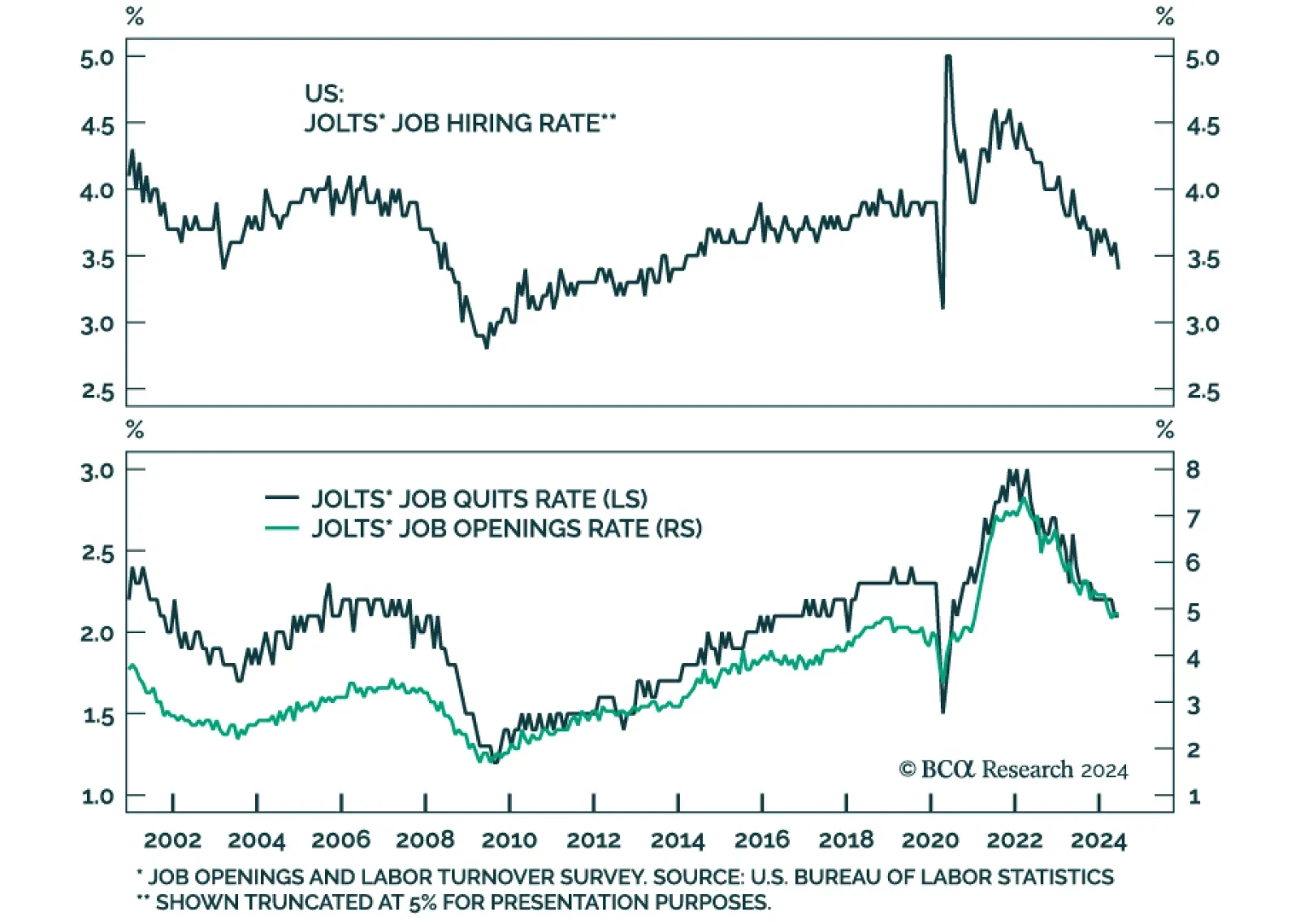

The US unemployment rate has clocked in below 4.5% for 33 consecutive months. However, this historically low rate camouflages nascent cracks in the US labor market. Ahead of recessions, firms usually reduce the pace of hiring…

