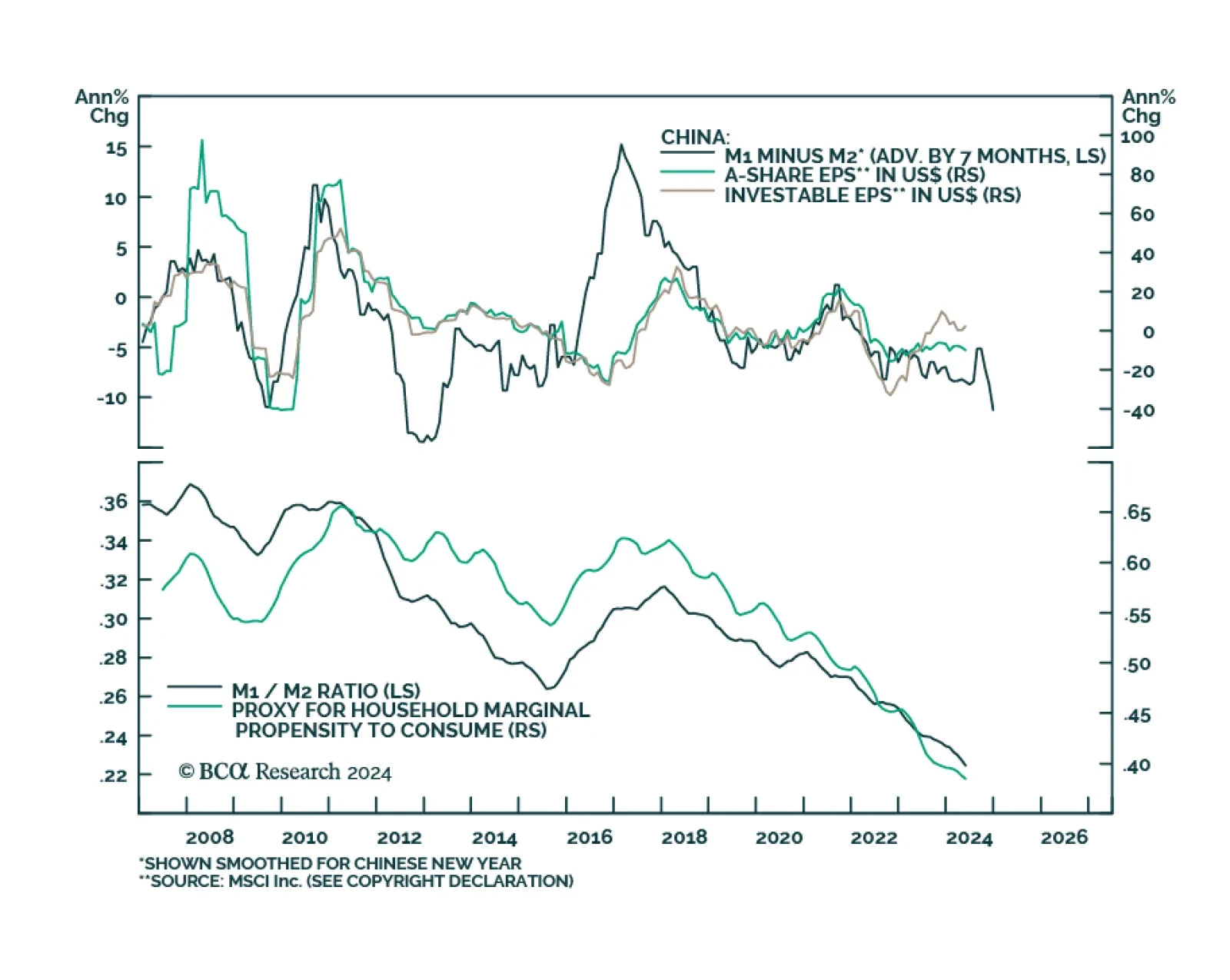

Chinese new loans grew from CNY 10.2 tr to CNY 11.1tr in May, disappointing expectations of CNY 11.3tr. Year-to-date aggregate financing also came short of anticipations, growing from CNY 12.7tr to CNY 14.8tr. Notably, the…

