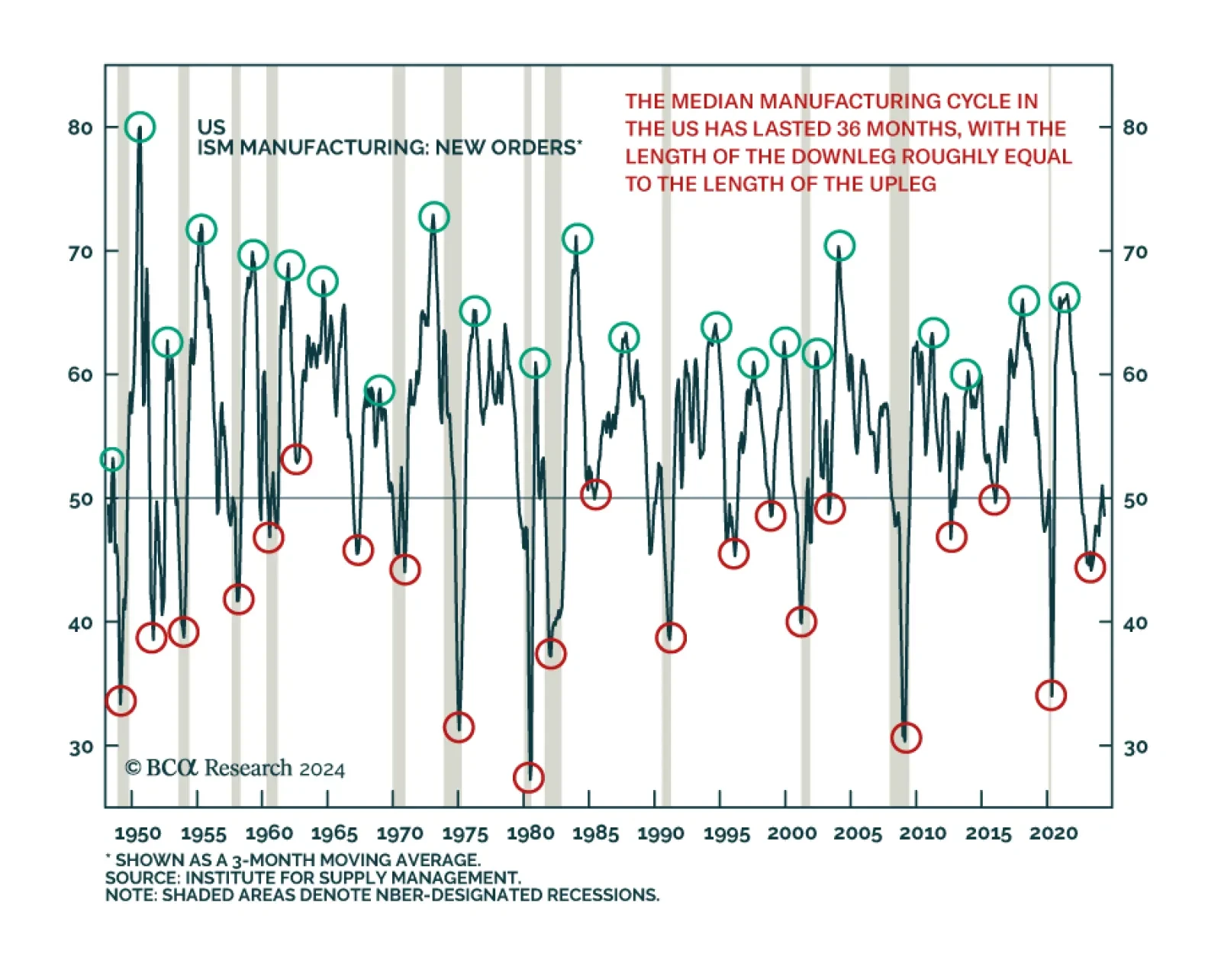

Our colleagues at Global Investment Strategy have shown that postwar US (and global) manufacturing cycles have tended to last 3 years, divided equally between an 18-month up leg and an 18-month down leg. This framework has been a…

