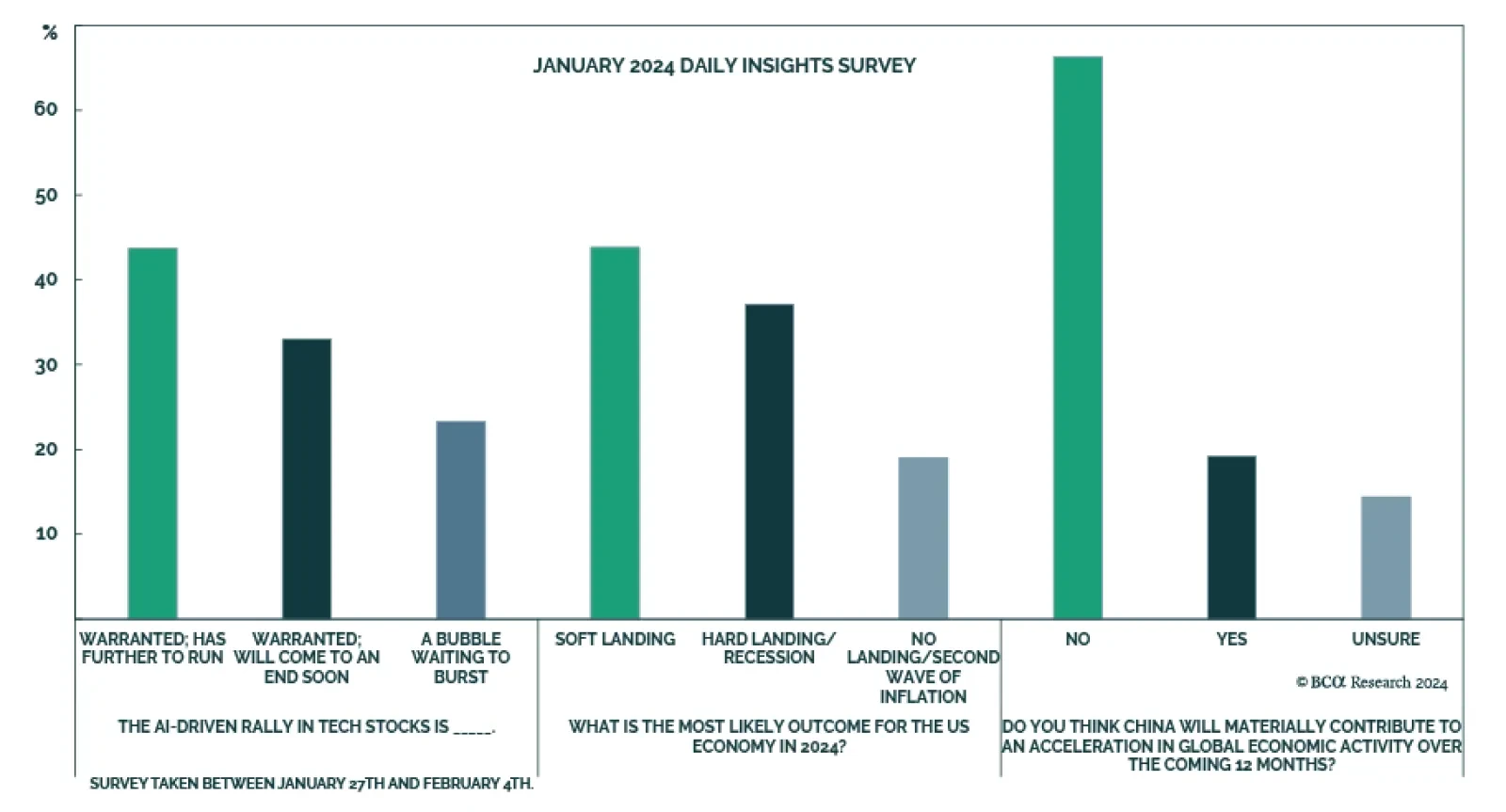

In the monthly Daily Insights Survey we conducted over the past week, we asked about our readers’ views on tech stocks, the US economy in 2024, and China’s contribution to global growth. Regarding tech stocks, 44%…

