Recession-Hard/Soft Landing

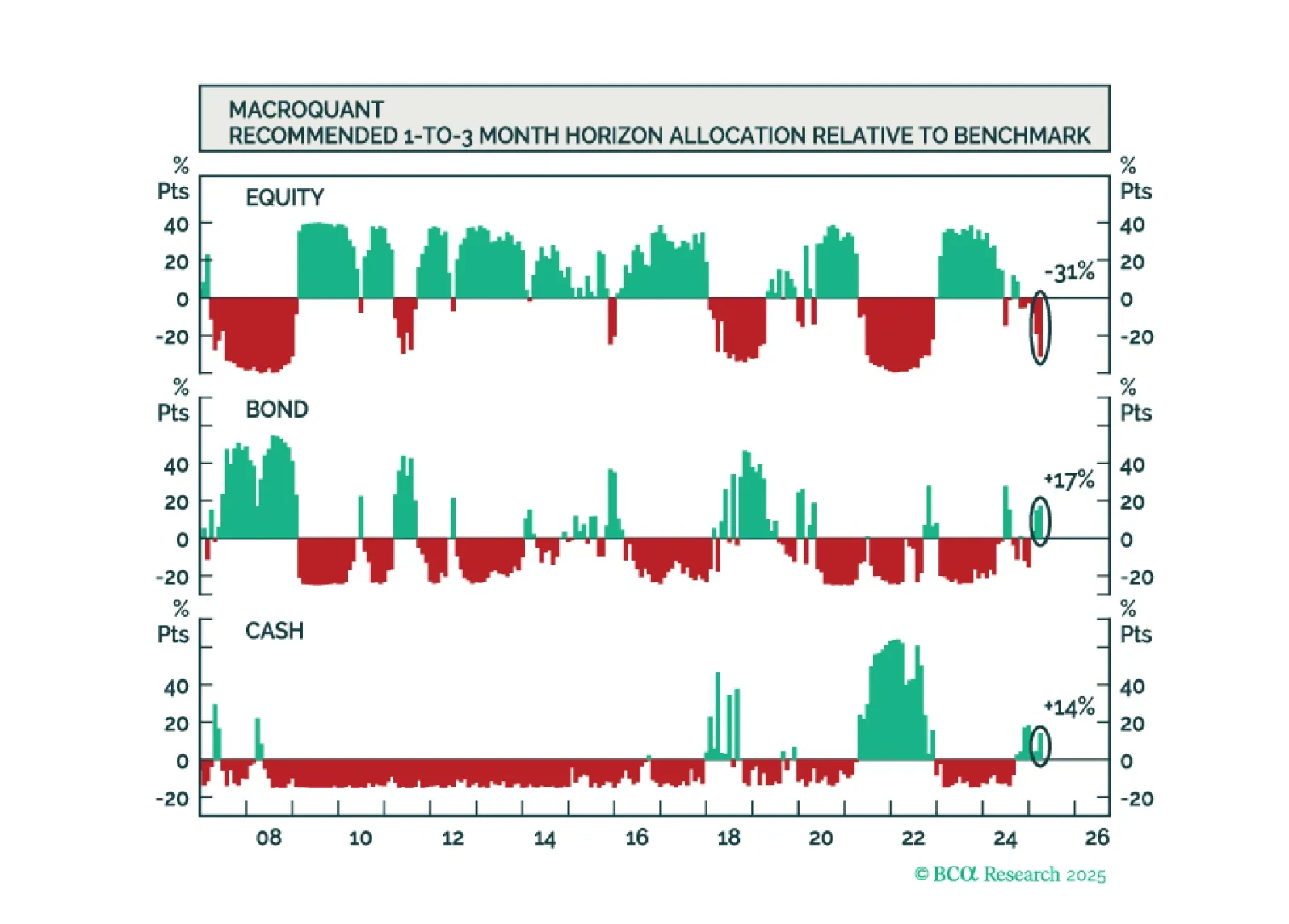

Our Portfolio Allocation Summary for May 2025.