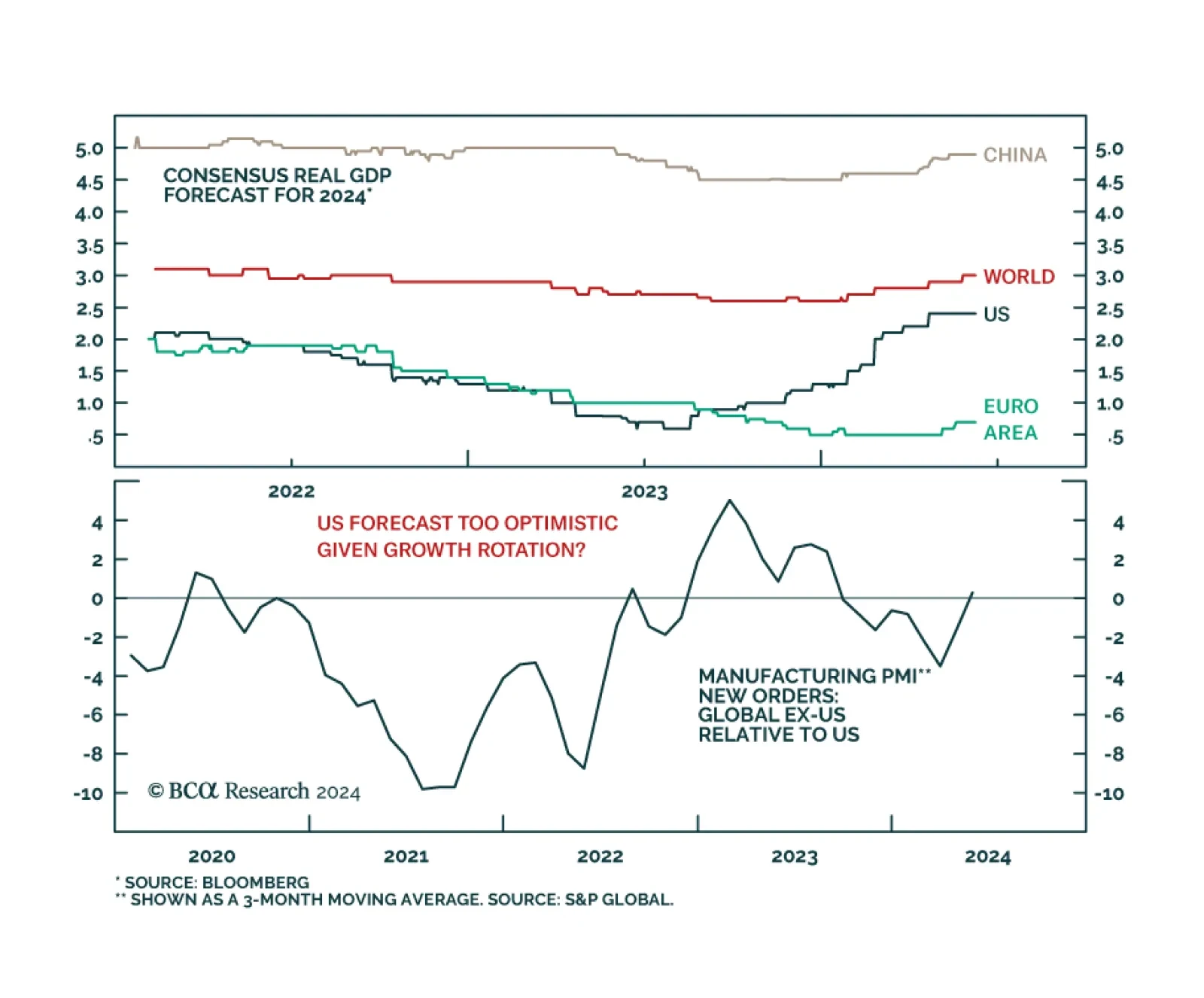

Global growth expectations for 2024 have been revised higher. Investors now forecasts 2024 GDP growth to clock in at 3%, up from 2.6% at the beginning of this year. A 1.1% upward revision in US growth expectations since January…

