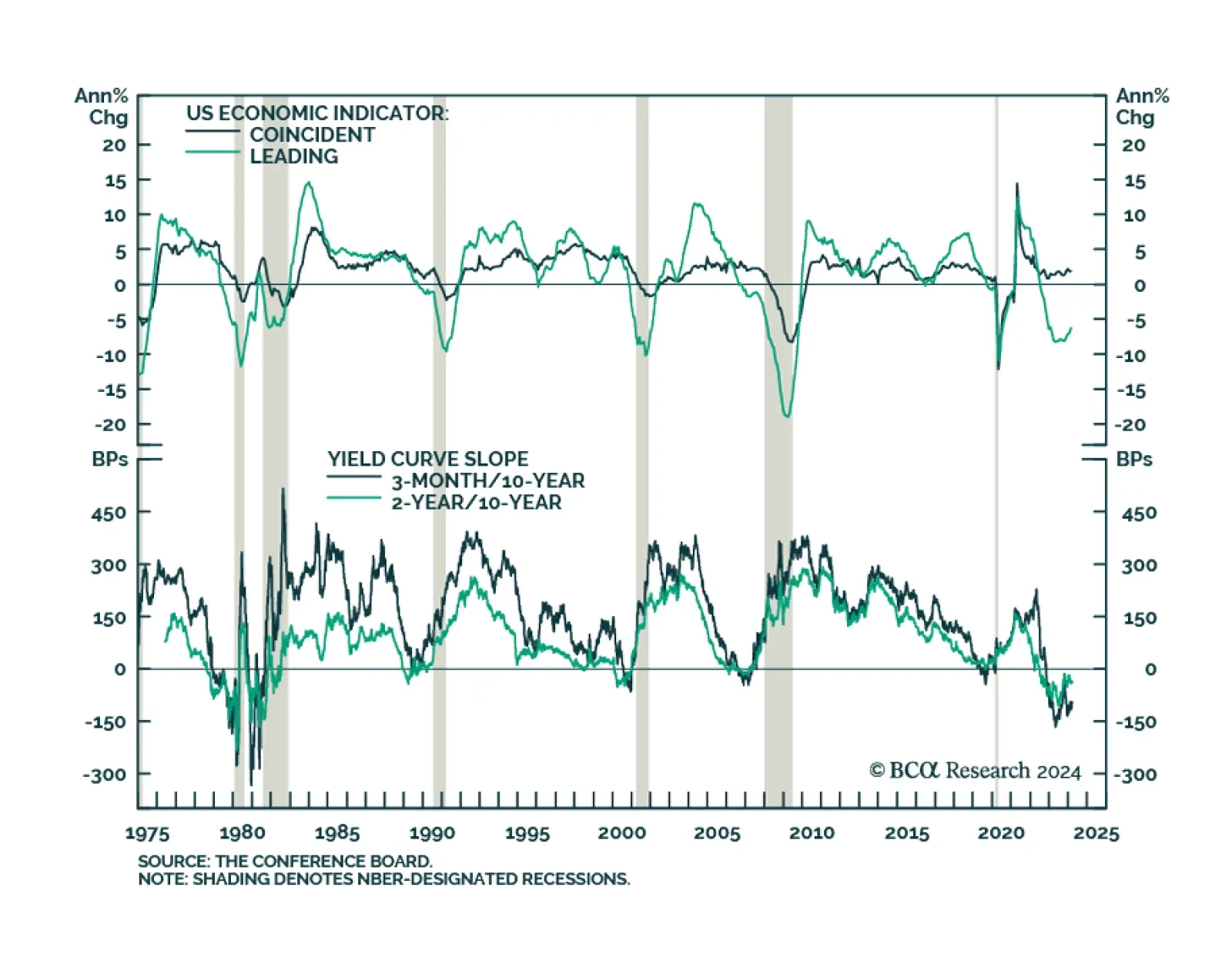

The US Conference Board’s Leading Economic Index (LEI) unexpectedly rose by 0.1% m/m in February, surprising anticipations that the pace of decline would ease from -0.4% m/m to -0.1% m/m. Equity gains and the…

