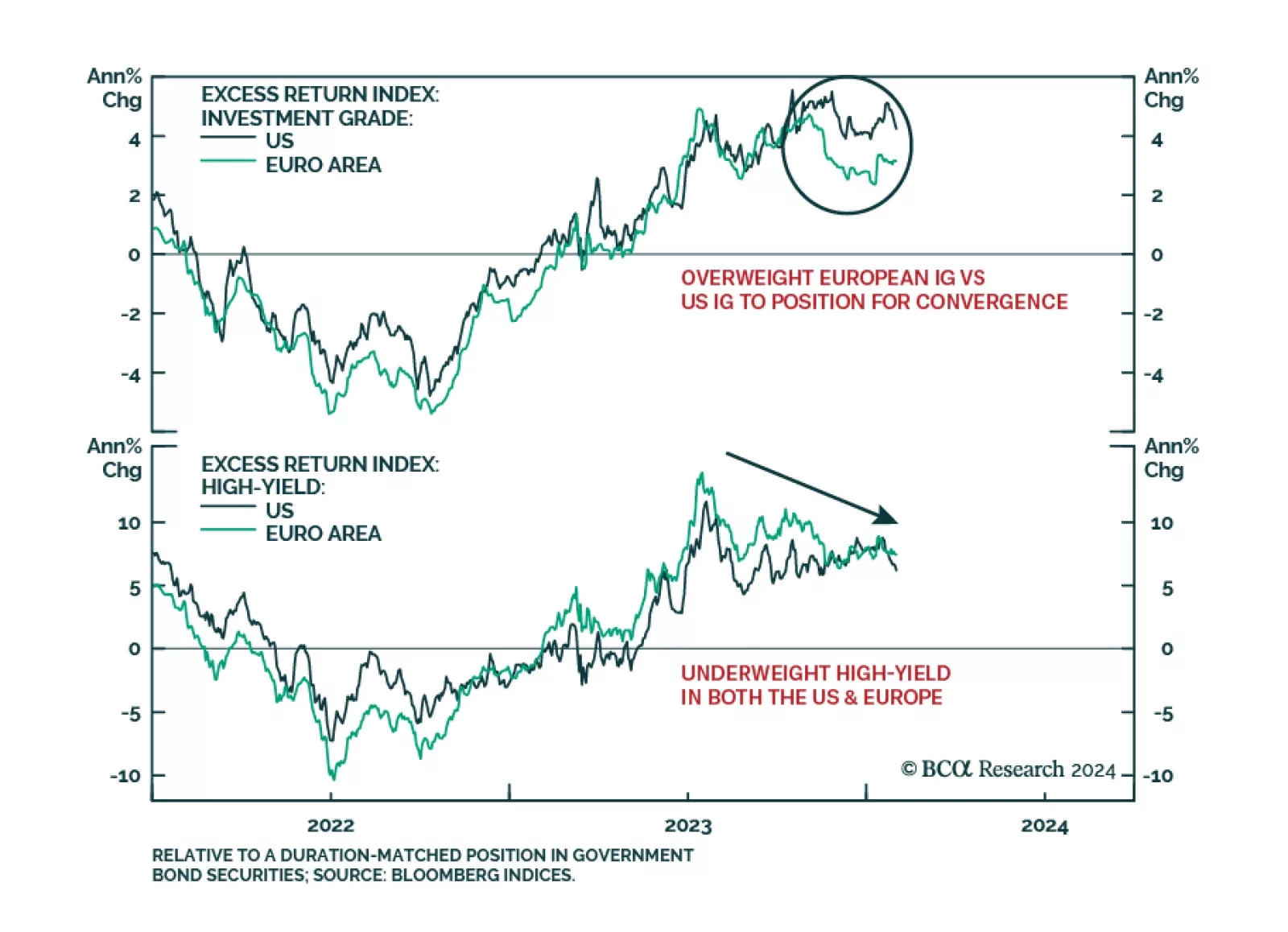

The strong H2/2023 rally in global credit markets can be attributed to lower global inflation and the associated reduction in global interest rate volatility. However, our colleagues at BCA Research’s Global Fixed Income…

