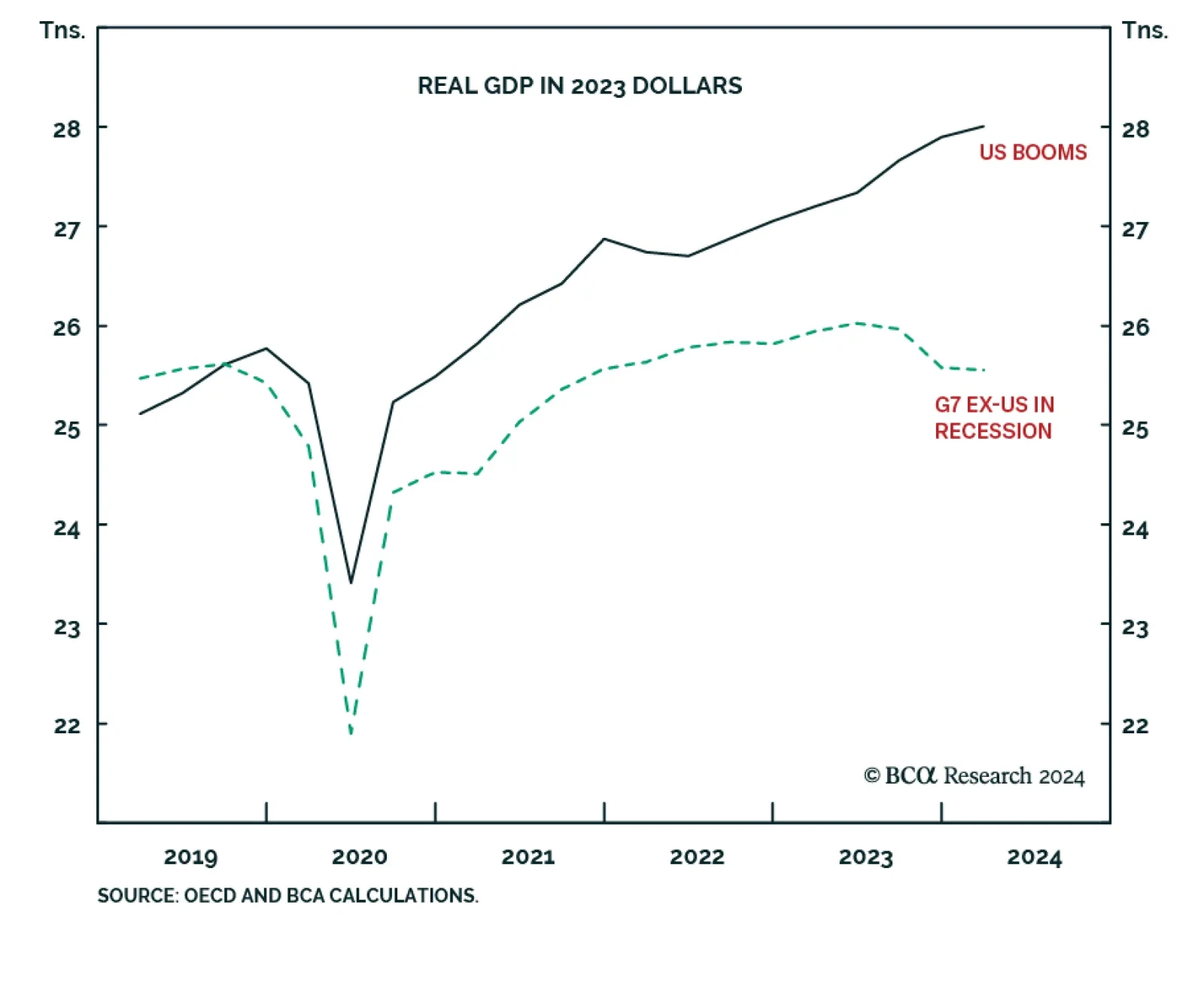

According to BCA Research’s Counterpoint service, the non-US developed economy is “demand-constrained” whereas the US economy is “supply-constrained”. This schism will continue but in reverse. The…