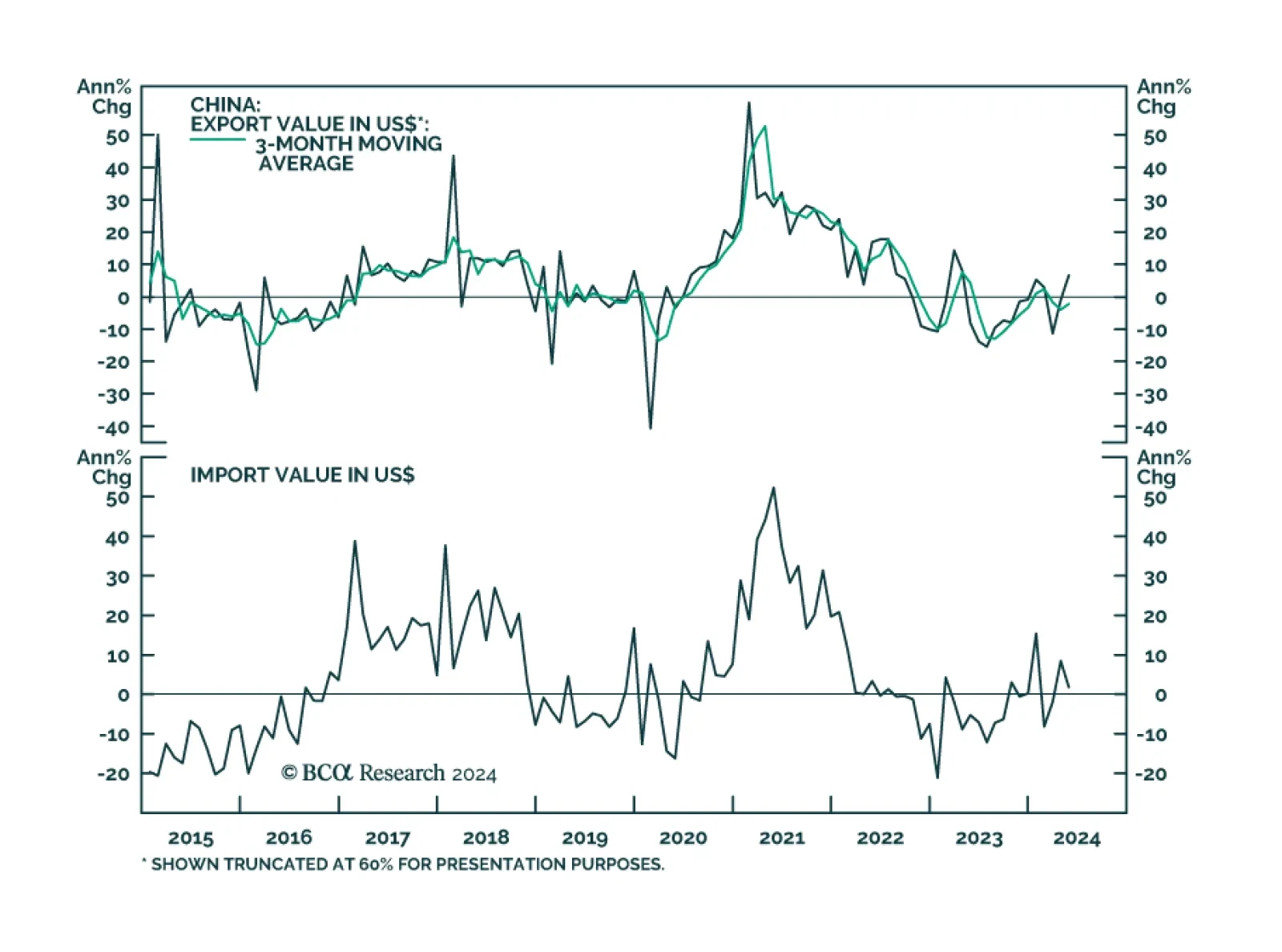

China’s exports in USD terms surged 7.6% y/y in May, from 1.5% in April, surpassing expectations of a 5.7% gain. However, base effects largely overstate the strength of Chinese exports given that they contracted by 8% y/…