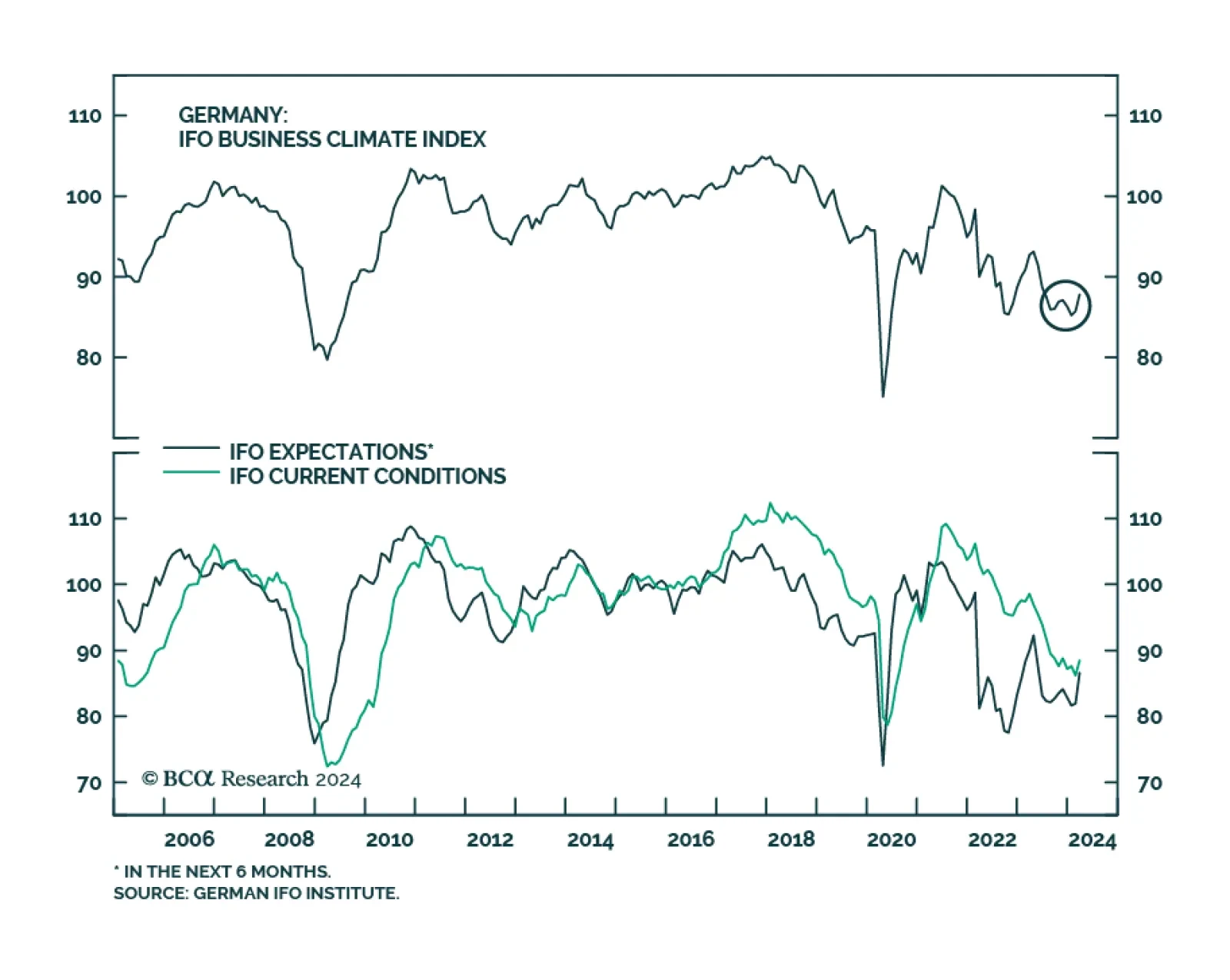

The 2.1-point increase in Germany’s Ifo Business Climate index in March brought it to a 9-month high of 87.8 and beat expectations of a more muted rise to 86.0. Both current economic conditions (+1.2 to 88.1) as well as…

