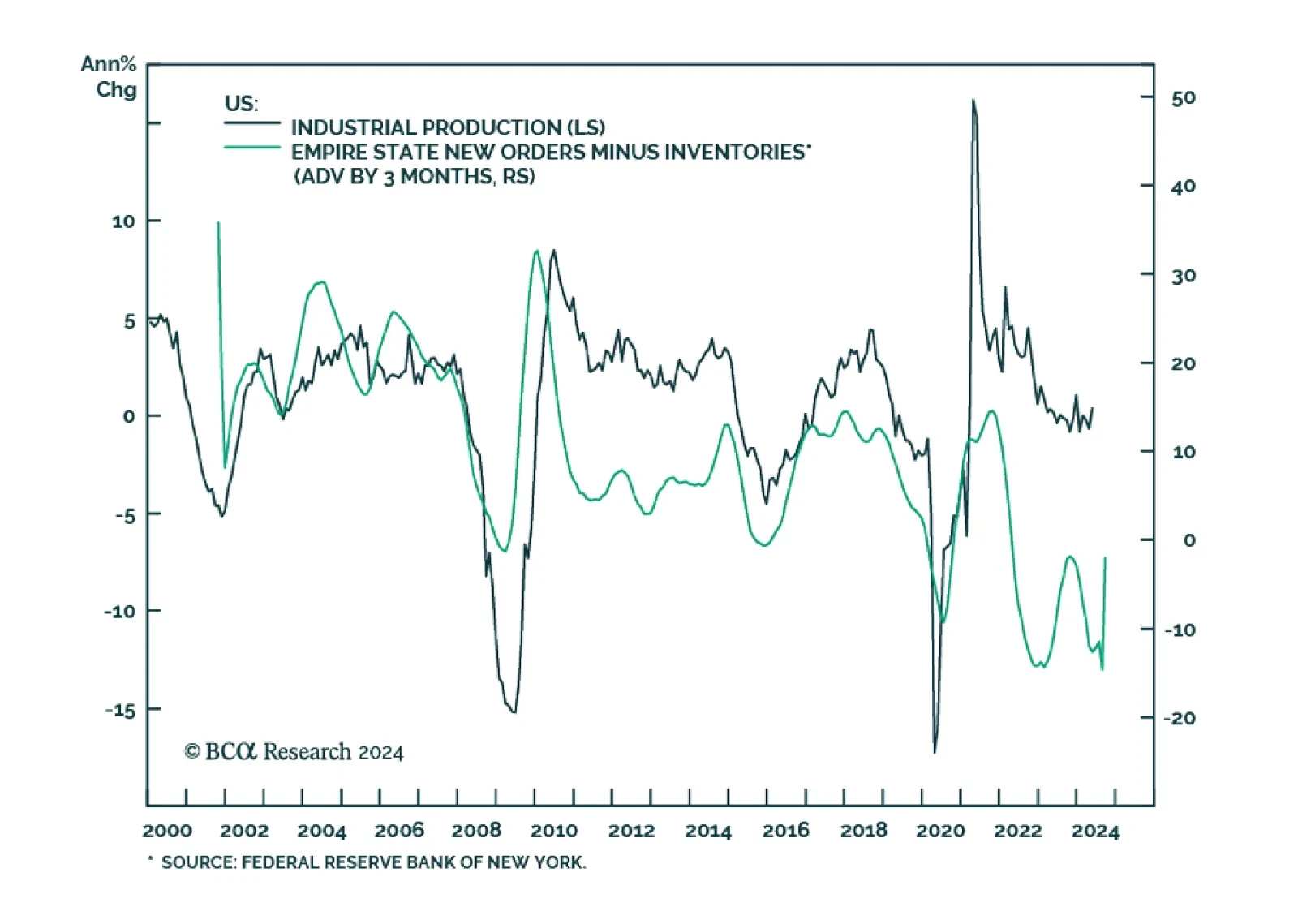

The heart of the US manufacturing sector is still pulsing. Industrial production surpassed expectations in May, growing by 0.9% m/m after having stagnated in April. Notably, the pro-cyclical manufacturing production index…

