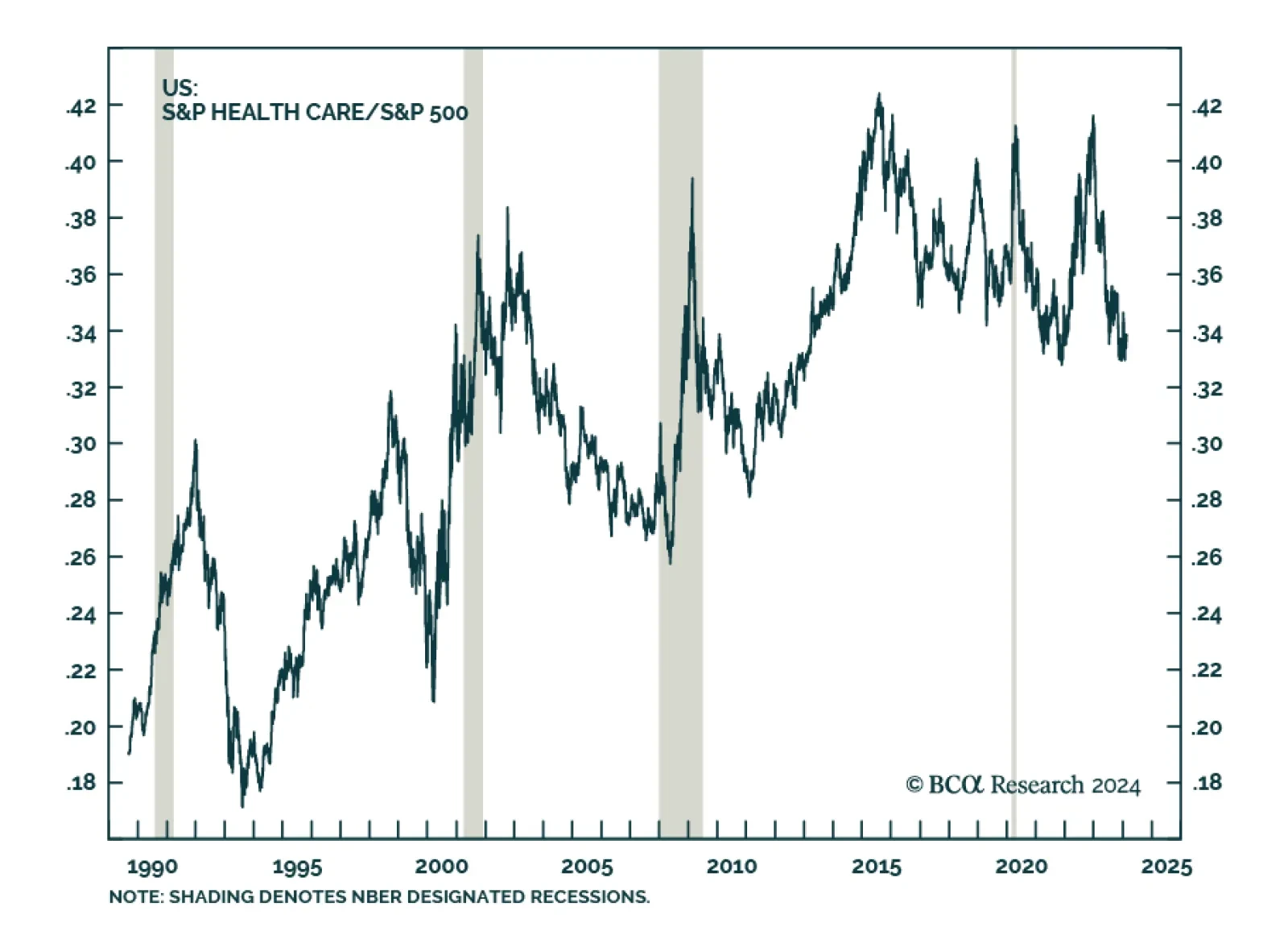

The Health Care sector is among the best performing US equity sectors so far this year. Its 6.2% year-to-date price gain exceeds the S&P 500’s 4.3% increase and is second only to Communication Services. This marks a…

