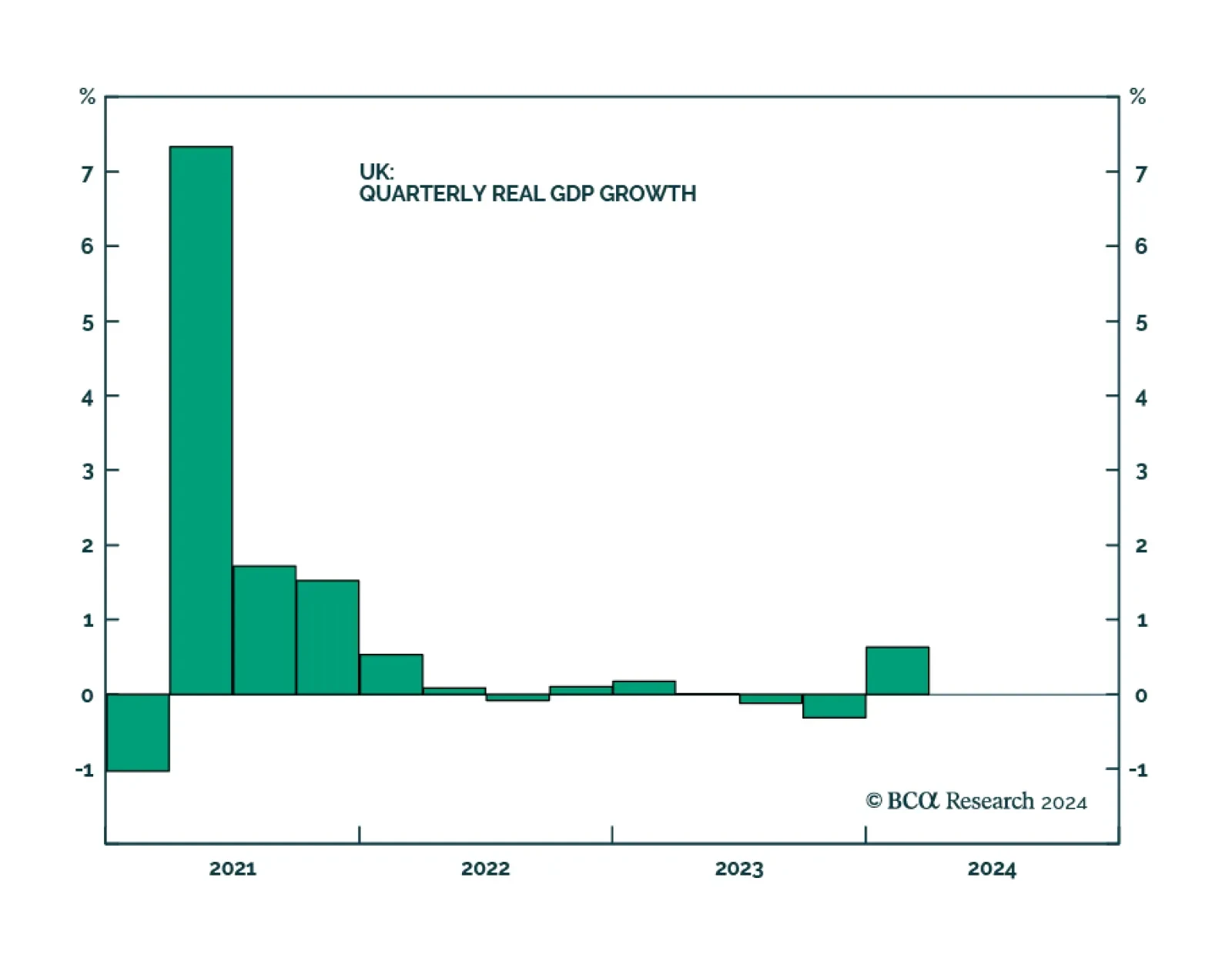

Preliminary GDP estimates suggest that the UK economy started growing again in Q1, thus exiting a technical recession in the past two quarters. Q1 growth came in at 0.6%, improving from a 0.3% contraction last quarter,…

