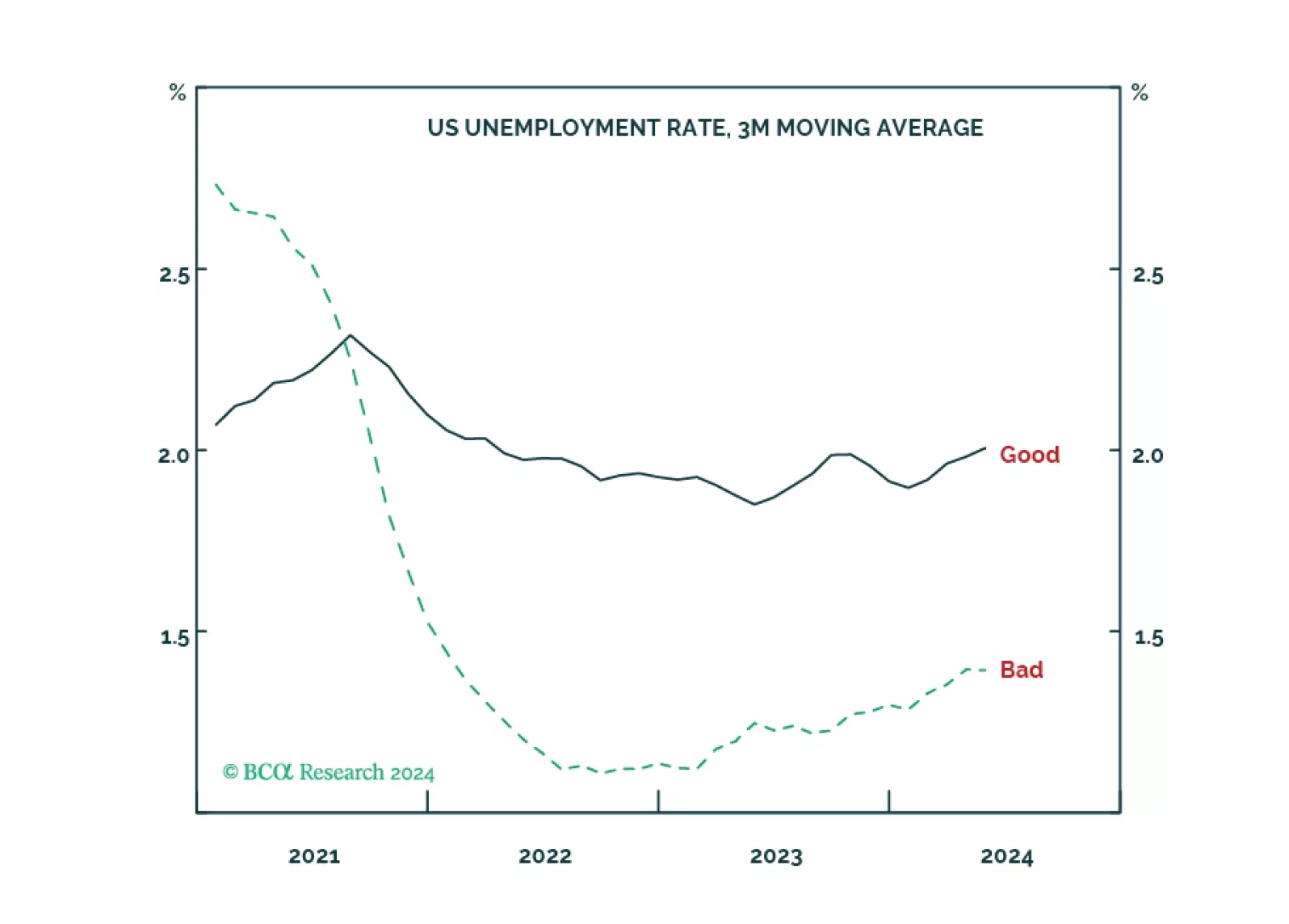

We explain how to distinguish between ‘good’, ‘bad’ and ‘ugly’ unemployment, why bad unemployment is a much better gauge of the jobs market than headline unemployment, and what this means for the tactical positioning in bonds and…

Our Portfolio Allocation Summary for July 2024.

