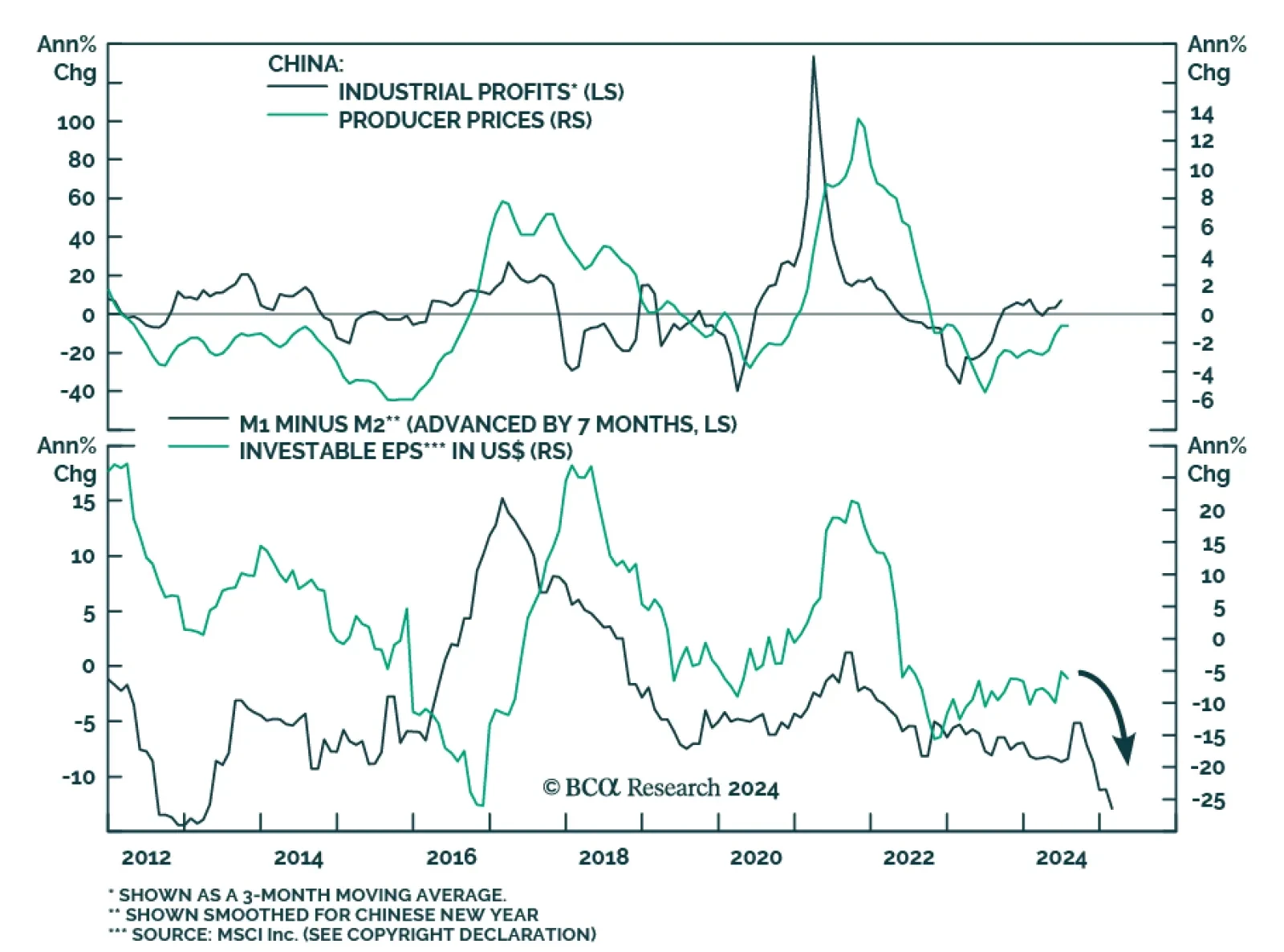

Chinese industrial profits rose by 4.1% y/y (3.6% YTD y/y) in July, from 3.6% (3.5%) in June. Upstream mining industries’ profits contracted 9.5% from January to July 2024, whereas downstream manufacturing sectors’…

