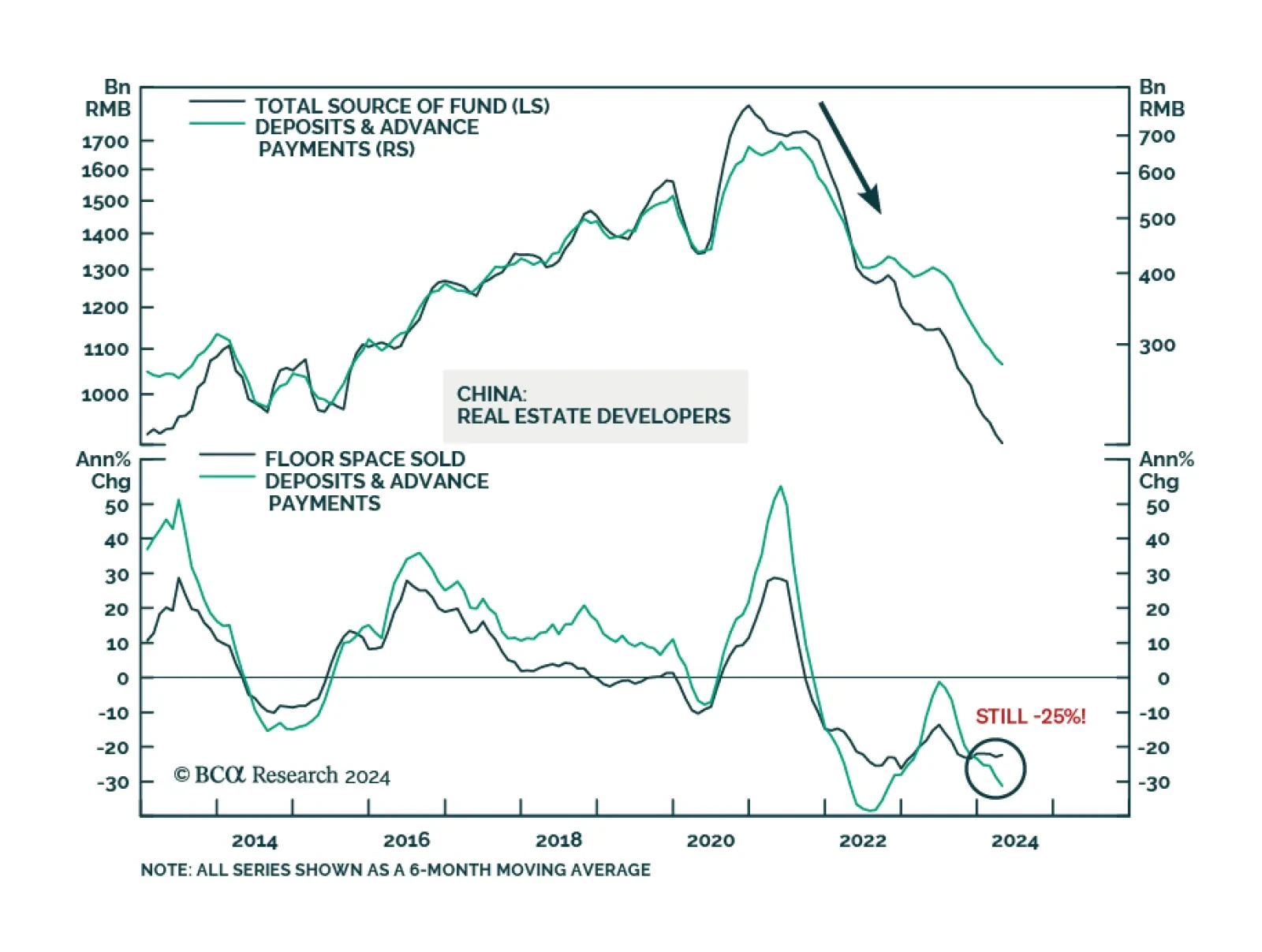

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…

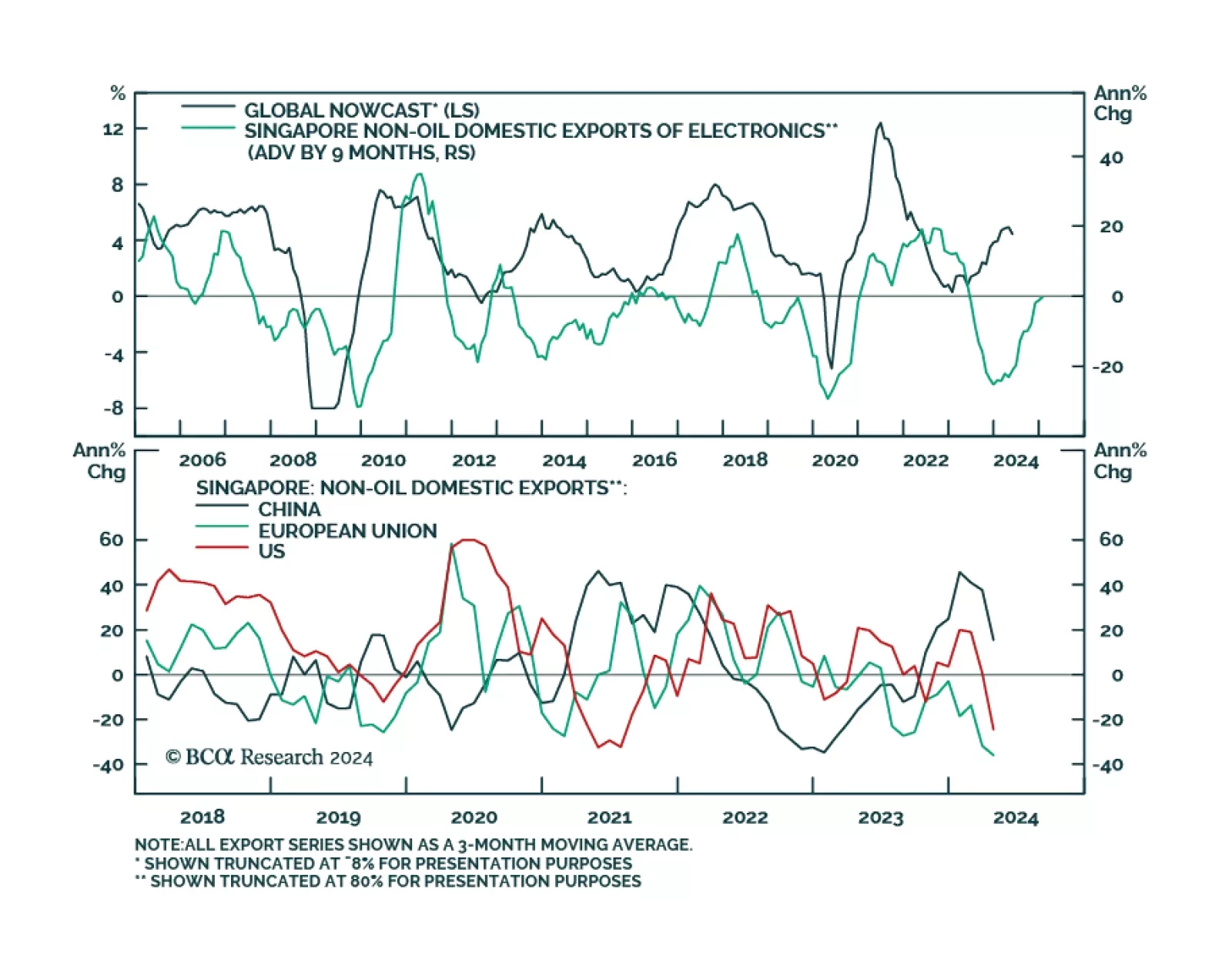

Export dynamics from small open economies are bellwethers for global trade and recent export data out of Taiwan and South Korea suggested robust global growth momentum in March. In April, Singapore’s electronics exports…

