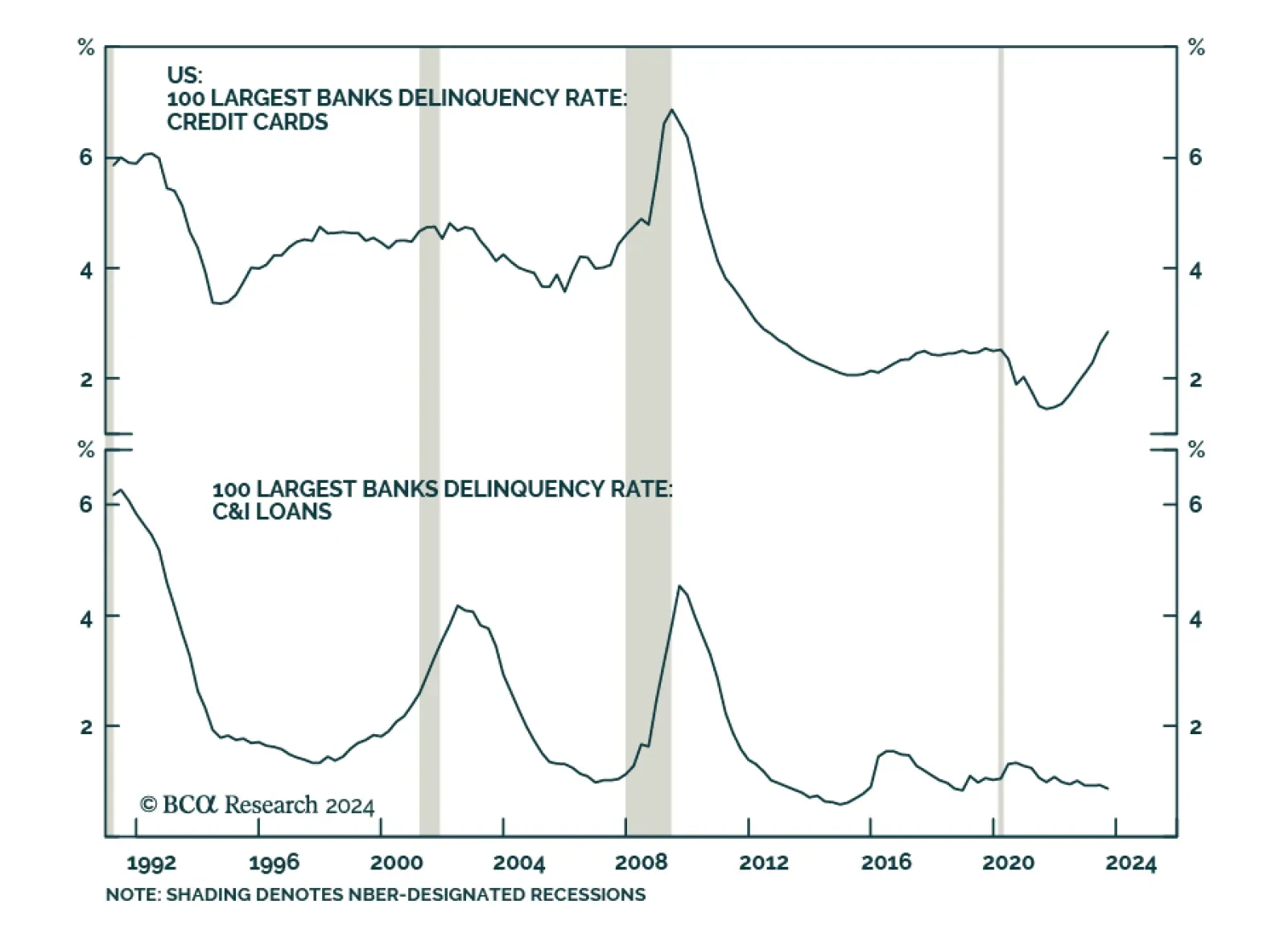

The SIFI banks (BAC, C, JPM and WFC) kicked off the fourth-quarter US reporting season on January 12th. As usual, our US Investment Strategists studied the SIFI’s earnings calls looking for macroeconomic insights from…