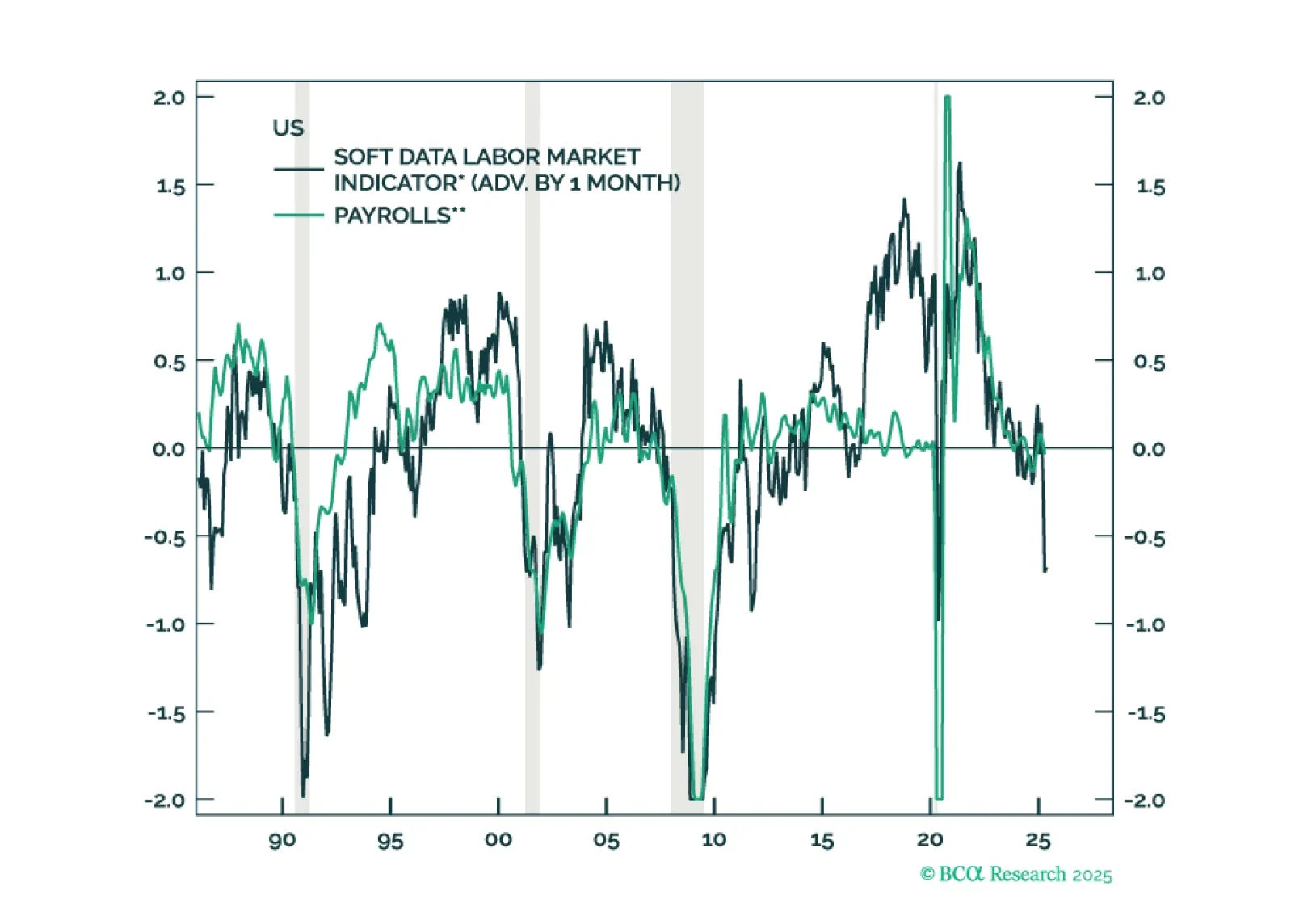

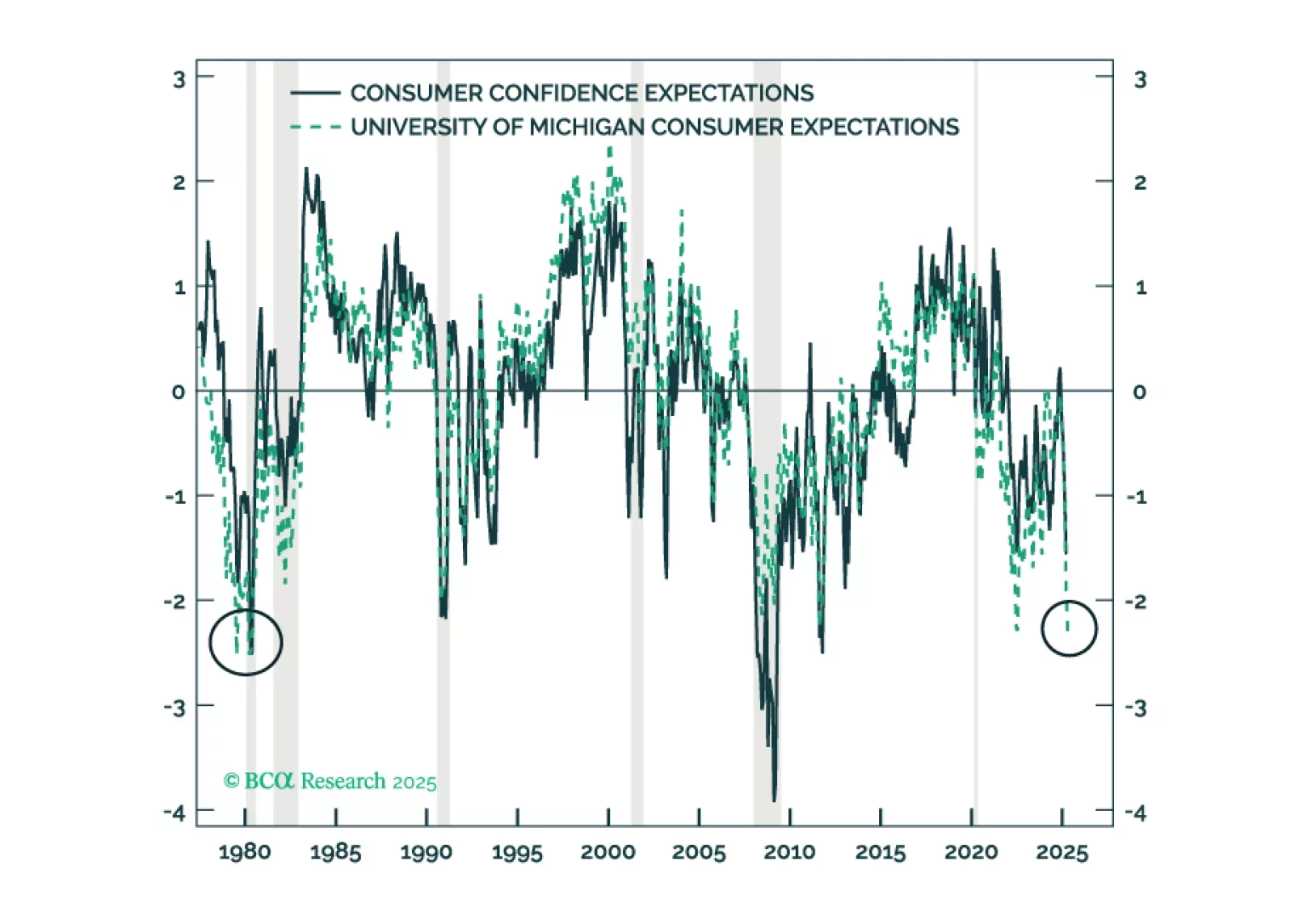

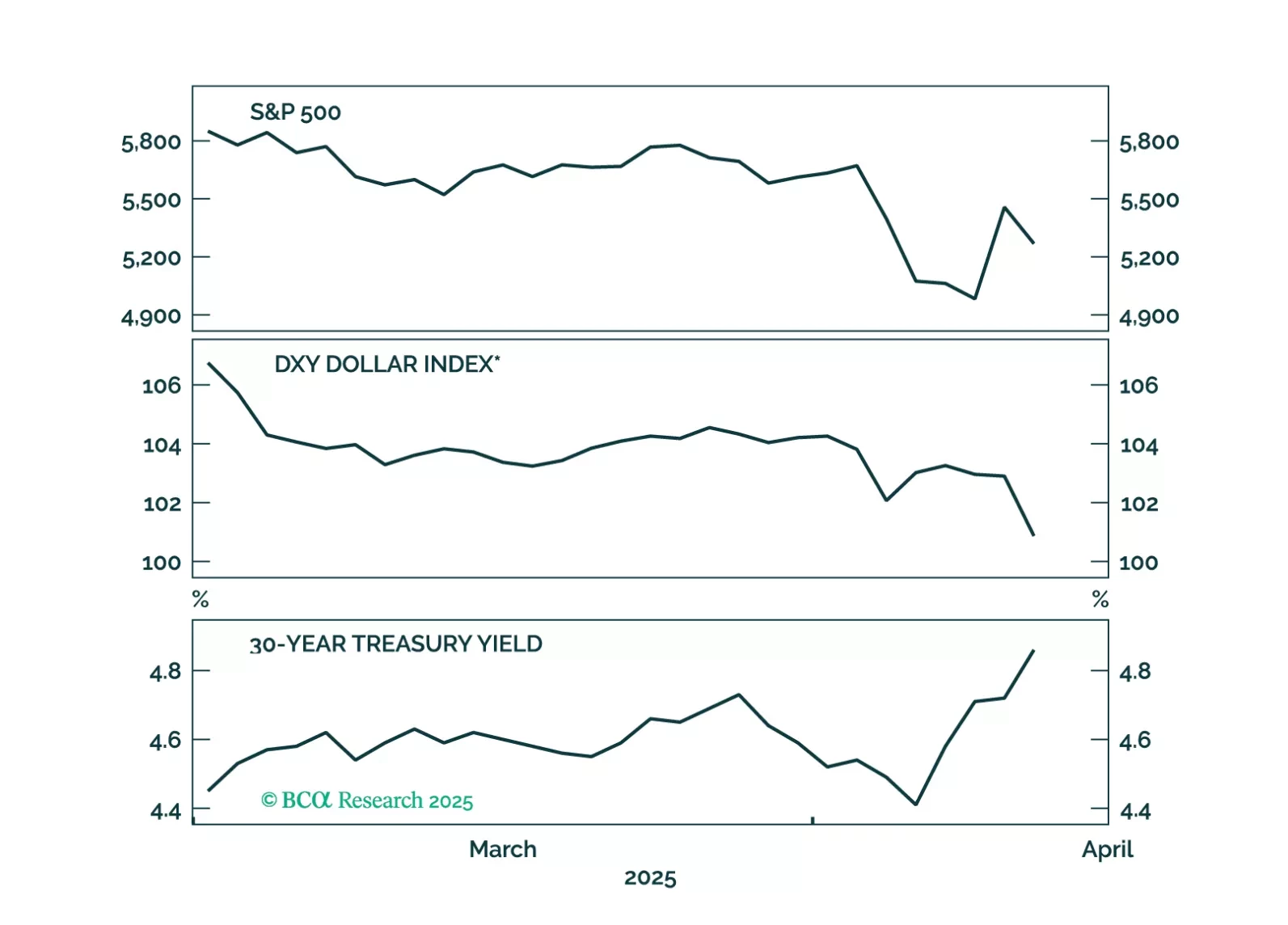