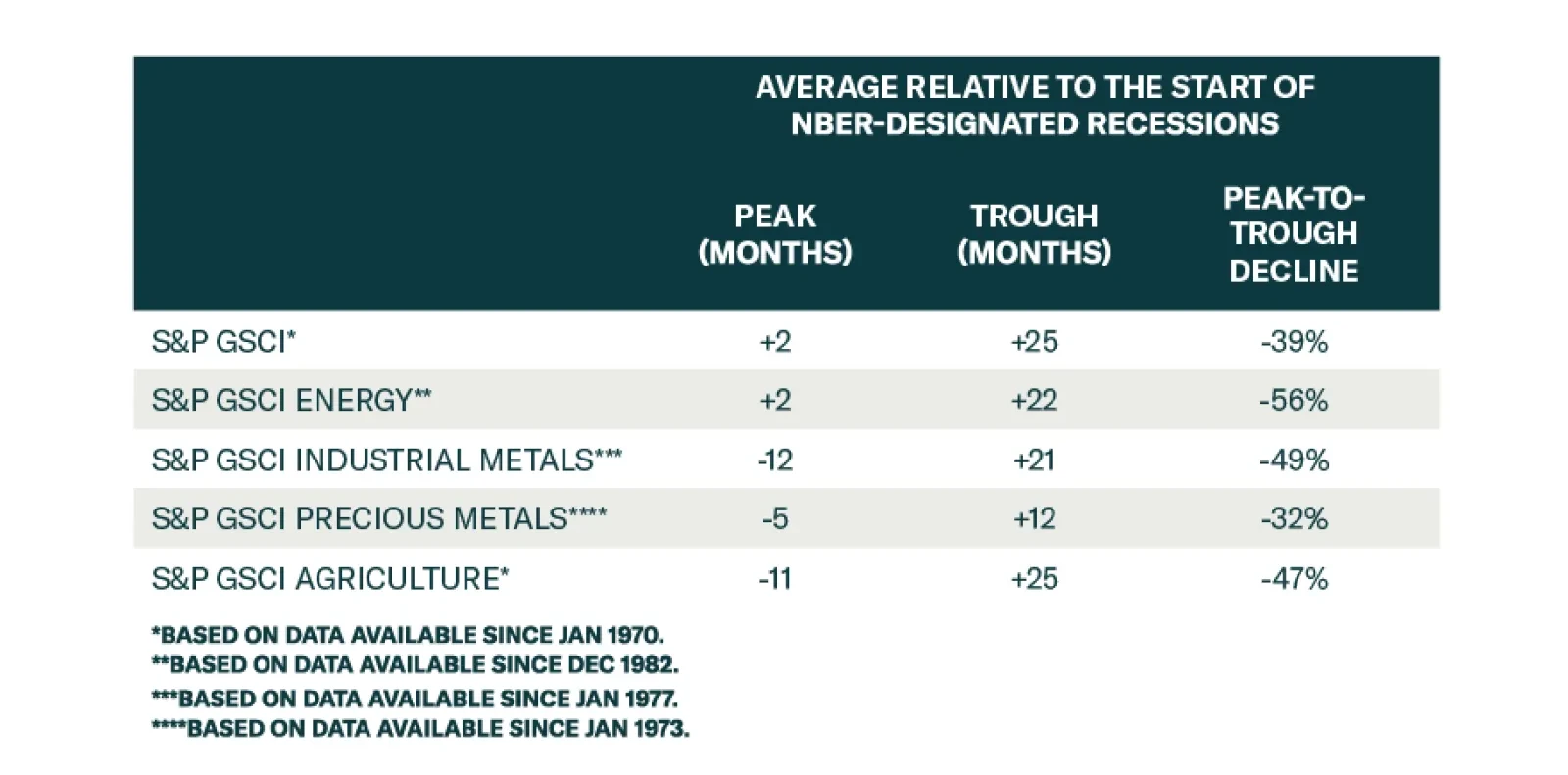

According to BCA Research’s Commodity & Energy Strategy service, among the commodity groups, industrial metals provide the most reliable leading signal that the US economy is heading toward recession. Industrial metals…

