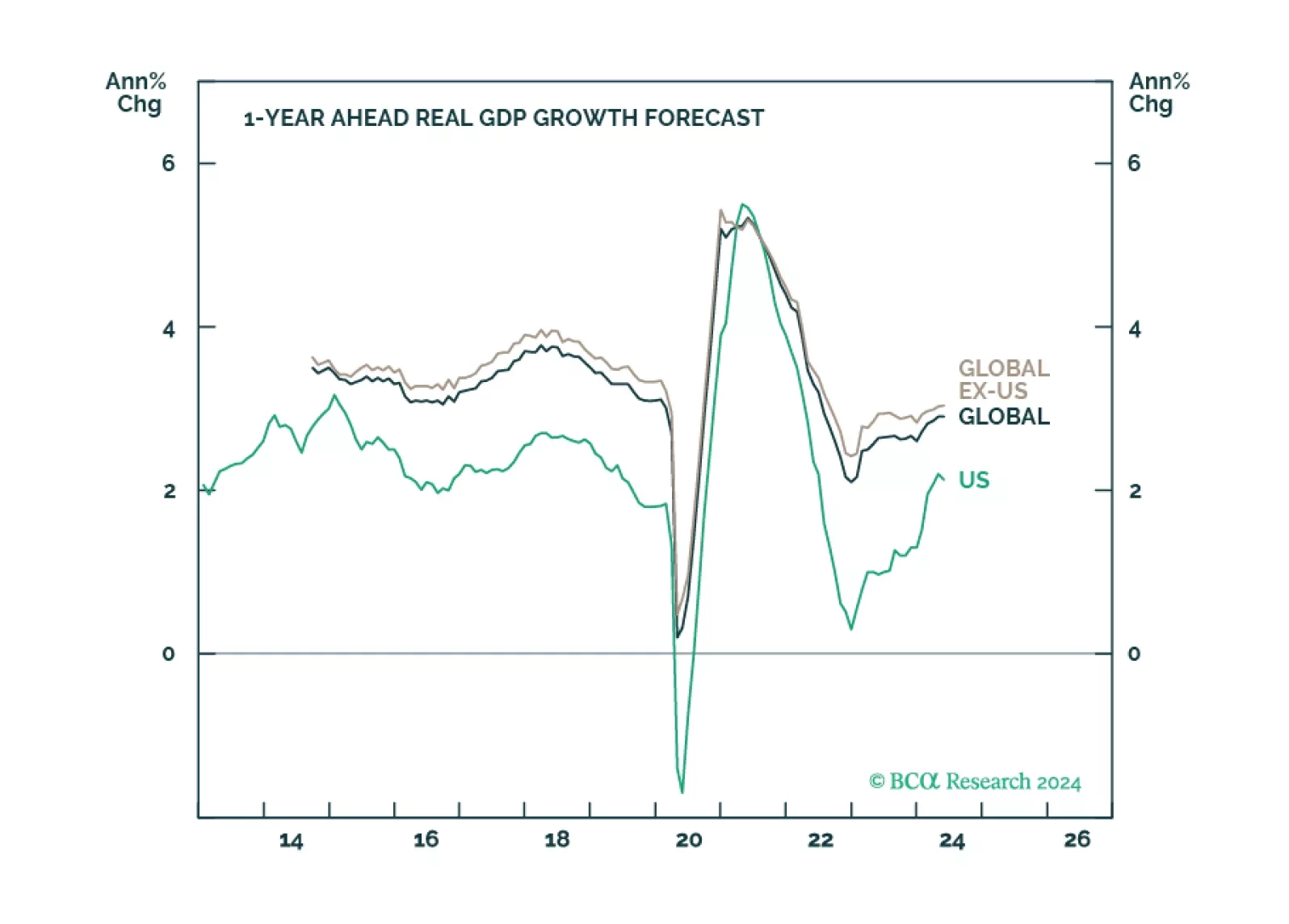

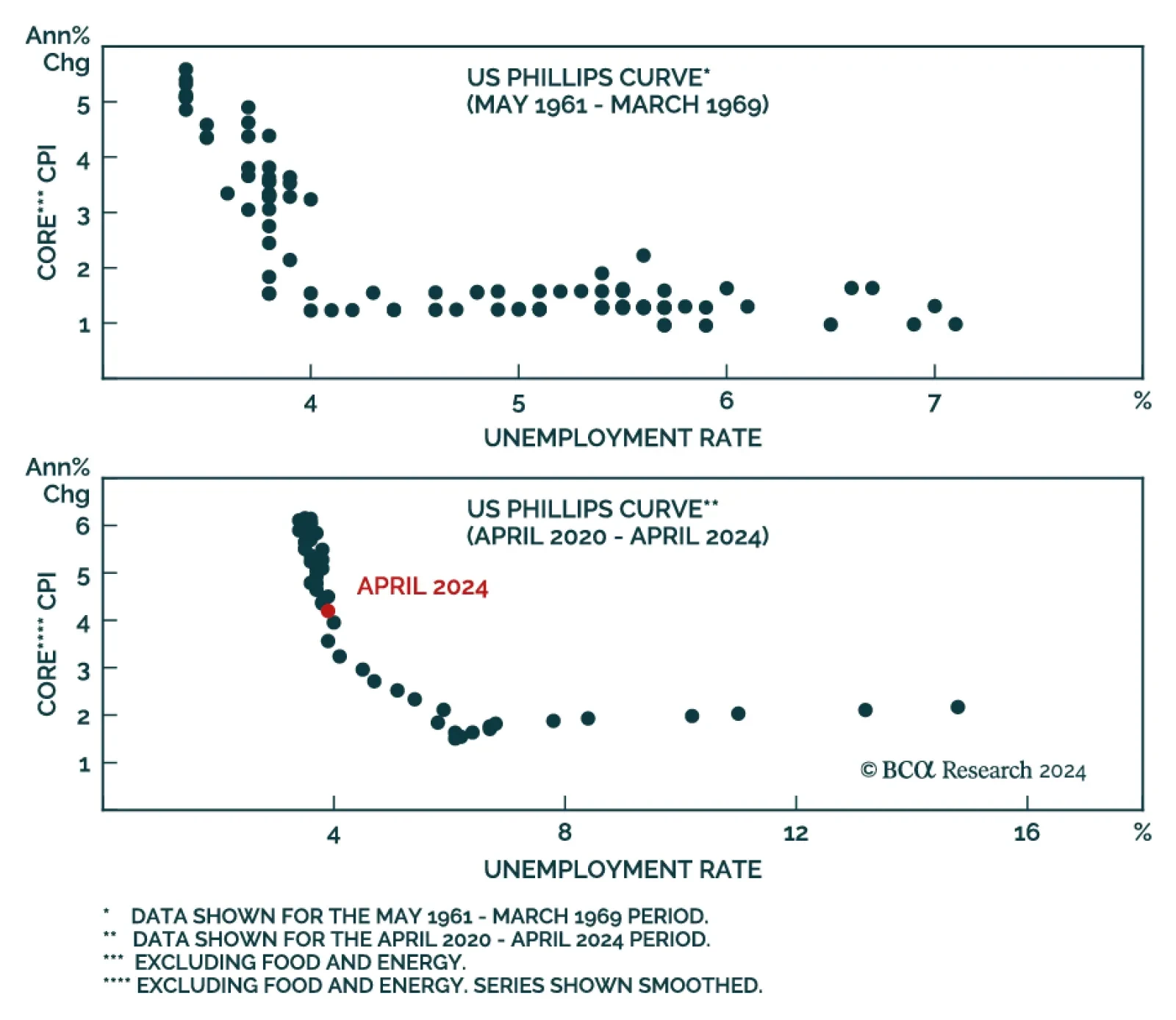

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

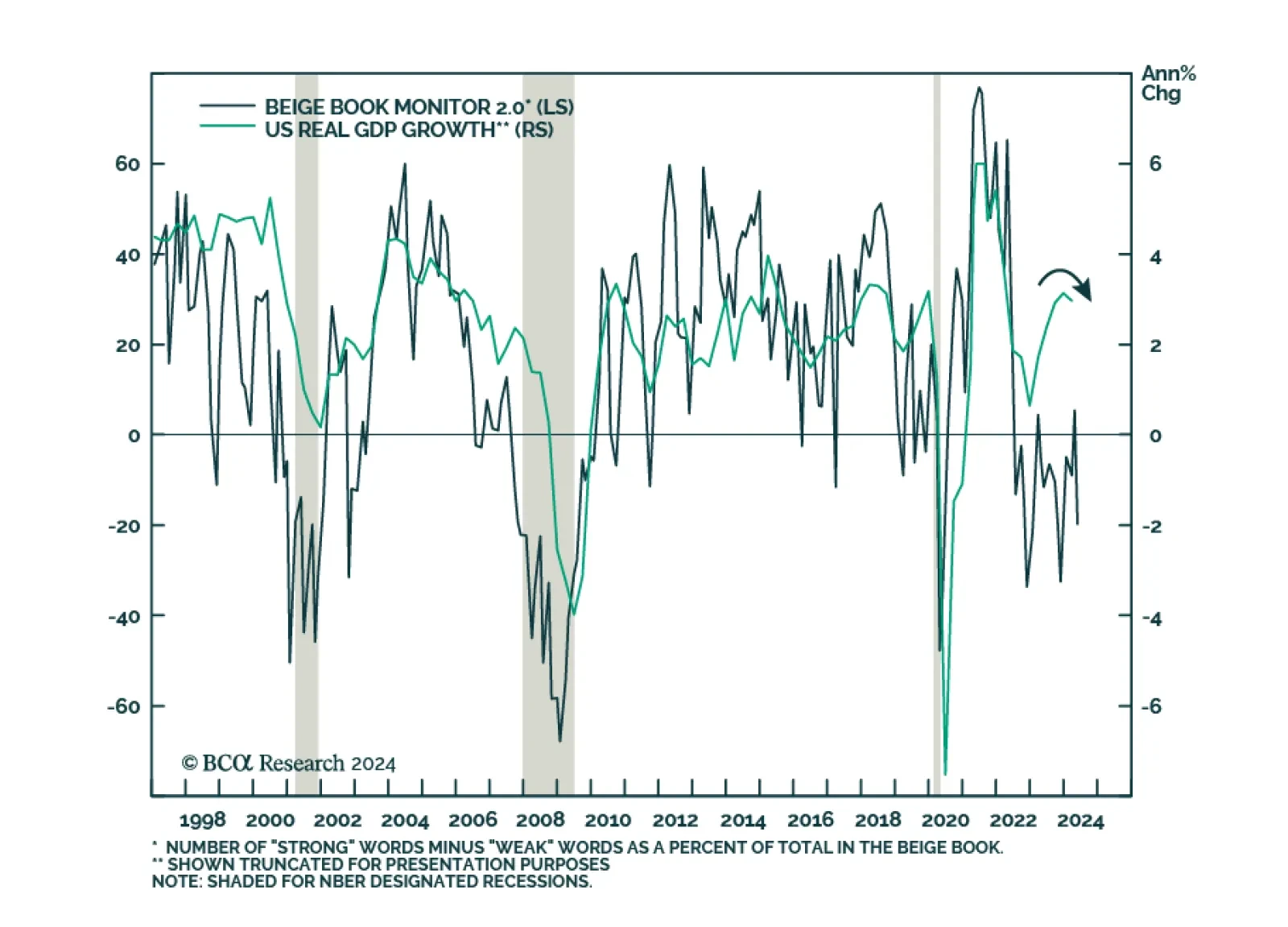

The message from the latest Beige Book release is confirming that US demand is showing signs of slowing down. Of the 12 Federal Reserve districts, 2 reported modest economic growth, 8 reported economic activity was slightly up,…

