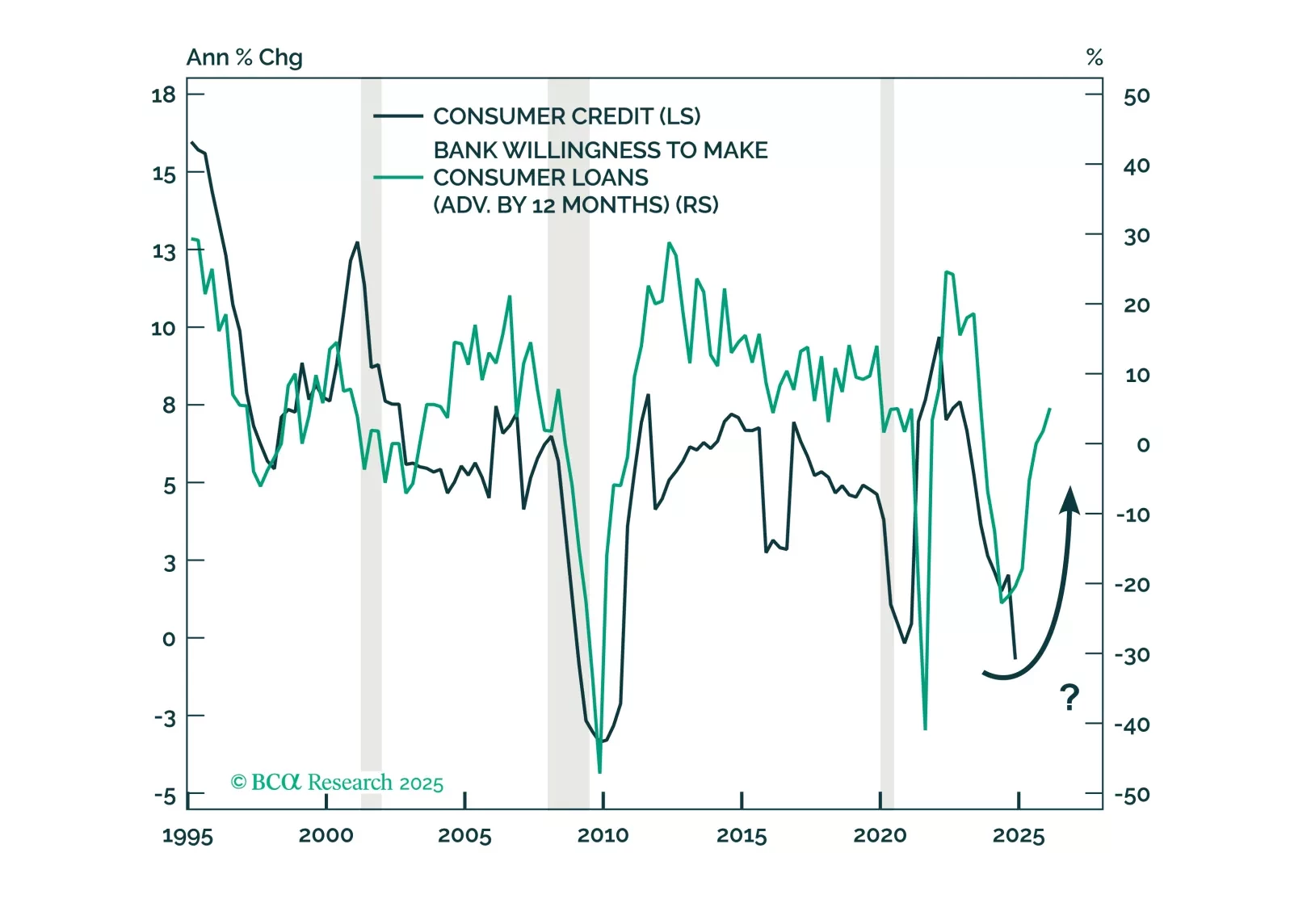

Households’ healthy balance sheets do not square with the rise in credit cards and auto loans delinquencies. The tailwinds that have supported higher-income cohorts’ spending have faded, presaging broad-based deterioration in credit…