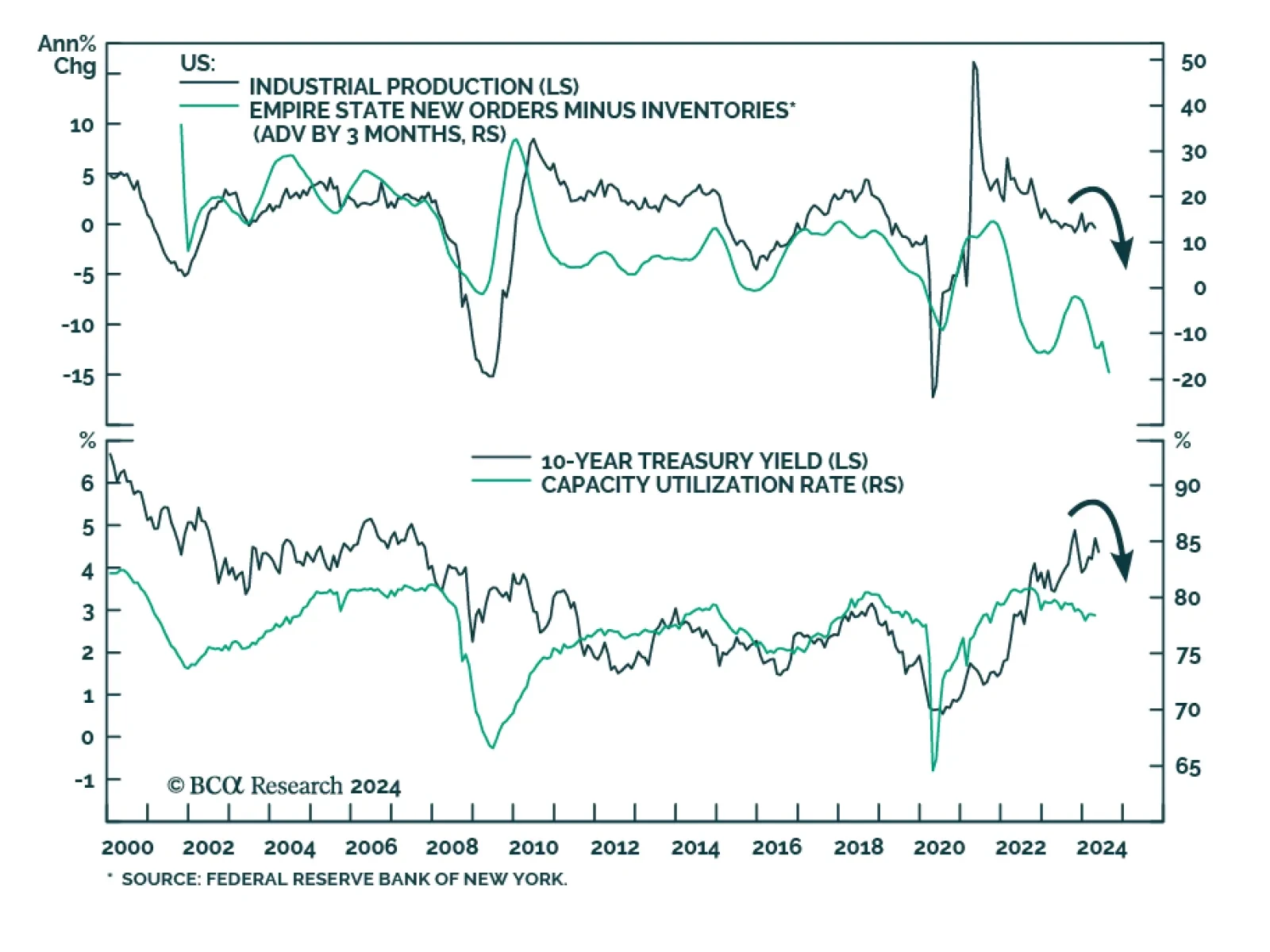

US industrial production stalled in April against expectations of a moderate pace of growth (0.1% m/m) and March’s growth rate was revised lower from 0.4% m/m to 0.1% m/m. Notably, pro-cyclical manufacturing production…

The stock market will suffer a setback from the weakening labor market and a rebound in US and global policy uncertainty.

