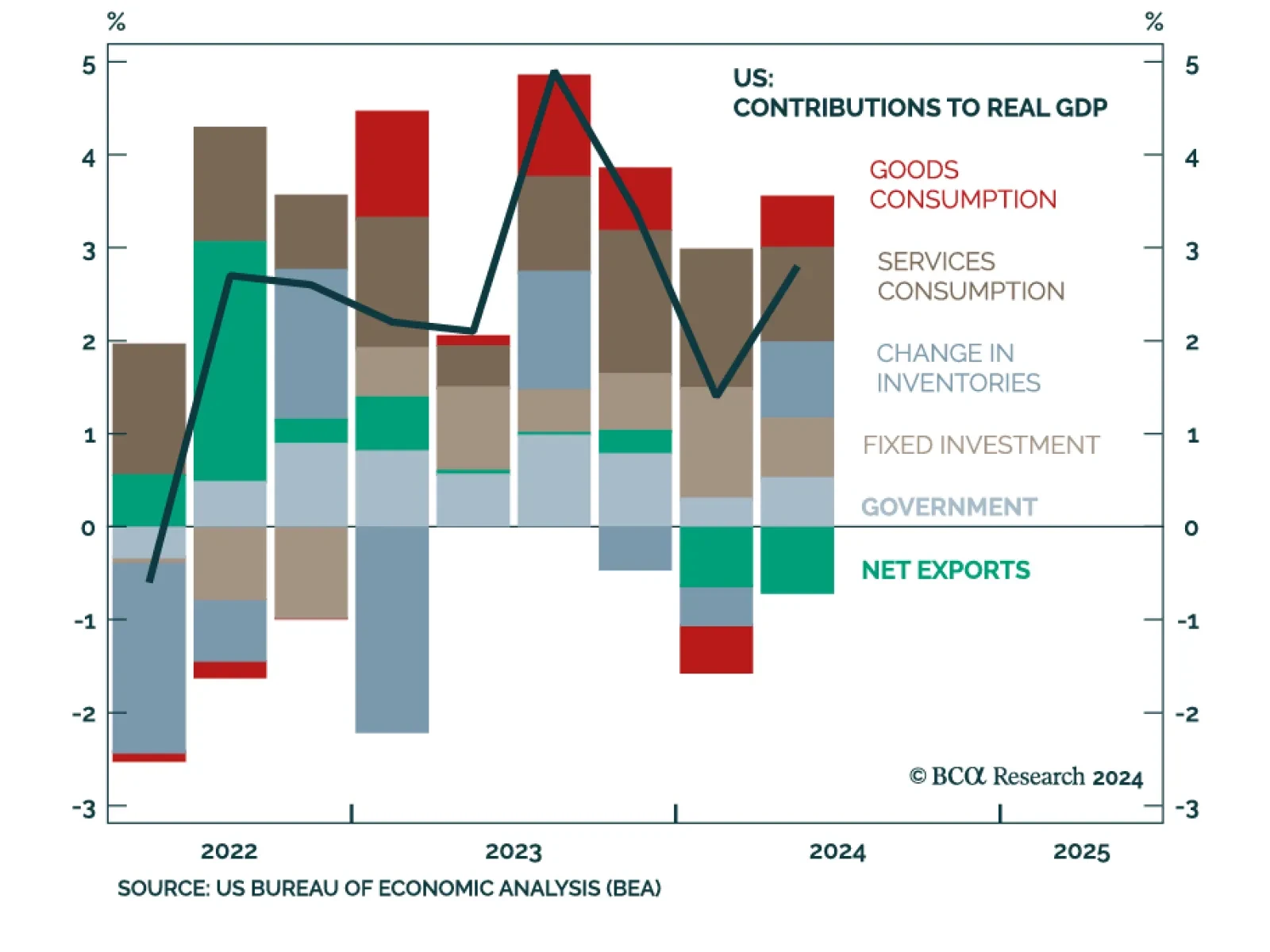

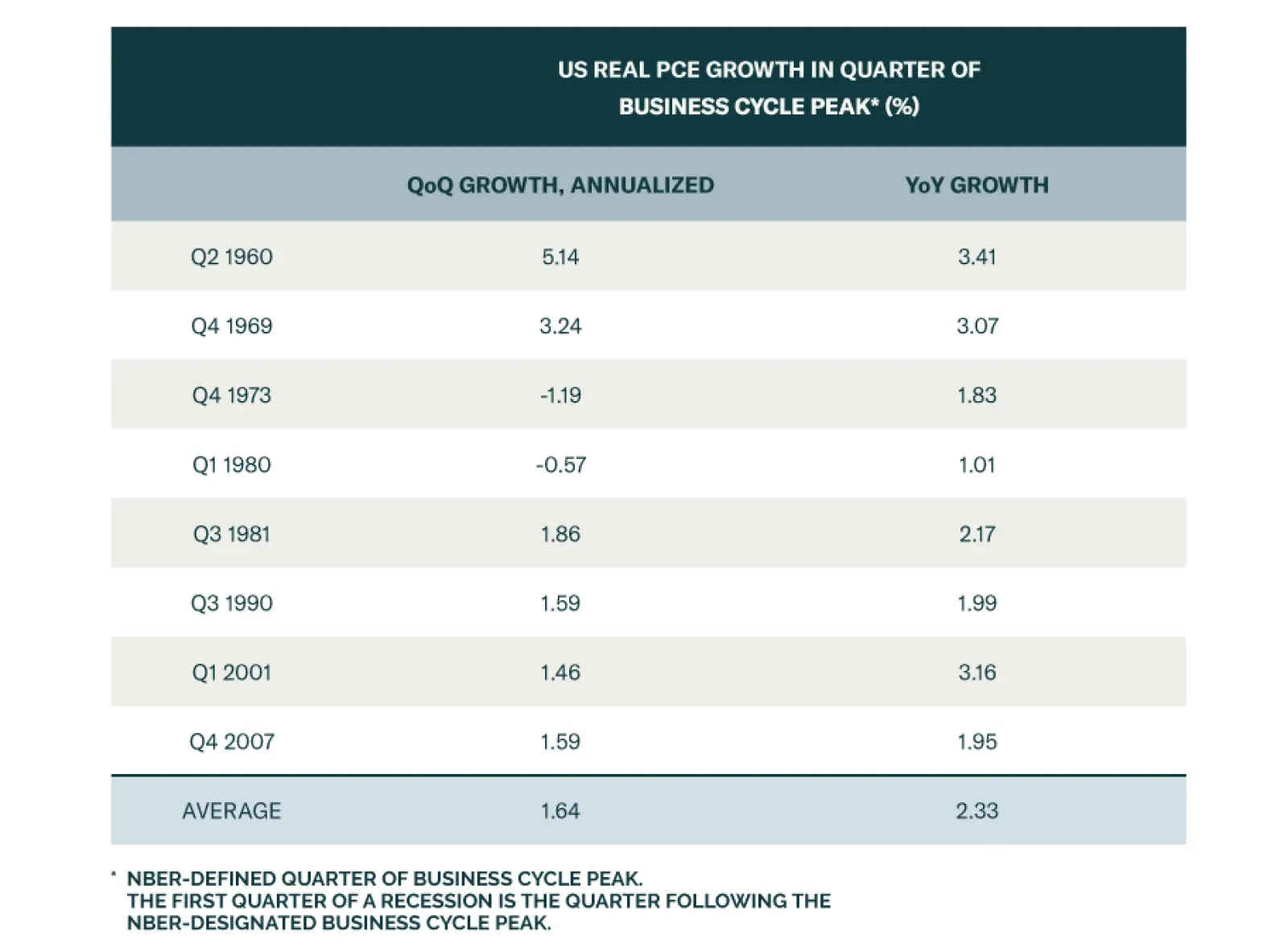

The preliminary release of Q2 2024 US GDP surprised to the upside on Thursday. The US economy grew 2.8% on an annualized basis, and 3.1% on a year-over-year basis. The two largest drivers of the acceleration were consumption (…

