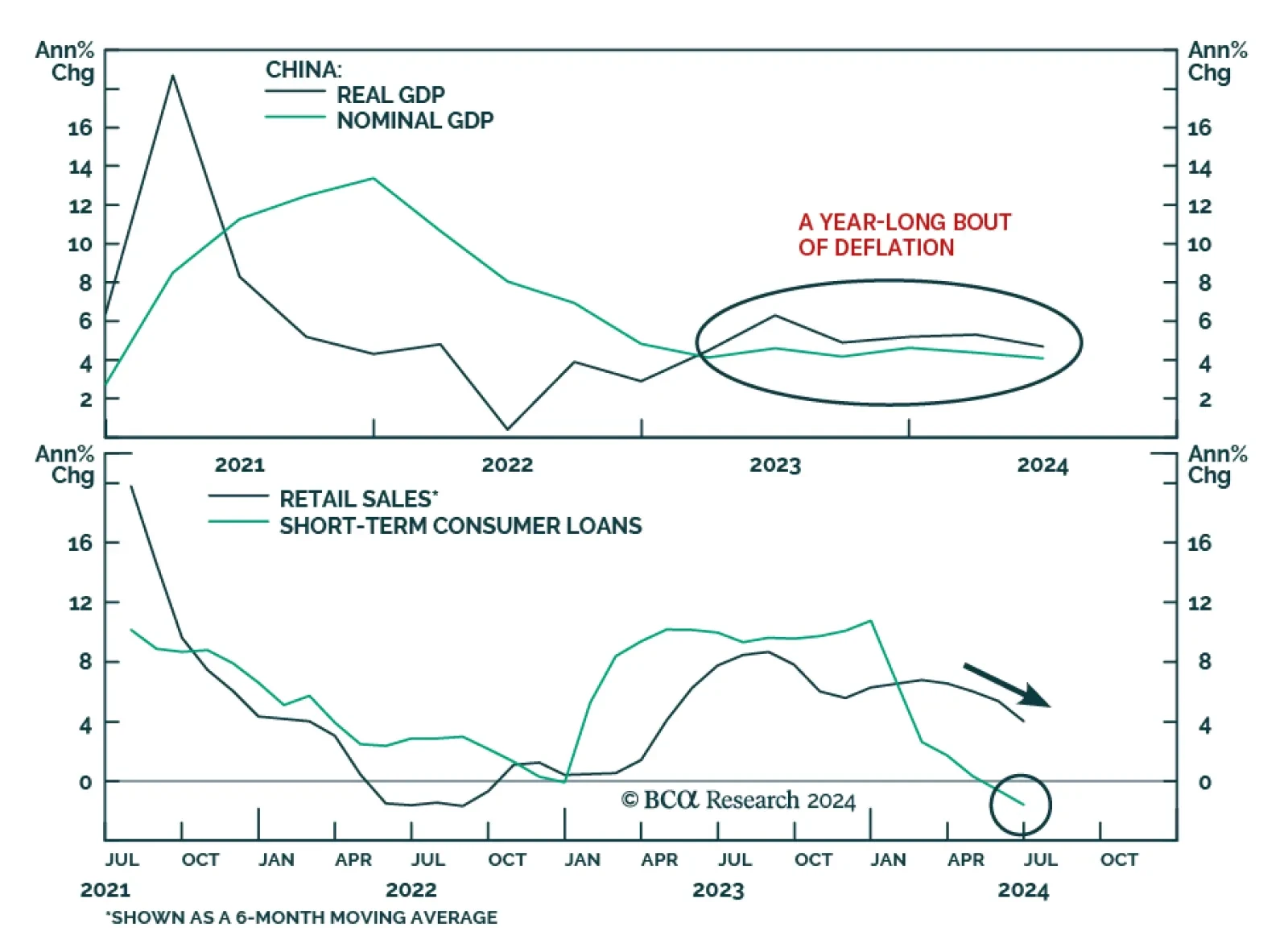

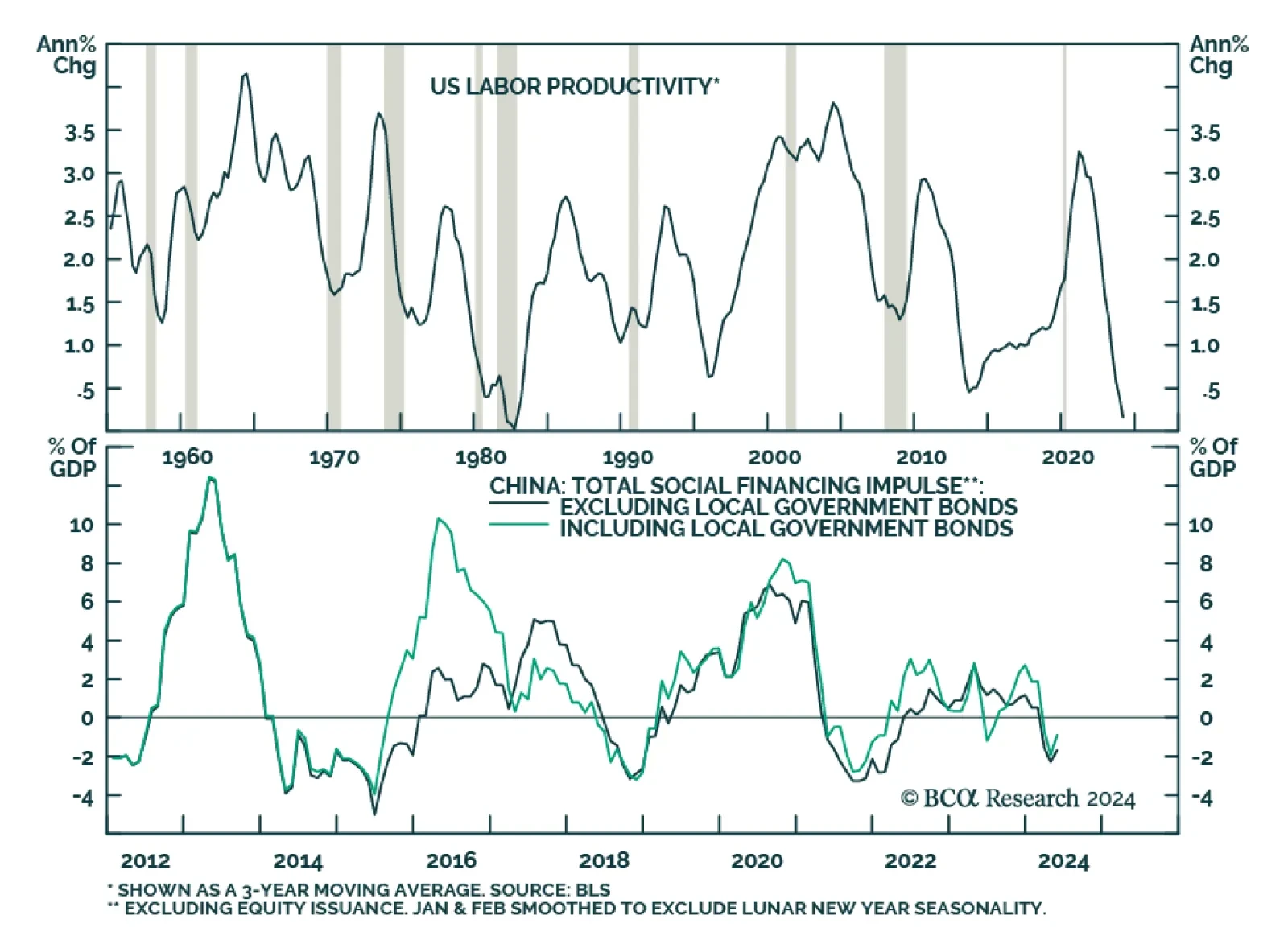

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

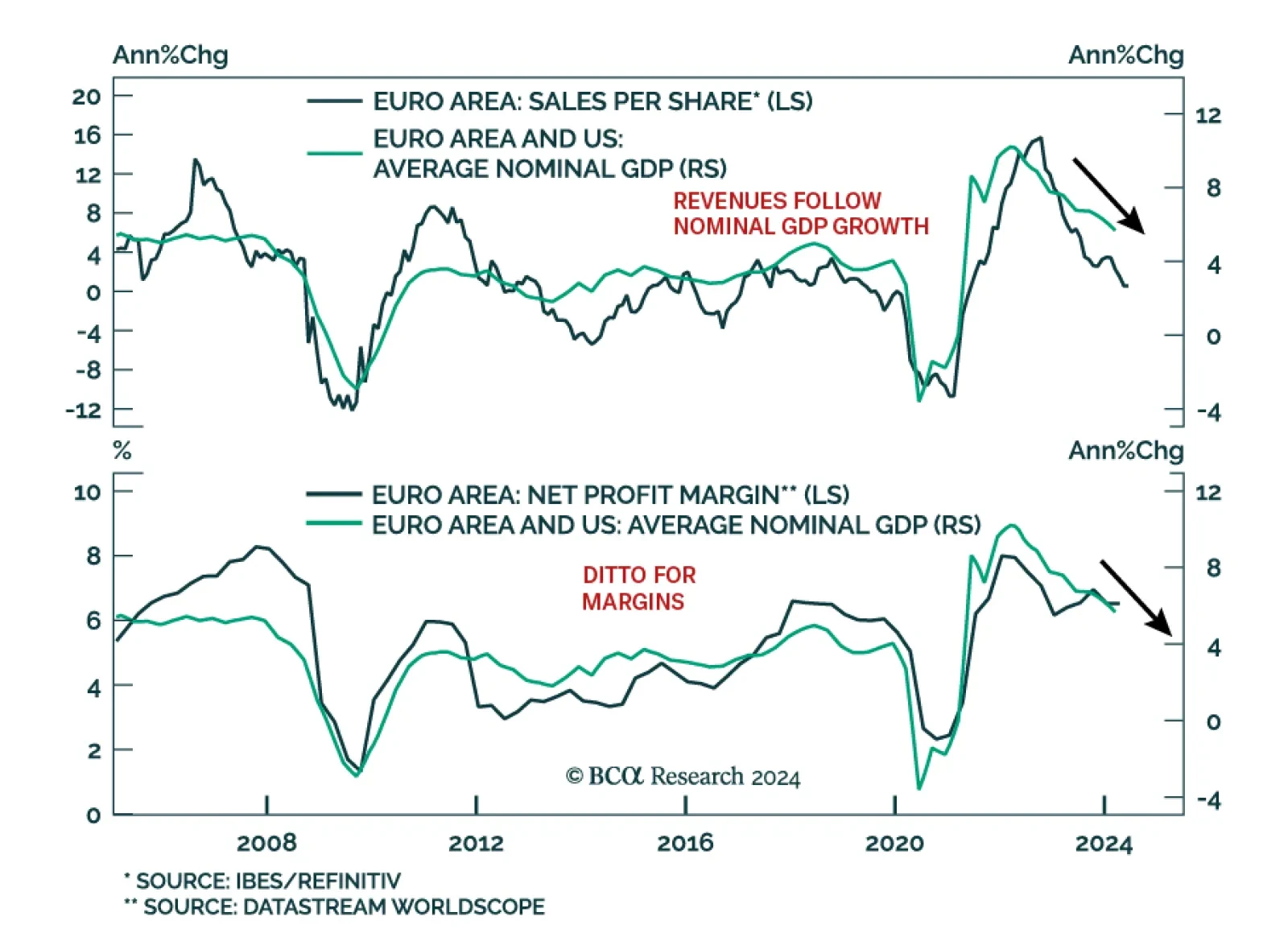

According to BCA Research’s European Investment Strategy service, the threat to European equities stems from growth, not French politics. After the dissolution of the French parliament on June 9th, investors sold…