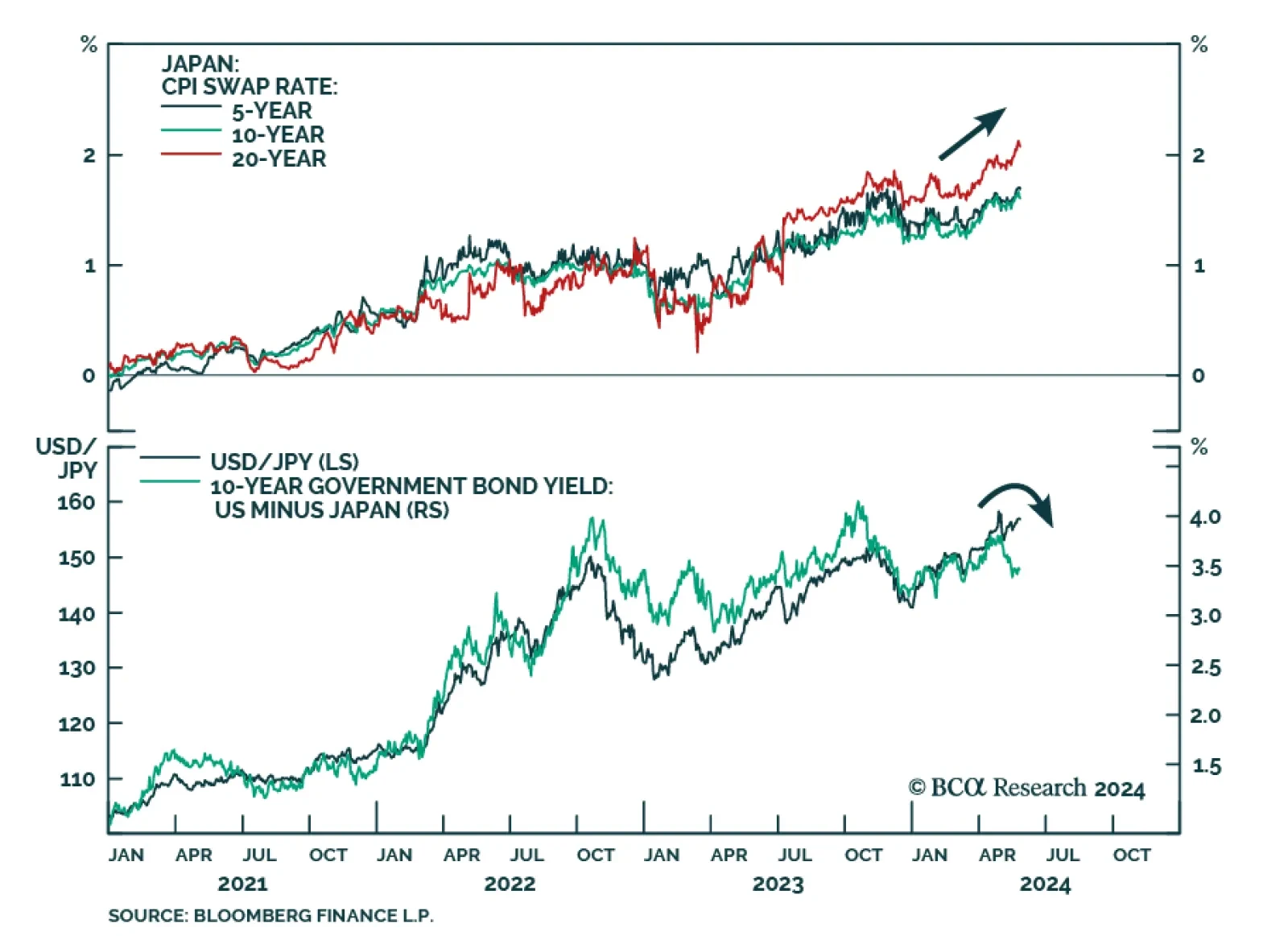

Our Global Investment strategists highlighted back in November 2022 that structural deflationary forces in Japan were weakening, thus setting the stage for inflation to make a historic comeback in Japan. About a year later…

