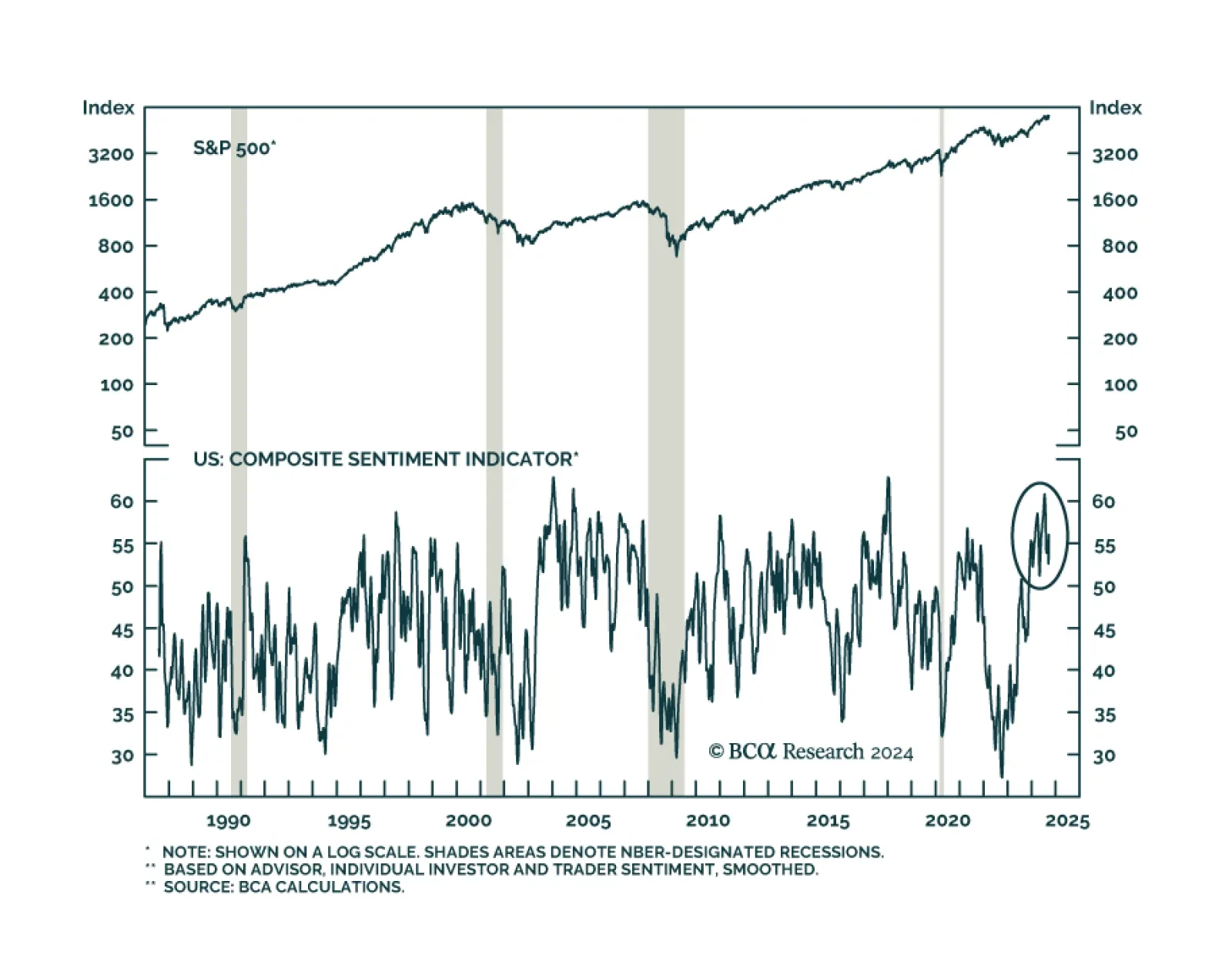

One key takeaway from Wednesday’s post-FOMC press conference is the Fed’s unshaken conviction that it can avoid a recession. A risk-on mood dominated markets on Thursday, with the S&P 500 breaching new all-time…