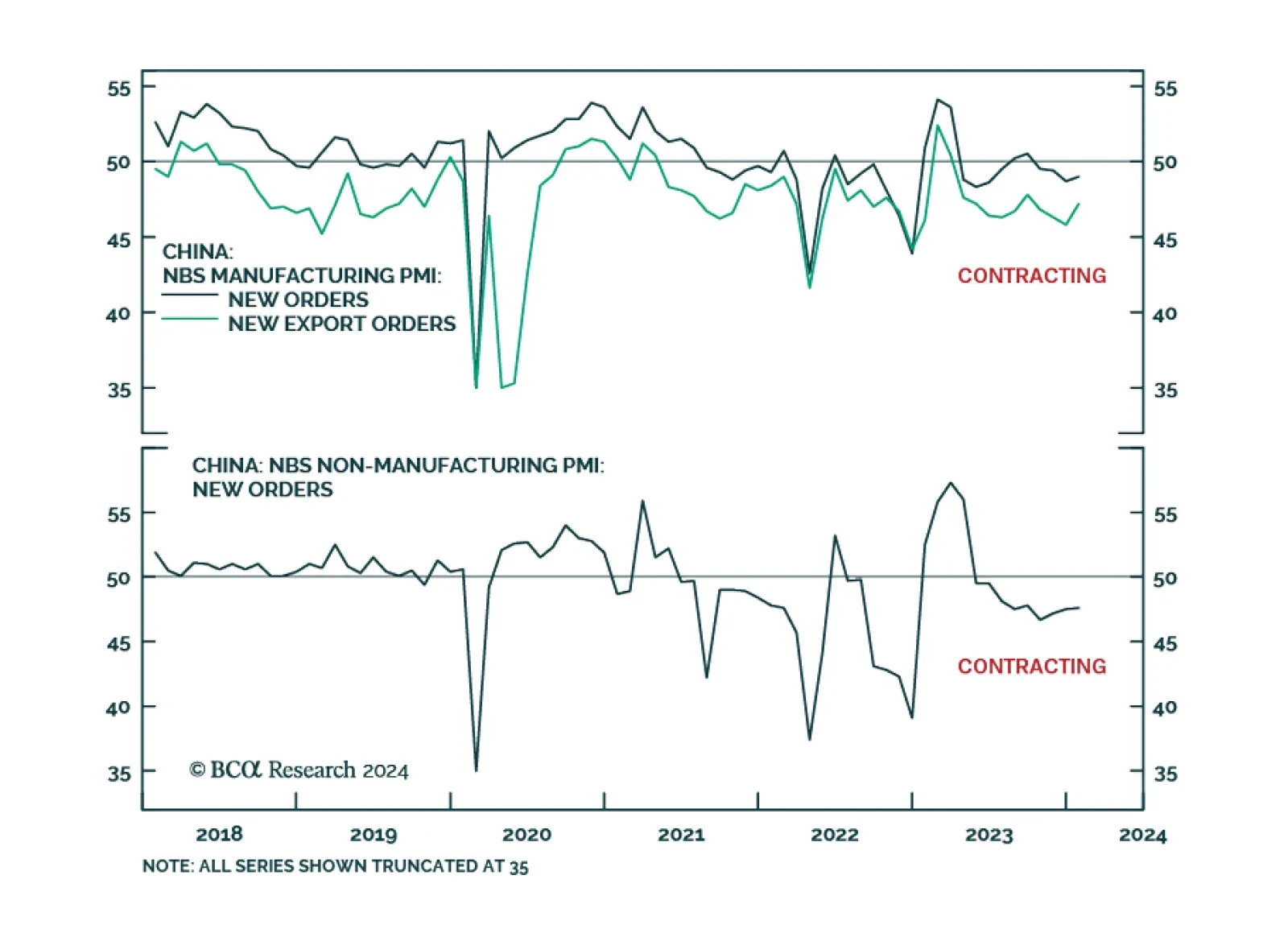

China’s official NBS PMI indicates that growth conditions remain sluggish. Although the composite index ticked up from 50.3 to 50.9, it is still barely in expansionary territory. Notably, the manufacturing PMI – which…

