According to BCA Research’s Emerging Markets Strategy service, the diminishing pace of disinflation in the US could pose a threat to US share prices in the near term. In the medium term, the key risk to US share prices is…

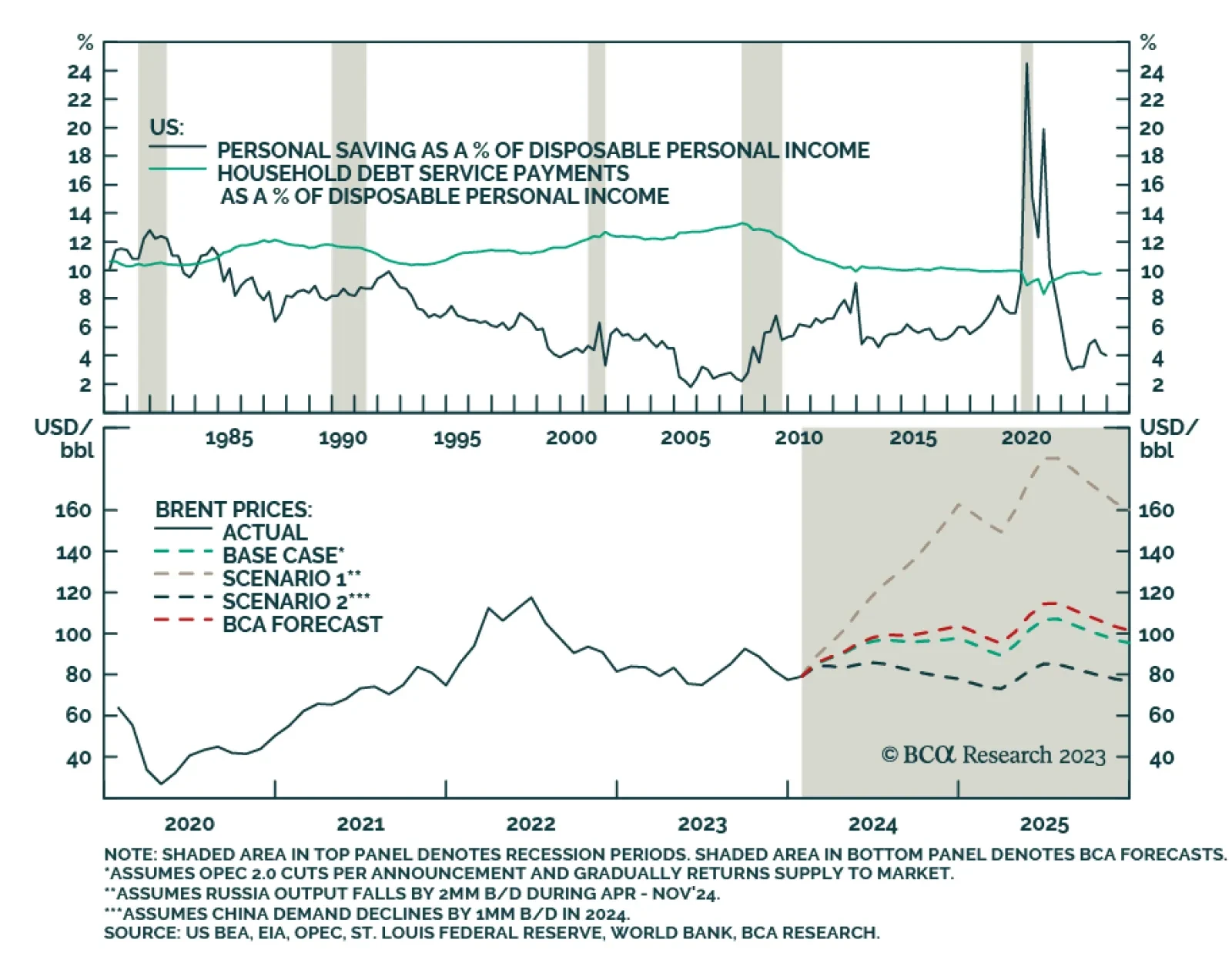

Our Commodity & Energy colleagues see oil markets balanced in the short run, which keeps their Brent price forecasts at $95/bbl and $105/bbl for 2024 and 2025. That said, they note the odds are increasing demand…