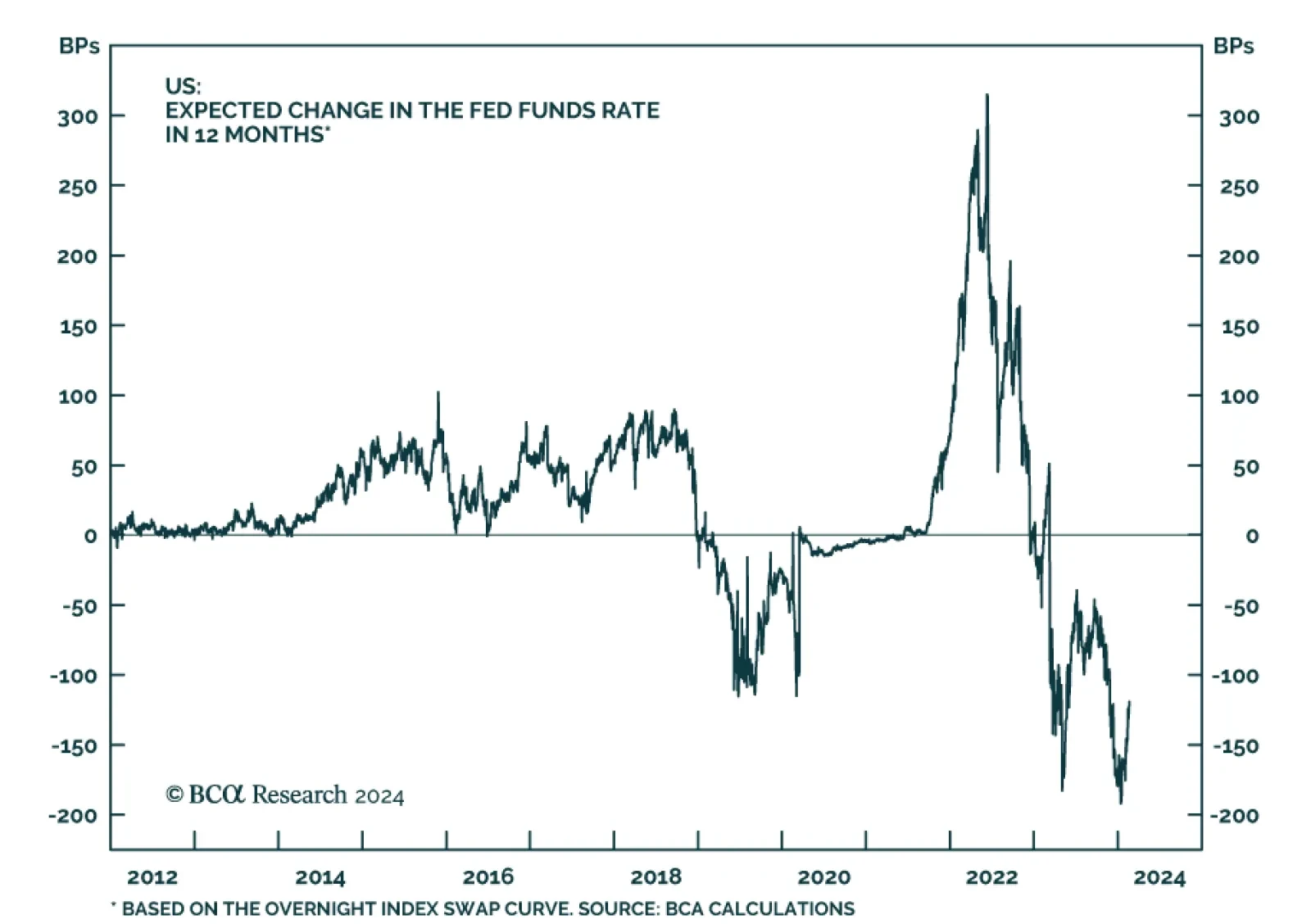

US Treasuries have been selling off over the past two months as investors downgrade the odds of an imminent start to the Fed’s easing cycle. Naturally, a question facing investors is whether current levels constitute a good…