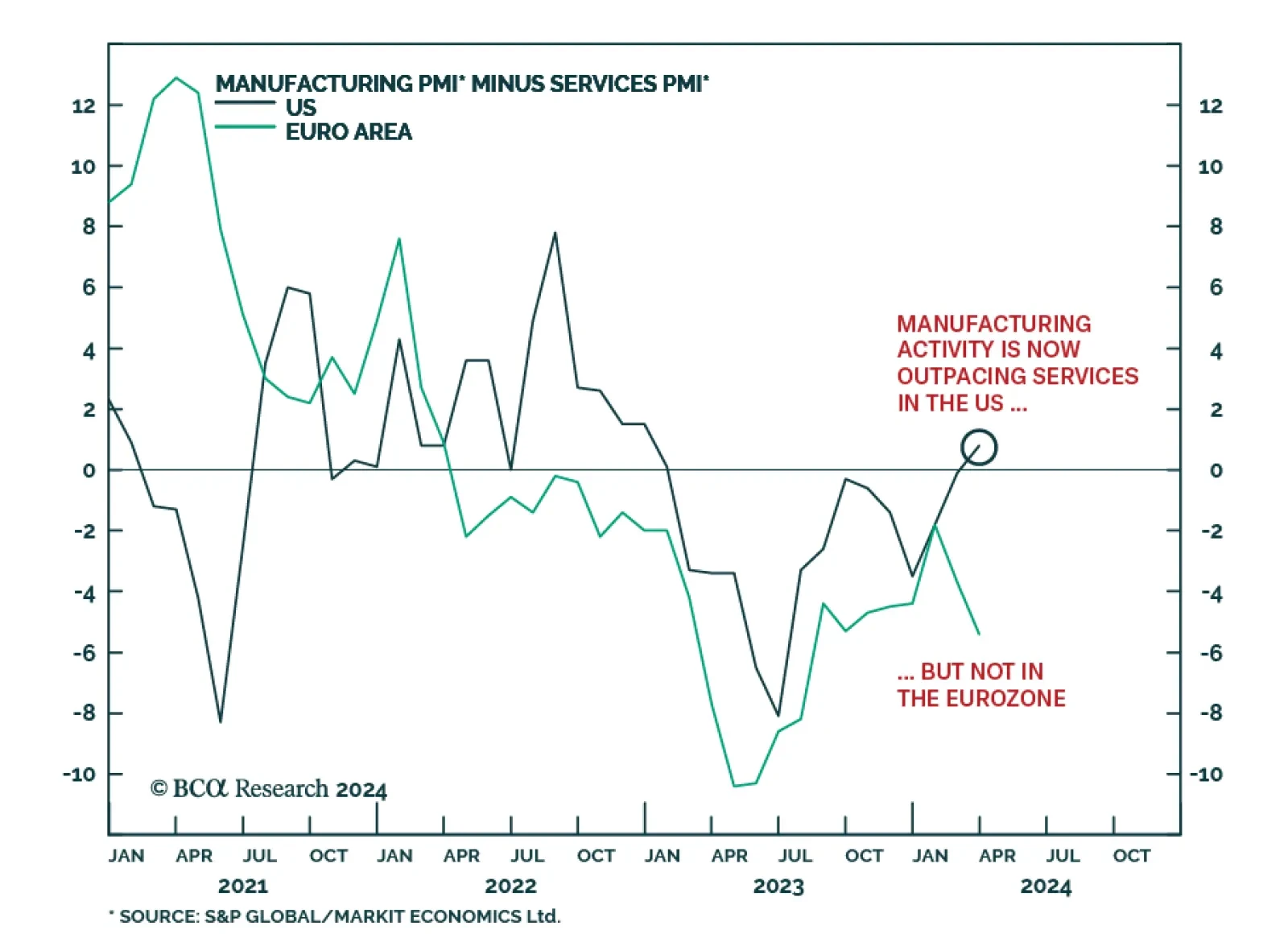

The flash PMI estimates for March produced a mixed update on manufacturing and service sector activity in the US and Eurozone. In the US, the results suggest that growth is more resilient in the manufacturing…