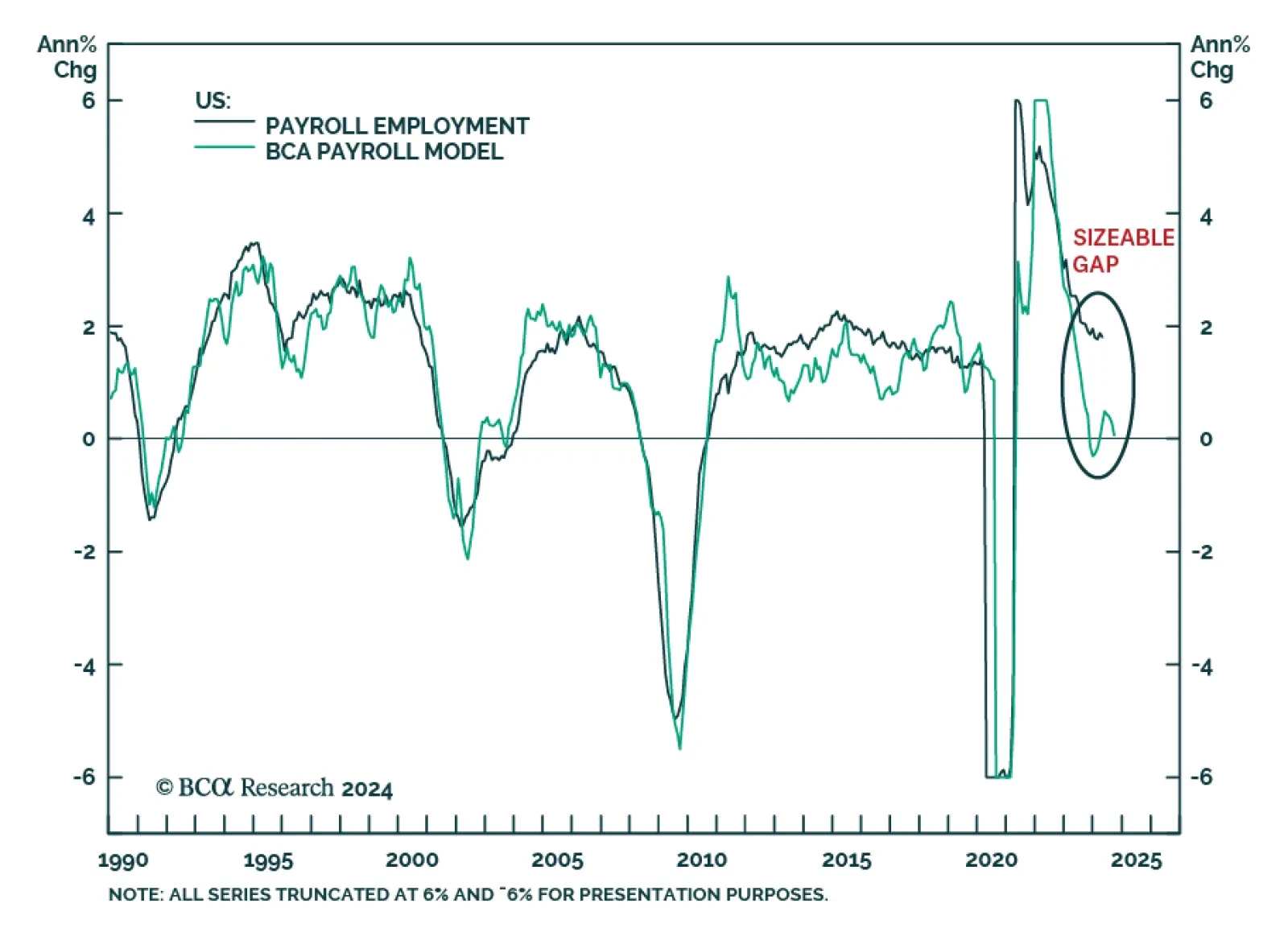

At BCA Research, fundamentals drive our analysis and we use indicators and quantitative metrics as guides to inform our views further. It is our fundamental assessment of the US labor market that underpins our view that softer…