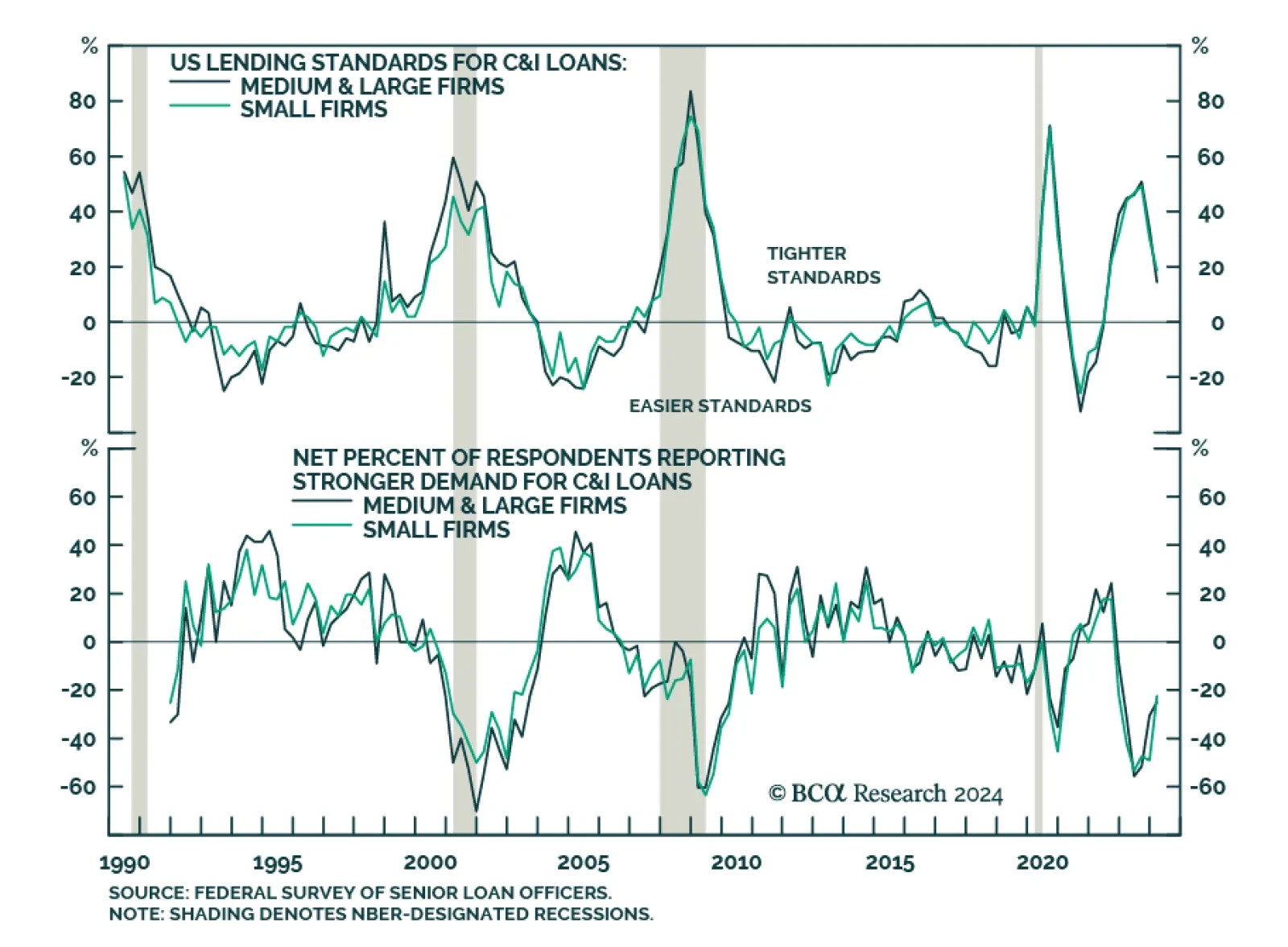

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) continues to show the impact of the Fed’s tightening cycle. Banks were still tightening lending standards for commercial and industrial (C&I),…

