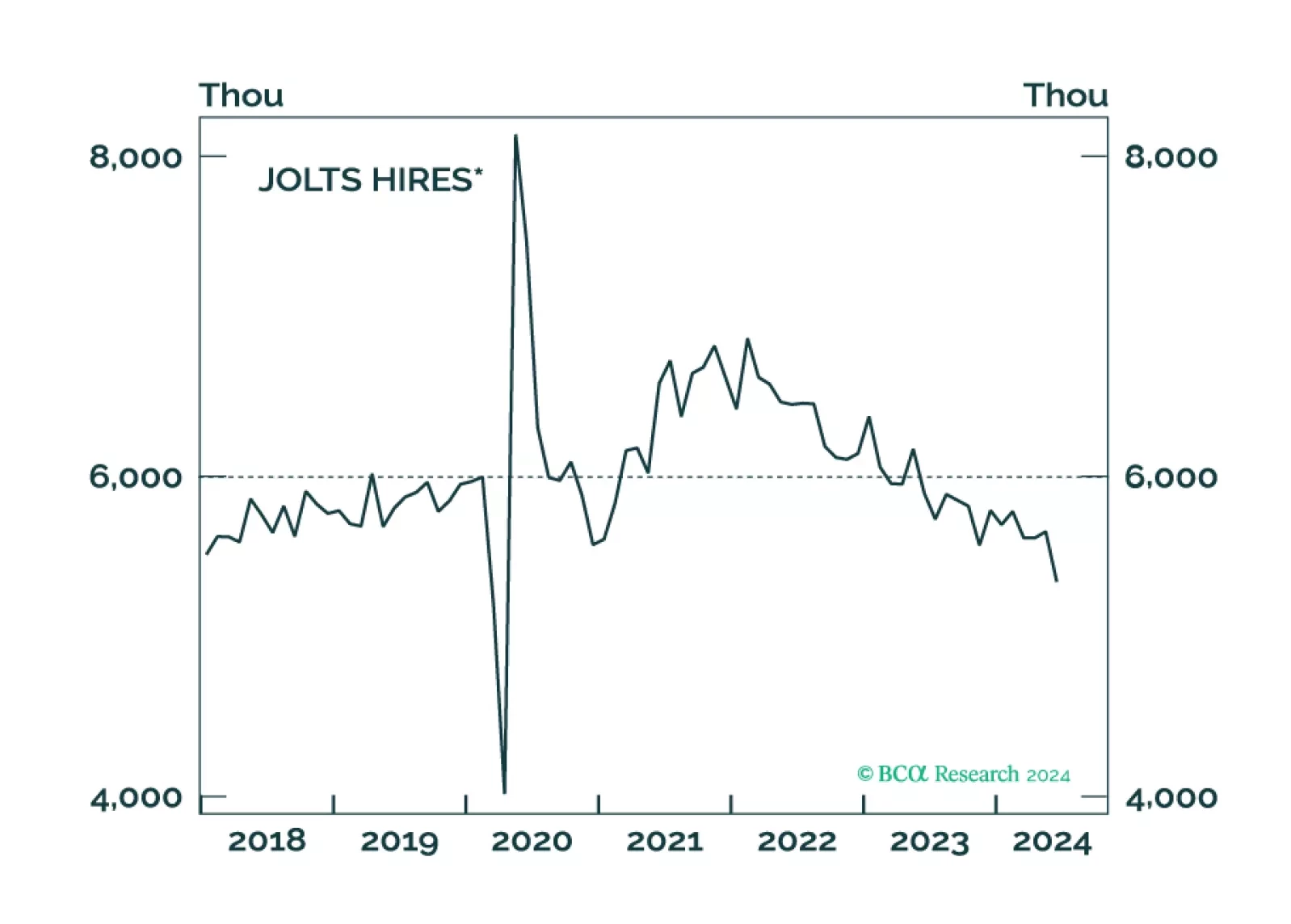

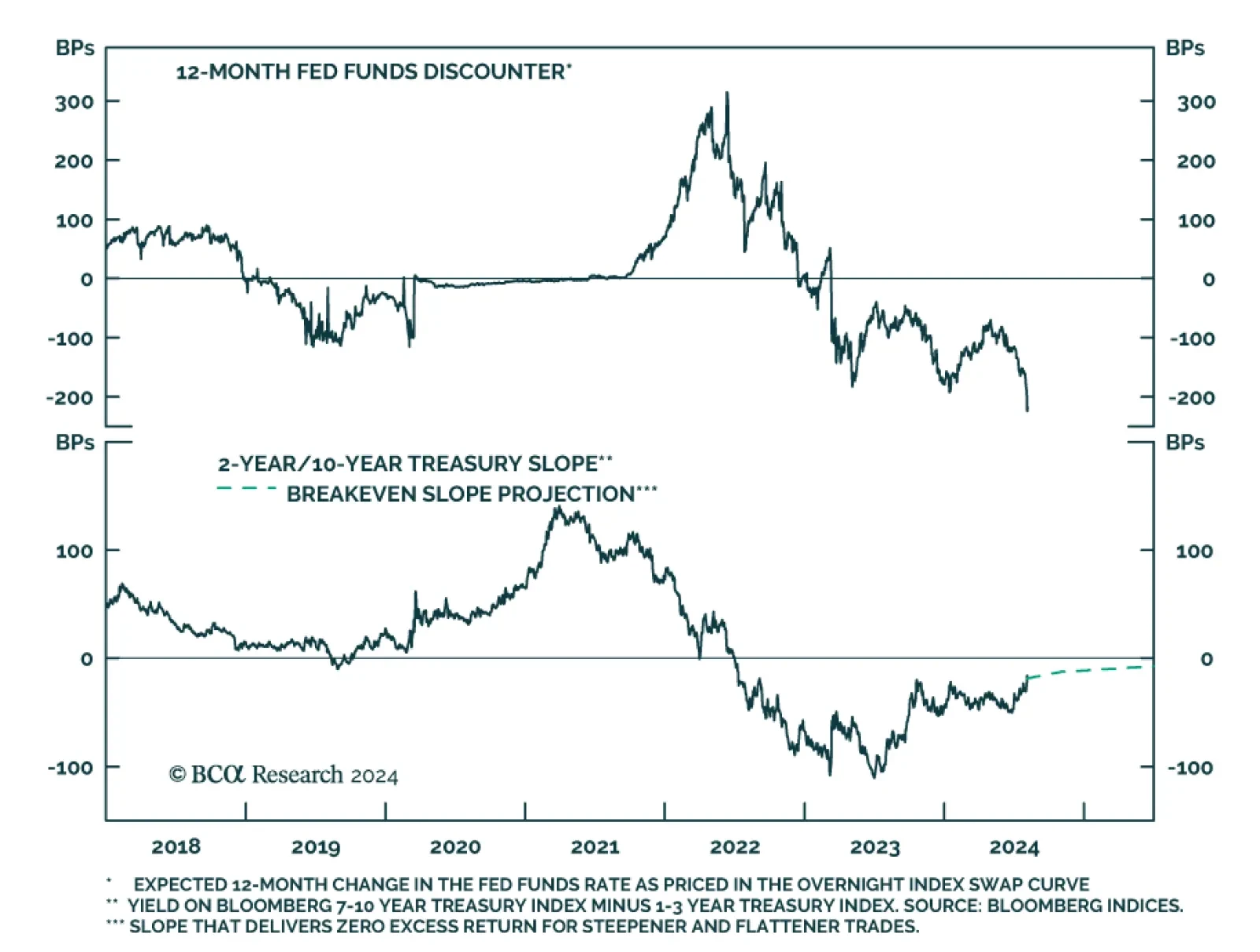

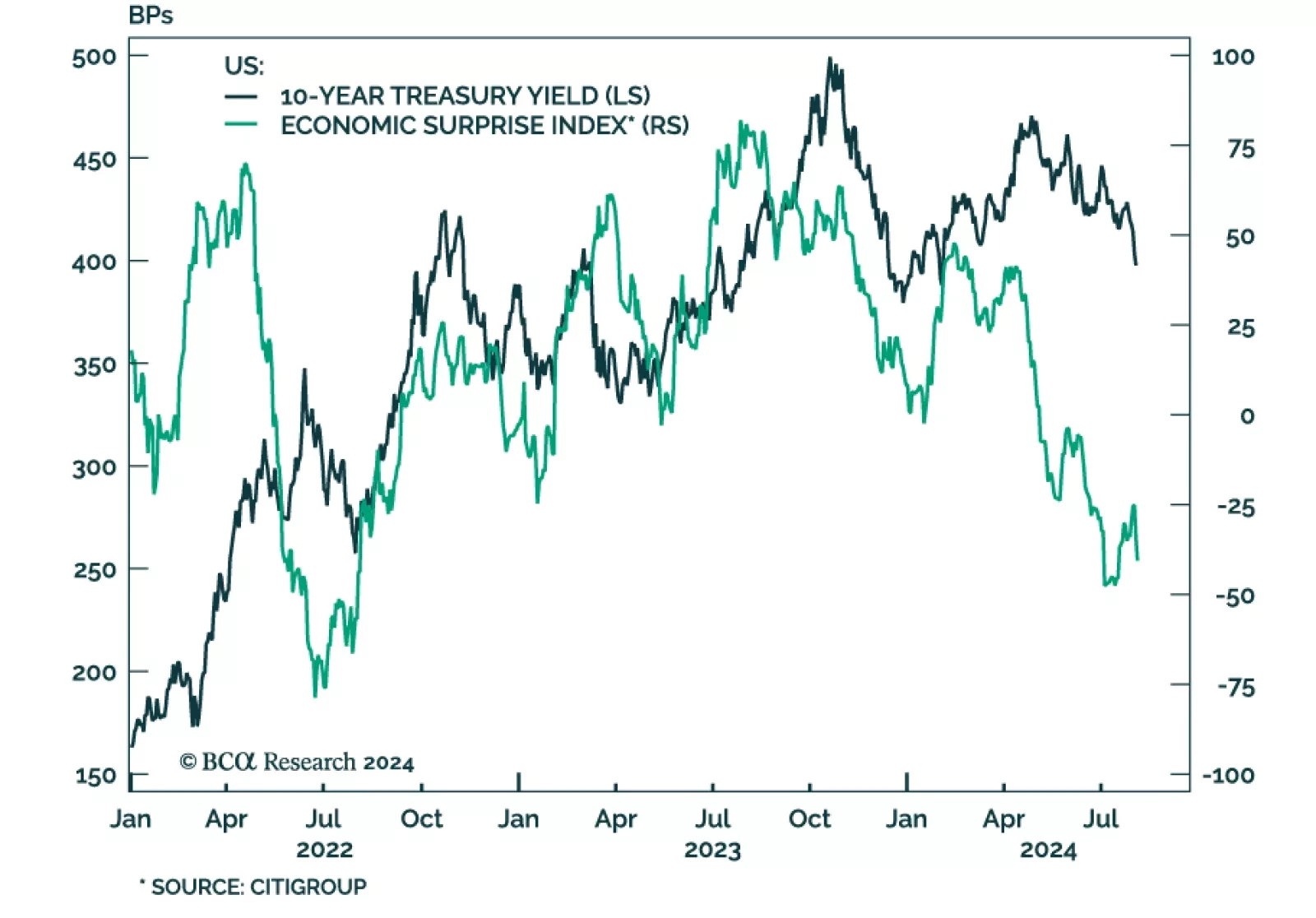

According to BCA Research’s US Bond Strategy service, Friday’s employment report caused financial markets to price-in some recession risk for the first time in months. The Treasury curve bull-steepened in July, a move…

The risk-off mood that dominated markets on Thursday, Friday and the early stages of Monday’s trading amid dismal payrolls, tech earnings and manufacturing PMIs seems to have dissipated for the time being. The positive…

Our Portfolio Allocation Summary for August 2024.

