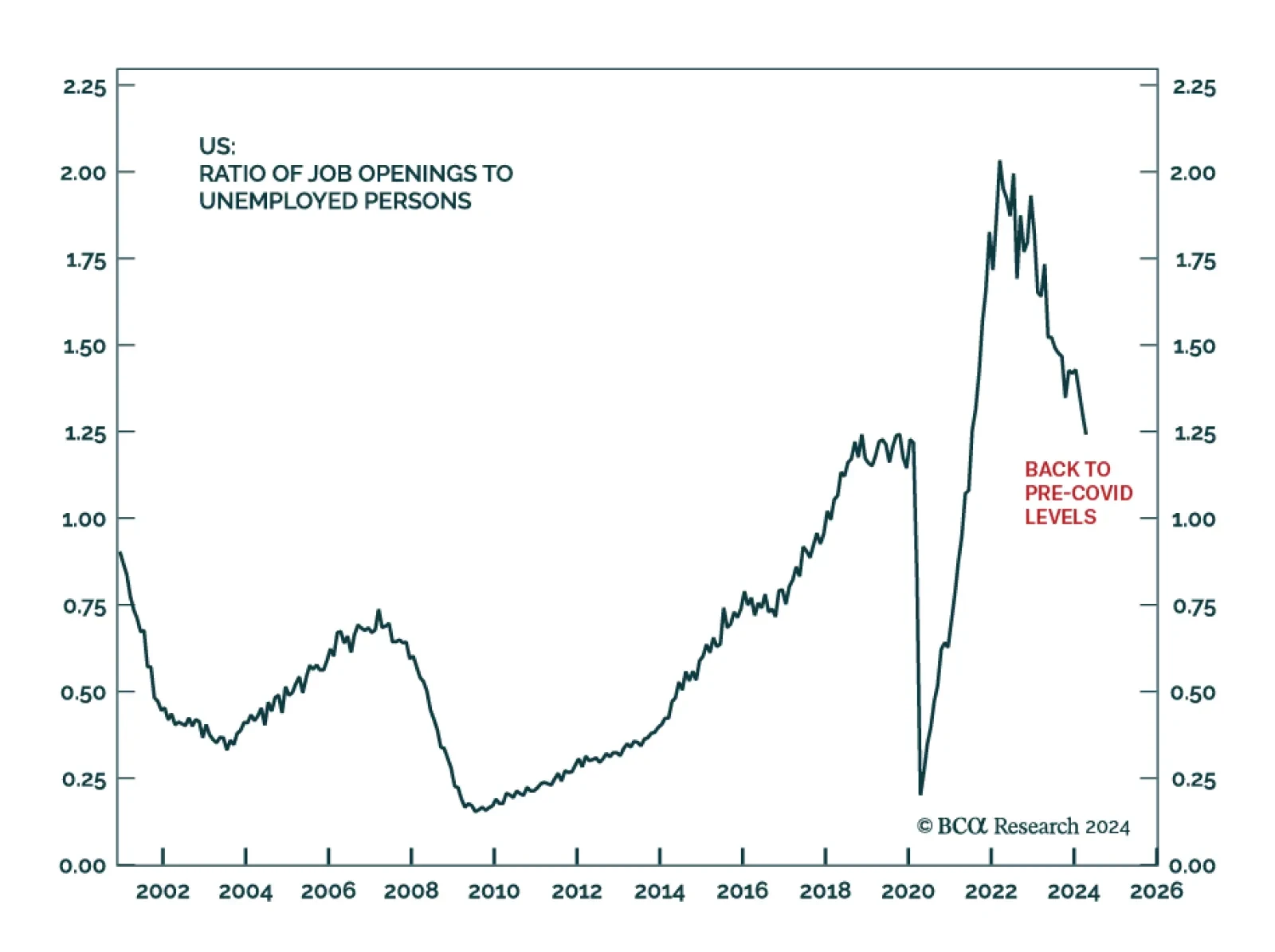

Our Global Investment Strategy team often highlights the job openings-to-unemployed ratio as a gauge of the labor market’s slack. This indicator climbed to over 2 job openings per unemployed person in 2022, as labor…