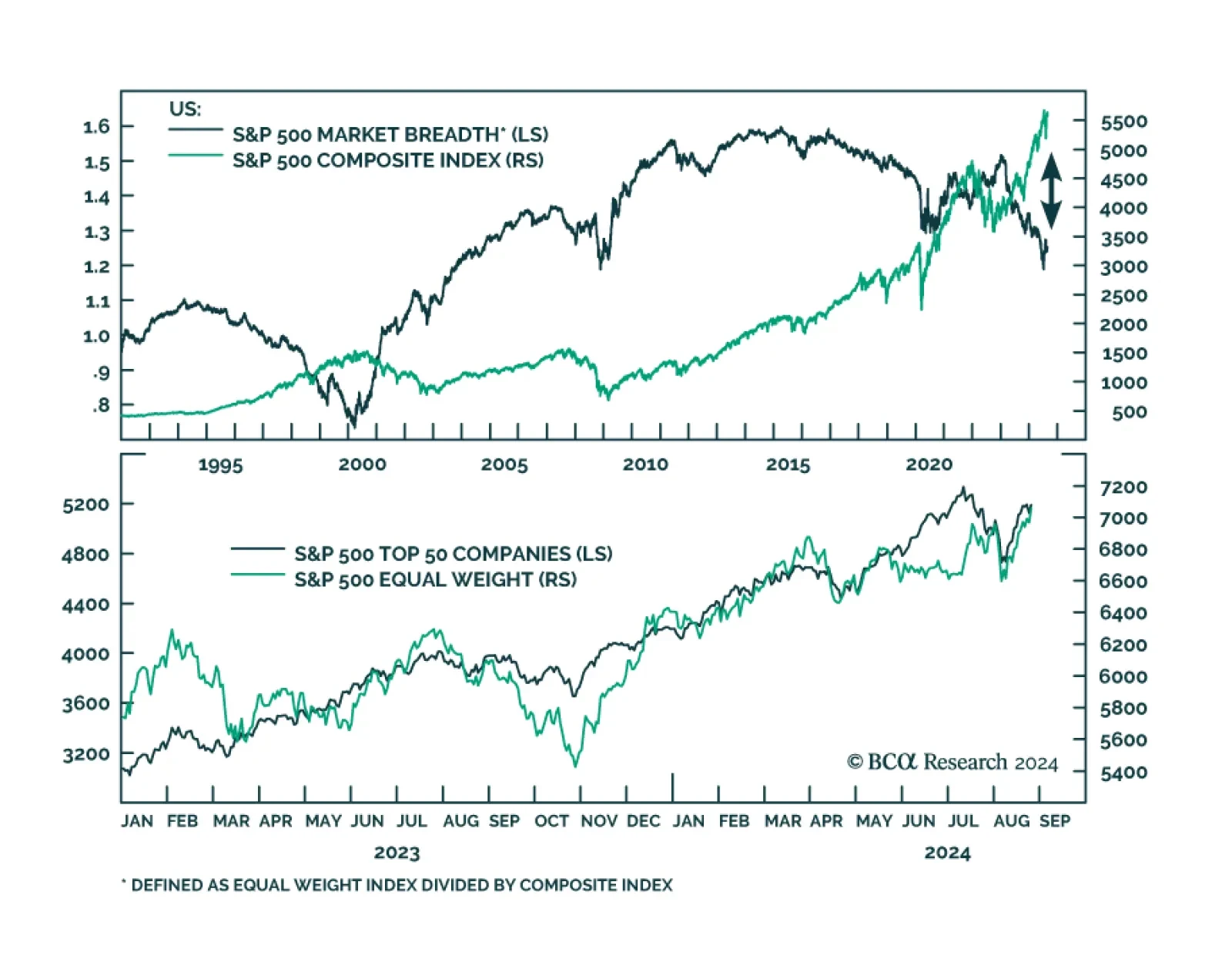

The equal-weighted S&P 500 index reached a new all-time high of 7,096.12 on Monday. Chair Powell’s comments at the Jackson Hole Symposium last week dispelled any remaining doubt about a September rate cut and sent…