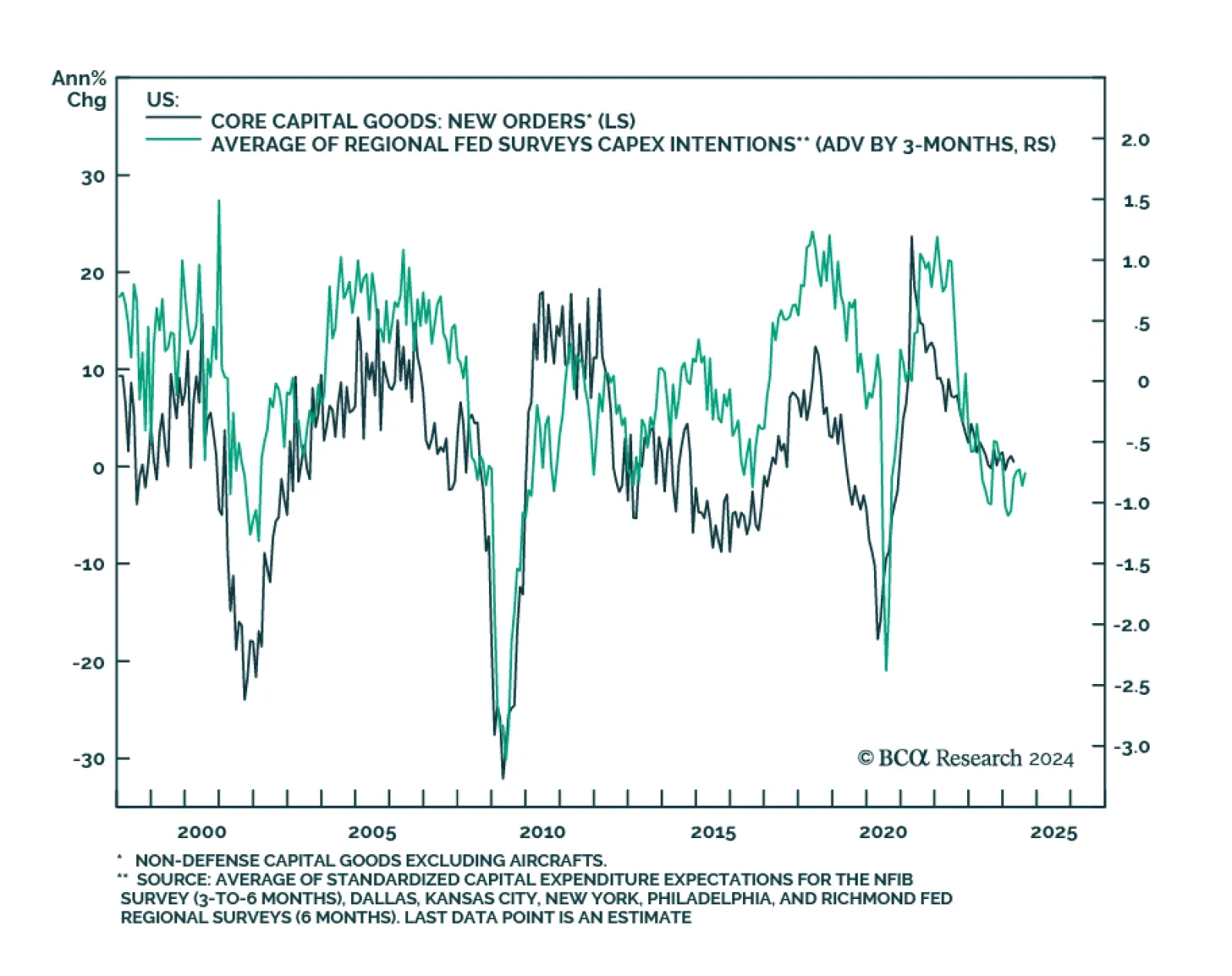

US durable goods orders surprised to the upside in April, growing 0.7% m/m against expectations they would decline. The March growth rate was nevertheless revised significantly lower, from 2.6% m/m to 0.8% m/m. Core capital…