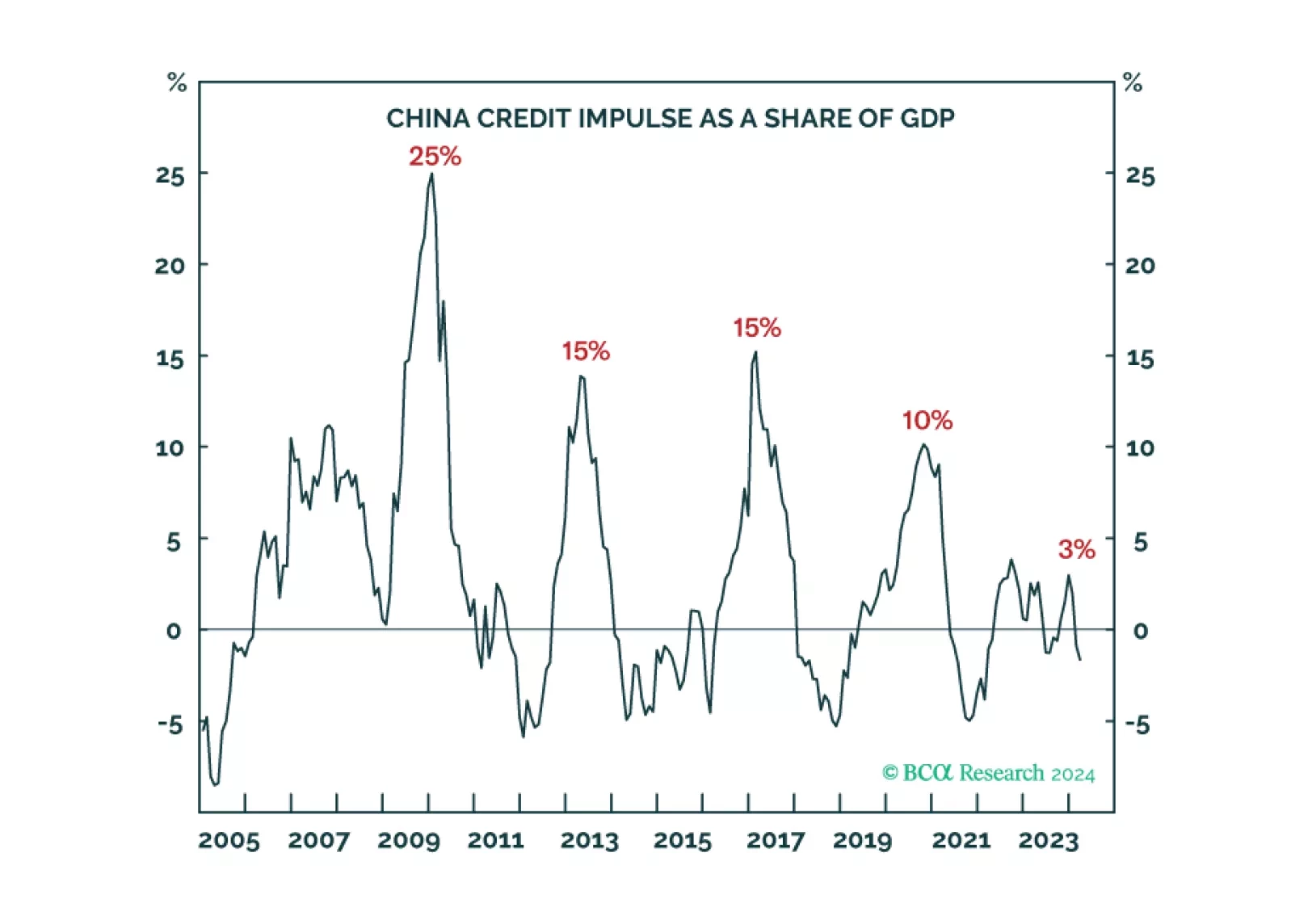

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

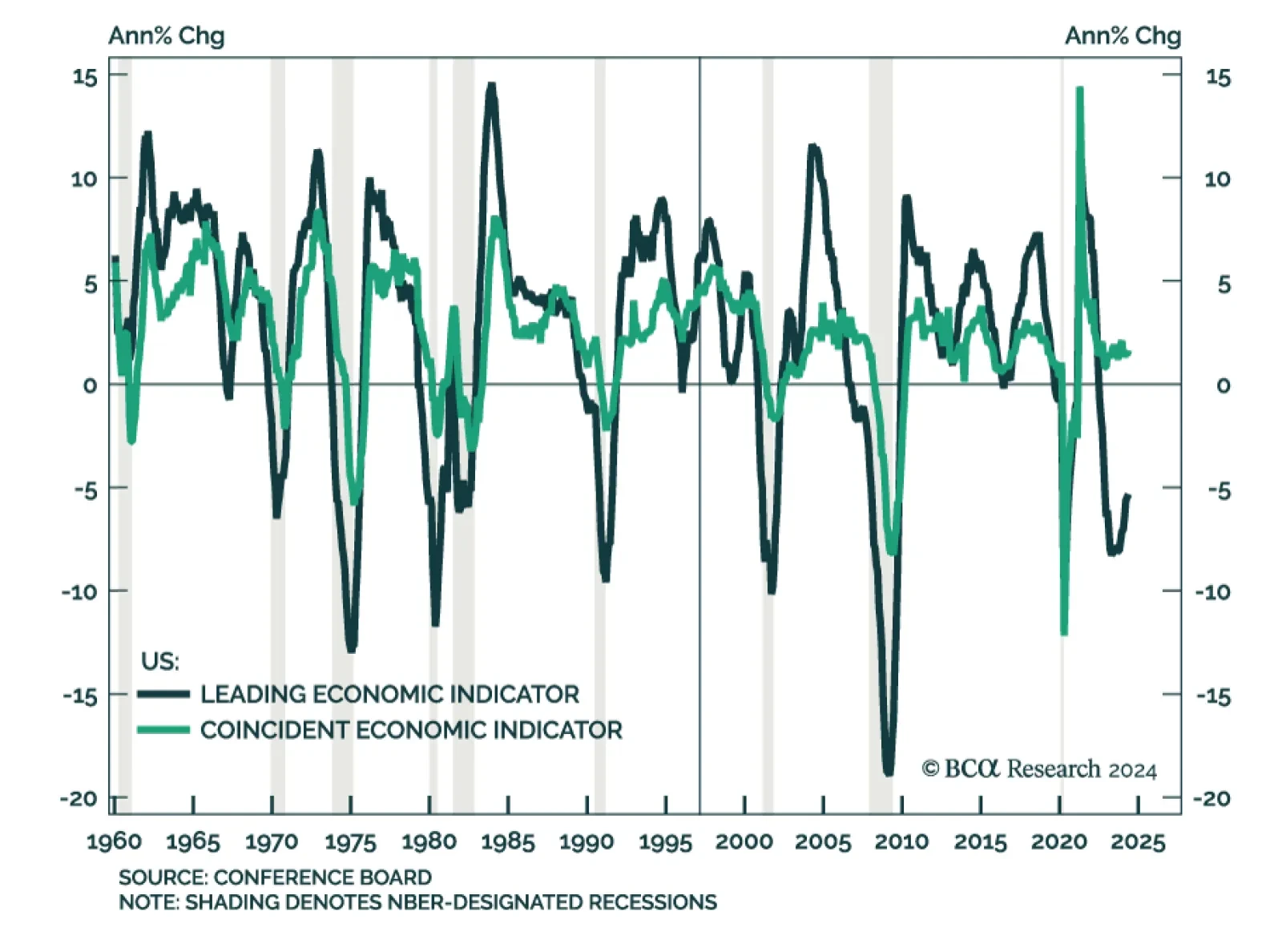

The Conference Board’s US Leading Economic Index (LEI) disappointed in May, contracting 0.5% m/m from a 0.6% decline in April. However, the Coincident Economic Index (CEI) grew 0.4% m/m in May. Year-on-year contractions in…