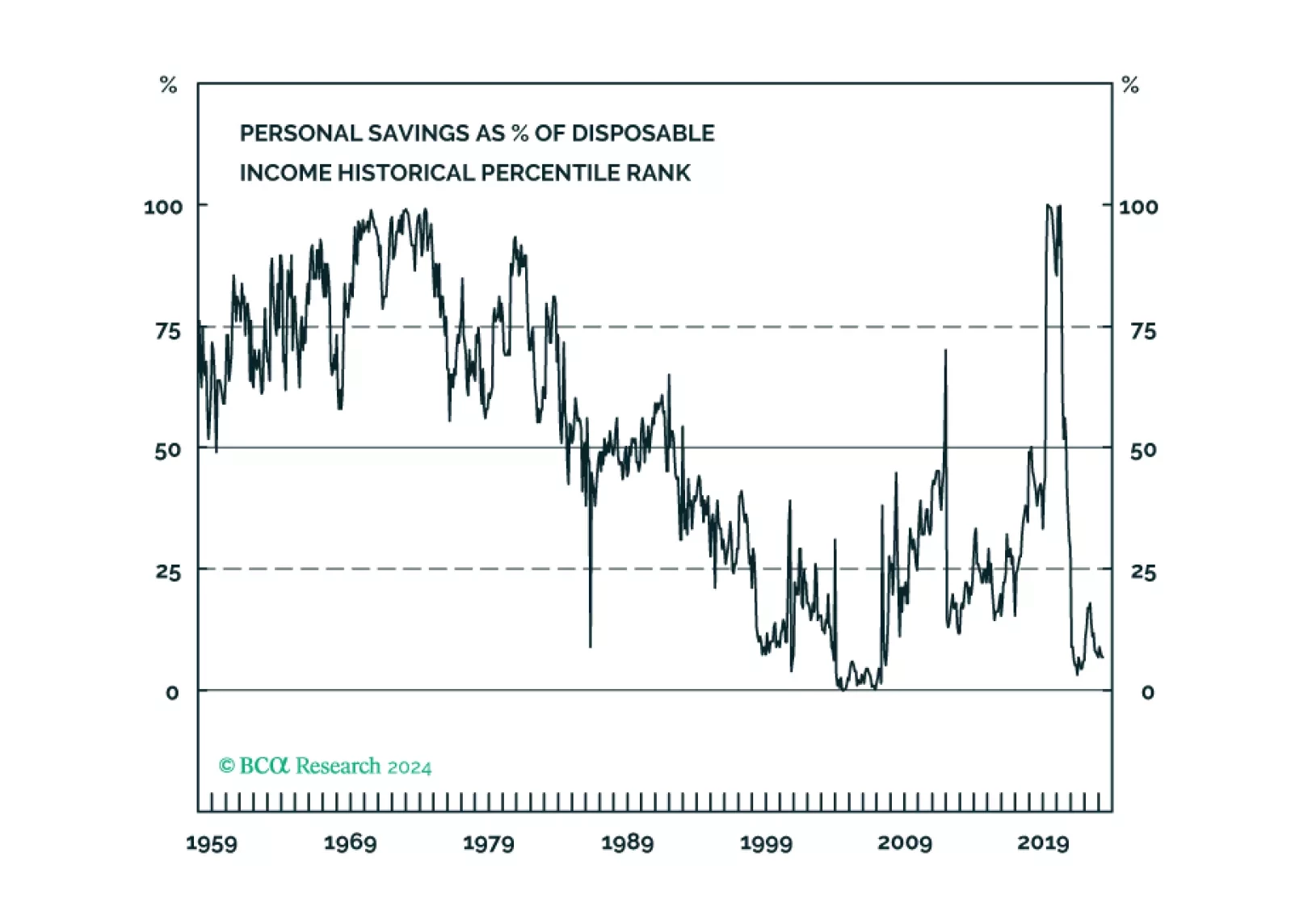

Global consumer spending is likely to slow over the coming quarters, culminating in a major economic downturn in late 2024 or early 2025. Investors should maintain benchmark exposure to equities for now but look to turn more…