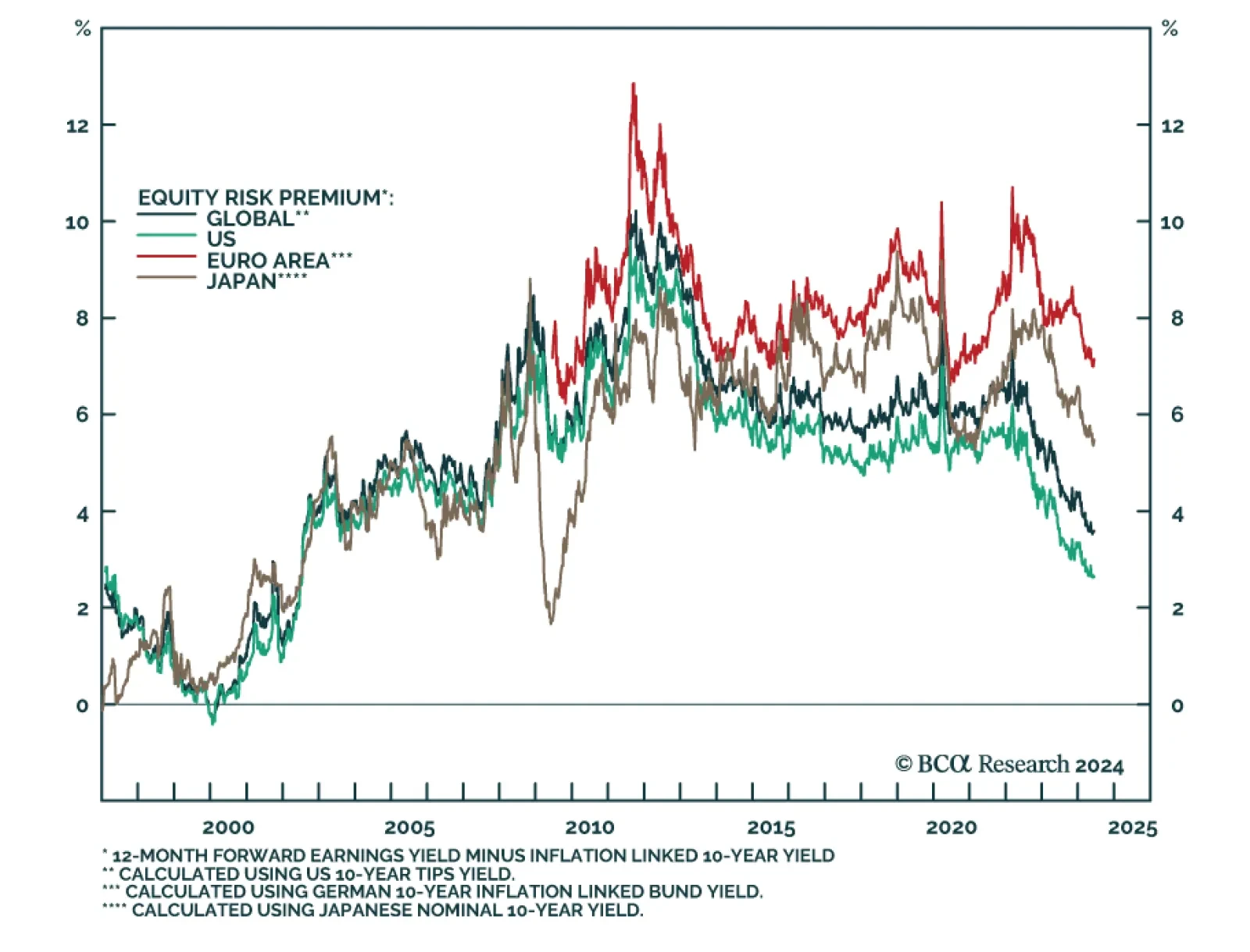

The equity risk premium (ERP) allows investors to assess the additional compensation they are offered as an enticement to assume equities’ incremental risk. The ERP measures equities’ excess return by deduct…