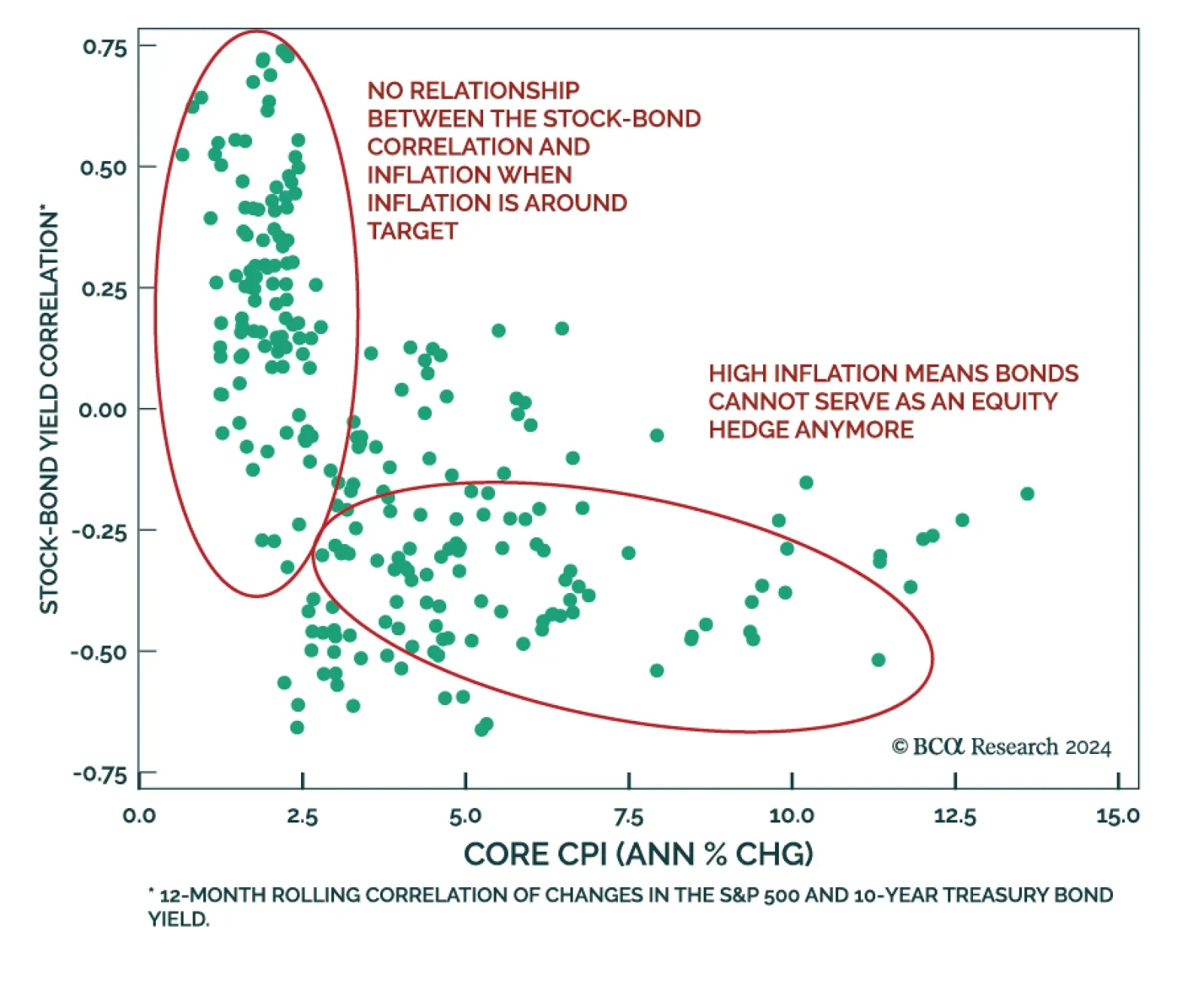

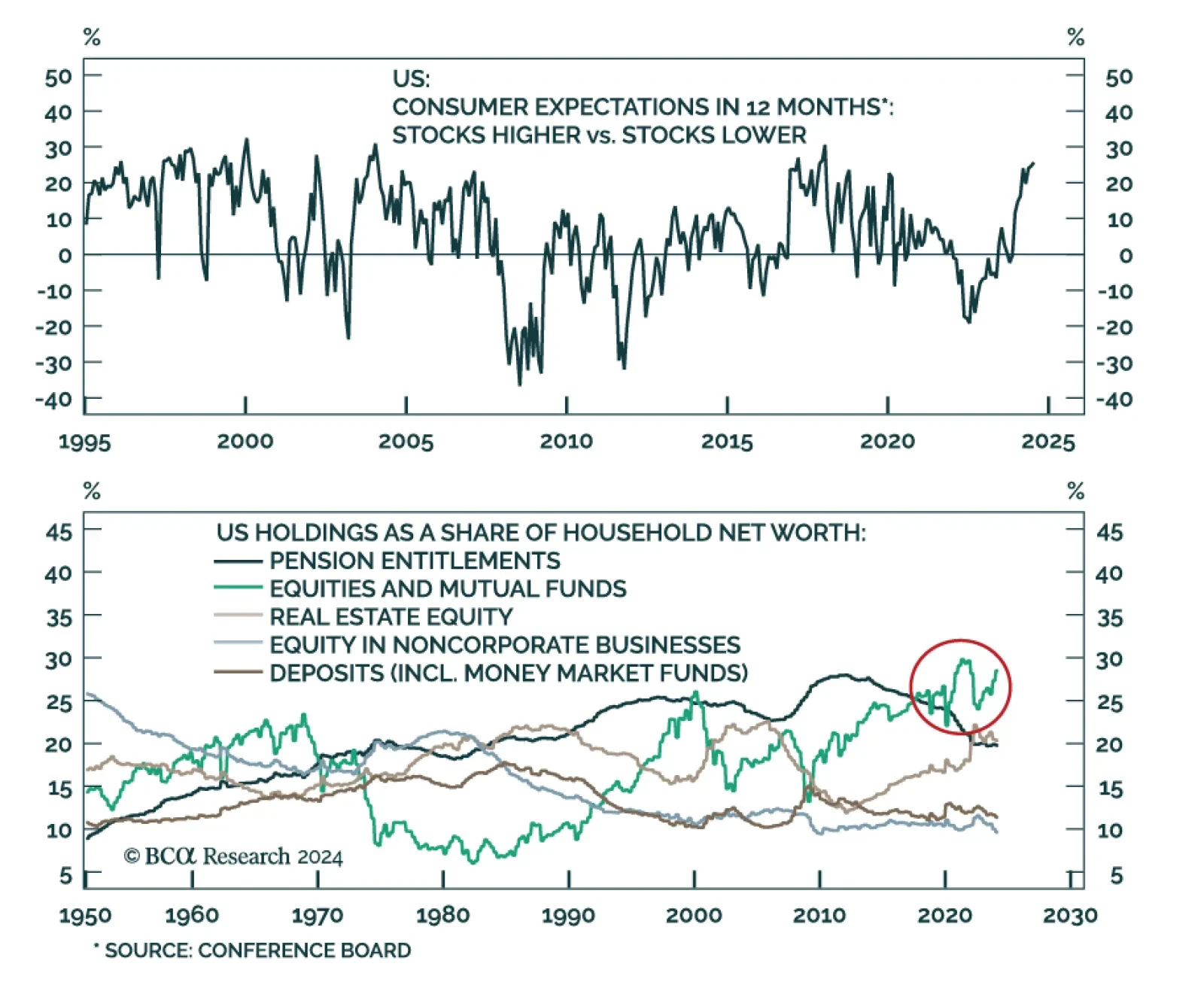

According to BCA Research’s Global Asset Allocation service, while the market action of the past few weeks is pointing to a return to a negative stock-bond correlation, more prints will be needed to confirm things are…

The latest Conference Board measure of consumer confidence suggested that consumers were increasingly downbeat about current economic conditions. Notably, their fading optimism about labor market conditions drove the jobs-…