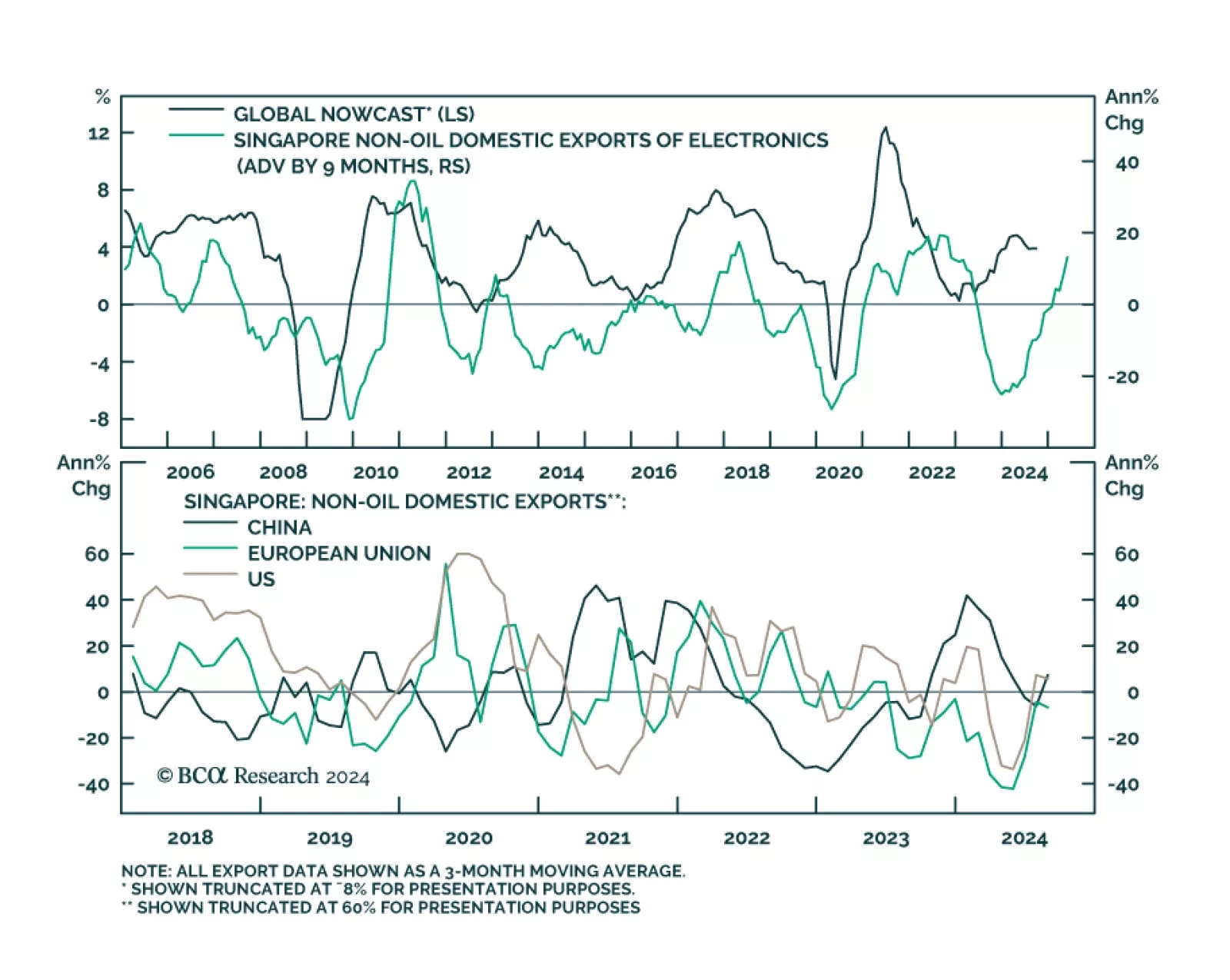

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions. Overall exports, which are highly volatile on a month-on-month basis,…