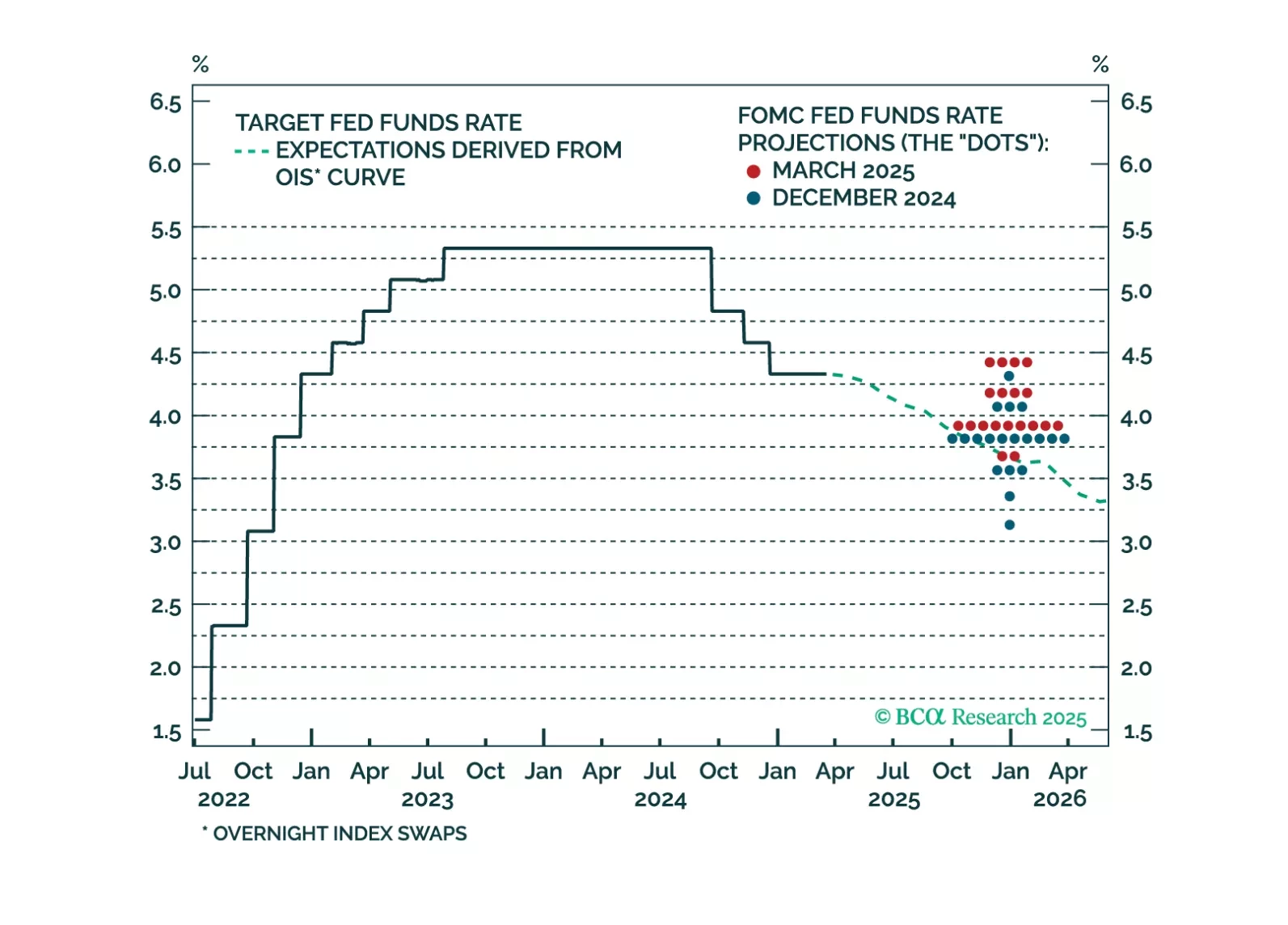

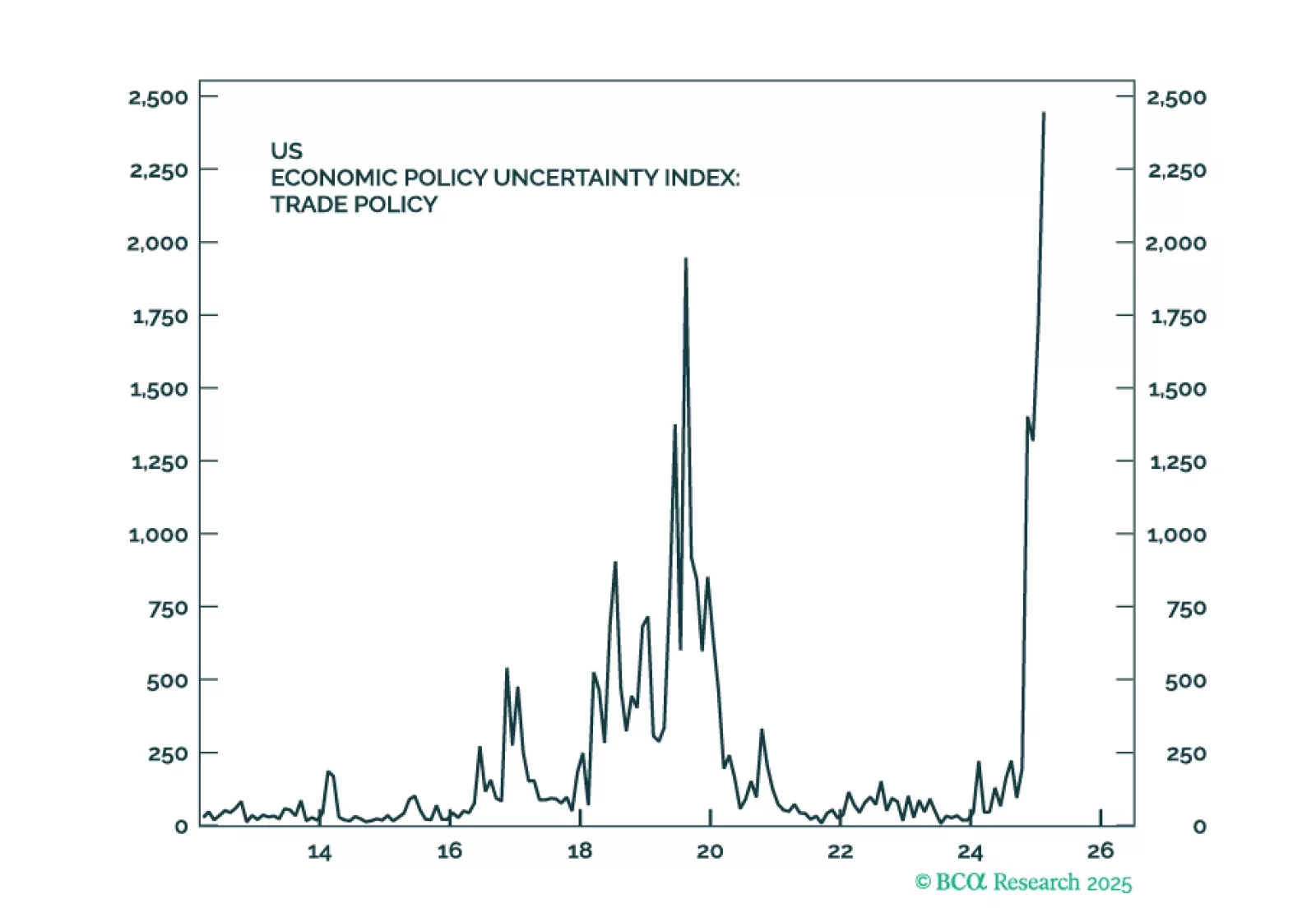

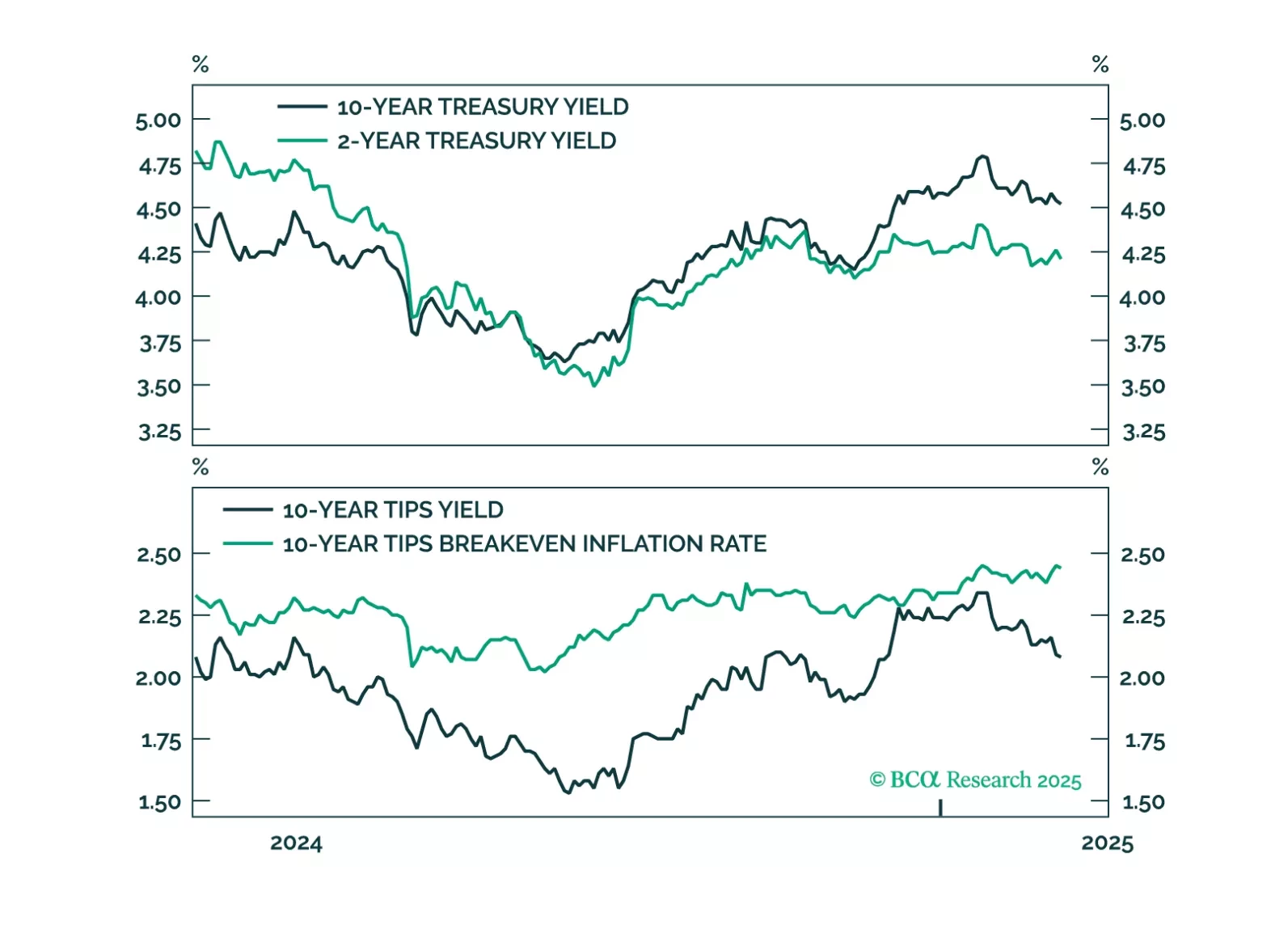

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

Despite our bearish predisposition towards stocks, we are open-minded to anything that could challenge our thesis. As such, in this report, we review five upside scenarios for equities.