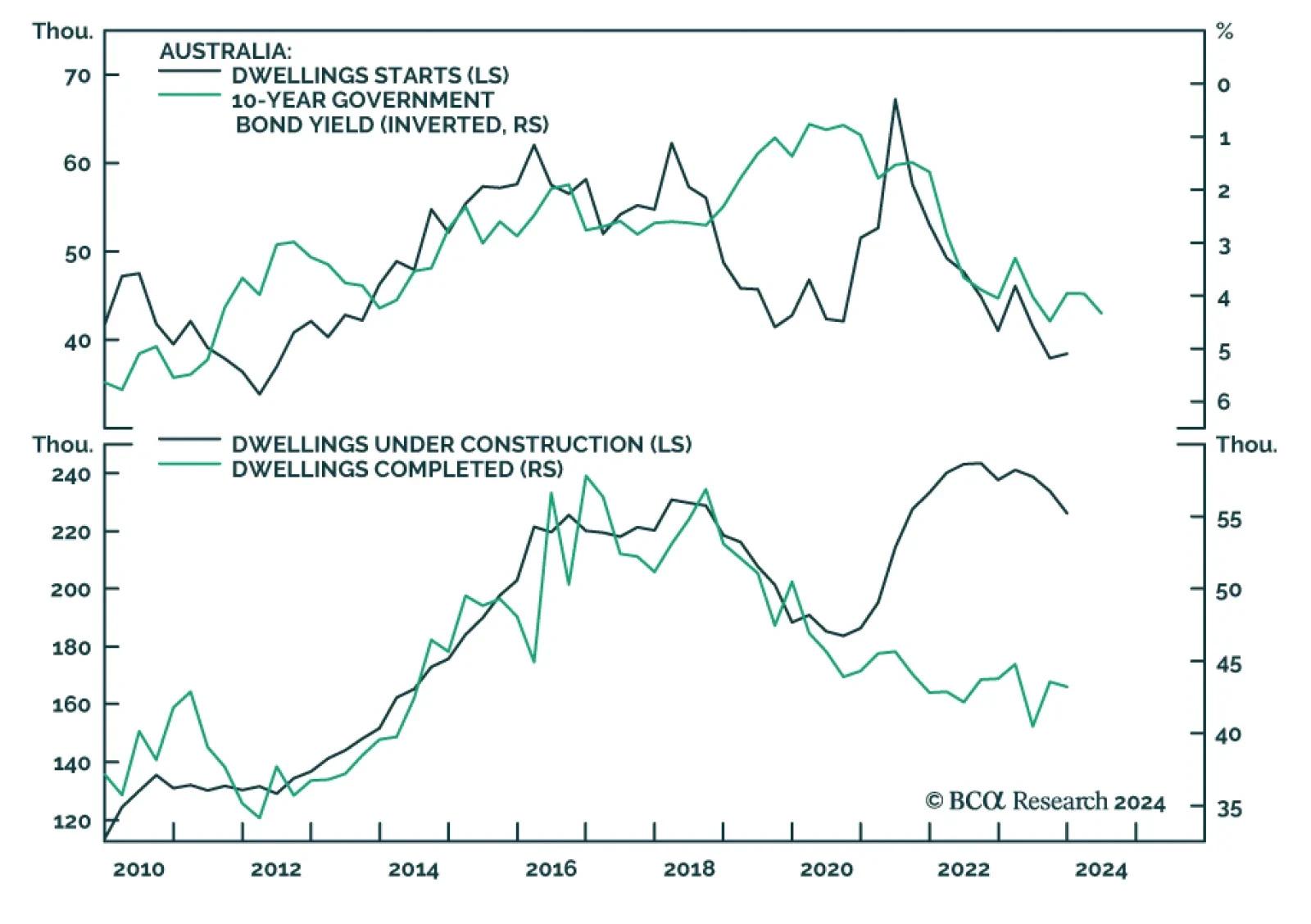

Despite historically high interest rates and the fact that variable-rate mortgage issuances dominate the mortgage market landscape, Australian home prices continue to climb at a close to double-digit annual rate. The Core Logic…