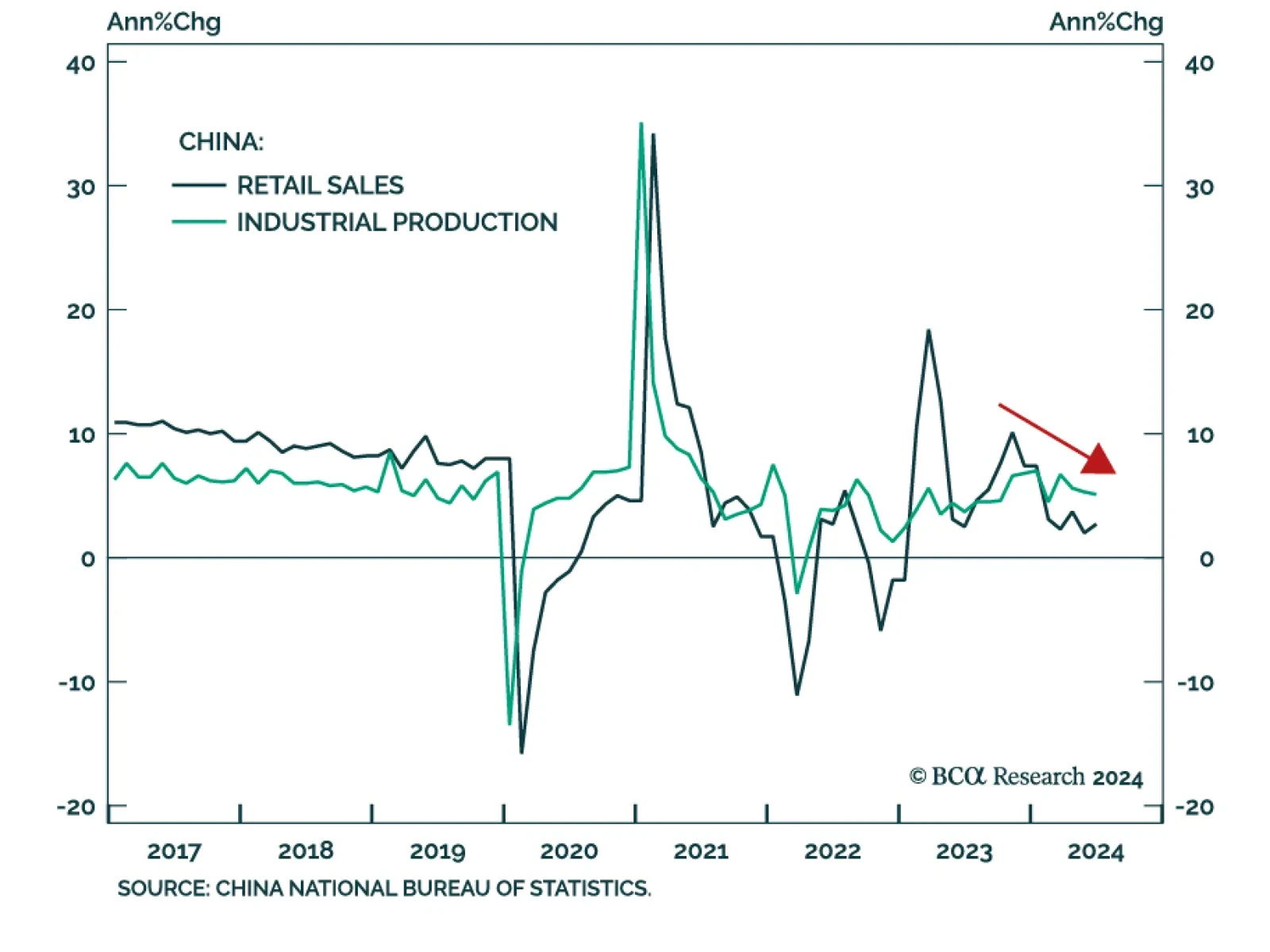

China’s economic malaise extended through the month of July. The contraction in property investment worsened (-10.2% YTD y/y) and disappointed expectations of a slower pace of decline. Residential property sales remained…