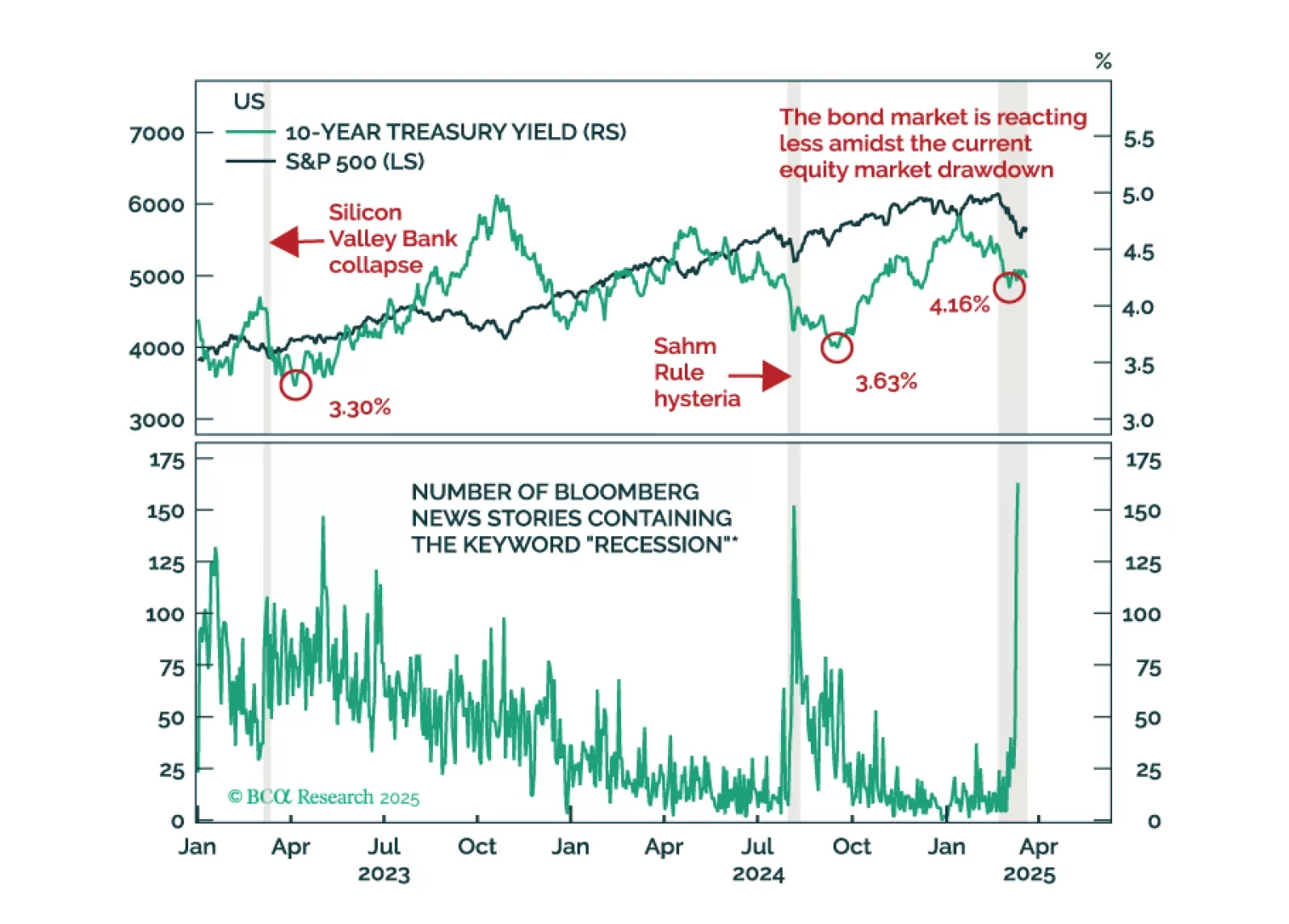

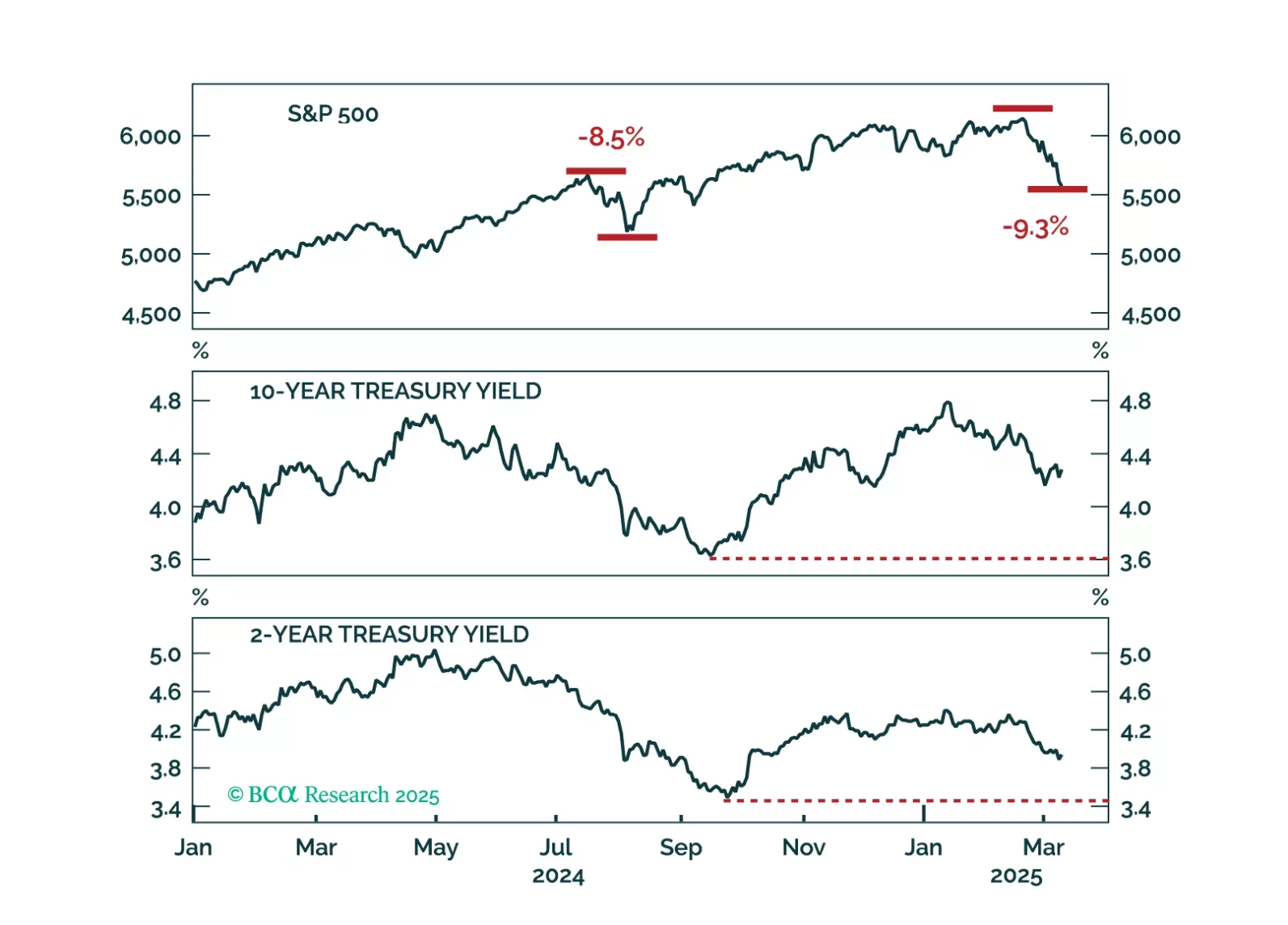

A falling stock market and sticky bond yields represent the worst of both worlds for investors. We interrogate why bond yields haven’t dropped more given the large selloff seen in equities.

