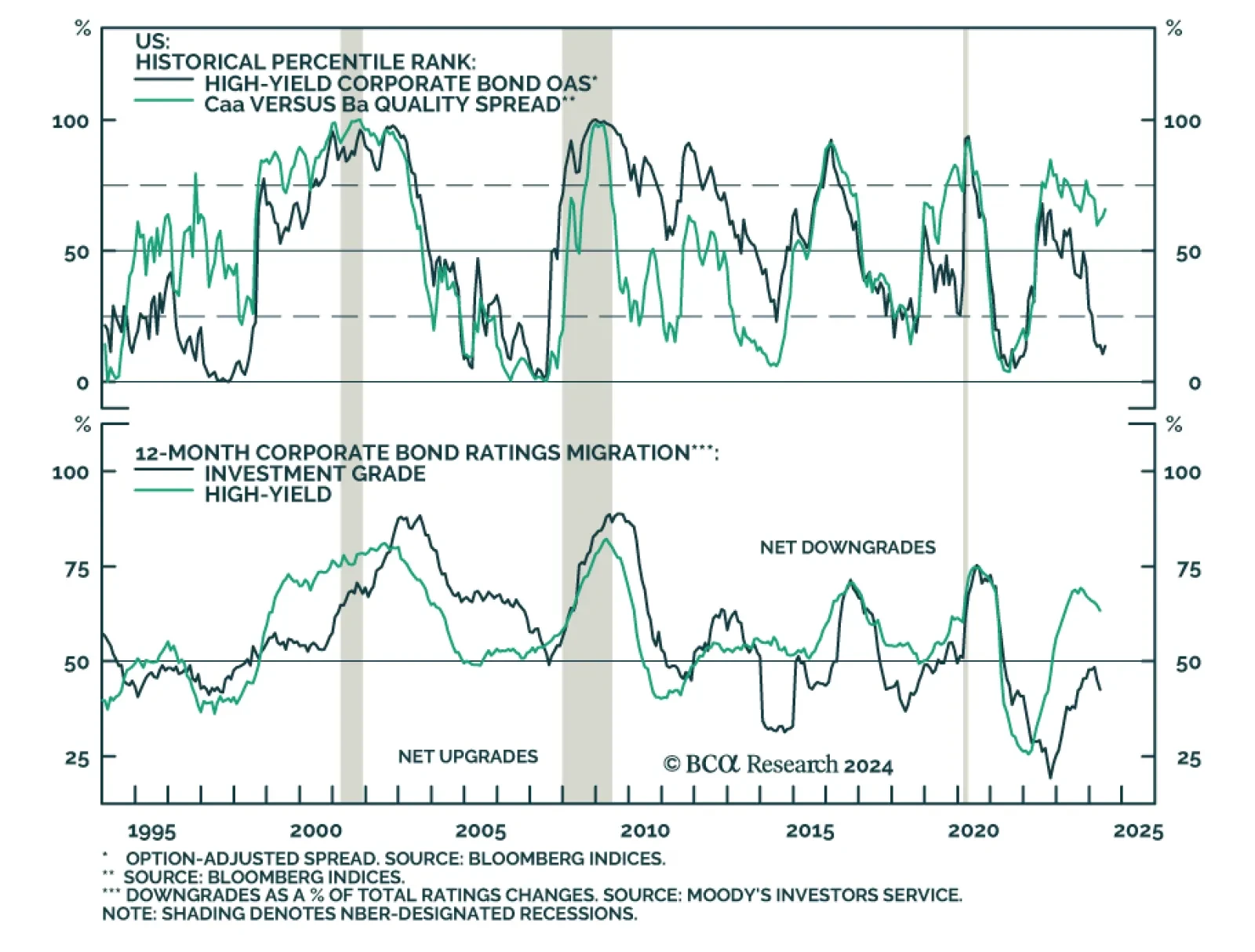

Corporate and junk bonds are the fixed-income sectors that are most exposed to an economic downturn. We’ve highlighted that markets continue to price in a Goldilocks scenario, with spreads narrowing despite ongoing…