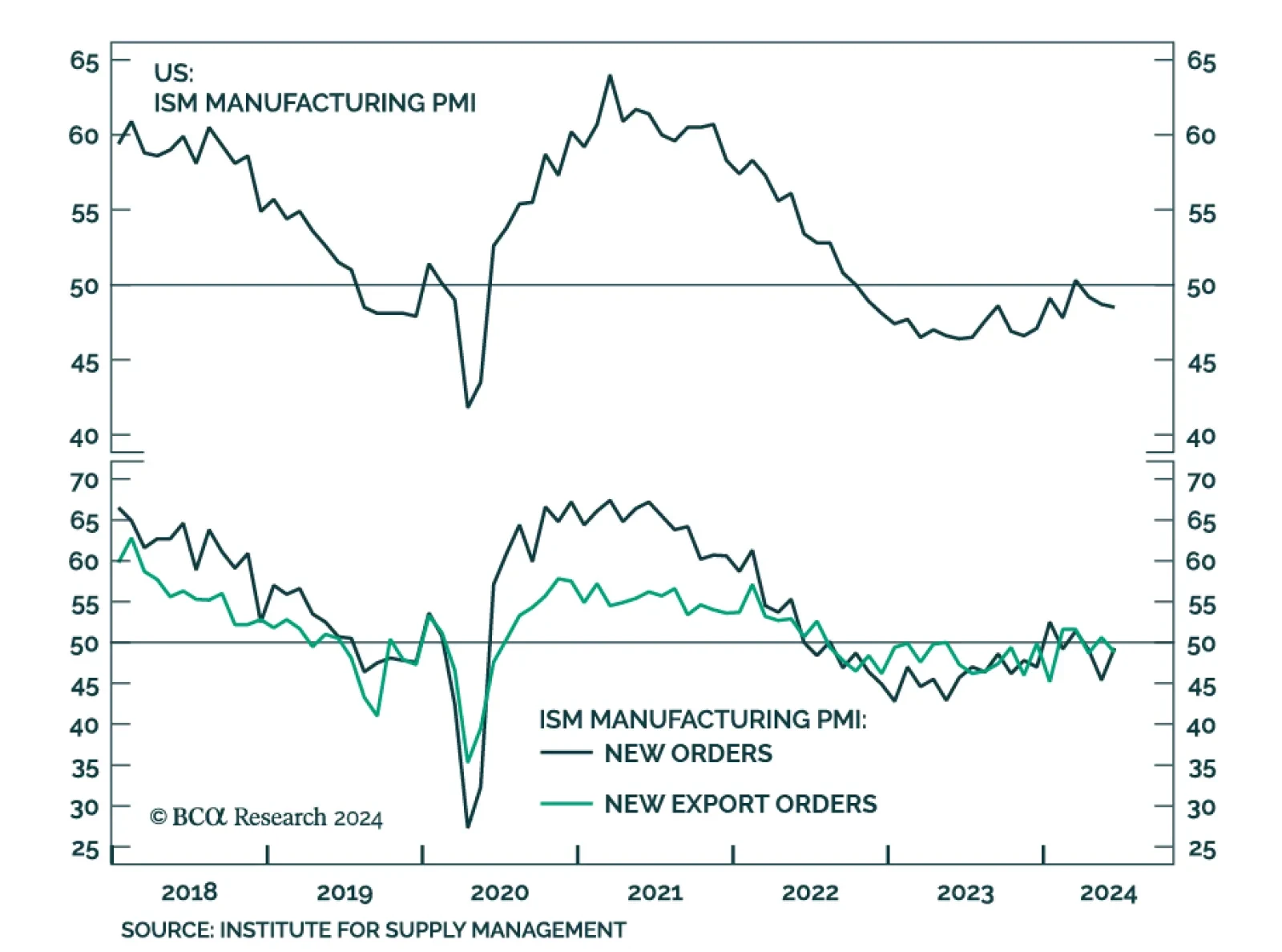

The ISM manufacturing PMI ticked lower in June, from 48.7 to 48.5, thus disappointing expectations of a slower pace of manufacturing sector contraction. The seemingly small decline hides more uninspiring dynamics. Most notably…