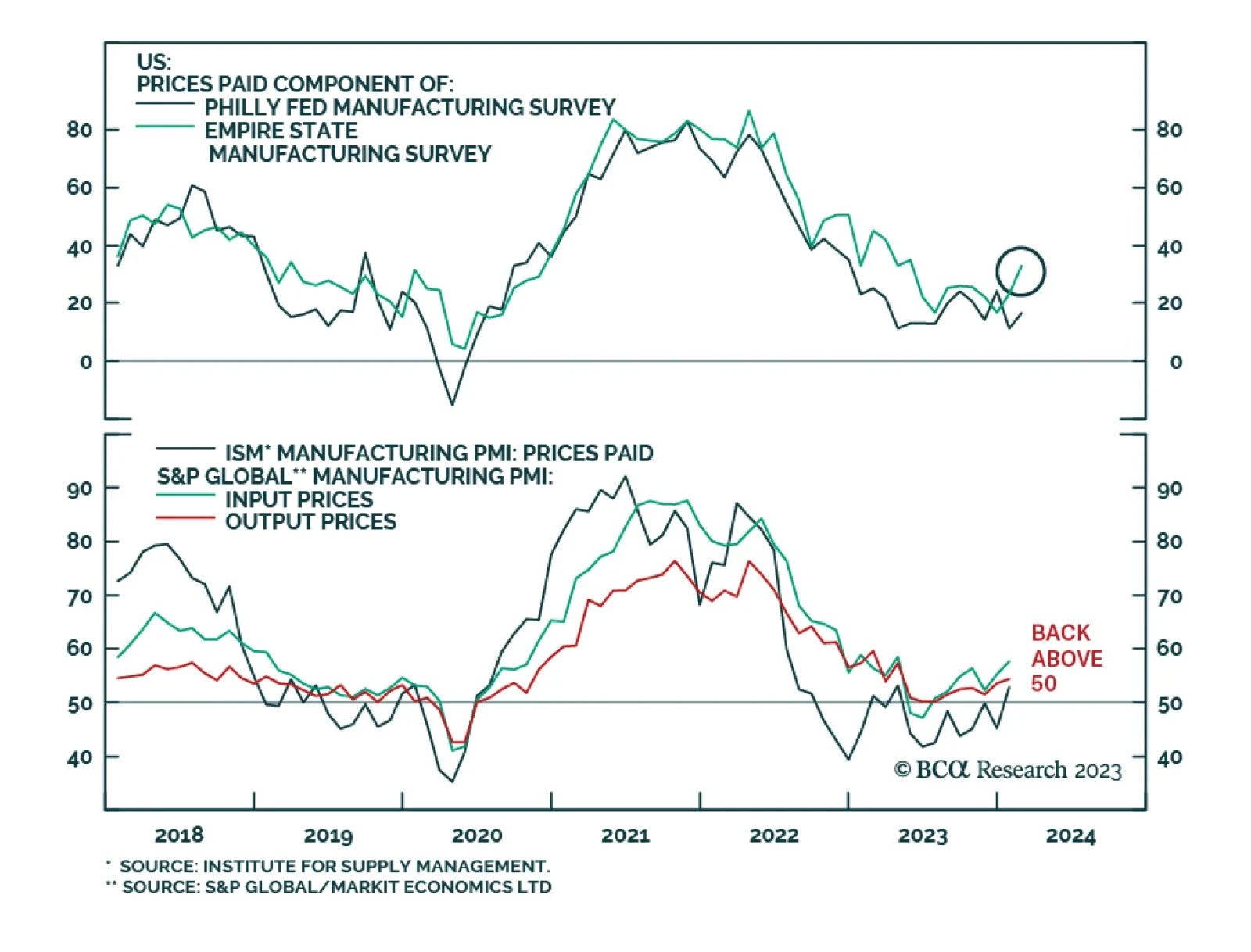

The first two regional fed manufacturing surveys for February delivered strong upside surprises. The New York Fed’s Empire Index surged from -43.7 to -2.4, unwinding its January slump. Similarly, the Philly Fed current…