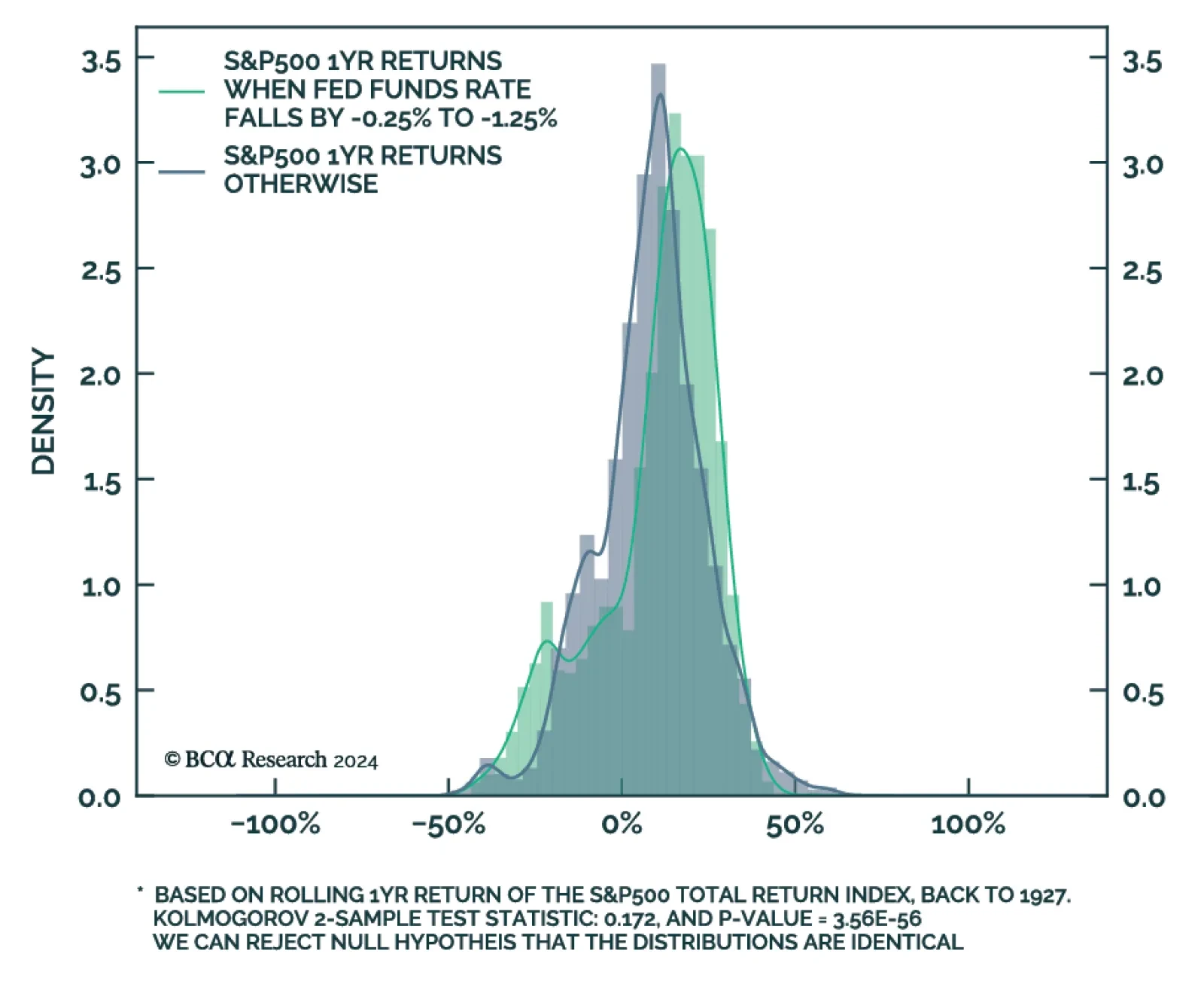

In this Insight our Equity Analyzer team explores how the S&P 500 behaves when the Fed Funds Target Rate drops by 25bps – 150bps within a single year. The current dot plot is signaling 75bps of cuts by the end of the…