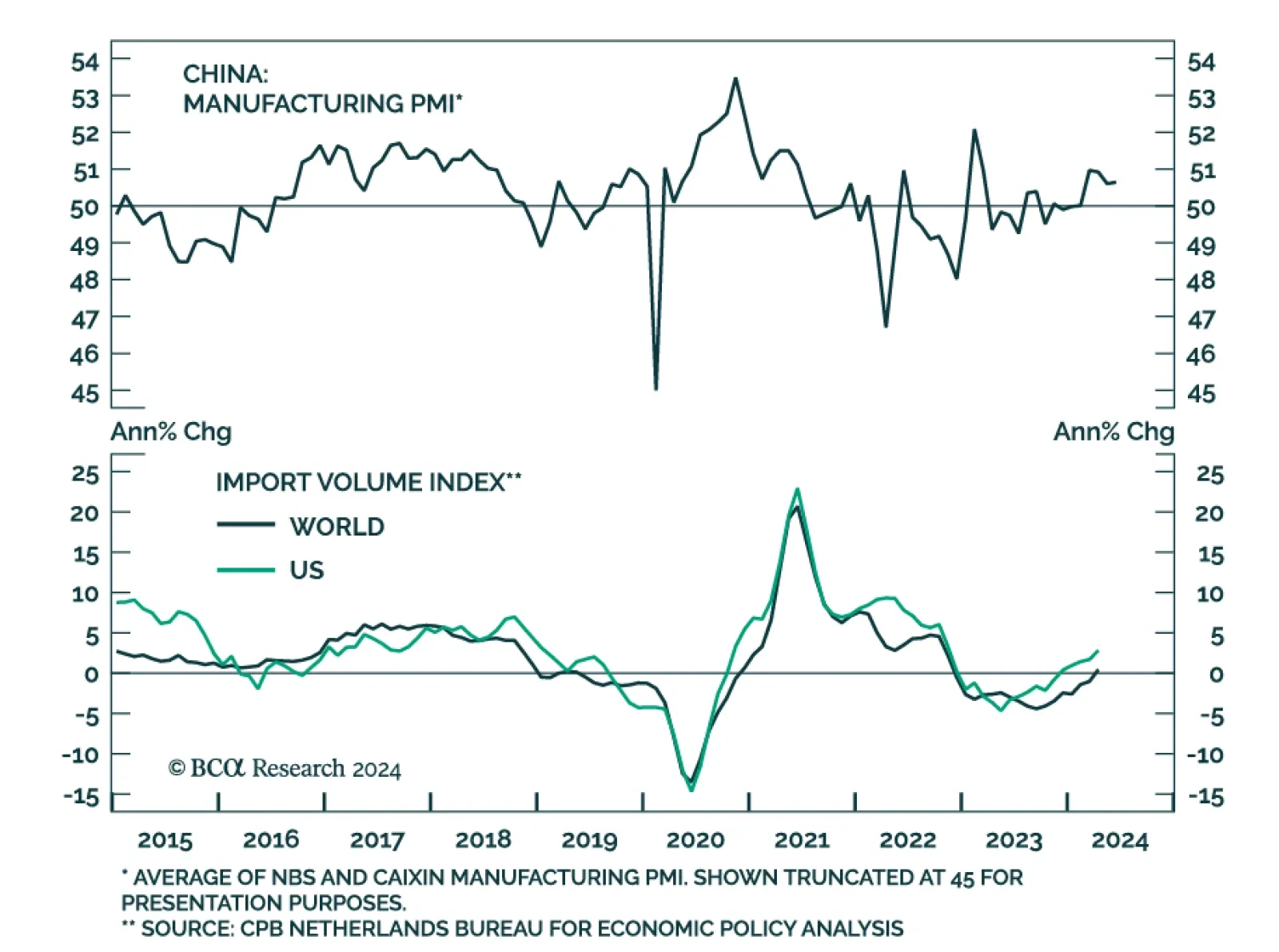

Chinese manufacturing PMIs remained mostly stable in June. The Caixin PMI ticked 0.1 point higher to 51.8 while the NBS measure remained at 49.5. Both leading gauges of Chinese manufacturing activity are thus sending seemingly…