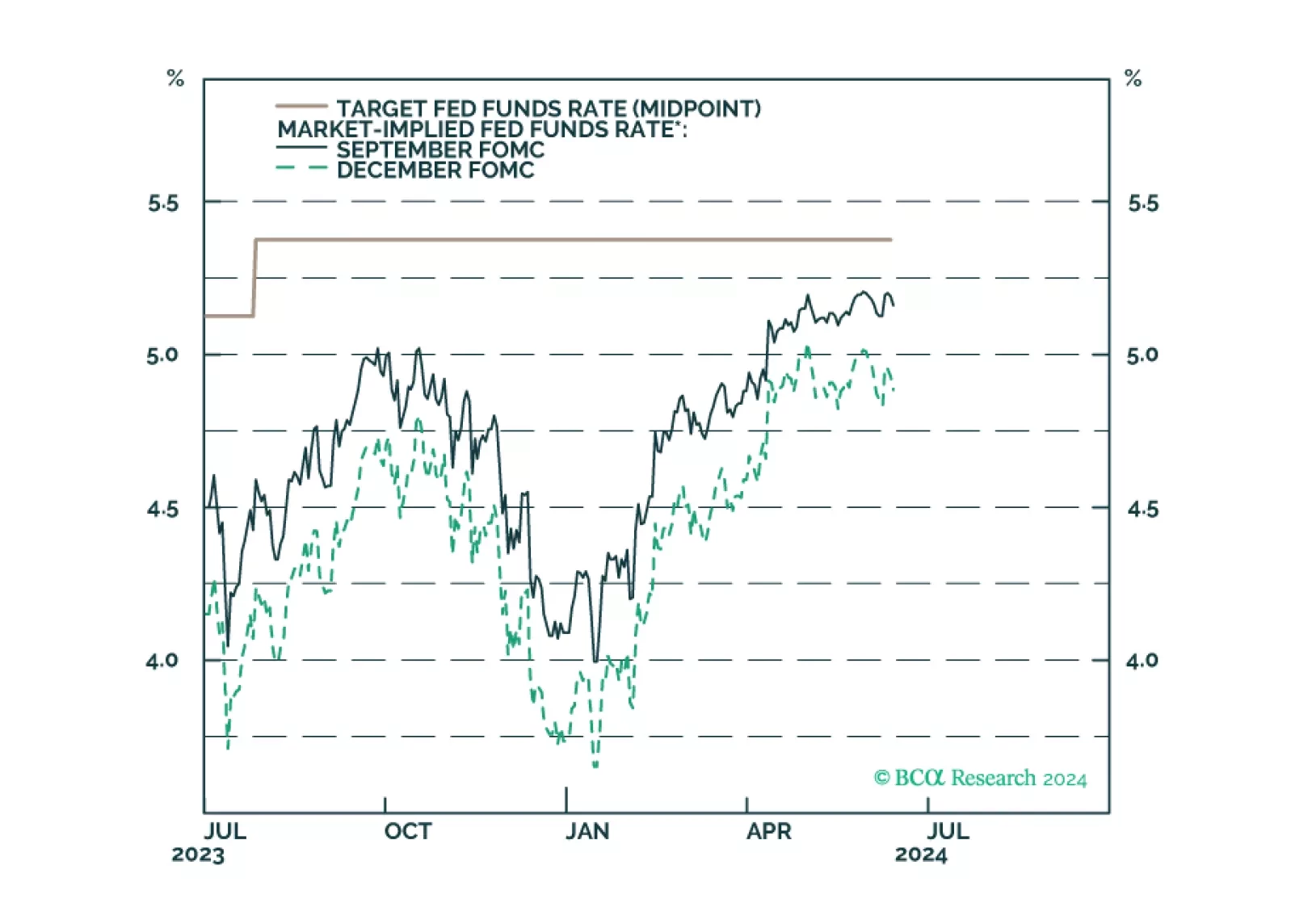

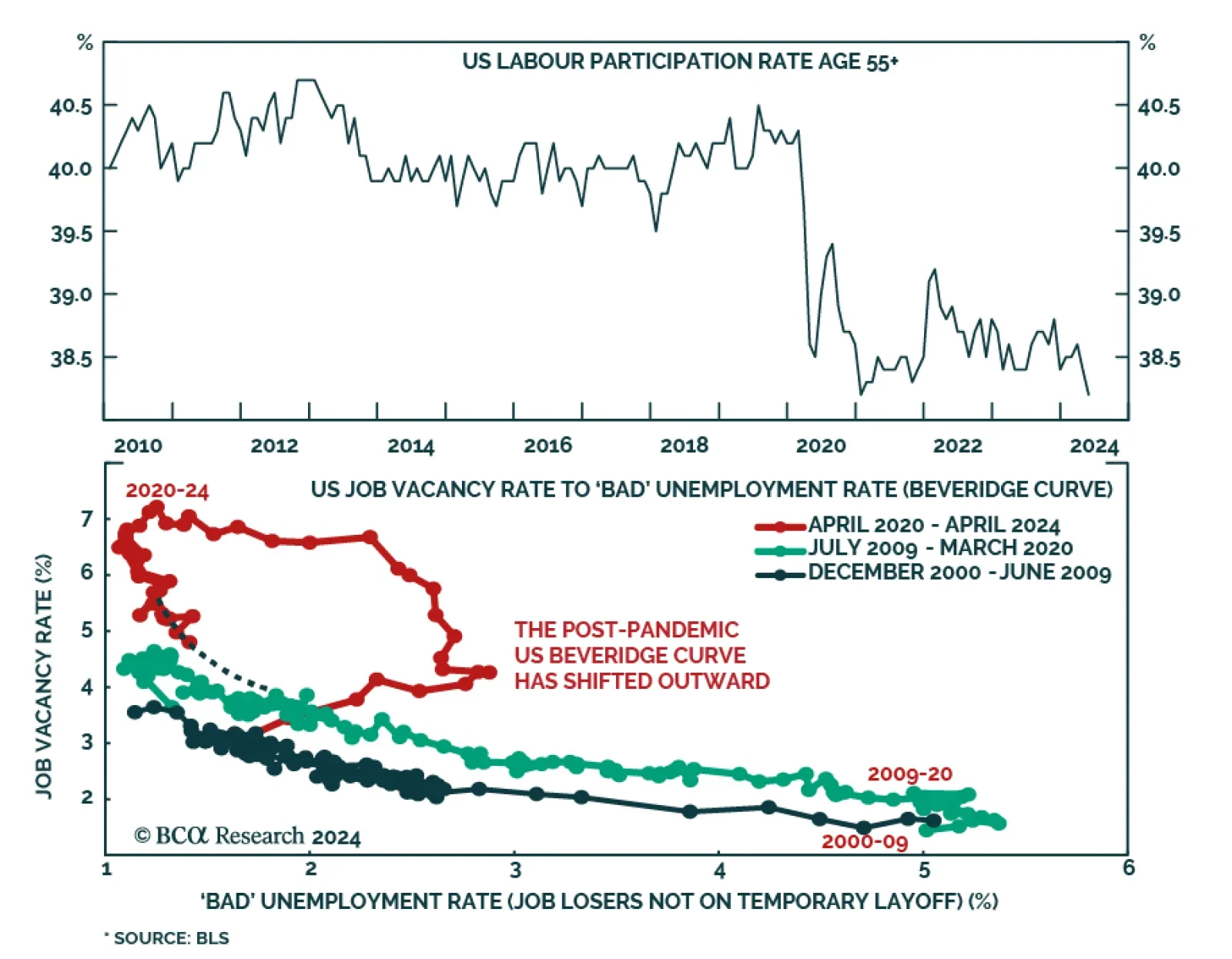

According to BCA Research’s Counterpoint service, job losers not on temporary layoff (‘bad’ unemployment) will need to rise further for the Fed to reach its 2 percent inflation target. Although prime-age…

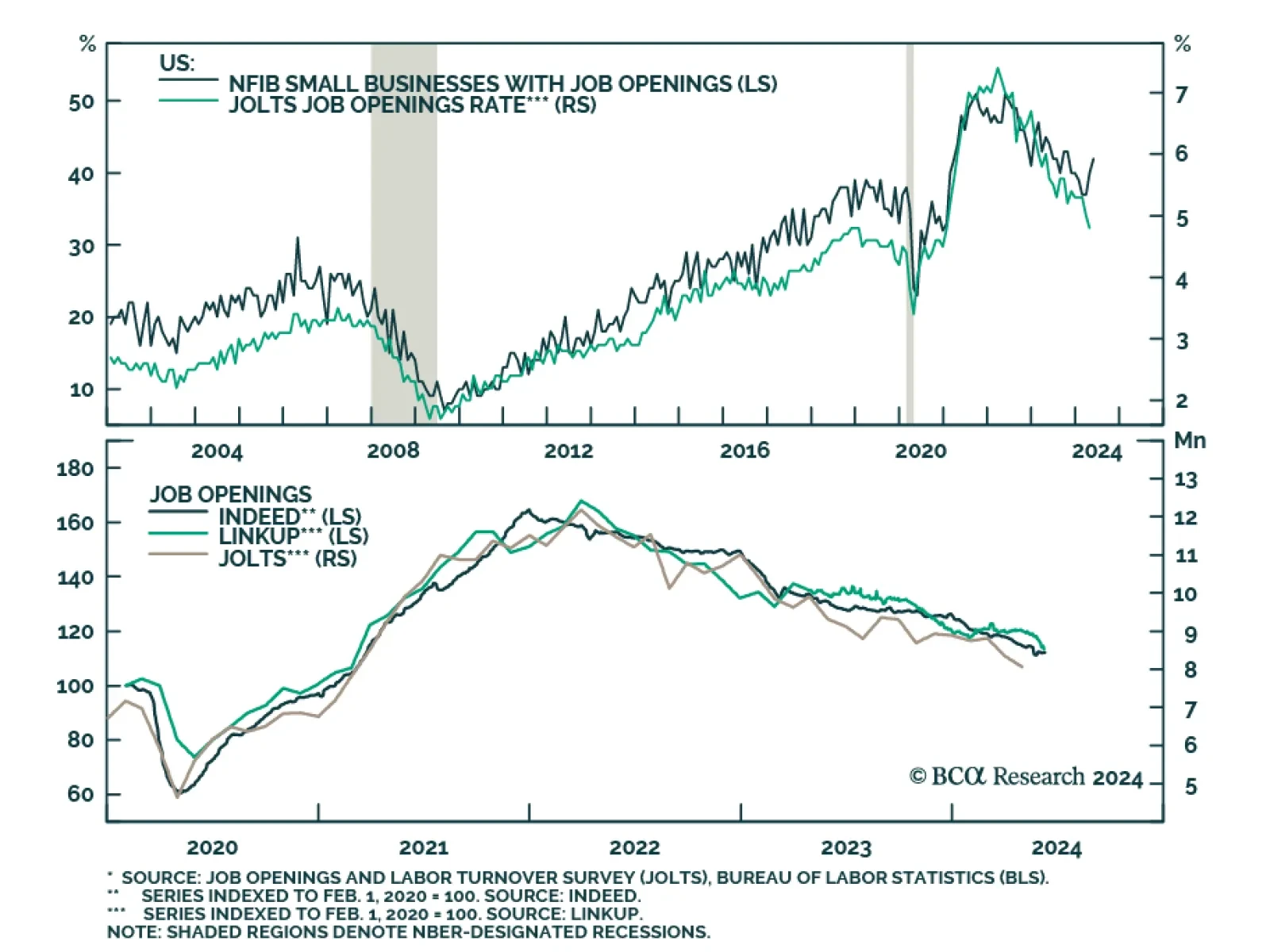

The NFIB Small Business survey surprised to the upside in May, suggesting improved optimism among small business owners. Most notably, an increasing share of respondents is planning on hiring workers, and the jobs opening…

Our reaction to this morning’s CPI report and this afternoon’s FOMC meeting.