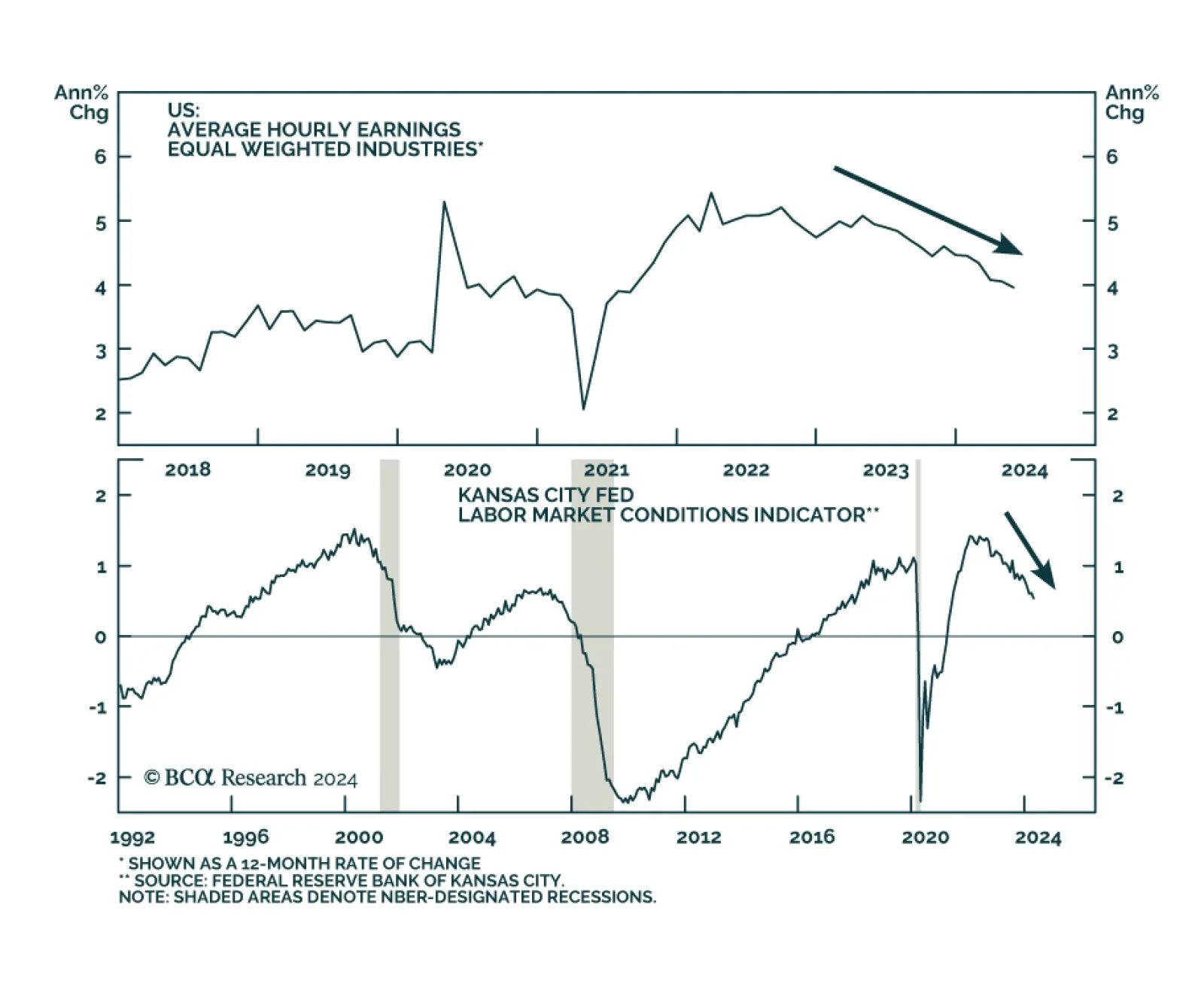

US nonfarm payrolls grew by 272 thousand in May, accelerating from 165 thousand in April, and swamping expectations of 180 thousand. Average hourly earnings increased by 4.1% y/y from an upwardly revised 4.0%. However, the…