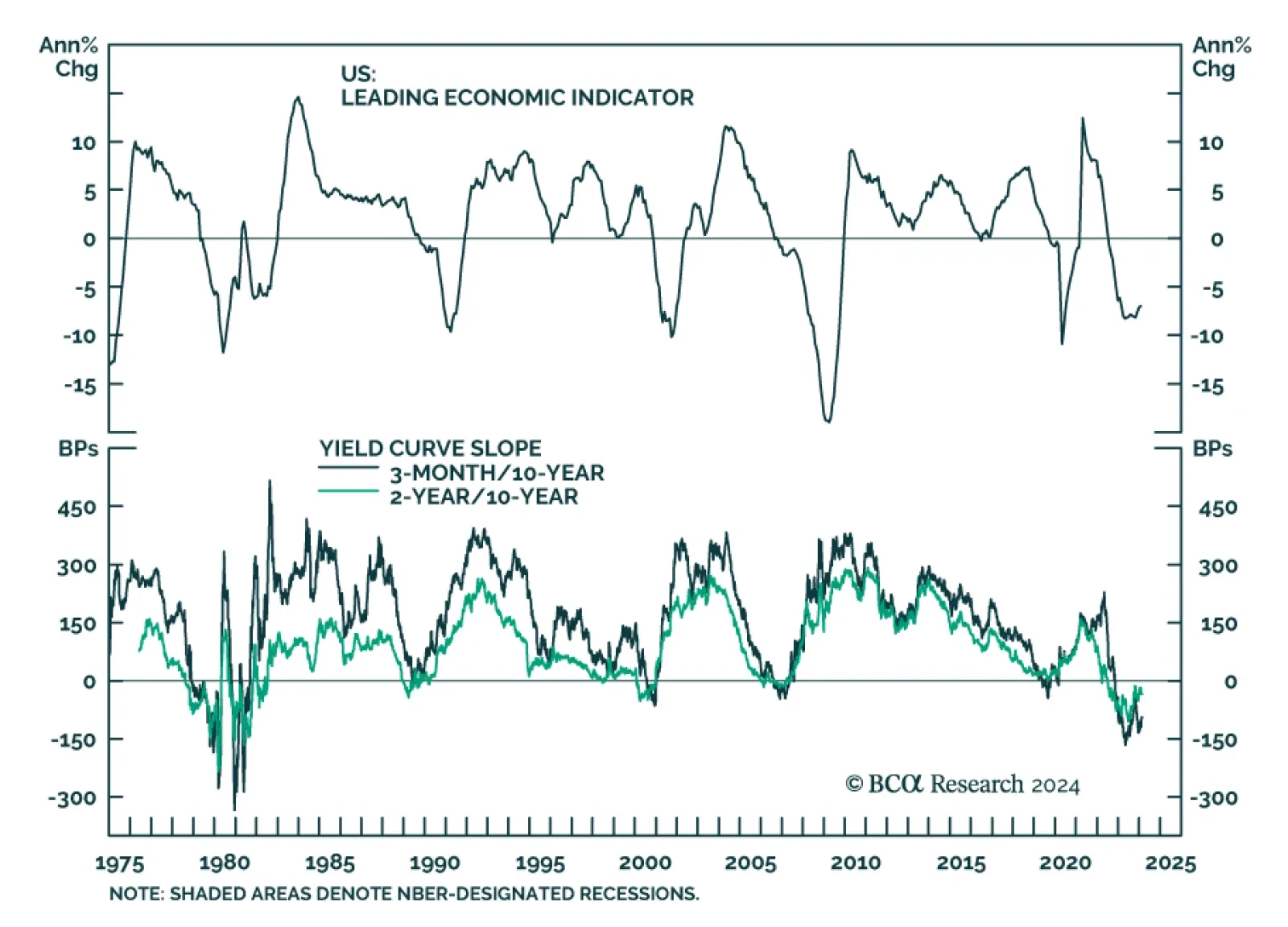

The US Conference Board’s Leading Economic Index (LEI) fell by 0.4% m/m in January, following a 0.1% m/m drop in December – disappointing expectations of a milder decline. This marks the 23rd consecutive monthly…

Democrats remain favored for reelection in 2024, which implies gridlock and policy status quo in 2025. That is not negative for stocks in the near term. However, economic, political, and geopolitical risks will escalate from here,…