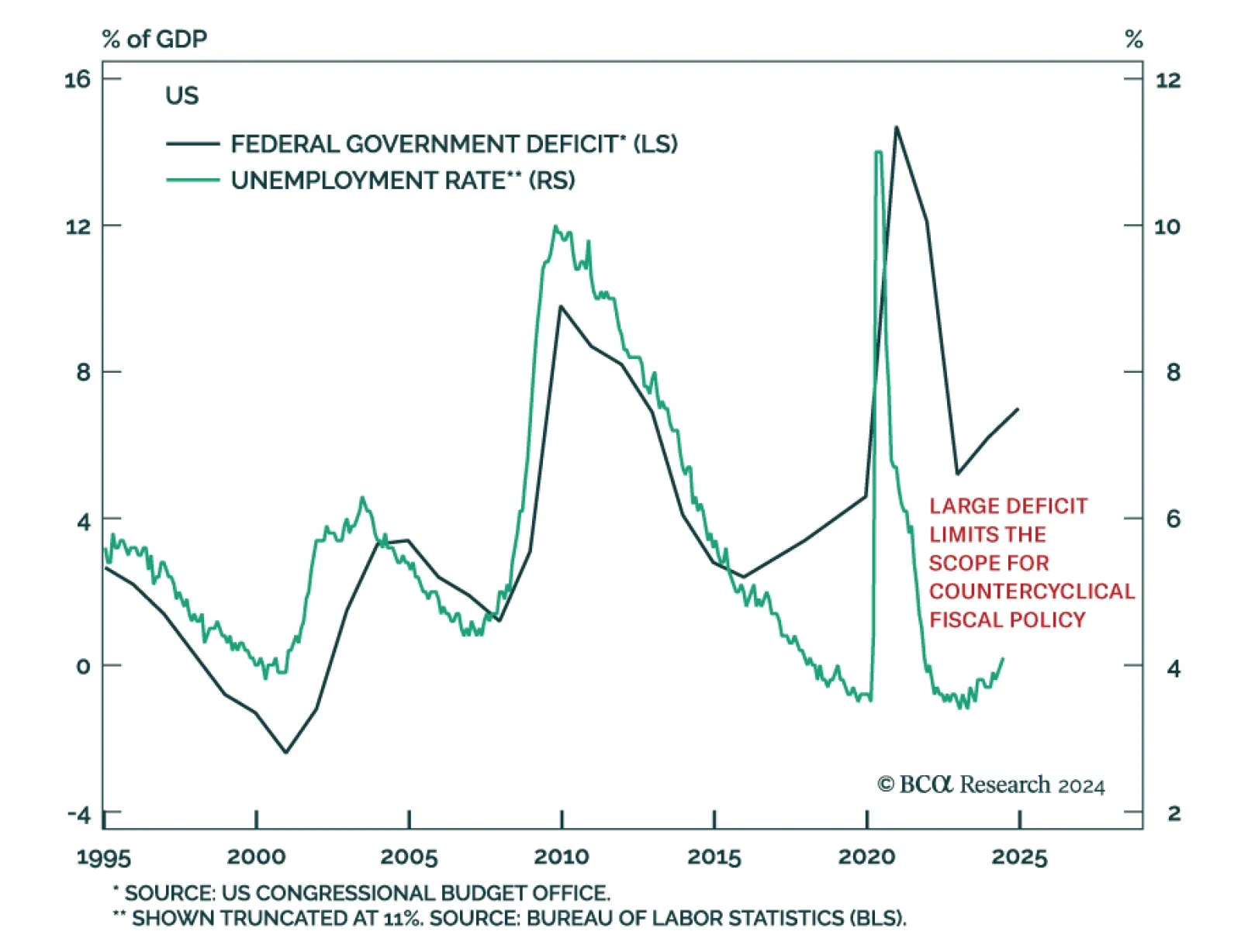

According to BCA Research’s Global Investment Strategy service, investors are overstating the degree to which bond yields will rise under a Trump presidency. For one thing, the team expects the US to fall into recession…

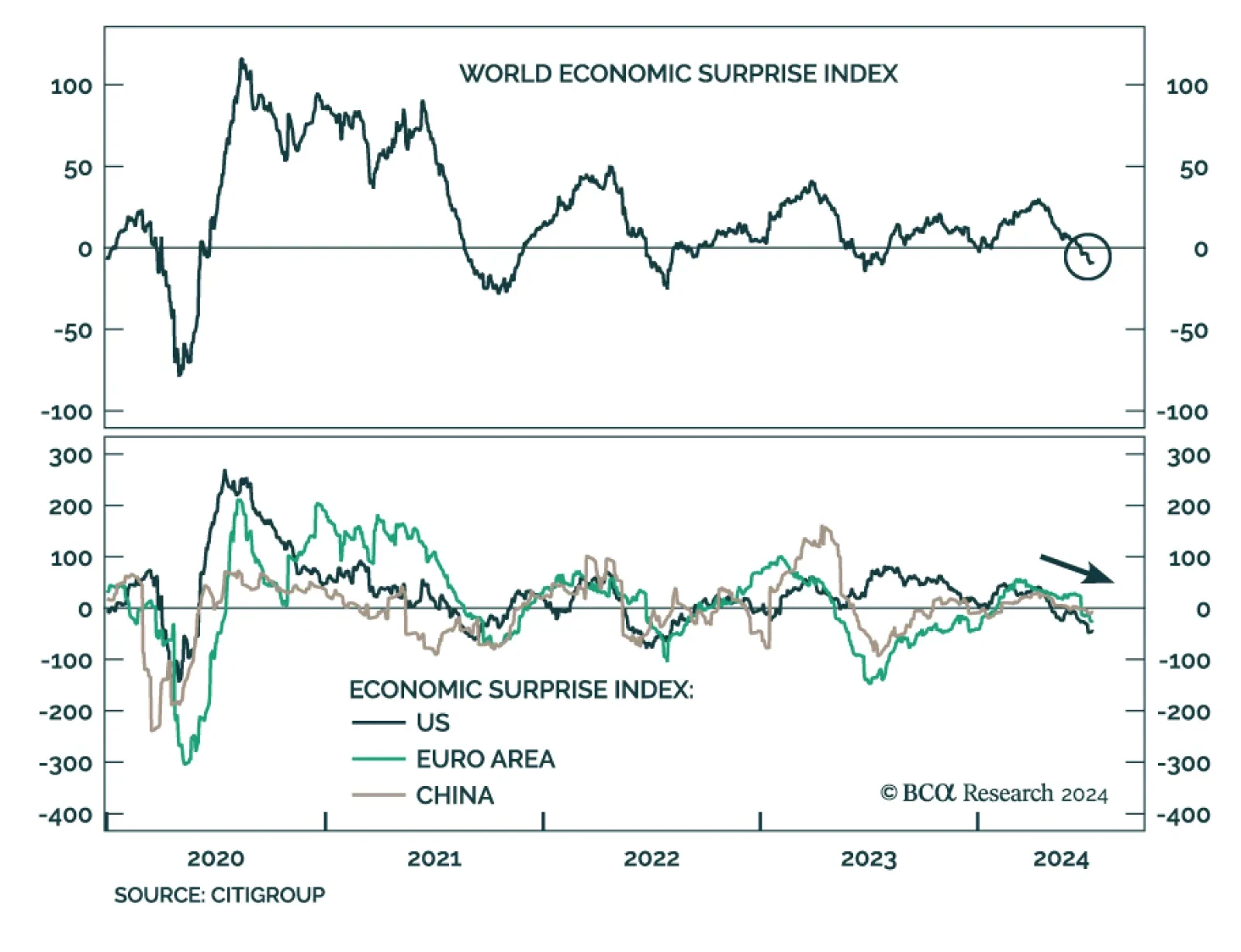

After having peaked in mid-April, Citigroup’s global economic surprise index has been in negative territory for the past few weeks. The sub-zero reading indicates that economic data have been surprising to the downside and…

