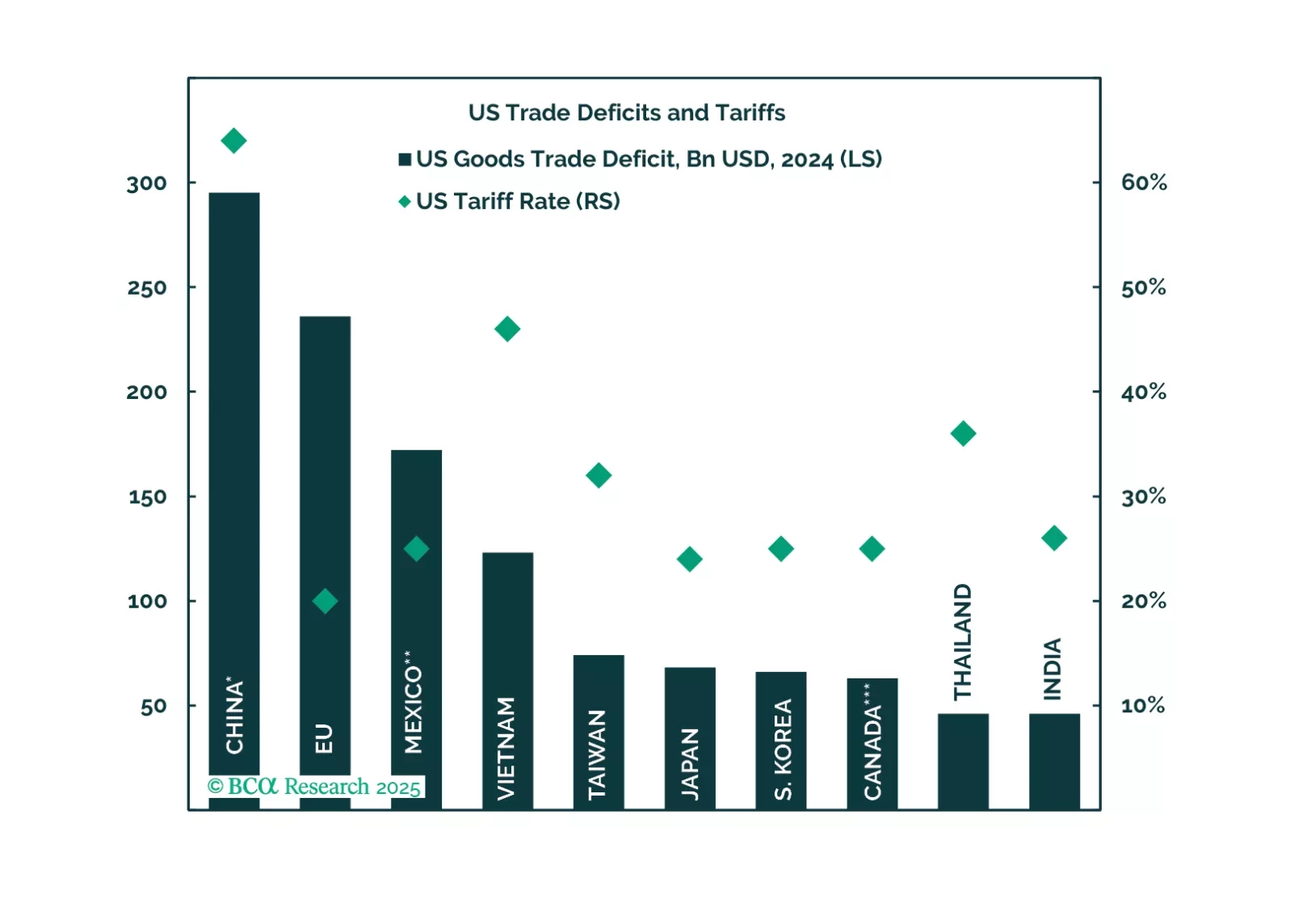

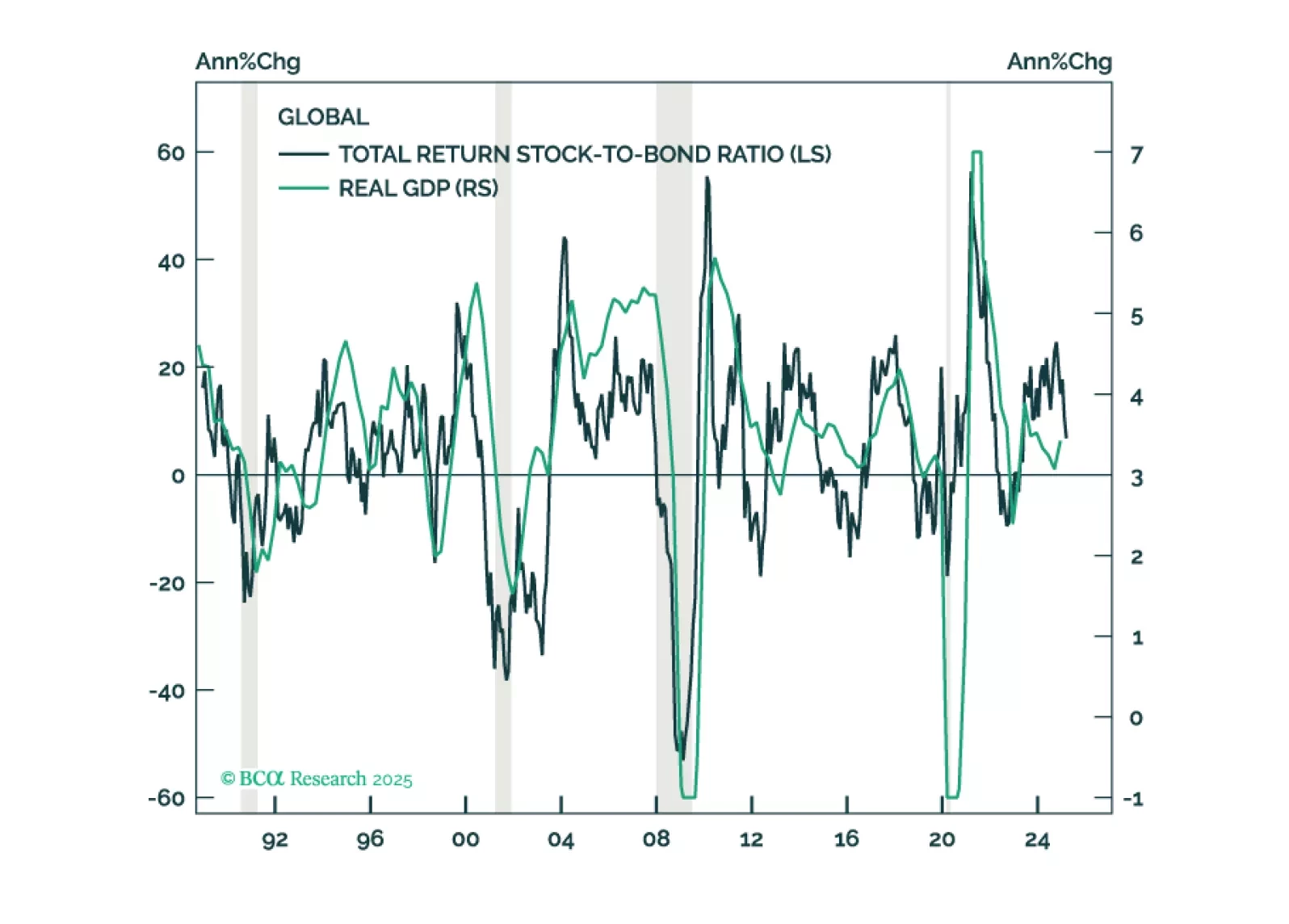

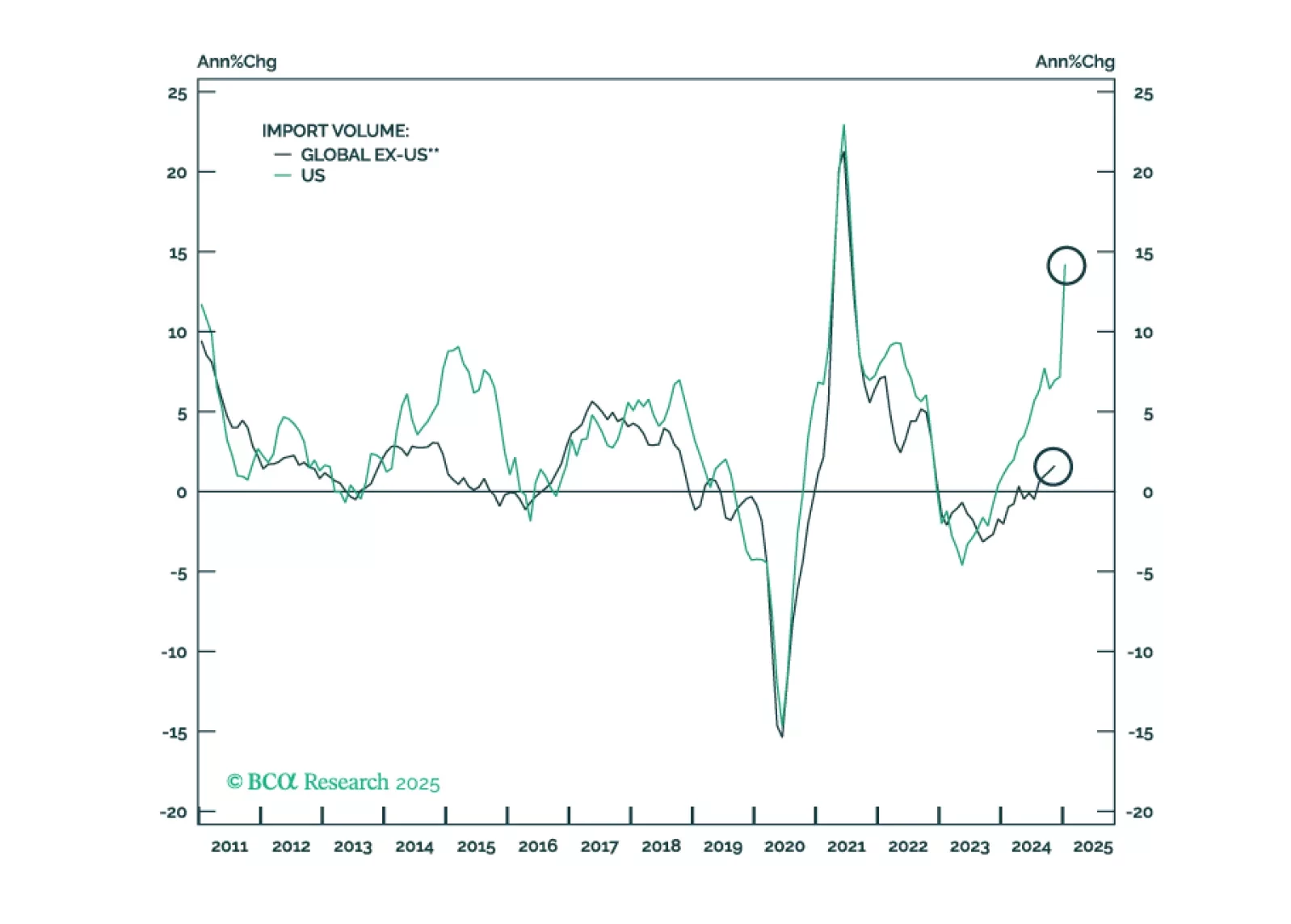

The stimulus measures driving the post-COVID expansion were beginning to wane after five years and pointing the economy in the direction of an organically occurring recession. Now that DOGE and the multi-front trade war have sped up…