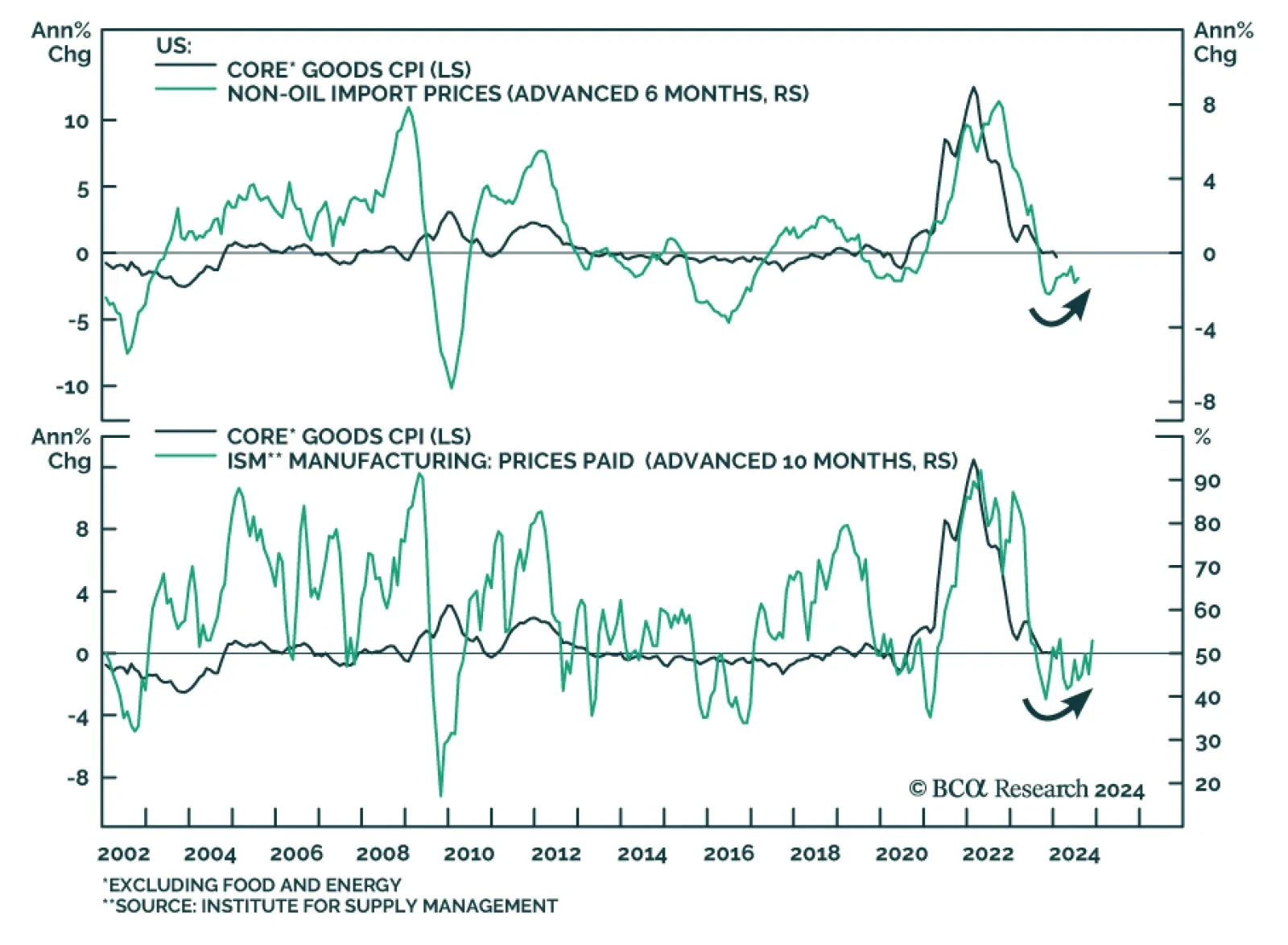

Much of the focus of investors concerned about lingering price pressures has been on services prices. There is good reason for that. Even though core CPI inflation remains relatively elevated at 3.9% y/y in January, core goods…