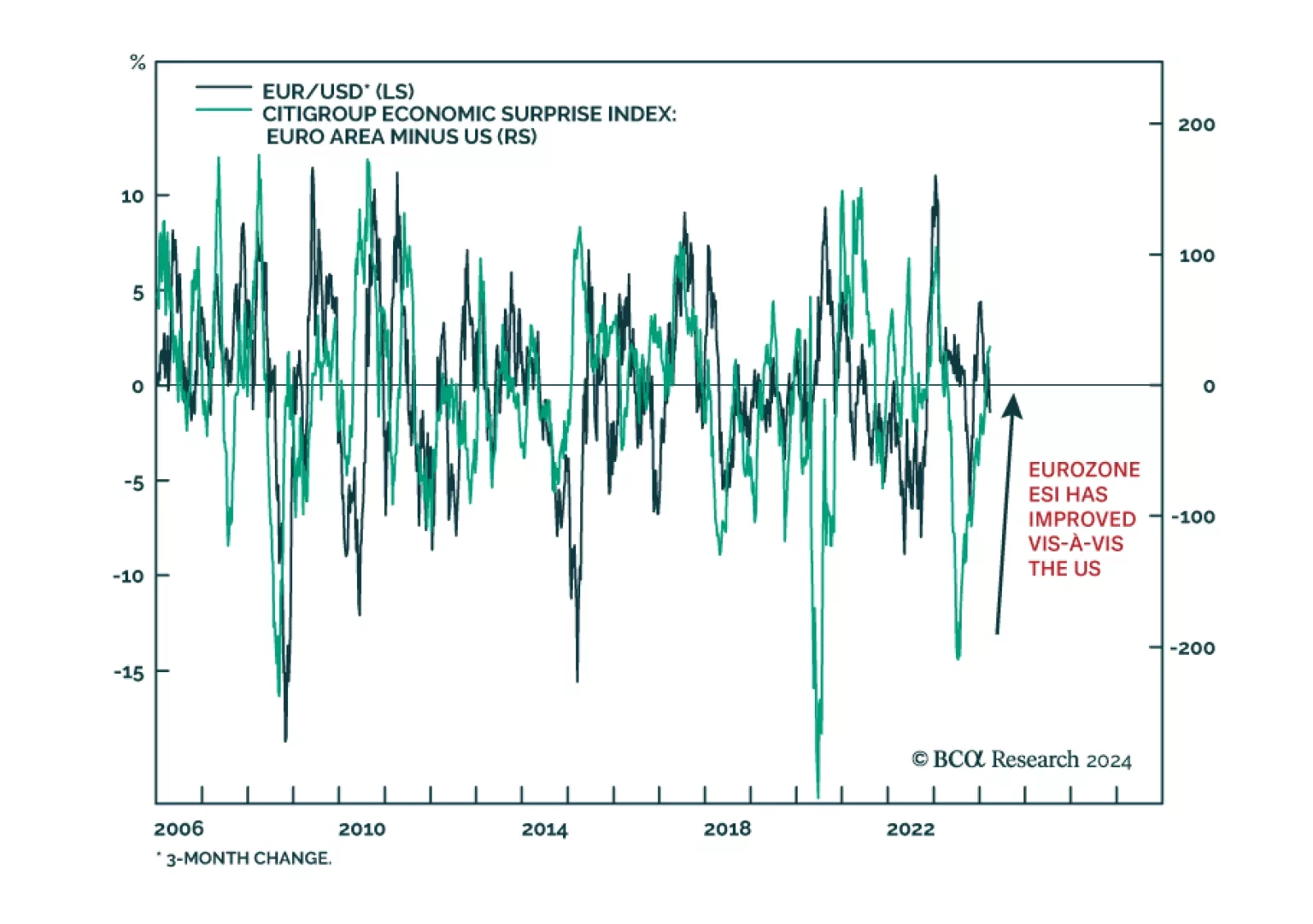

Citigroup’s economic surprise index for the Euro Area has been on a steady ascent since mid-2023. Its continued increase after breaking into positive territory at the start of February indicates that the region’s…