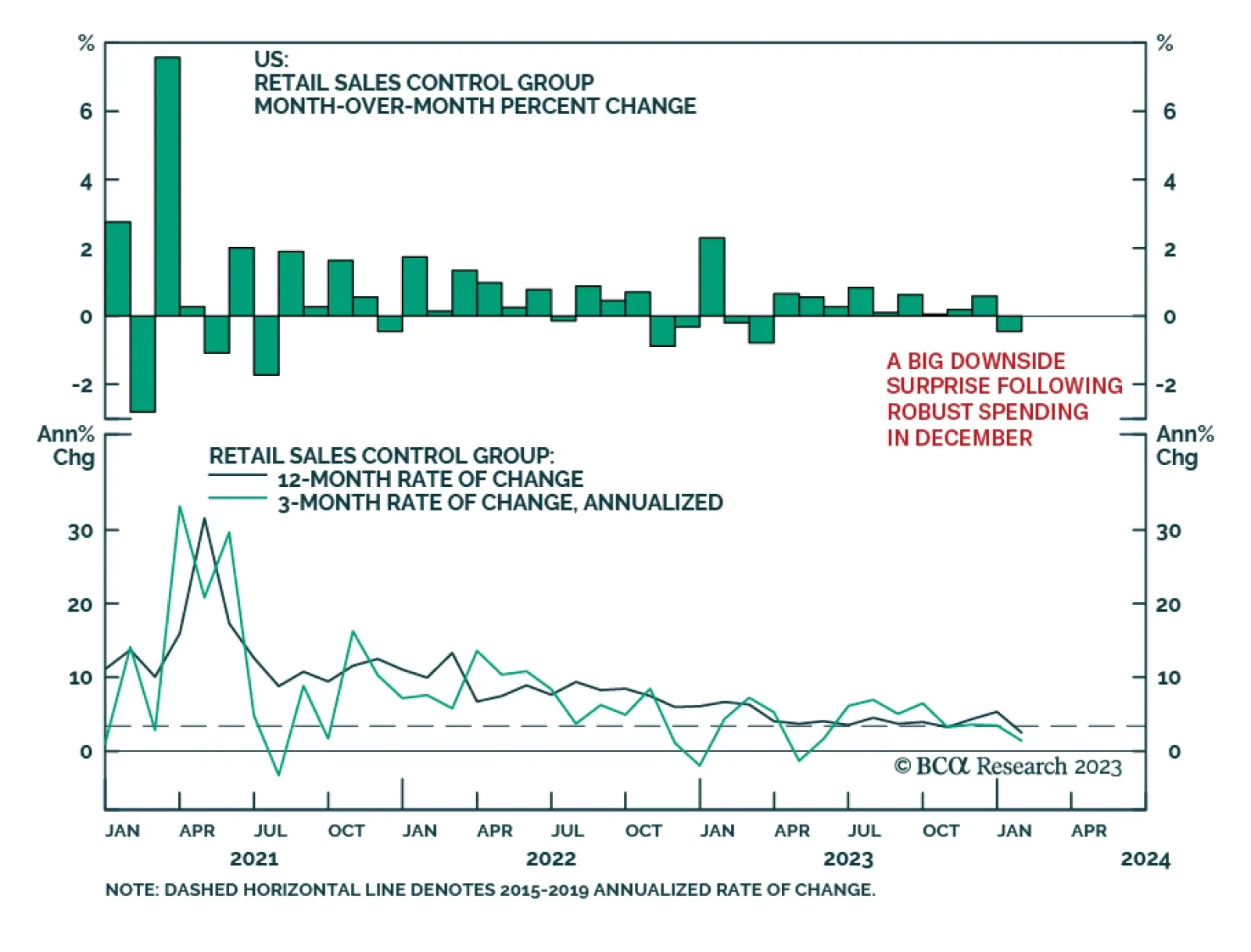

The US retail sales report for January delivered a disappointing message about consumer spending. The 0.8% m/m drop in overall retail sales was worse than expectations of a 0.2% m/m decline and marked the most severe monthly…