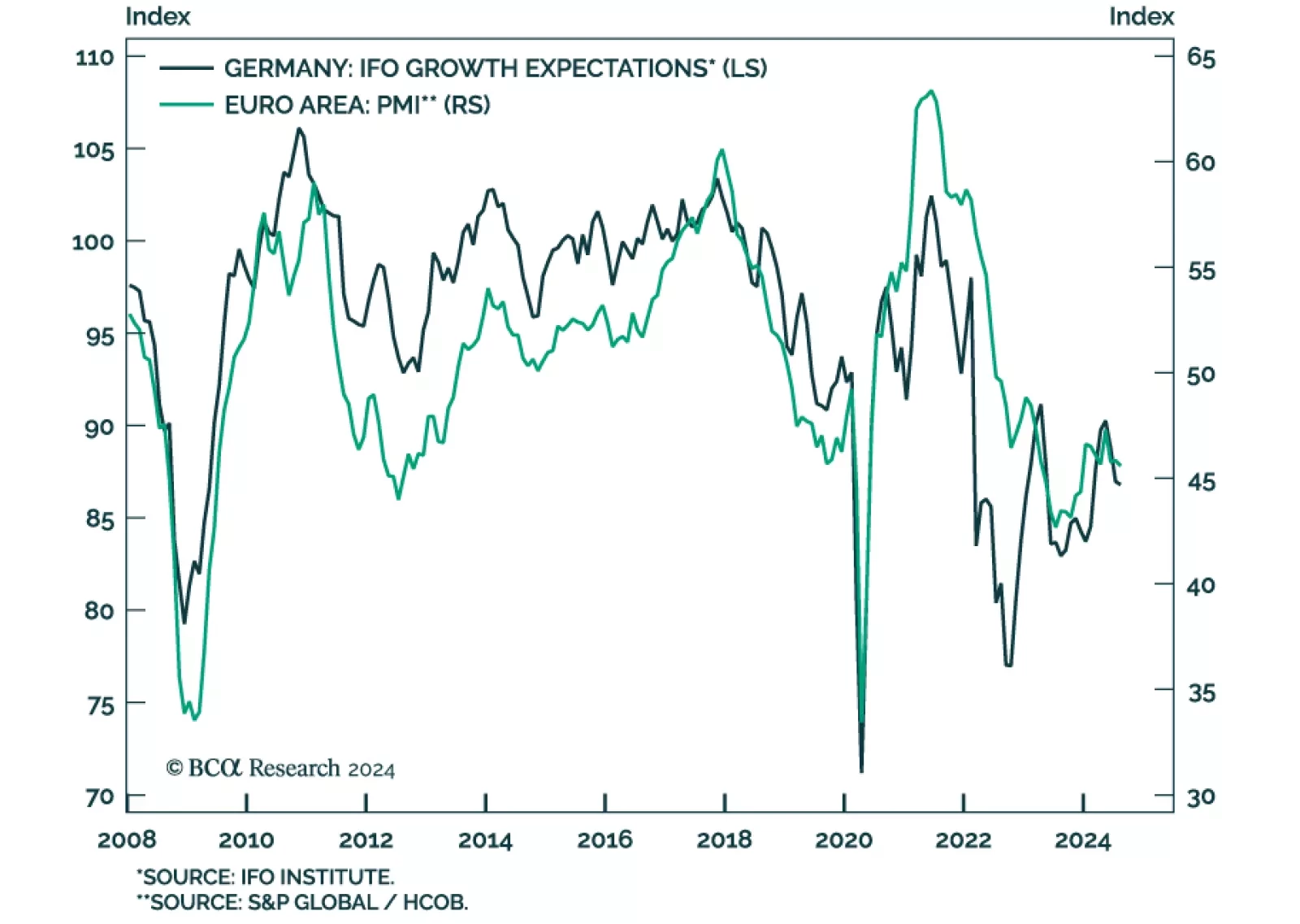

Sentiment among German companies declined in August from 87.0 to 86.6. Current conditions shed 0.6 points to 86.5 while the expectations component ticked 0.2 points lower. It nevertheless exceeded consensus expectations for a…