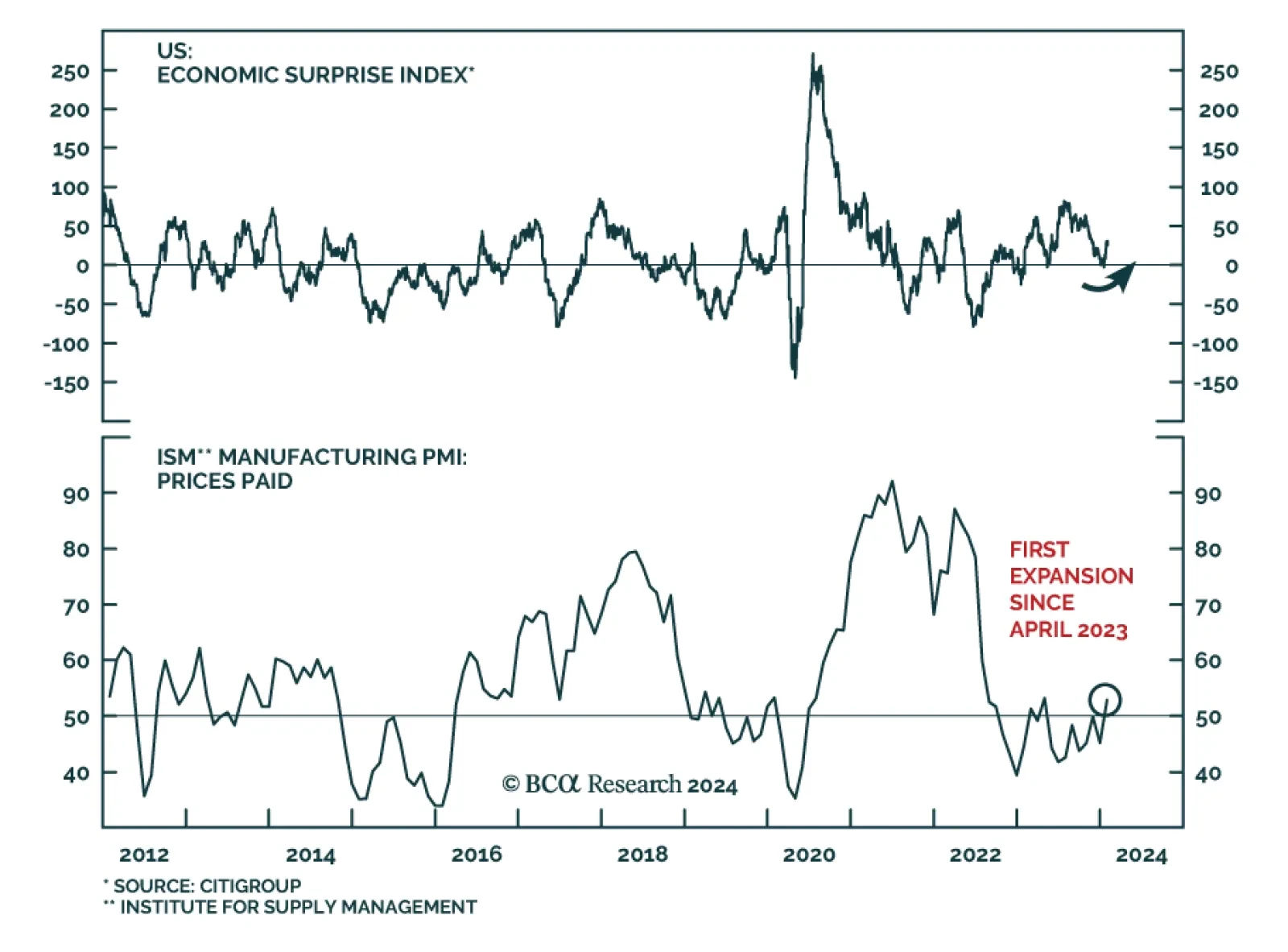

After falling throughout most of the second half of 2023, the US economic surprise index has surged over the past few weeks, indicating that economic conditions are firm at the start of the year. Indeed, Manufacturing PMIs…