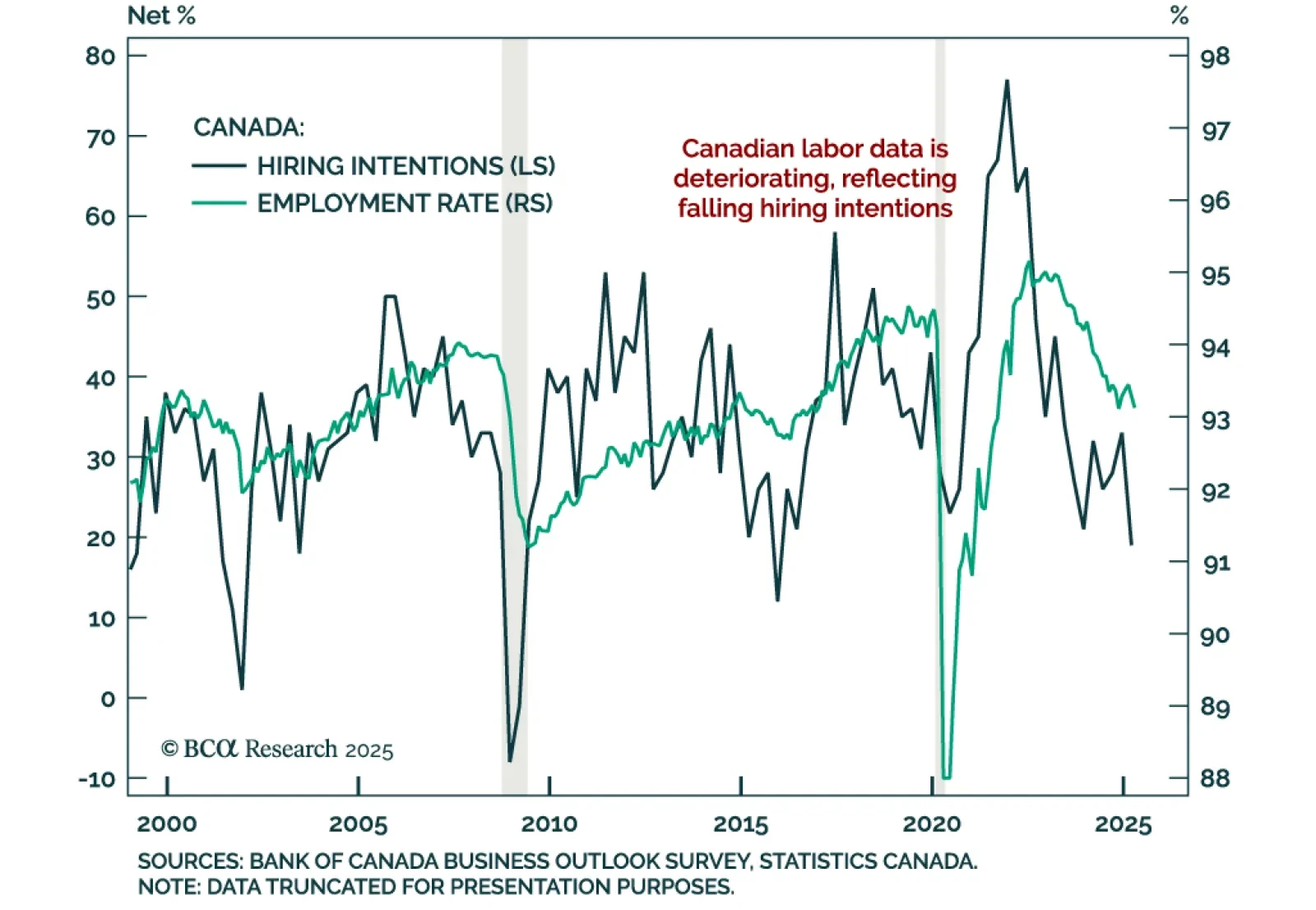

It may take several months for the tariff shock and policy uncertainty to filter through the real economy, but survey-based data are already sending a warning. Equities have priced in a lot of good news, and investors are too sanguine about the risk of a US recession.