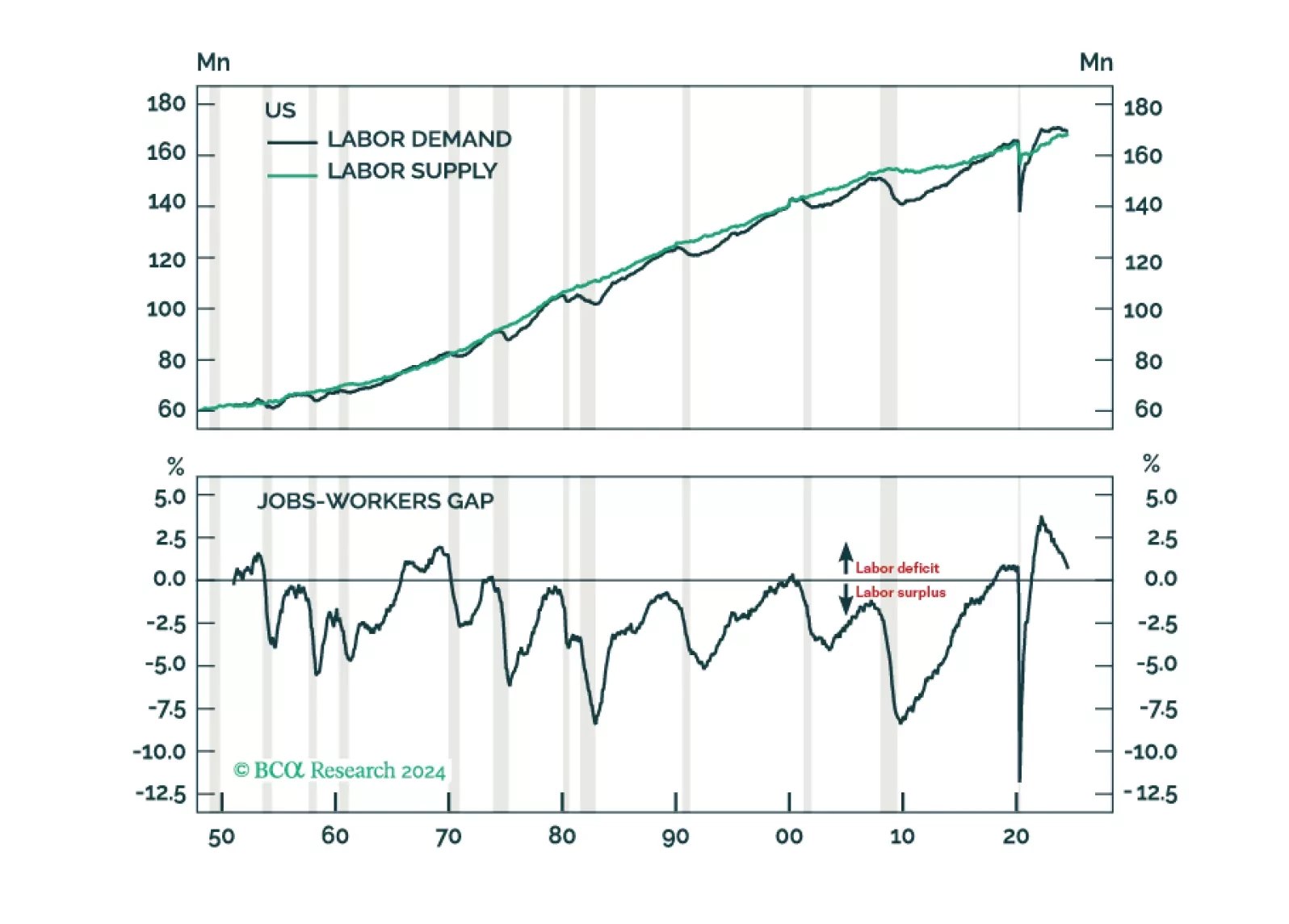

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

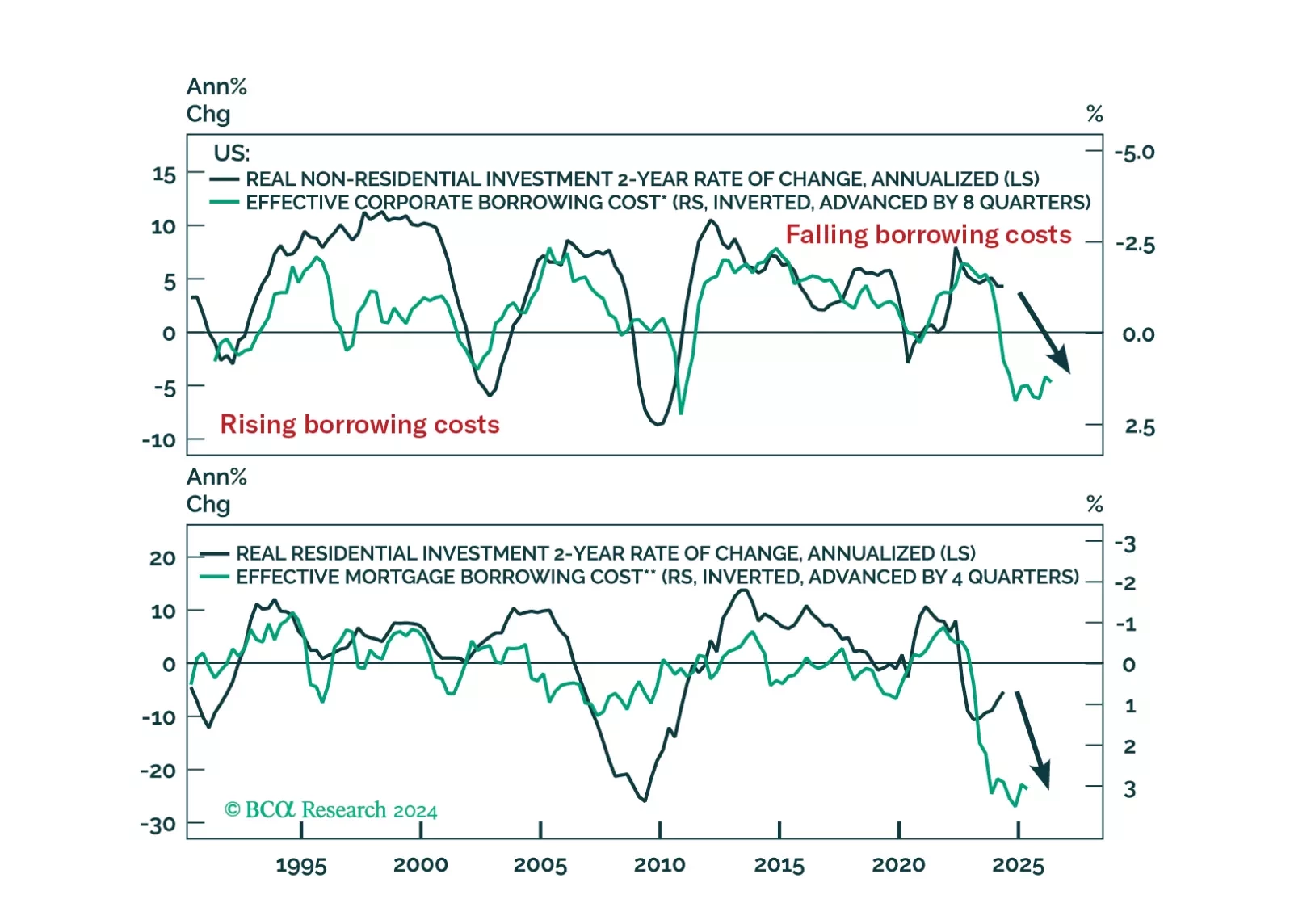

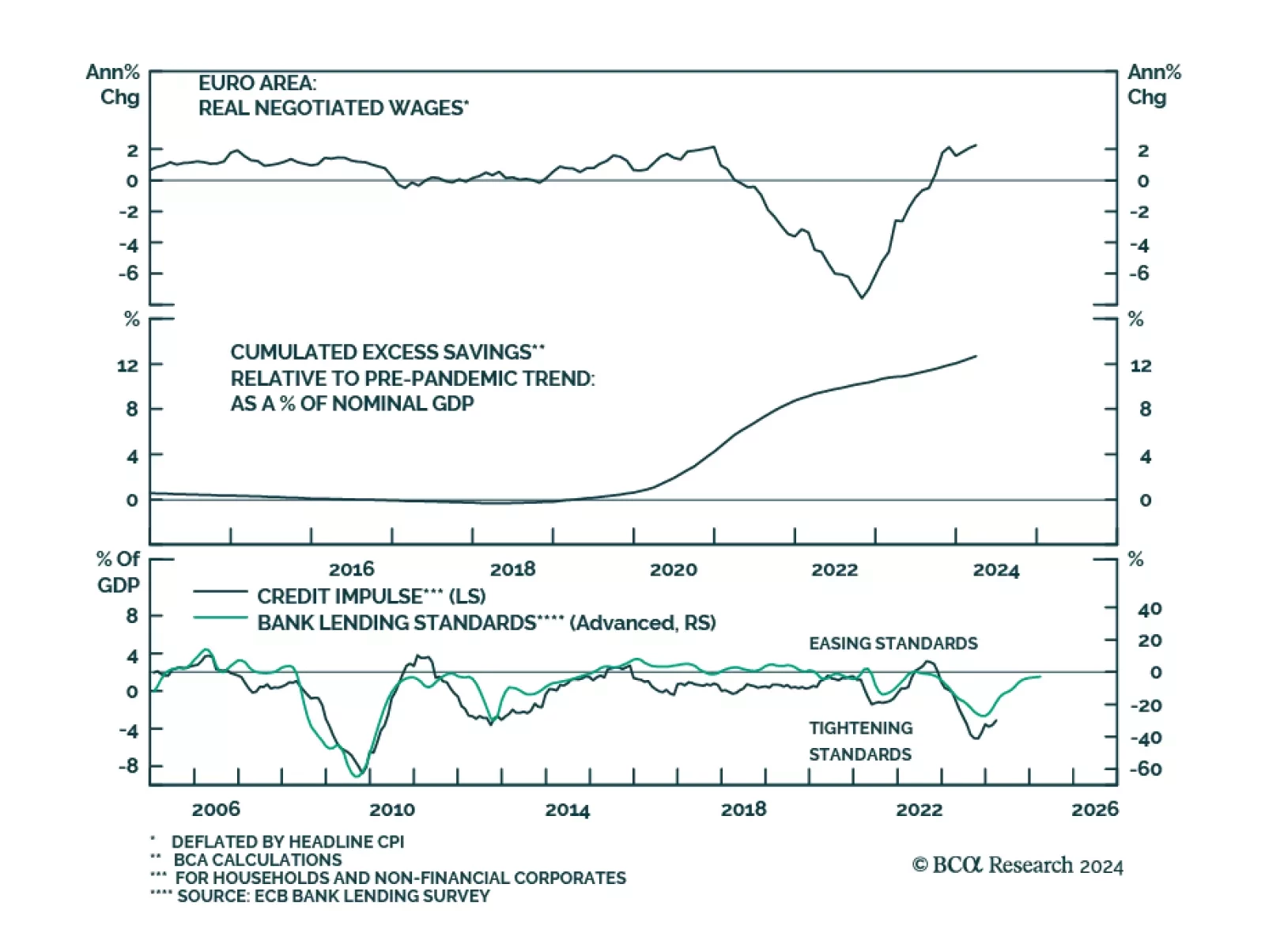

We’ve highlighted that continued deterioration in consumer fundamentals will tip the US economy into a recession. Slower compensation growth, tighter lending standards for consumer loans and dwindling excess savings will…