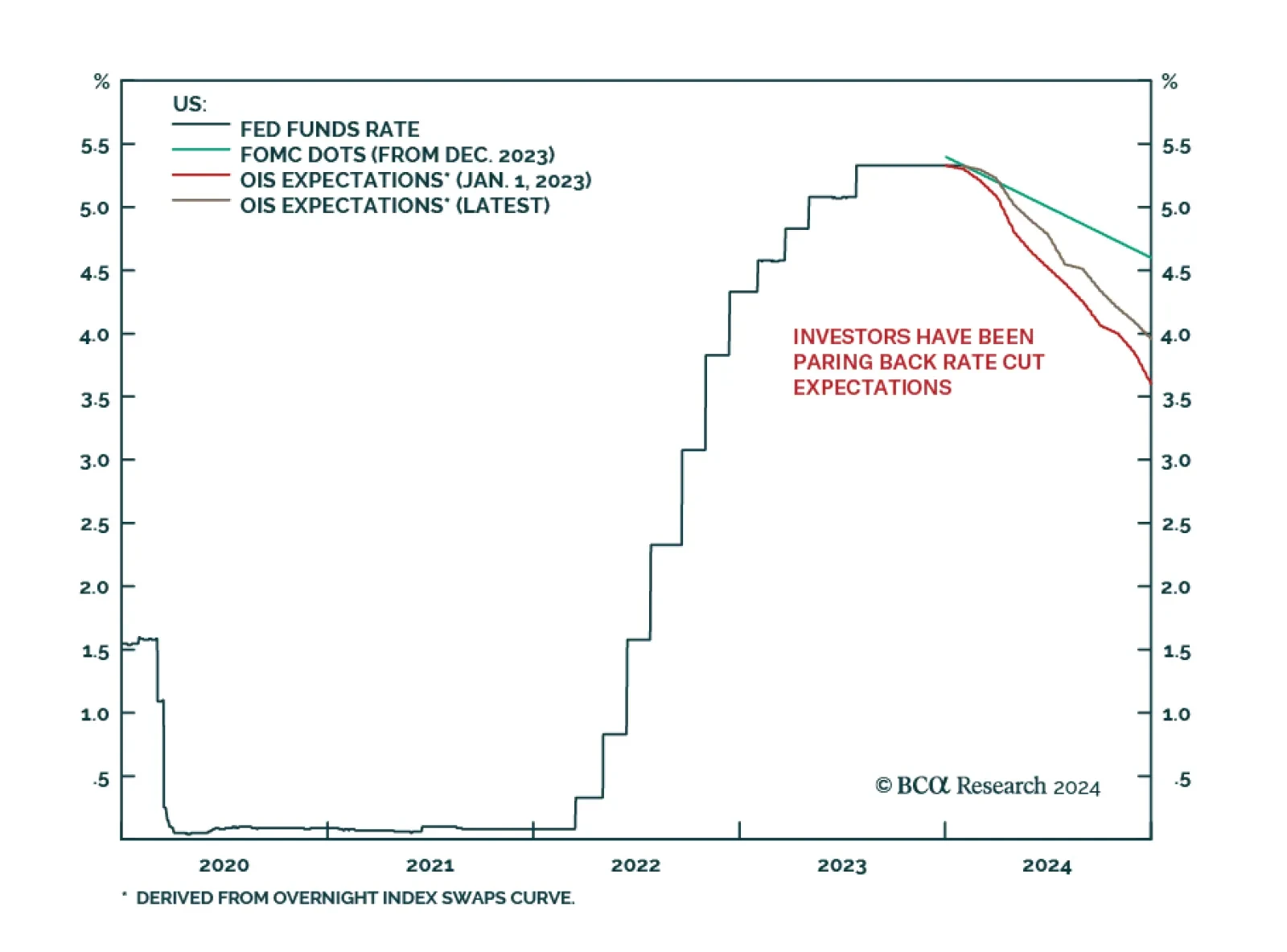

As expected, the Fed decided to keep policy unchanged at the conclusion of the FOMC meeting on Wednesday. The changes to the Fed Statement generally indicate that the central bank is preparing to move towards easing monetary…