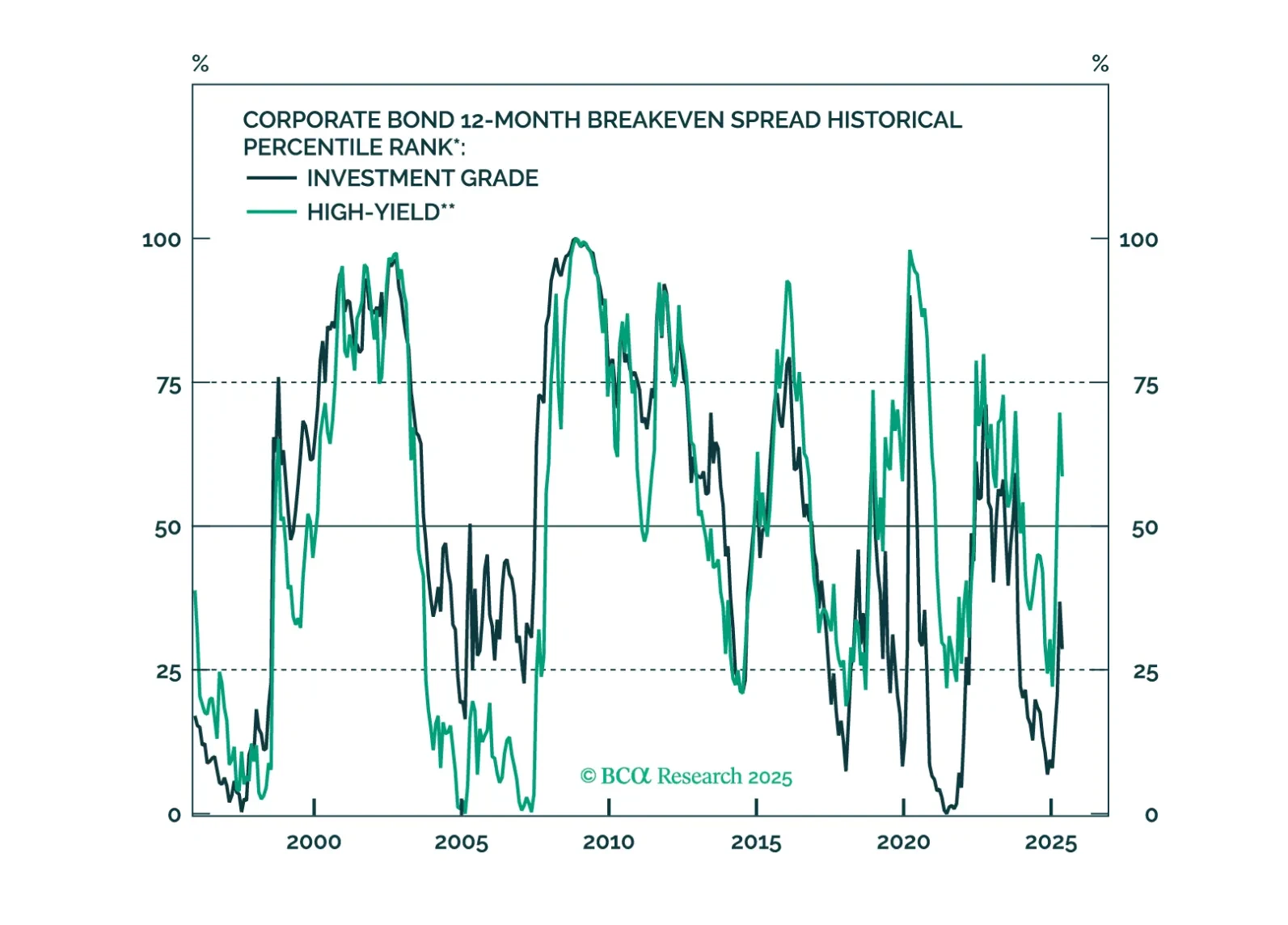

This year’s corporate bond sell off has hit high-yield more than investment grade, and high-yield spreads have turned relatively more attractive as a result.