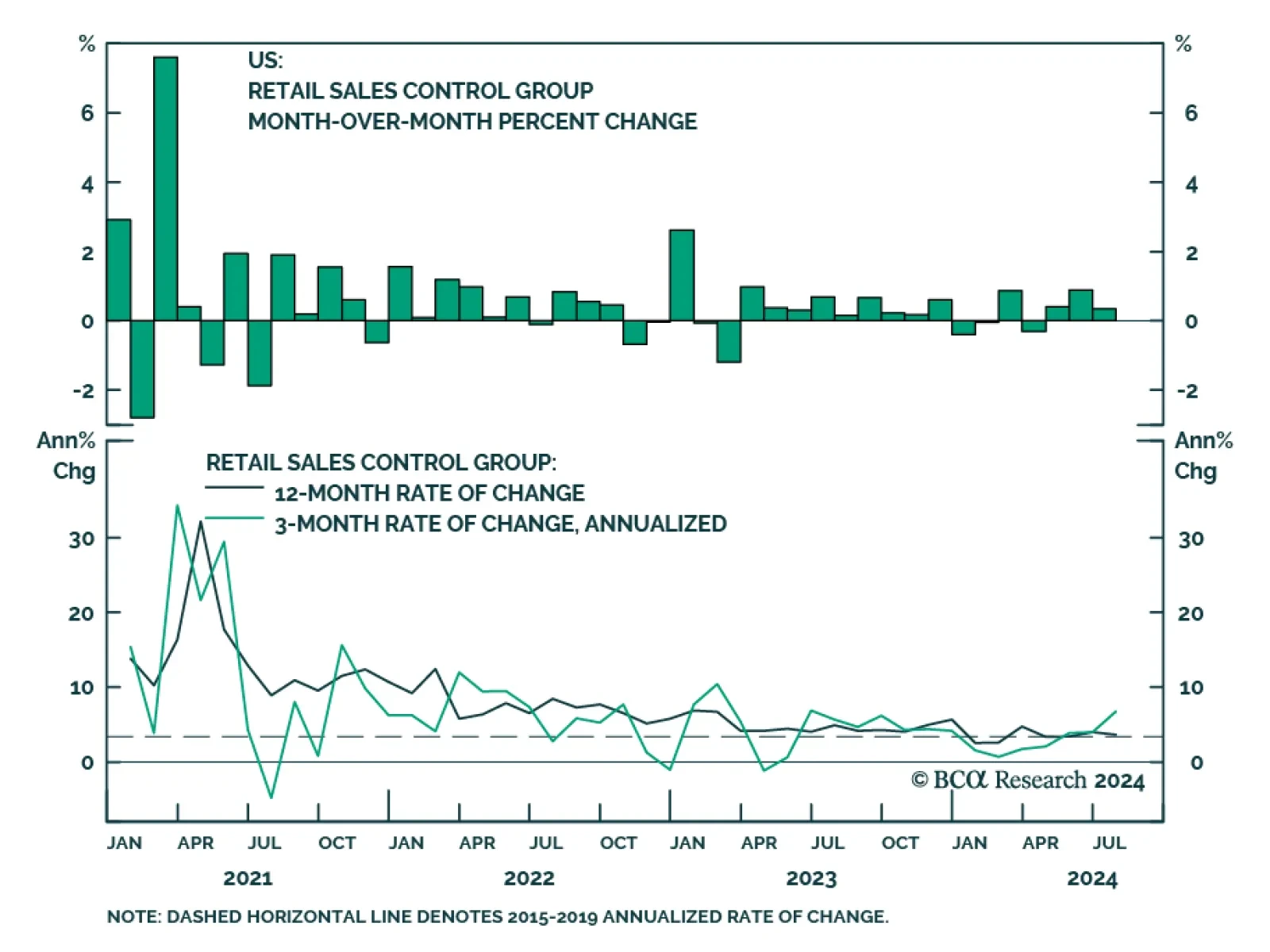

Preliminary estimates suggest that US retail sales surprised to the upside in July. They grew by 1.0% m/m from a 0.2% monthly contraction in June, exceeding expectations of a slower 0.4% pace of growth. Sales of vehicles and…