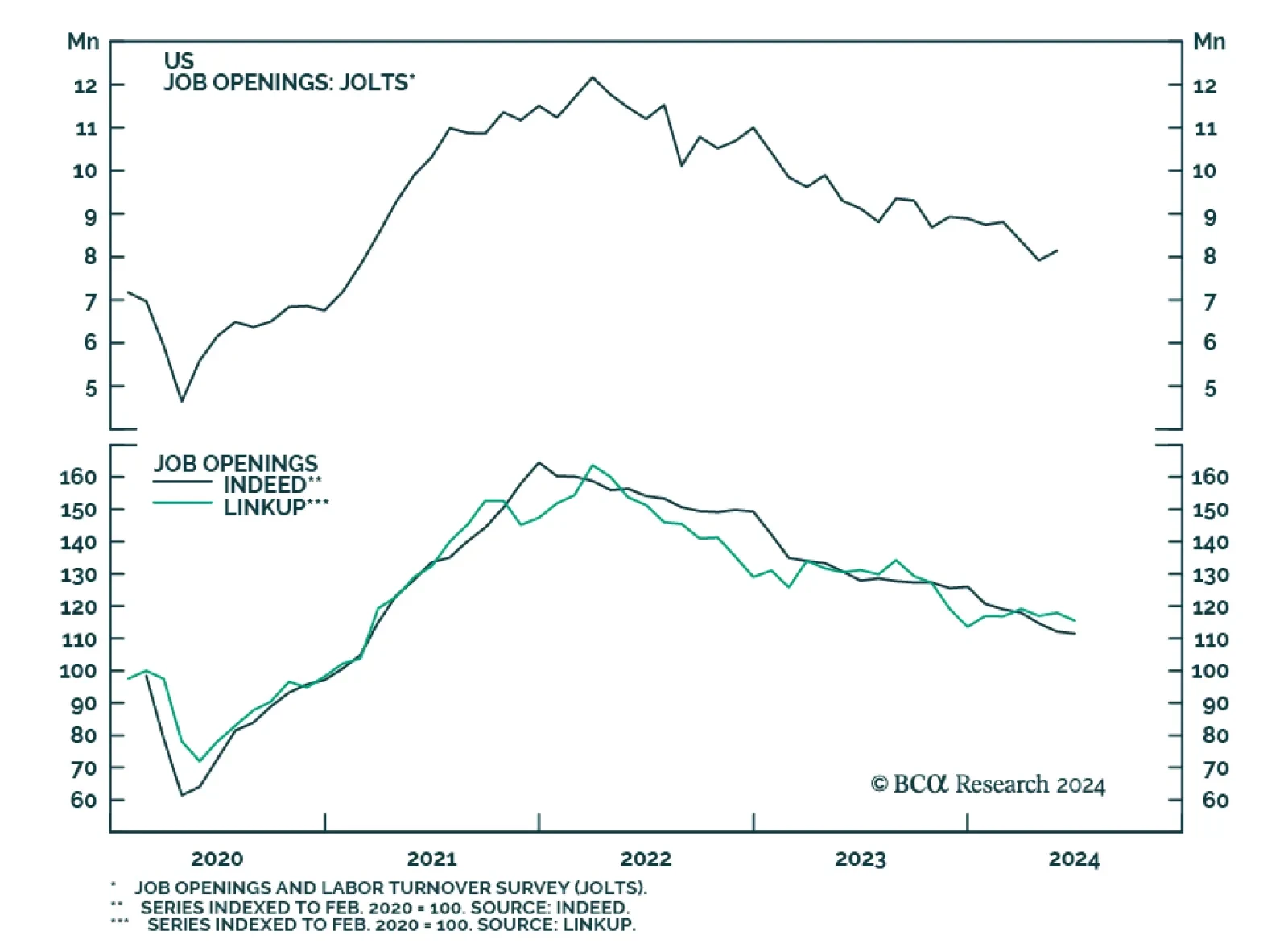

The number of job openings in the US surprised to the upside in May, growing from a downwardly revised 7.9 million to 8.1 million. Not only did the growth in job openings beat expectations of a decline, but the May number even…