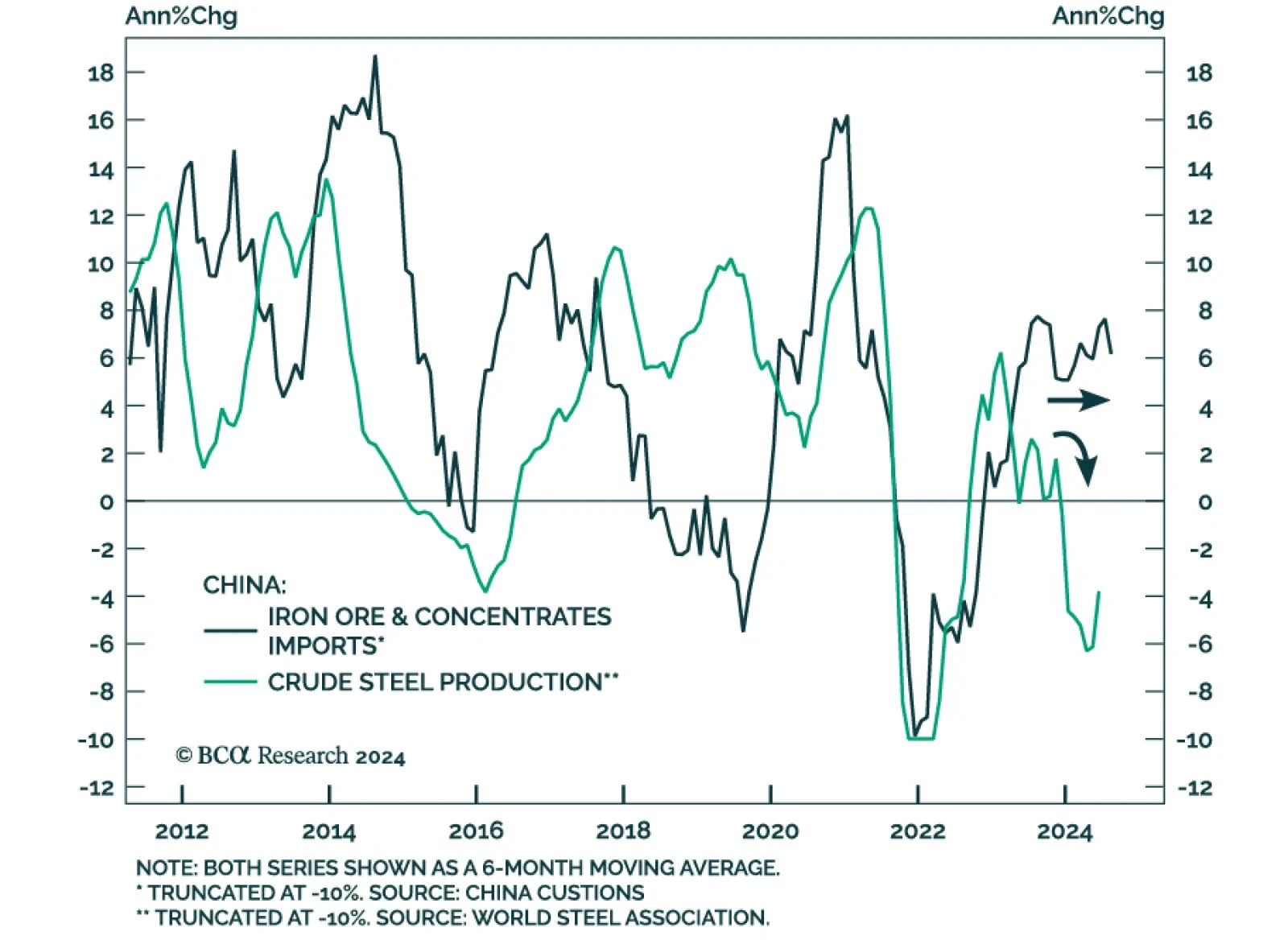

According to BCA Research’s Commodity & Energy Strategy service, robust iron ore imports are sending a false signal about steel demand. Instead, these supplies are being used to restock inventories. By the end of…

A decisive risk-off mood dominated markets at the end of last week, amid disappointing payrolls, tech earnings and manufacturing PMIs. The Nasdaq and other tech-heavy stock markets such as Japan, Korea and Taiwan led the equity…