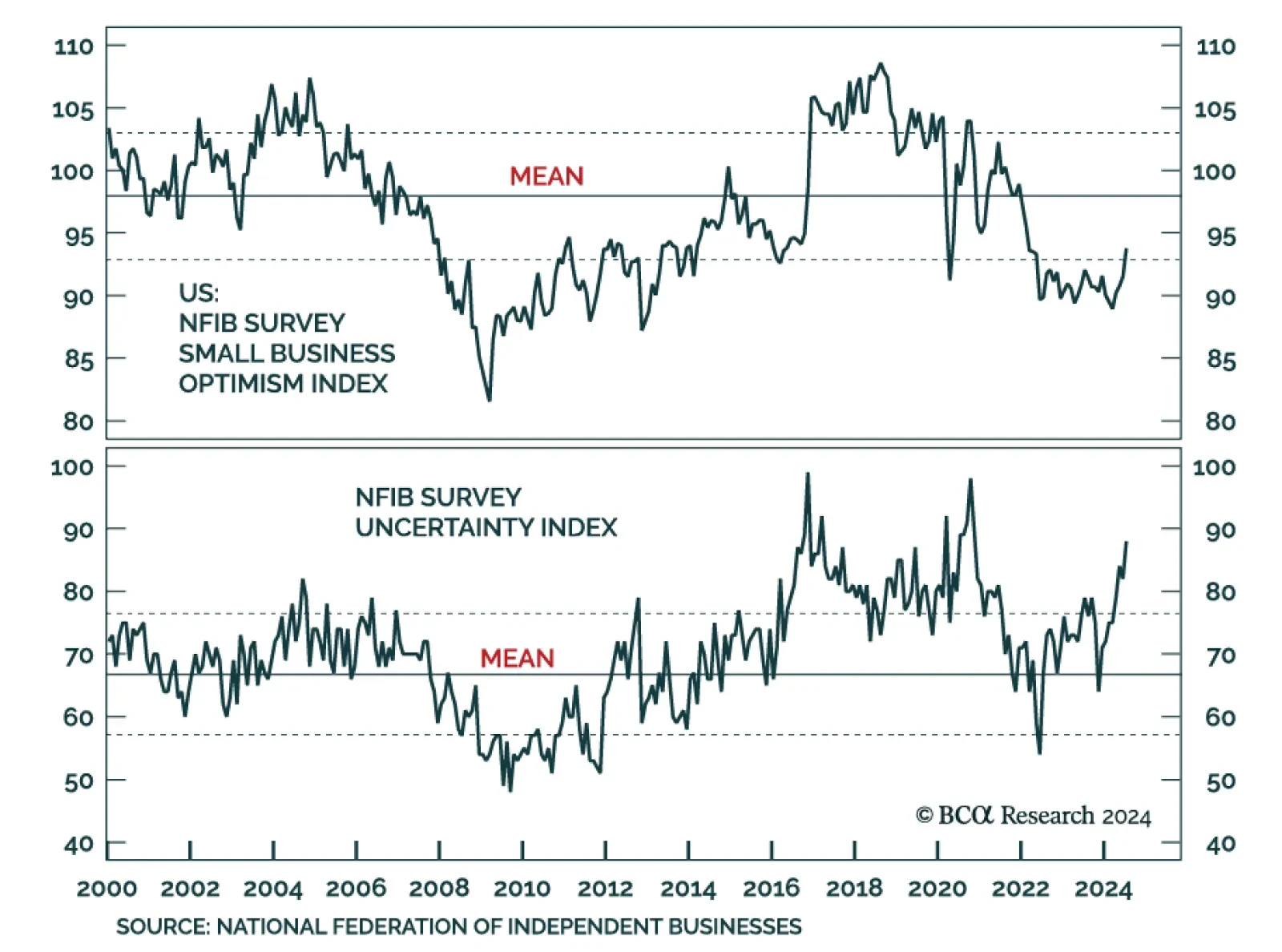

Tuesday morning’s NFIB Small Business Survey release surprised to the upside. The Small Business Optimism Index increased to 93.7 from 91.5, above expectations of remaining flat. The July reading was the highest since…

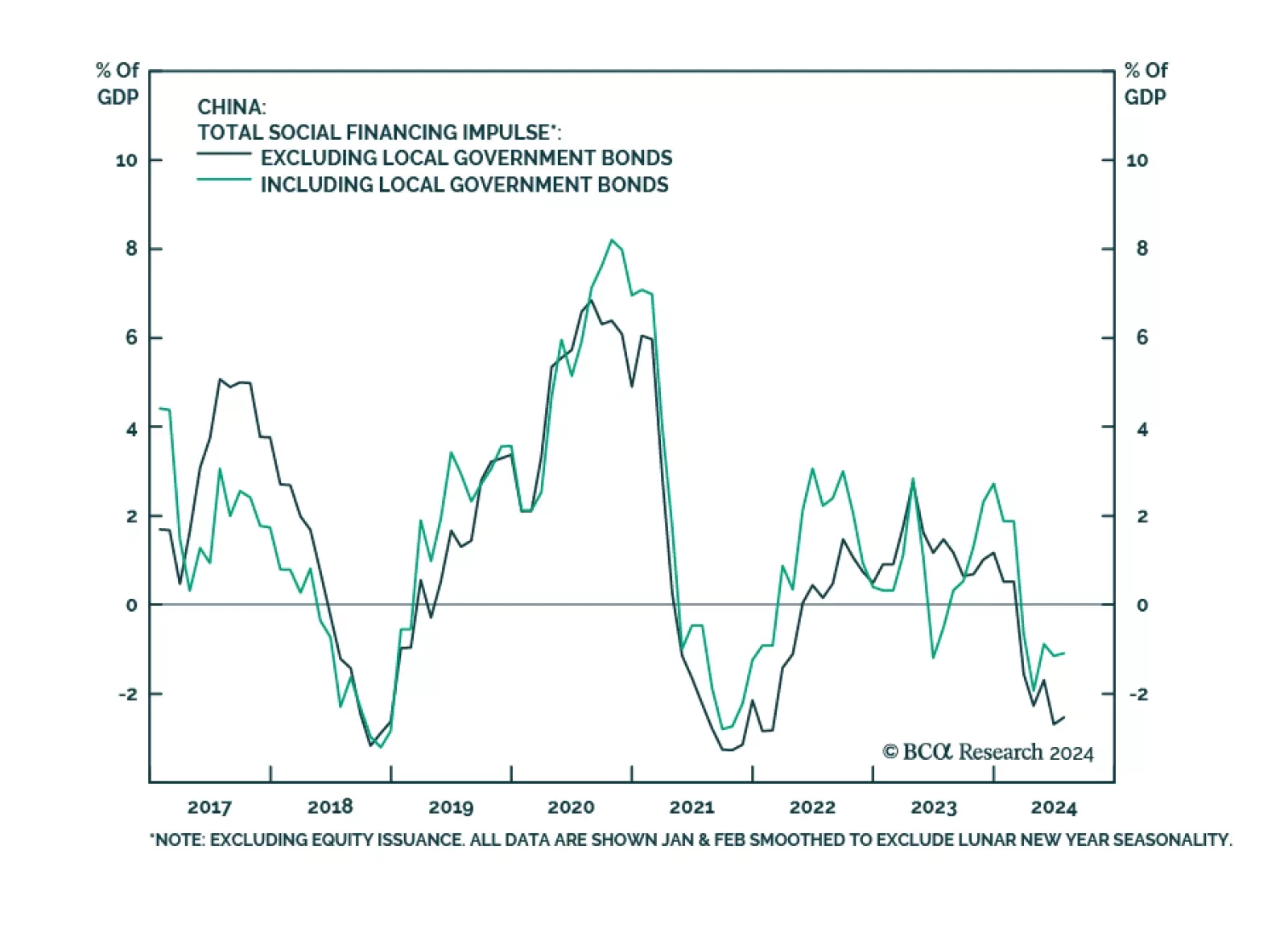

Subdued demand for credit among Chinese private-sector businesses and households persisted through July. Aggregate financing missed expectations, growing CNY 0.8bn to CNY 18.9bn in July on a YTD basis. New loans grew CNY 0.2bn…