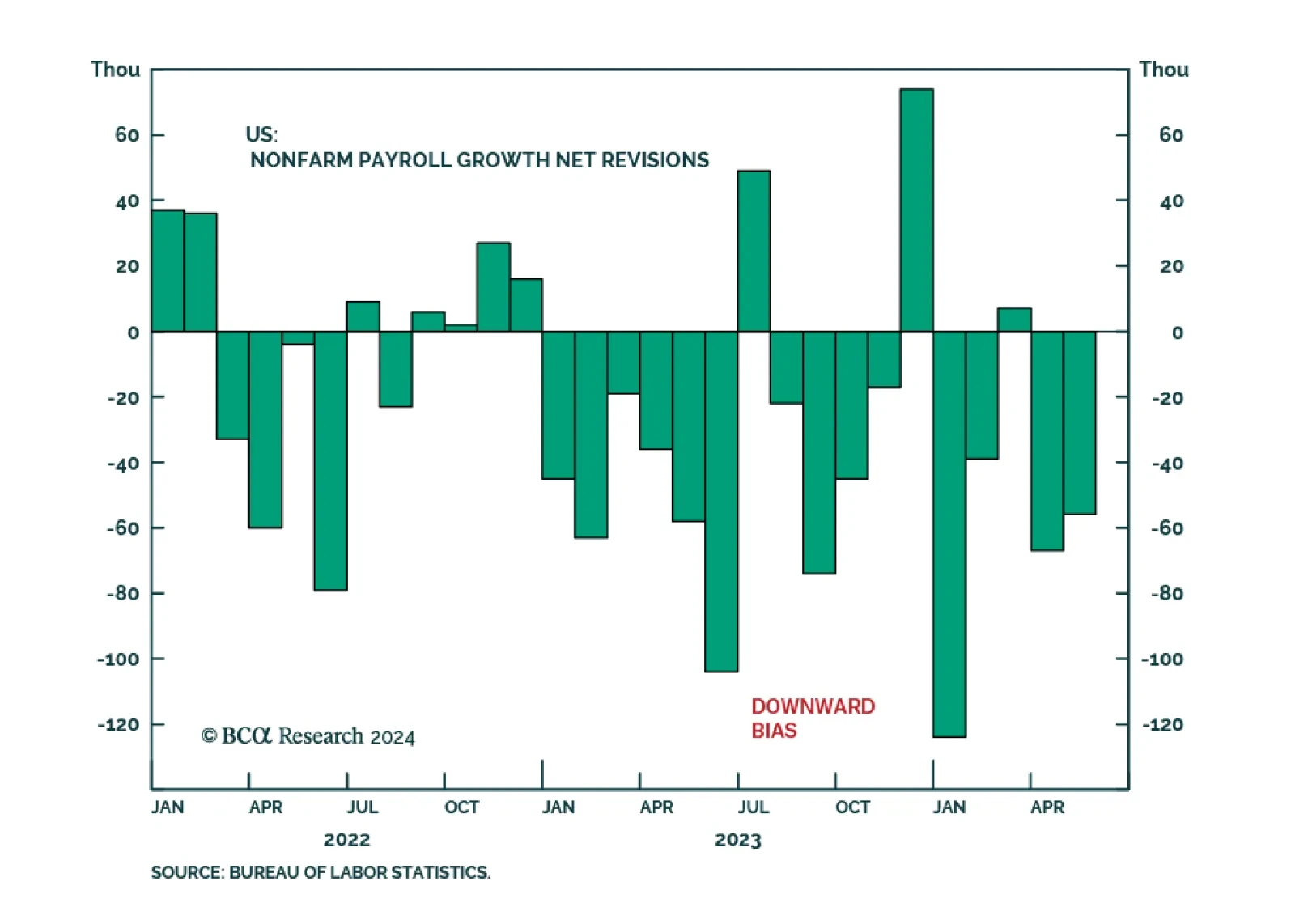

The Bureau of Labor Statistics (BLS) revised down the number of workers on payrolls by 818 thousand over the twelve months period ending March 2024. This largest downward revision since 2009 thus implies that the labor market has…