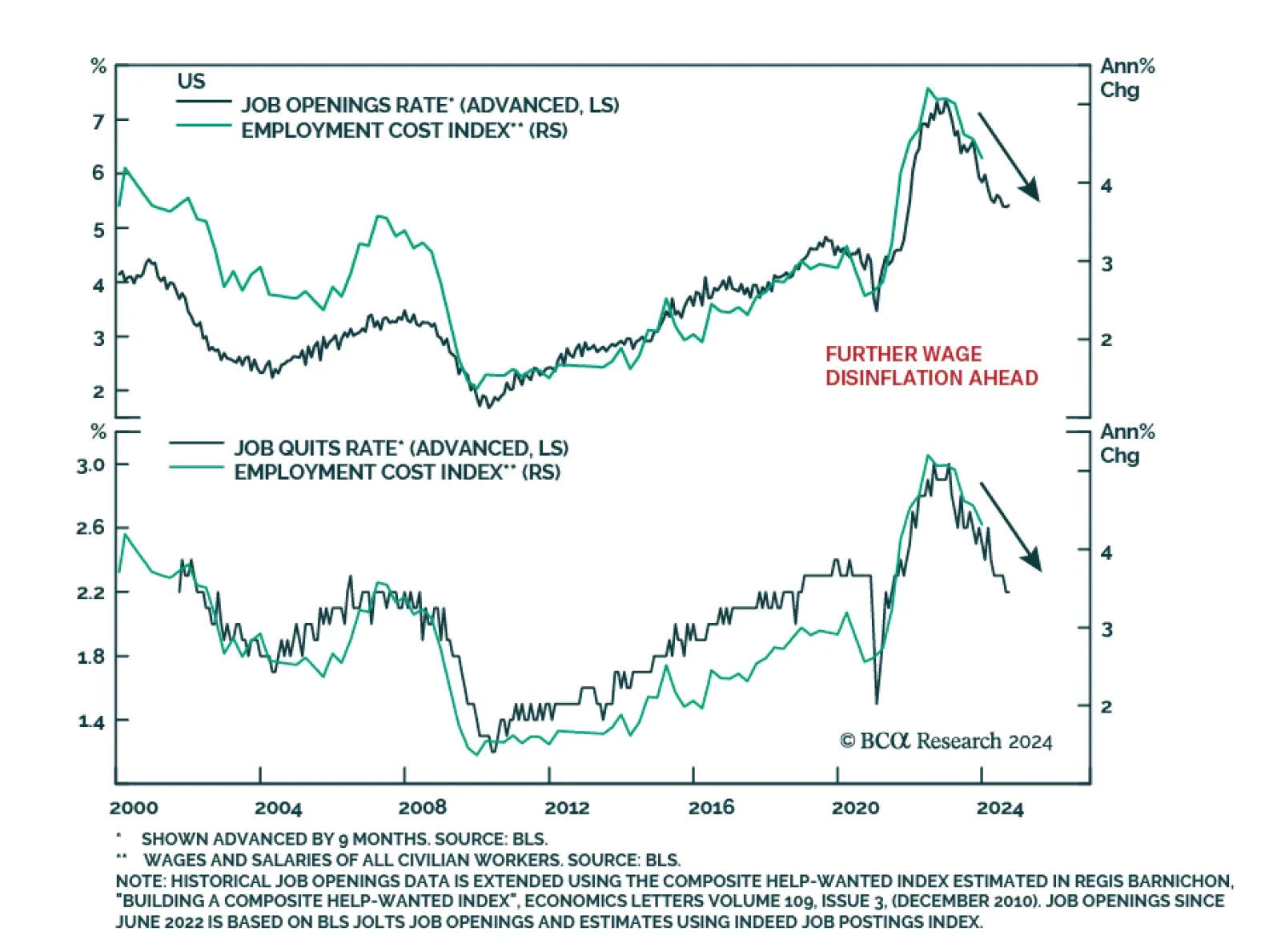

The US Employment Cost Index for Q4 delivered a positive signal that the disinflation process is intact. The ECI’s slowdown from 1.1% q/q to 0.9% q/q came in softer than anticipations of 1.0% q/q. This marks the slowest…