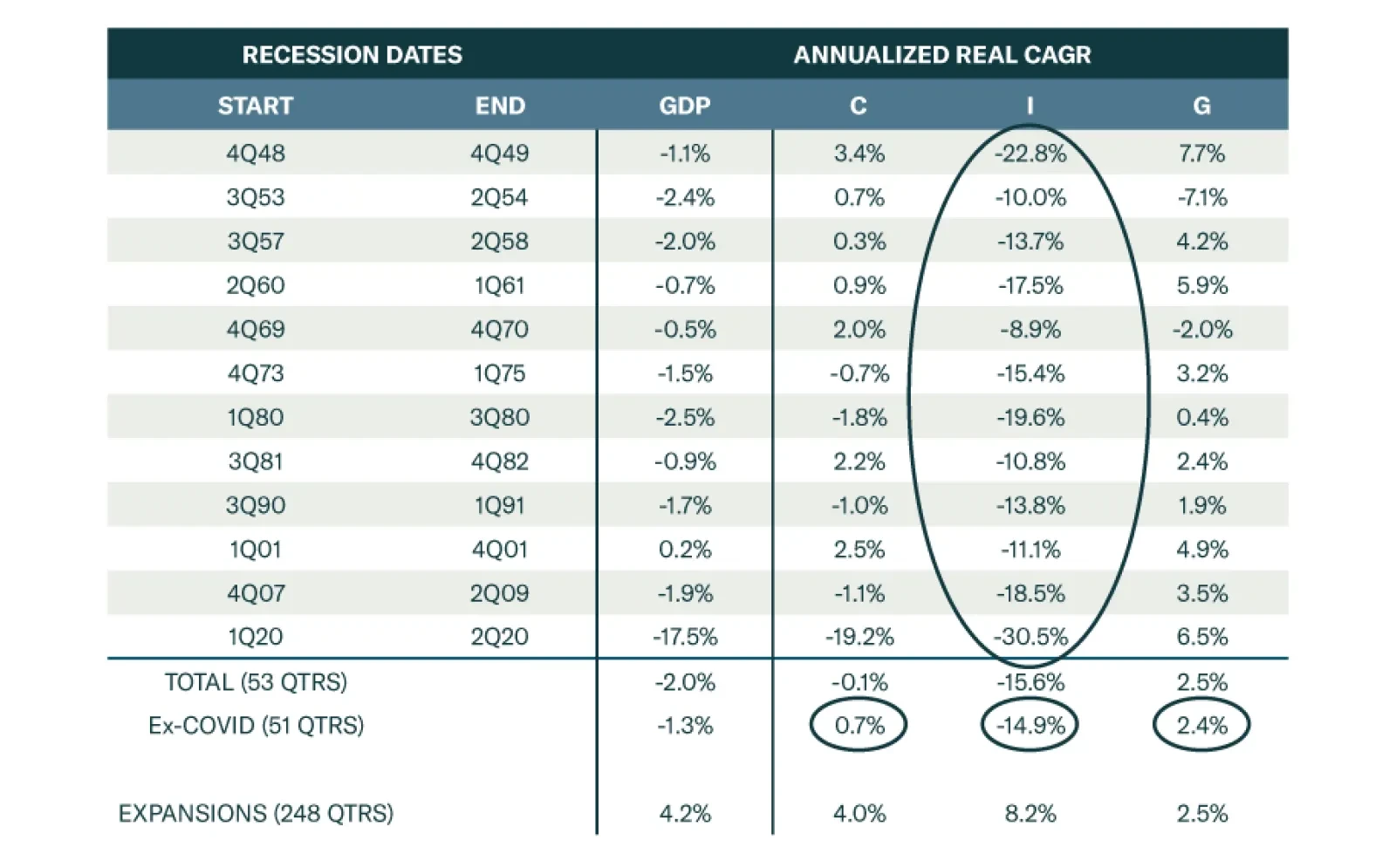

Consumption accounts for two-thirds of the US economy, and our recession view relies heavily on the deteriorating outlook for US consumers. That said, dissecting US GDP into its components reveals that consumption tends to…