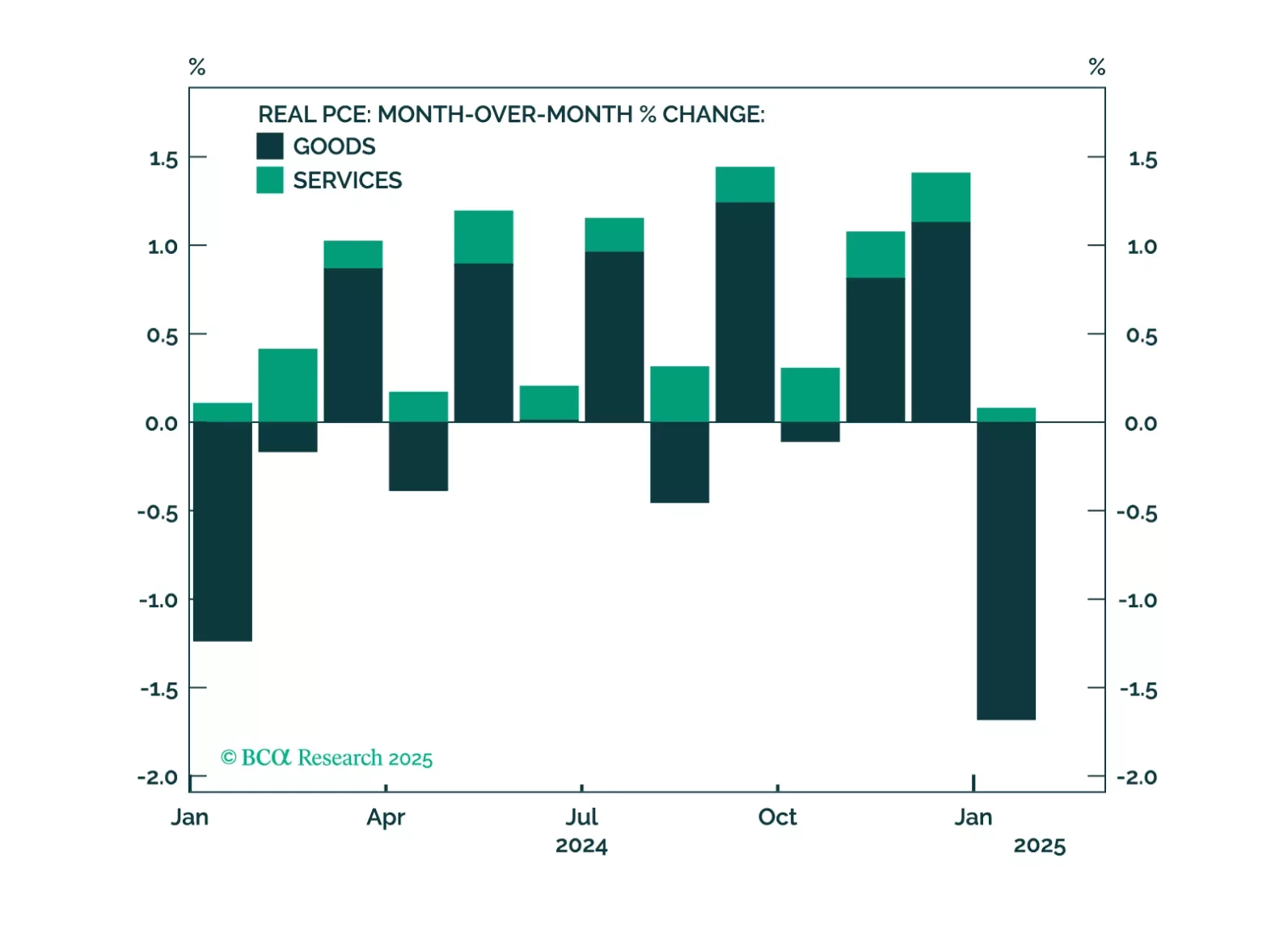

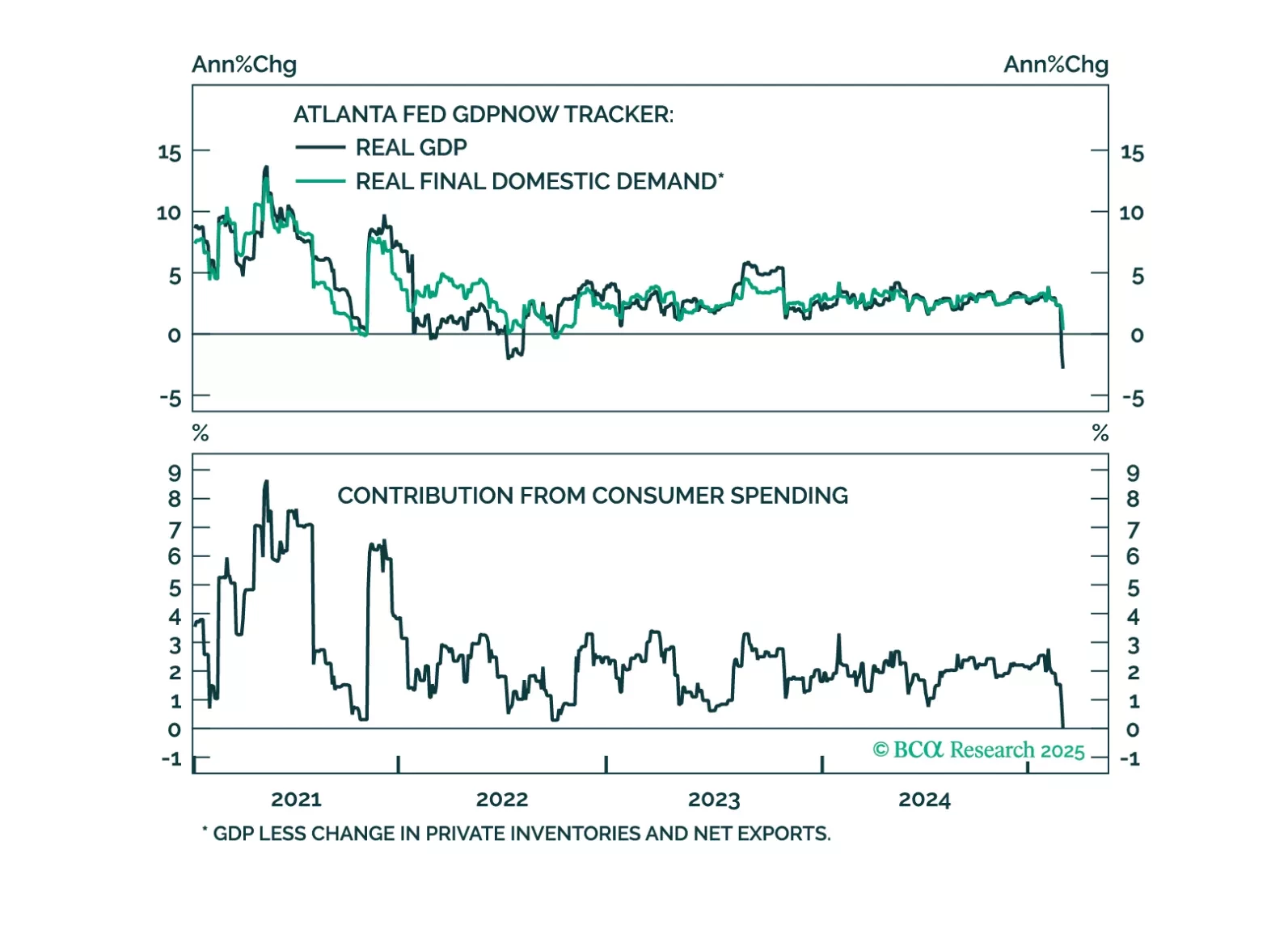

This morning’s employment report showed solid job growth, but recent consumer spending indicators are more concerning. The risk of recession starting within the next few months has increased. We suggest some important indicators for…

The US economy is set to enter a recession within the next few months. Stay underweight equities and overweight cash. Look to increase fixed-income duration exposure over the coming months. The euro is likely to strengthen and…

Our Portfolio Allocation Summary for March 2025.