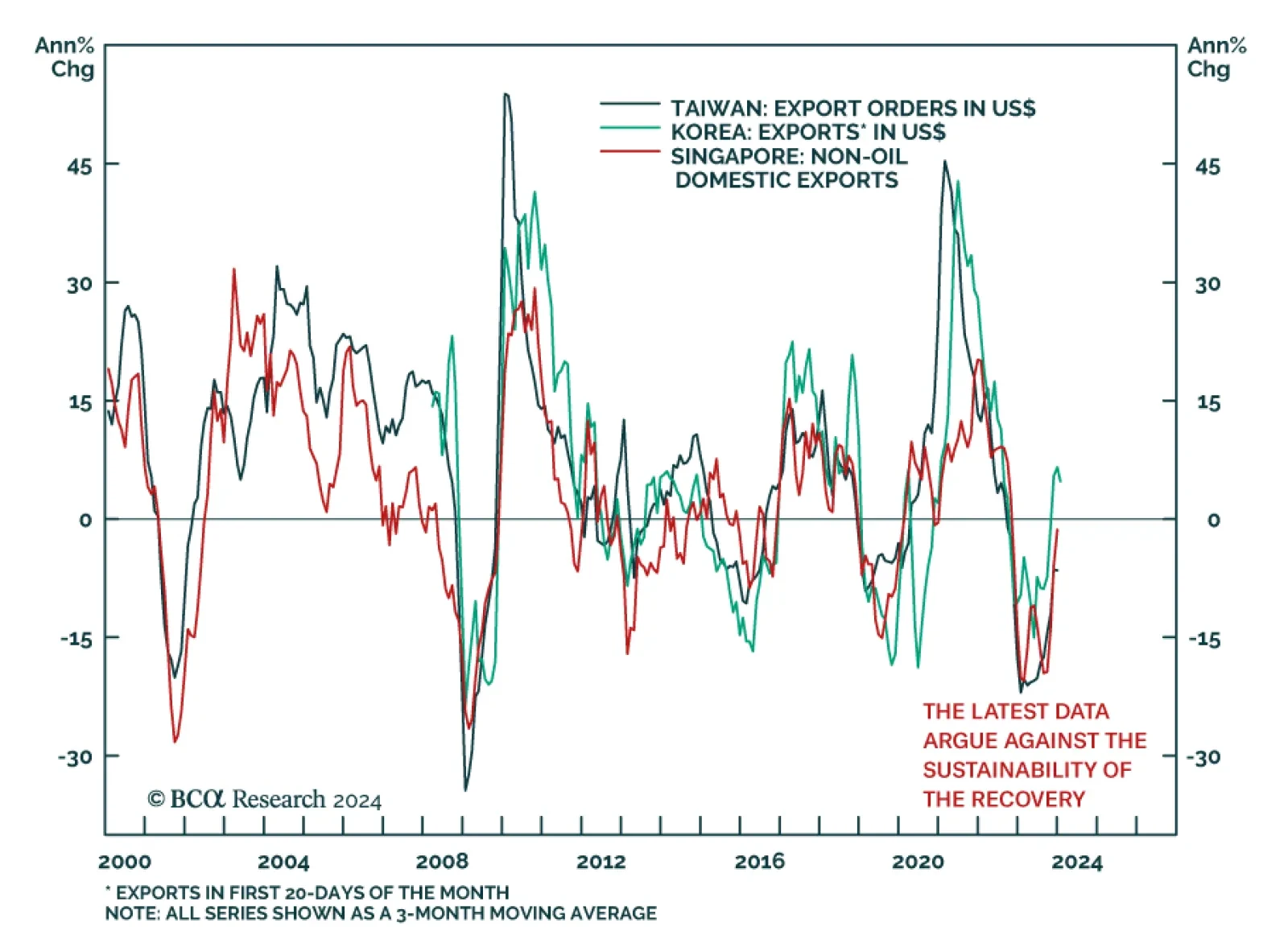

Some key Asian trade indicators are warning against betting on a sustained rebound in global trade activity. In particular, Taiwanese export orders collapsed by 16% y/y in December – significantly below expectations of a…