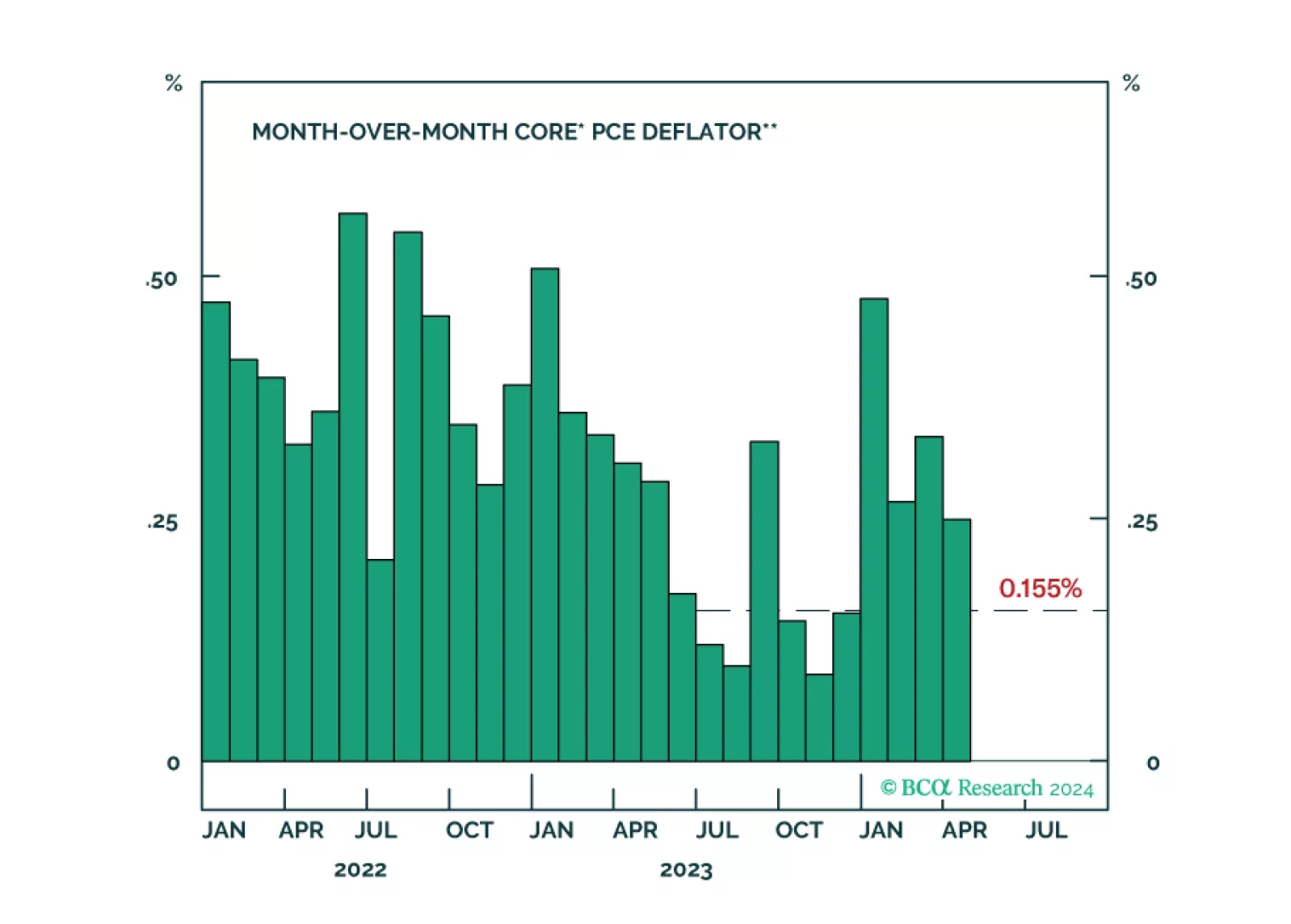

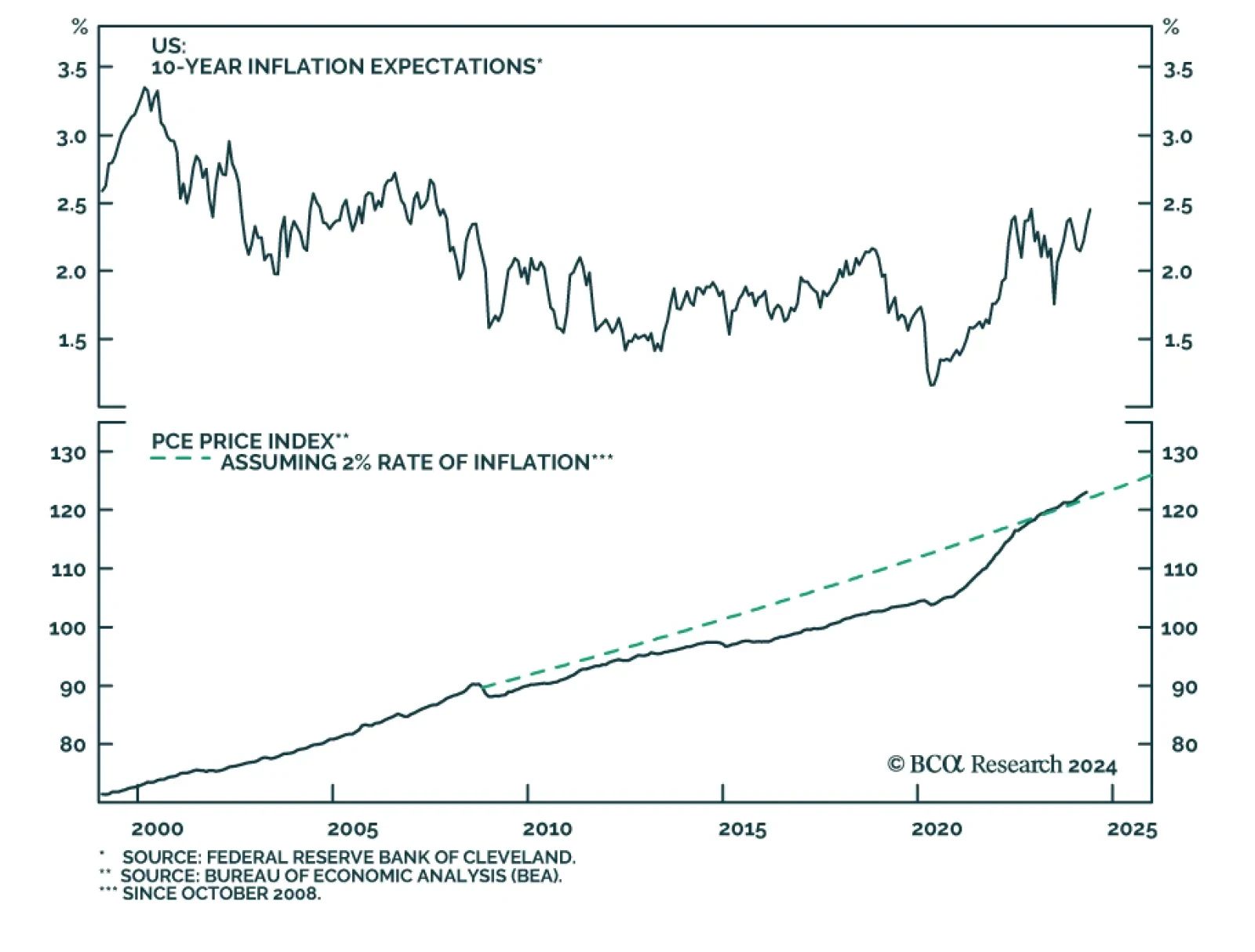

The moderation in core PCE in April was a step in the right direction towards a Fed easing. Our Global Investment Strategists also highlighted that outside of a few pandemic-related “catch-up” categories such as…