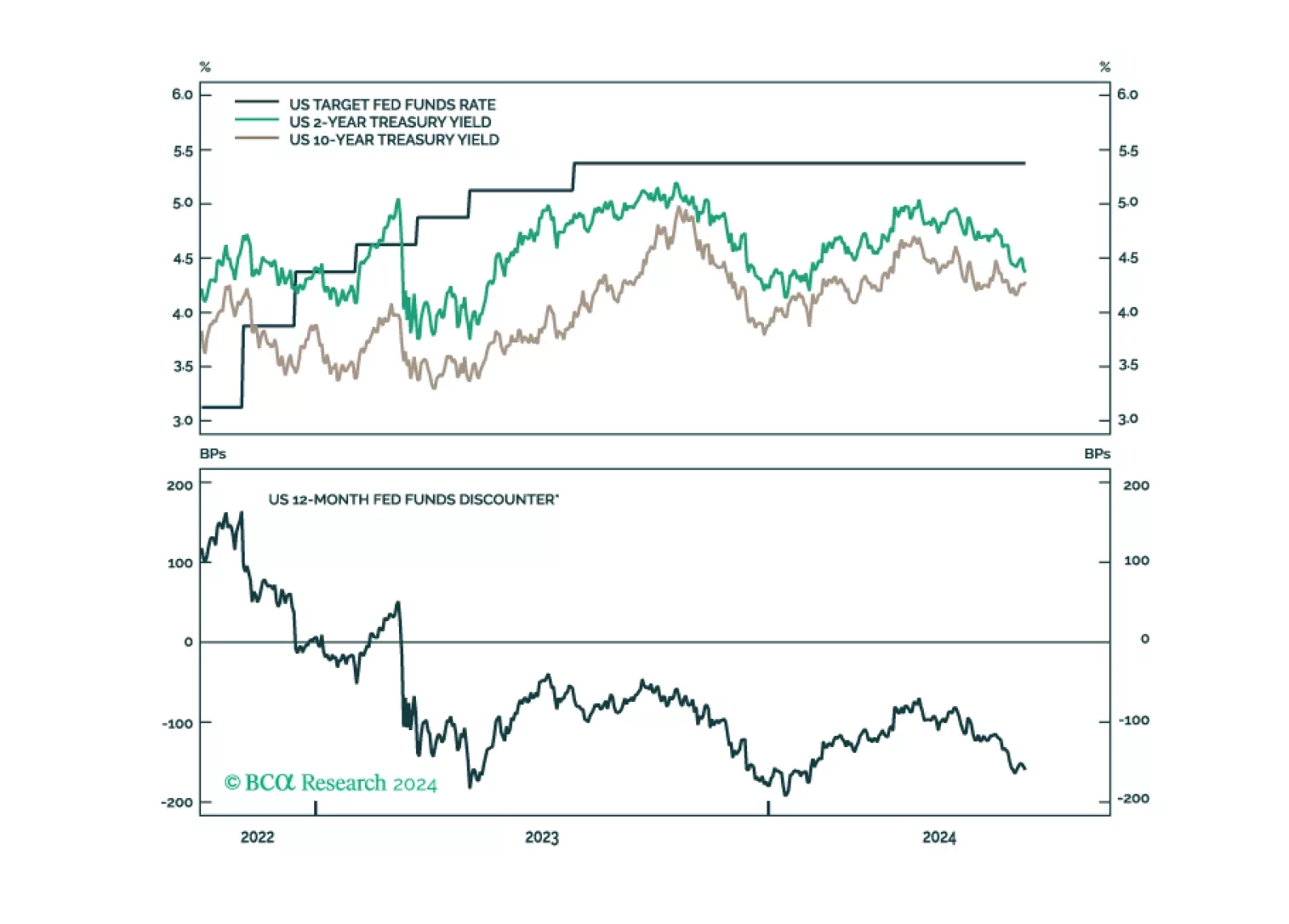

After this morning’s jobless claims number, we have now seen enough deterioration in our preferred labor market indicators to increase portfolio duration from “at benchmark” to “above benchmark”.