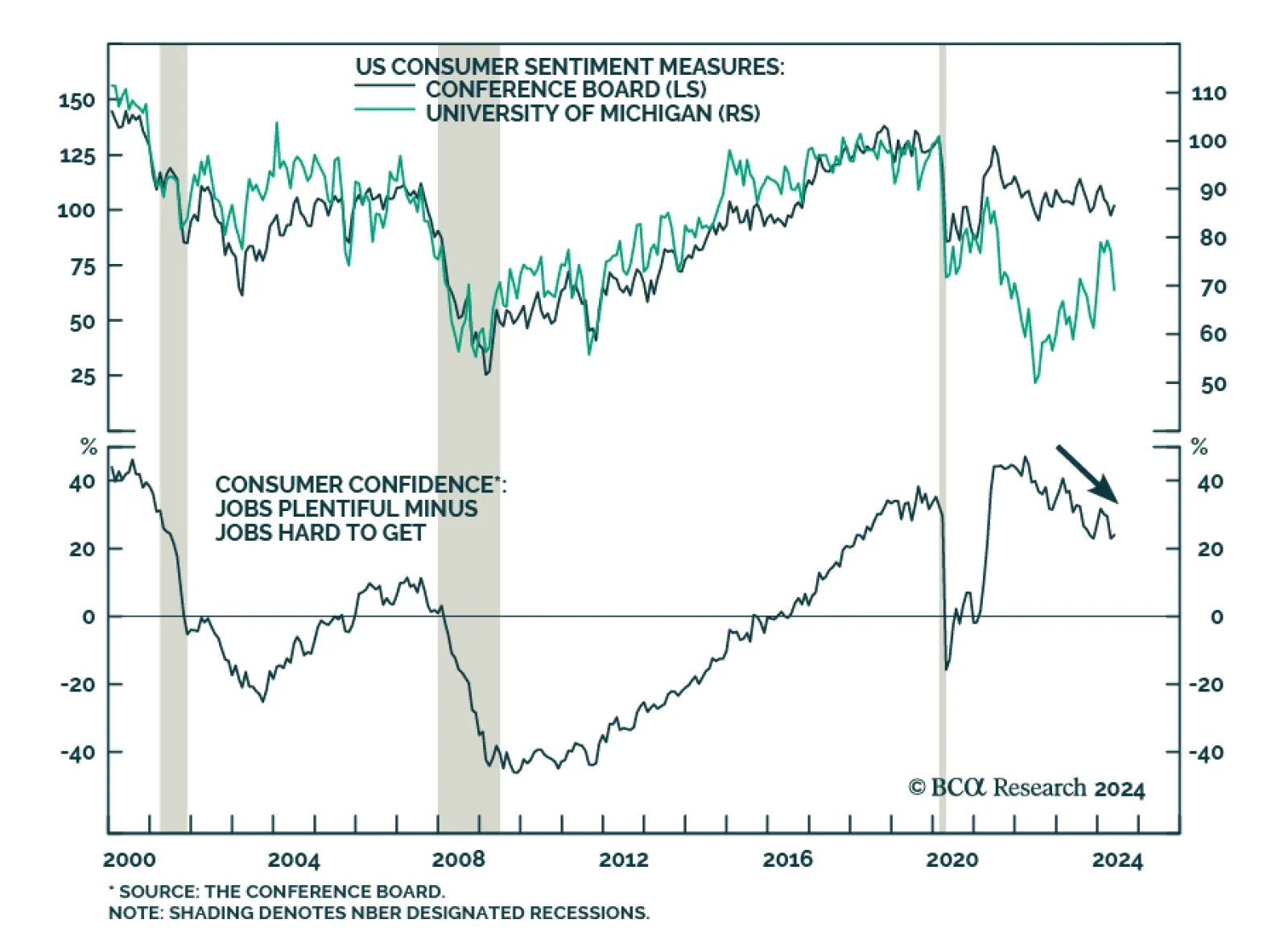

The Conference Board’s measure of consumer confidence surprised to the upside on Tuesday. The headline index improved to 102 from 97.5, upending expectations of a continued moderation to 96. The rebound follows 3…