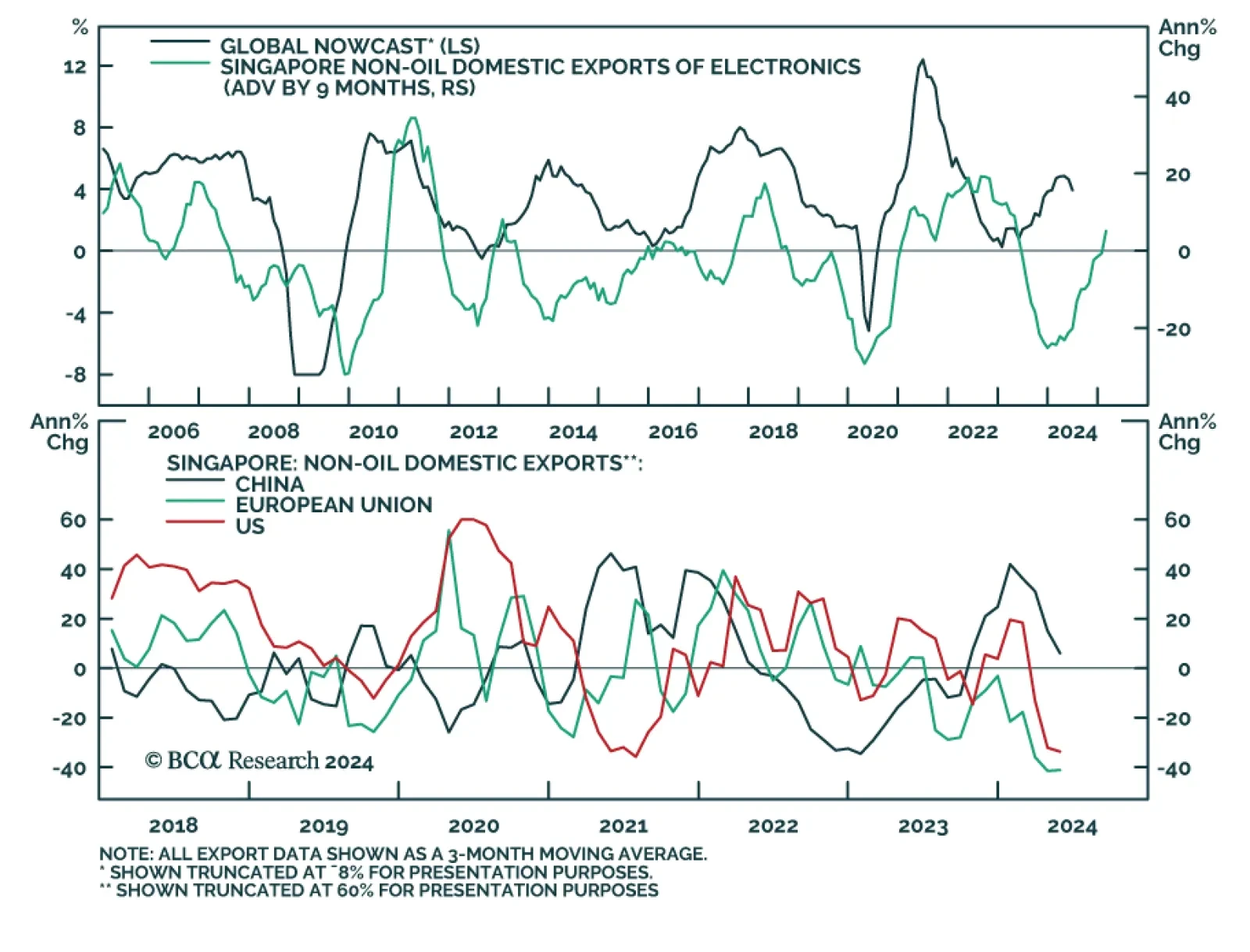

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions and they surprised to the upside in May. Notably, electronics exports, which…