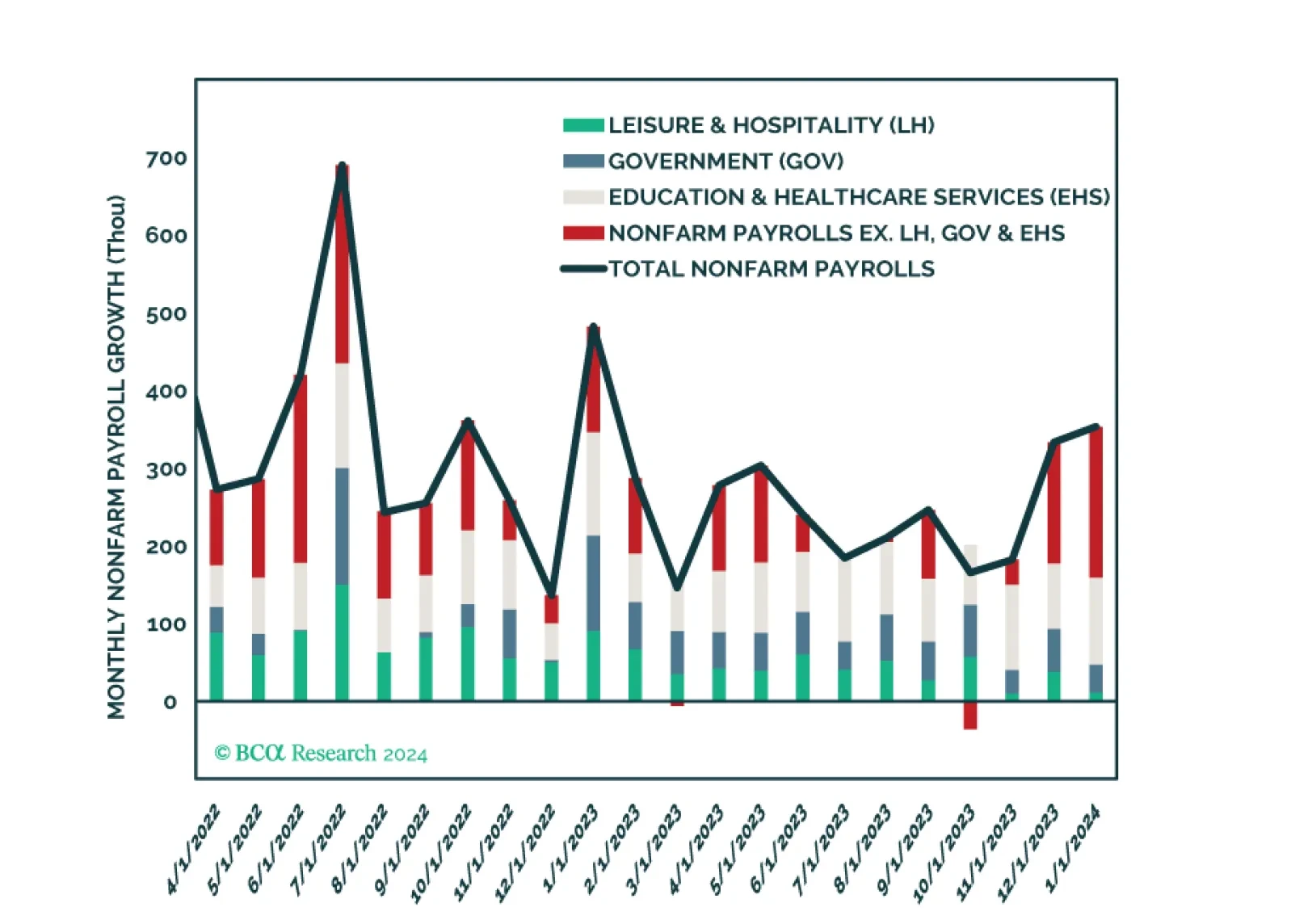

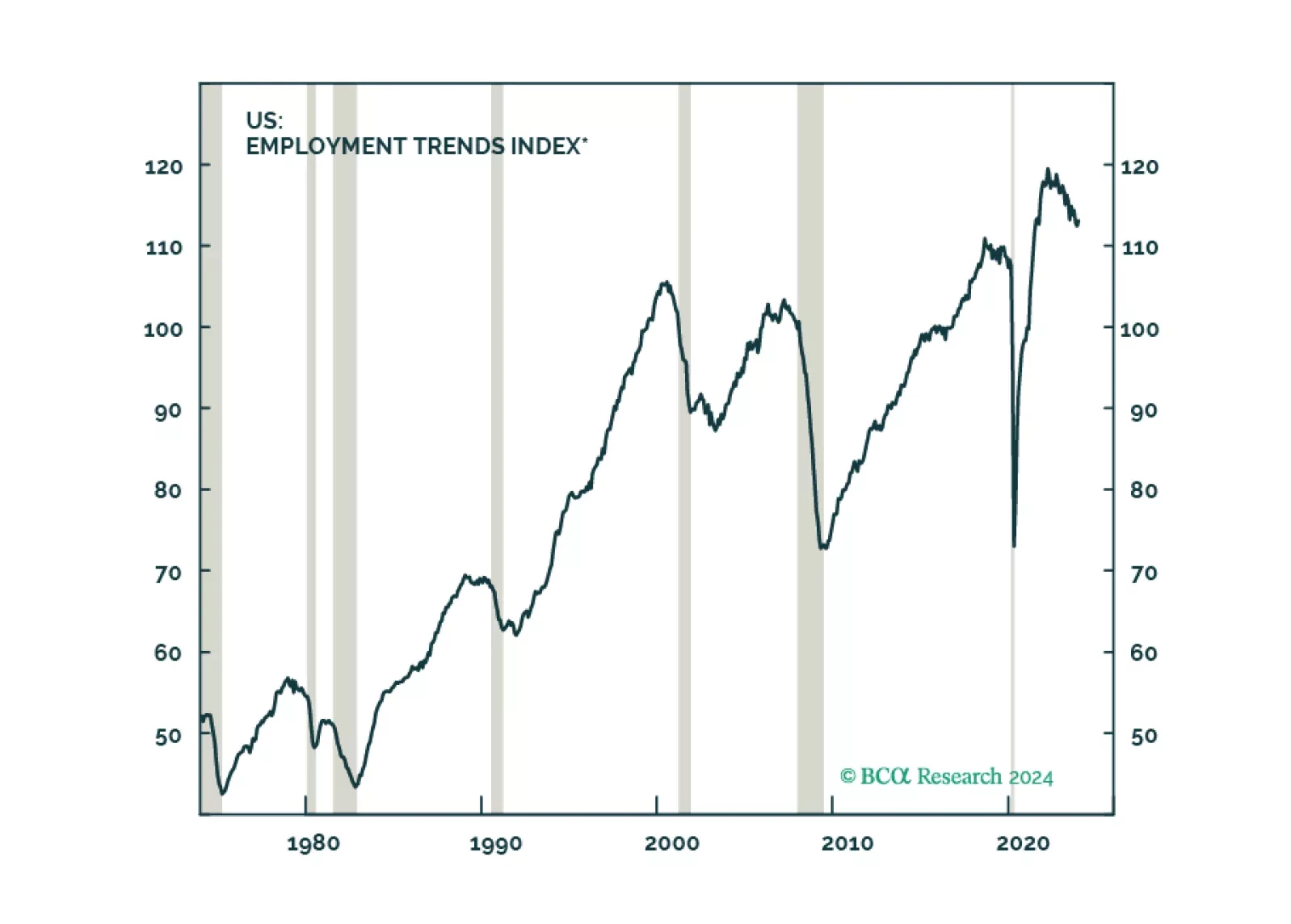

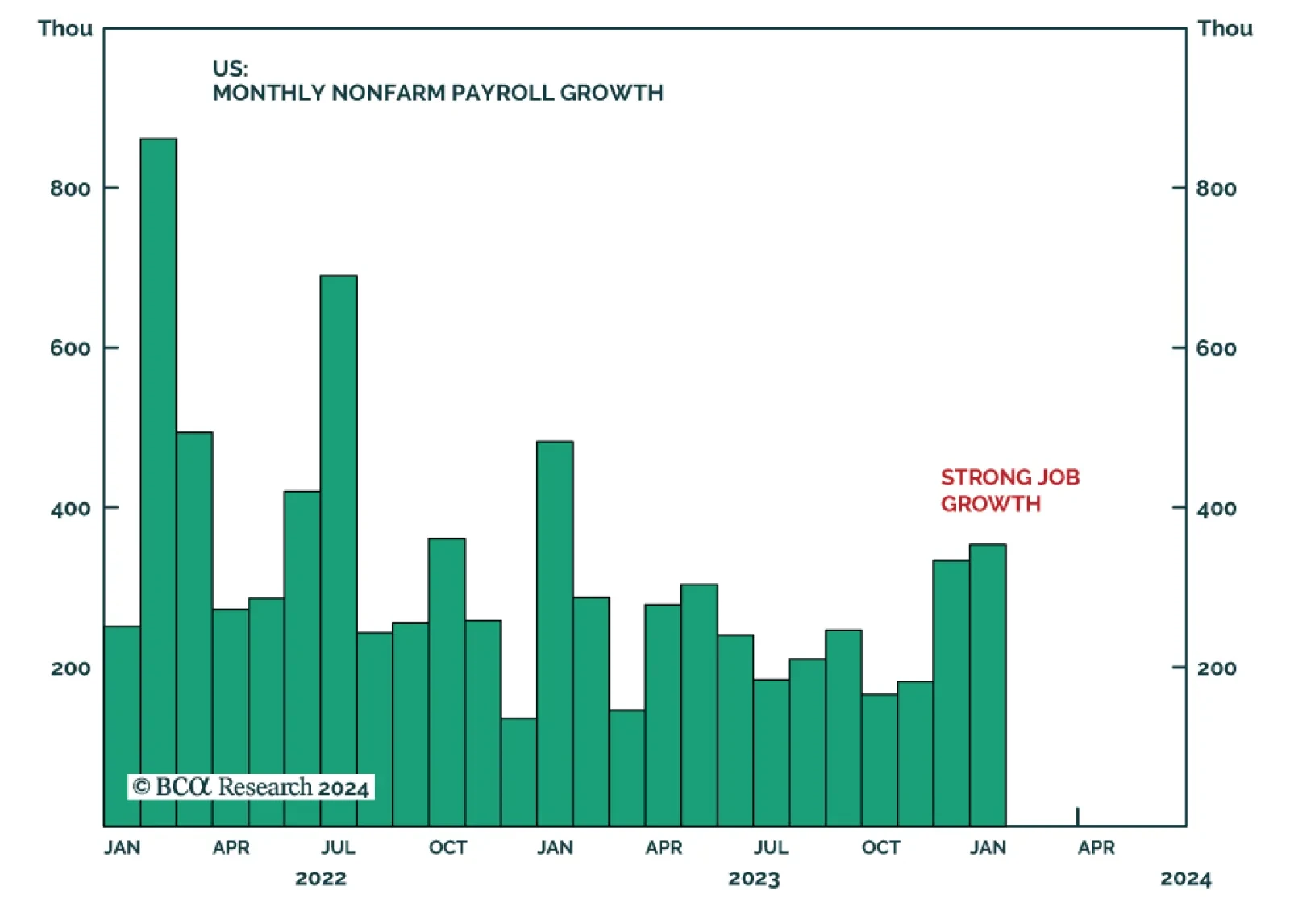

The US Employment report came in well above consensus expectations on Friday, delivering a strong positive signal on labor market conditions in January. The 353 thousand increase in nonfarm payroll employment beat expectations of…