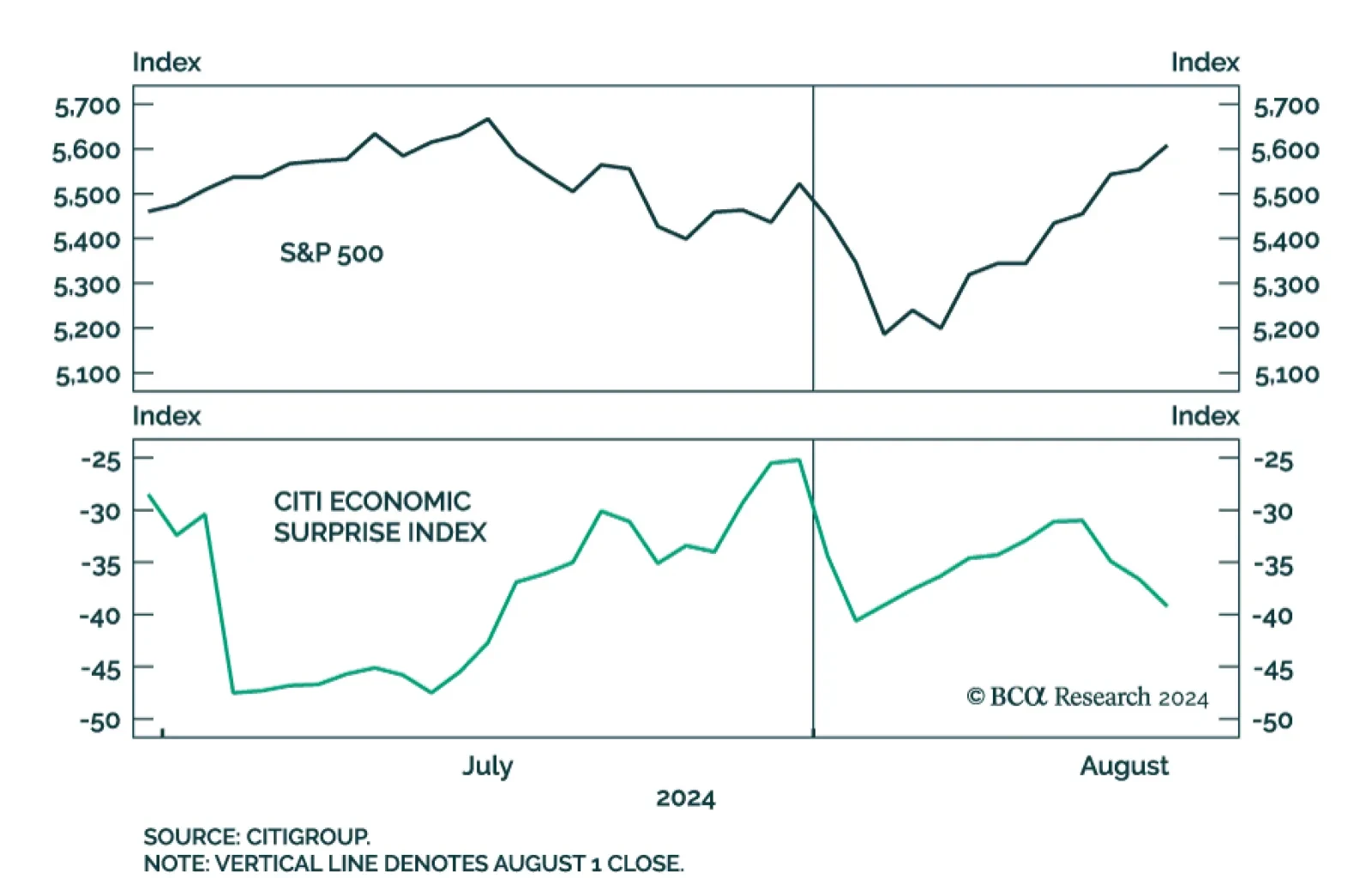

It didn't take long for markets to utterly shrug off the surprise rise in July's unemployment rate. On Tuesday, the S&P 500 closed higher than it was the day before the July Employment Situation report was released…