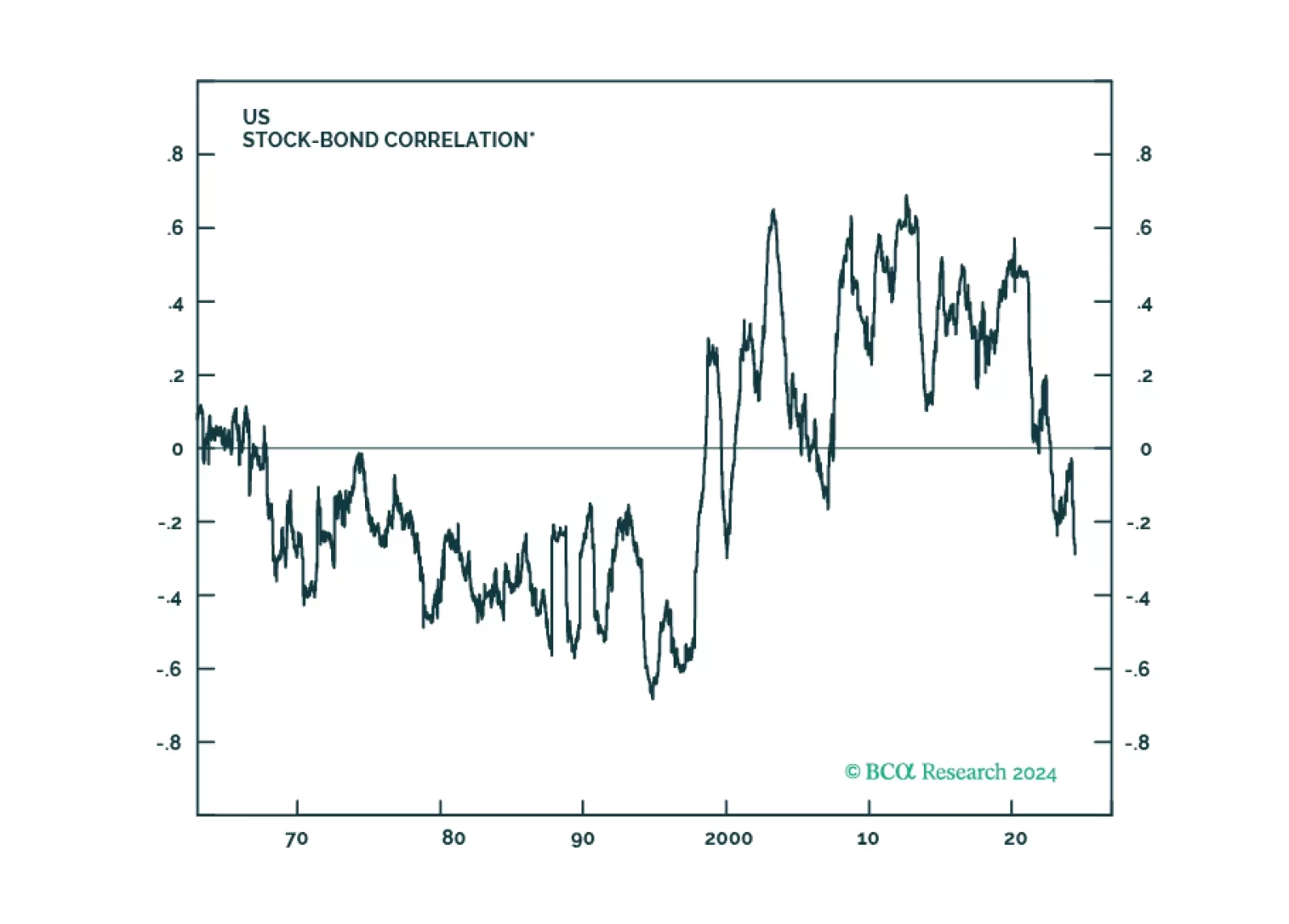

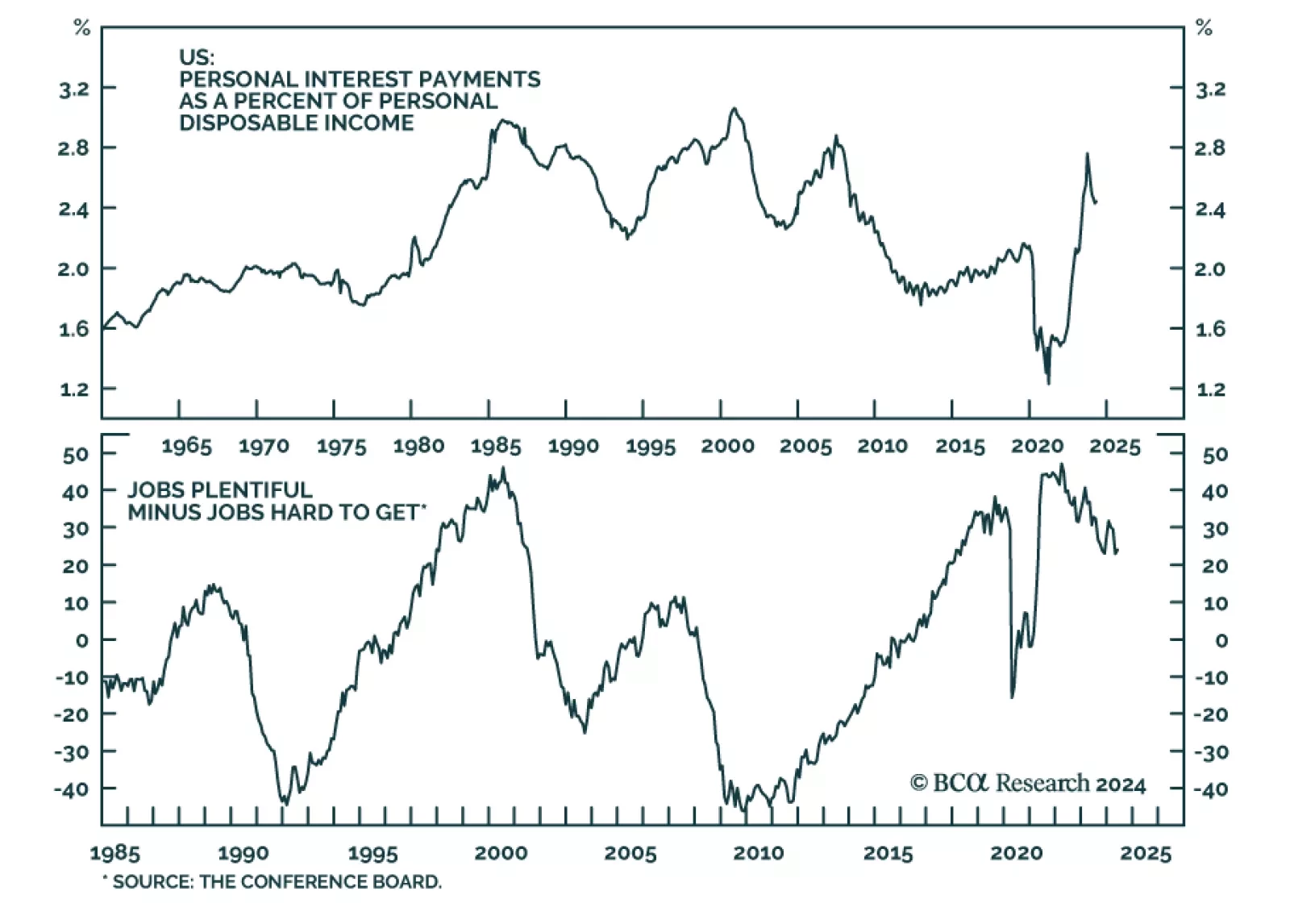

The US economy remains on a path towards a recession, most likely starting in late 2024 or early 2025. For now, investors should maintain a benchmark allocation to equities, but employ a barbell strategy of overweighting defensives…