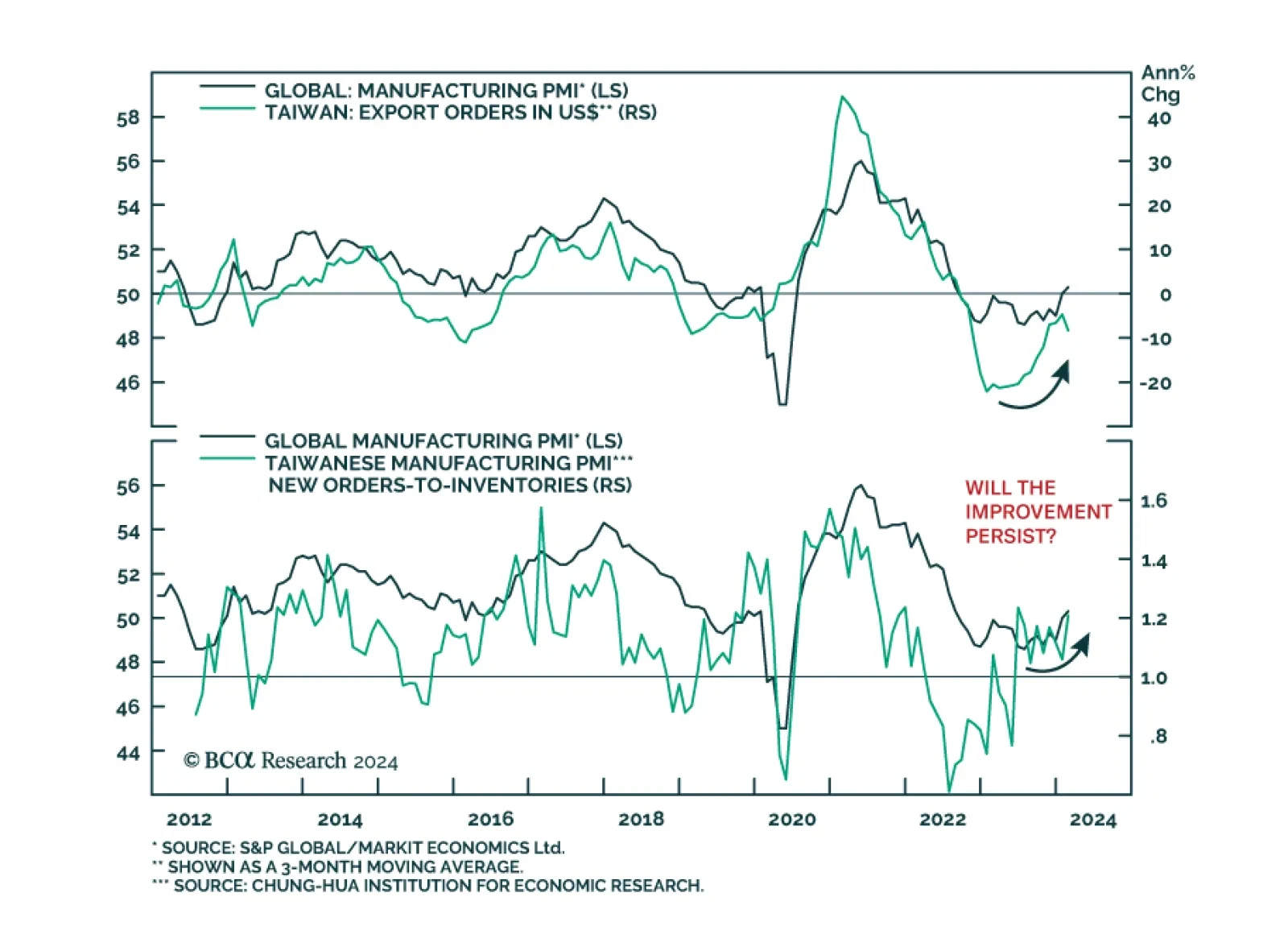

The 10.4% contraction in Taiwanese export orders for February delivered a negative surprise to expectations that the pace of expansion would slow from 1.9% y/y to 1.2% y/y. However, investors should not read too deeply into this…