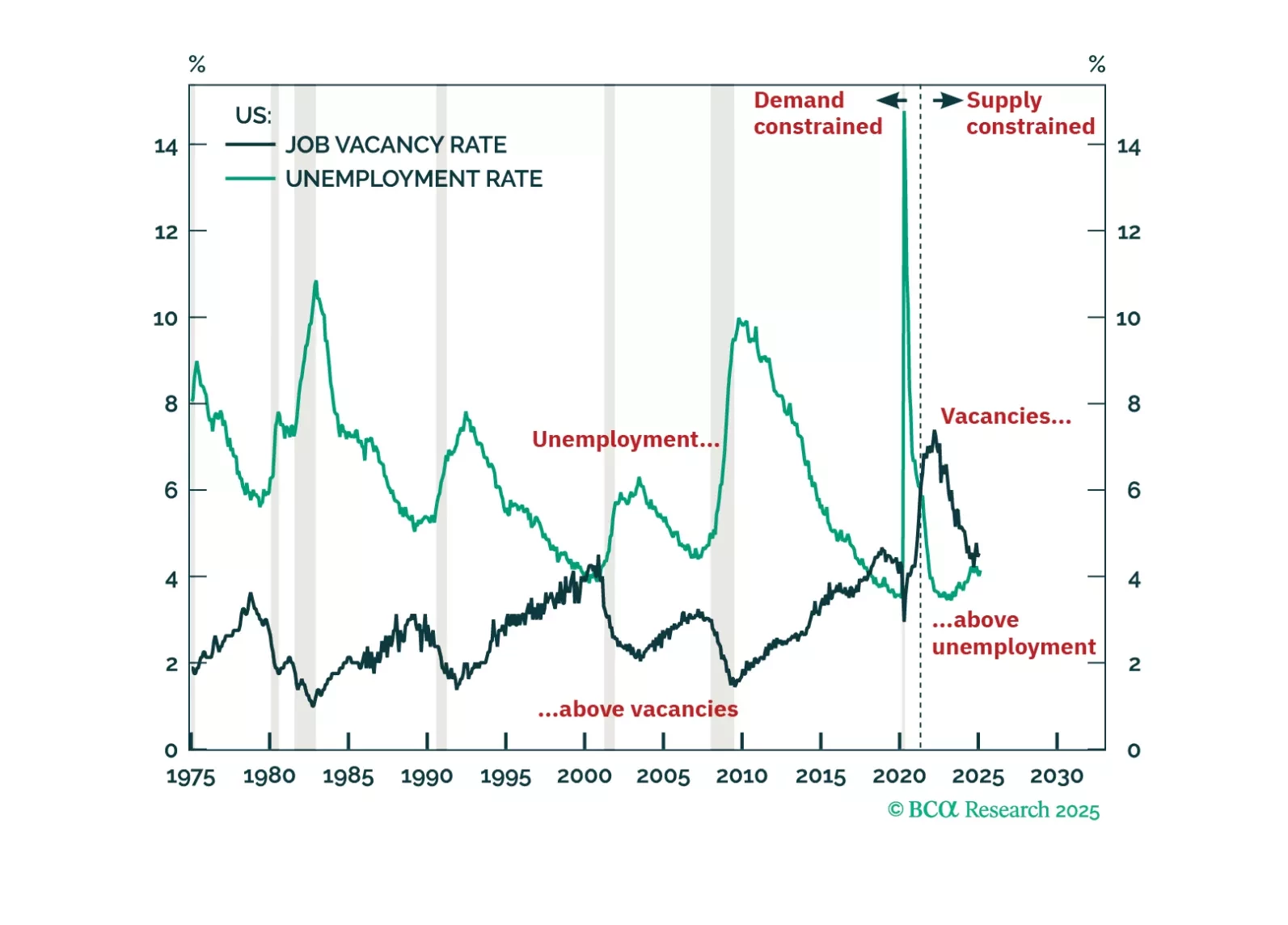

The March employment report showed strong job growth, but the labor market remains in a fragile state and the demand shock from tariffs could be the catalyst that tips it over the edge into recession.