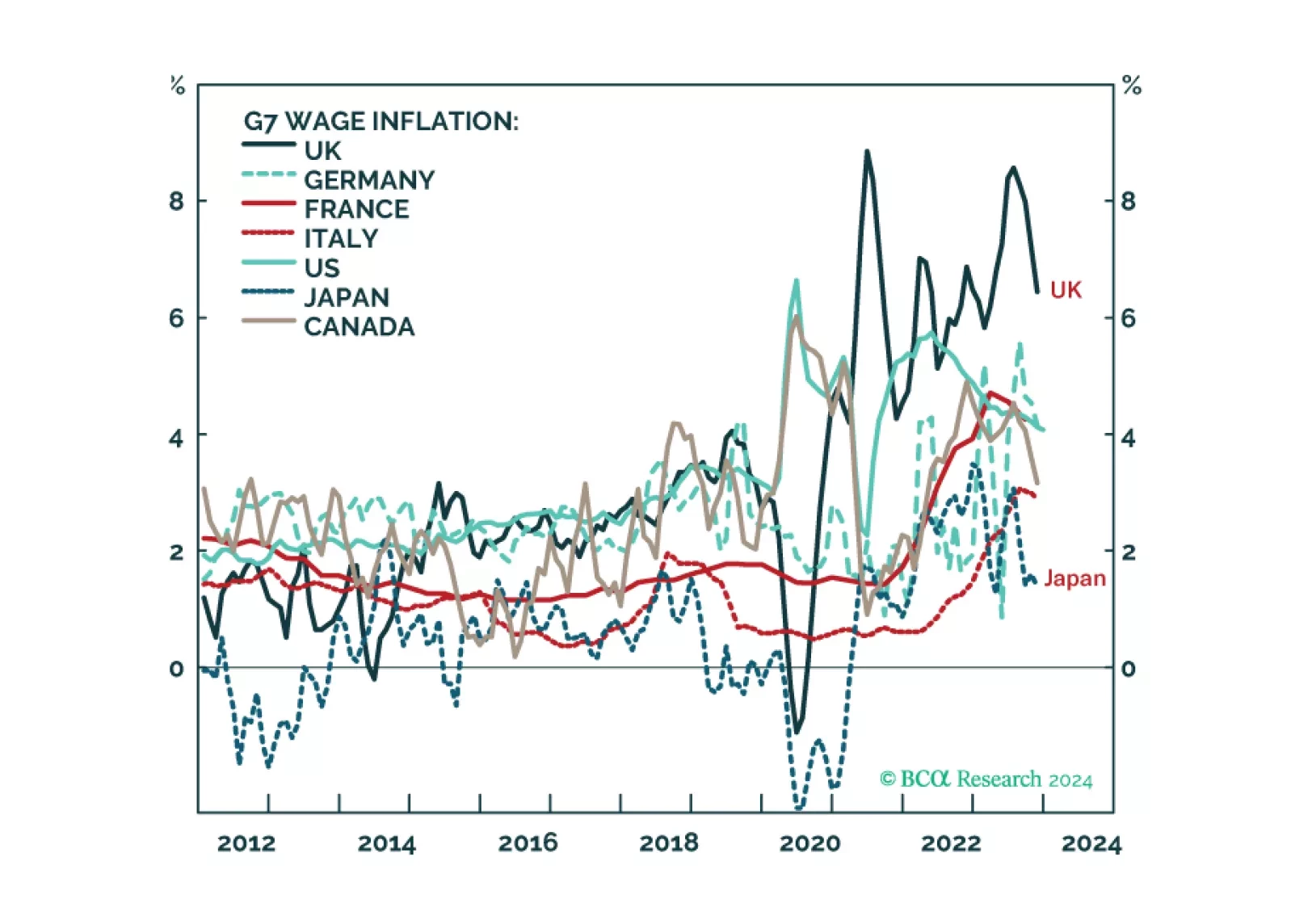

We describe and explain the wide disparity of wage inflation across G7 economies, and discuss what it means for the Fed, ECB, BoE, and BoJ policy moves in the coming year. Plus: we highlight two investments ripe for reversal, and two…