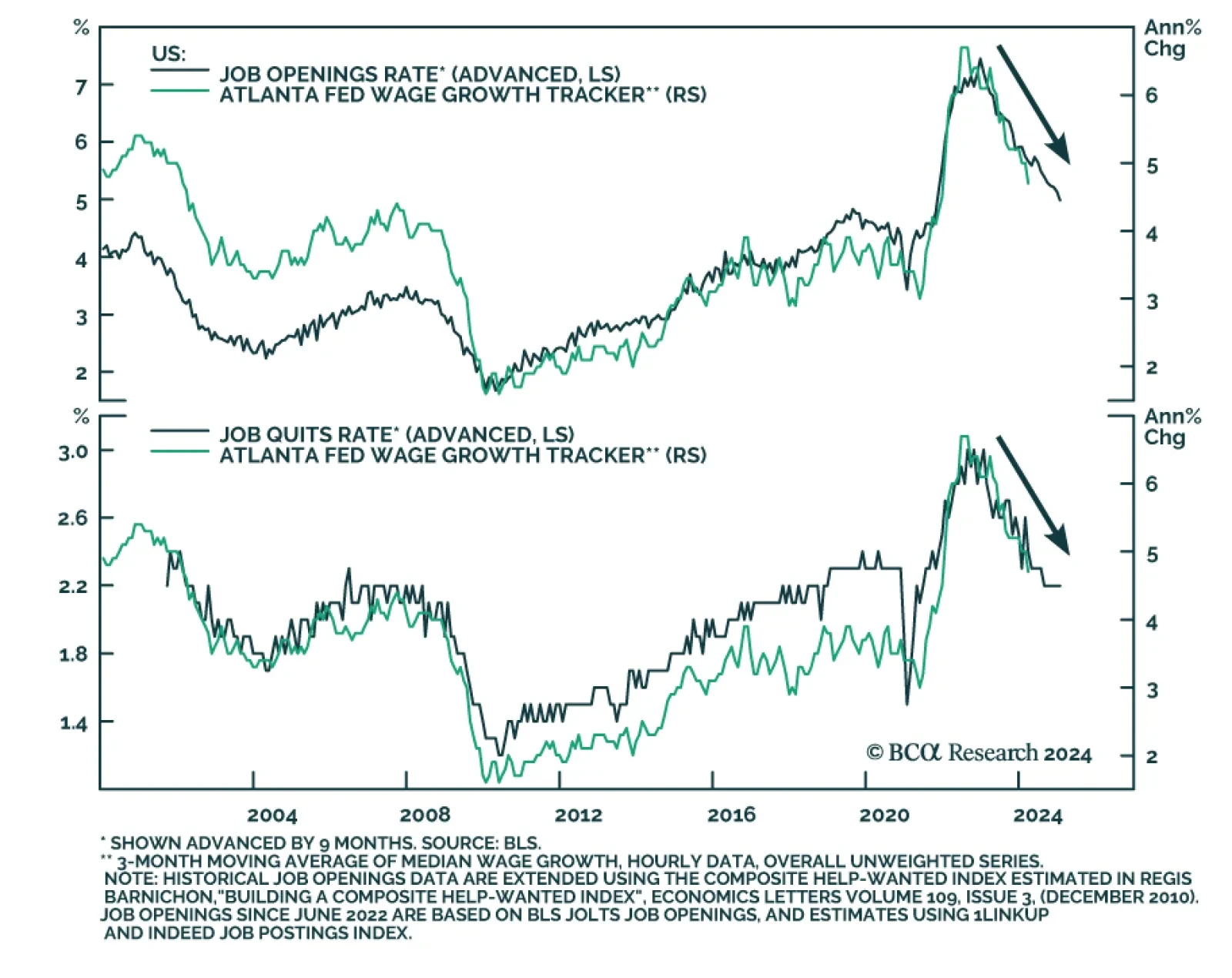

US job openings softened from 8.5 million in March to 8.1 million in April, below expectations of 8.4 million, and the lowest level in three years. Healthcare and social assistance, as well as leisure and hospitality, drove the…