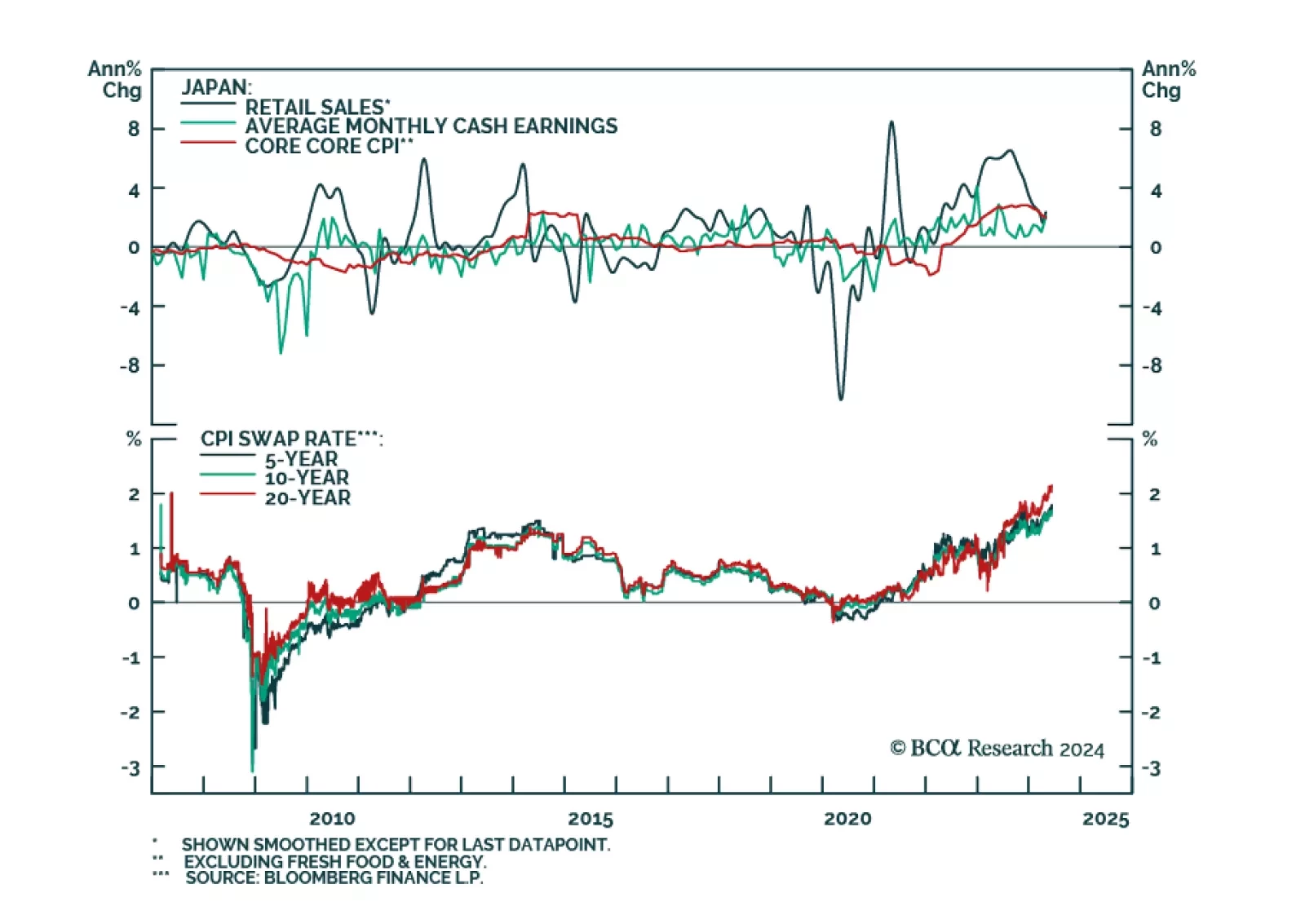

The Bank of Japan exited negative interest rate policy in March, but subsequent softer-than-expected CPI inflation prints have complicated its path towards tightening. The central bank is widely expected to stay put when it meets…