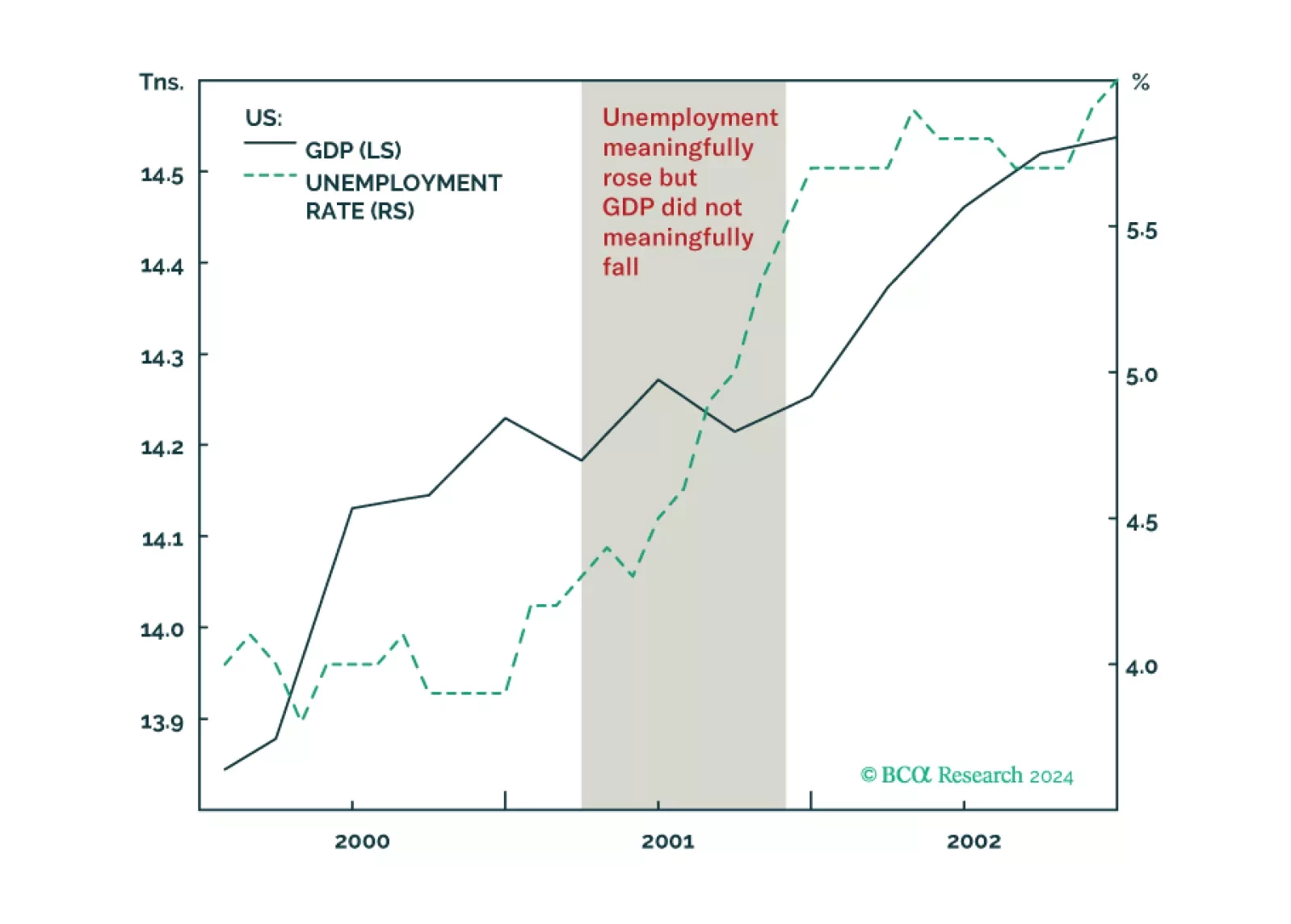

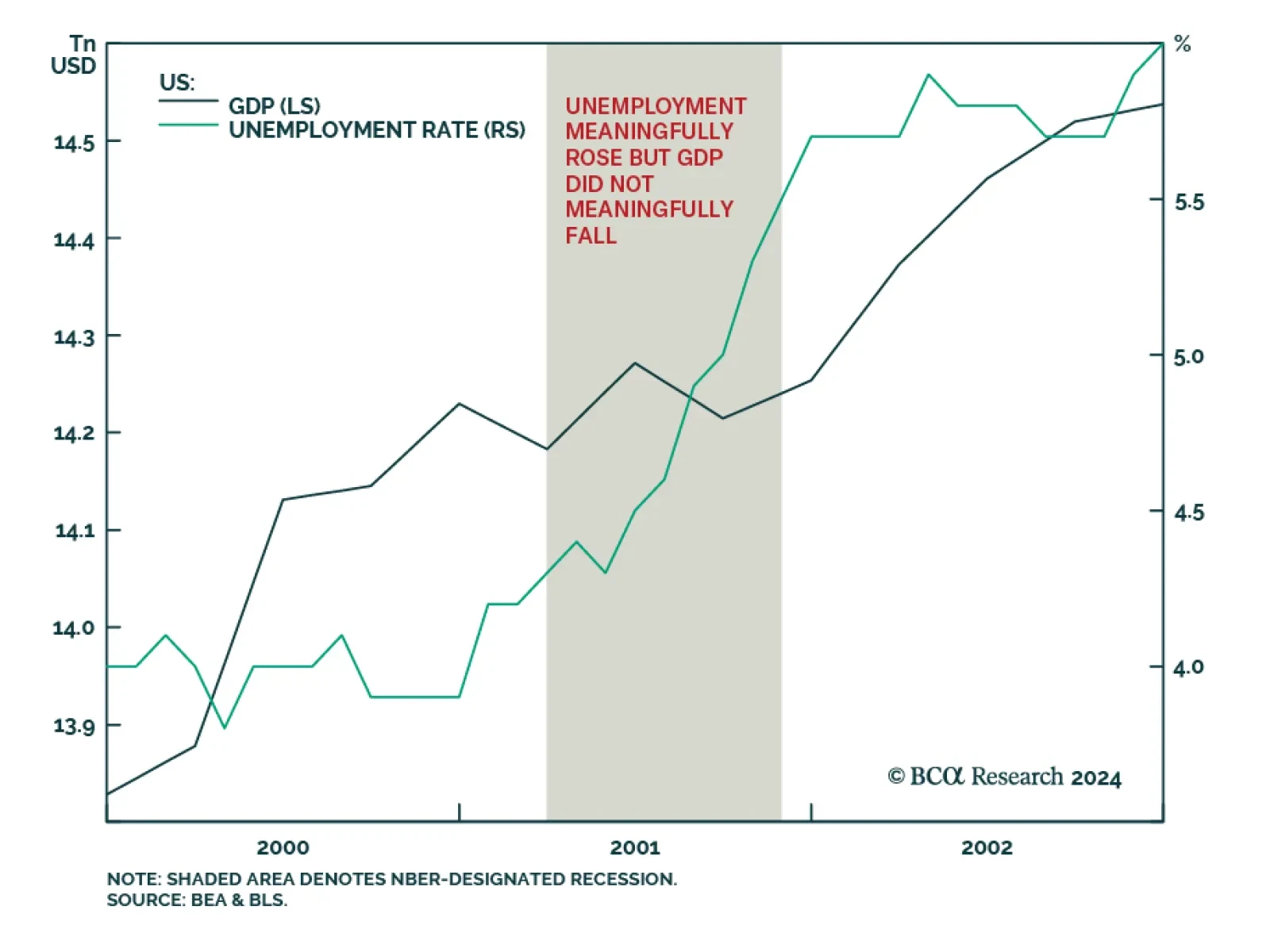

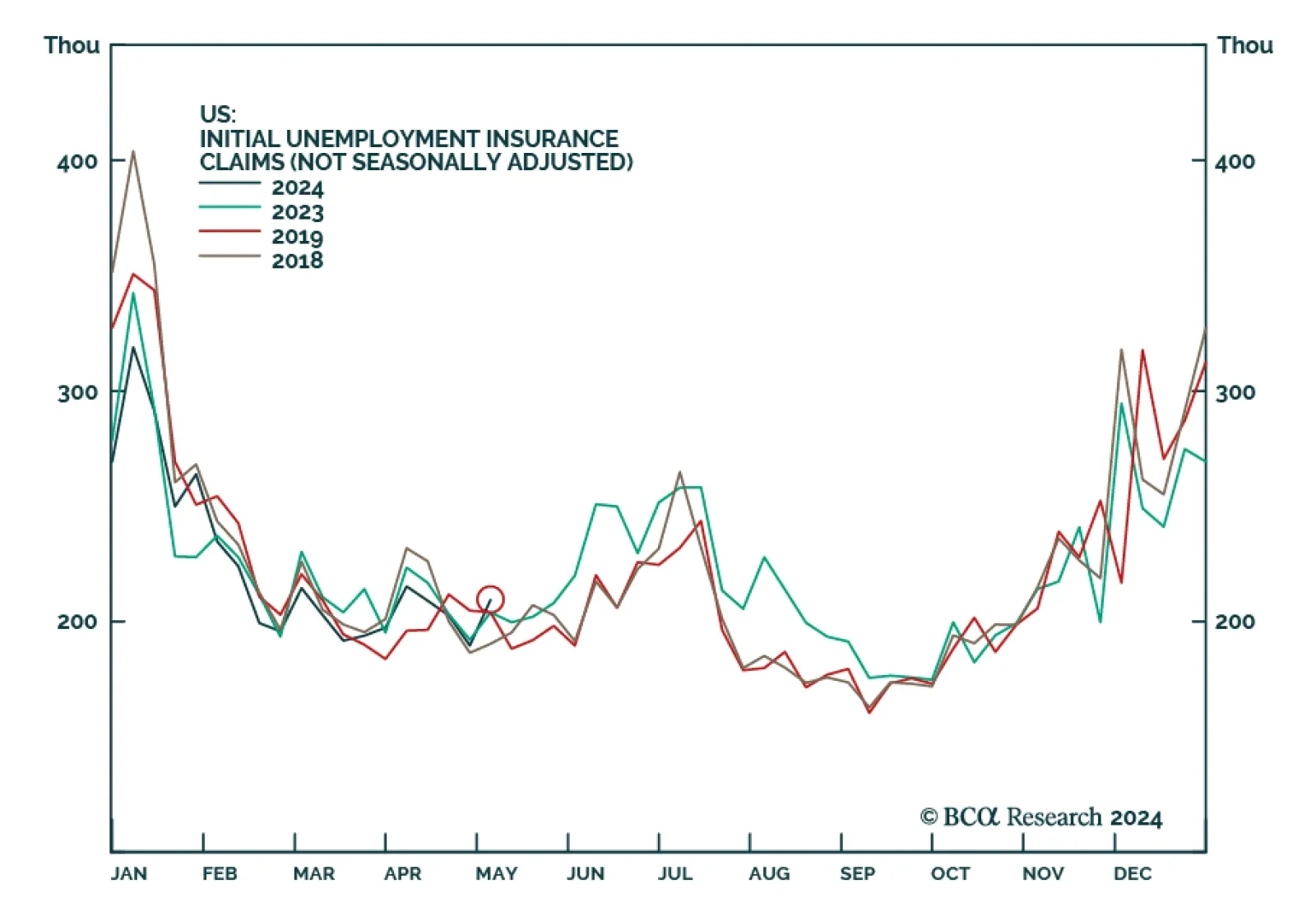

According to BCA Research’s Counterpoint service, it is possible that there will be a jobs recession without an economic recession in the US, as happened in 2001. The Fed is “trying to cool demand and work with…