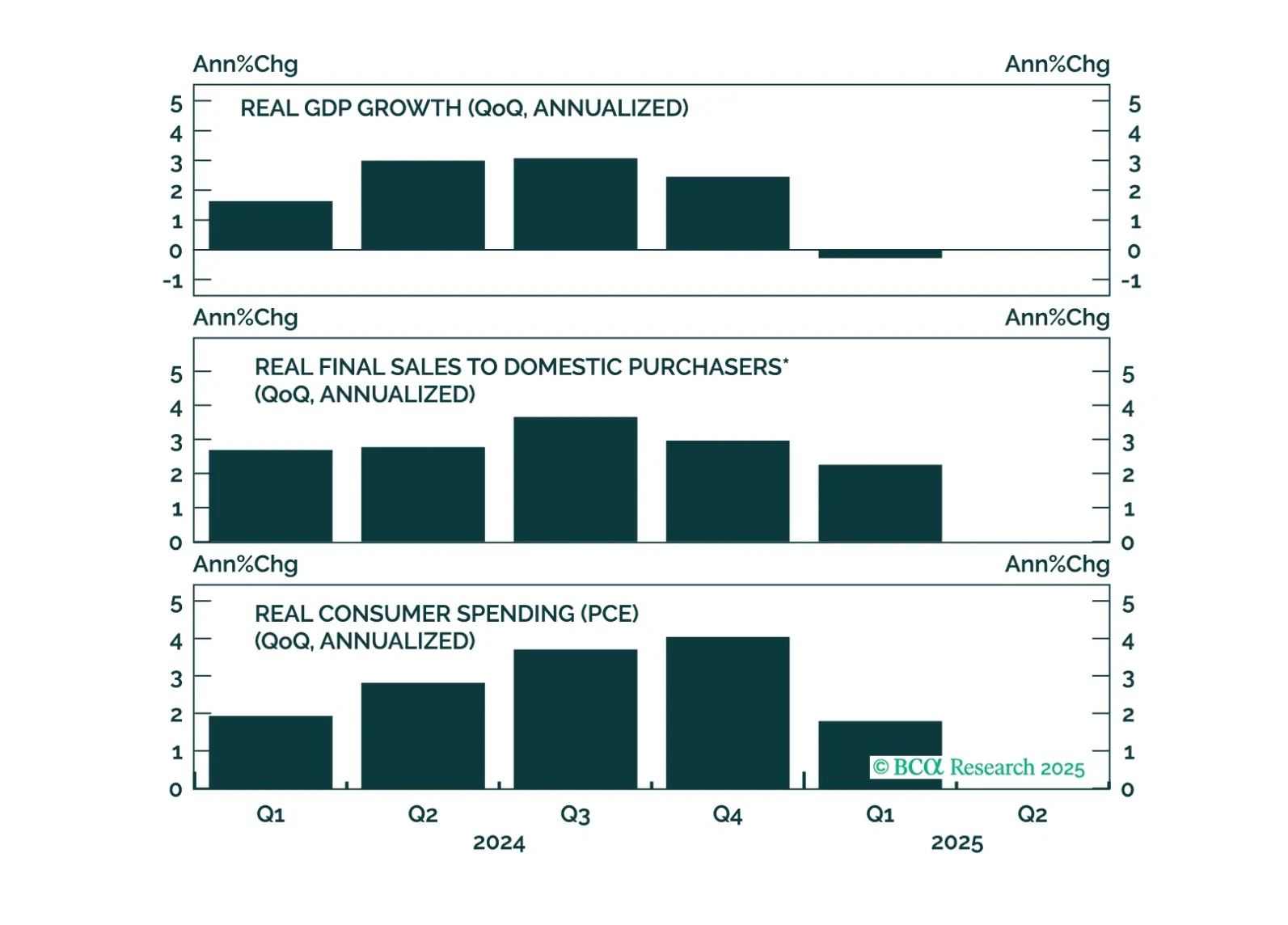

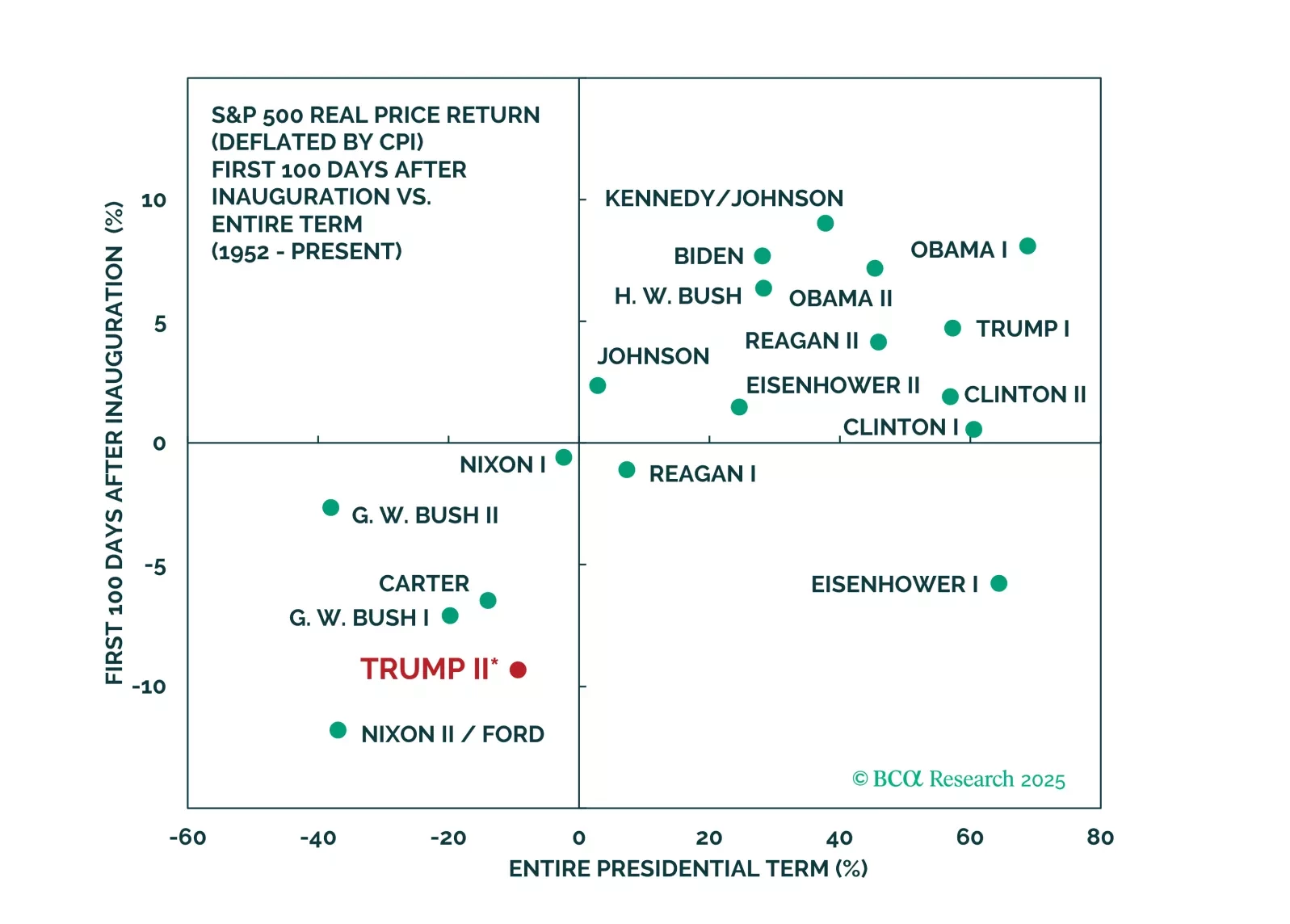

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

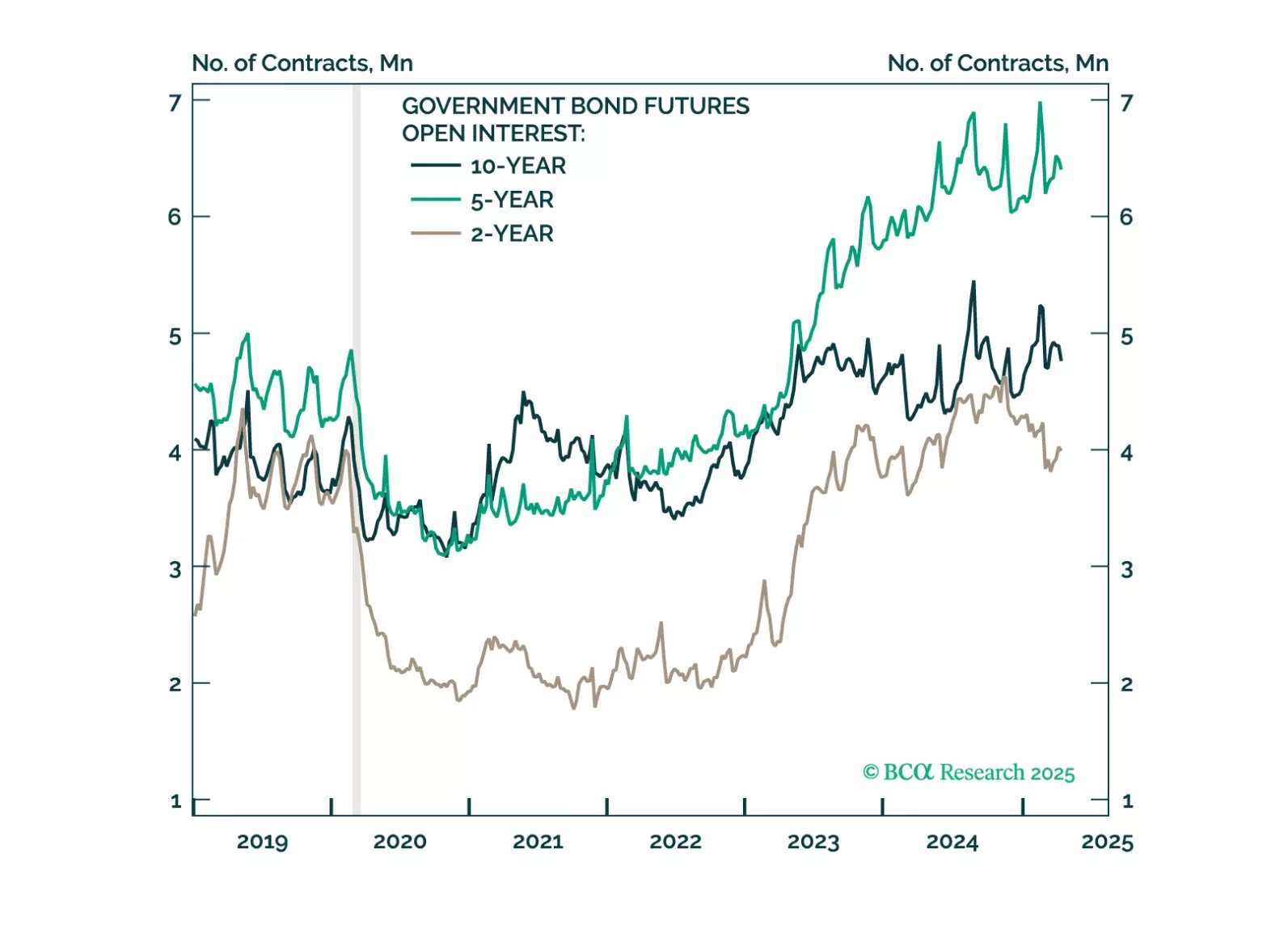

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.

Do not play the bounce in US and global cyclical assets as Trump backpedals from the trade war. China will talk, but the pace will be slow and the outcome disappointing. Fiscal stimulus will surprise marginally in the EU, China, and even the US, but still may not rescue the business cycle.

The policy-induced decline in consumer confidence has spread to businesses and investors, increasing the probability of a recession even if the administration reverses field on its aggressive tariff measures. We reiterate our defensive asset allocation recommendations.

The combination of dollar weakness and rising US yields suggests global investors are questioning the safe-haven status of US Treasuries.