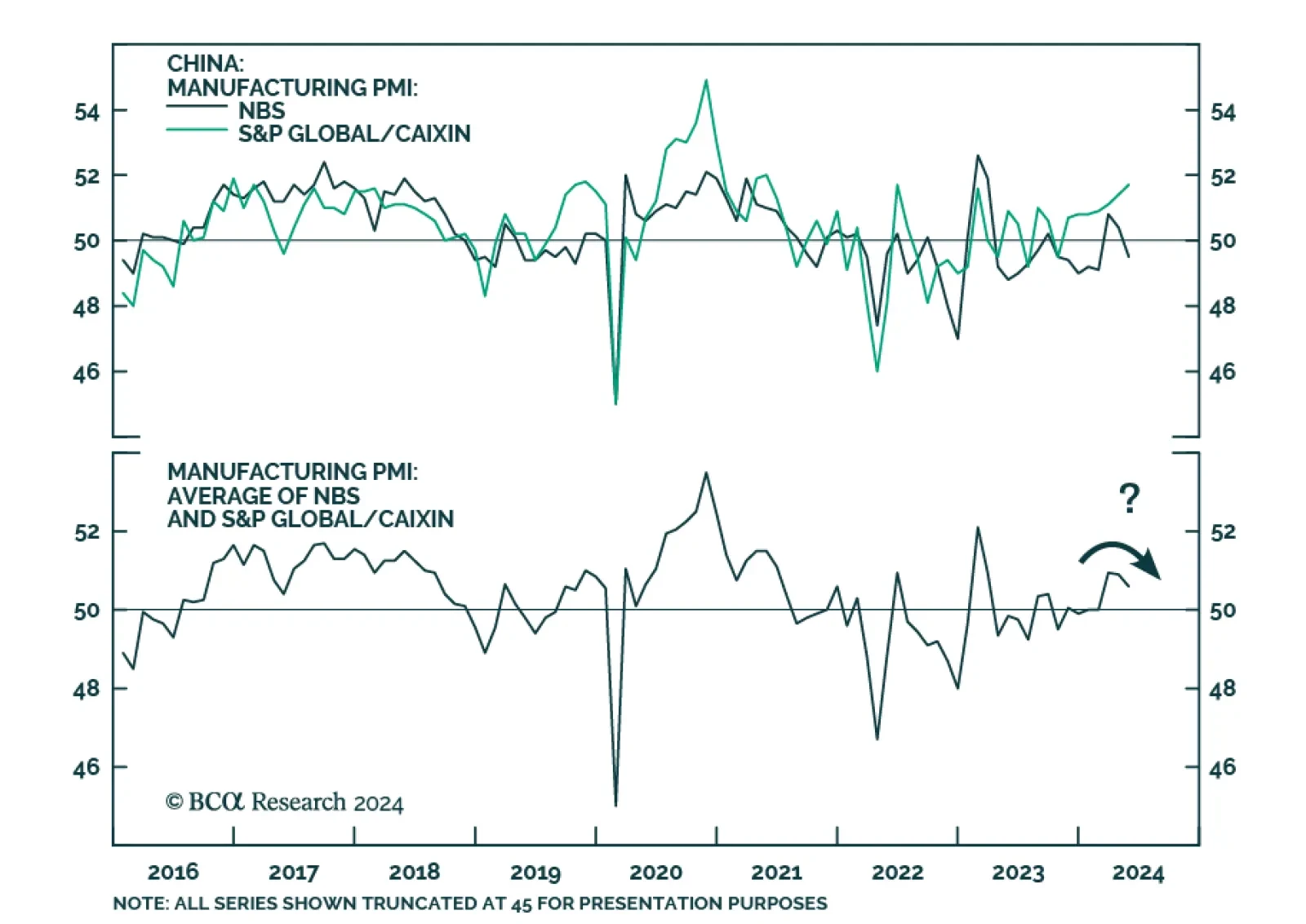

The Caixin Chinese manufacturing PMI reached a two-year high in May, expanding at a larger-than-expected rate from 51.4 to 51.7. The Caixin figure thus contrasts with the alternative NBS manufacturing PMI, which unexpectedly…