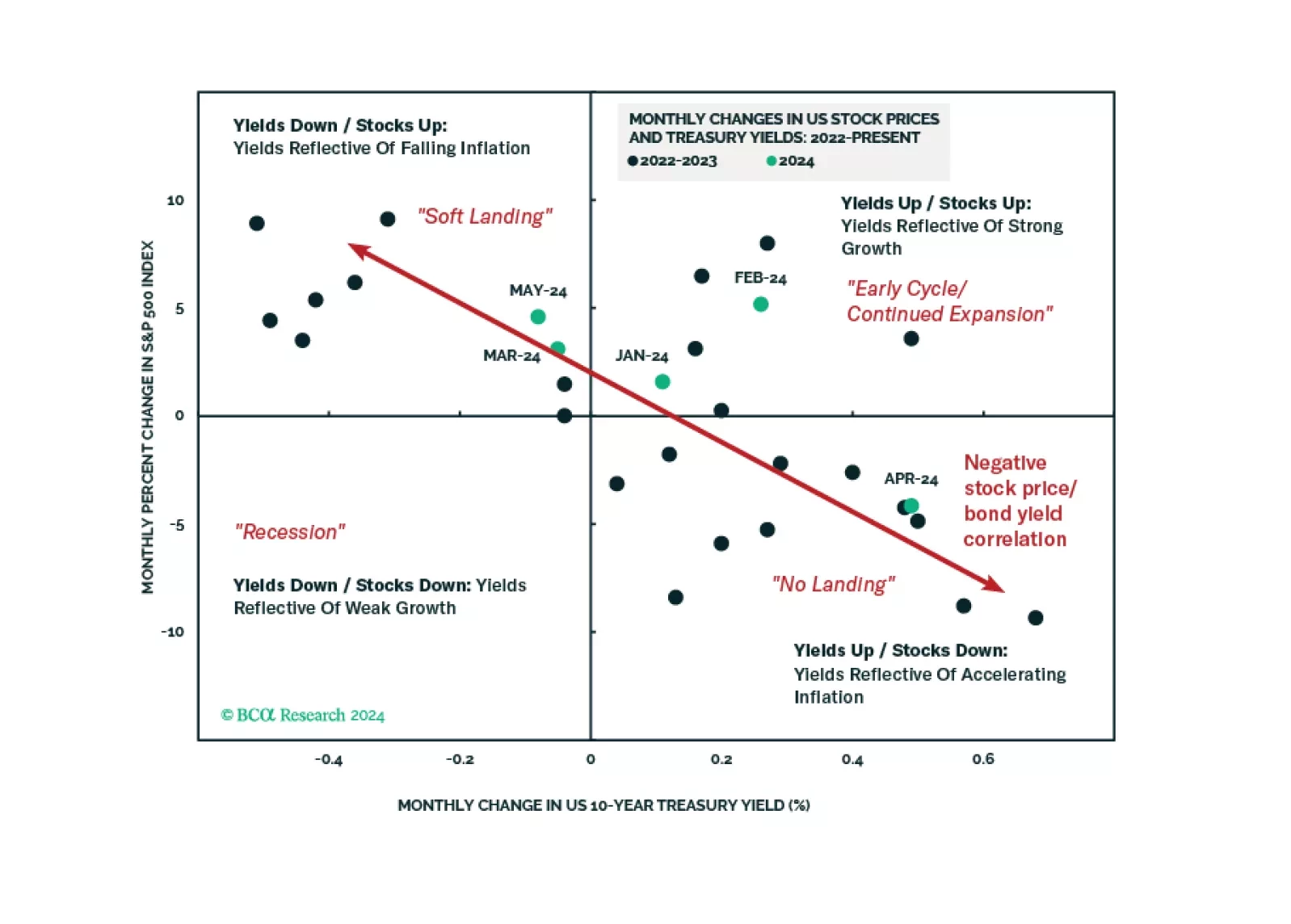

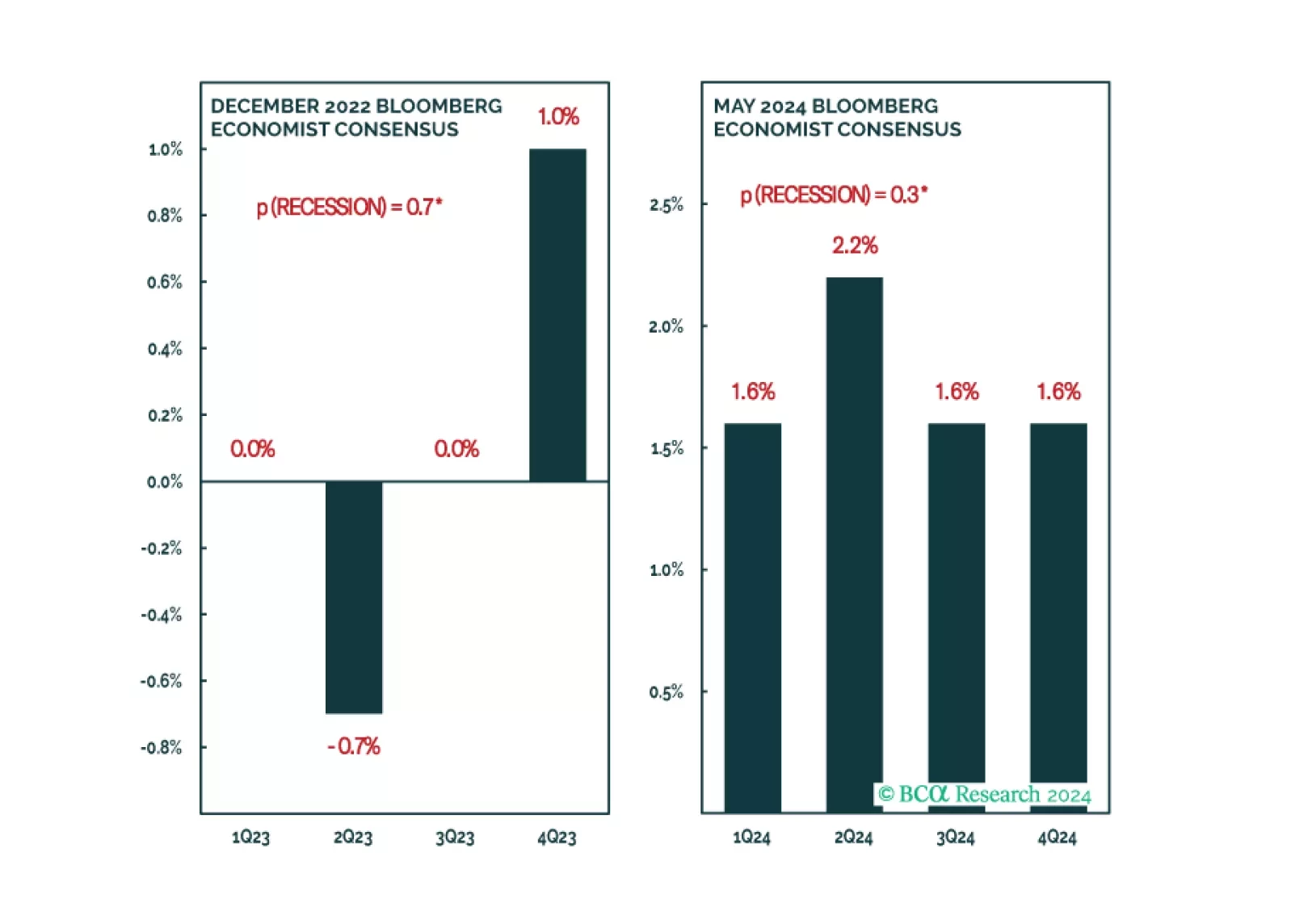

According to BCA Research’s Global Investment Strategy service, there is only a narrow path to a soft landing. Our colleagues estimate a mere 20% chance that the US will avoid a recession before the end of 2025. The US…

