Our Portfolio Allocation Summary for March 2024.

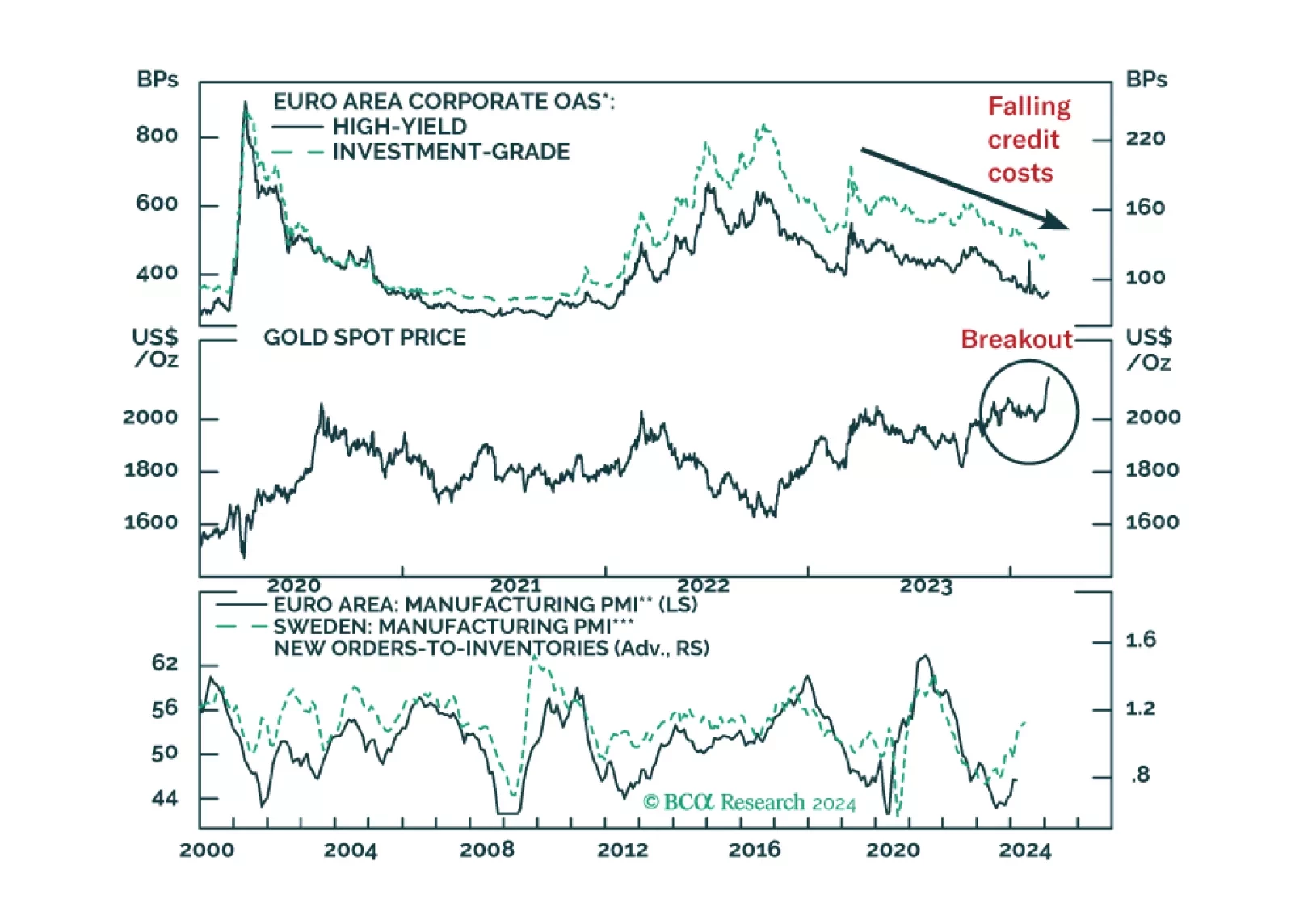

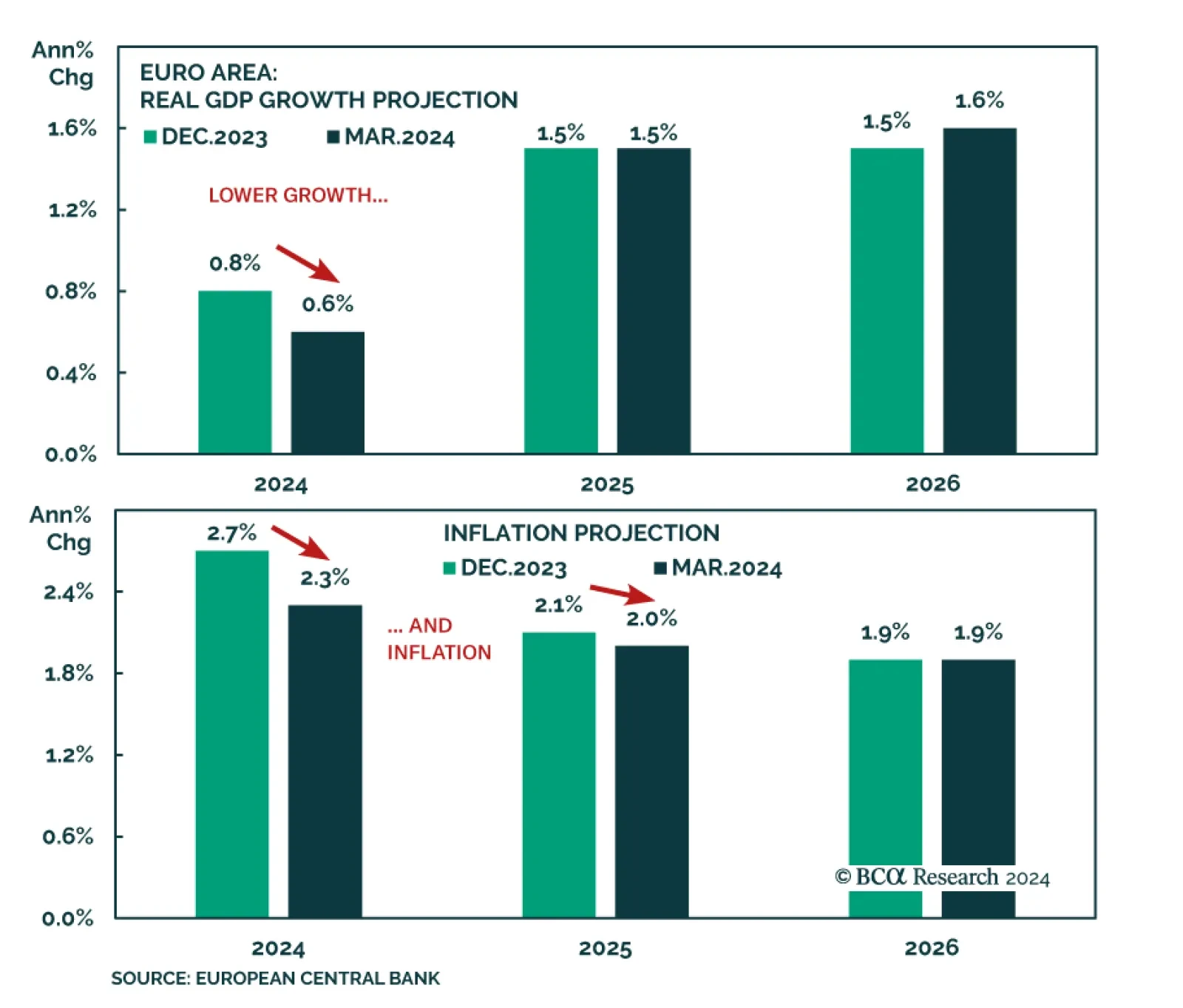

According to BCA Research’s European Investment Strategy service, last week’s ECB meeting confirmed their long-held view that the most likely date for the first ECB rate cut would be June. The ECB continues to…