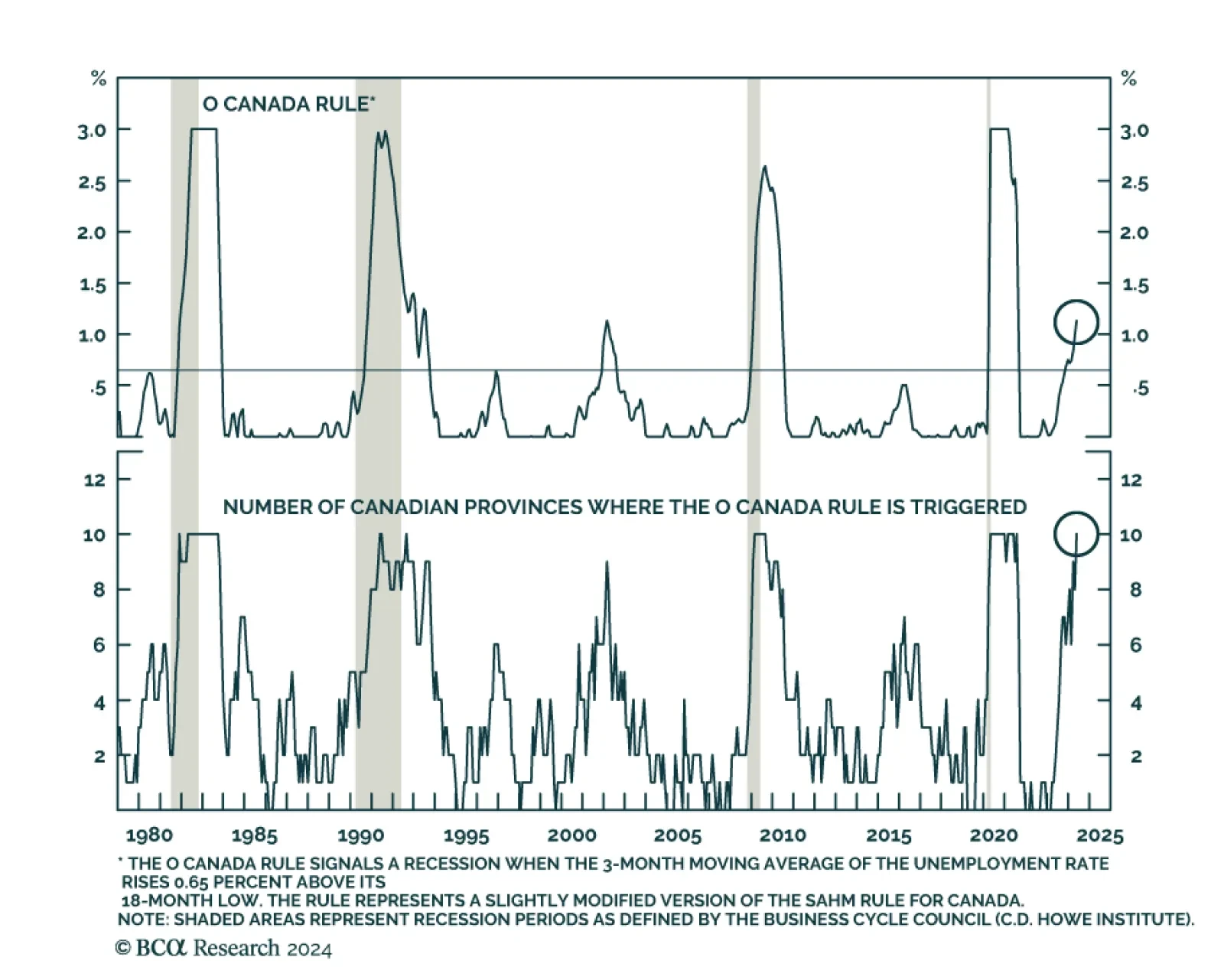

The Bank of Canada (BoC) cut interest rates from 5% to 4.75% in June and another rate cut in July would be warranted. Tight monetary policy is impacting the labor market. The unemployment rate (6.1%) has been on an uptrend…