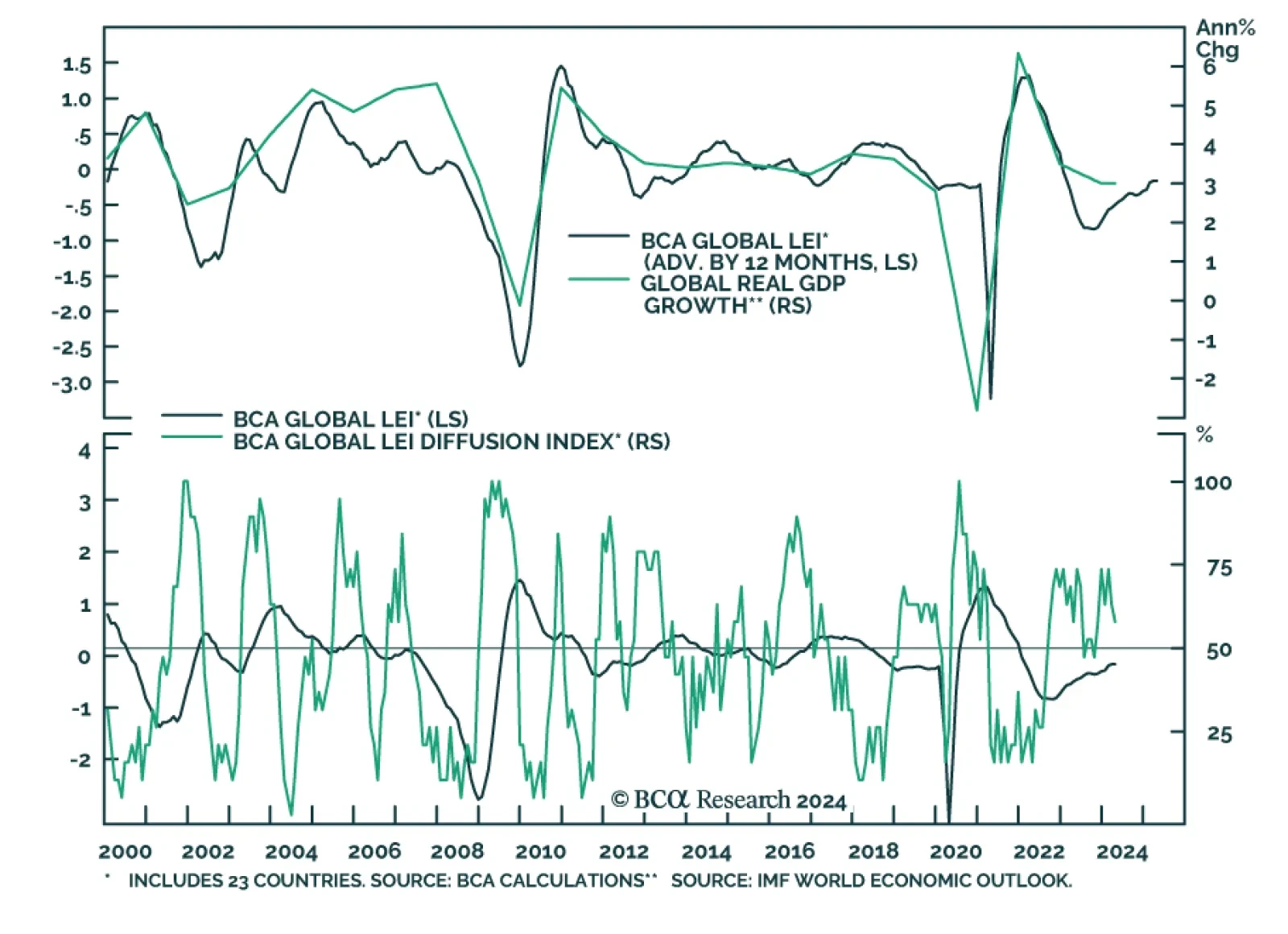

BCA’s Global Leading Economic Indicator has had a good track record of predicting year-on-year changes in the IMF global real GDP growth series. This GDP-weighted average of the standardized leading indicators of 23 DM and…