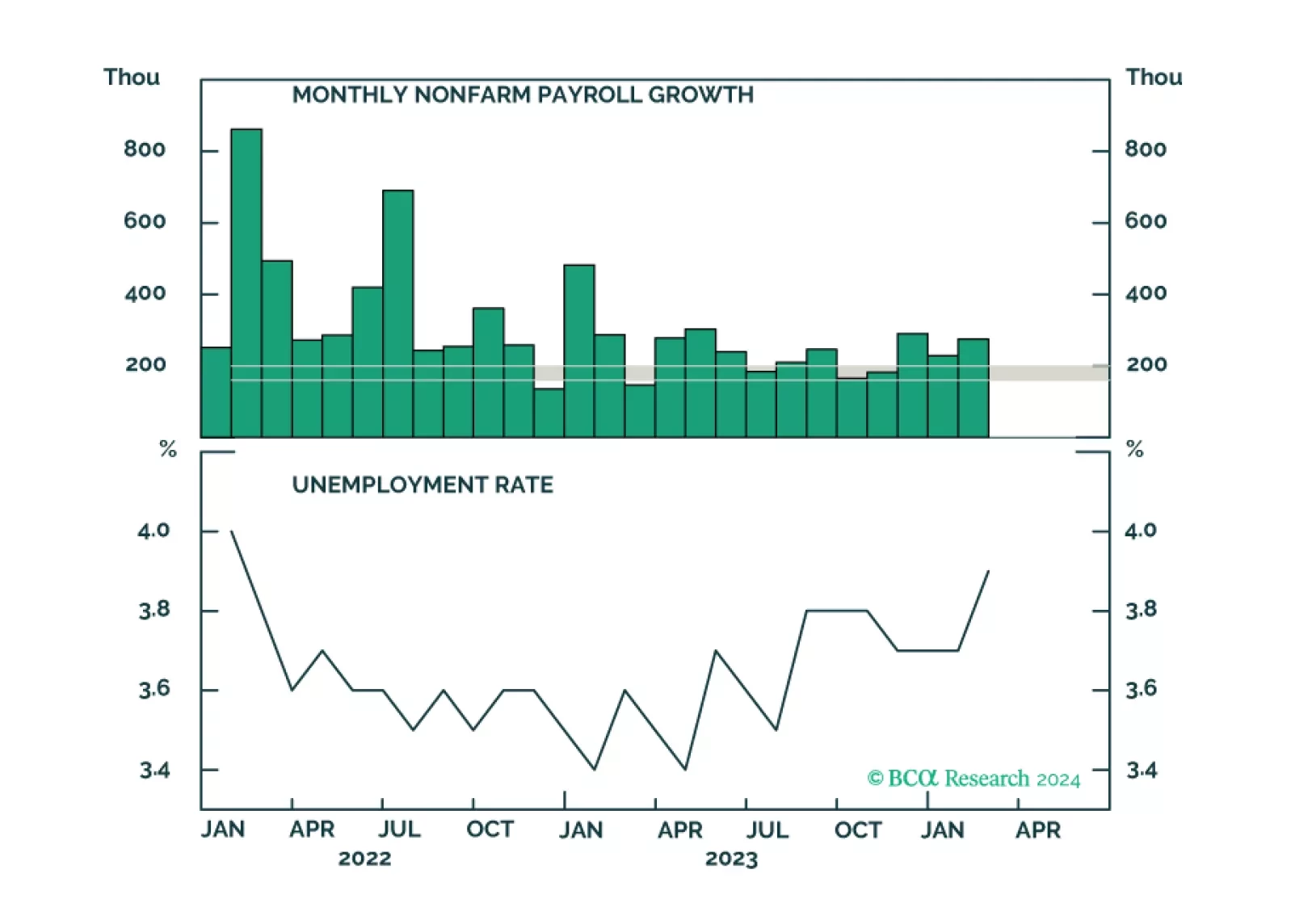

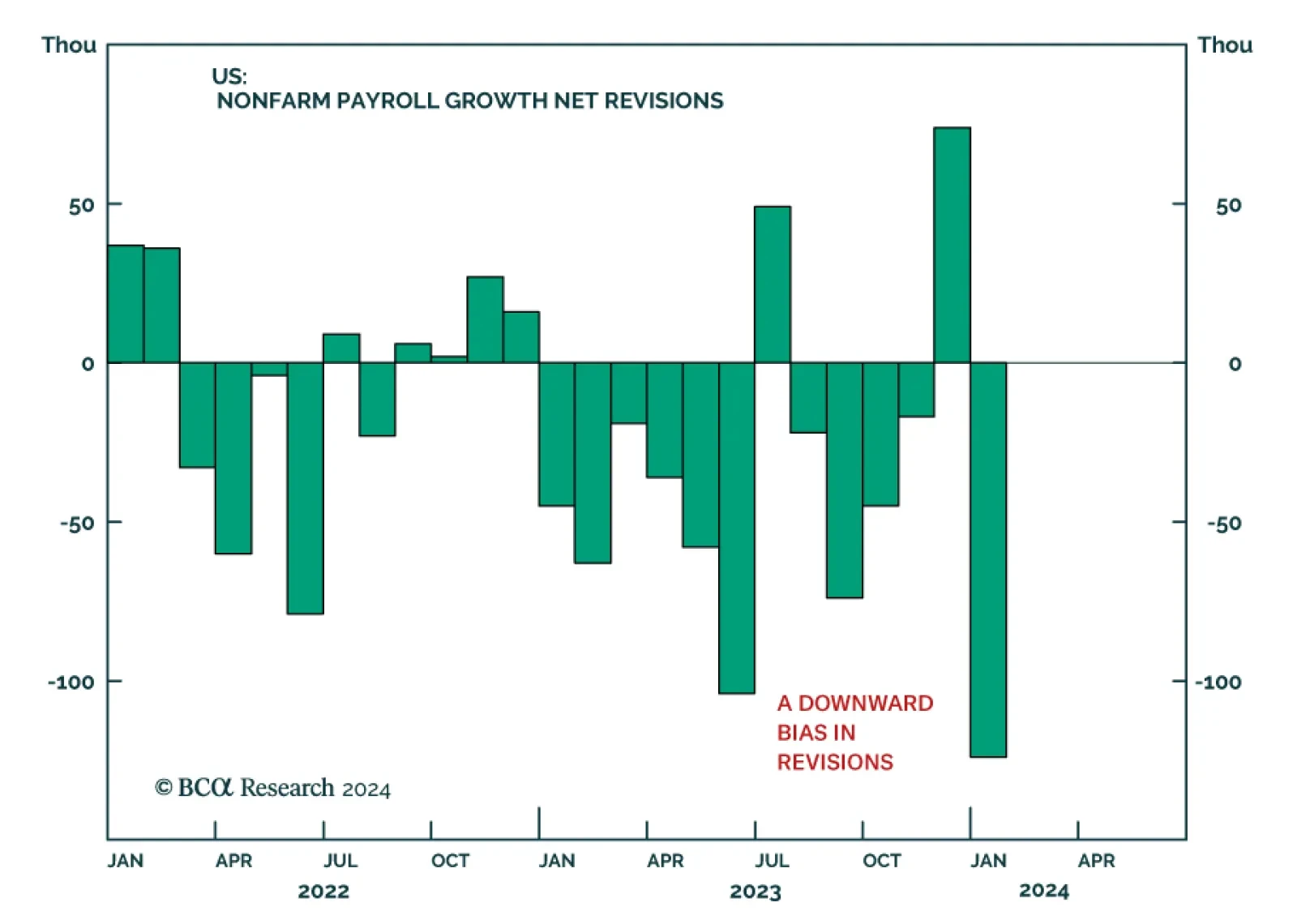

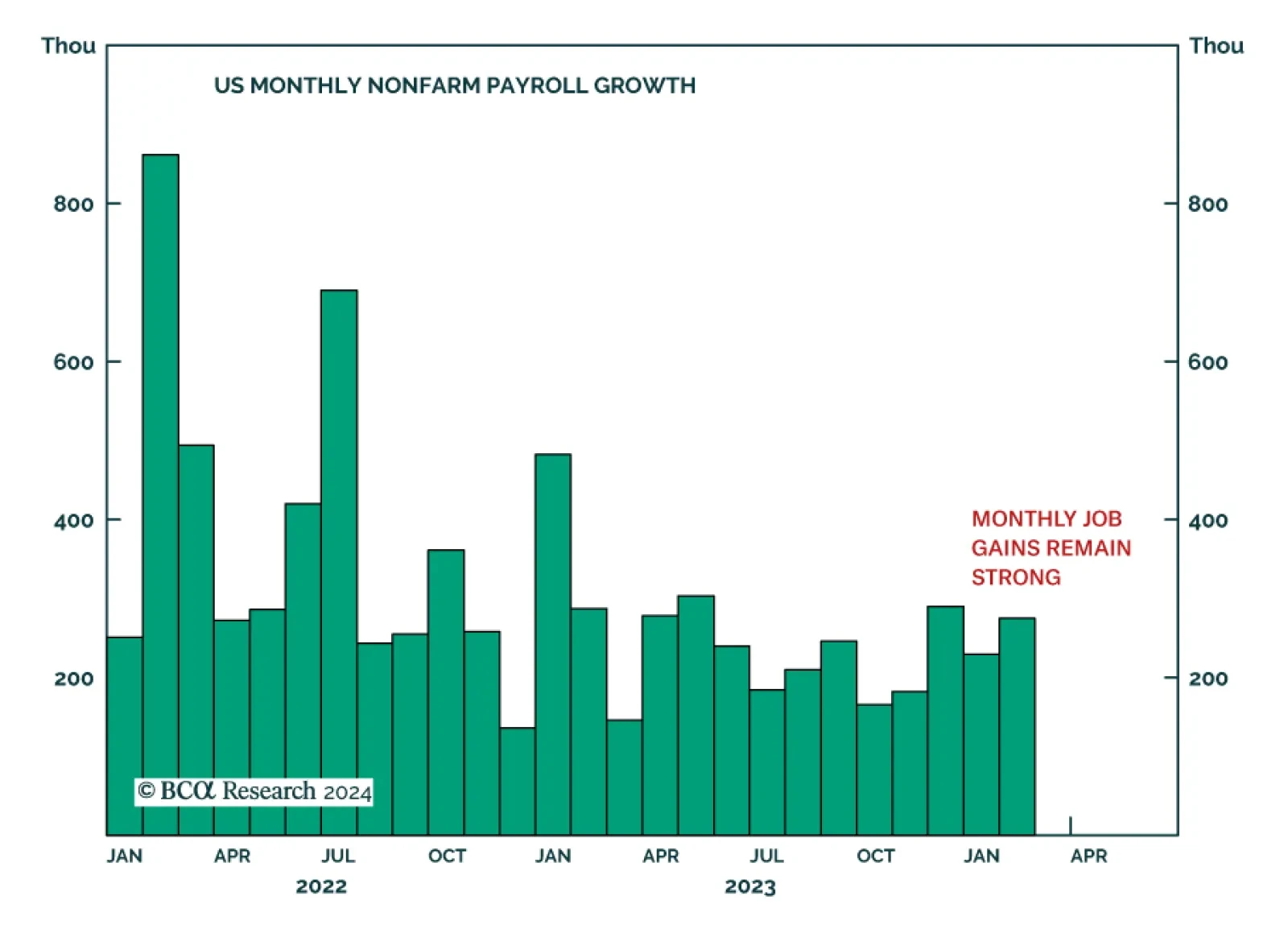

For the past year, relatively large downward revisions have been key features of the monthly US nonfarm payrolls reports. Friday’s release was no exception. Although it showed the magnitude of job gains beat expectations in…

The US employment situation report sent a mixed signal on Friday. While total nonfarm payrolls rose by 275 thousand jobs in February, exceeding the 200 thousand expected, the previous two months’ numbers were revised lower…