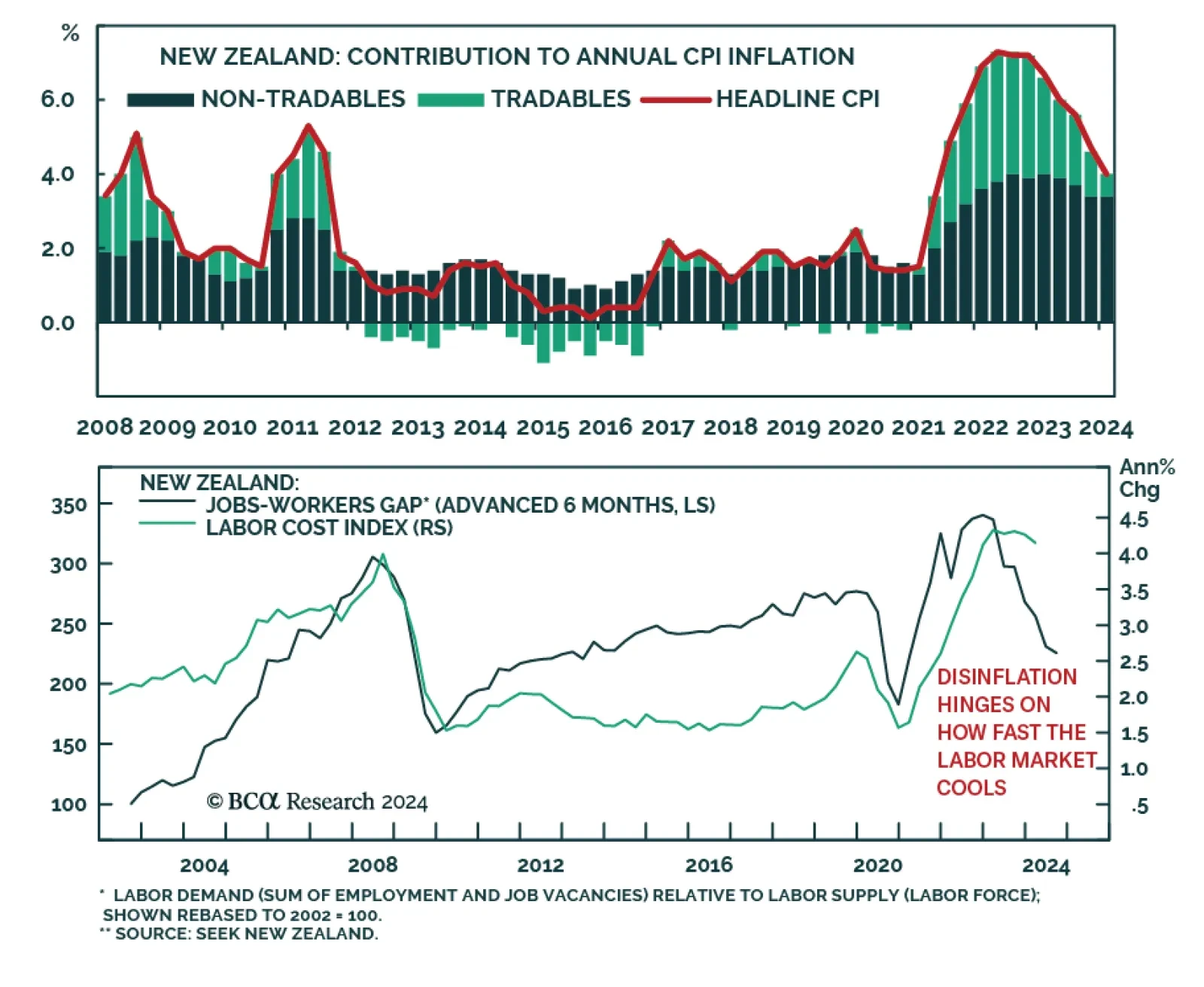

The Reserve Bank of New Zealand (RBNZ) kept interest rates on hold at this week’s monetary policy meeting, in line with expectations. However, there were three new notes from its monetary policy statement that will likely…