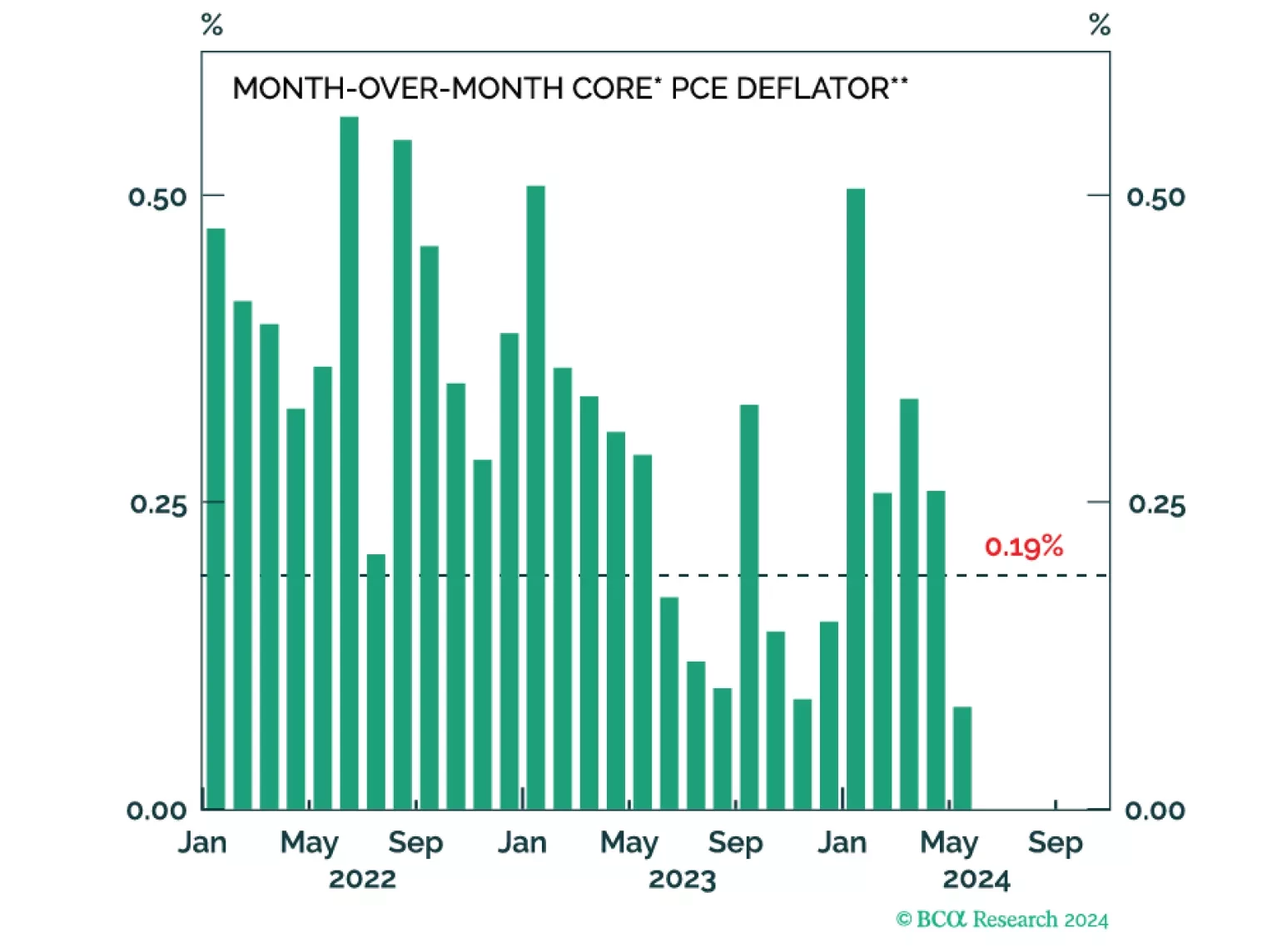

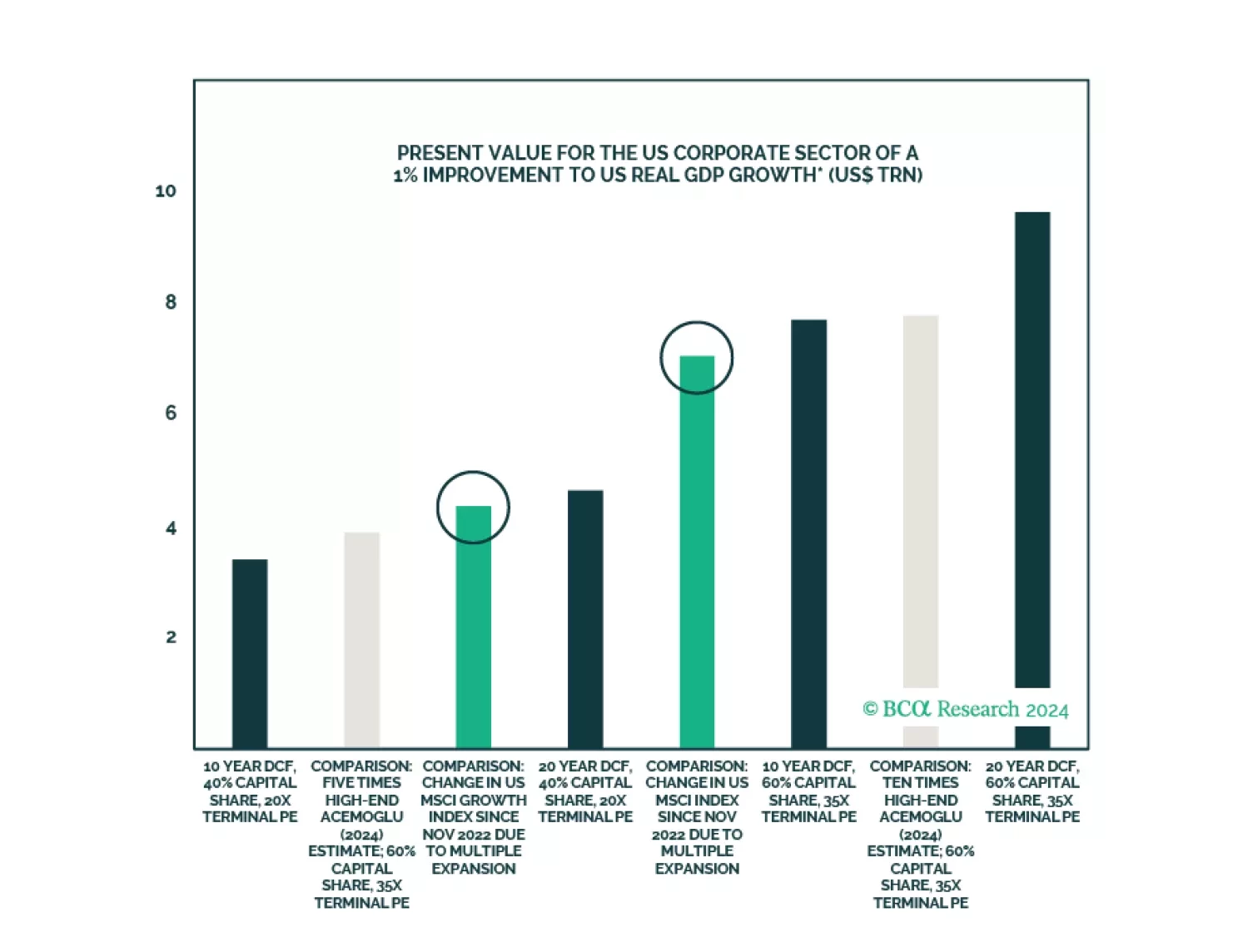

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