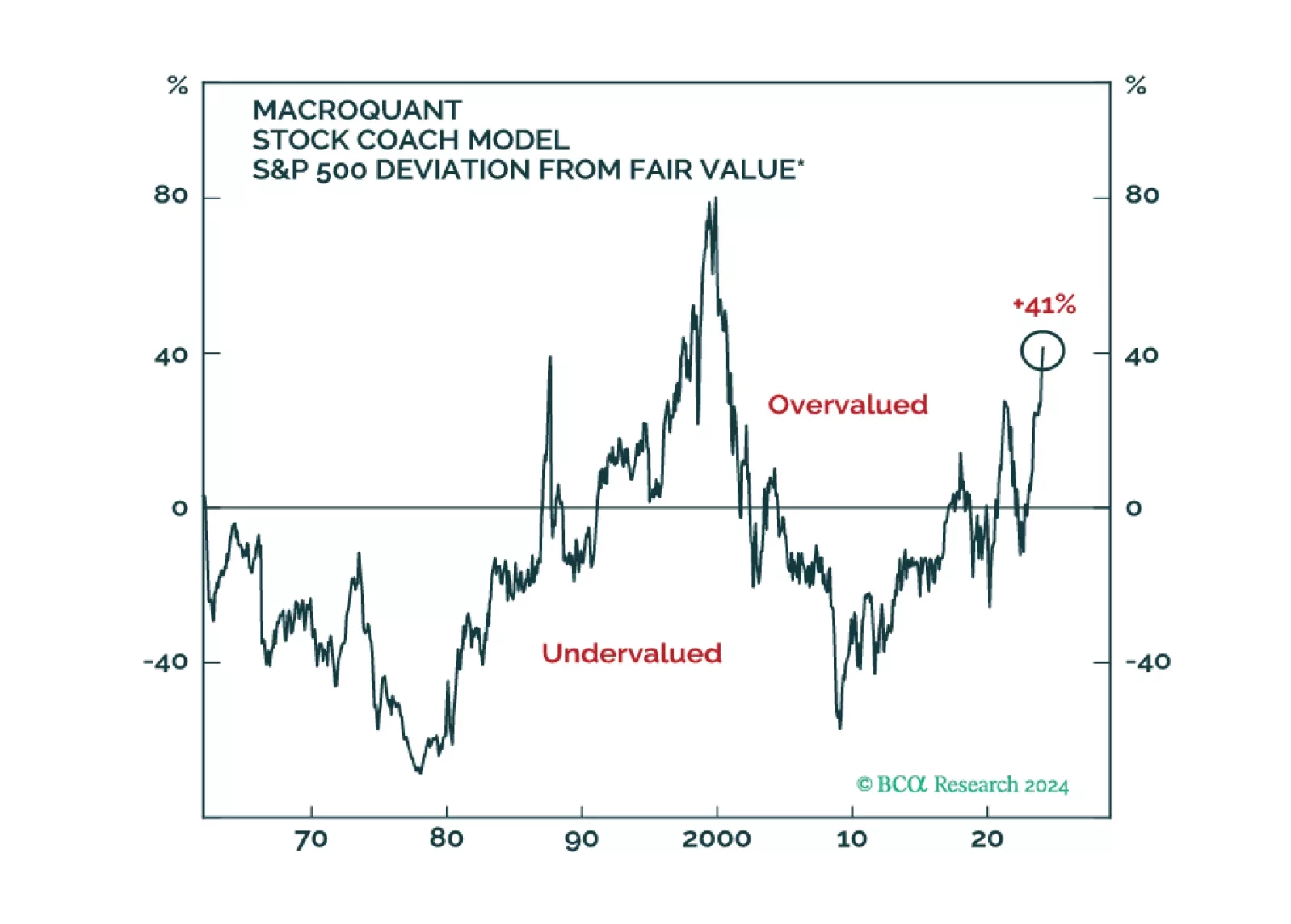

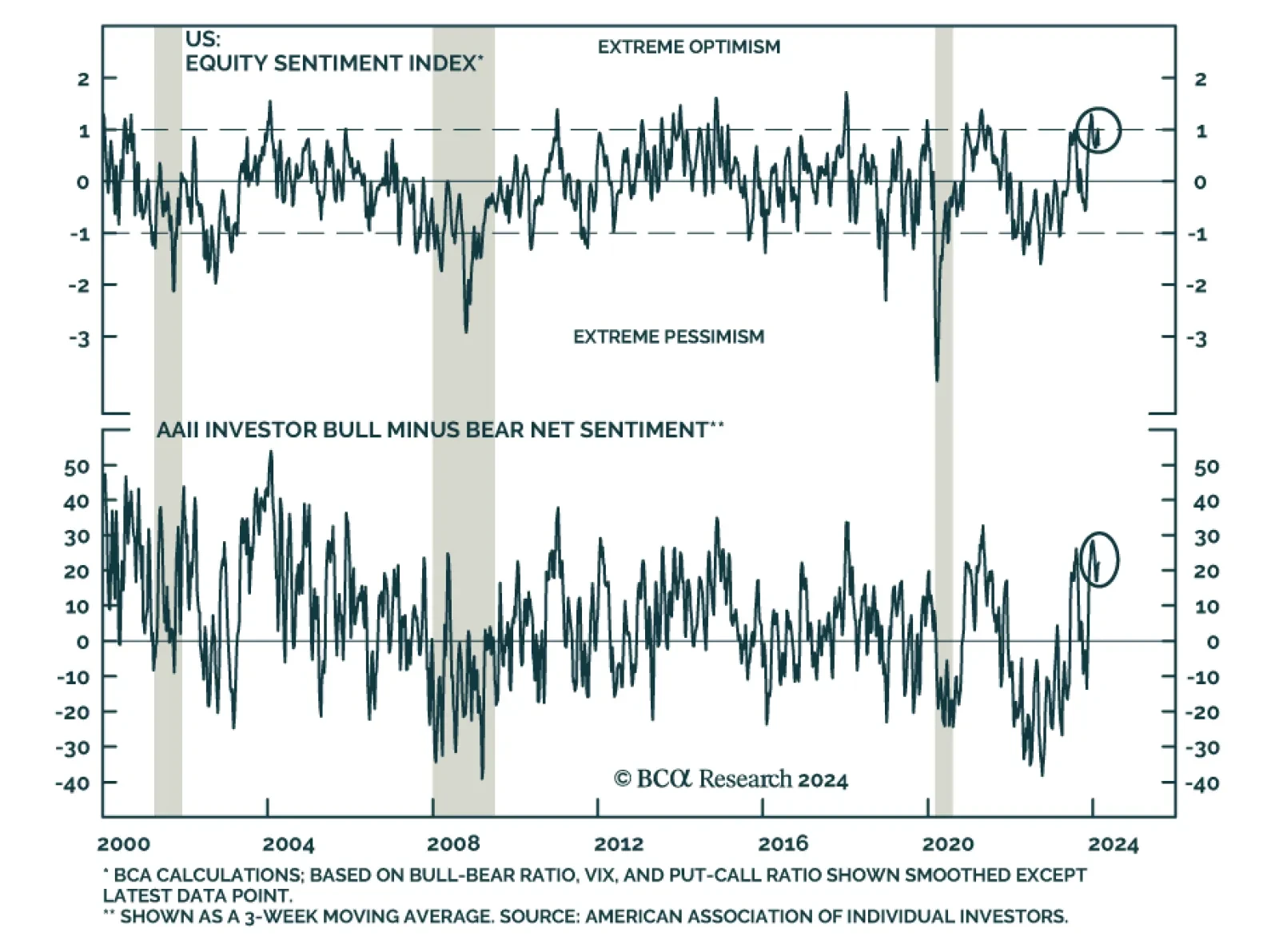

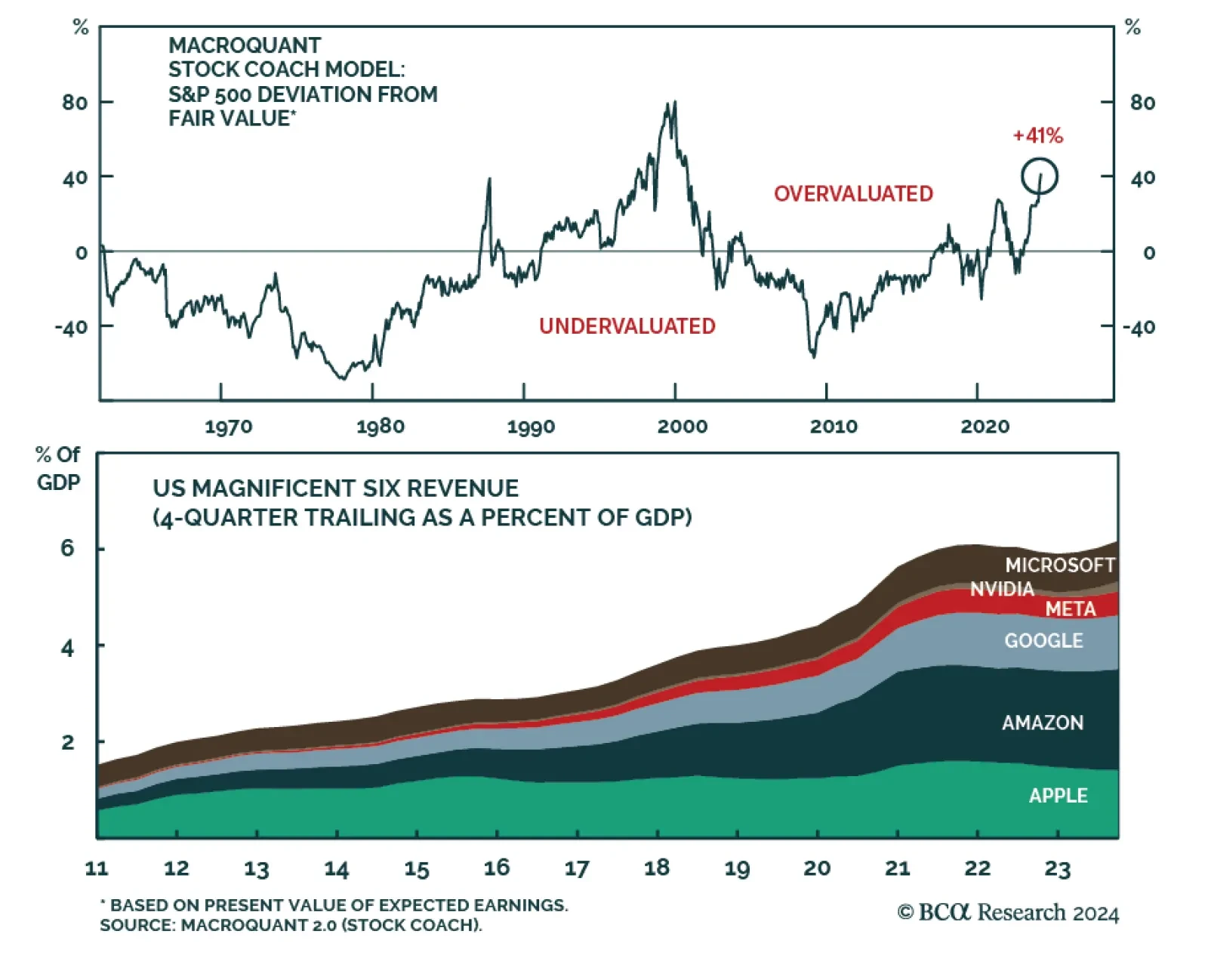

The S&P 500 forged a new all-time high last Thursday and ended the week with a 