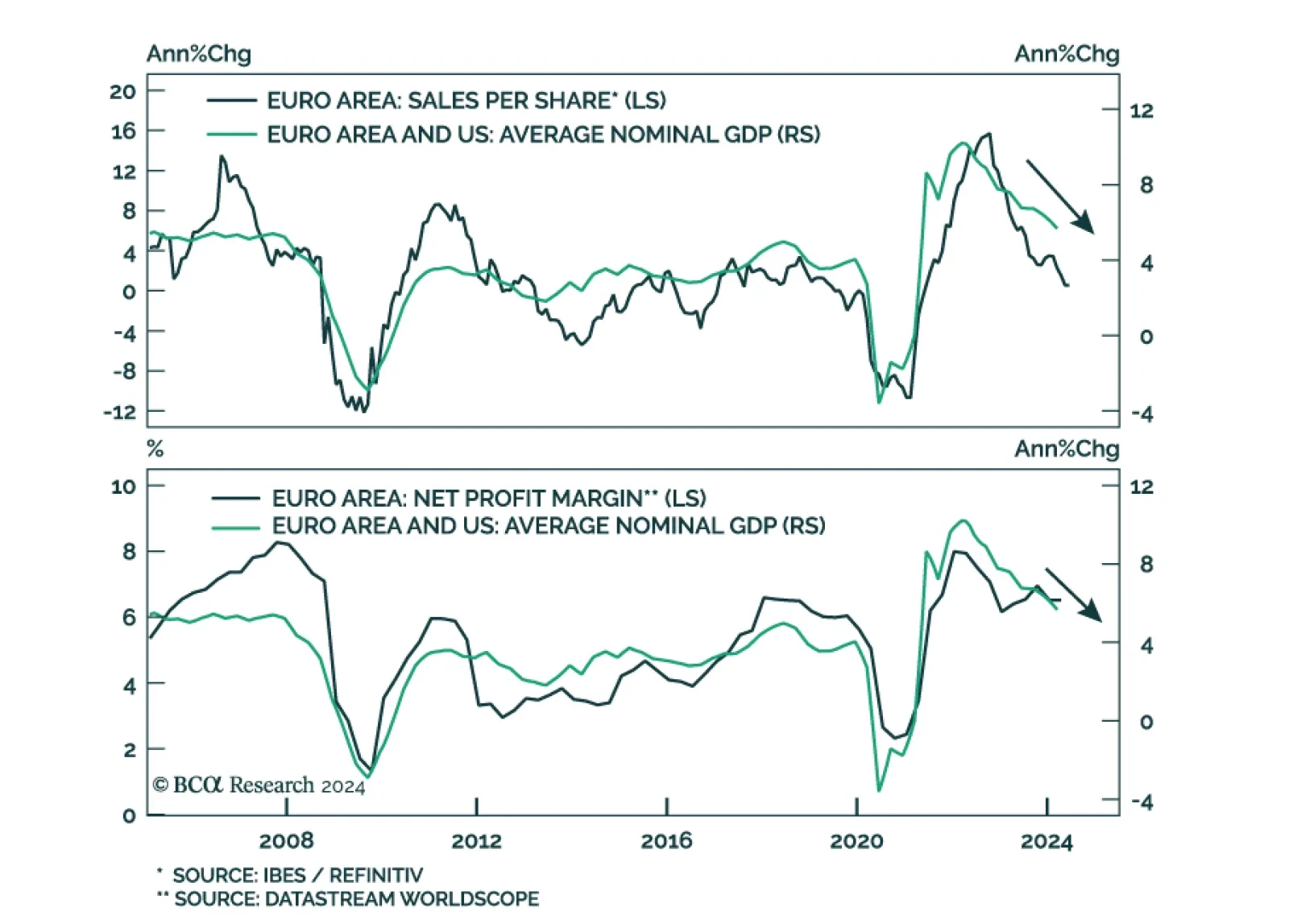

We assign high odds that the US will tip into a recession by year-end or early 2025. Given it has been the largest driver of global demand in this cycle, a US recession will morph into a global downturn. The procyclical…

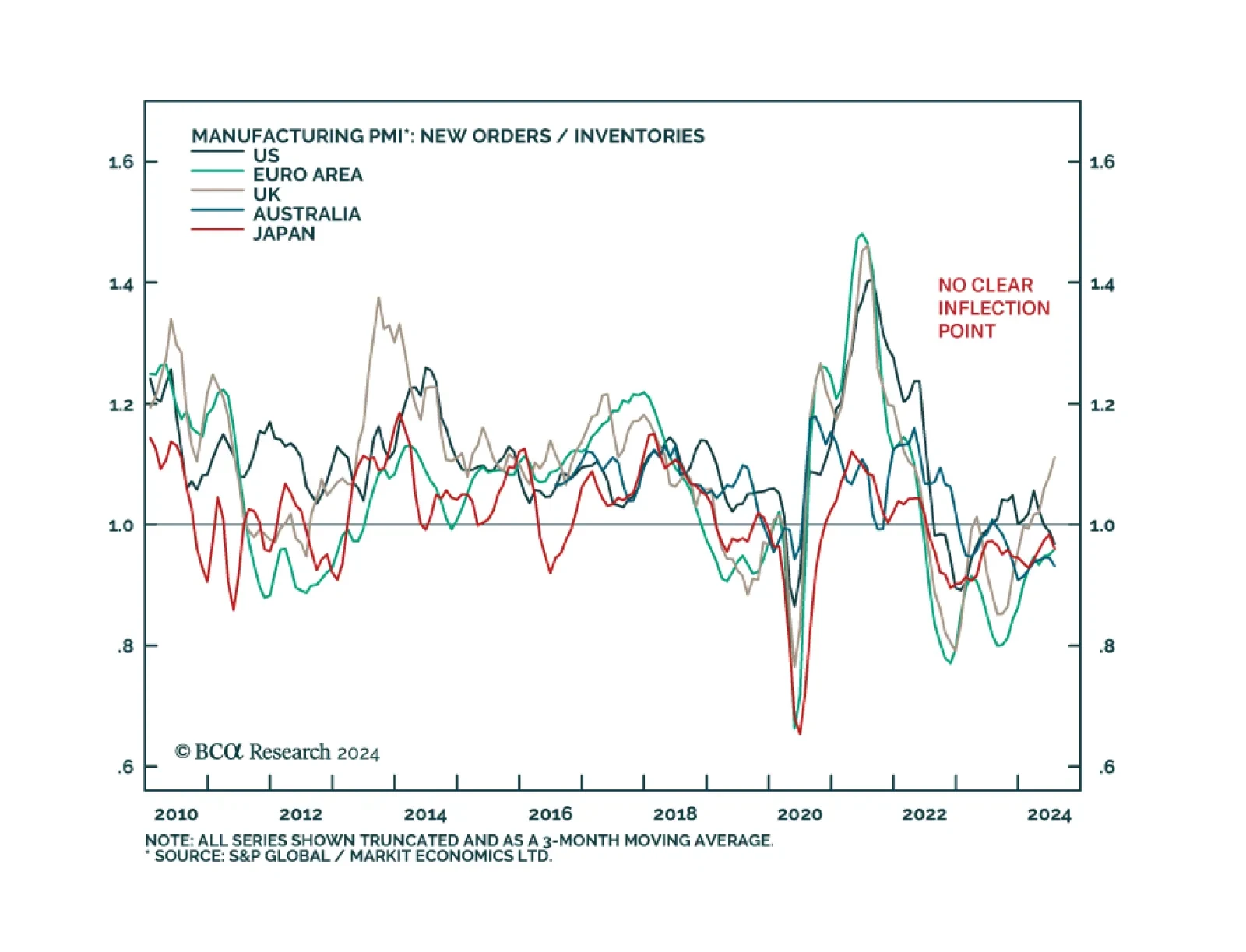

Preliminary PMIs suggest that, with the exception of the Eurozone, growth was still resilient in DM economies in July. Composite PMIs expanded across the board, at a faster pace in the US and the UK, and from previously…