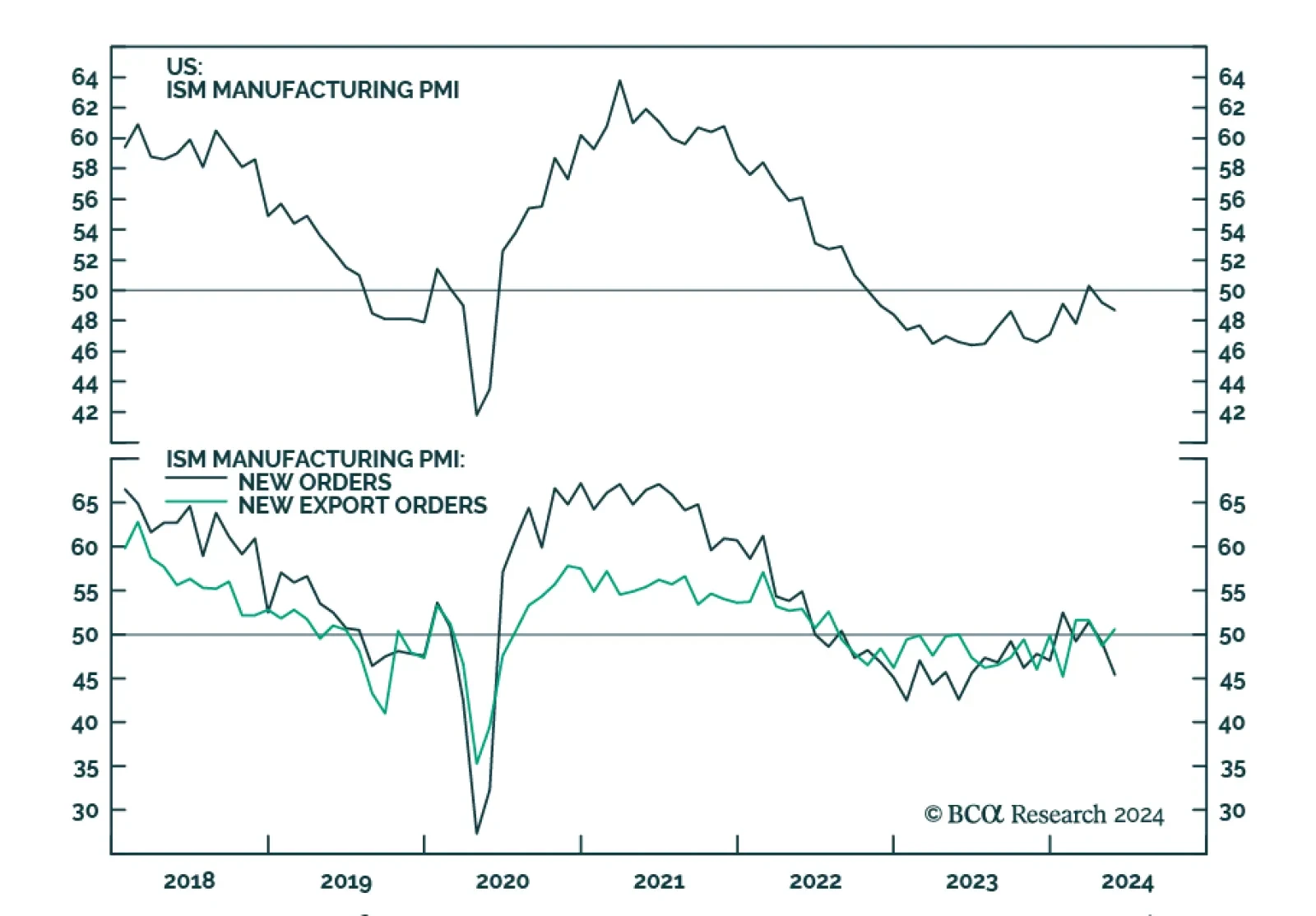

The ISM manufacturing PMI declined further in May, from 49.2 to 48.7, thus disappointing expectations of a slower pace of deterioration. Similar to dynamics observed with their Chinese counterparts (see Country Focus), both US…

Our Portfolio Allocation Summary for June 2024.