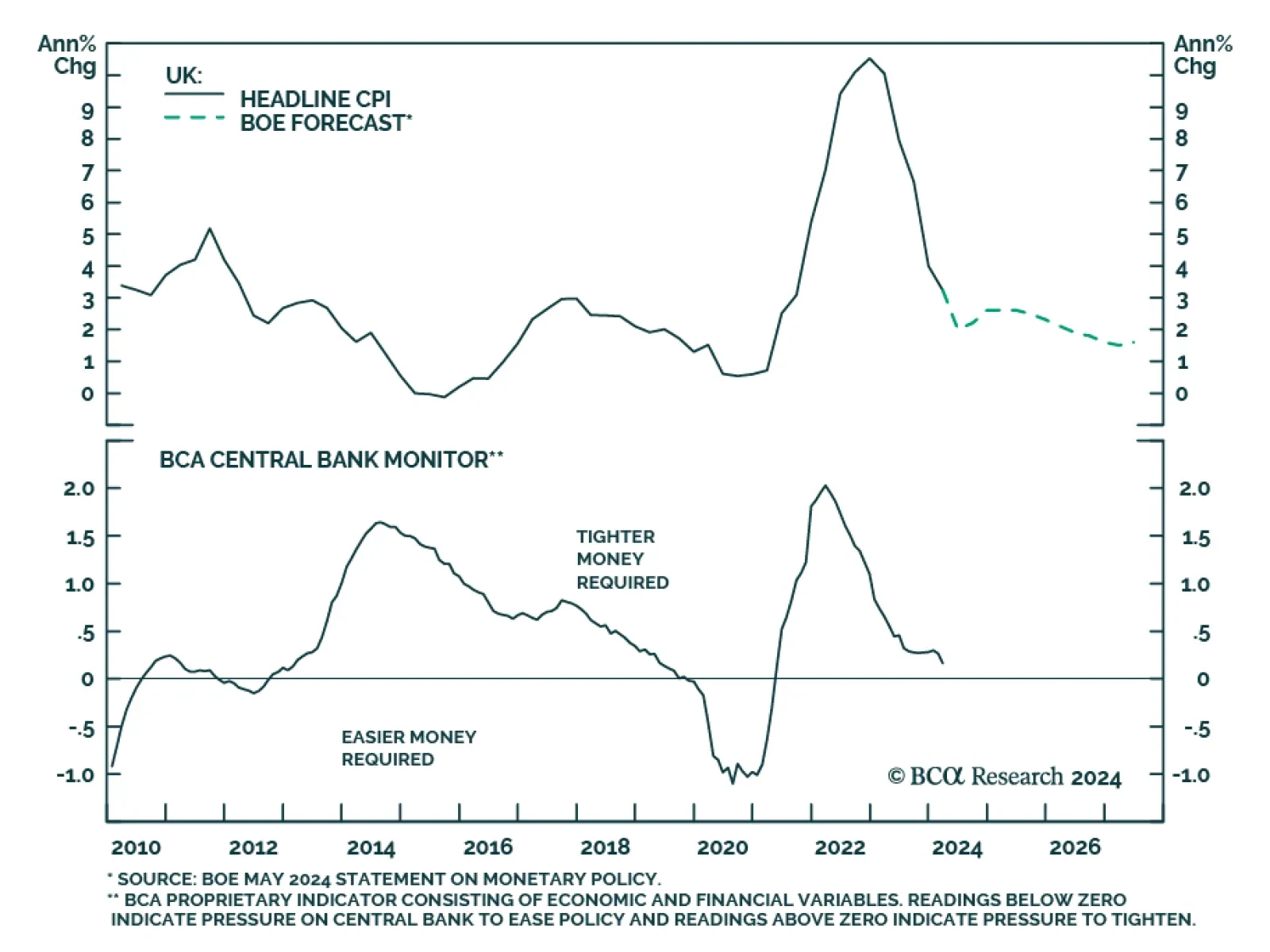

In a widely expected move, the Bank of England (BoE) maintained its policy rate at 5.25% in May. Nevertheless, two Committee Members voted in favor of cutting rates, one more than was anticipated. The tone of the report was…

US initial jobless claims increased from 209 thousand last week to 231 thousand, surpassing expectations of 212 thousand. Moreover, continuing claims also surprised to the upside, increasing from 1.768 million to 1.785 million…