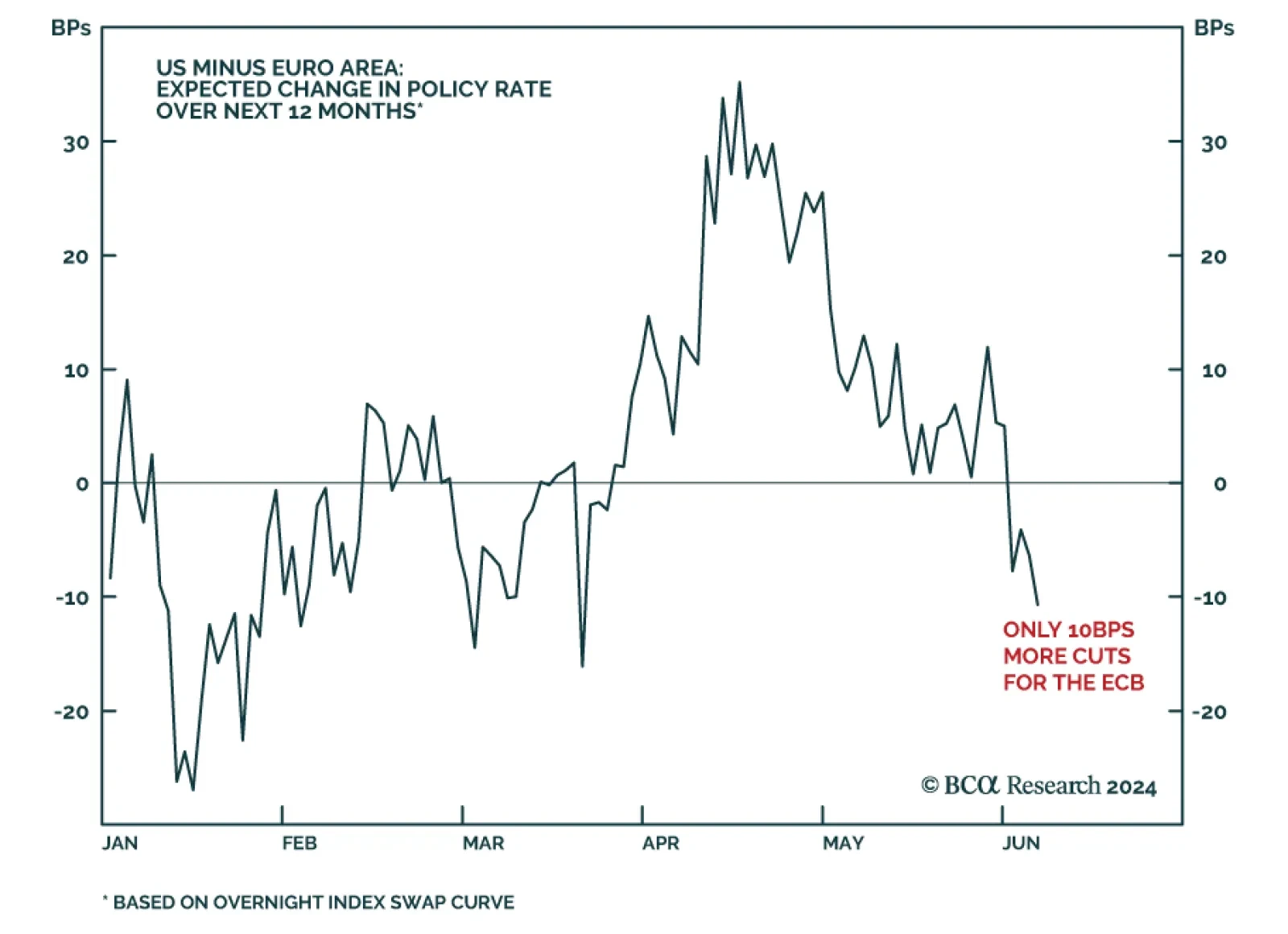

After holding rates steady over the past nine months, the ECB delivered on its widely expected rate cut on Thursday. The Governing Council lowered all three key ECB interest rates by 25 bps, bringing the refinancing, marginal…