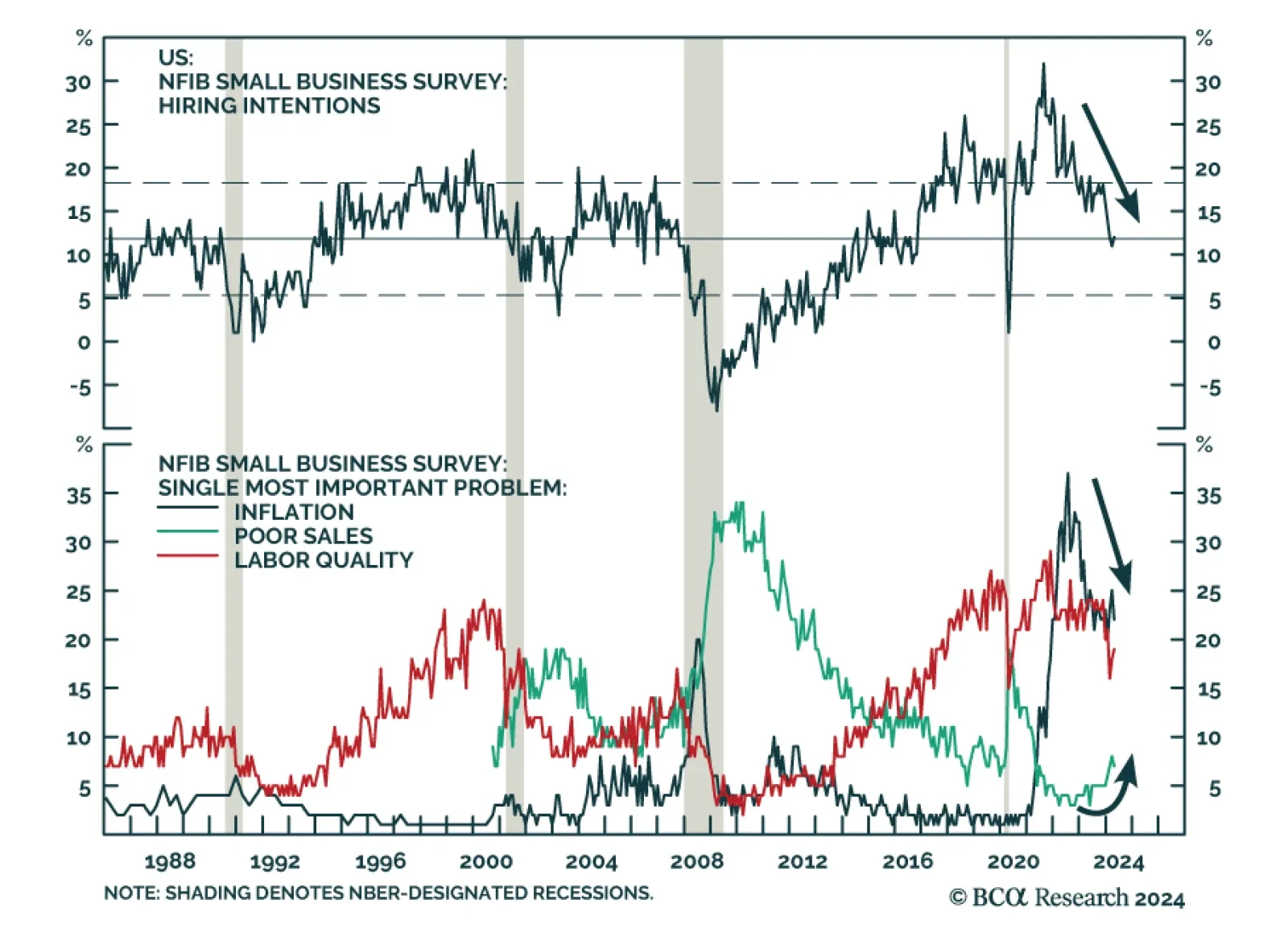

On the surface, the Tuesday release of the NFIB Small Business Survey indicated resilience among small businesses. The headline index appreciated to 89.7 from 88.5, upending expectations of a moderation to 88.2. However,…