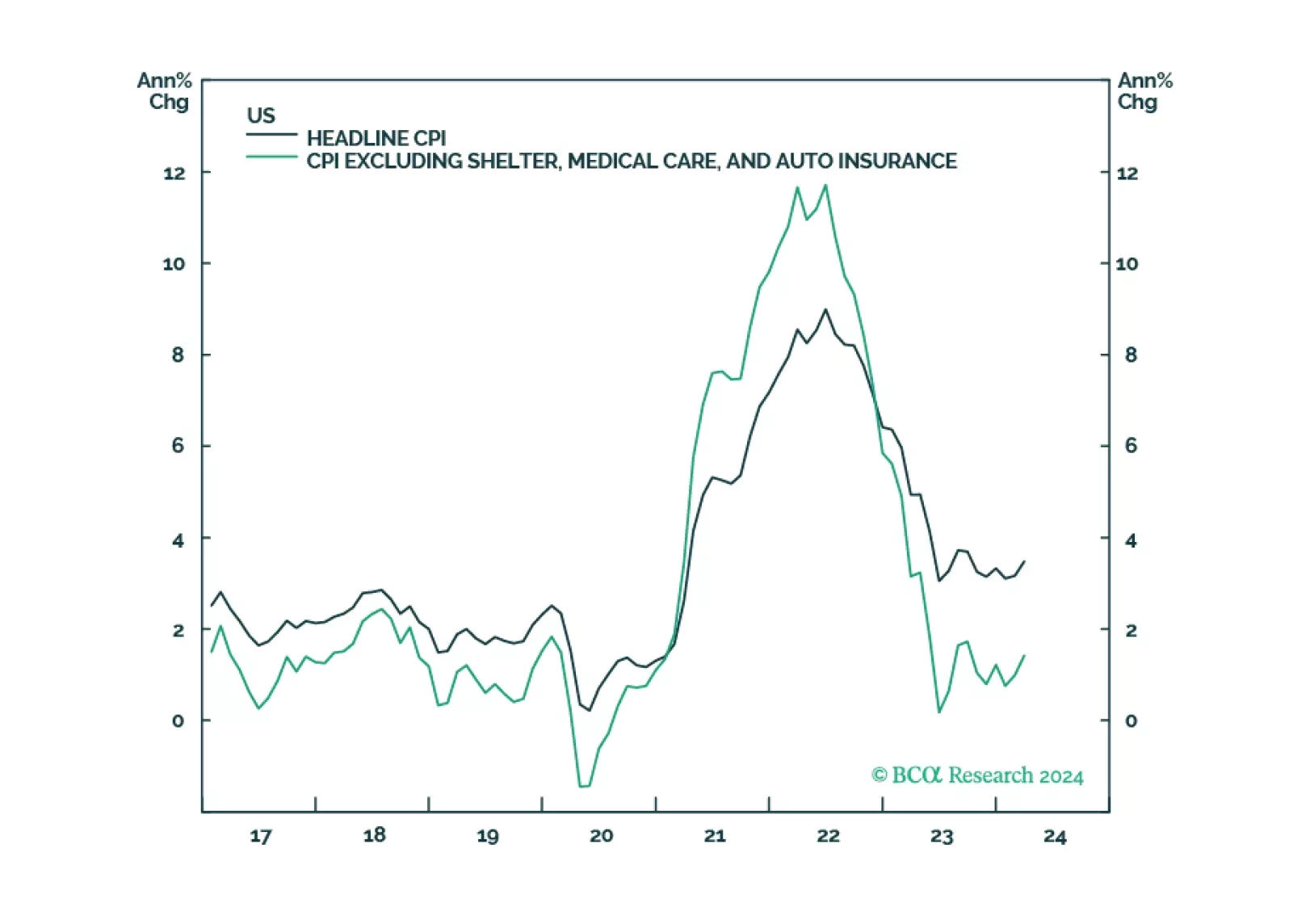

In this week’s report, we defend four out-of-consensus claims. Claim #1: Underlying inflation in the US is not reaccelerating. Claim #2: The US labor market is set to weaken abruptly. Claim #3: The S&P 500 will drop to 3700 in…