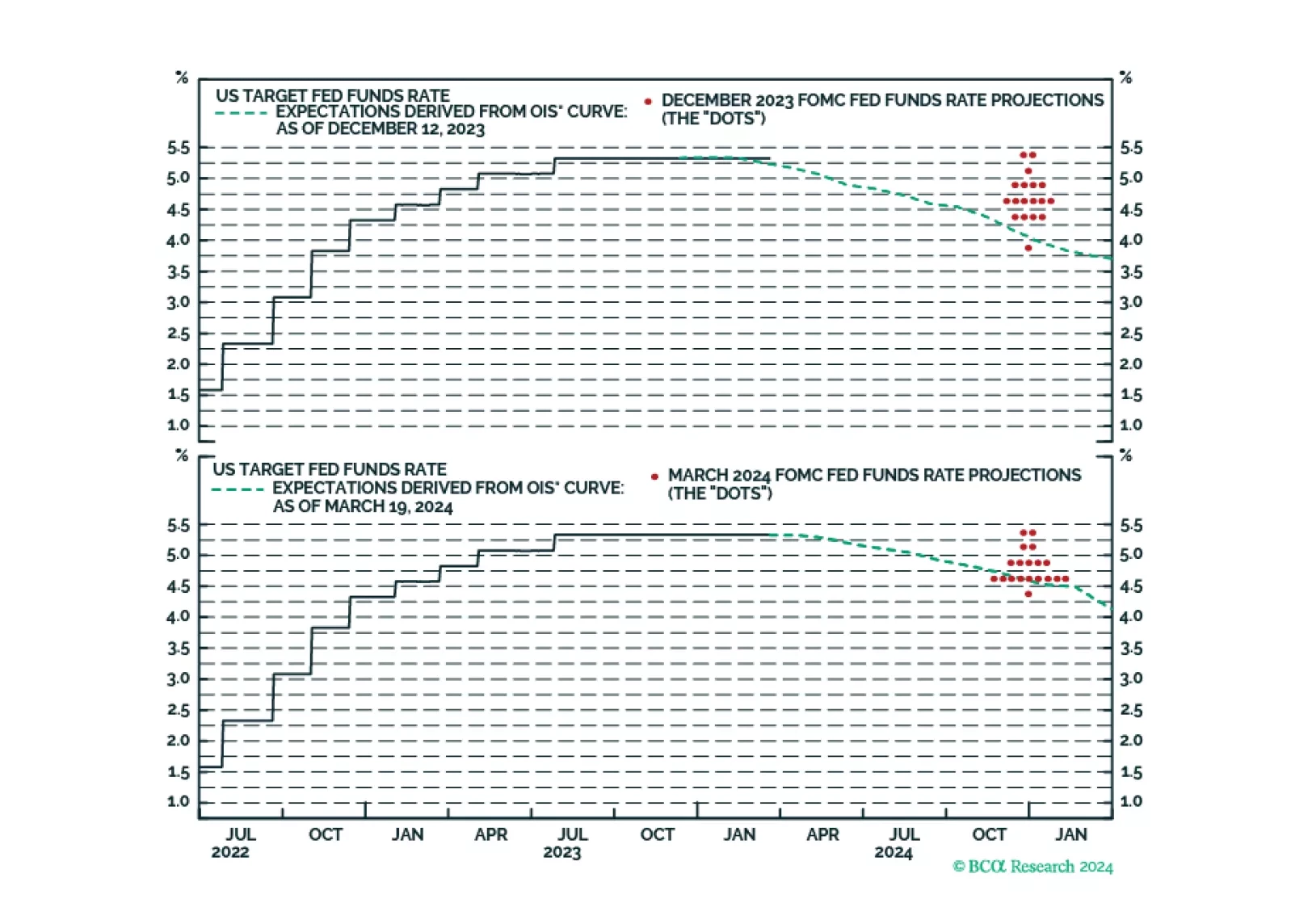

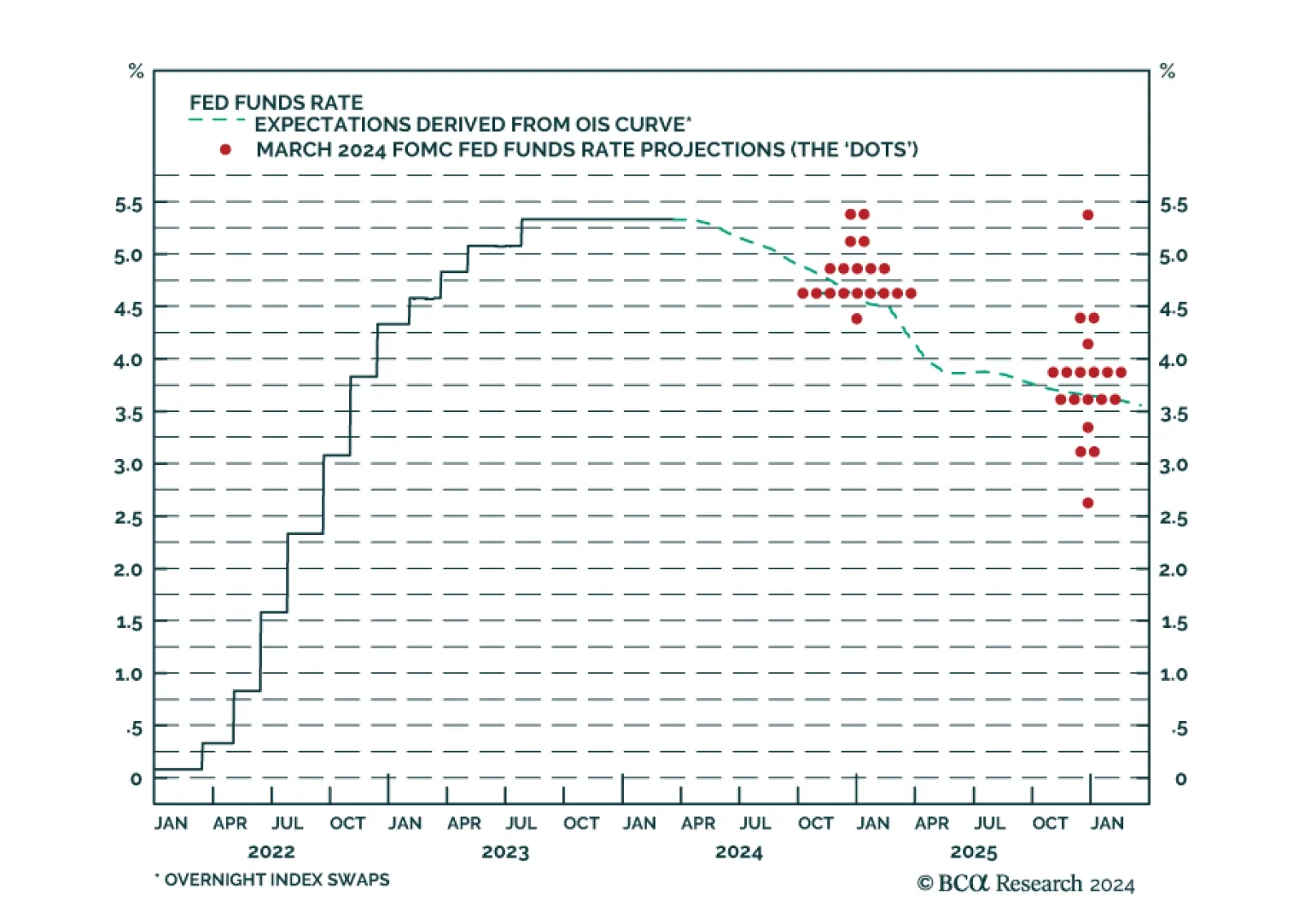

There were no meaningful adjustments to the Fed’s communication on Wednesday. The post meeting statement was essentially unchanged with Chair Jay Powell noting that the risks to achieving the Fed’s goals are coming…