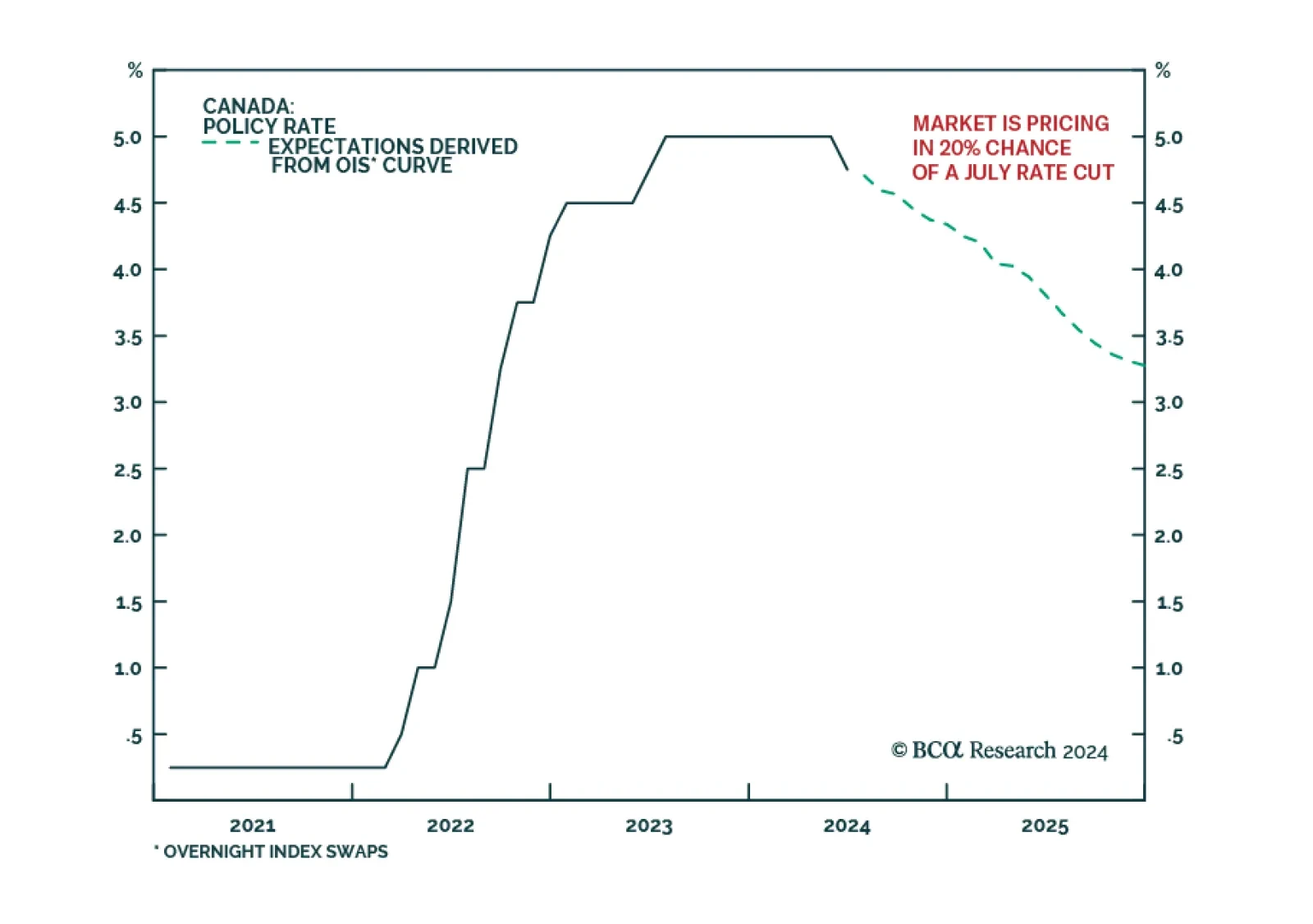

The Bank of Canada reduced its policy rate by 25 basis points from 5% to 4.75% on Wednesday, in line with the market consensus. Headline inflation and the BoC’s preferred measures of core inflation are within the BoC’…

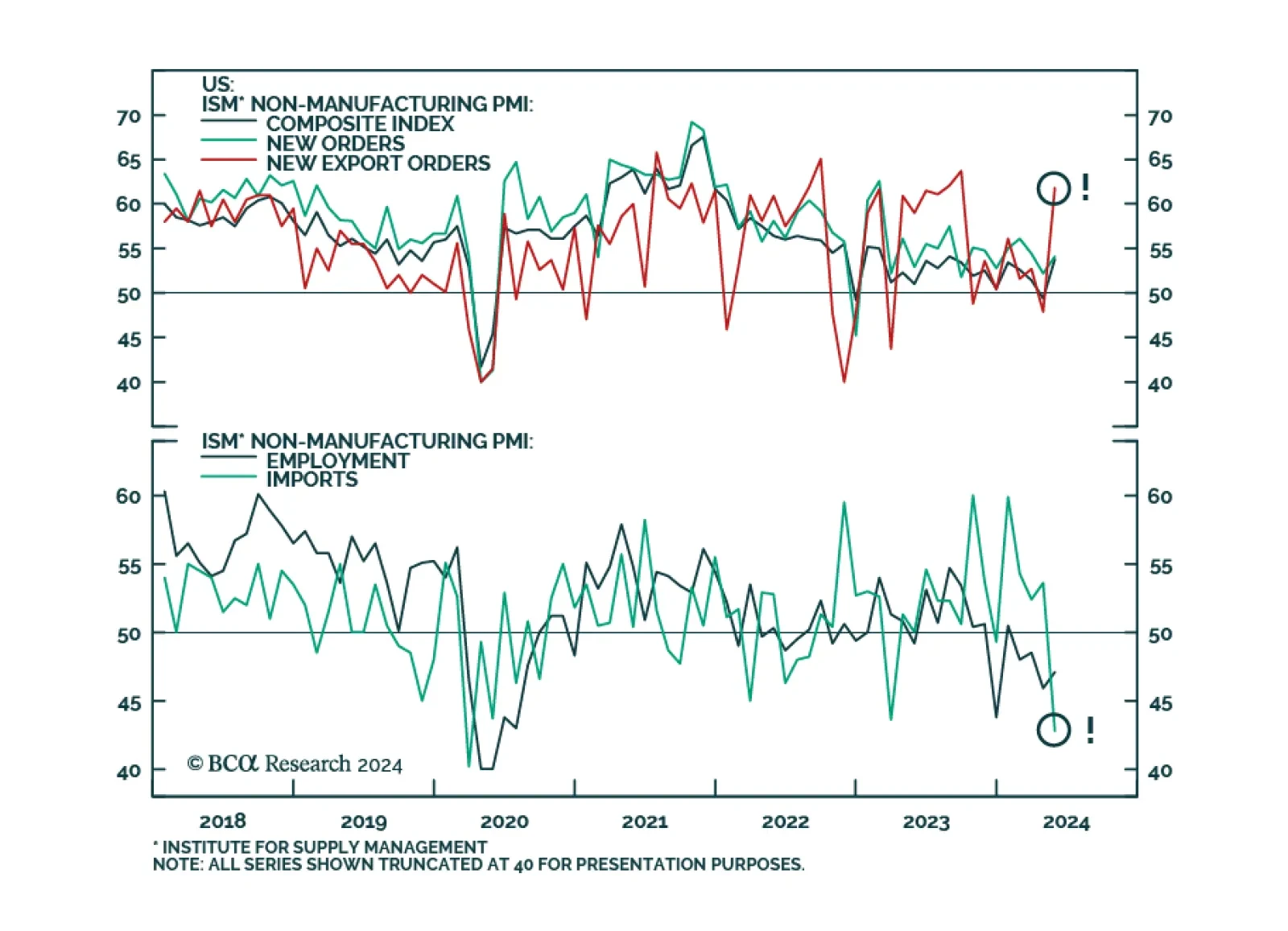

The ISM Services PMI largely surpassed expectations in May. The headline index grew by 4.4 ppt to 53.8, returning to expansion following April’s one-month contraction. Double-digit jumps in new export orders (13.9 ppt) and…

According to BCA Research’s Global Asset Allocation service, the economy has been in the “Overheating” phase of the cycle for a while, with signs of slowing growth but also stubbornly high inflation. The most…