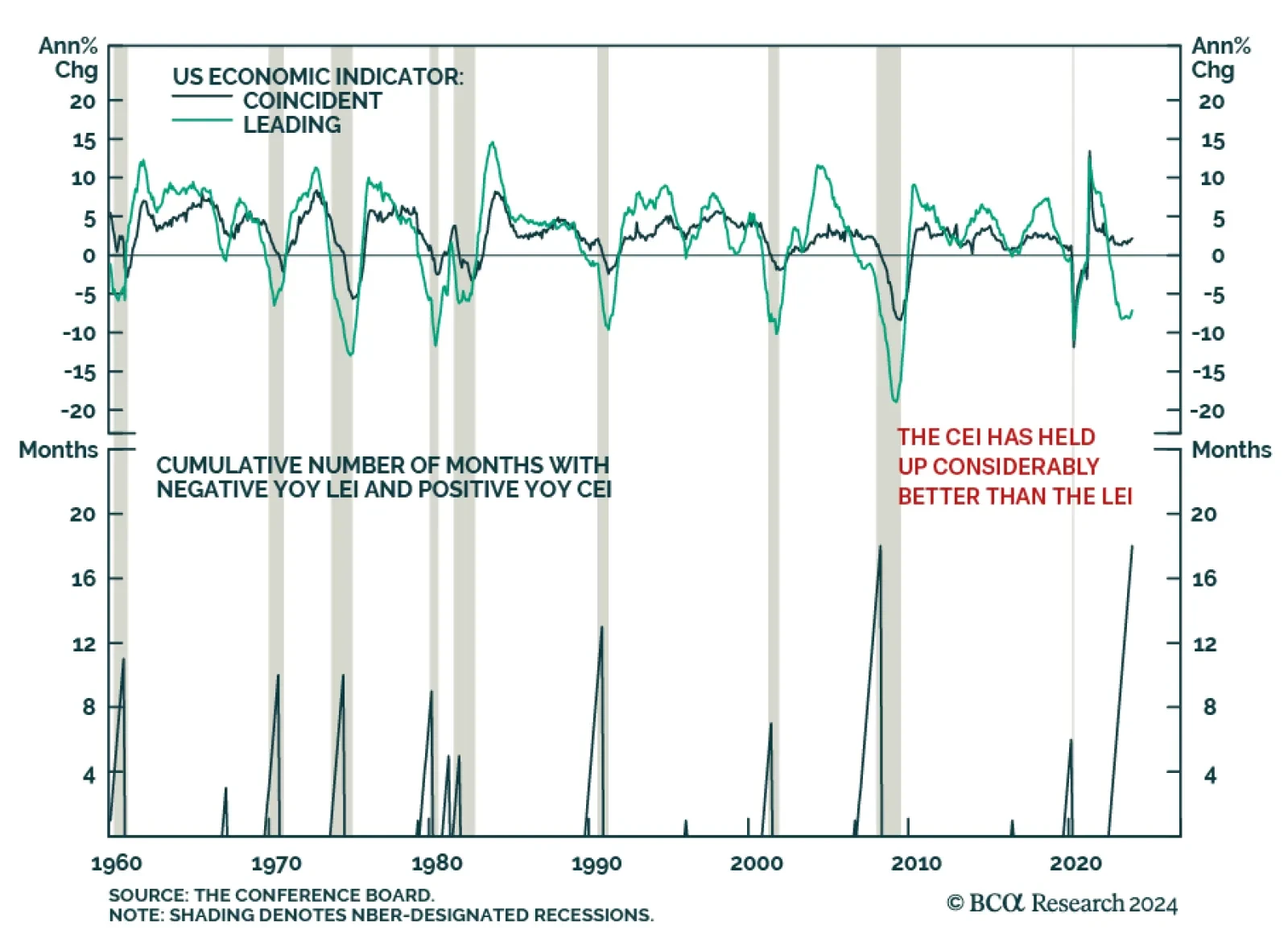

The US Conference Board’s Leading Economic Indicator (LEI) sent a mixed signal on Monday. On the one hand, the LEI posted its 22nd consecutive month-over-month decline in December – a negative sign for the…

The SIFI banks expressed confidence in their credit outlook for 2024 and expect that credit losses will crest soon, given the reserves they’ve already set aside. Their implicit embrace of the soft-landing narrative suggests to us…