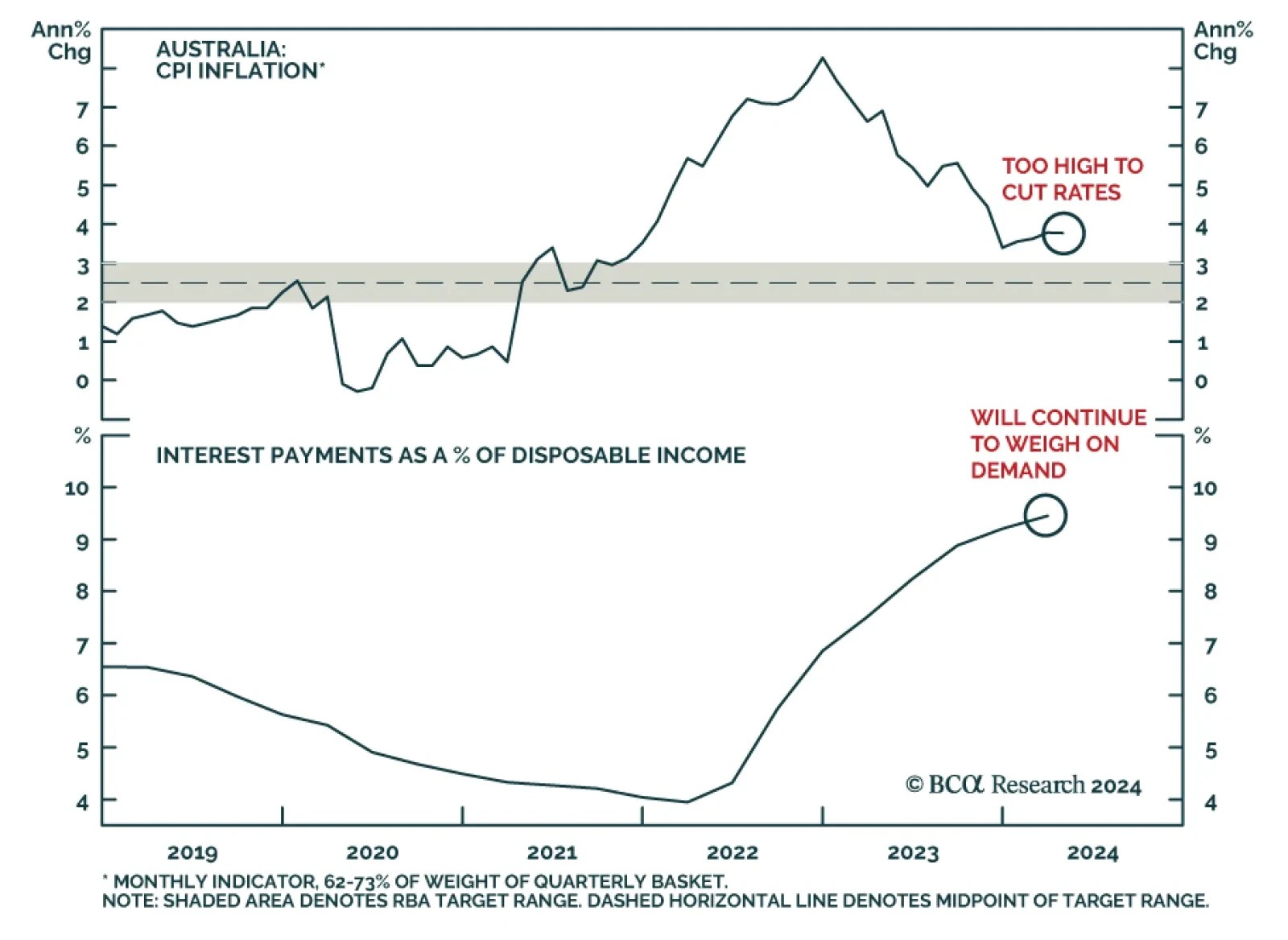

The Reserve Bank of Australia kept its cash rate at 4.35% at its policy meeting on Tuesday, in line with market expectations. Australia’s monthly measure of headline inflation came in at 3.6% in April, still considerably…

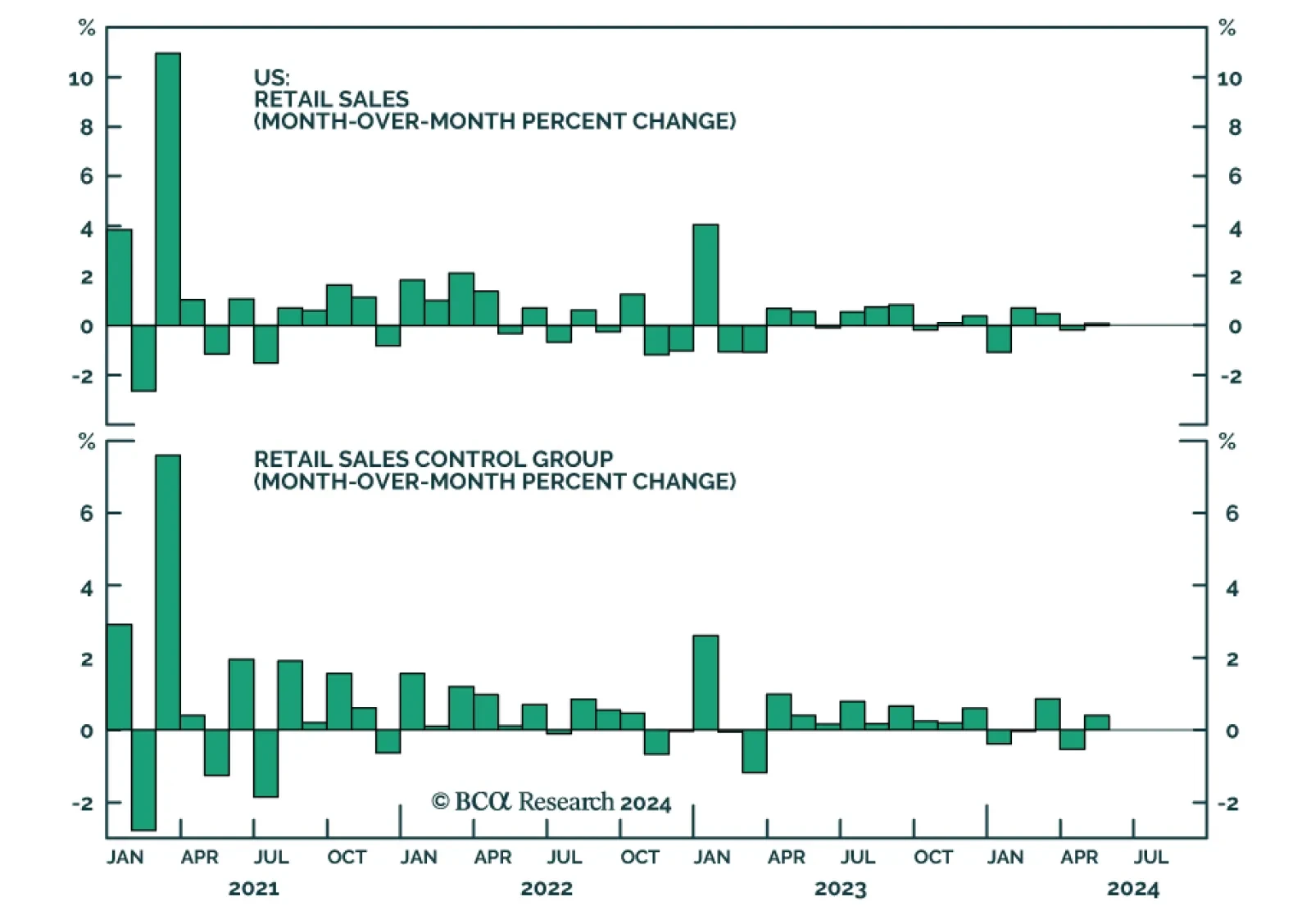

US retail sales were mostly unchanged, growing by a mere 0.1% m/m in May, short of the expected 0.3% monthly increase. A 2.2% m/m decline in gasoline stations’ sales weighed on the overall result, though retail sales…