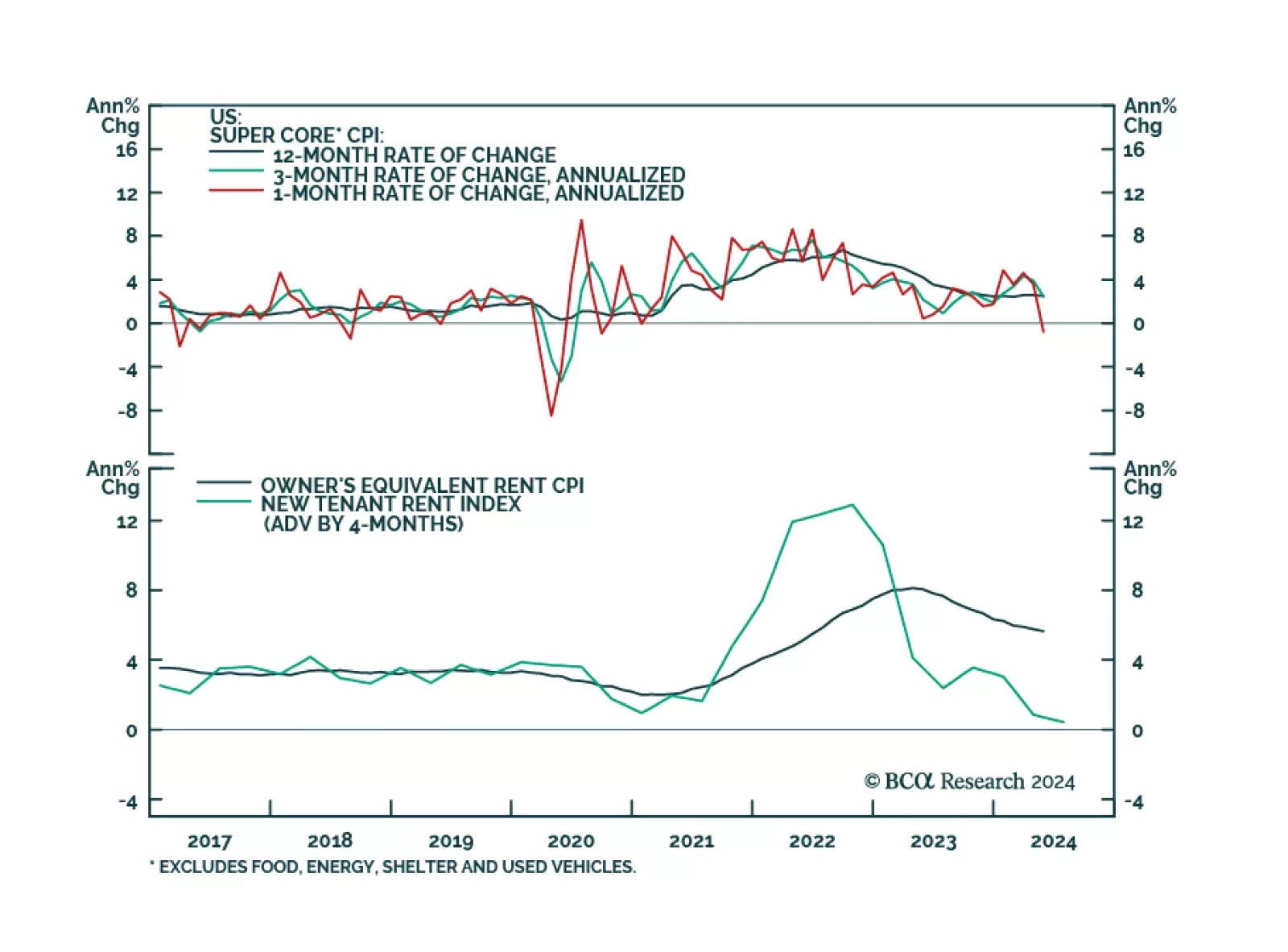

US CPI inflation continued to ease in May. Headline CPI stagnated on a month-on-month basis (3.3% y/y) in May, down from April’s 0.3% m/m (3.4% y/y), and below expectations of a more muted rate of growth. Core CPI also…