4.9% year-to-date gain, extending the rally that started in late-October. Interestingly, the recent increase comes even though investors have…

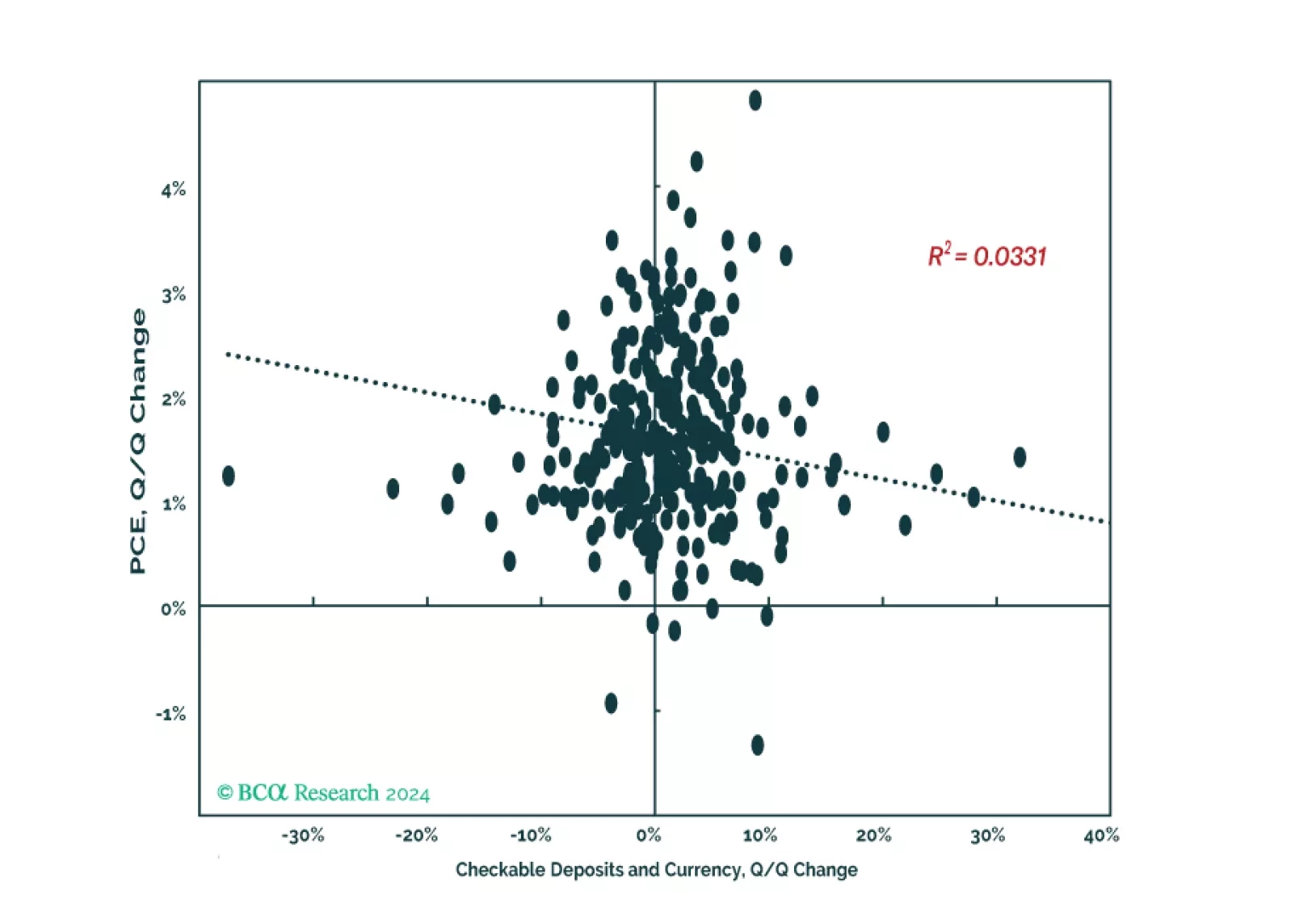

Households have ramped up their cash holdings since the end of 2019, but the absence of an empirical link between cash and consumption leads us to believe that we’ve modestly overestimated the risk of consumer-driven overheating.