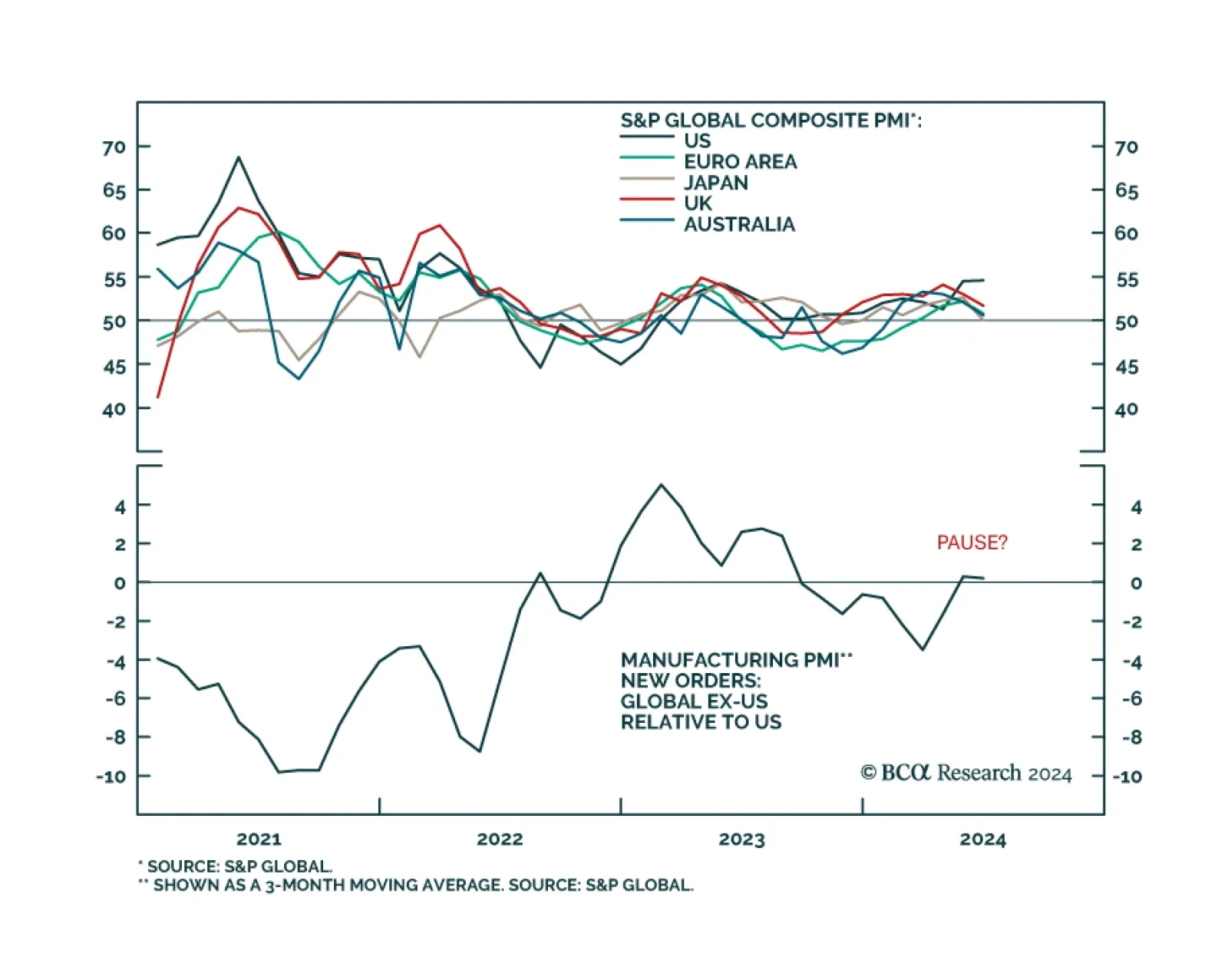

Preliminary PMI estimates suggest that US economic leadership remained intact in June, despite previous signs that it was passing the global growth baton to the rest of the world. US manufacturing, services and composite PMIs…