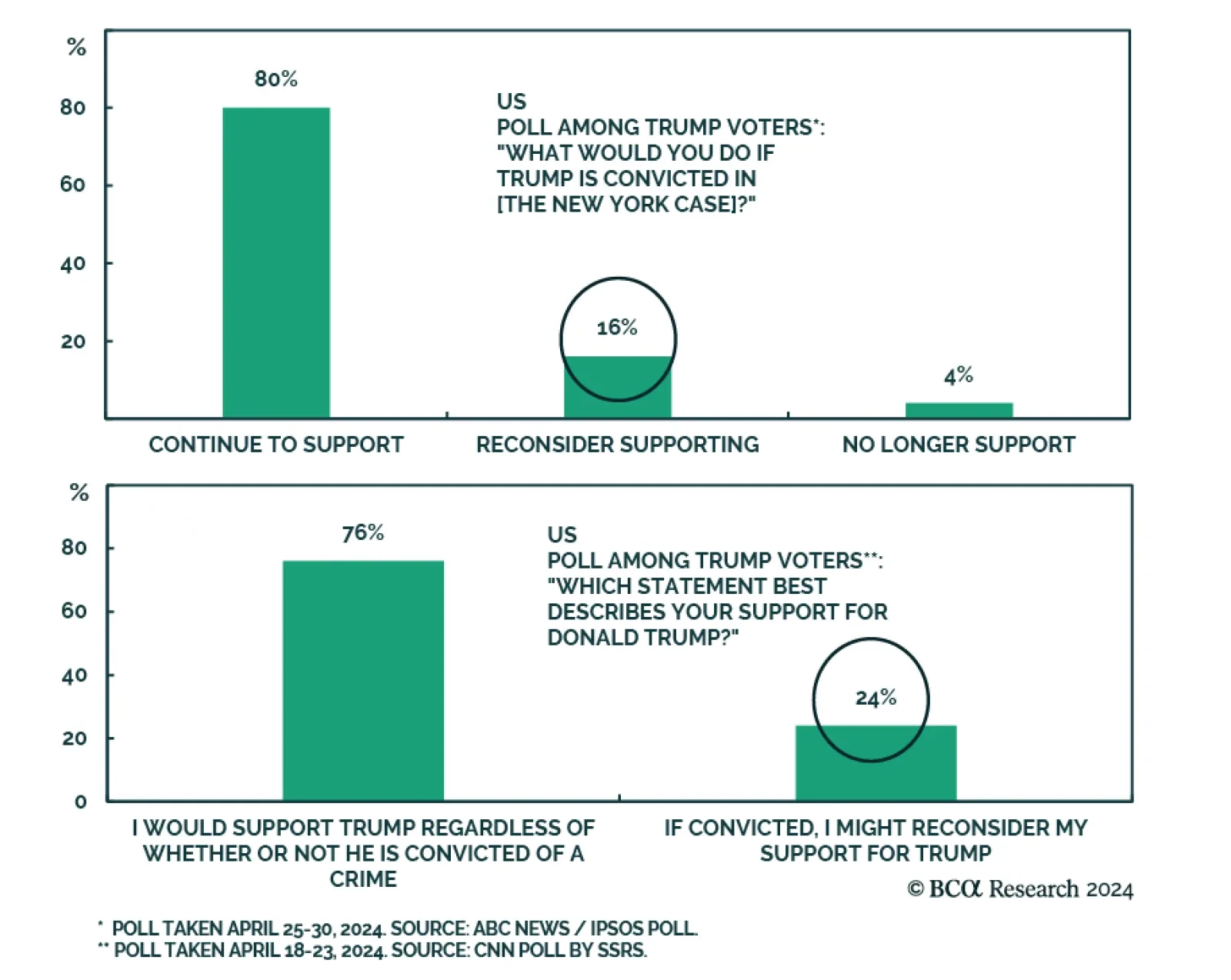

According to BCA Research’s US Political Strategy service, Trump’s conviction will not be a game changer in the upcoming Presidential election. President Trump was convicted of 34 felony charges by a 12-person jury…