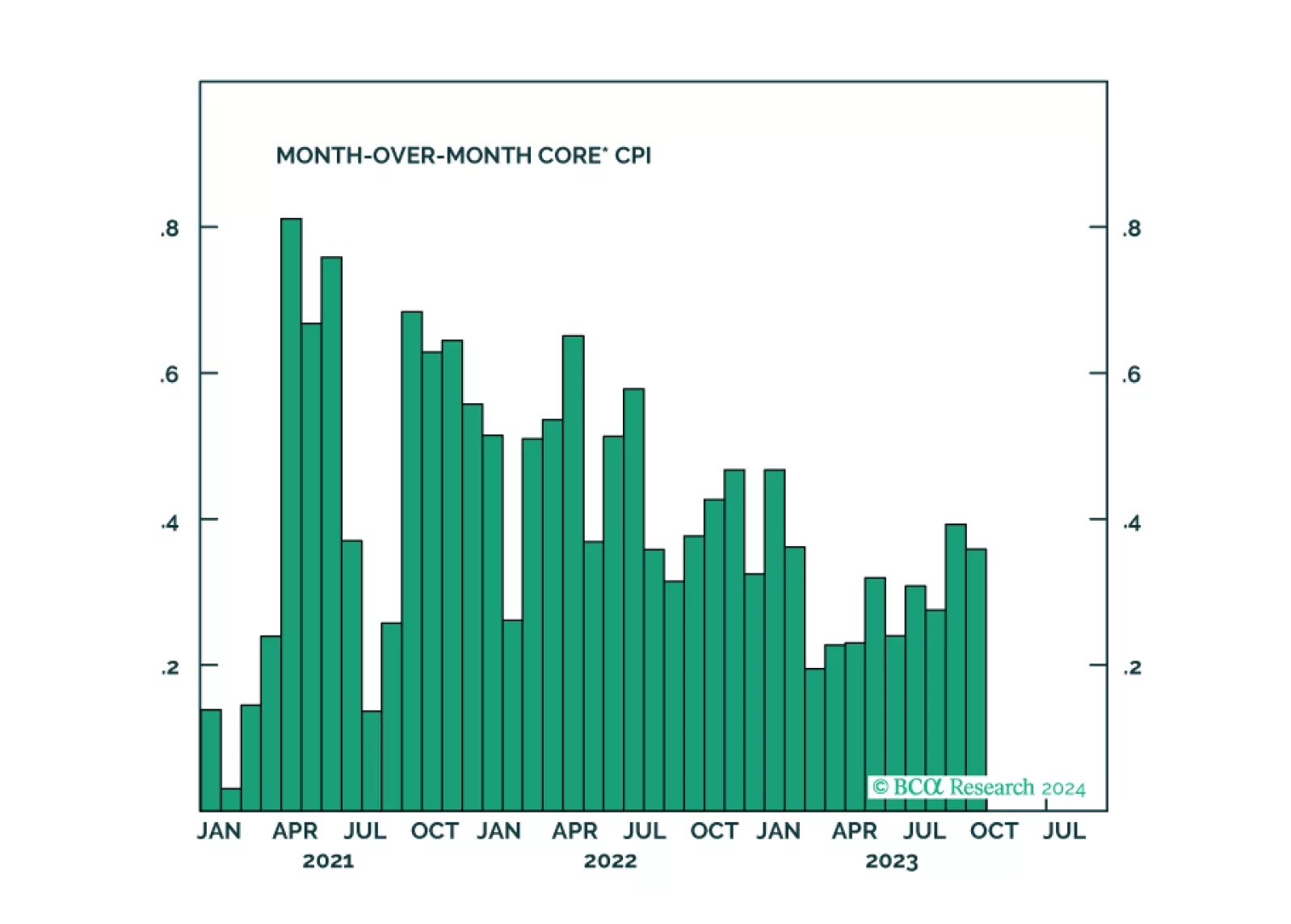

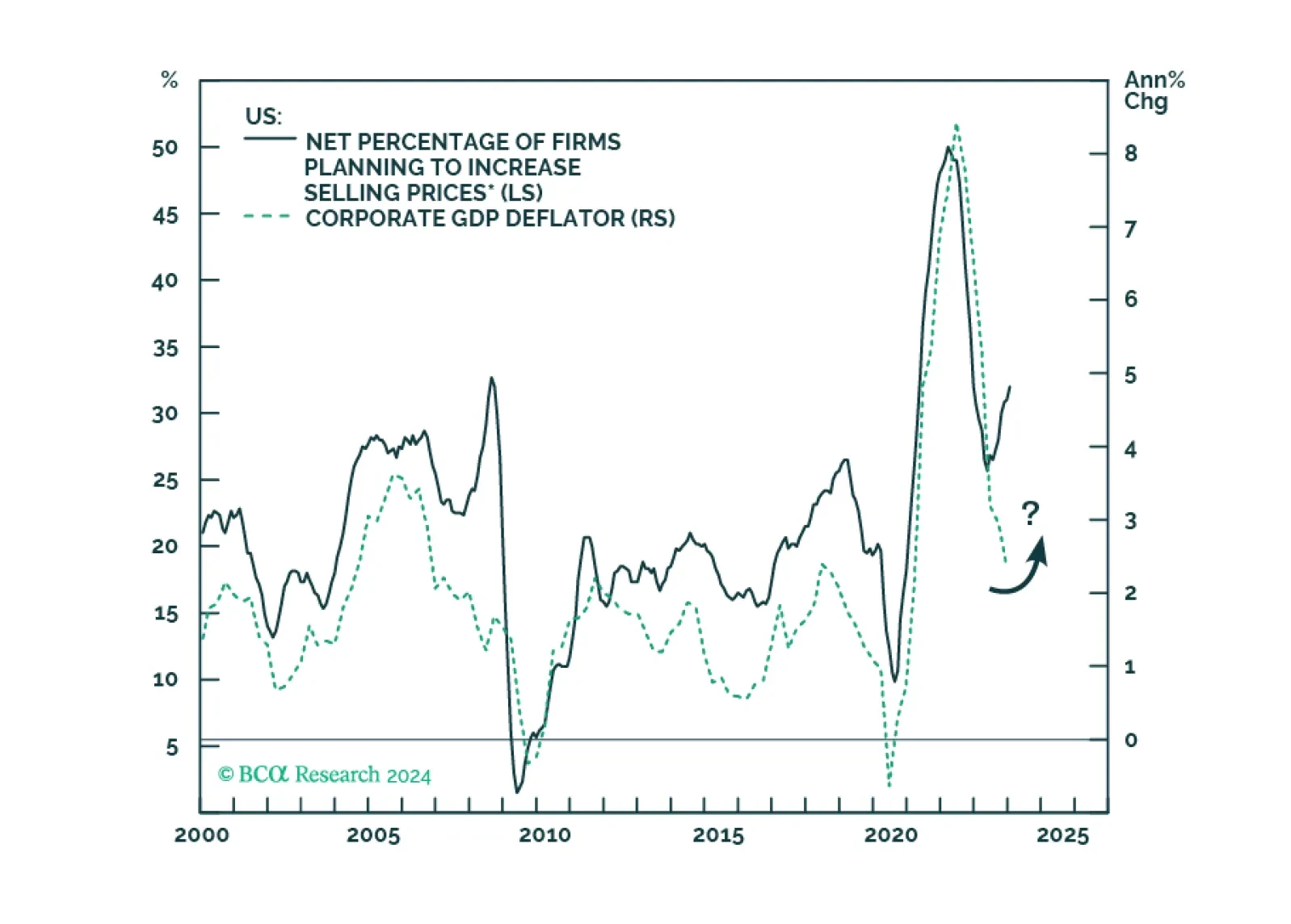

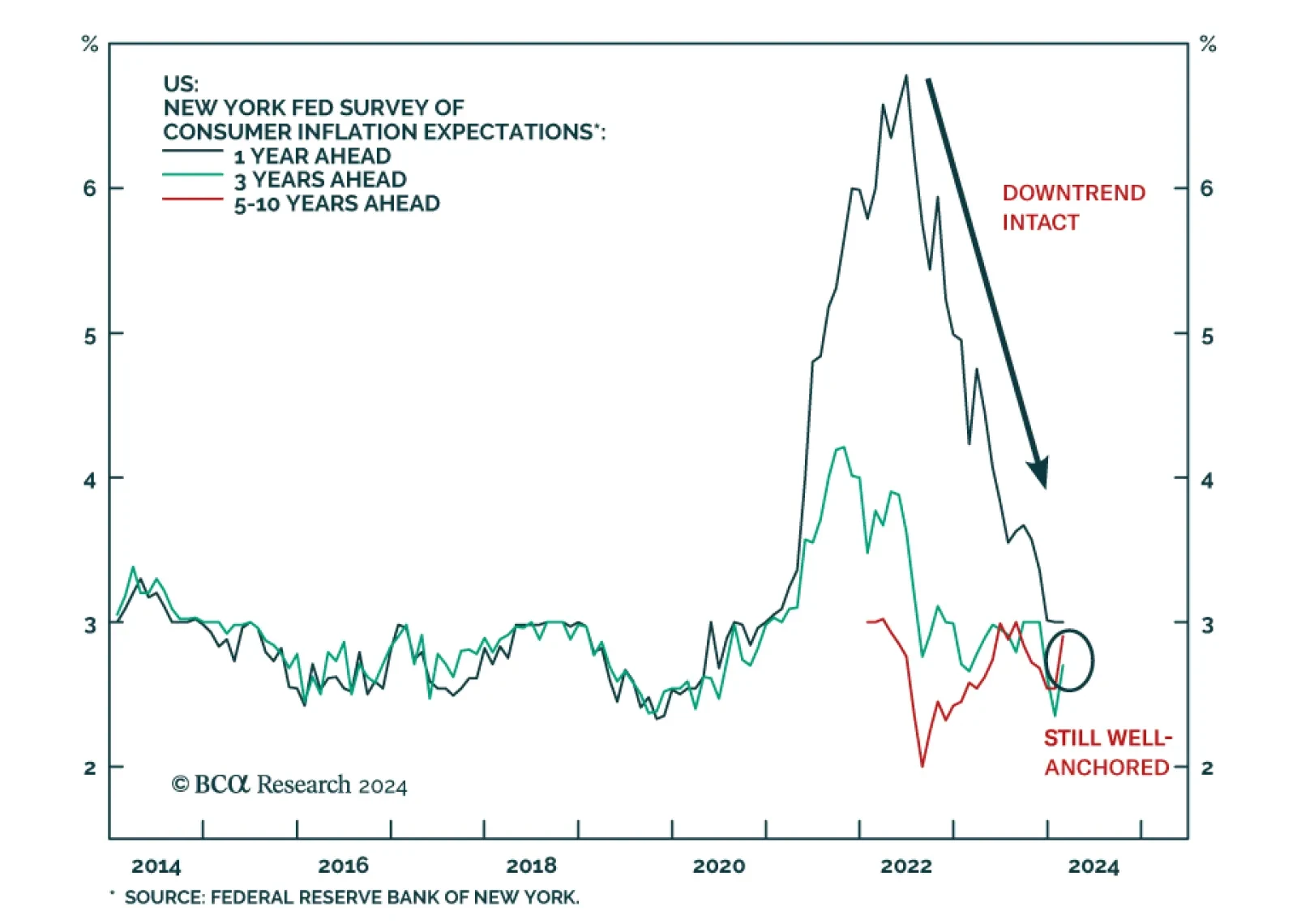

Results of the New York Fed’s Survey of Consumer