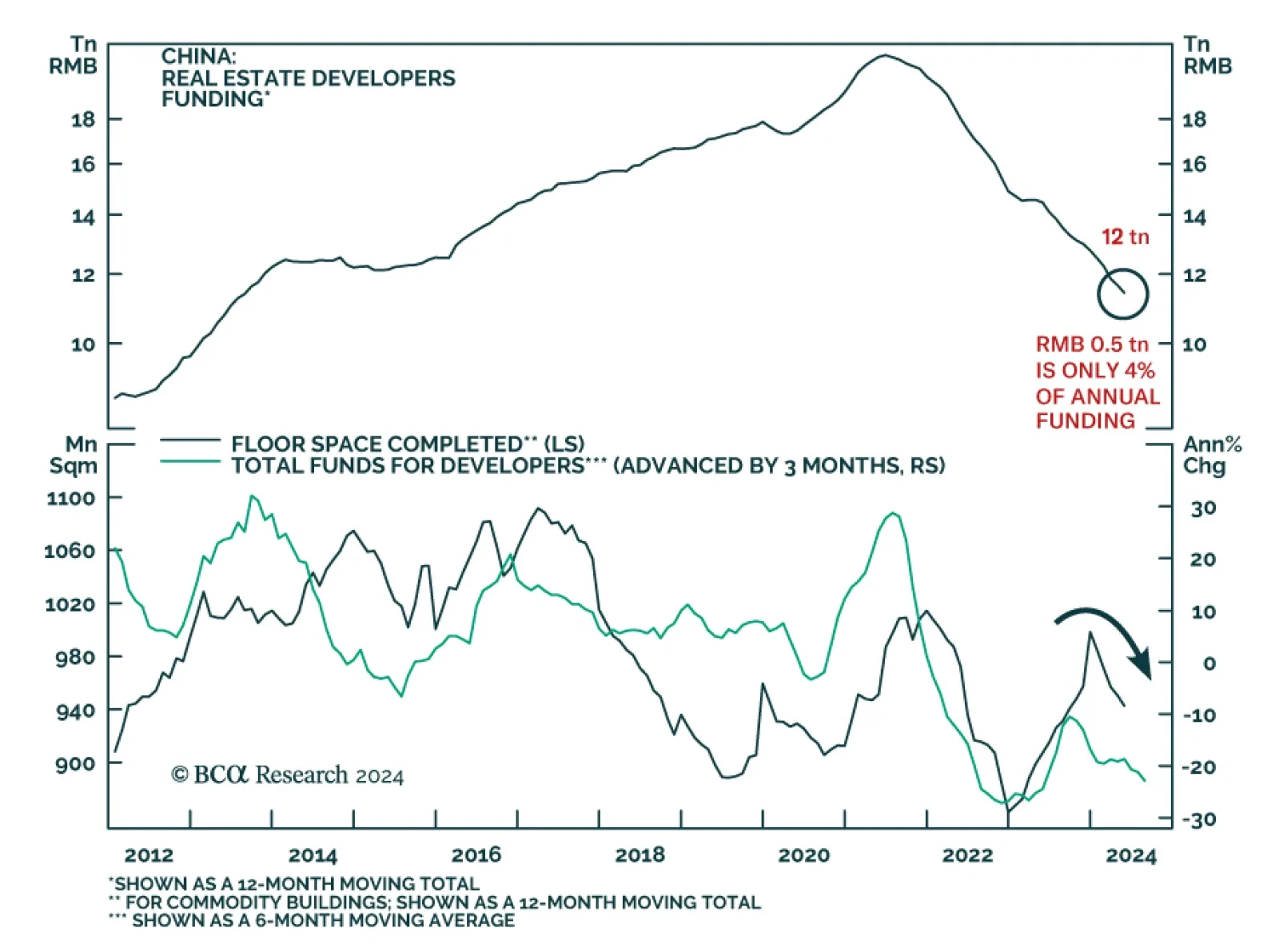

Declines in Chinese new and used home prices accelerated in May to 0.71% m/m and 1.00% m/m respectively, and the contraction in residential investment deepened to 10.1% YTD y/y. These figures come on the heels of relaxed purchase…