Our Portfolio Allocation Summary for January 2025.

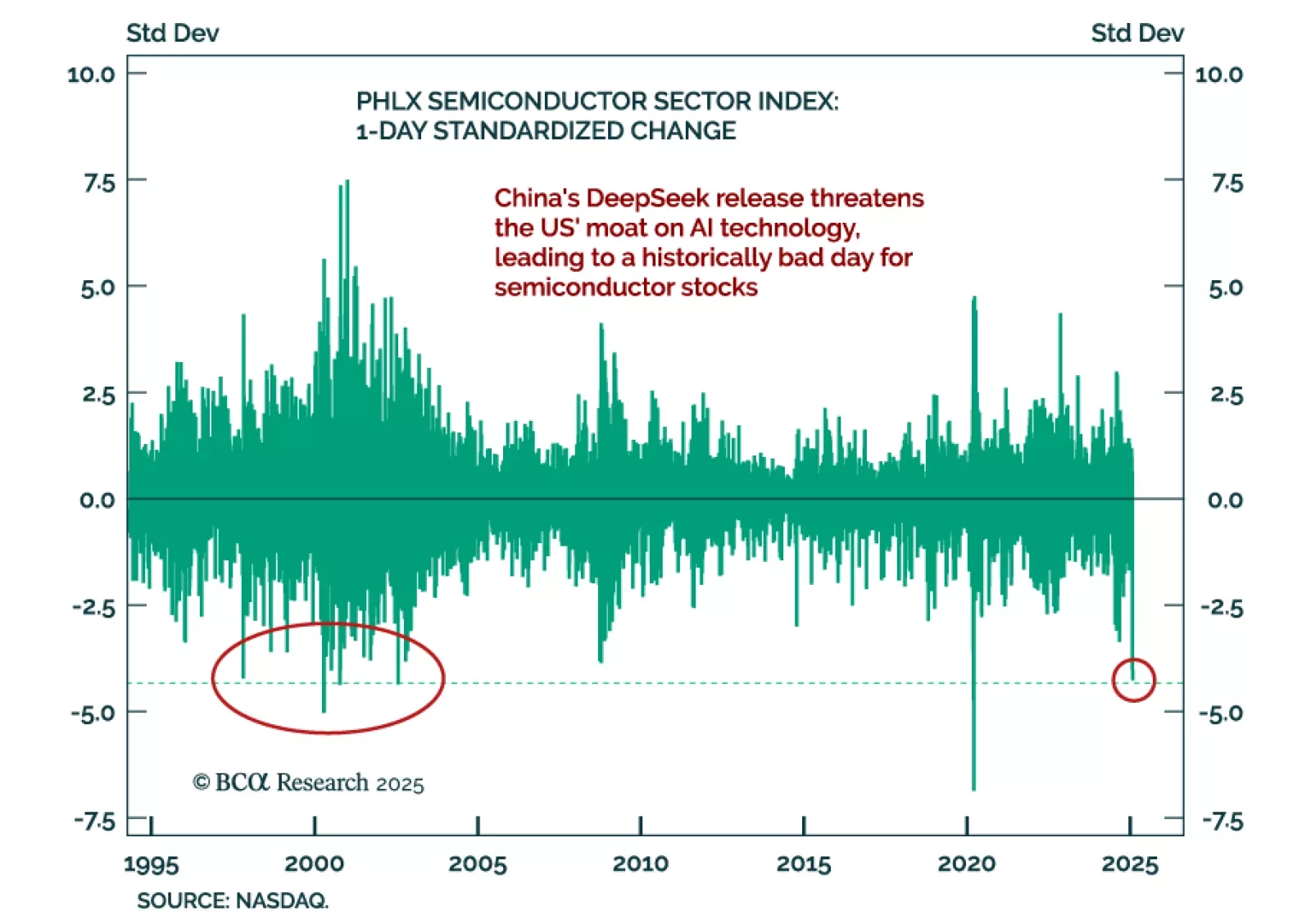

News of a cheaper Chinese-developed AI model sent a tremor through markets, with a selloff in the S&P 500, NASDAQ, and leading tech names associated with AI. The narrative on Monday was that the eye-watering sums spent on AI…