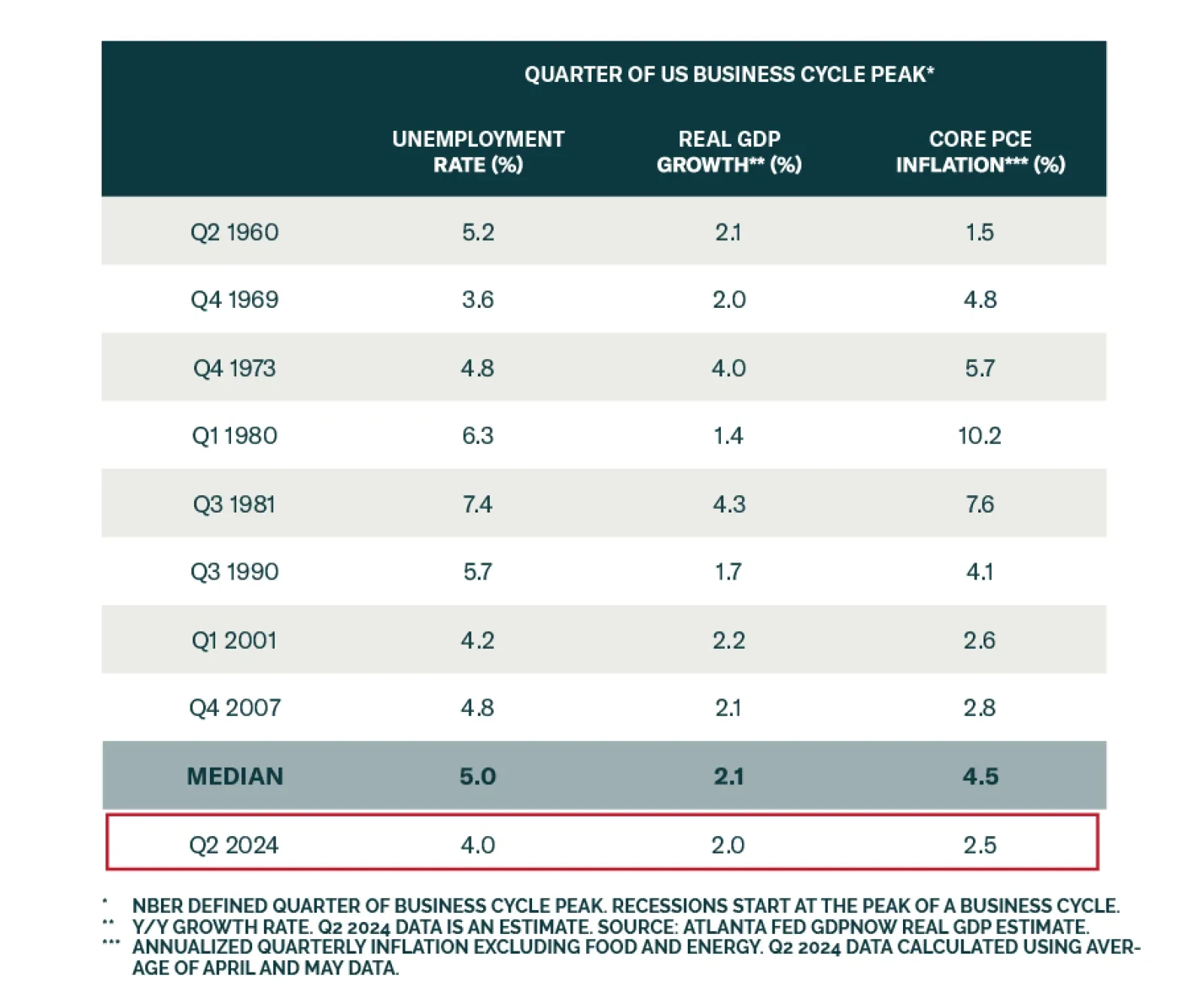

An investor looking at the low unemployment rate and elevated job vacancy rate could reasonably conclude that the US expansion will continue. However history suggests that recessions often start seemingly out of the blue.…