According to BCA Research’s Global Investment Strategy service, although the next recession is likely to be mild-to-moderate, the ensuing financial avalanche will be more severe. Valuations are highly stretched and hopes…

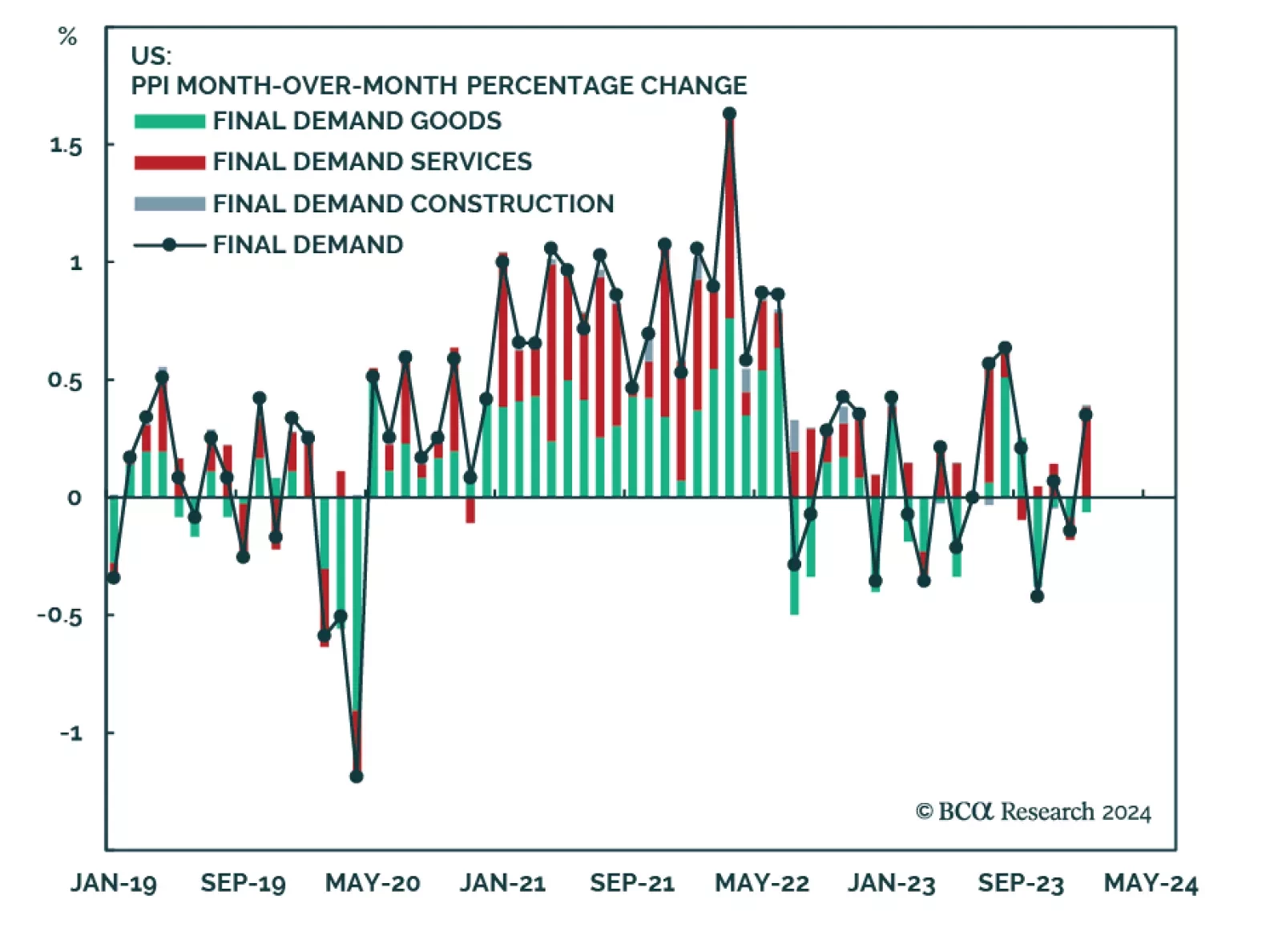

The hotter-than-anticipated US PPI report for January prompted a selloff in Treasuries on Friday. The monthly and annual changes in both the headline as well as the core measures of final demand PPI came in above expectations.…

Recessions often begin seemingly out of the blue when the economy’s temperature falls enough to set in motion adverse feedback loops that cause unemployment to rise. We expect the US economy to suddenly freeze over towards the end of…