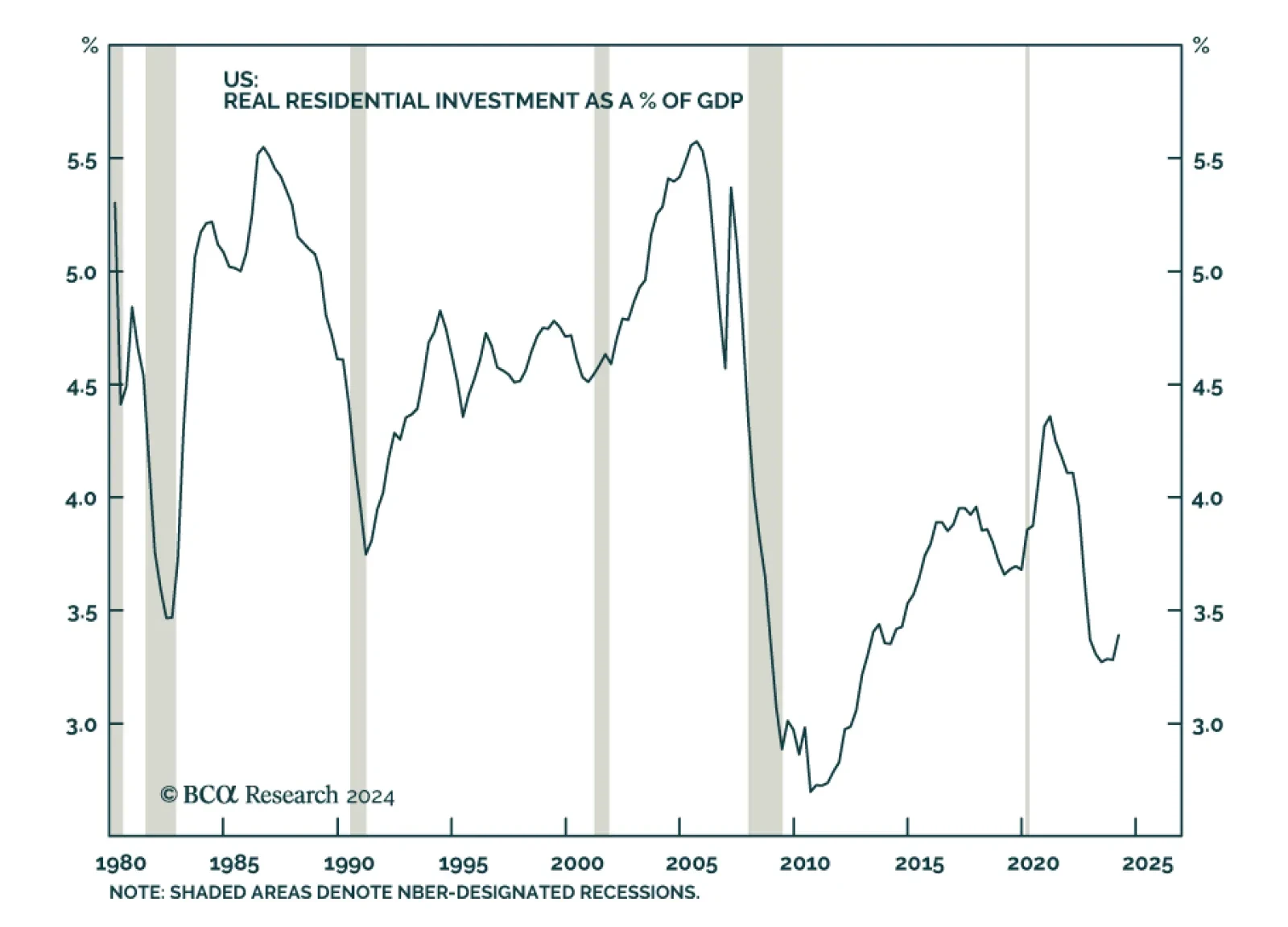

Housing is the most interest-rate-sensitive sector of the economy. Yet, the very aggressive monetary tightening cycle has only had a muted effect on home prices. While recent housing market data have been mixed, prices have not…