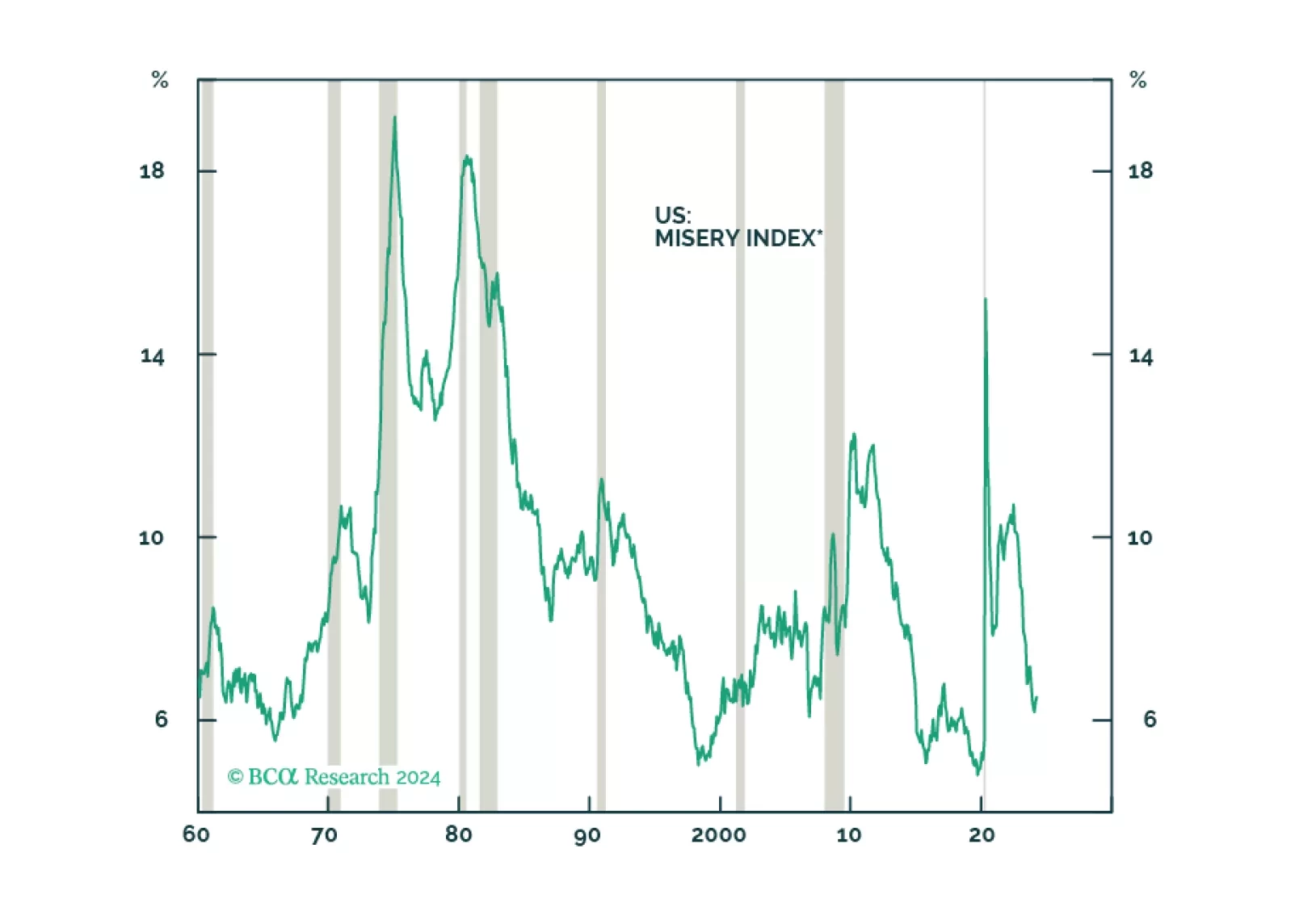

The US Citi Economic Surprise Index has recently dipped below zero, indicating that US economic data releases have been disappointing expectations. Most notably, the ISM Services PMI started contracting in April against…