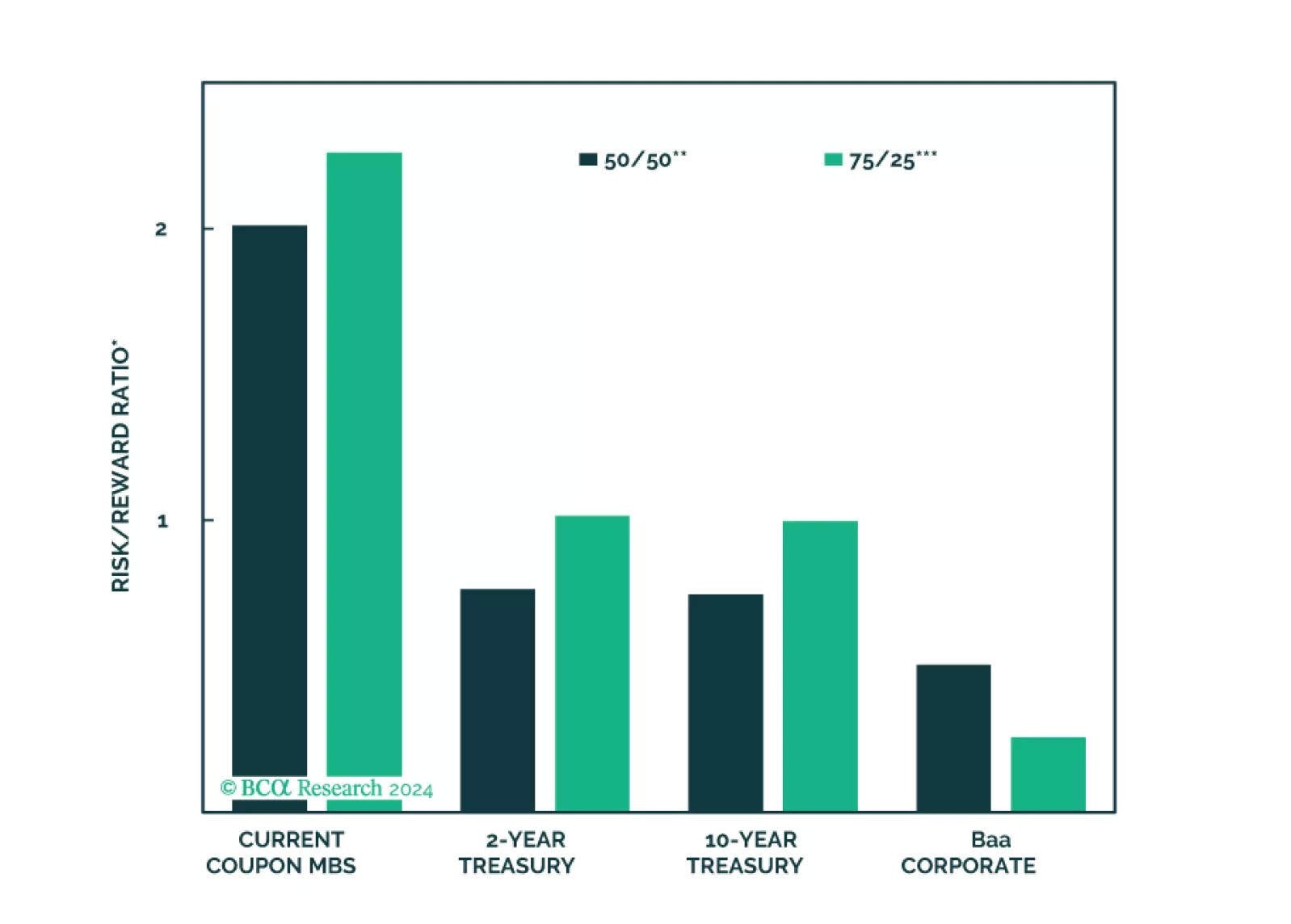

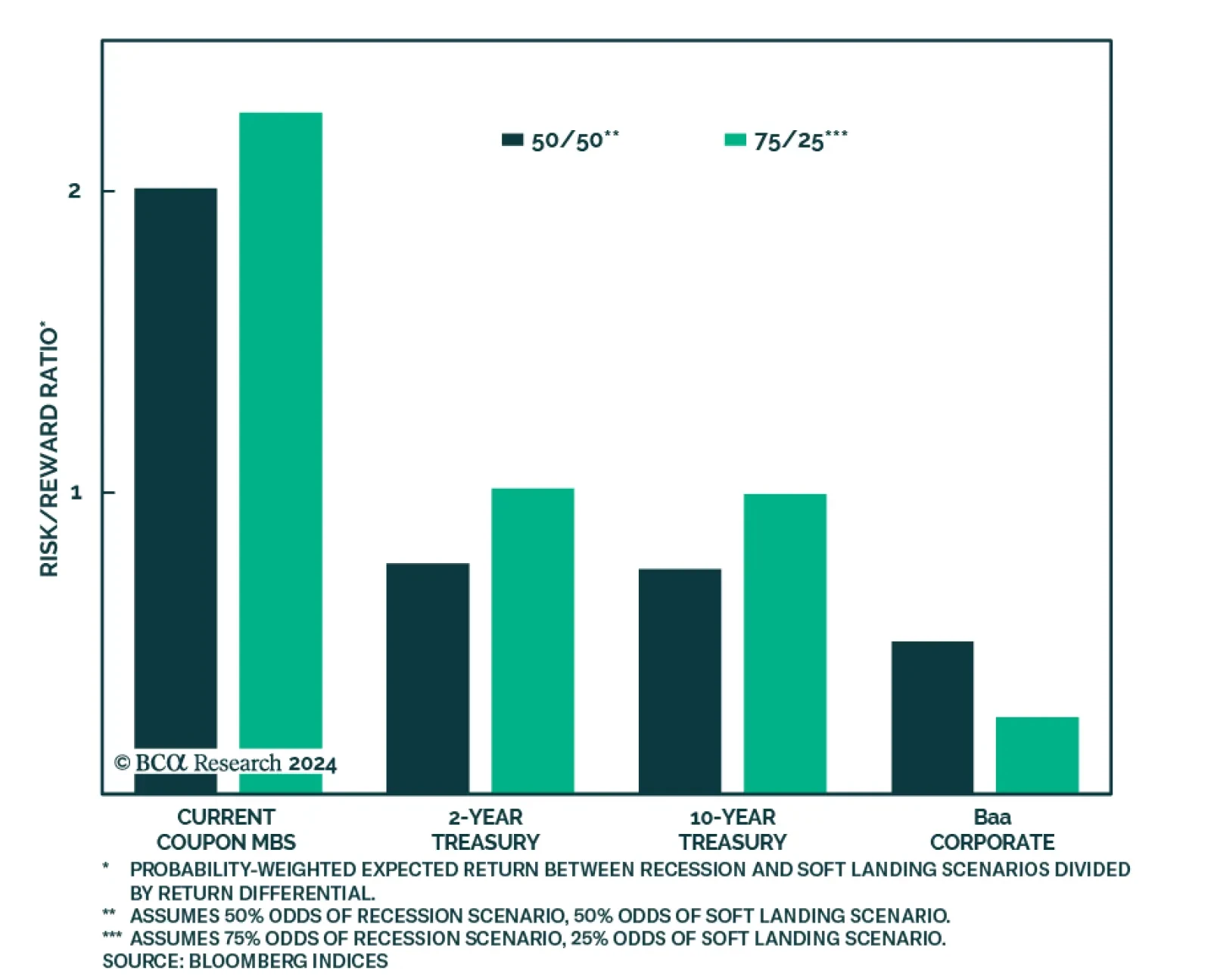

In its latest Special Report, BCA Research’s US Bond Strategy service considers the relative merits of four different fixed income investments in the current economic environment: 2-year Treasuries, 10-year Treasuries, Baa-…