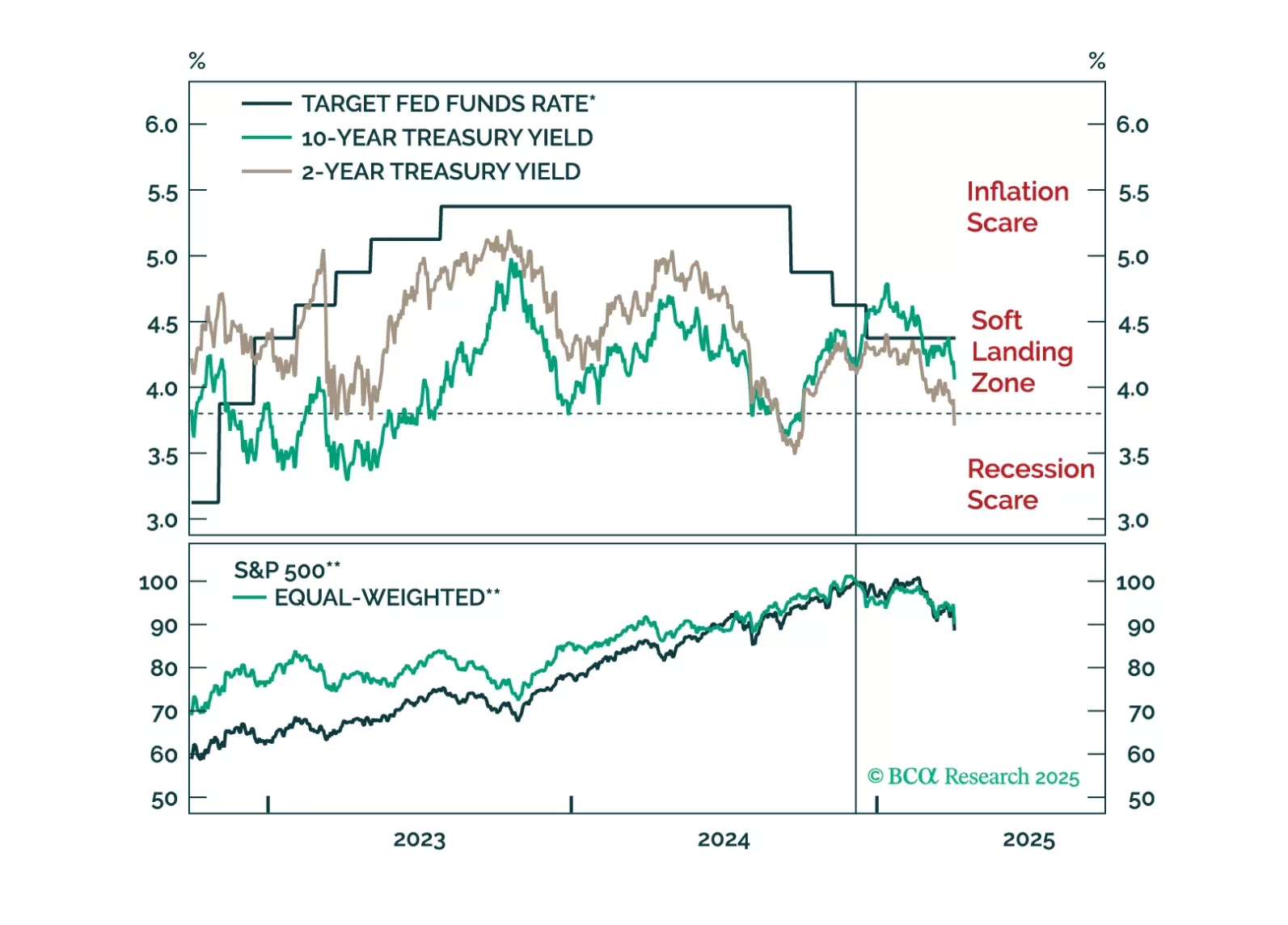

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

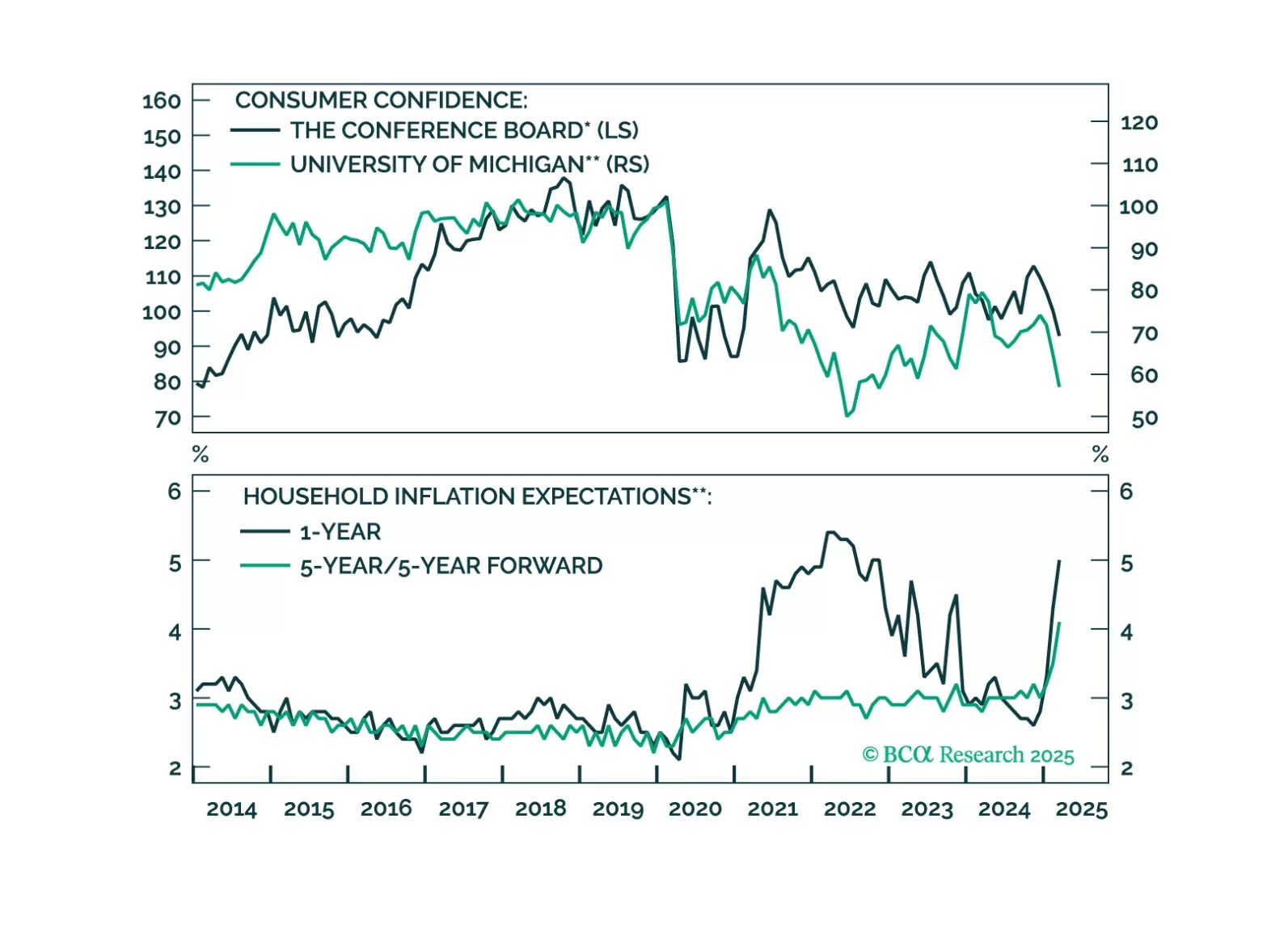

This morning’s weak consumer spending and strong inflation data reinforce our sense that the US economy is heading toward recession.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