Expectations showed an uptick in medium- and long-term inflation expectations in February. Specifically, the three-year ahead measure rebounded from a record low of 2.4% to 2…

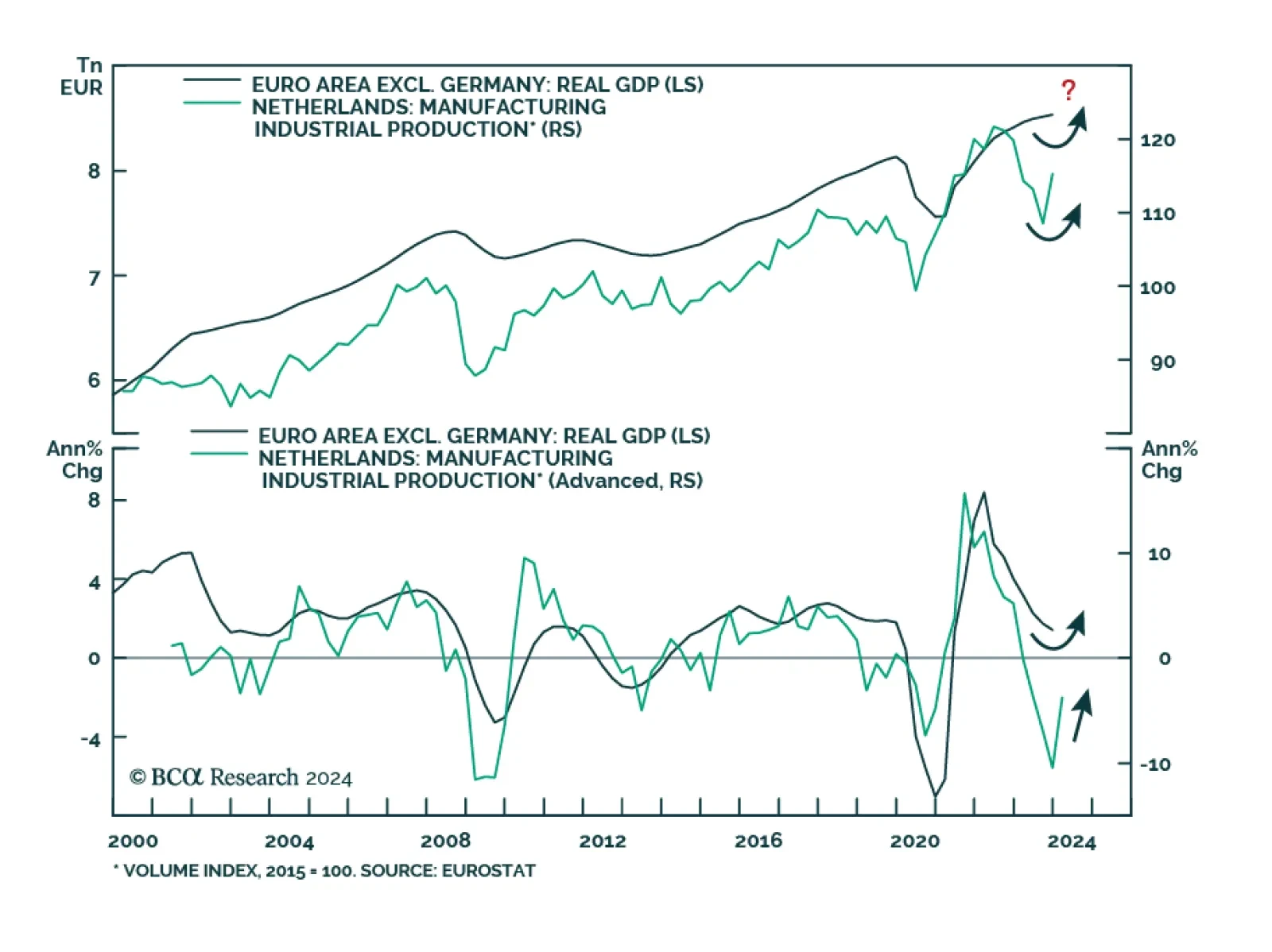

We are pushing back the anticipated start date for a Eurozone recession and assessing how it affects our equity stance.