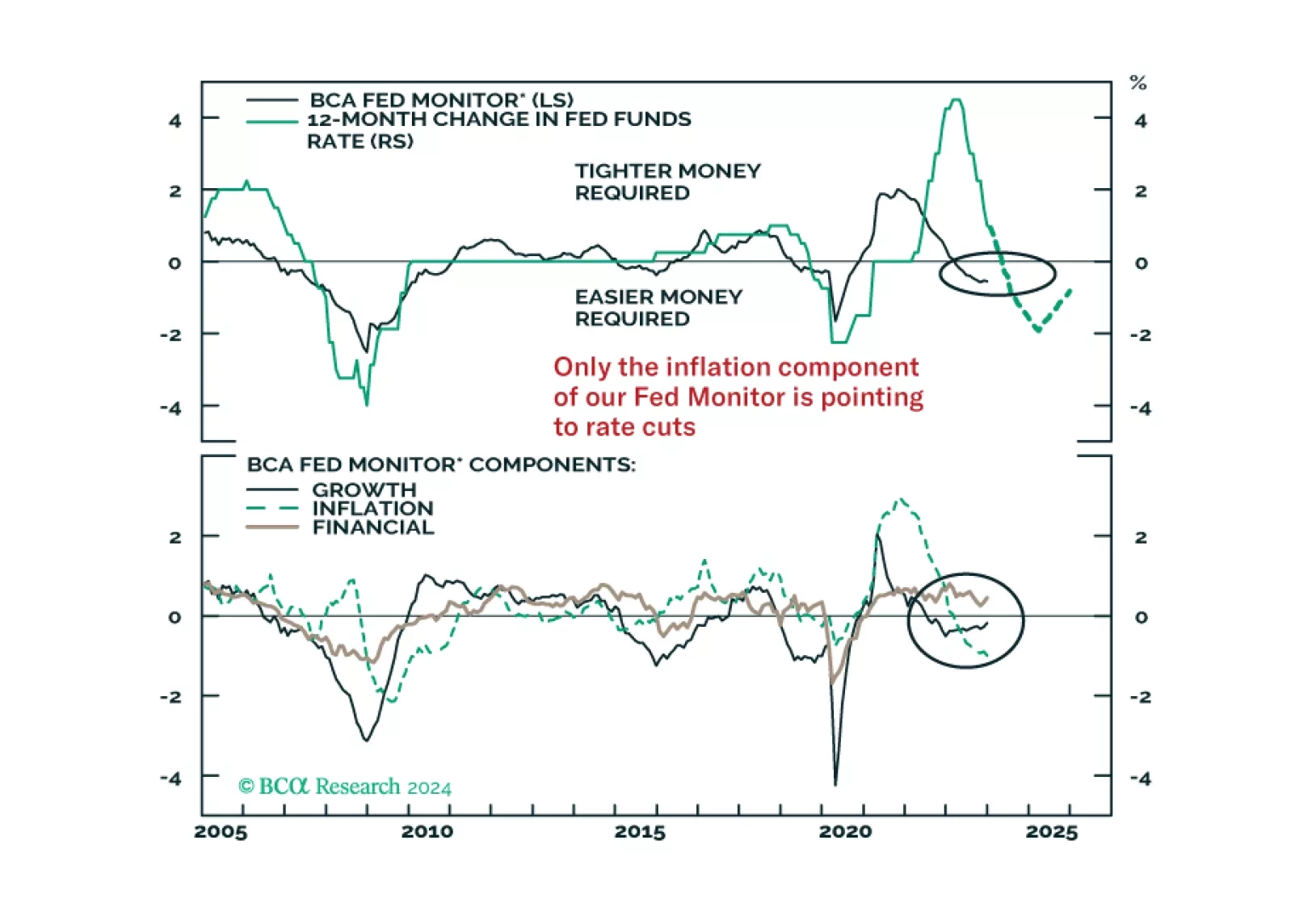

Our thoughts on bond positioning following this morning’s employment data.