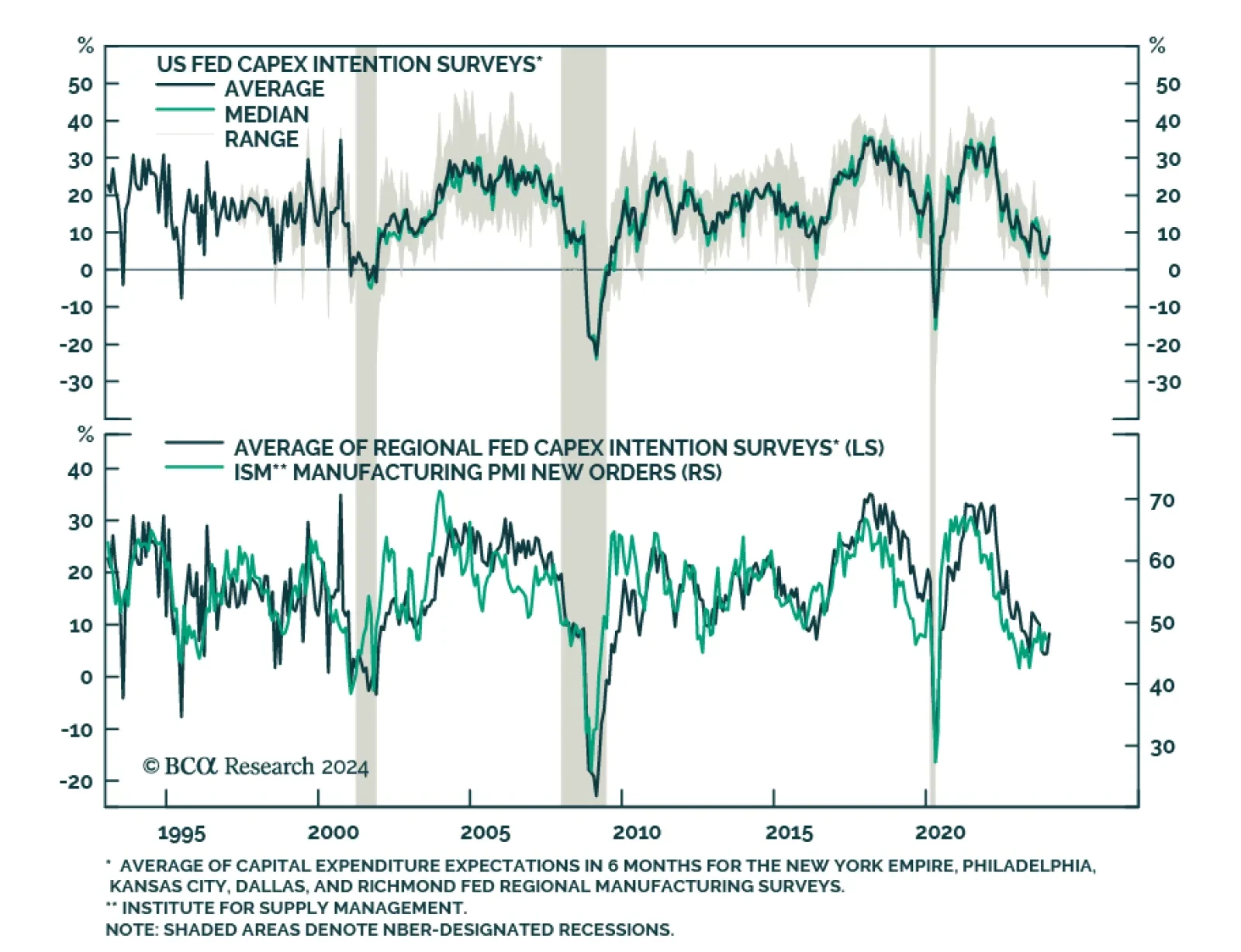

Results of regional Fed surveys suggest that the US manufacturing sector is starting the year on a weak footing. Monday’s report from the Dallas Fed– the last to release its results for January – showed the…

Since the low of 27 October last year, MSCI US has rallied by 19.1% and this rally has been firmly driven by cyclical sectors. Performance-wise Information Technology (IT), Communication Services and Financials and Real Estate…