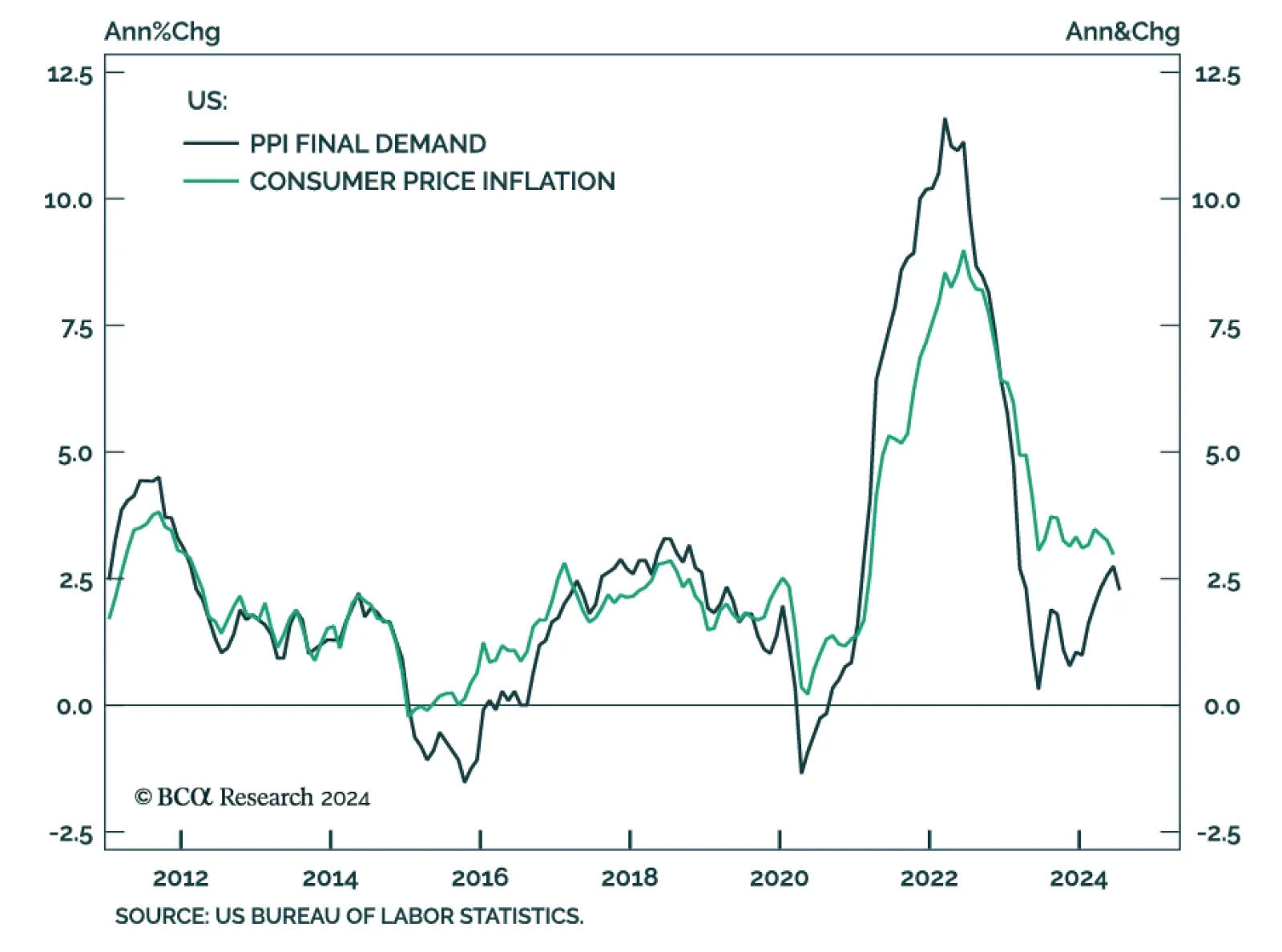

US producer prices rose by a softer-than-expected 0.1% m/m in July, from 0.2% in June. The core measure remained unchanged, the tamest reading in four months. Notably, the index for final demand services fell 0.2% m/m. Our US…