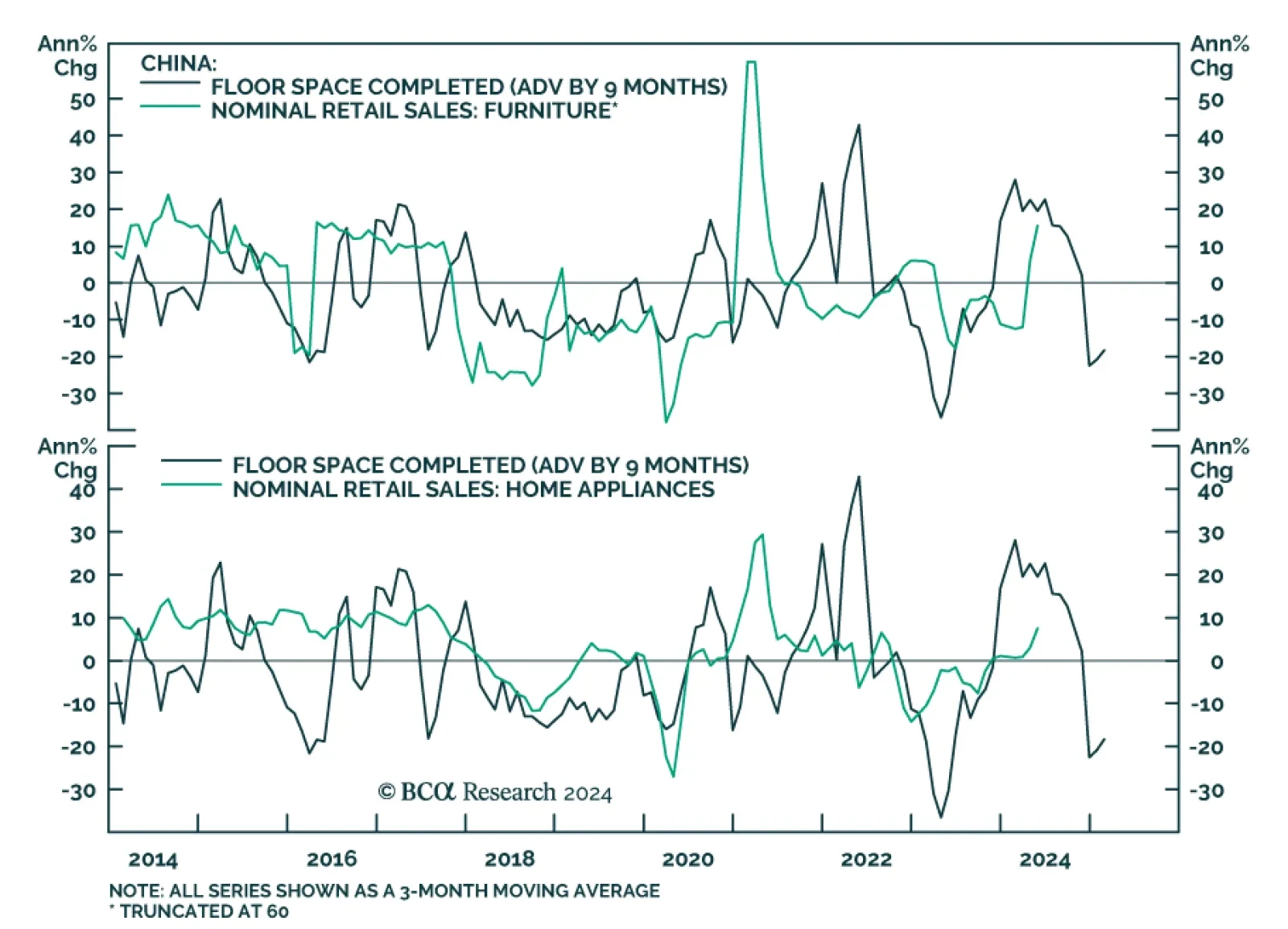

Chinese retail sales grew 3.7% y/y in May, from 2.3% in April, upending expectations of a more muted 3.0% increase. The government appliance trade-in program has likely boosted these figures. Sales of home-related goods such…