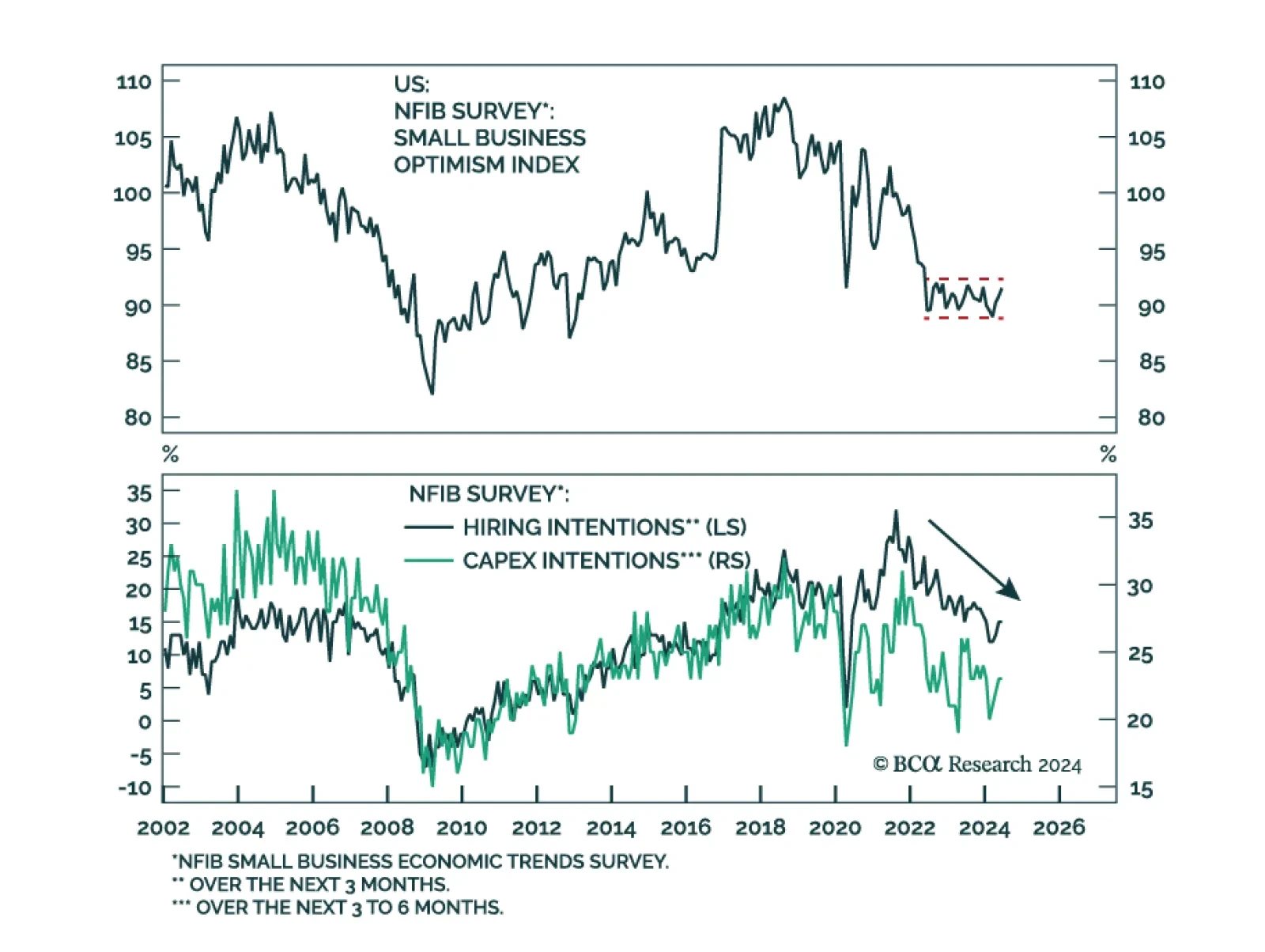

The NFIB Small Business Optimism (SBO) index climbed from 90.5 to 91.5 in June, the highest print this year, topping consensus expectations of a softening to 90.2. On the surface, this appears to be good news. Indeed, small…