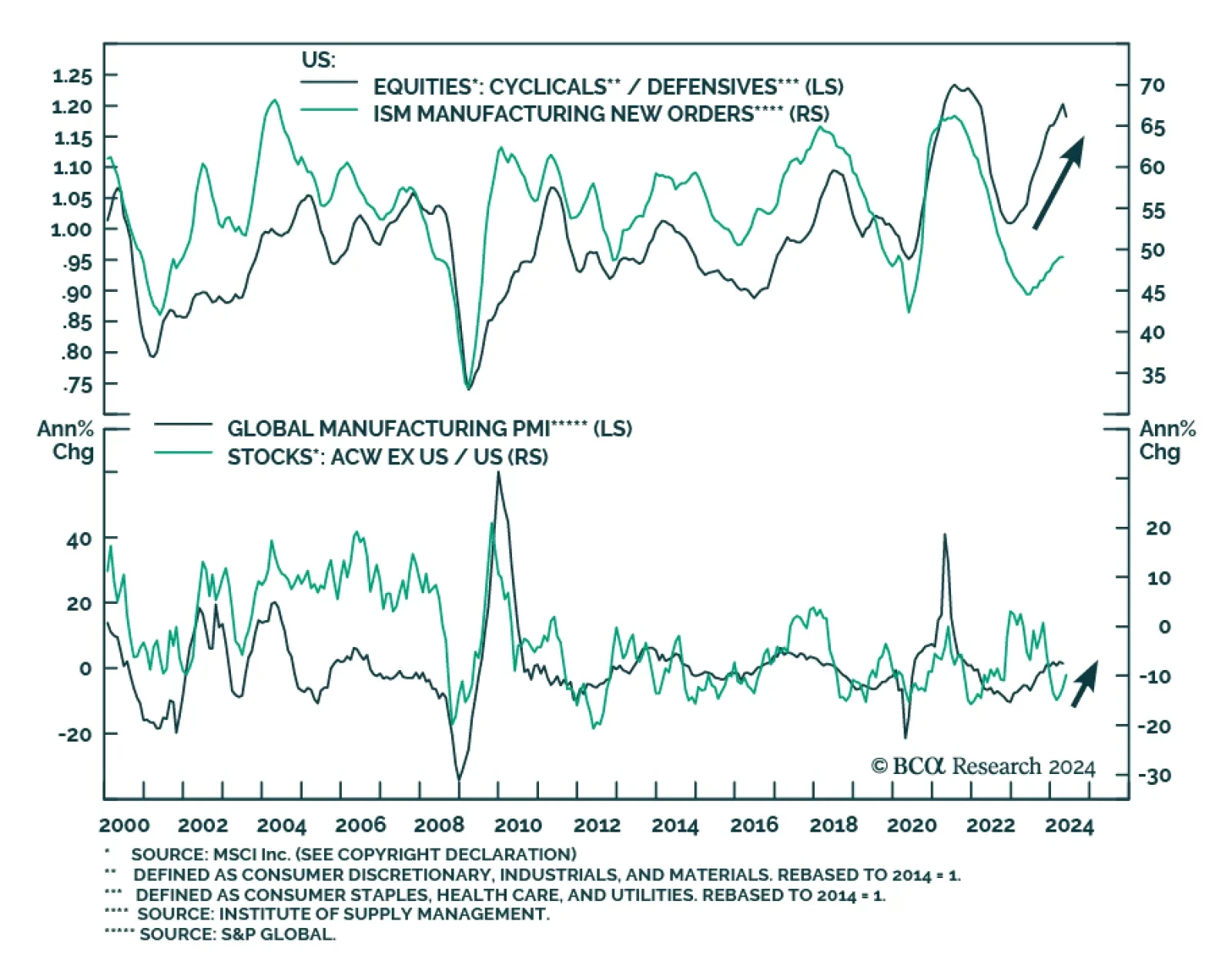

The US manufacturing cycle has followed a surprisingly stable pattern for over seven decades. History suggests that this cycle tends to last for about 36 months, with a down leg spanning 18 months, followed by an up leg…