Our takeaways from this afternoon’s FOMC meeting.

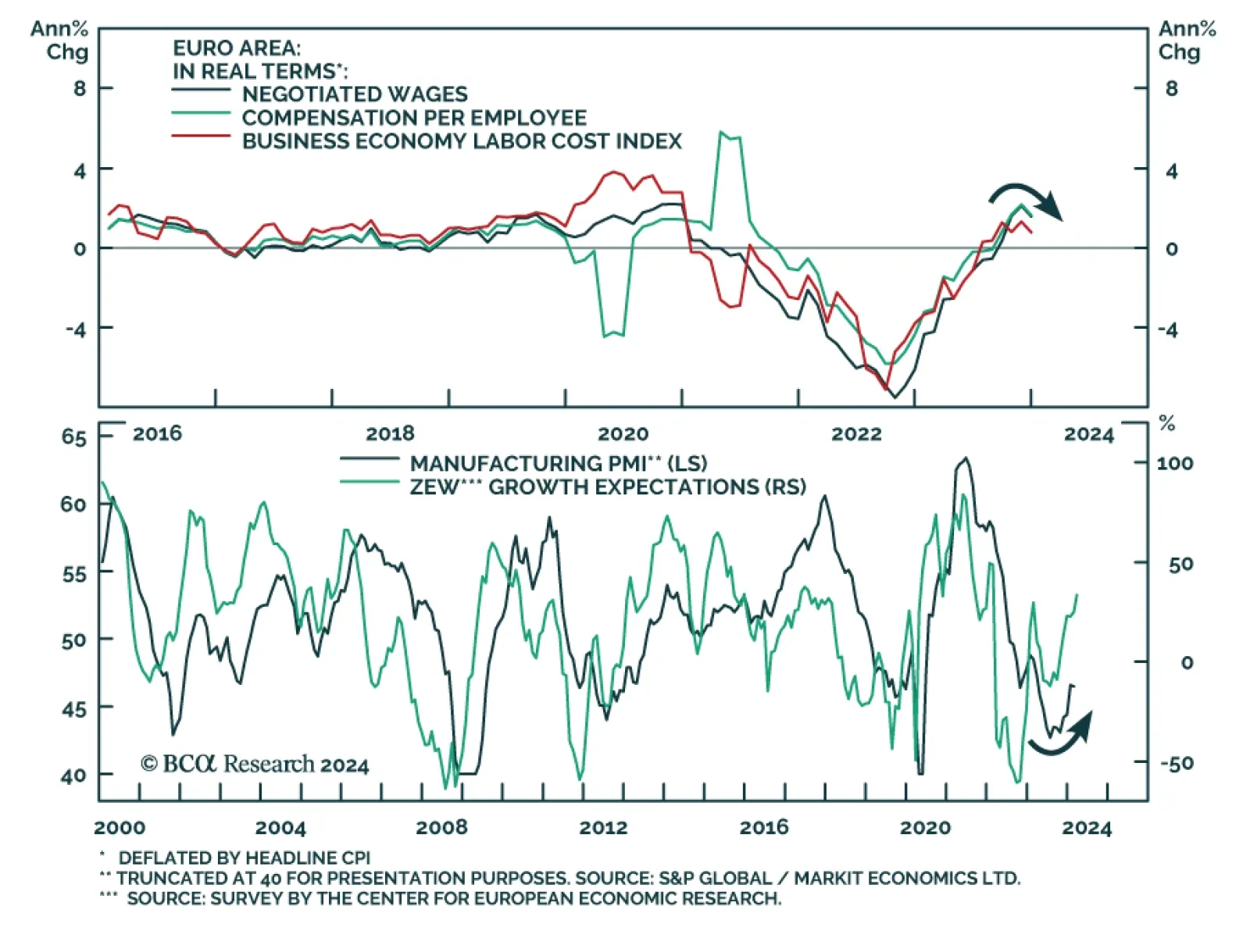

Various indicators of Eurozone wage growth have cooled off in recent months. Notably, the labor costs index eased sharply from a downwardly revised 5.2% y/y to 3.4% y/y in 2023Q4 – the slowest pace of increase since…