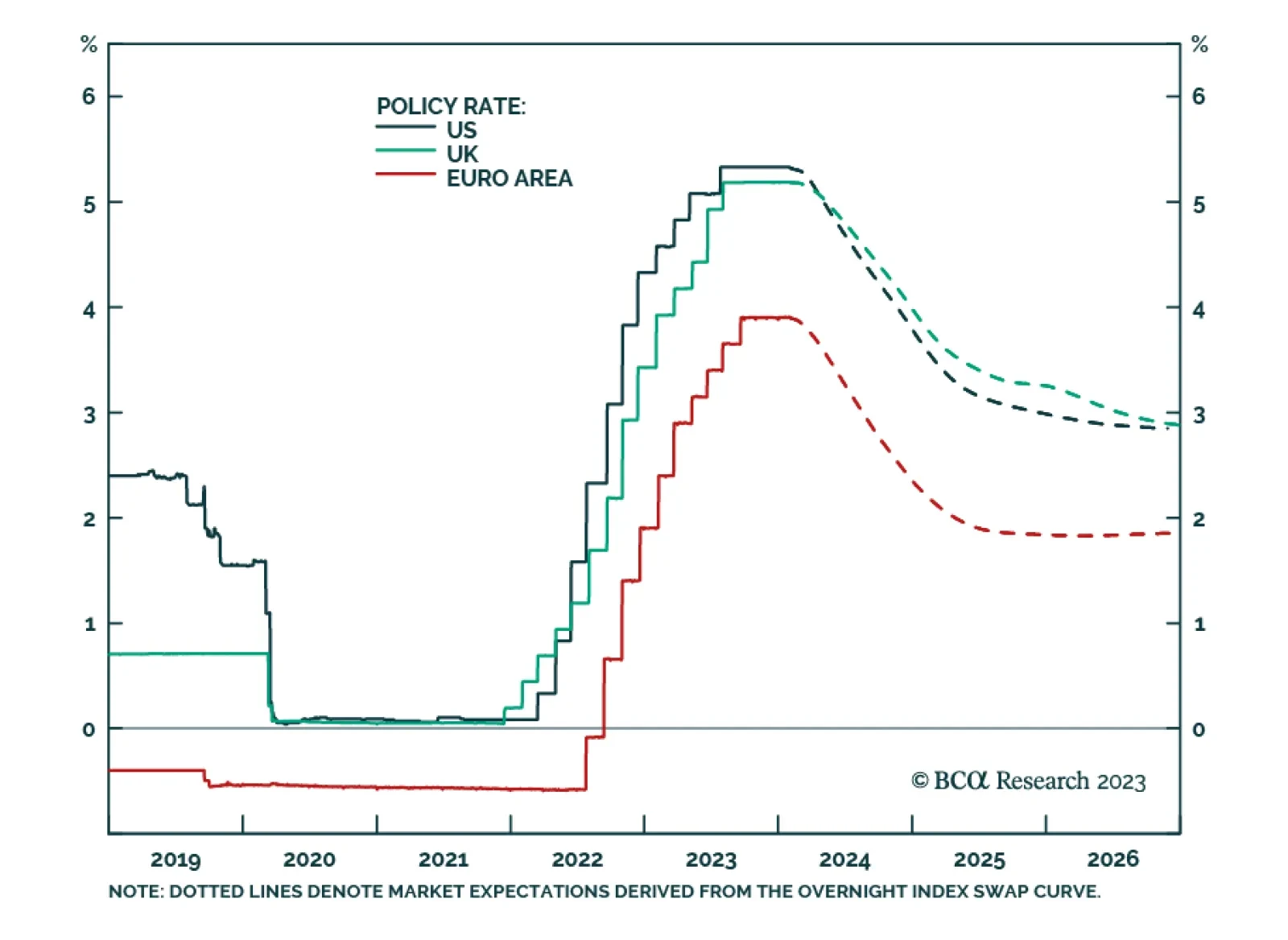

Given the huge disparities in wage inflation between the US, euro area and UK, it is remarkable that the markets are pricing near-identical rate cuts from the Fed, ECB, and BoE of around 150 bps through 2024. Assuming central…

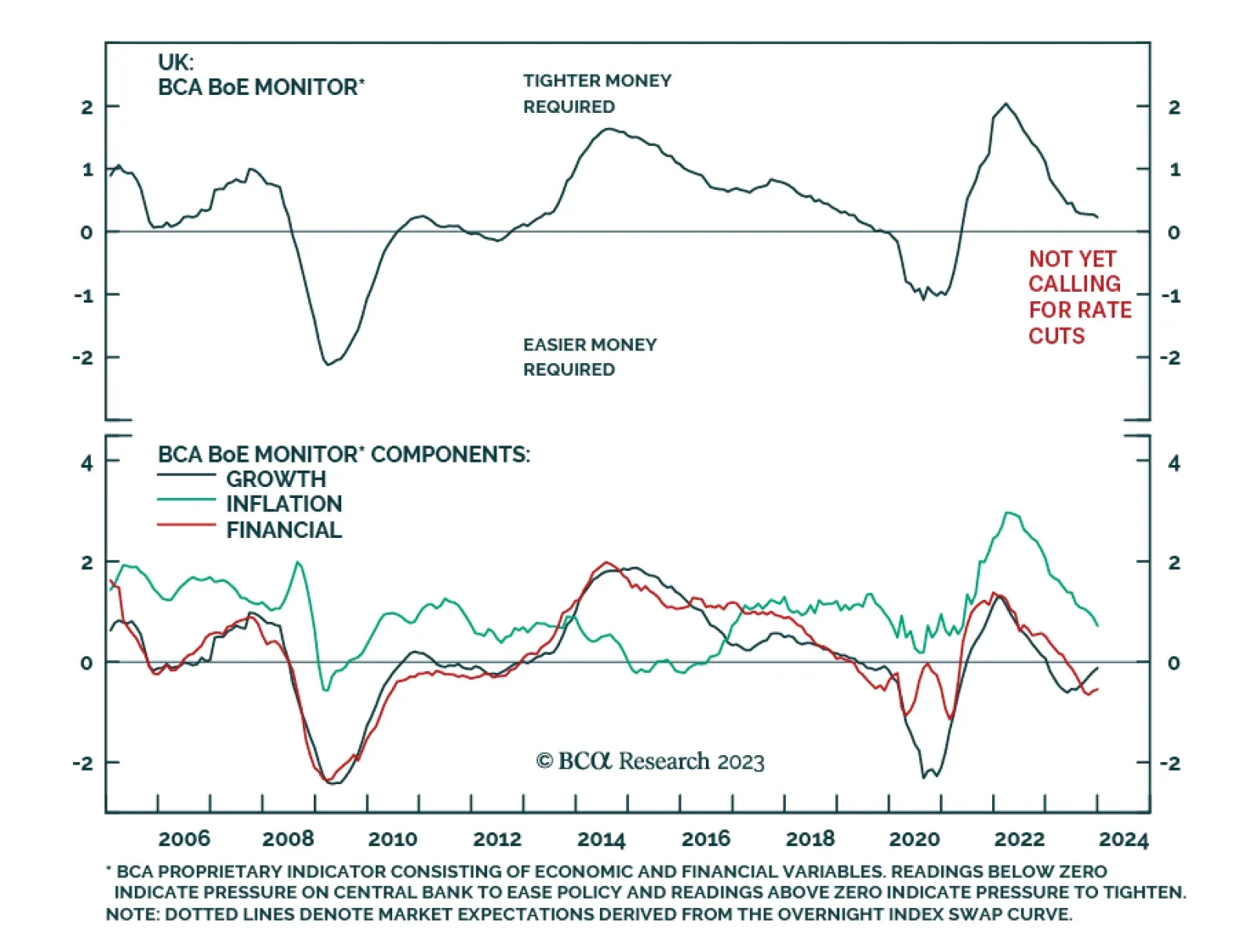

As expected, the Bank of England voted to keep its bank rate unchanged at 5.25% on Thursday – maintaining policy on hold for the fourth consecutive meeting. Two of the nine MPC members voted in favor of a 25bps rise (one…

In this Insight, we share our thoughts on yesterday’s FOMC meeting and the Fed’s likely next moves, with implications for US bond strategy.

When will the US also buckle under high rates? We expect a US recession to begin around mid-year. Stay defensive.