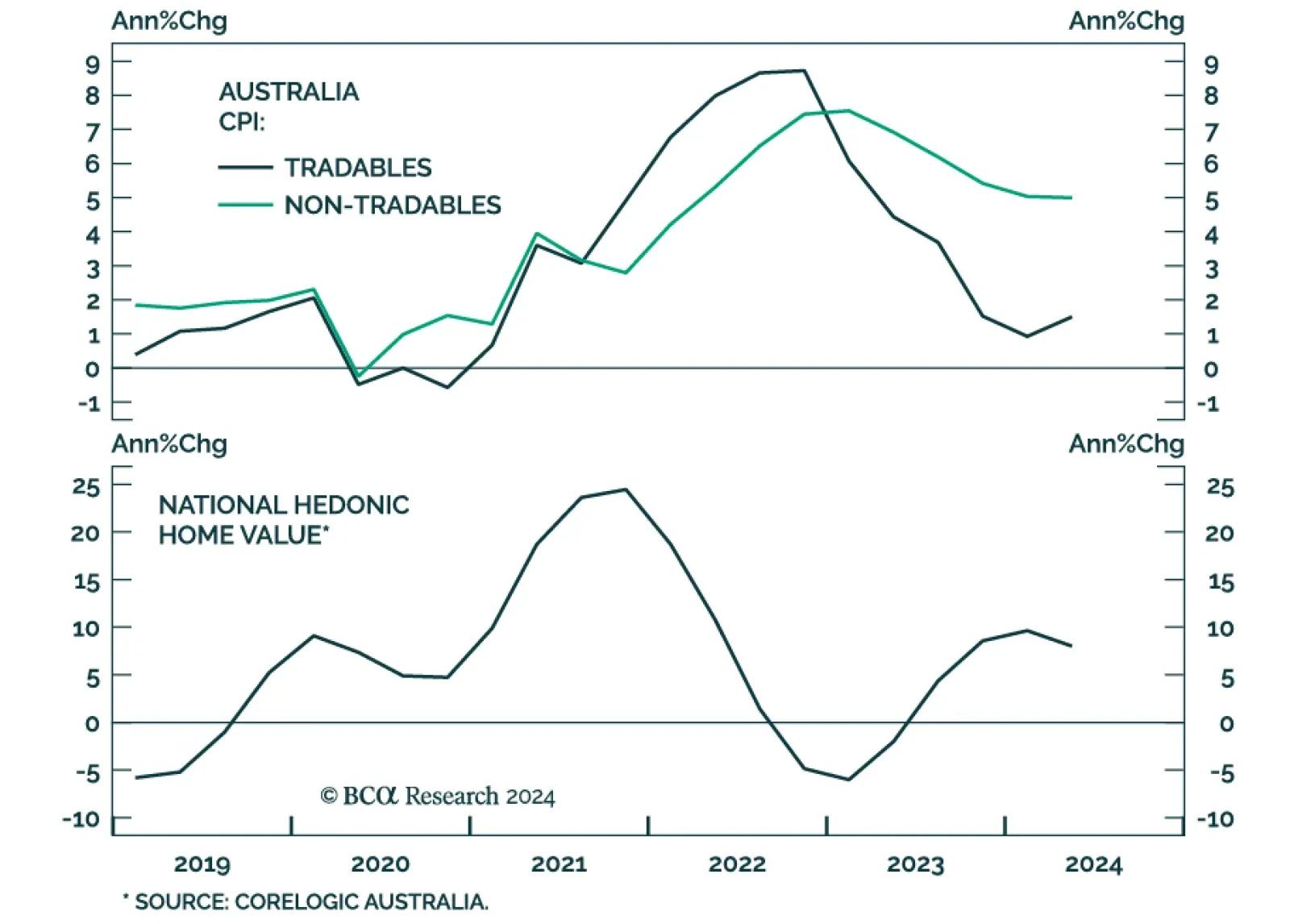

The RBA kept its cash rate unchanged at 4.35% in August, in line with expectations. However, it lifted its trimmed-mean inflation forecast to 3.5% y/y in Q4 2024 and to 2.9% by Q4 2025 (up from 3.4% and 2.8% in its May forecast,…