Prices of agricultural commodities have come under intensified downward pressure this year. Corn, soybean, and wheat prices have fallen by 8.6%, 8.3%, and 4.9% respectively so far this year. Multiple factors are behind the…

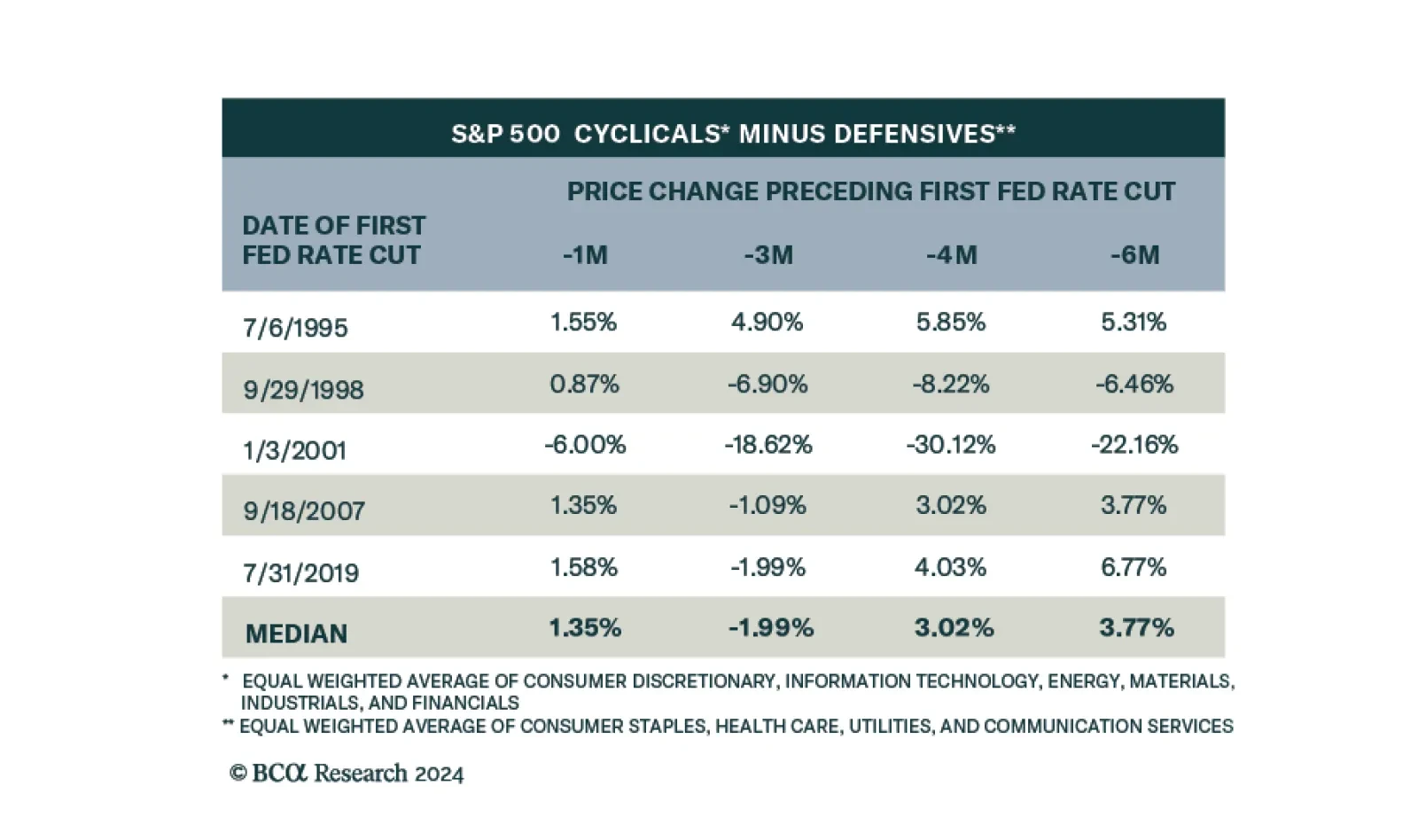

In a recent Insight we looked at the performance of equities following the start of monetary easing cycles. Specifically, we looked at the historical performance of US cyclical sectors versus defensive sectors at various points…