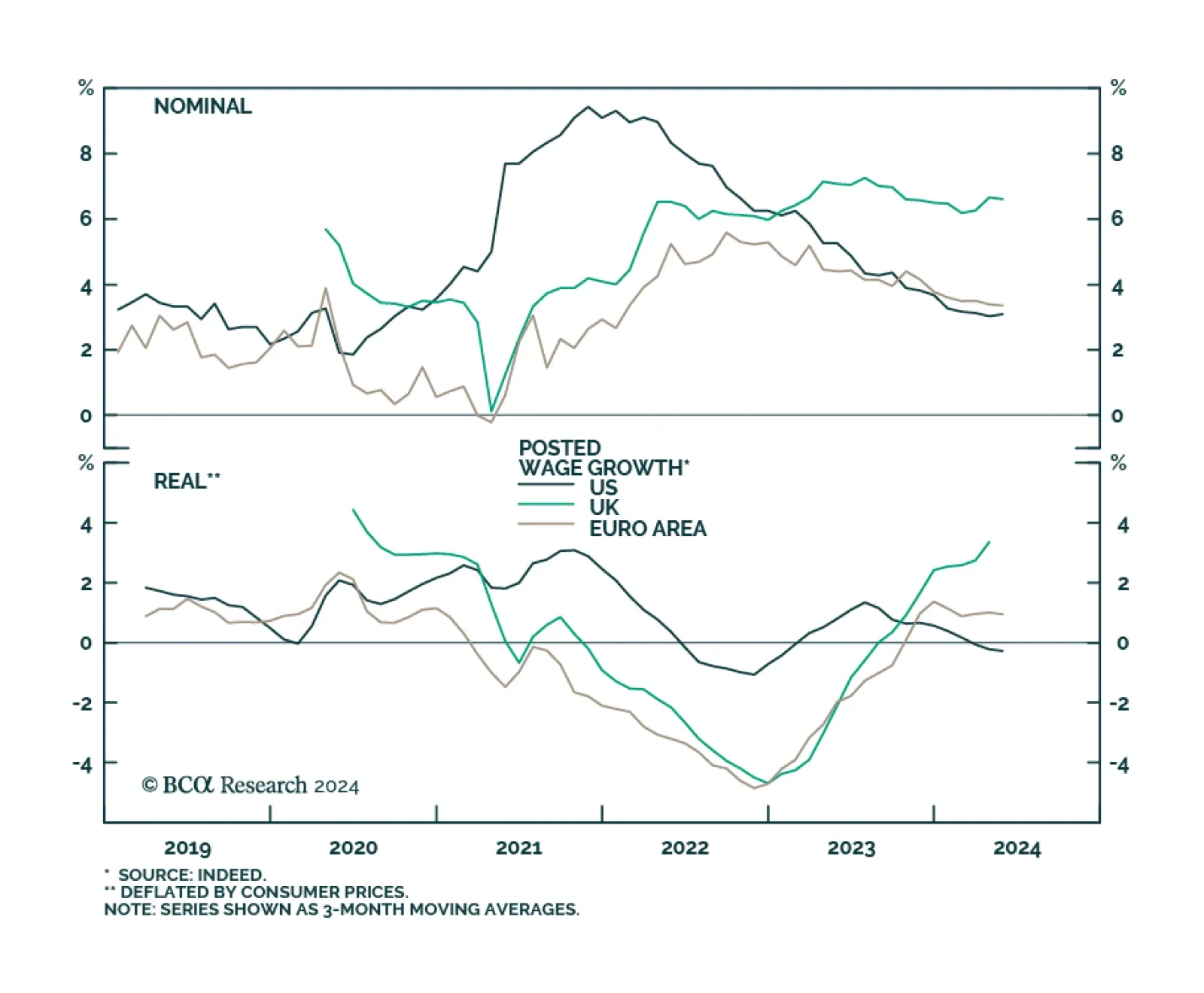

According to BCA Research’s Global Investment Strategy service, aggressive fiscal stimulus and labor market flexibility contributed to the relative strength of the US consumer. However, adverse region-specific effects also…

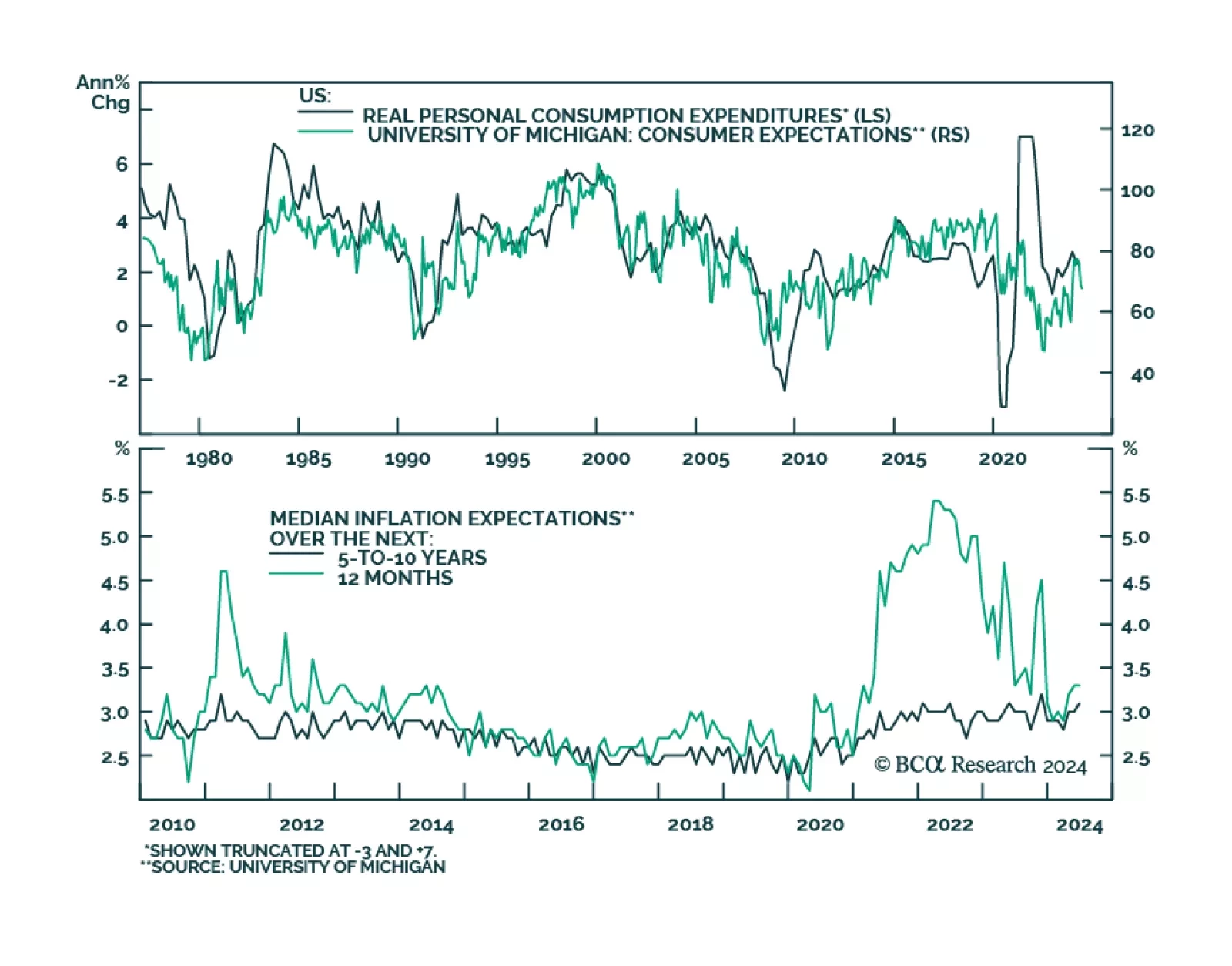

The preliminary University of Michigan gauge of consumer sentiment unexpectedly dropped in June to 65.6 from 69.1, against expectations of improving morale. Consumers’ assessments of current conditions declined by a larger…