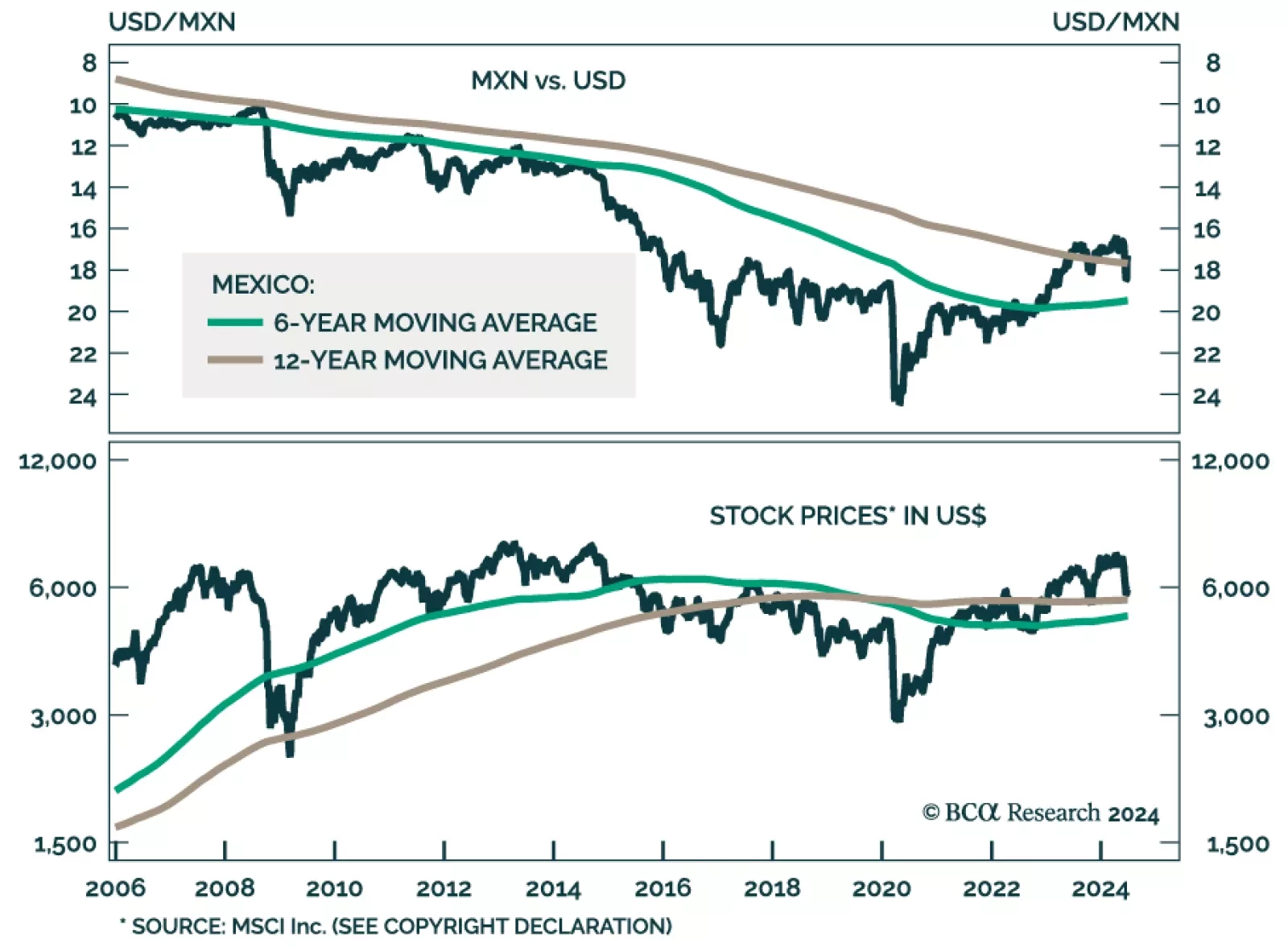

Mexico has gone from investor darling to massive underperformer within the EM space in the past month. In the eyes of our Emerging Markets Strategy team, the near-term outlook for Mexican risk assets remains poor in absolute…