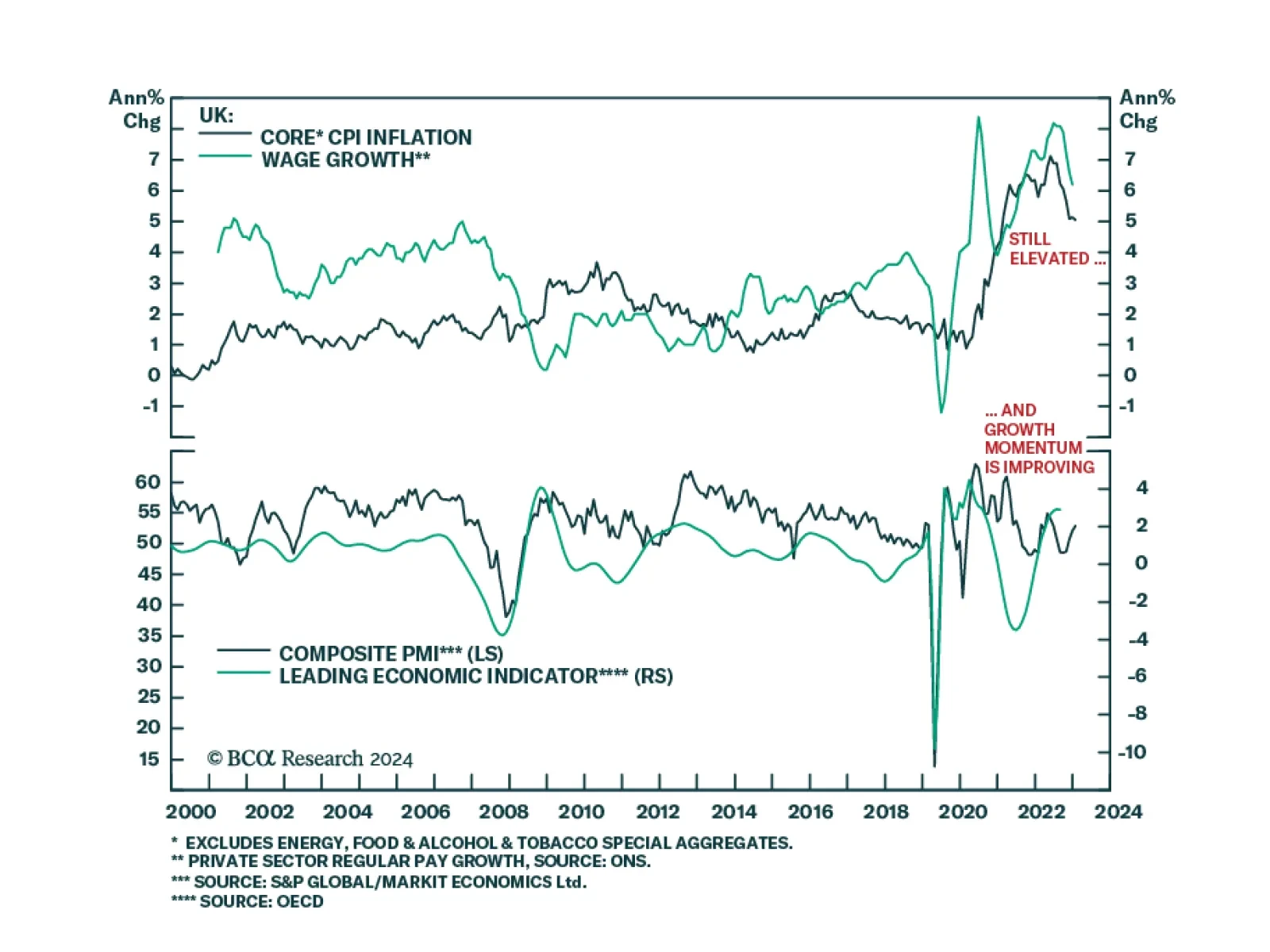

The UK inflation release for January came in slightly softer than anticipated. Both headline and core CPI were unchanged on year-over-year basis at 4.0% and 5.1%, respectively – below expectations of slight accelerations.…

Comments on yesterday’s CPI report and yield moves.