We update the indicators in our duration checklist following this morning’s employment report.

Presently, our four high-conviction themes are: (1) the US dollar will rally as US growth continues to outpace the rest of the world; (2) US equities will continue to outperform EM and European stocks until a major sell-off occurs; (…

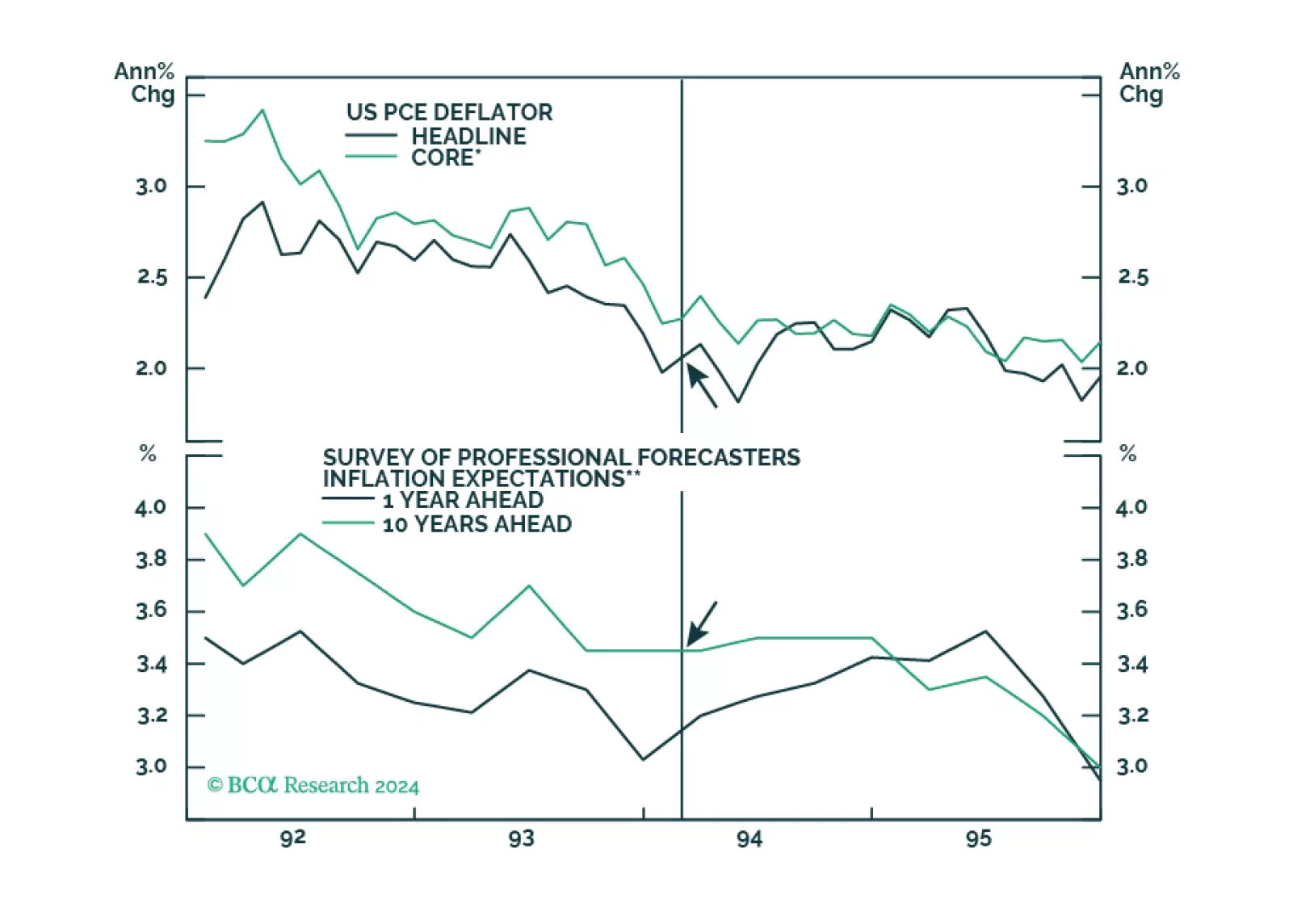

Many investors have cited the 1994 tightening cycle as an example of how the Fed managed to raise rates without triggering a recession. However, the unemployment rate was 6.5% in early 1994, which meant that inflation was less of a…

BCA’s European Investment Strategy team continues to expect the German economy to trail that of the rest of Europe. Since 2020, Germany has fallen behind, with its real GDP lagging that of the broader Eurozone by 5%. The…