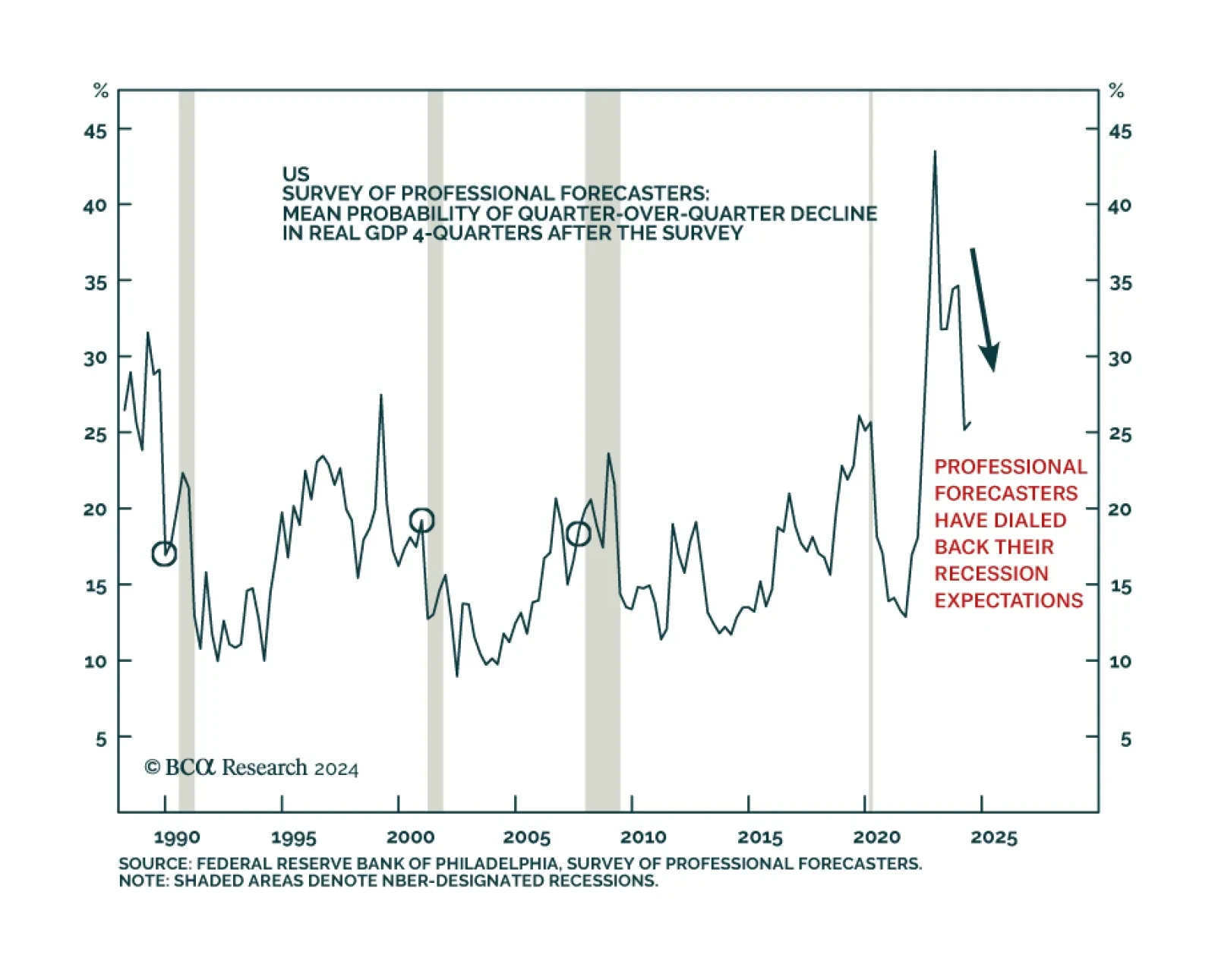

Participants in the Philly Fed’s Survey of Professional Forecasters (SPF) assign a 26% probability to a contraction in US real GDP four quarters from now, down from their 44% peak probability in 2022. The unwieldy…