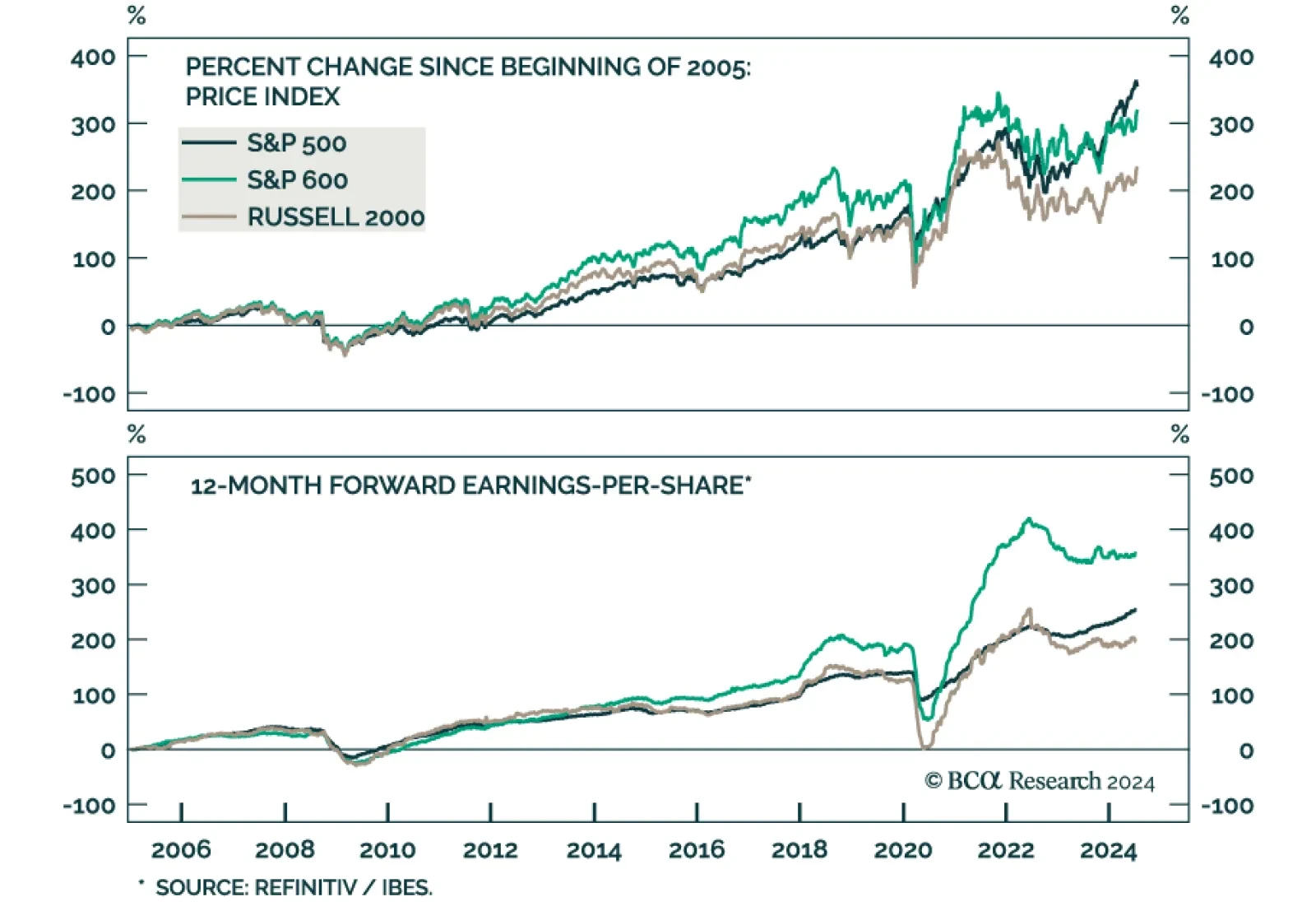

The S&P 600 and Russell 2000 have outperformed the S&P 500 by close to 10% since July 9. Small caps typically outperform in the early stages of economic expansions when growth is accelerating, demand-driven inflation is…