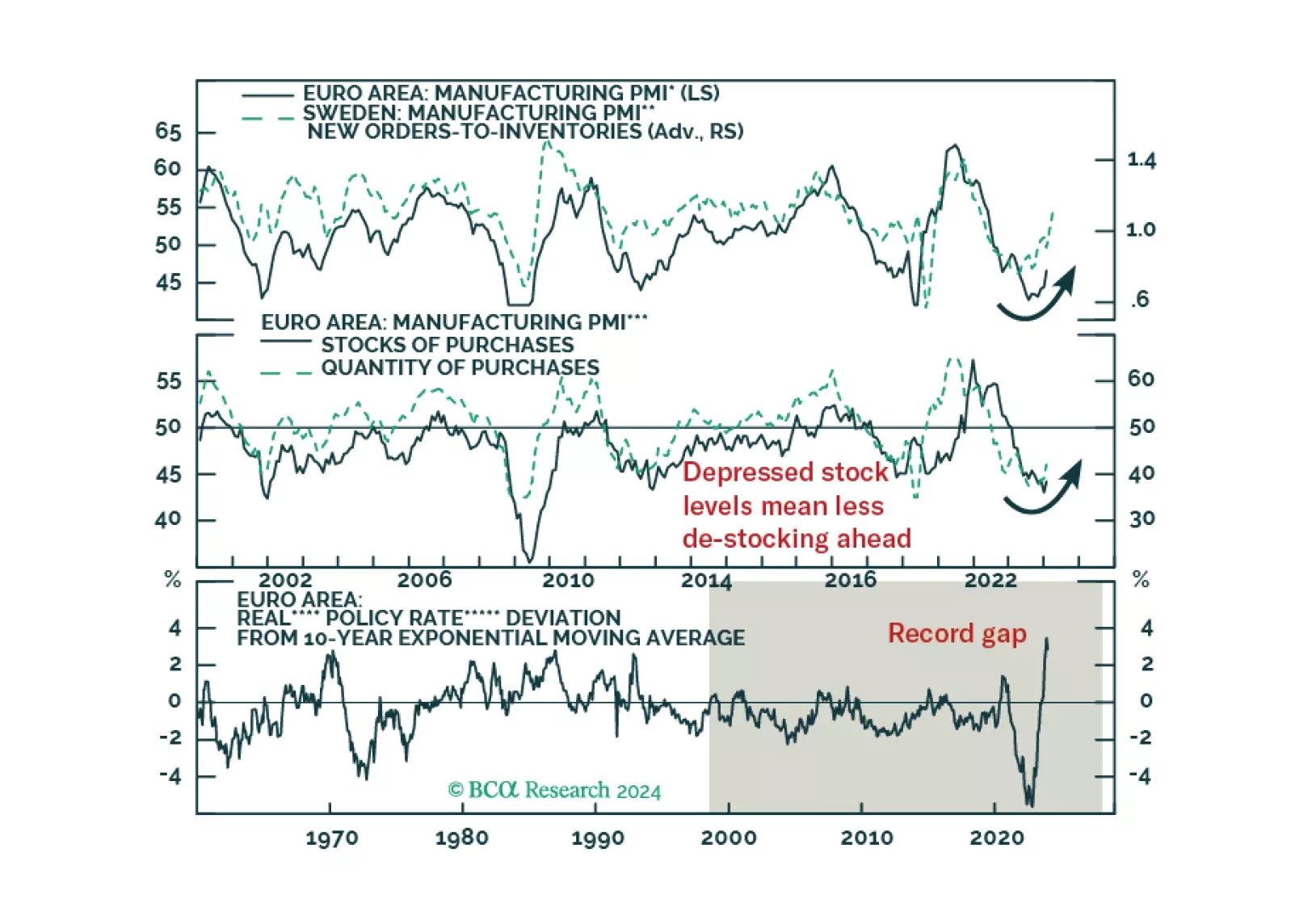

Is the rebound in European PMIs enough to boost the appeal of European risk assets?