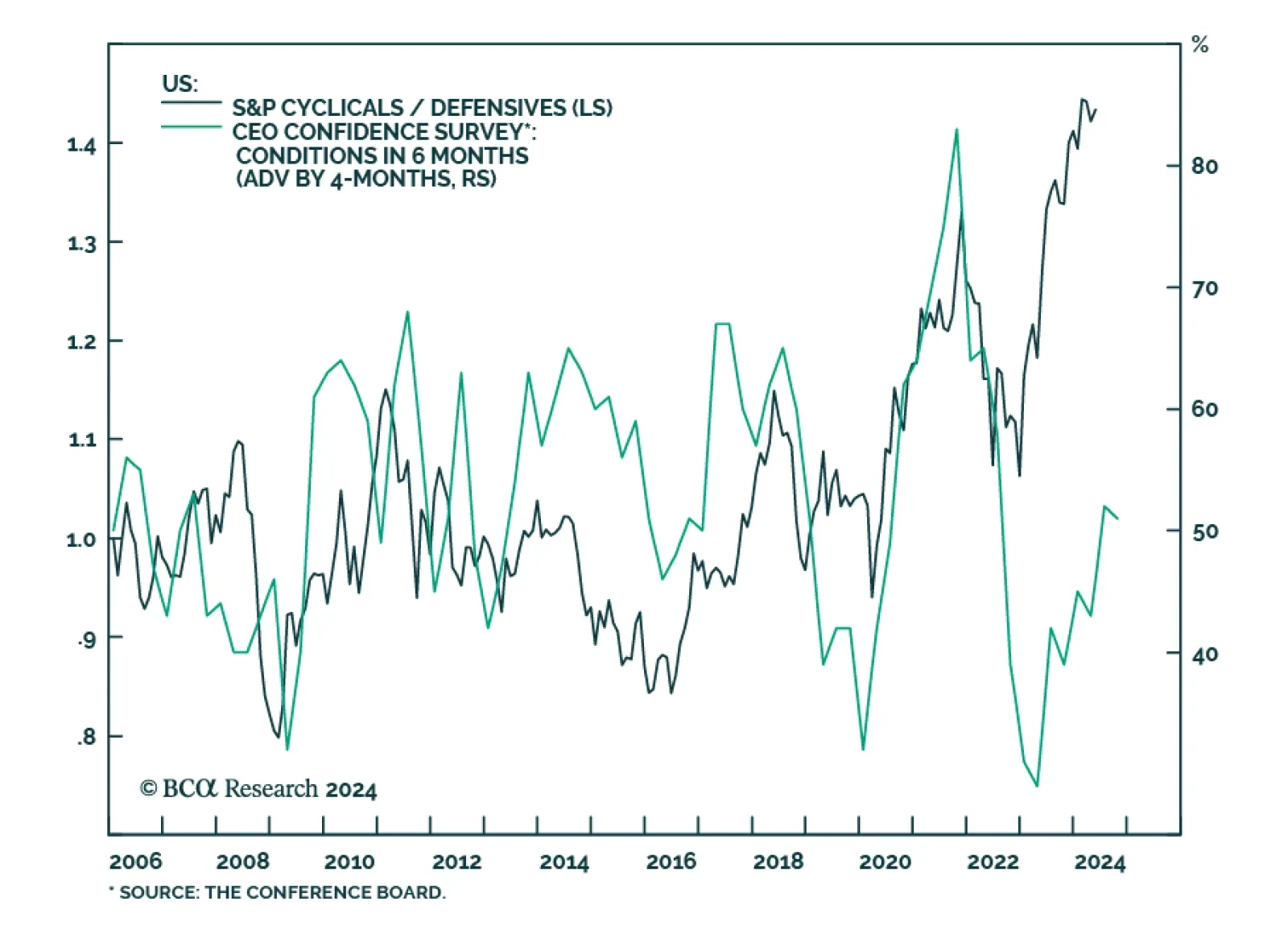

The Conference Board measure of CEO Confidence improved slightly in Q2, from 53 to 54. A reading above 50 indicates that optimistic perceptions of business conditions outweigh pessimistic assessments. The Q2 survey result marks a…