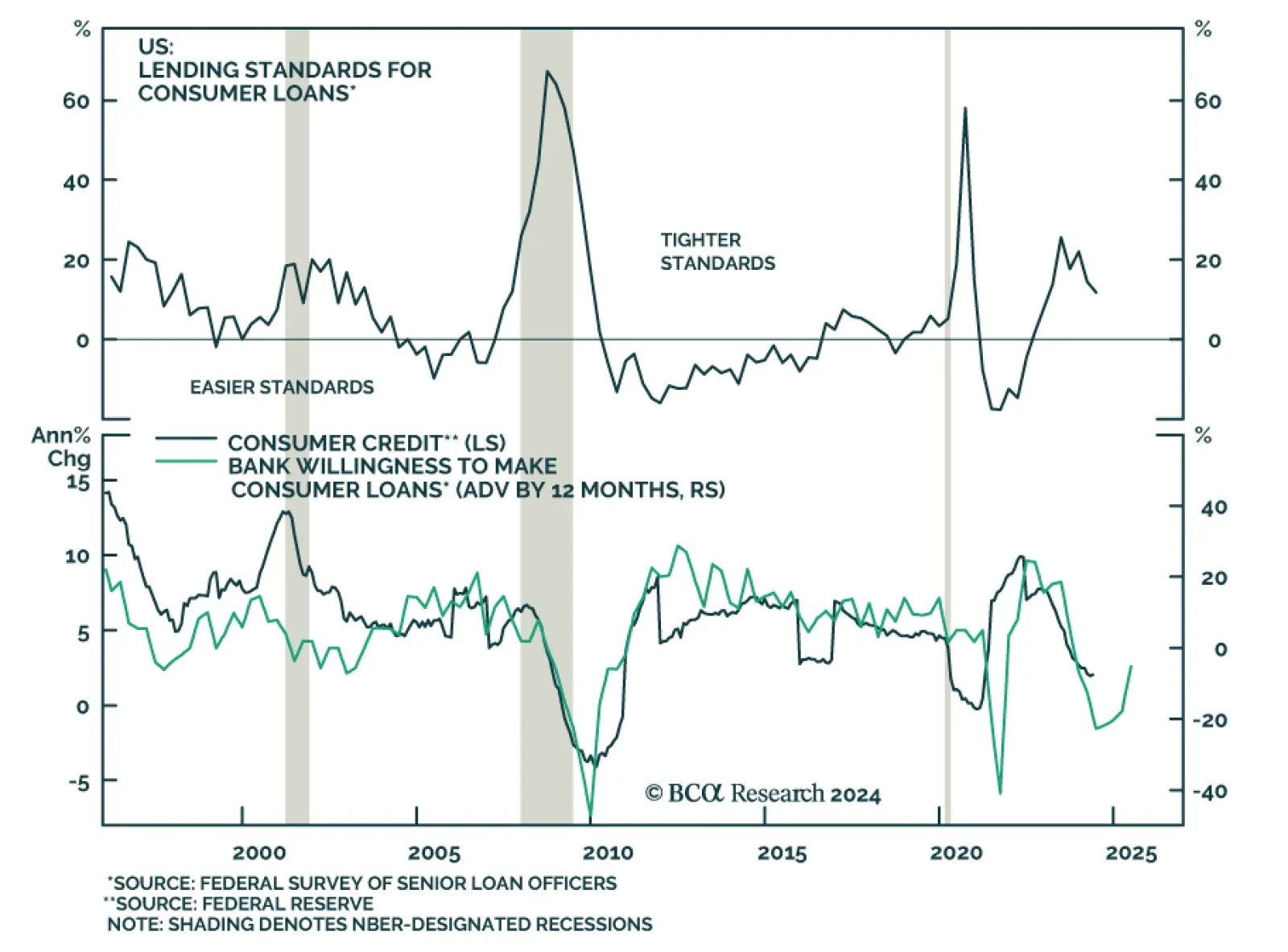

Total consumer credit rose by USD 11.4 billion in May (to USD 5,065 billion outstanding) from a slightly upwardly revised USD 6.5 billion increase in April, surpassing expectations of a smaller increase. Notably, revolving credit…

The US economy has clearly cooled from its above-trend pace of growth in 2023. The consensus view among BCA Research’s strategists project that this deceleration will eventually culminate in a recession by year-end or early…