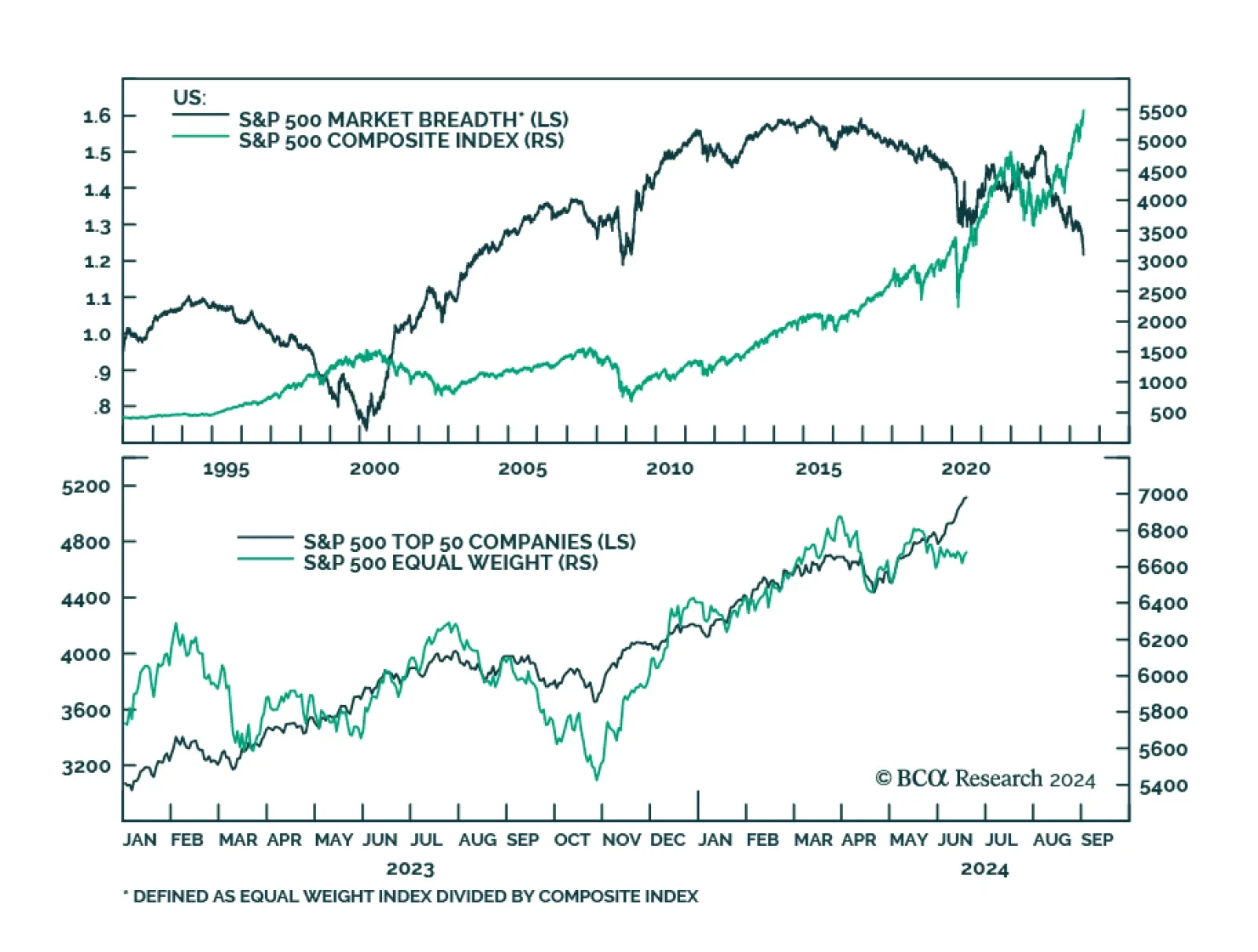

Nvidia is now the largest company in the world. Its market capitalization has not only surpassed Microsoft’s, it also tops the entire stock market capitalizations of the UK and France. While Nvidia founders and owners are…