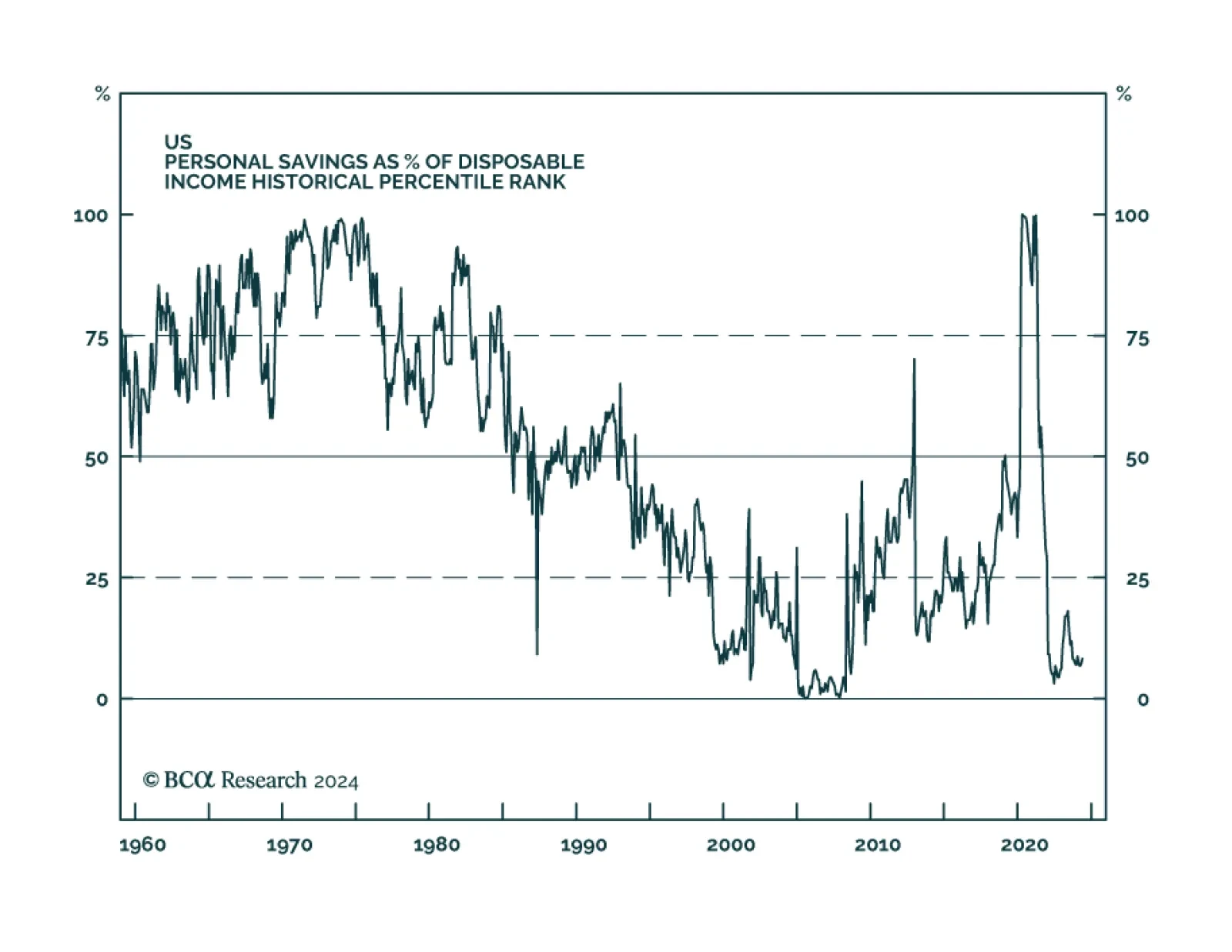

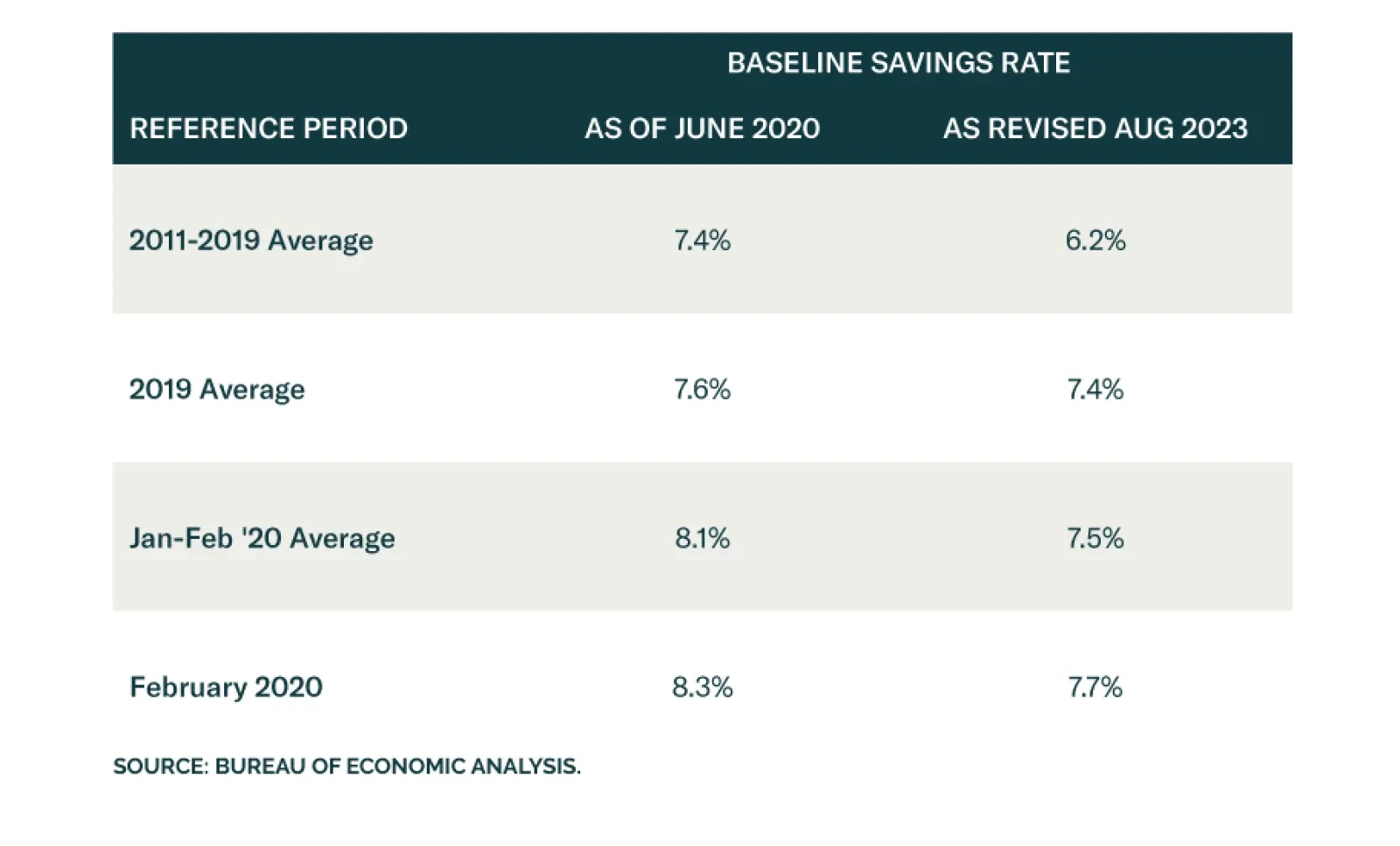

Our US Investment Strategy colleagues have kept a close eye on excess savings and their disposition since the CARES Act funds began to flow in the spring of 2020. Their conviction that the consensus failed to recognize the…

Our US Investment strategists define excess savings as the difference between what households saved beginning in March 2020 and what they might have saved had the pandemic not occurred. To estimate the latter, they assumed that…

We expect continued softening in the US economy will lead to decelerating wage growth, muffling the principal consumption driver. Because the US has been the foremost catalyst for global growth in this cycle, a US recession will…