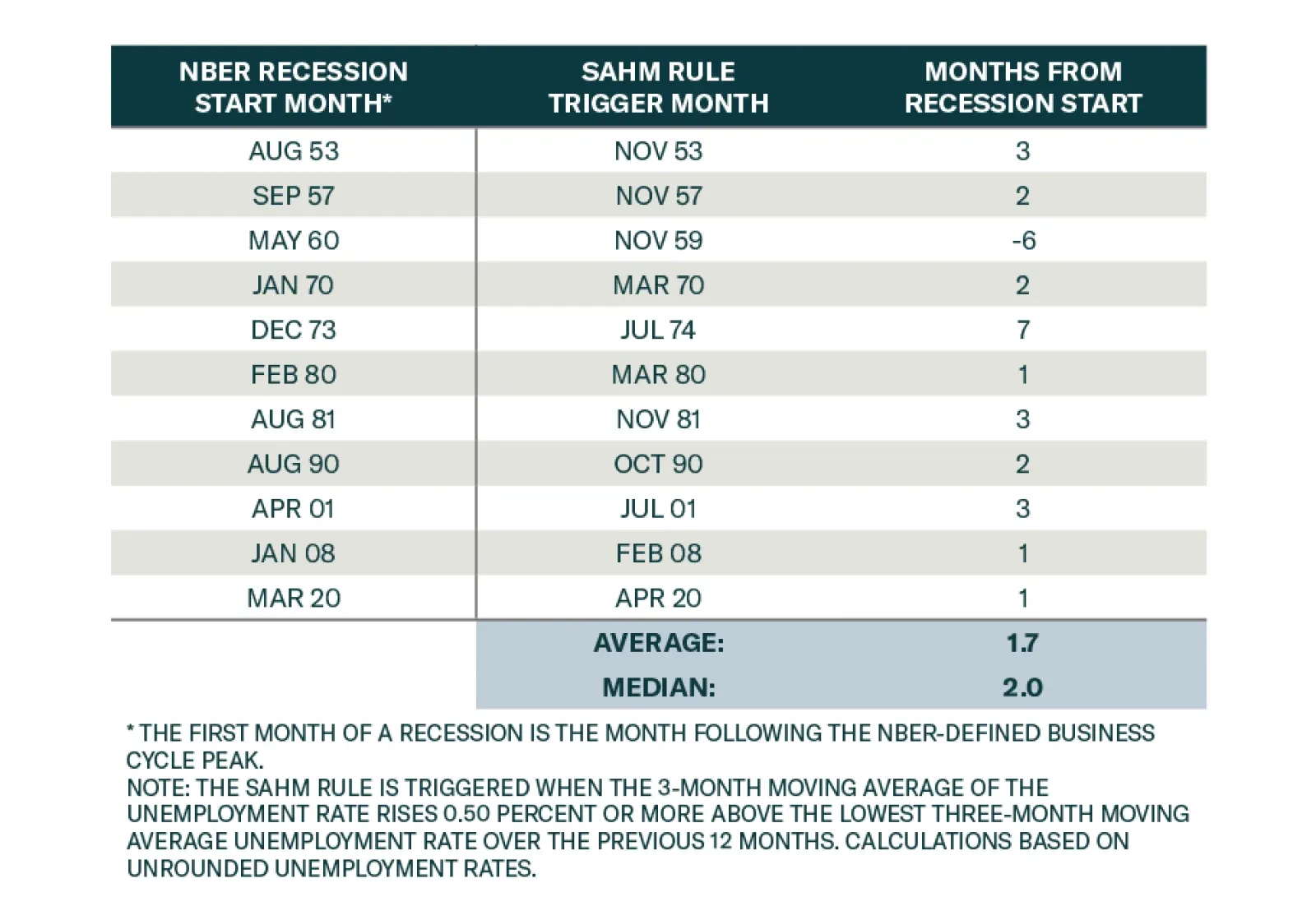

Market and economic observers have devoted a lot of attention to the Sahm Rule following July’s employment report, and whether or not it has been triggered. BCA’s analysis has highlighted that the overall direction of…