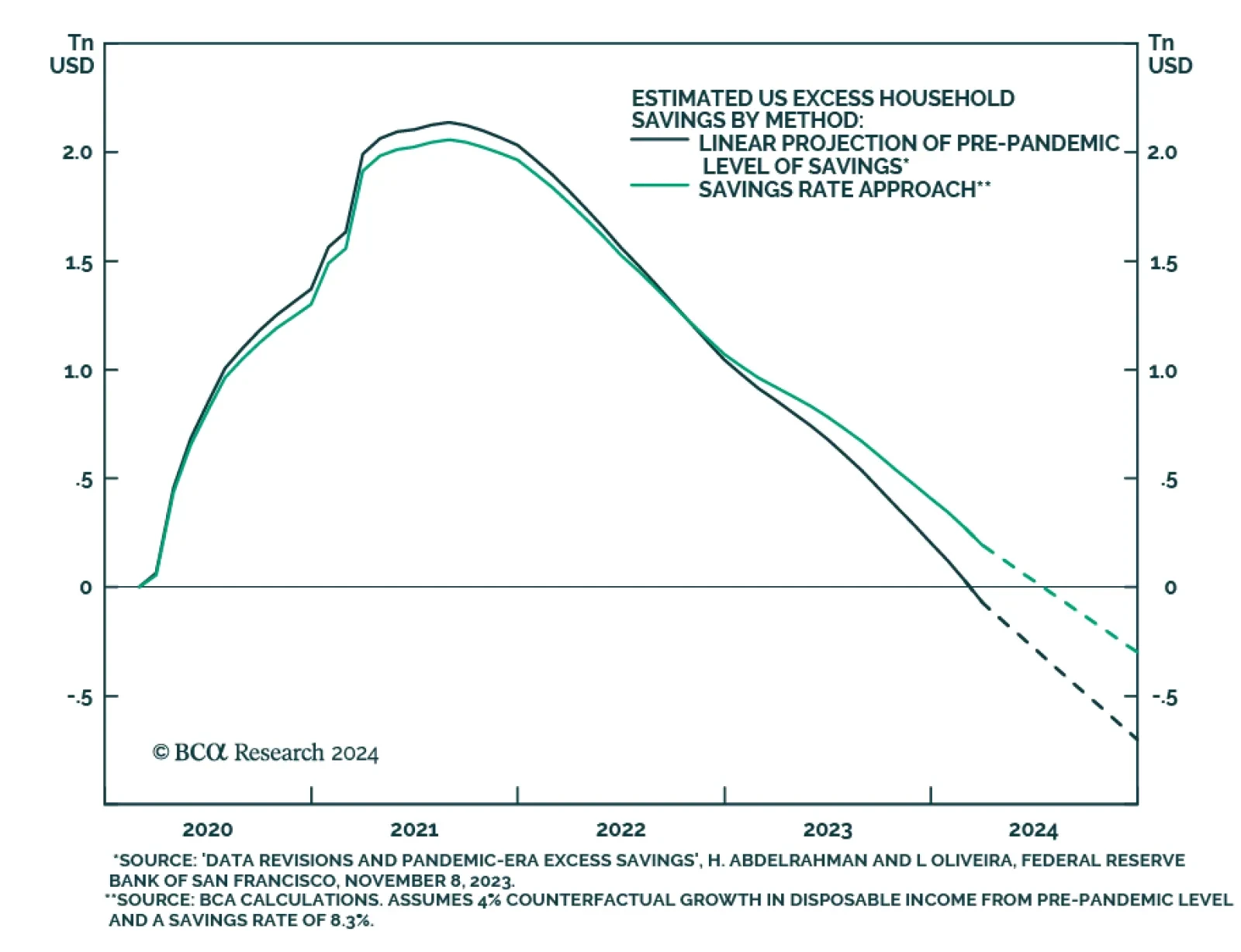

Emergency pandemic policies elongated the lag between Fed rate hikes and an observable slowdown in the economy. Notably, fiscal transfers and constrained consumption options endowed households with more than $2 trillion of…