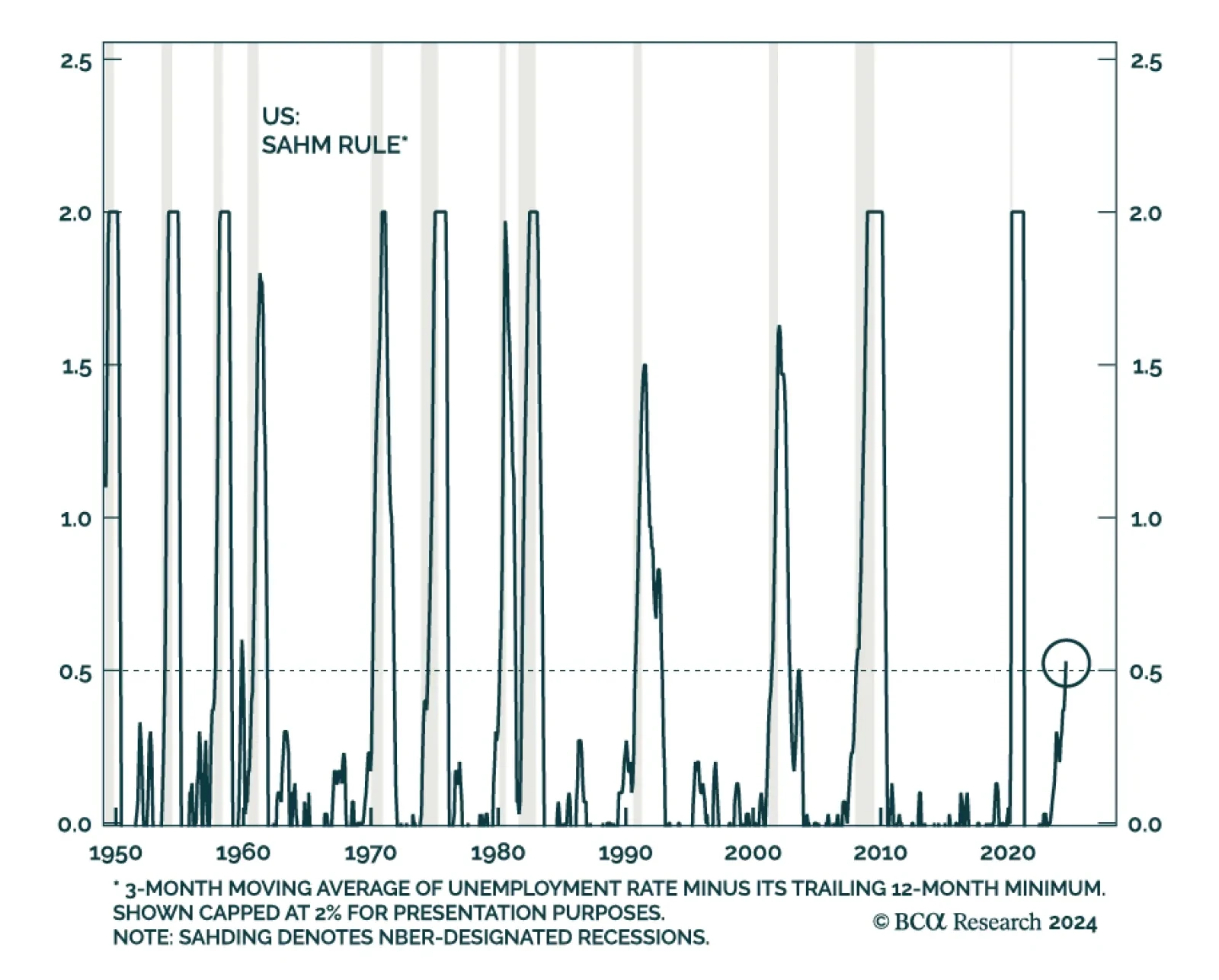

The Sahm Rule – a widely watched real-time recession indicator – signals the early stages of a recession when the 3-month moving average of the unemployment rate rises at least half a percentage point above its past…