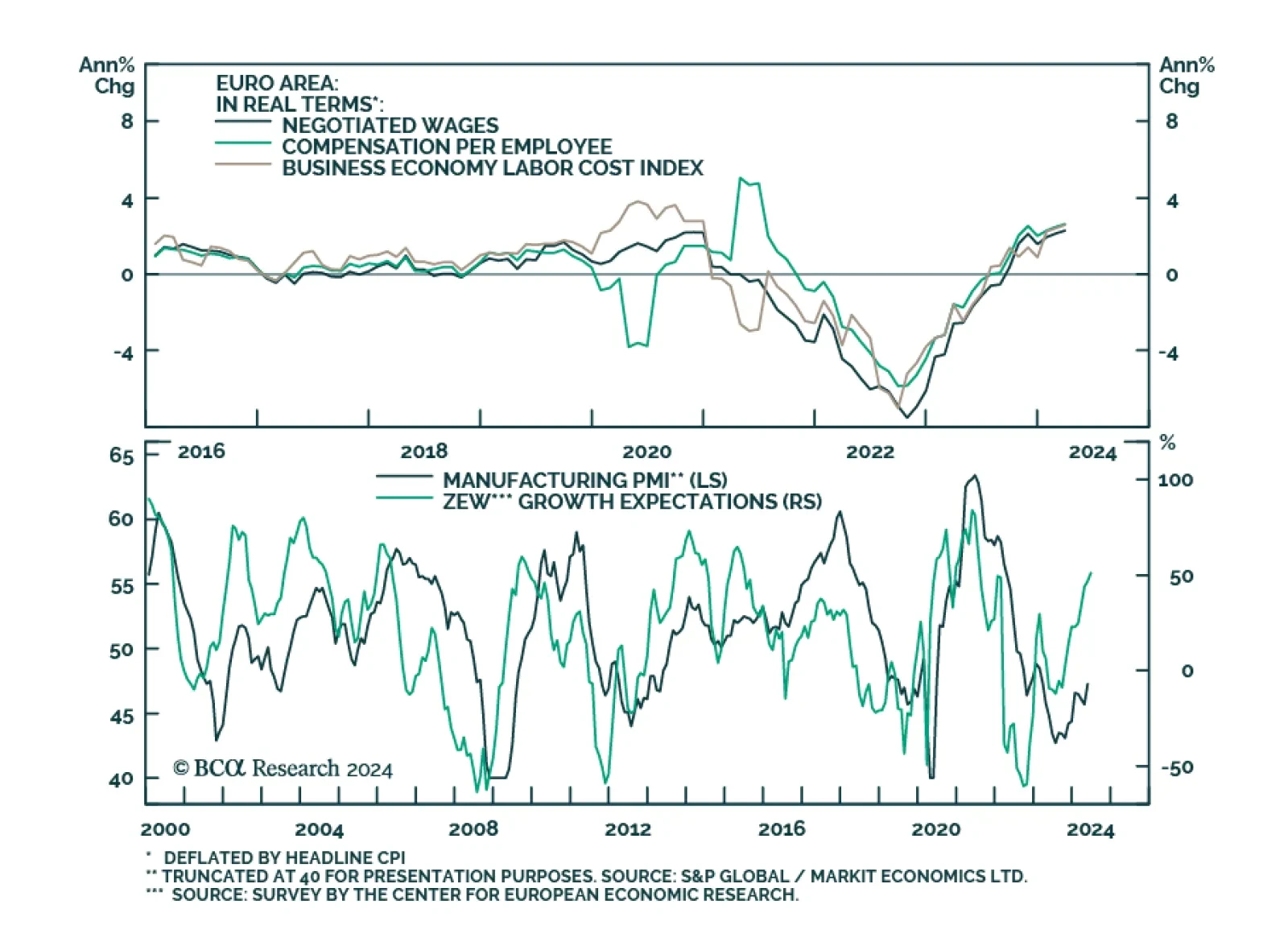

The ECB delivered its first rate cut in June, moderating the degree of restriction rather than pivoting outright to easy monetary policy settings. Indeed, the rate cut was accompanied by an upward revision of inflation and growth…