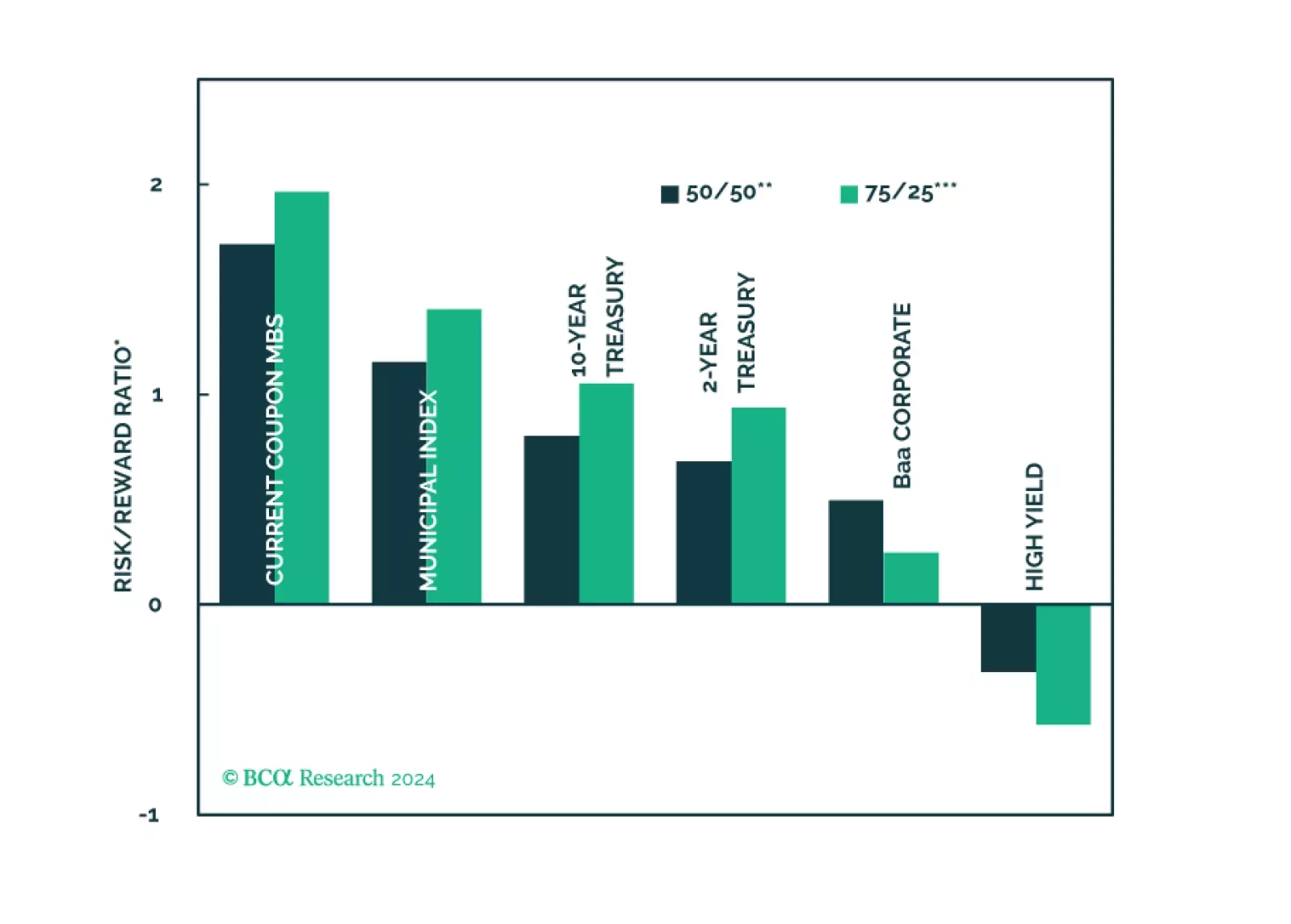

We calculate expected returns for several different US fixed income sectors with a focus on how municipal bonds stack up against the investment alternatives.