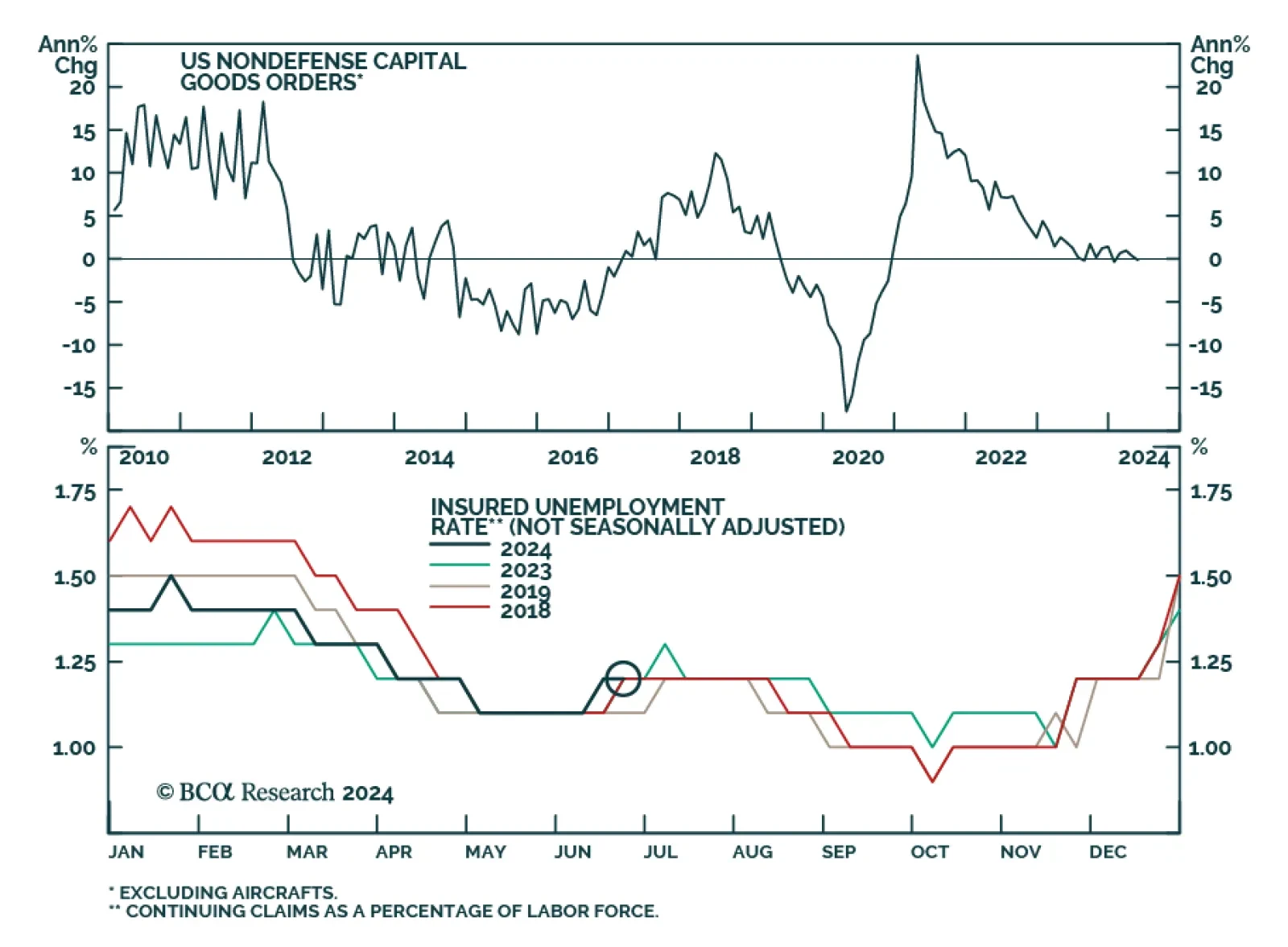

Several pieces of data were released for the US on Thursday. US durable goods orders growth slowed from 0.2% to 0.1% in May, beating expectations of a 0.5% contraction. However other components of the report disappointed…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…