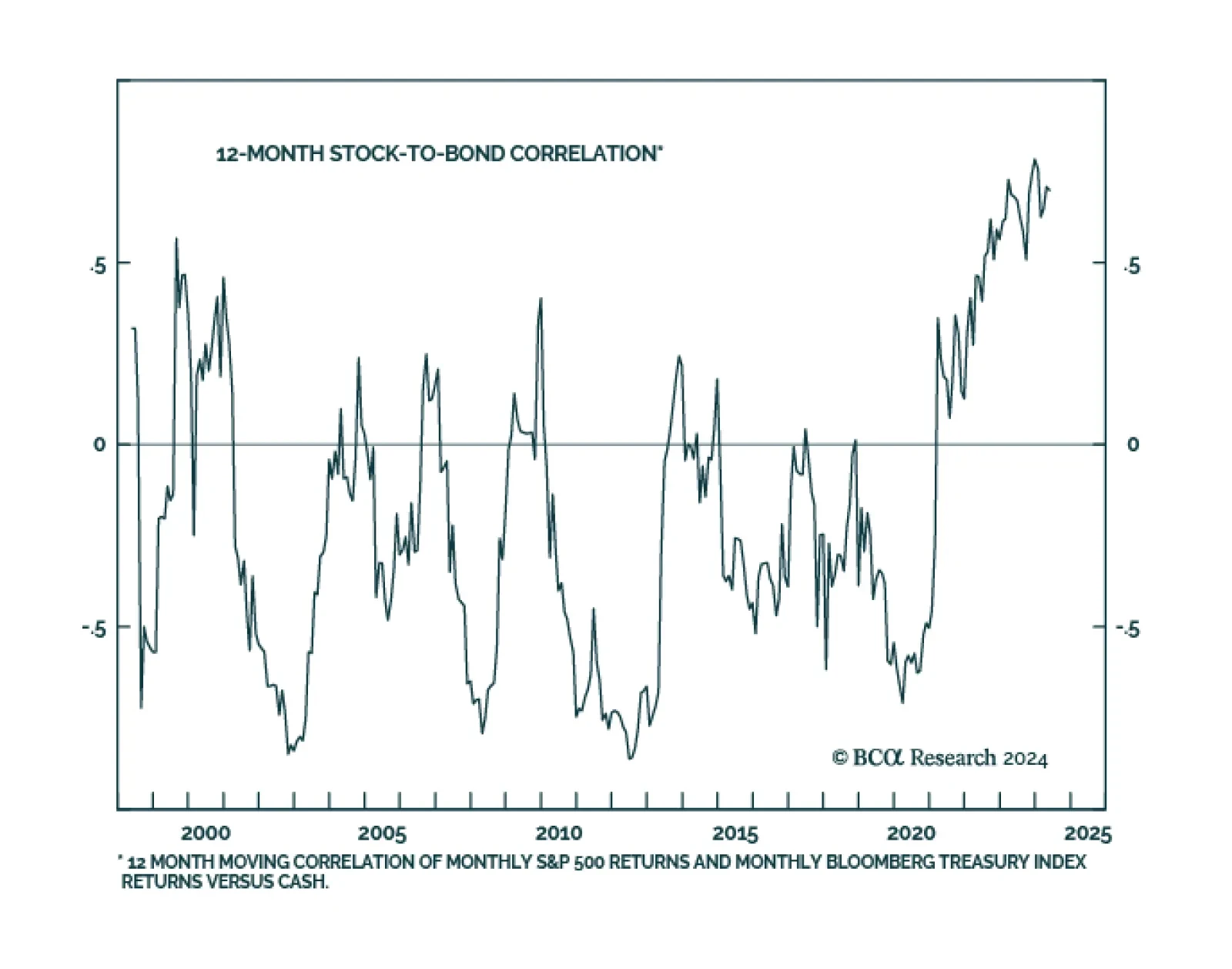

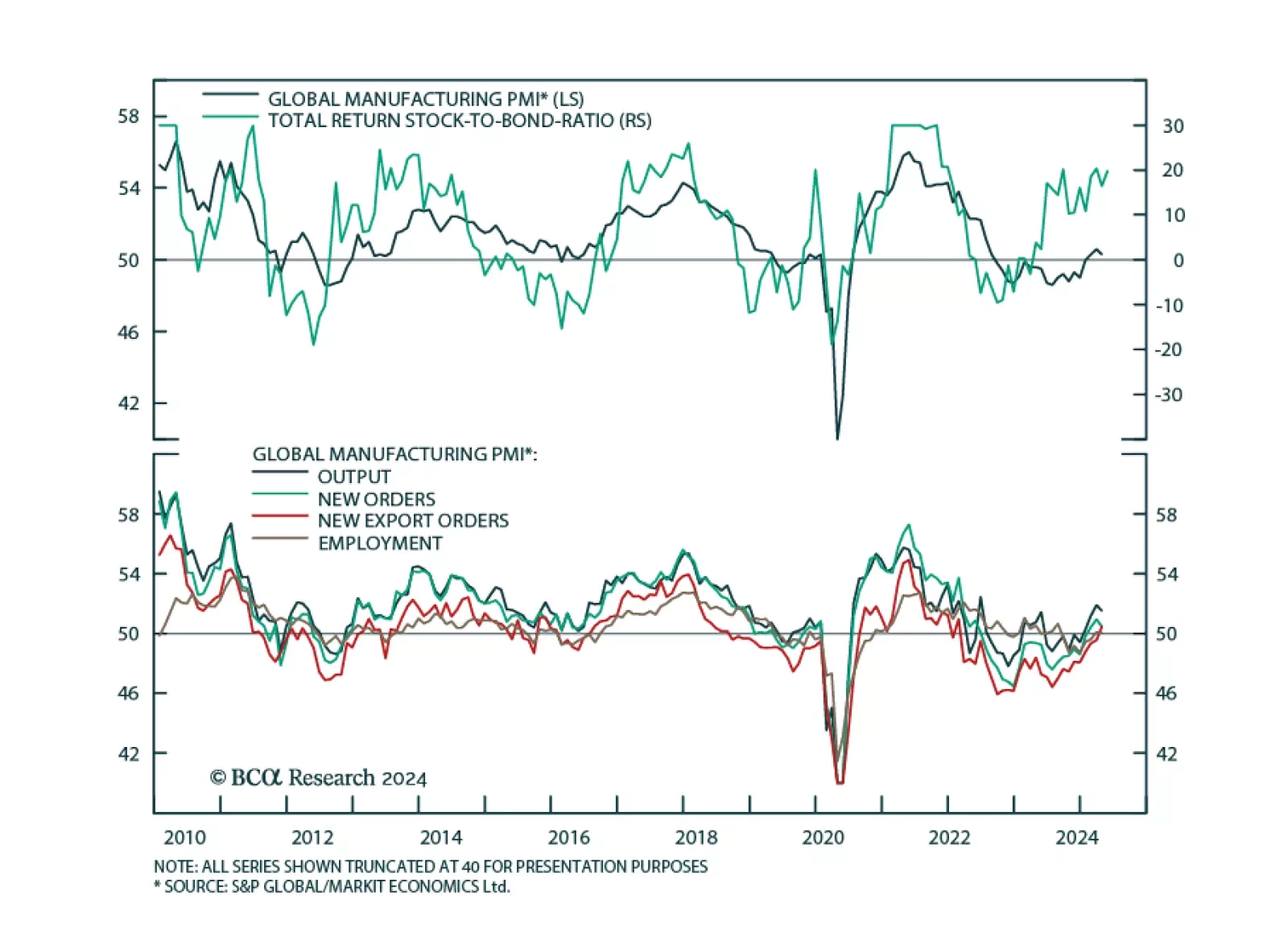

According to BCA Research’s US Bond Strategy service, investors should look to the stock-to-bond ratio to time the breakout in yields. The strong positive correlation between stock and bond returns has been a consistent…