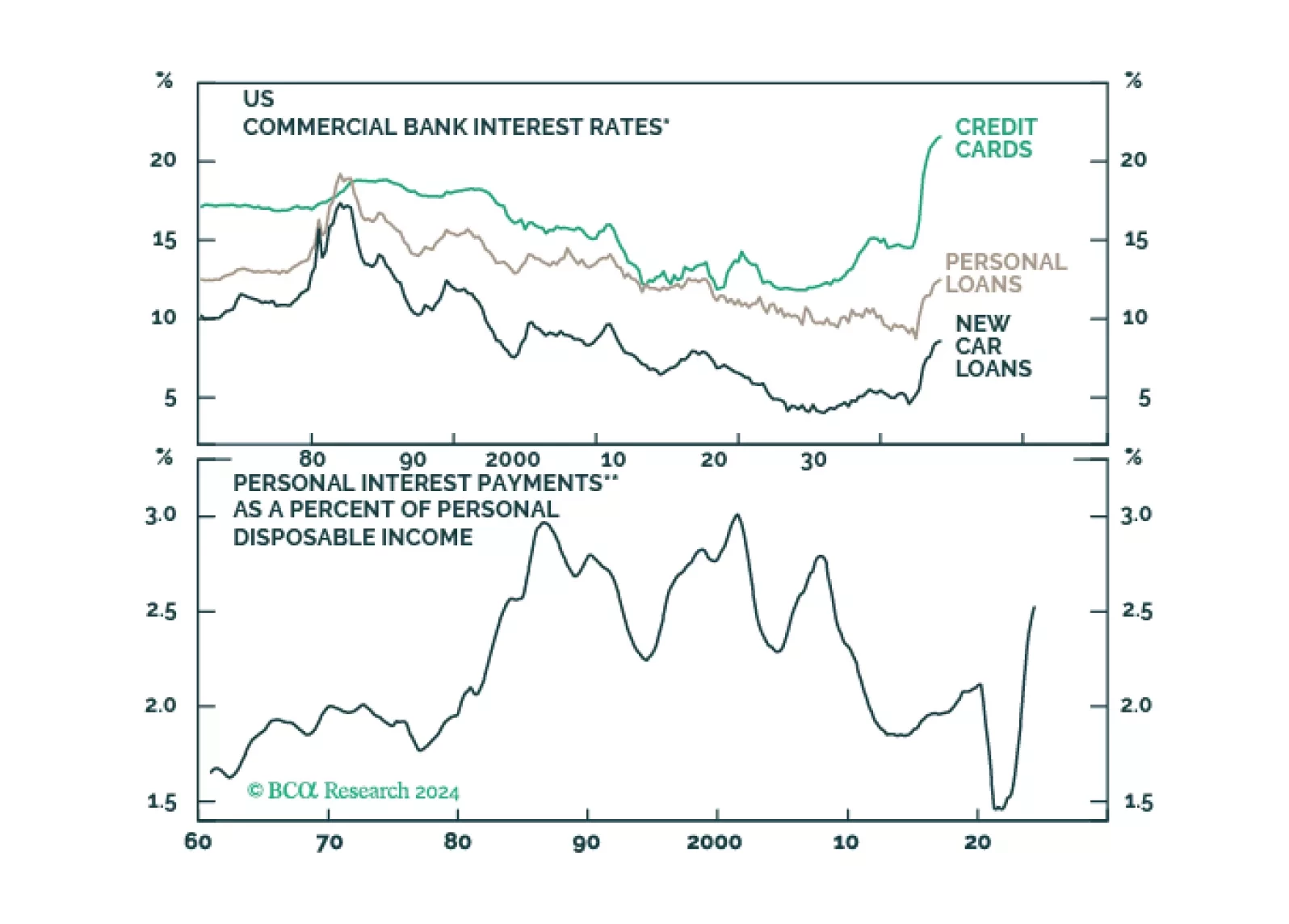

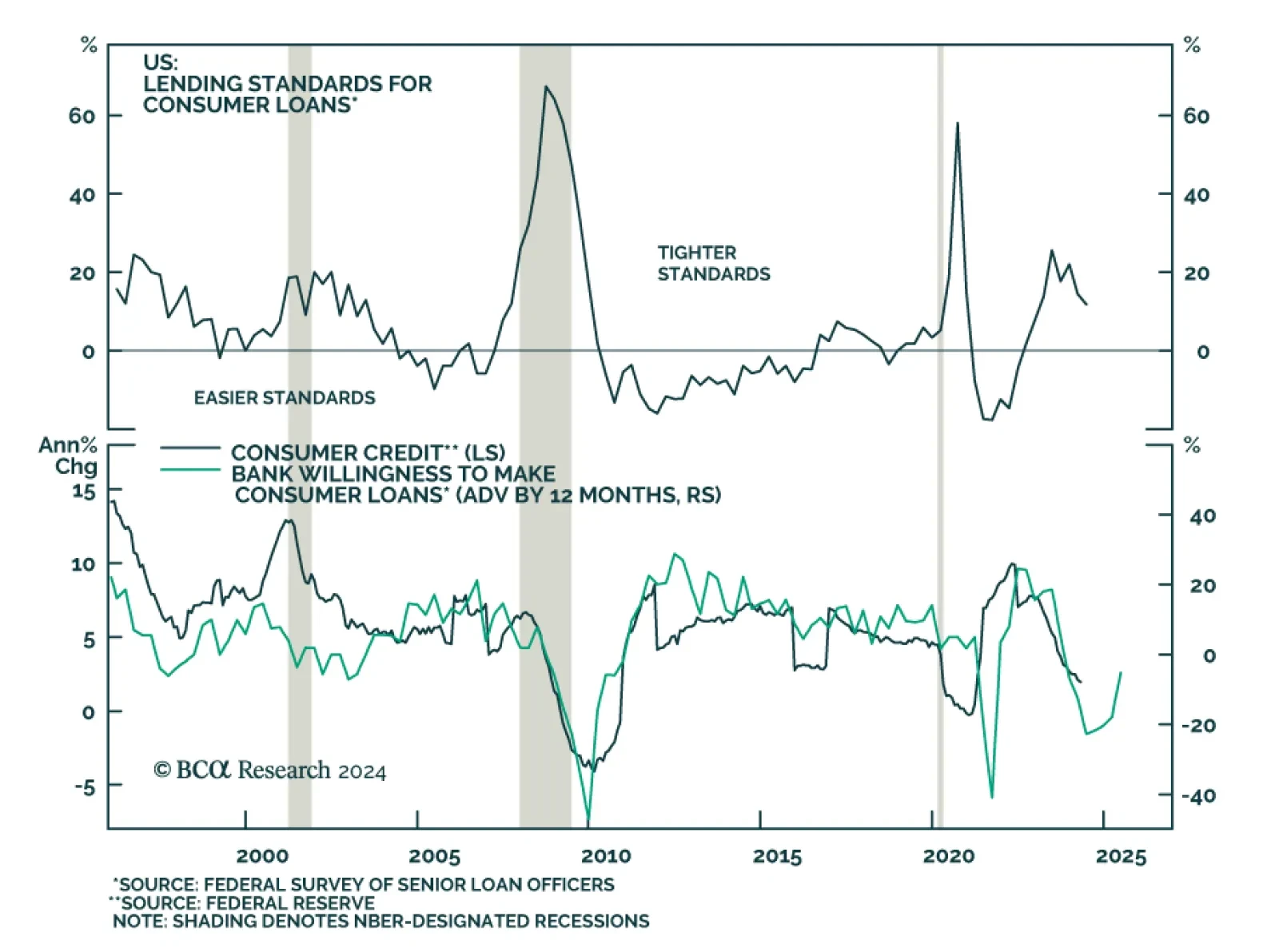

Total consumer credit rose by USD 6.4 billion in April (to USD 5,053 billion outstanding), from a USD 1.1 billion decrease in March (a large downward revision to the USD 6.3 billion rise initially reported) and significantly shy…