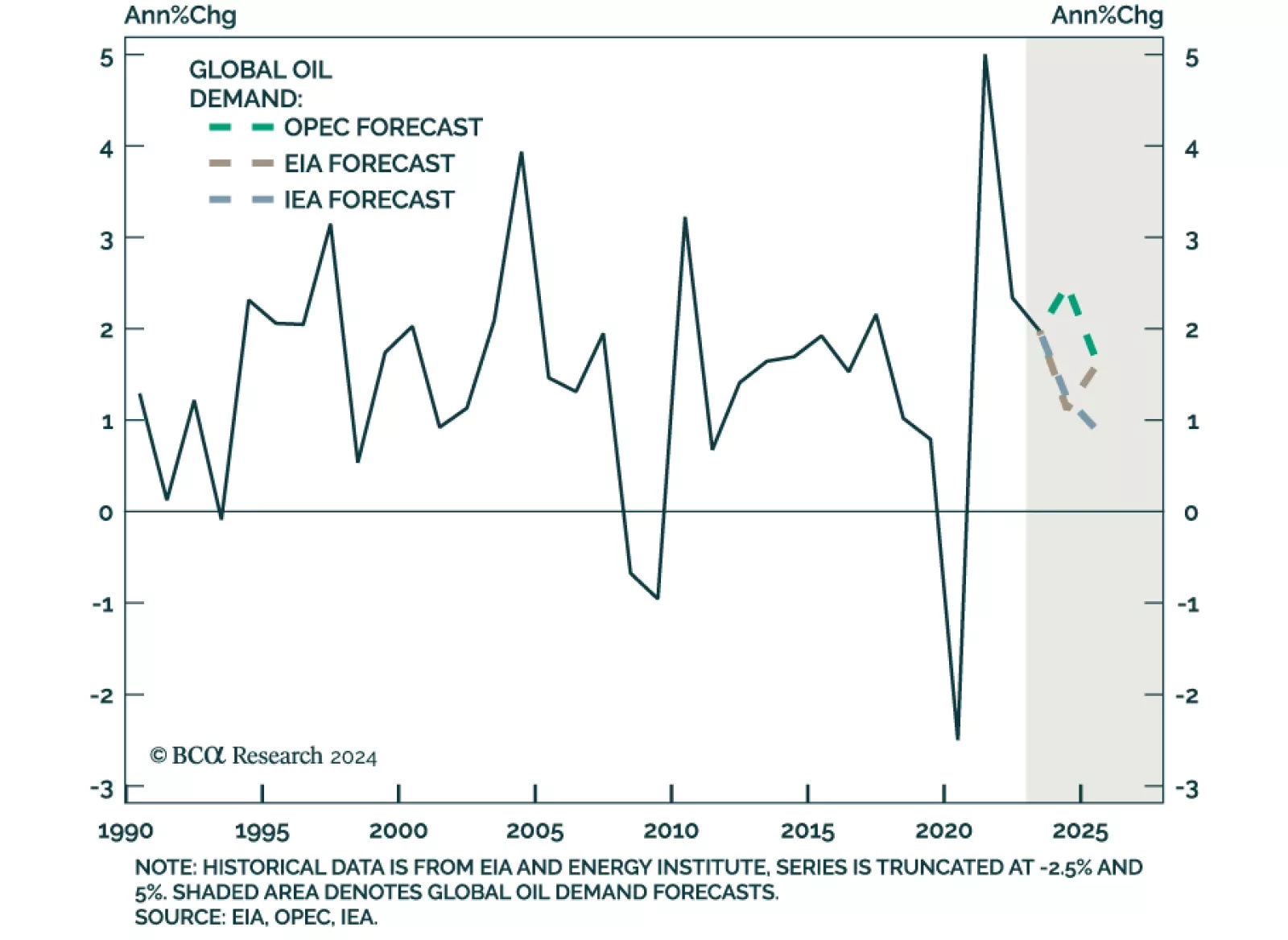

Back in May, our Commodity and Energy strategists argued that OPEC, EIA, and IEA oil demand forecasts were likely too optimistic. Indeed, while all three major oil price forecasters projected a moderation in demand this year,…

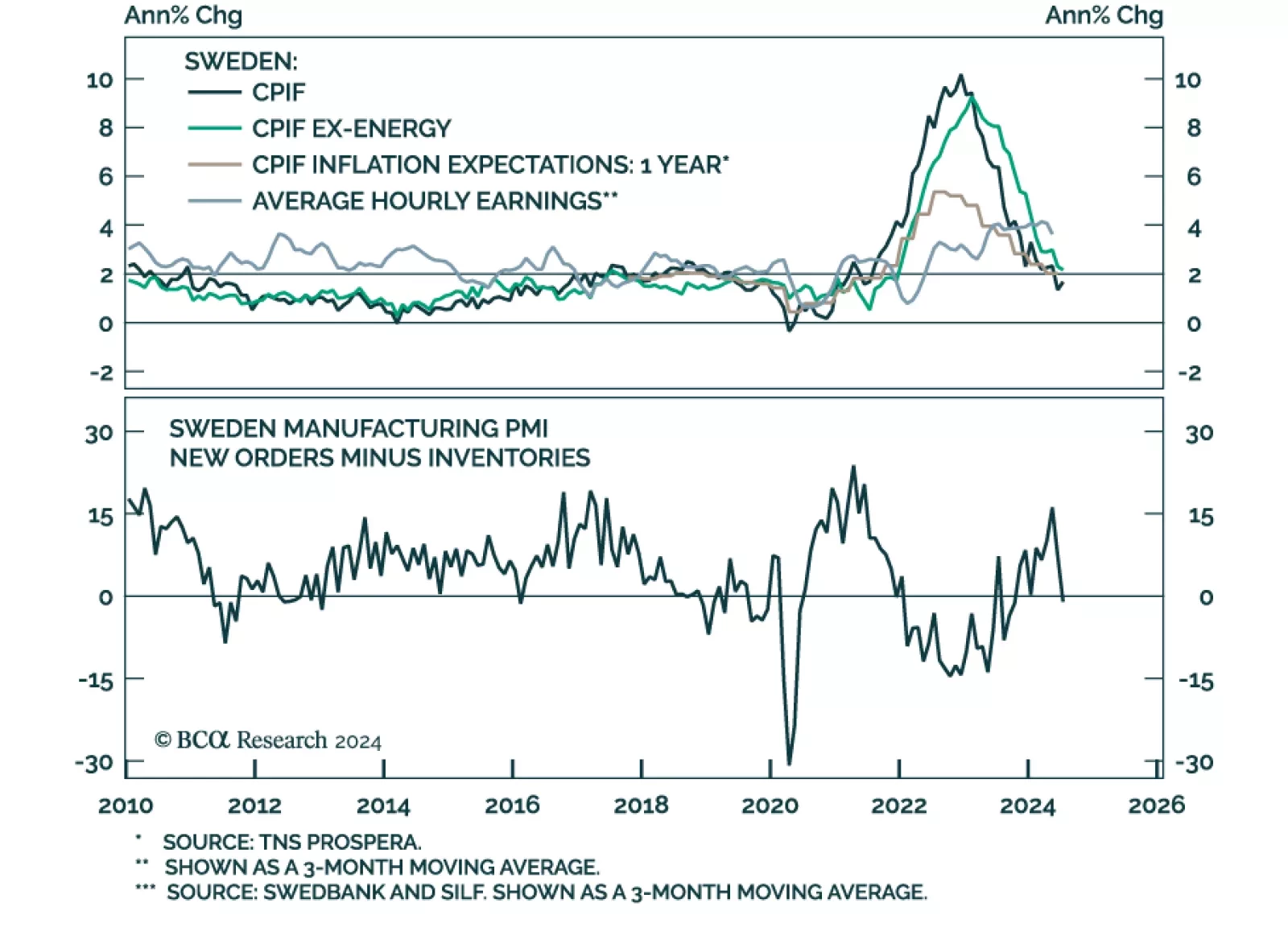

In a widely expected move, the Riksbank lowered its policy rate from 3.75% to 3.5% in August. It had kept rates on hold in June, after having led many other major DM central banks in easing policy in May. The Riksbank also…