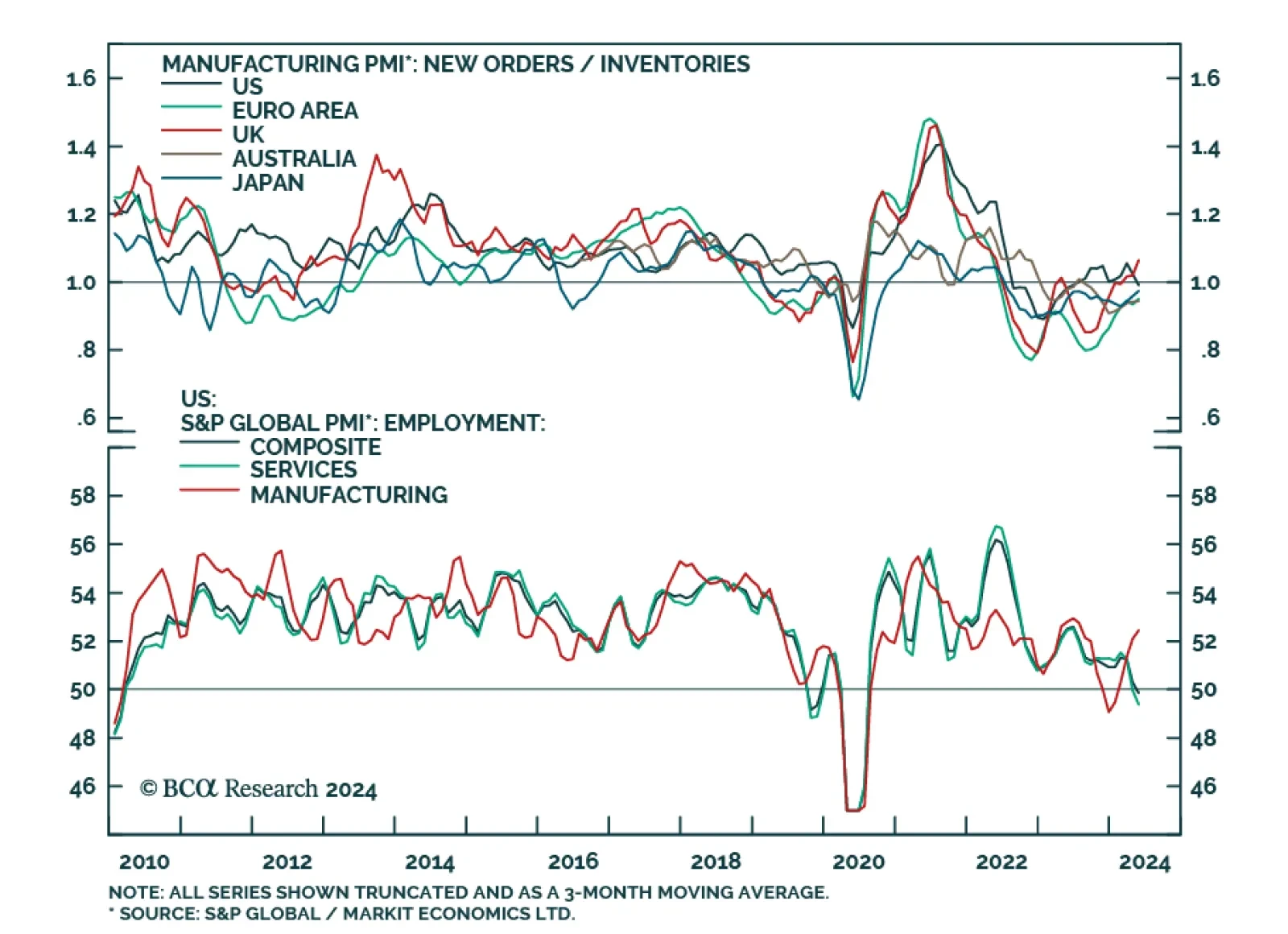

Preliminary estimates suggest that manufacturing activity generally improved across DM economies in May. Manufacturing PMIs for the US, the Eurozone, Japan and the UK all improved from their April levels. Notably,…