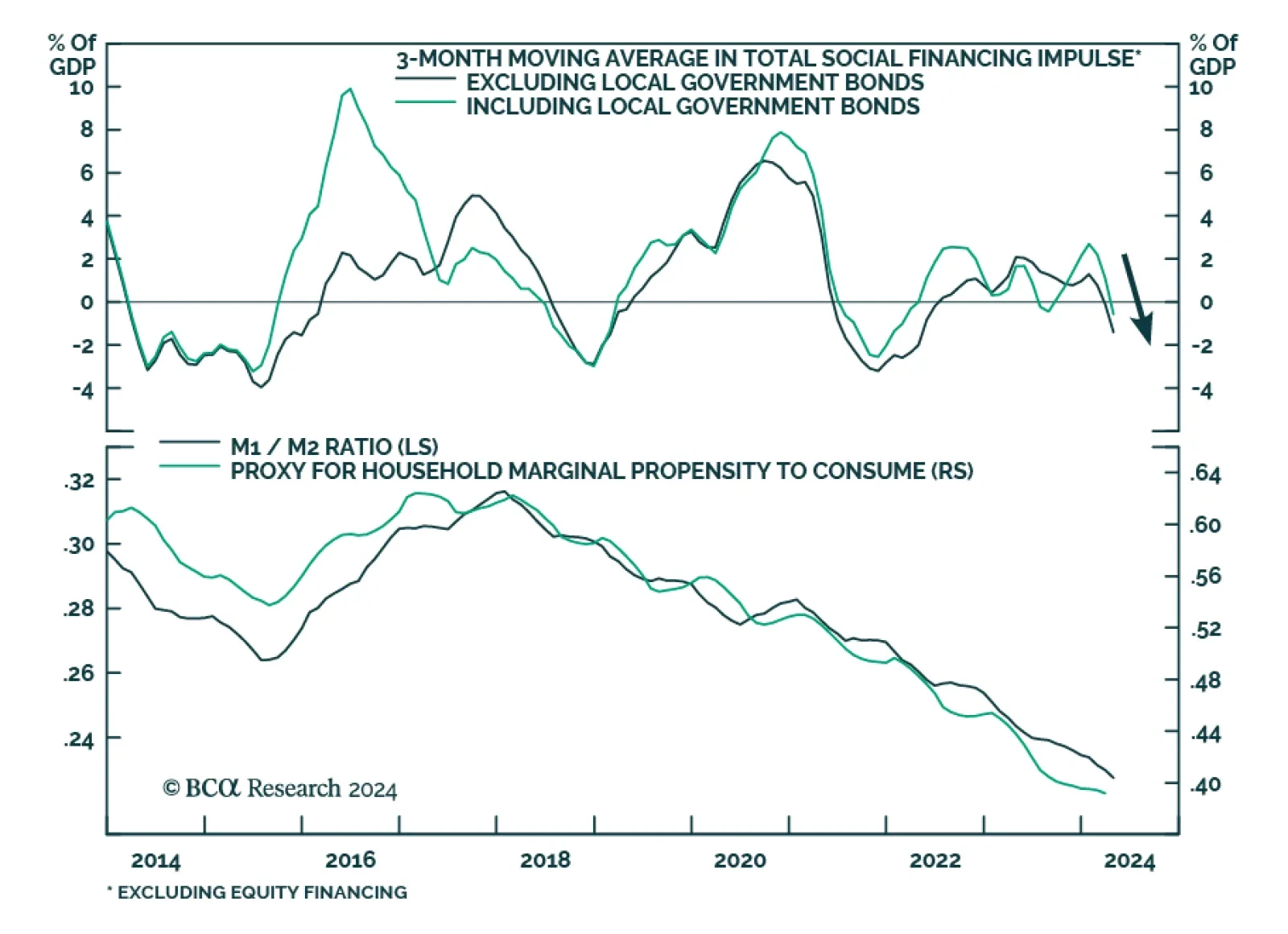

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…