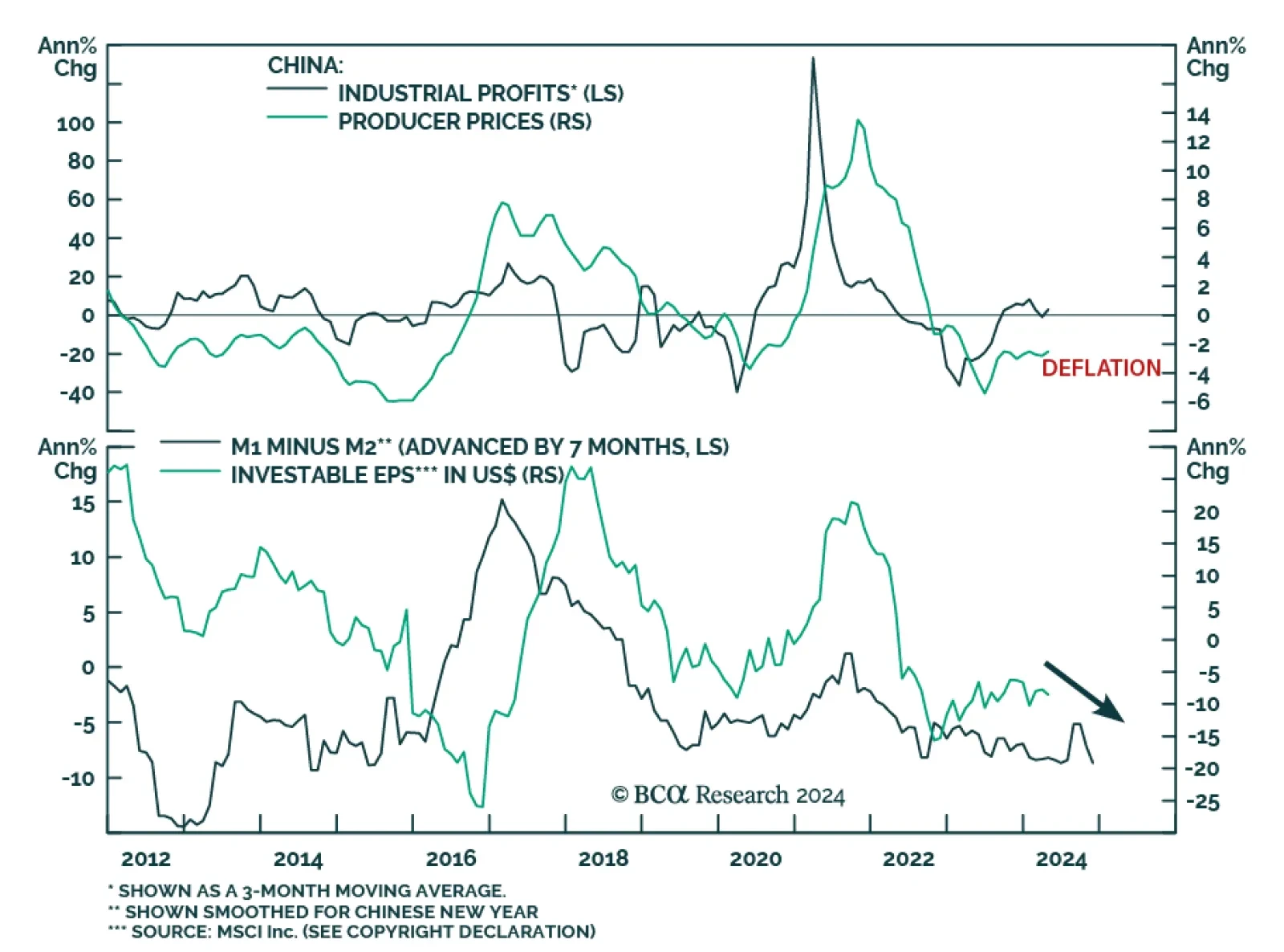

Chinese industrial profits rose by 4.0% y/y in April, from a 3.5% y/y contraction in March. They grew by 4.3% in the first four months of the year, compared to the same period in 2023. In March, the central government pledged…

The signs of an approaching recession are starting to emerge. We will turn tactically defensive once they all fall into place.

There is a path to a soft landing, but it is a narrow one. We estimate that there is only a 20% chance that the US will avoid a recession before the end of 2025. We are currently neutral on global equities, but expect to downgrade…