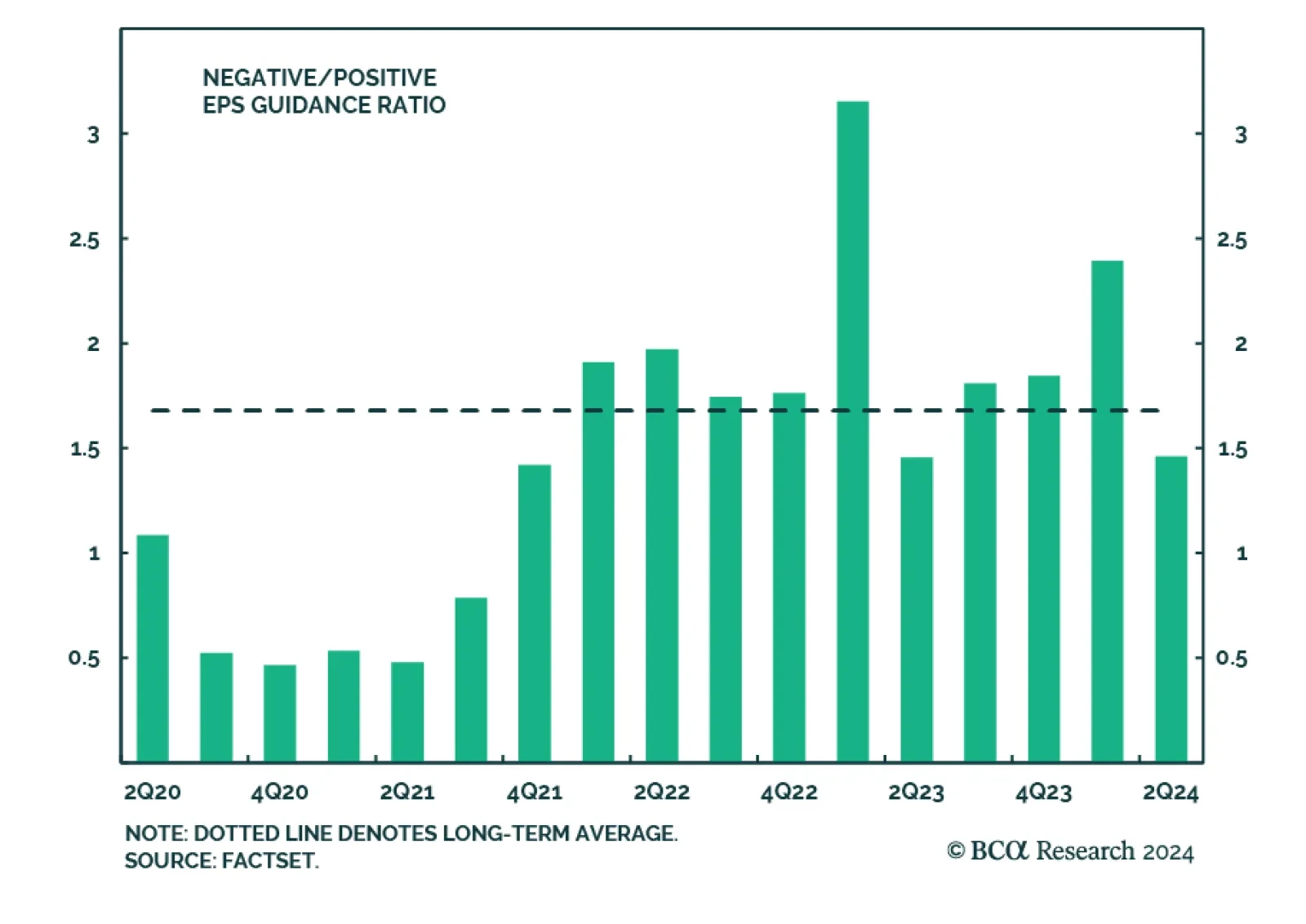

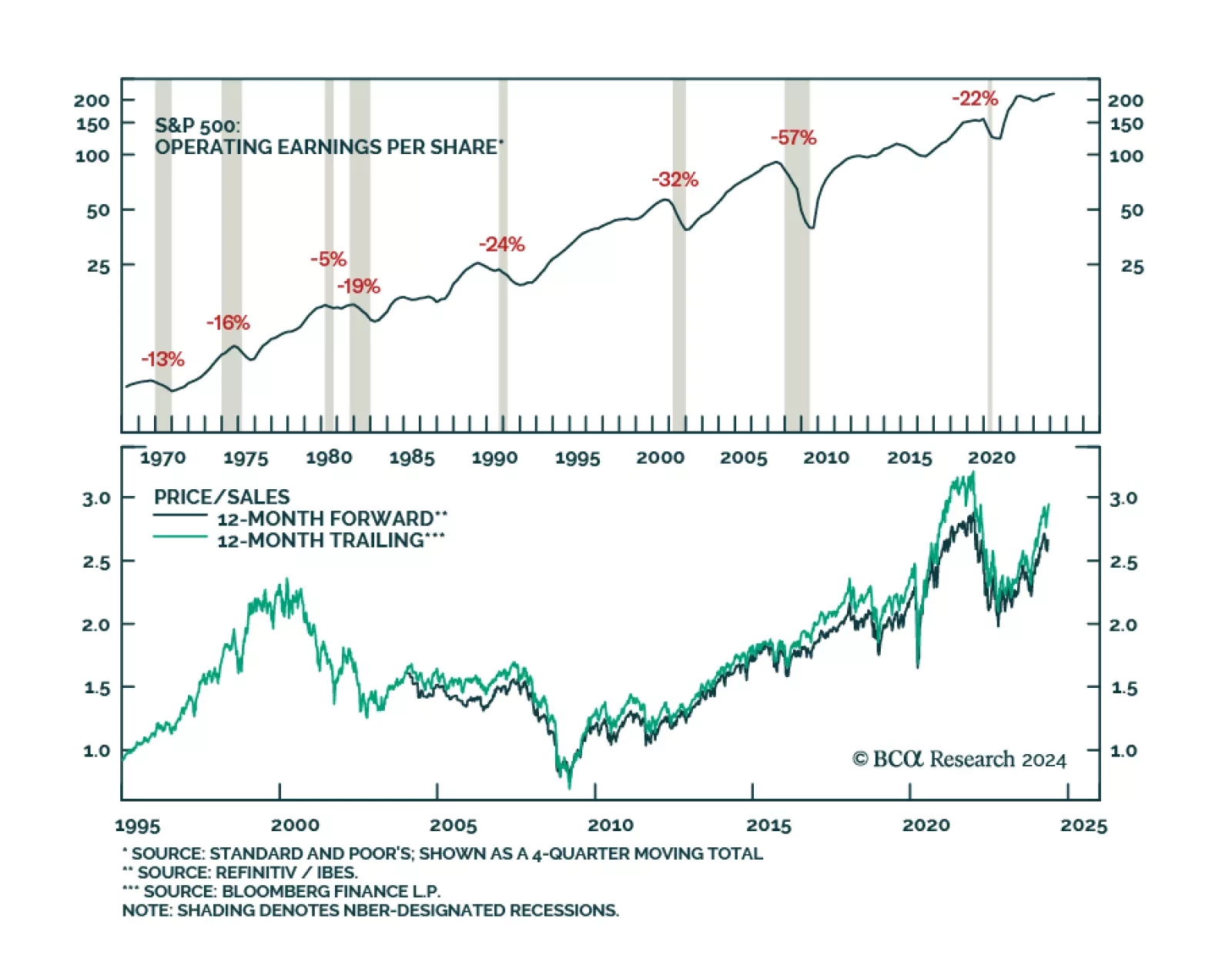

The Q1 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Three-quarters (two-thirds) of companies have topped earnings (sales) expectations in Q1, according to…