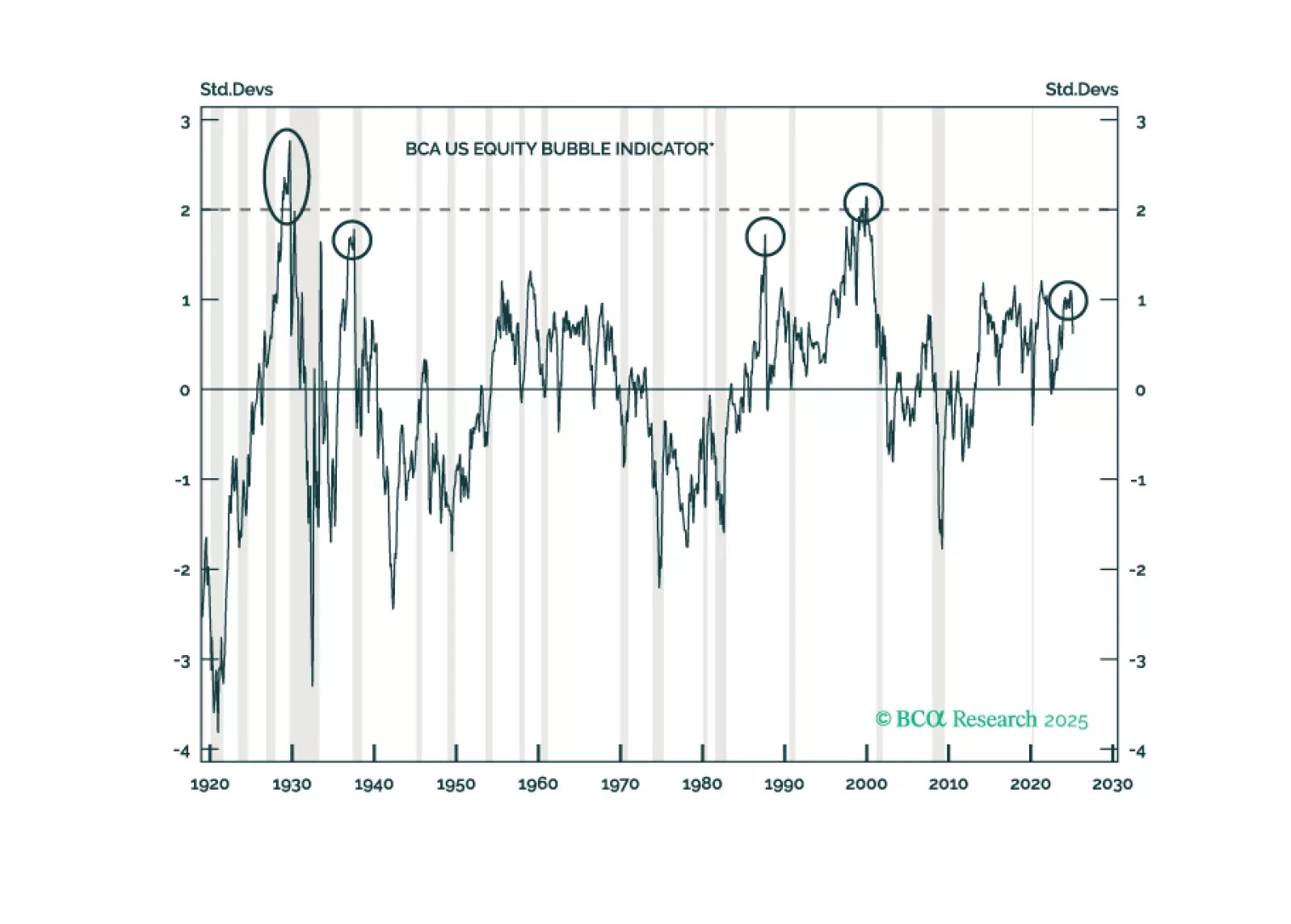

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

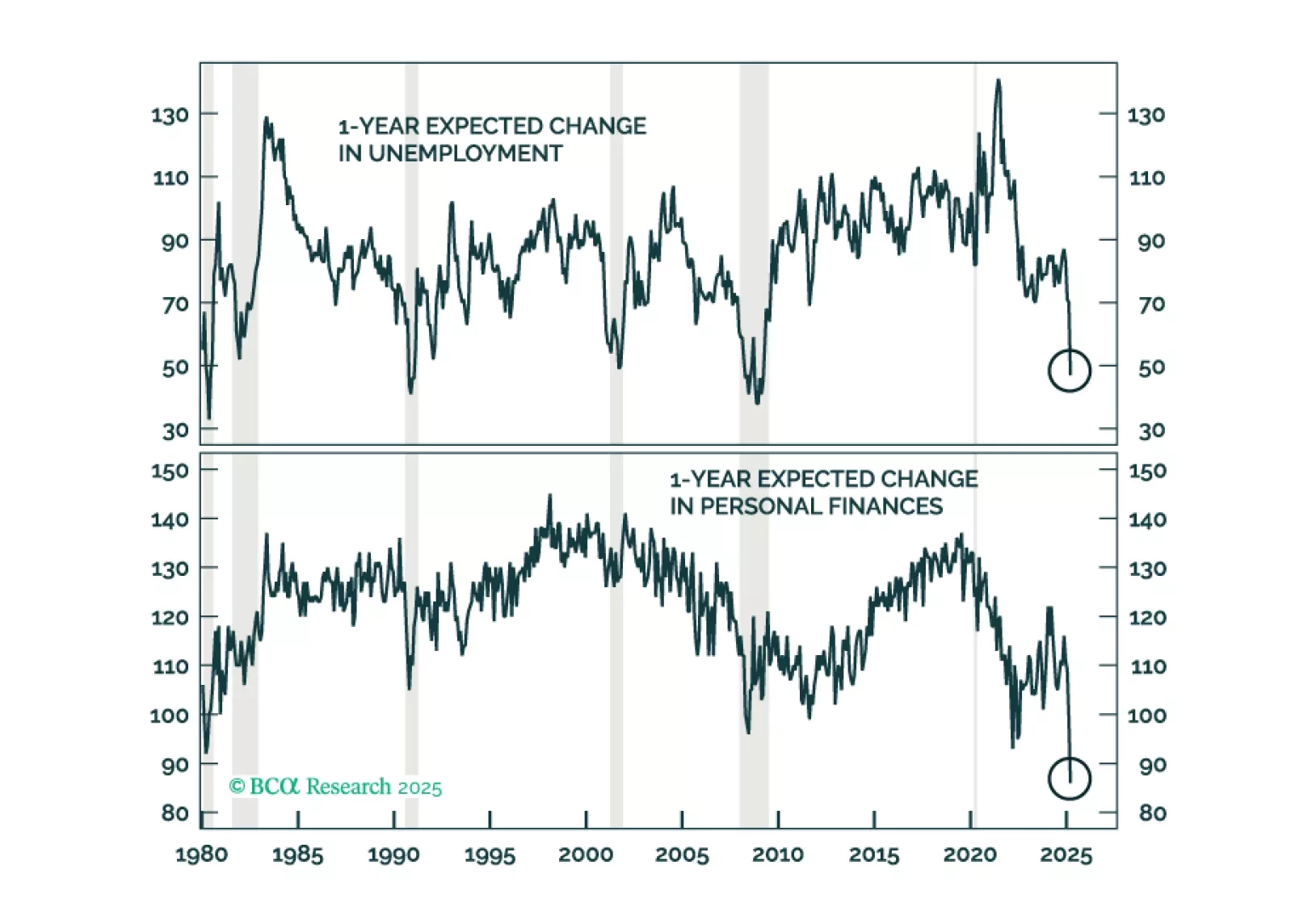

In Section I, Doug notes that weak US consumer sentiment is beginning to manifest. A wide sweep of consumer-facing companies have lowered guidance, and monoline credit card lenders shed nearly 20% over just three weeks across late…