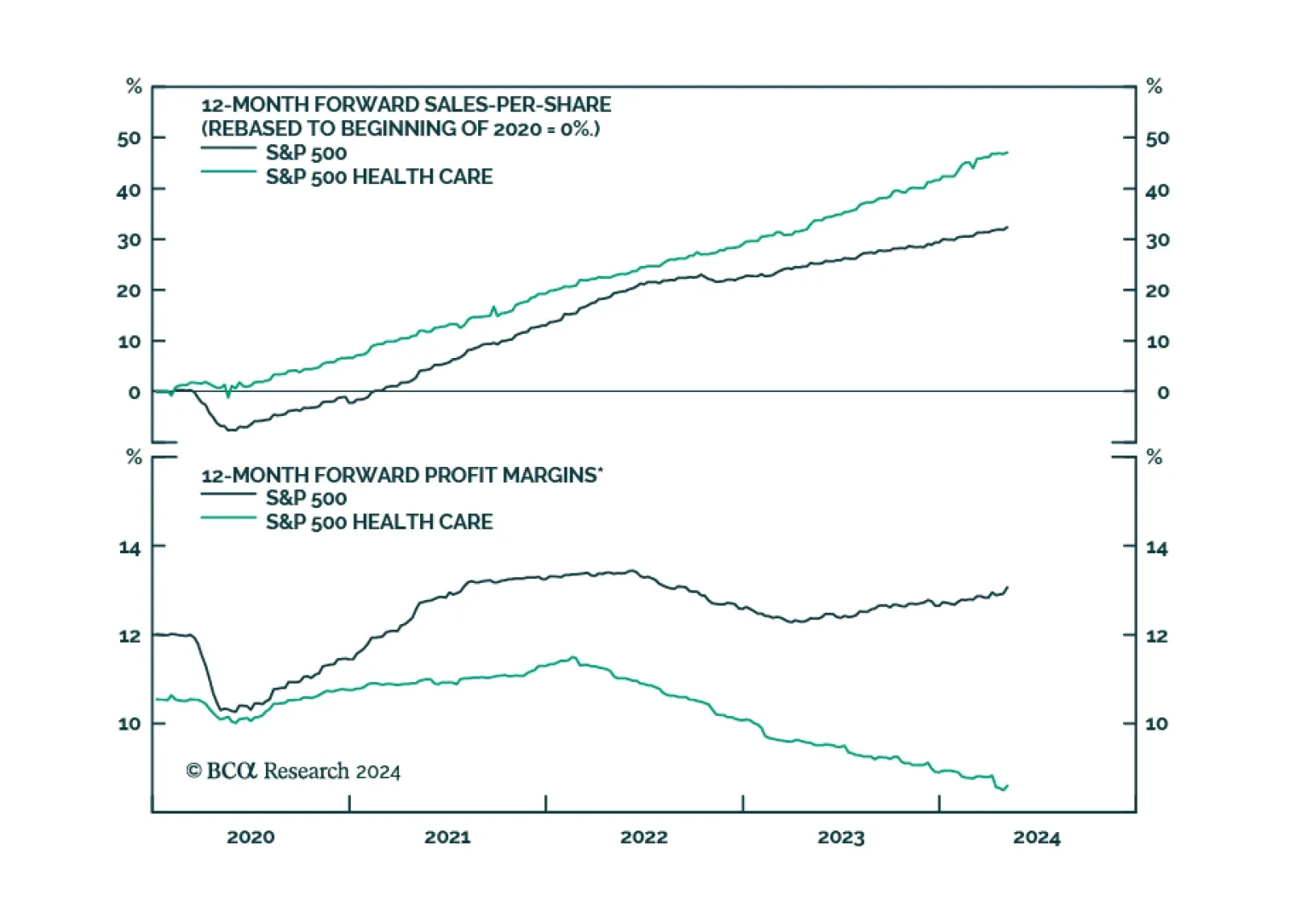

Health care stocks have underperformed the US broad market by over 20% since the beginning of 2023. Indeed, vaccination campaigns during the pandemic years had initially boosted health care companies’ earnings. However,…