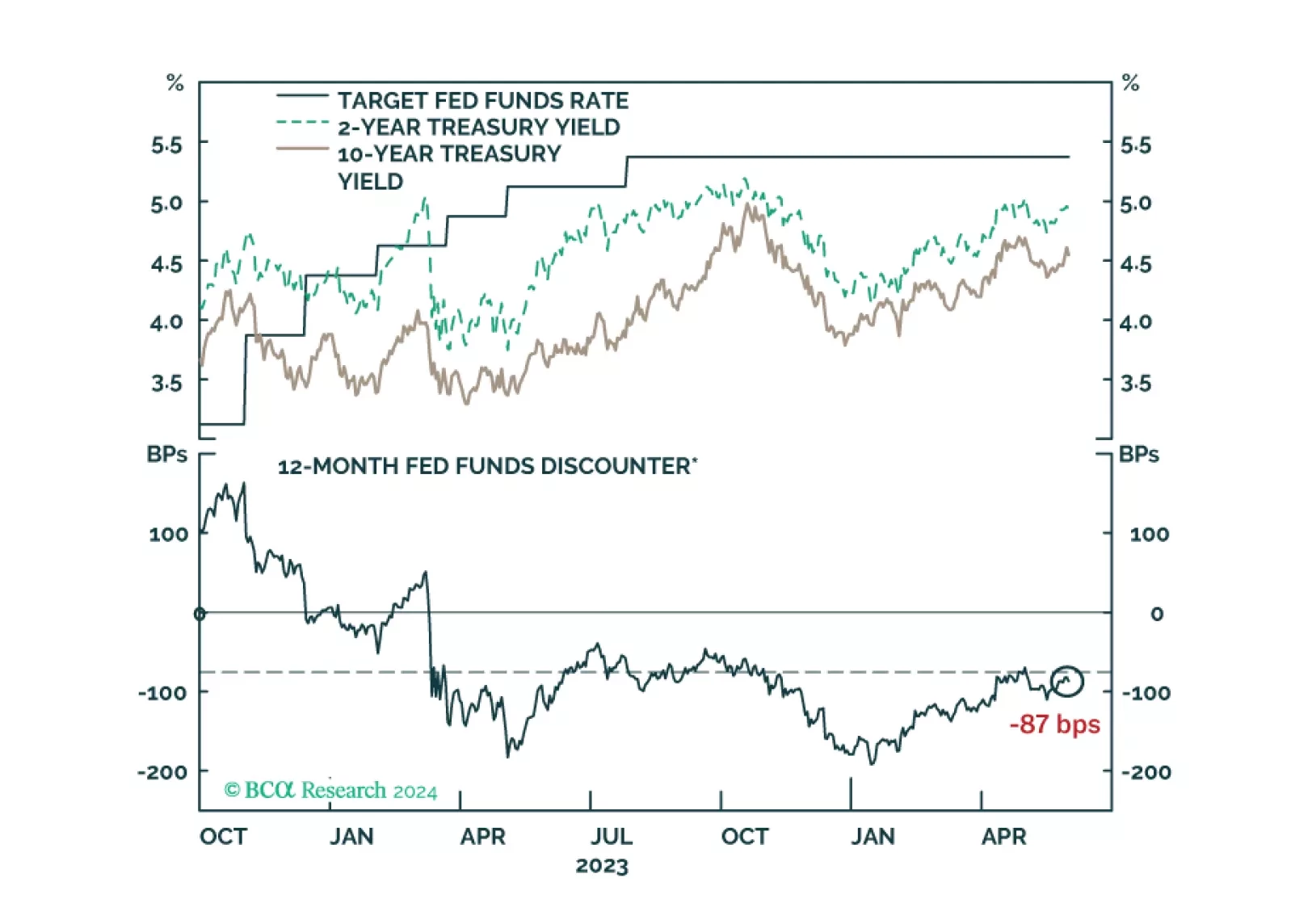

We comment on whether Treasury market valuation is sufficiently attractive to get long bonds and consider some of the common arguments for why yields may yet make new highs.

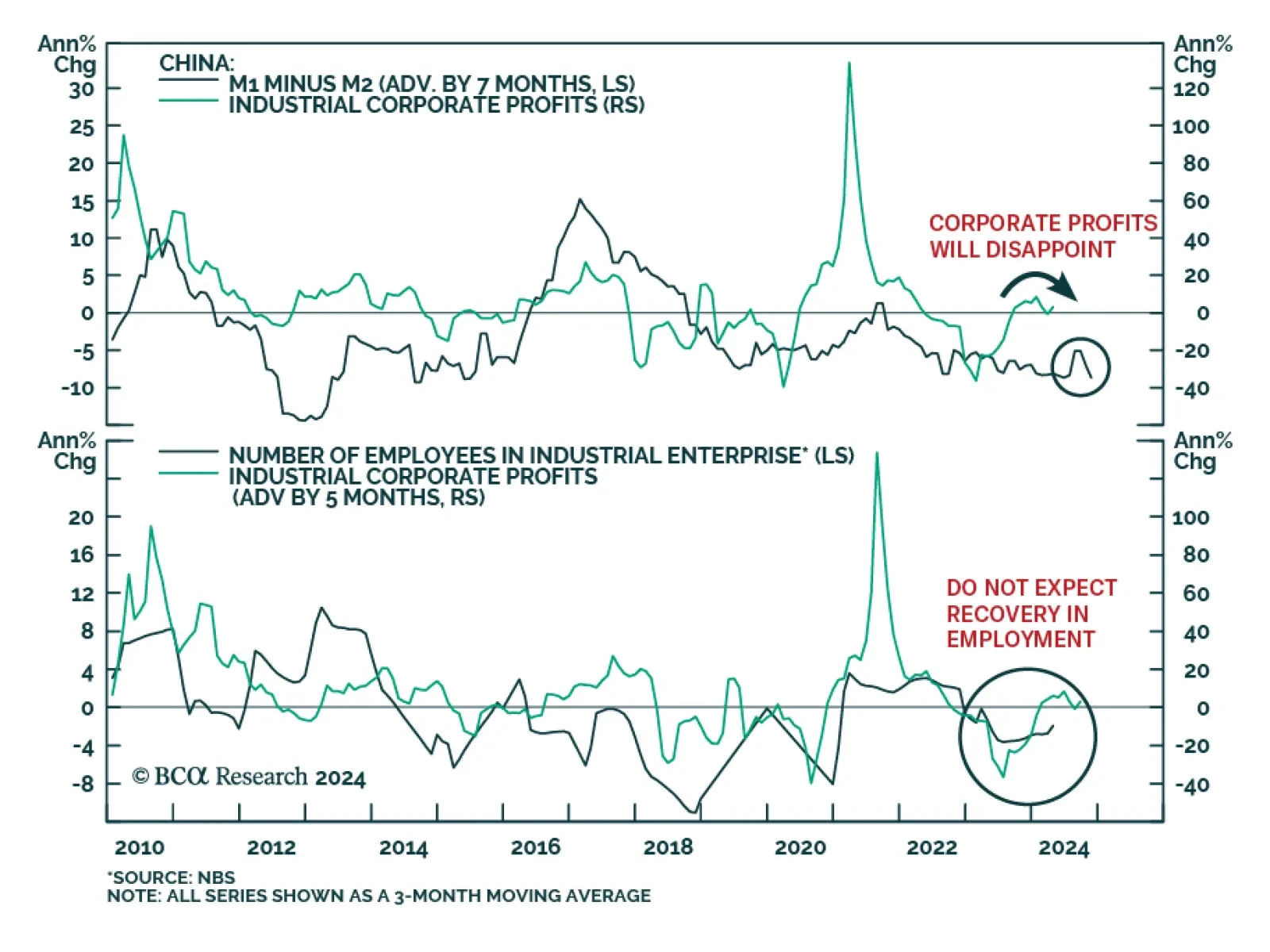

As in many other countries, China’s cyclical consumption growth is primarily driven by labor market conditions, income, and borrowing. BCA Research’s China Investment Strategy service maintains the view that these…