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

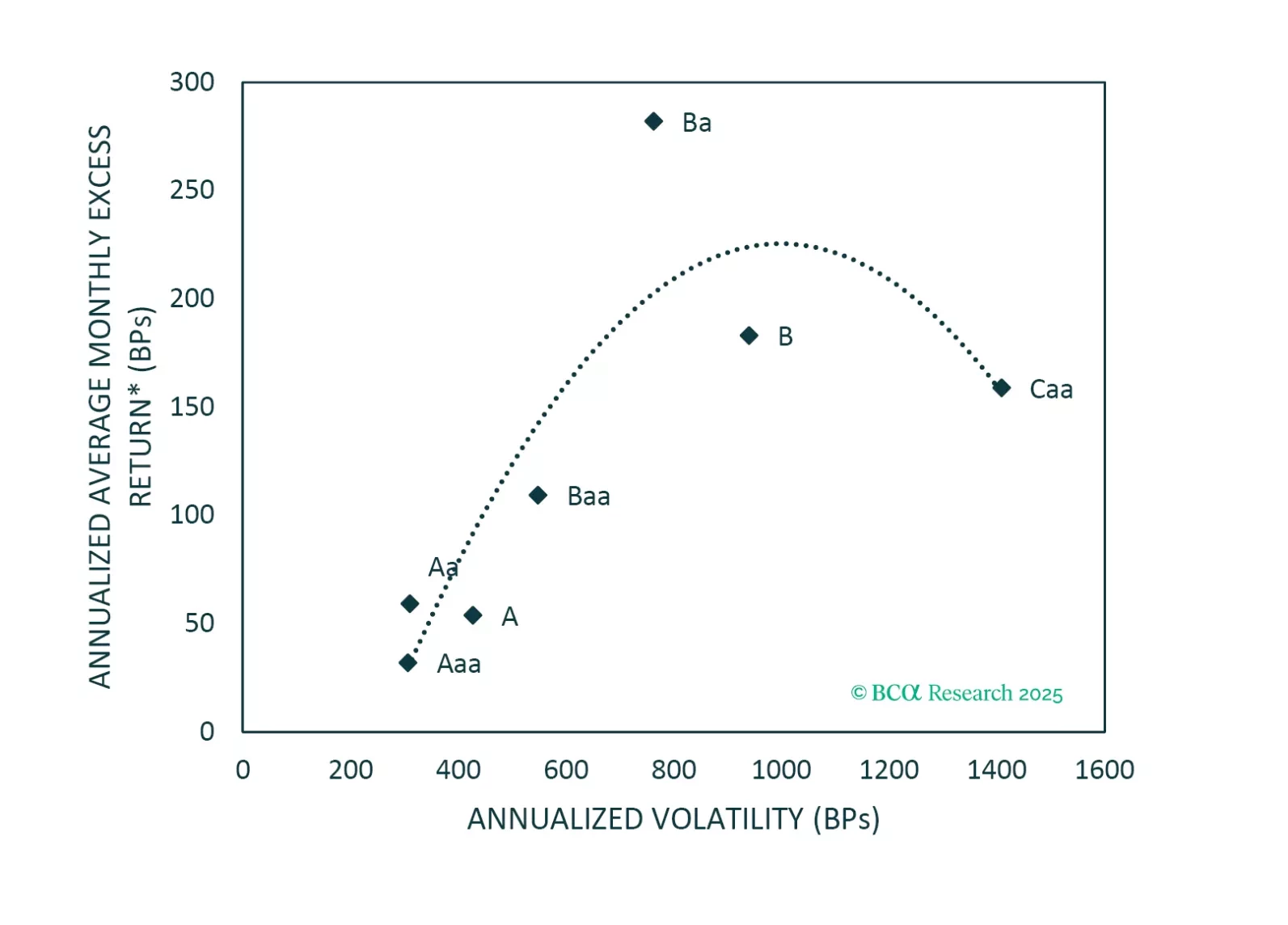

An analysis of historical data shows that Ba-rated bonds outperform other corporate credit tiers in the long-run on a risk-adjusted basis. That said, today’s fragile macro environment warrants a more cautious allocation.