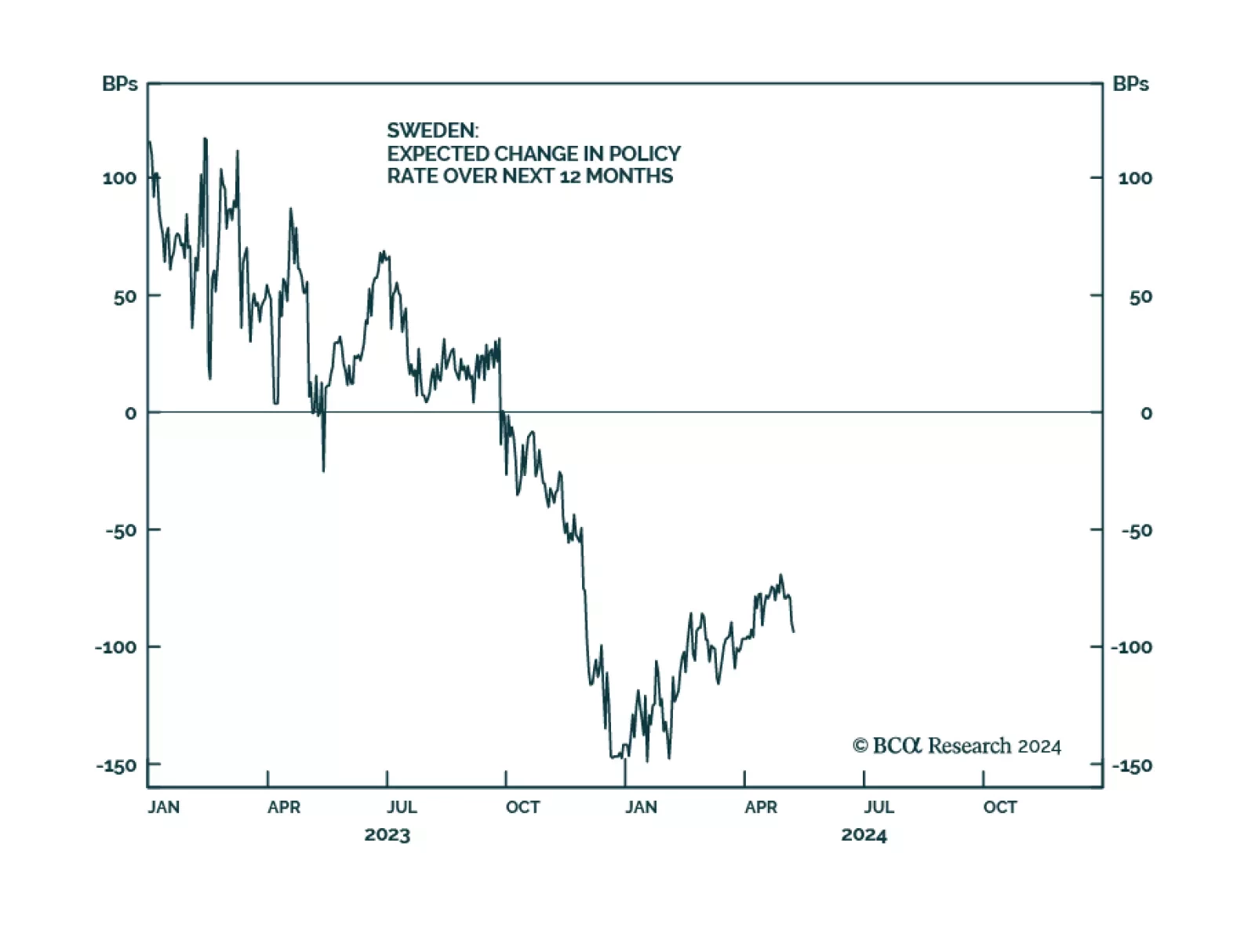

In a widely expected move, the Riksbank cut its policy rate by 25 basis points on Wednesday from 4% to 3.75%. The policy statement highlighted that inflation is approaching its 2% target, that leading indicators are pointing to…

The revival in global growth momentum continued in April. The JPM Global Manufacturing PMI came in at 50.3, marking its third consecutive month of expansion. Details underscored solid demand conditions. Output and new orders…

Why the US could get a jobs recession without a GDP recession, as happened in 2001, and what it means for stocks and bonds. Plus, an update on the Joshi rule.