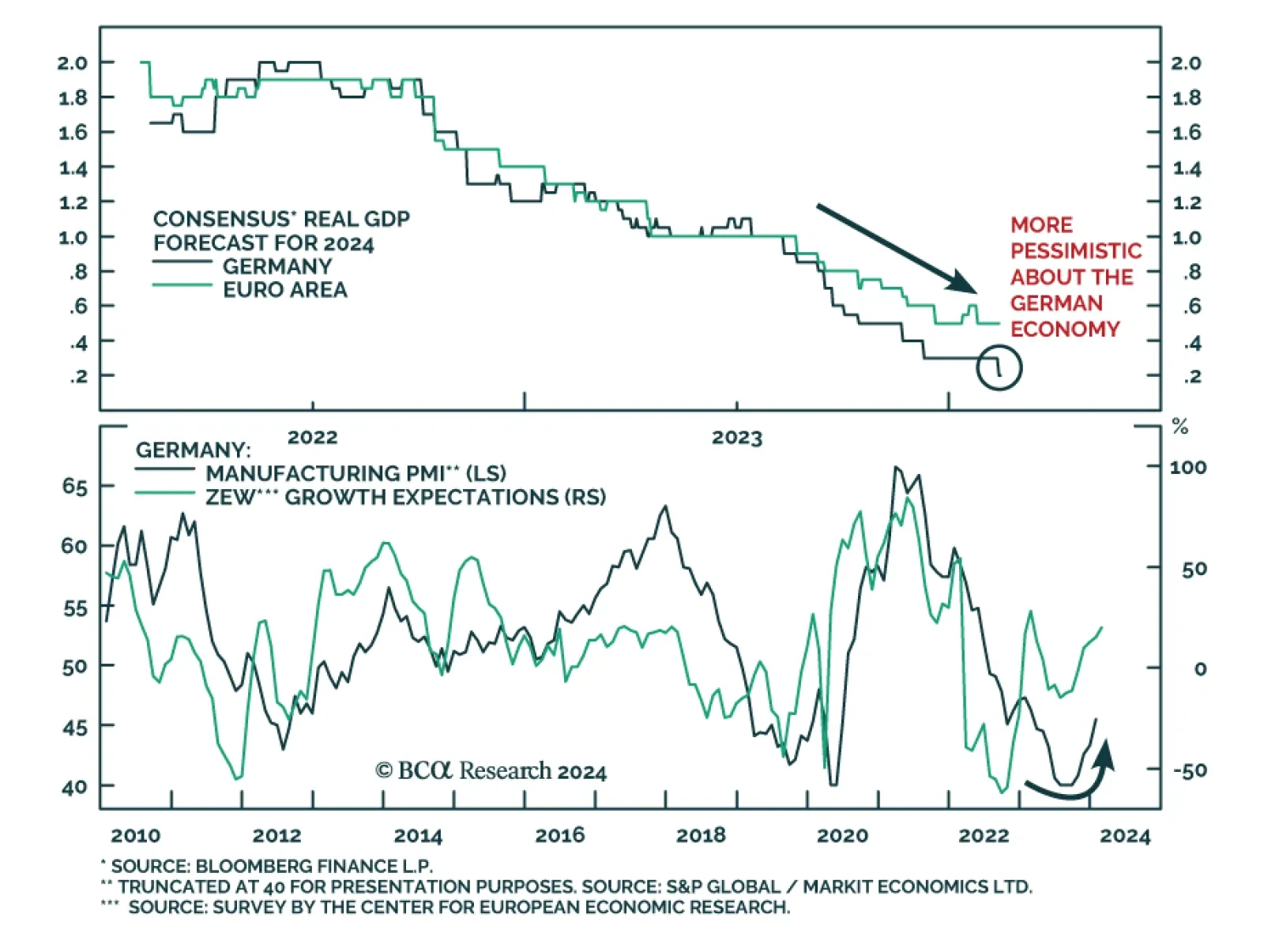

The German economy was a laggard at the end of last year, posting a 0.3% q/q real GDP contraction in Q4 2023 while the broader Eurozone economy stagnated. Importantly, while economists have been revising up their 2024 forecasts…