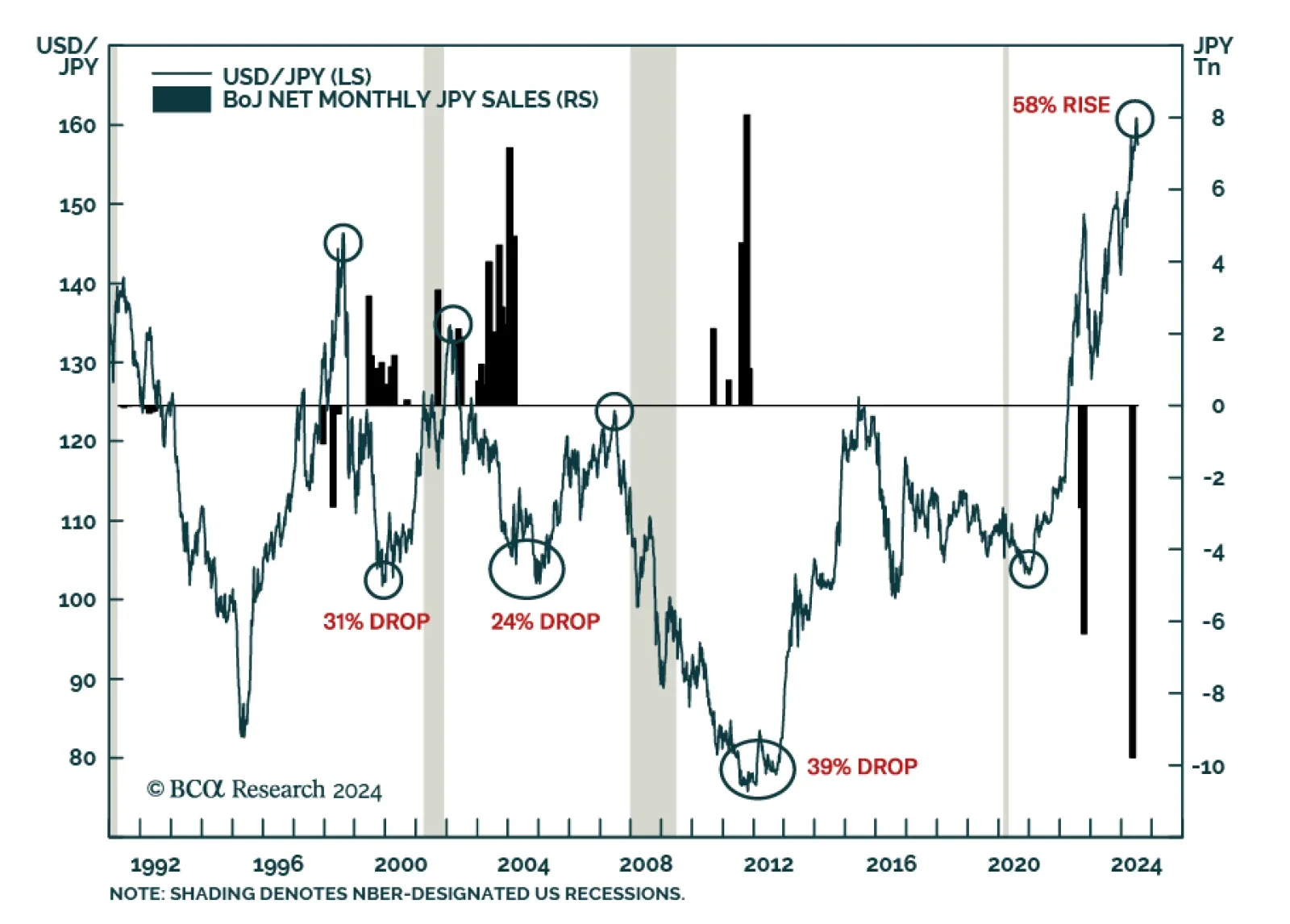

The yen rallied against most major currencies in July and has climbed close to 3.5% so far this month against the greenback. Resurfacing suspicion of central bank interventions to prop up the currency is one of the factors…