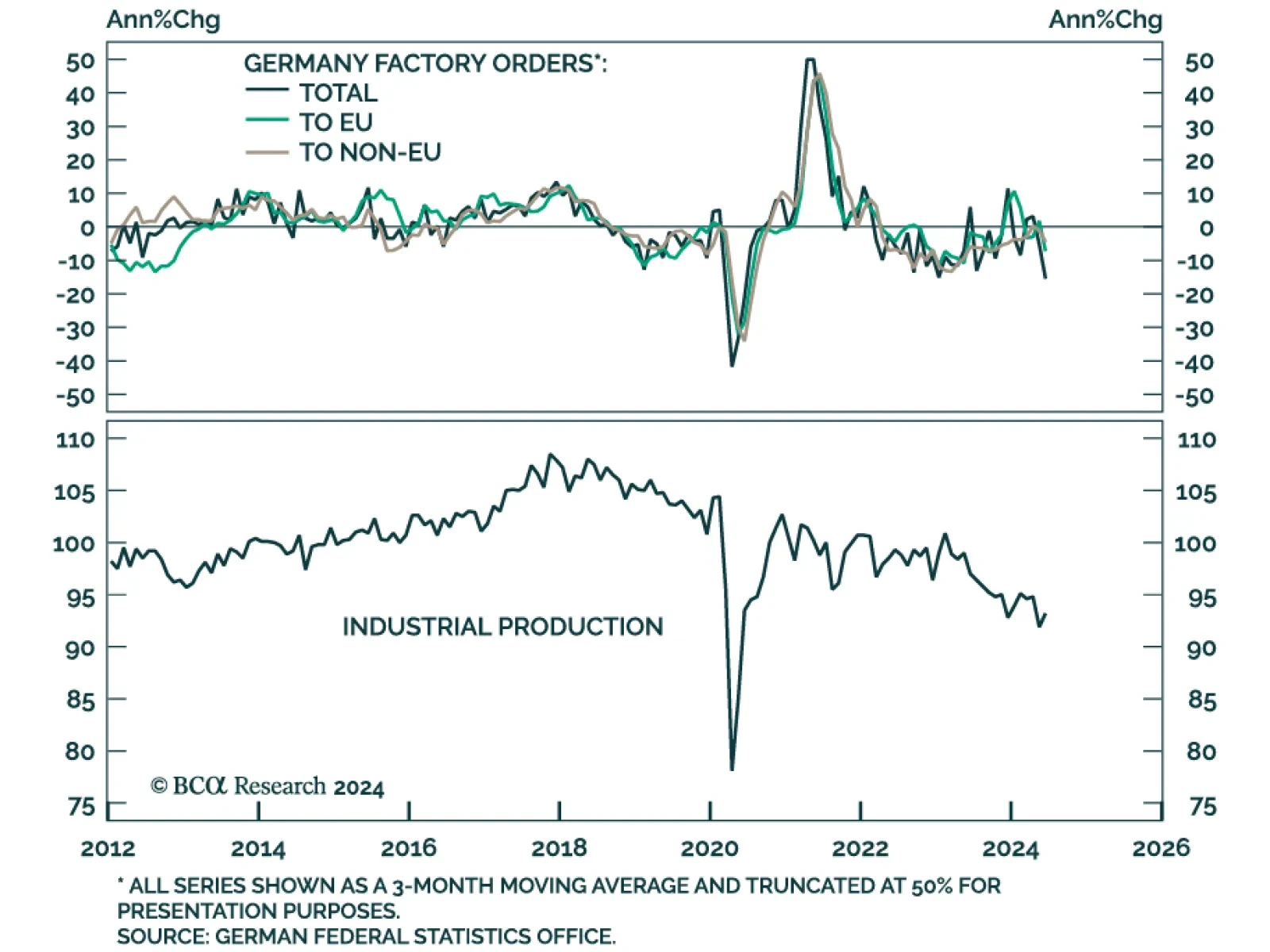

German Industrial production and factory orders continued their slump in June. The usual powerhouse of the Euro Area economy has been trailing its peers throughout 2024. While both industrial production and factory orders…

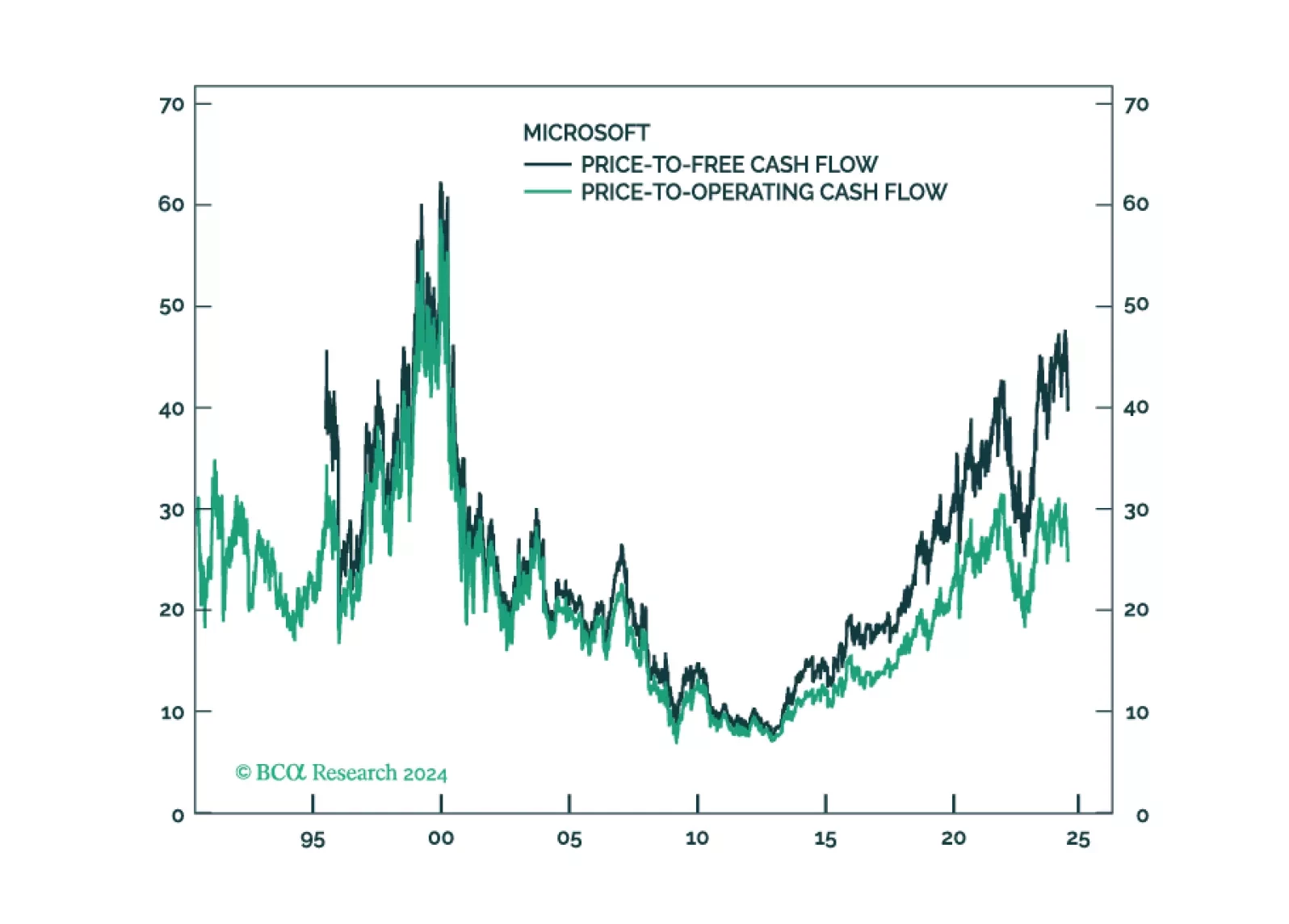

Over the past few weeks, global equities have been hit by rising scepticism over the bullish AI narrative and increasing concerns over global growth. Stocks should stabilize in the near term, but the medium-term direction is to the…