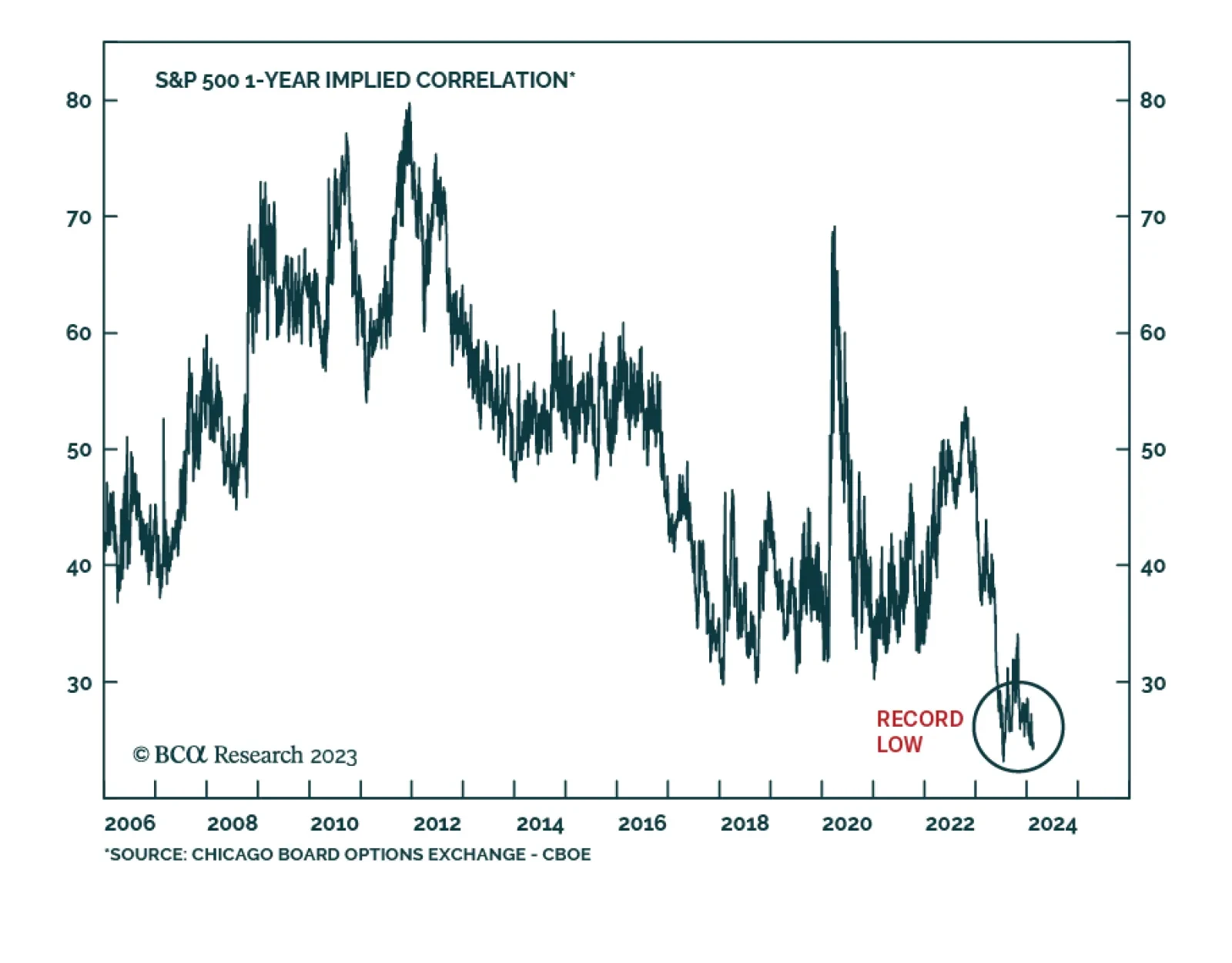

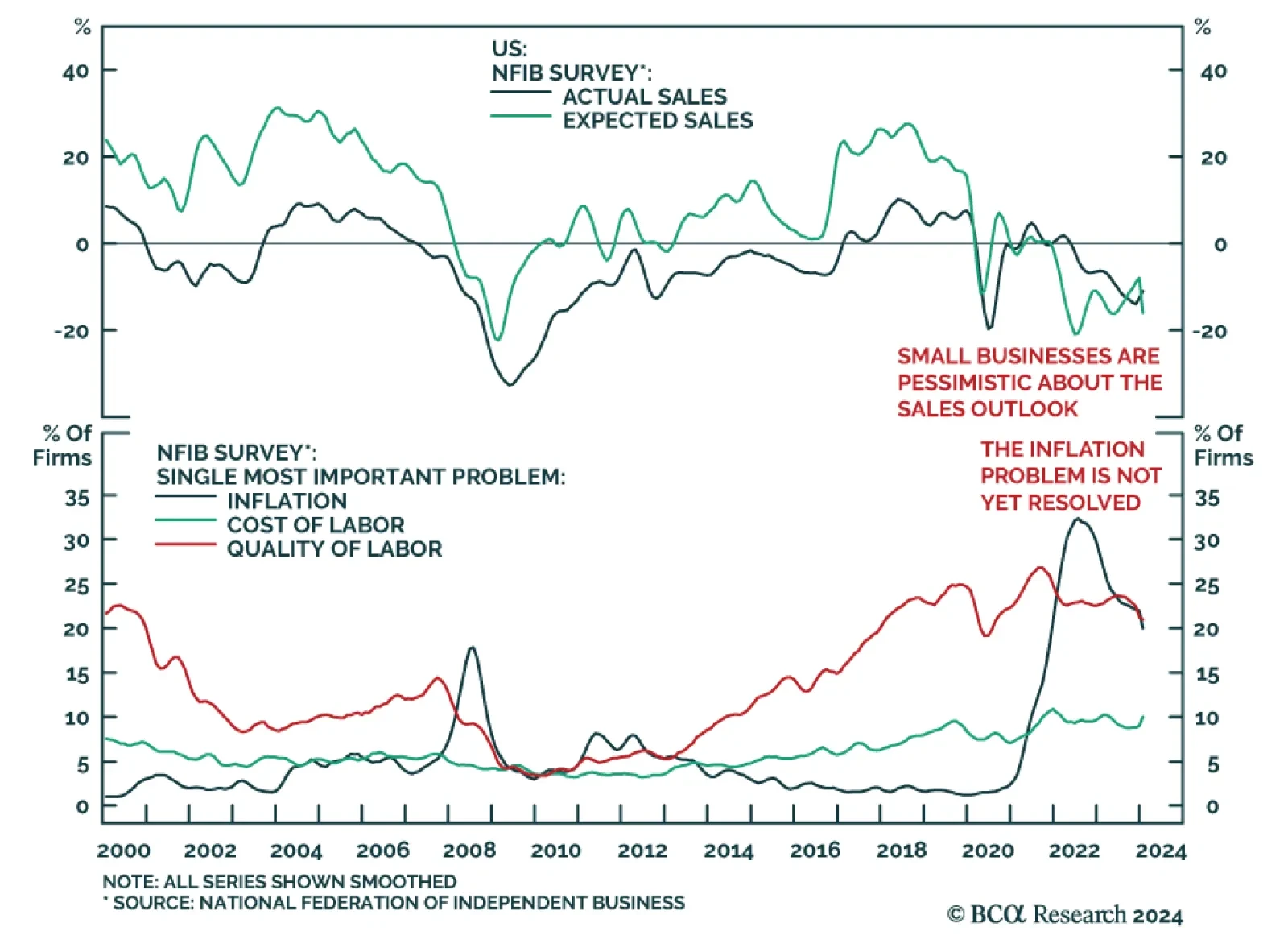

We highlighted in a recent Insight that positive economic surprises are prompting economists to revise up their US economic growth expectations. The Goldilocks narrative is supporting the rally in risk assets. However, results of…