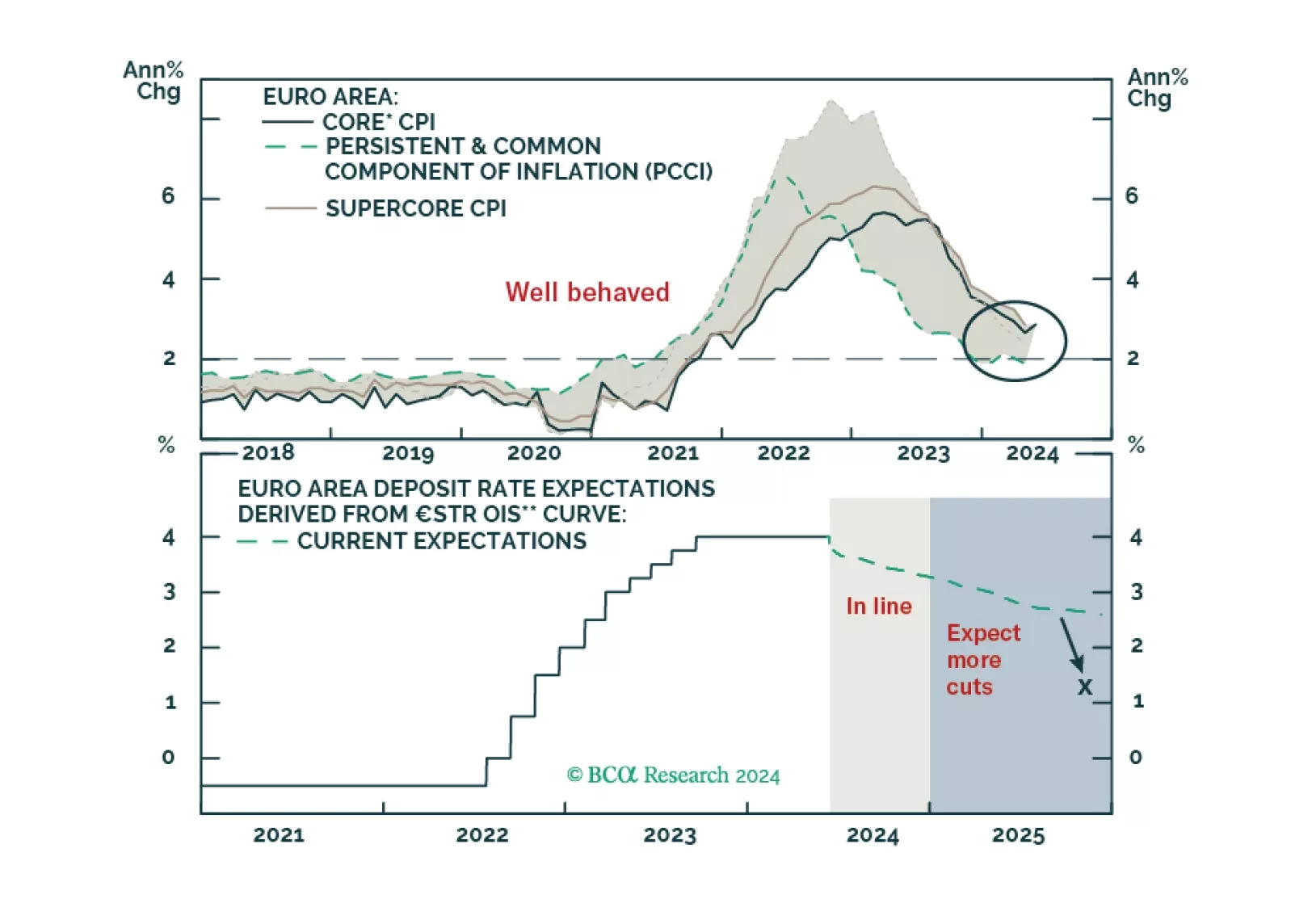

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

Although the comprehensive economic surprise indexes continued weakening in May, the metrics in our equity downgrade checklist haven’t softened enough to check more boxes now. While we continue to expect the US economy will enter a…