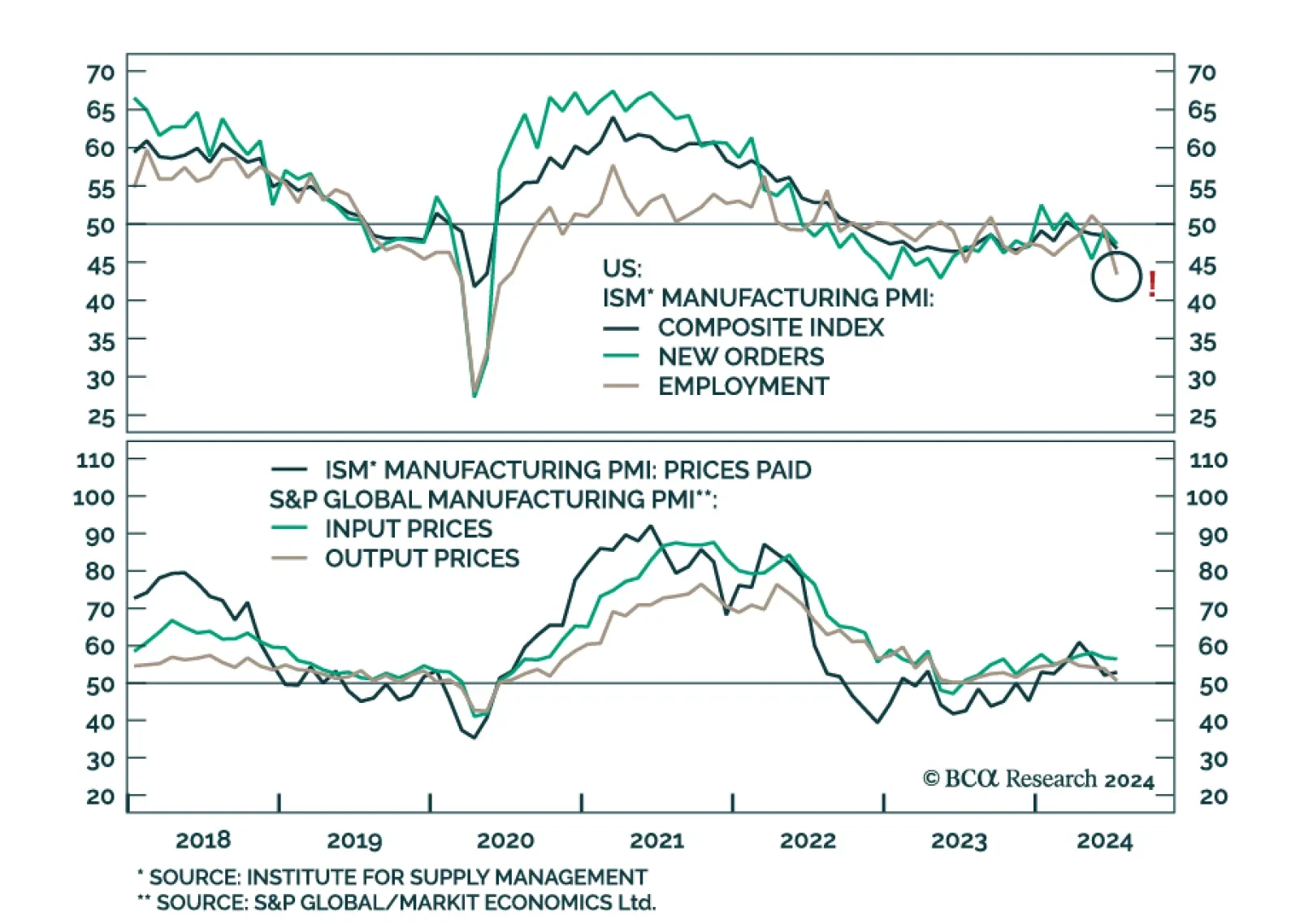

The ISM Manufacturing PMI disappointed in July. The headline index declined at a faster pace, from 48.5 to 46.8, disappointing expectations and extending a four-month contraction streak. Details were uninspiring. New orders…

According to BCA Research’s Global Asset Allocation service, there are clear signs that growth is weakening. BCA’s Global Nowcast has been slowing for three months. Behind this slowdown is the fact that the US…