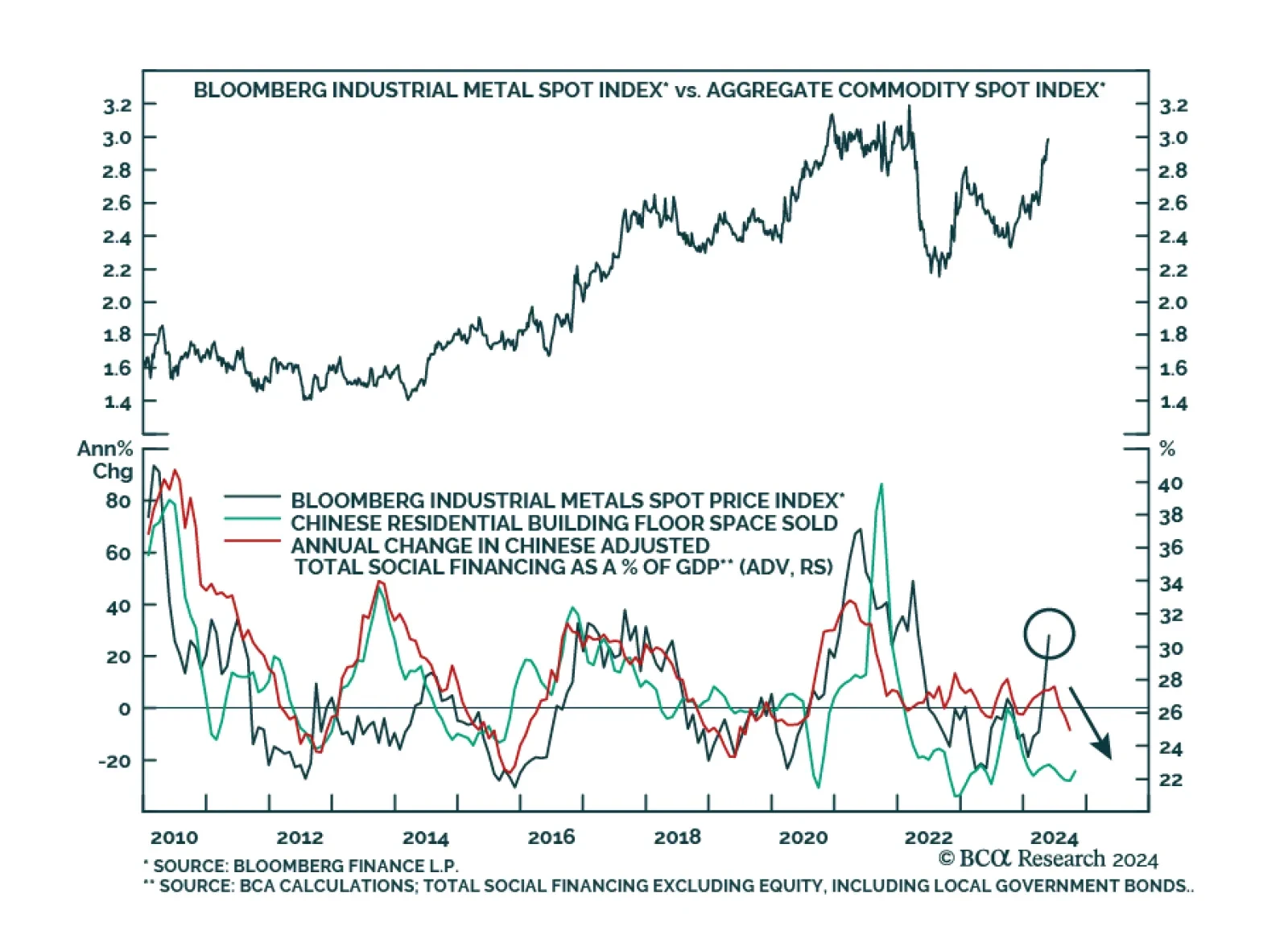

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

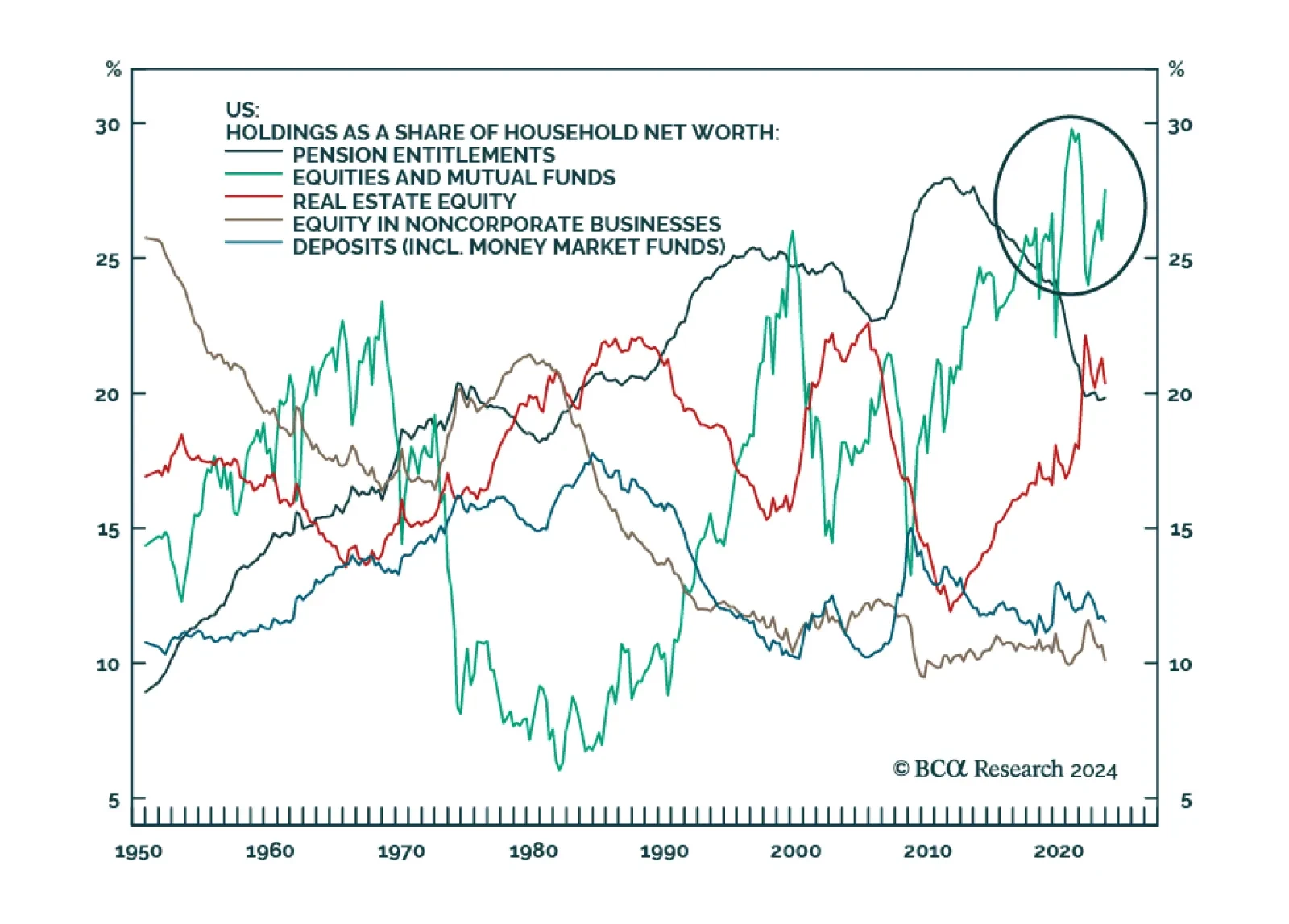

We do not subscribe to the Goldilocks scenario in which price pressures continue to ease while economic growth remains robust. We expect that softening labor demand will eventually hinder consumption as wage and payrolls growth…

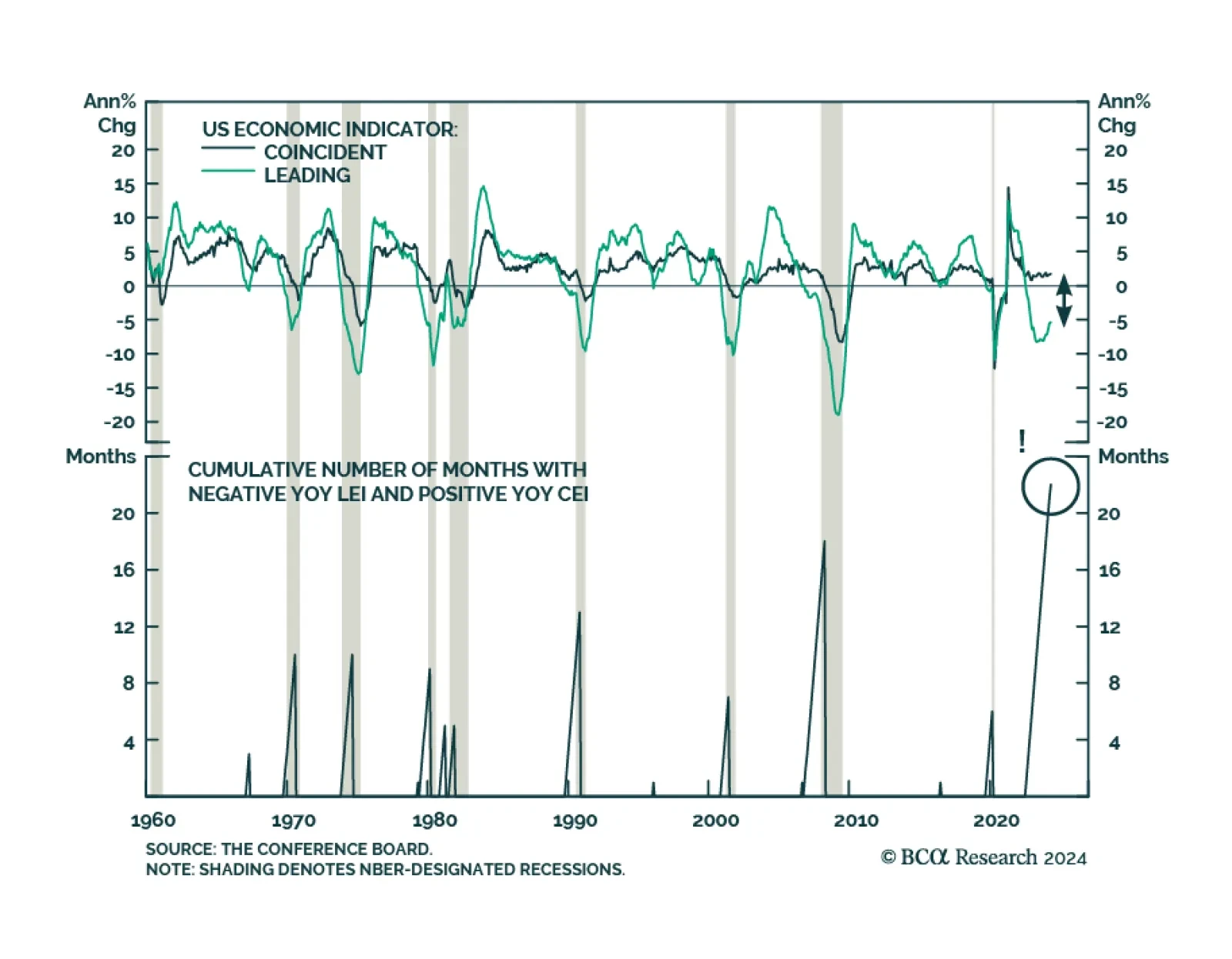

An adverse shock is not a recession prerequisite. The empirical record shows that the US economy regularly evolves its way into a contraction with little fanfare. If current cooling trends continue, we project a recession will…

The Conference Board US Leading Economic Index (LEI) declined by a larger-than-expected 0.6% m/m in April from 0.3% m/m. Deteriorating consumer sentiment and manufacturing new orders led the overall decline. Contractions in…