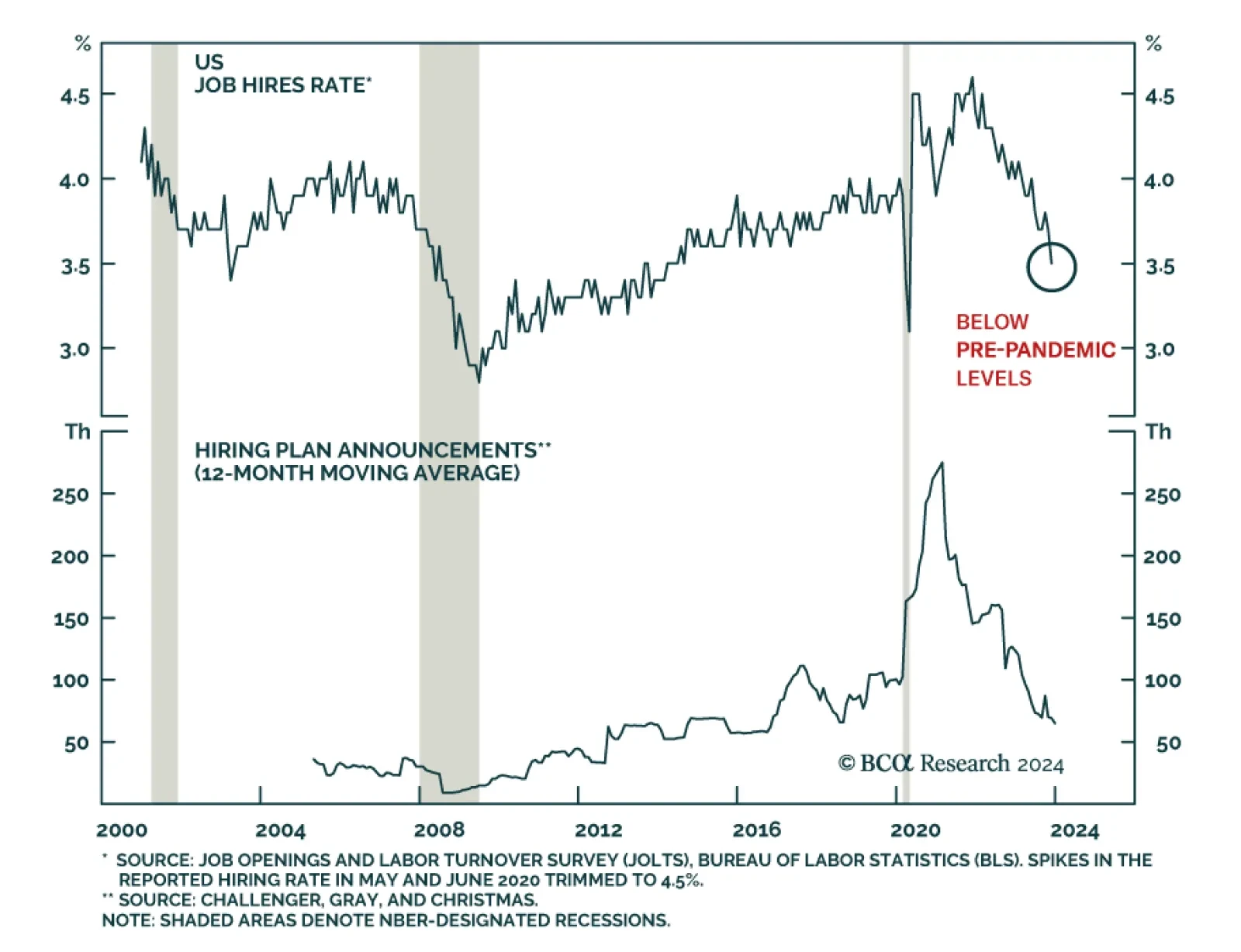

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

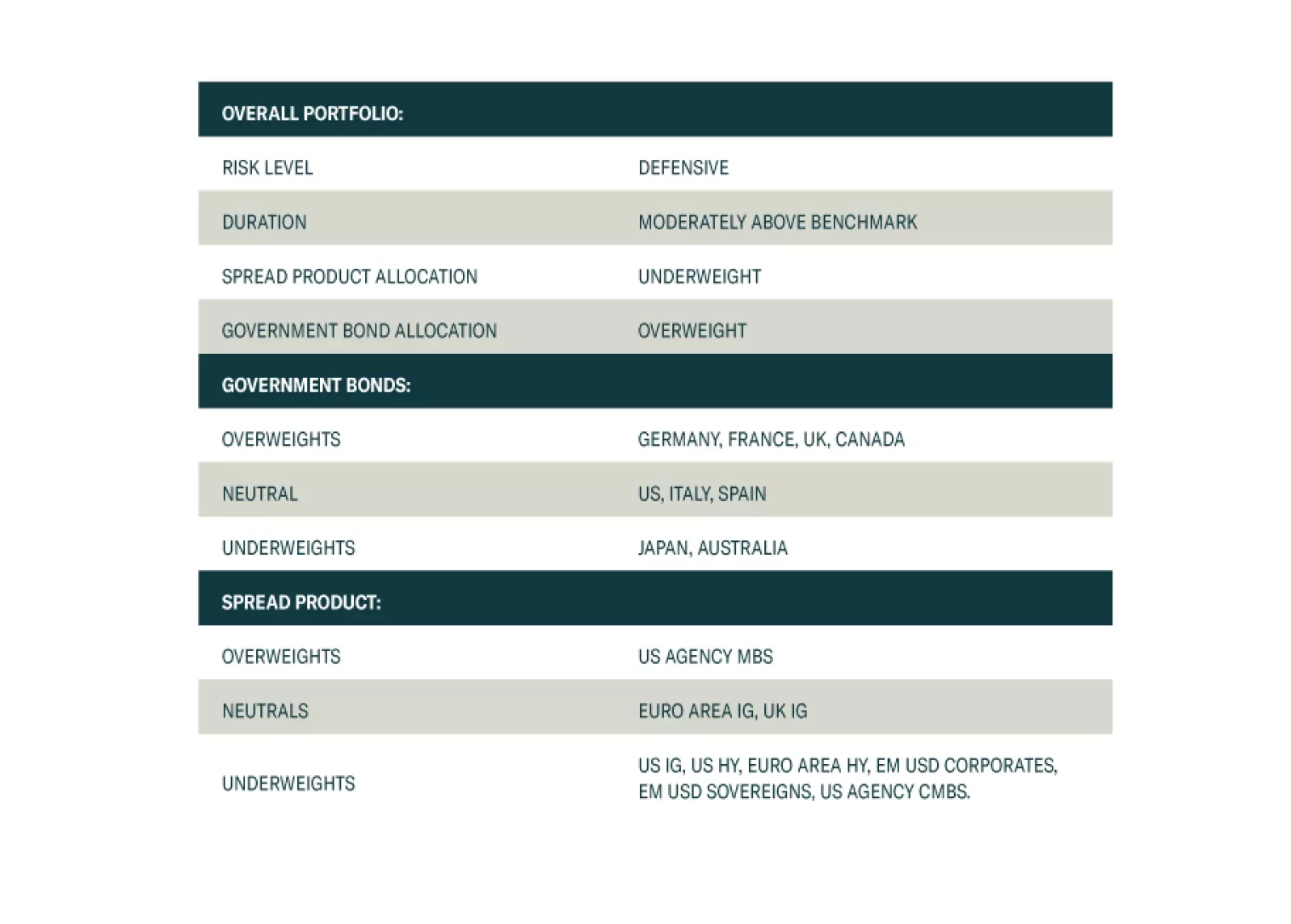

We present the performance review of the Global Fixed Income Strategy Model Bond Portfolio for 2023. We also discuss the outlook for 2024 performance based on our Key Views for the year. The portfolio is positioned to benefit from a…