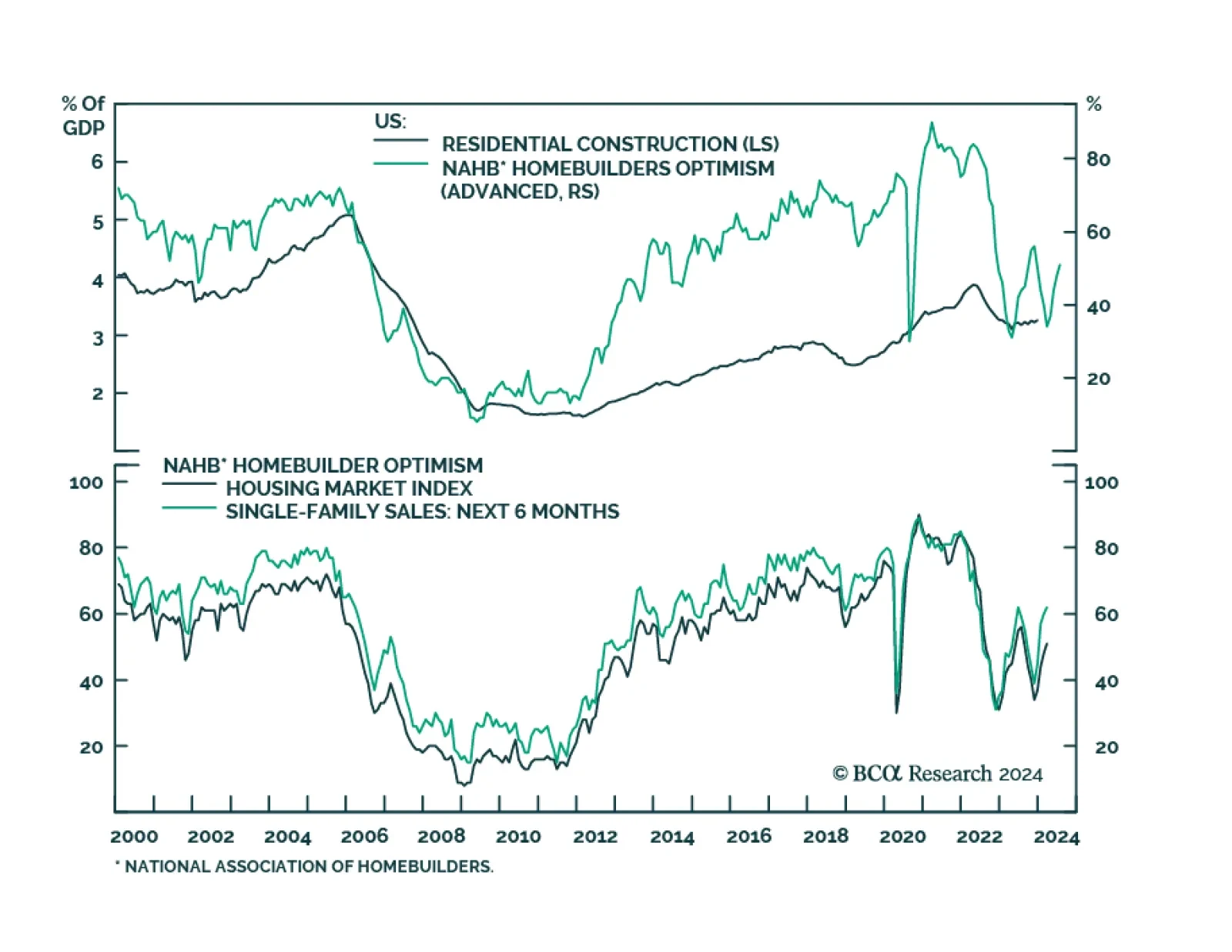

Indicators continue to point to resilient US housing market dynamics. The NAHB Housing Market Index increased for the fourth consecutive month to an 8-month high of 51 in March, beating expectations it would remain unchanged at…