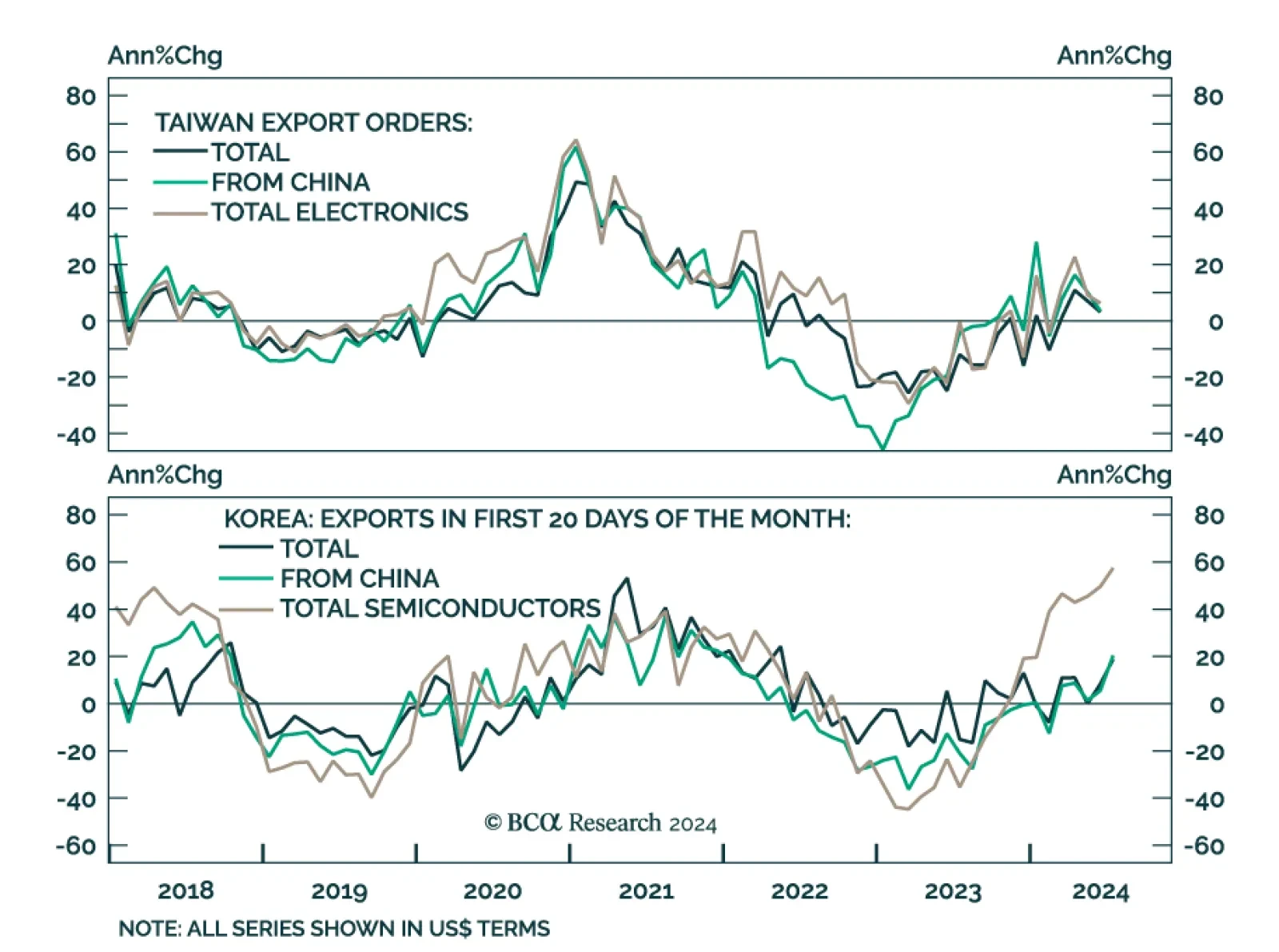

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders decelerated from 7.0% y/y to 3.1% in June, badly disappointing expectations of a double-digit growth rate and…