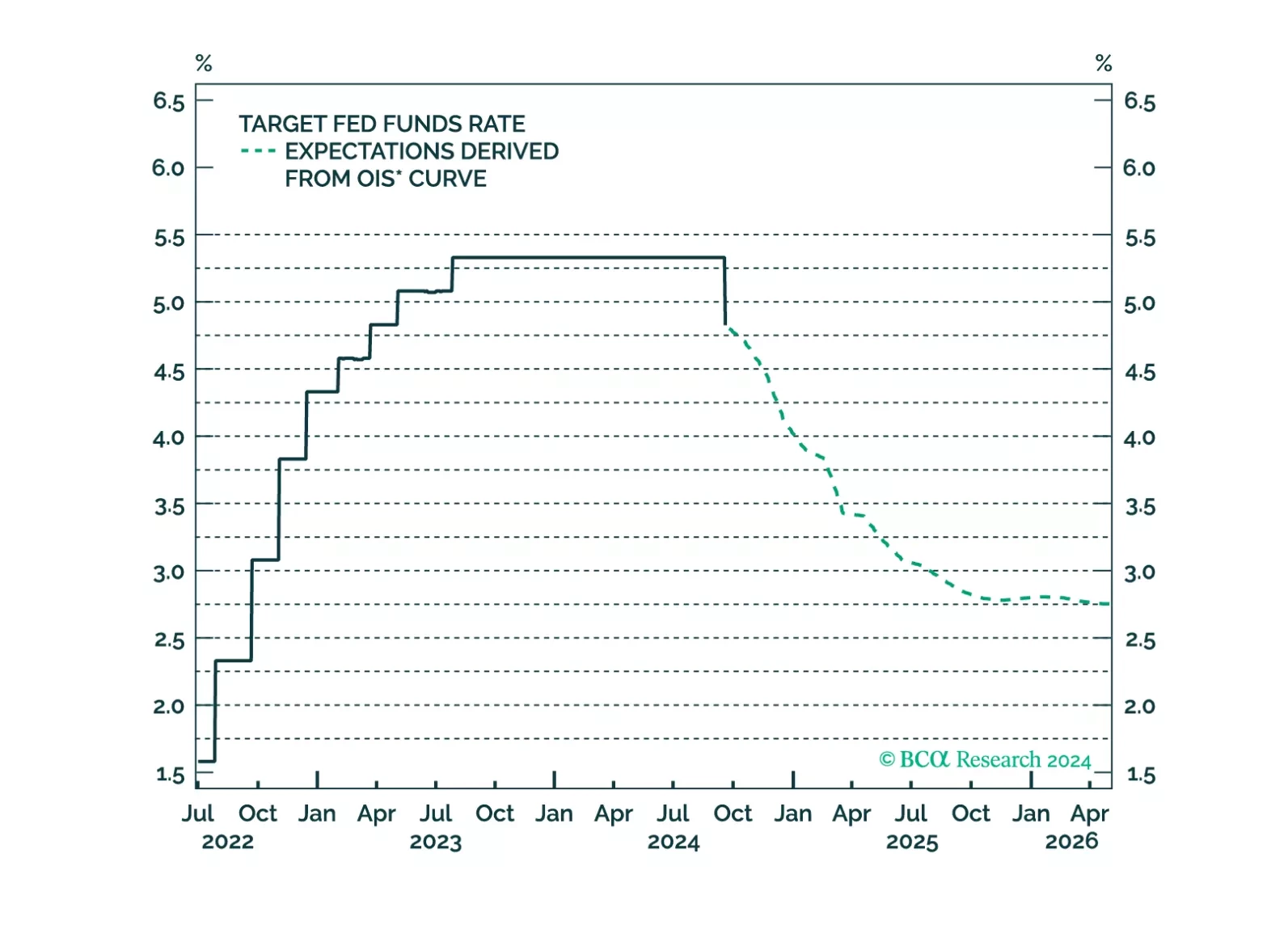

We update our bond views following today’s 50 bps rate cut.

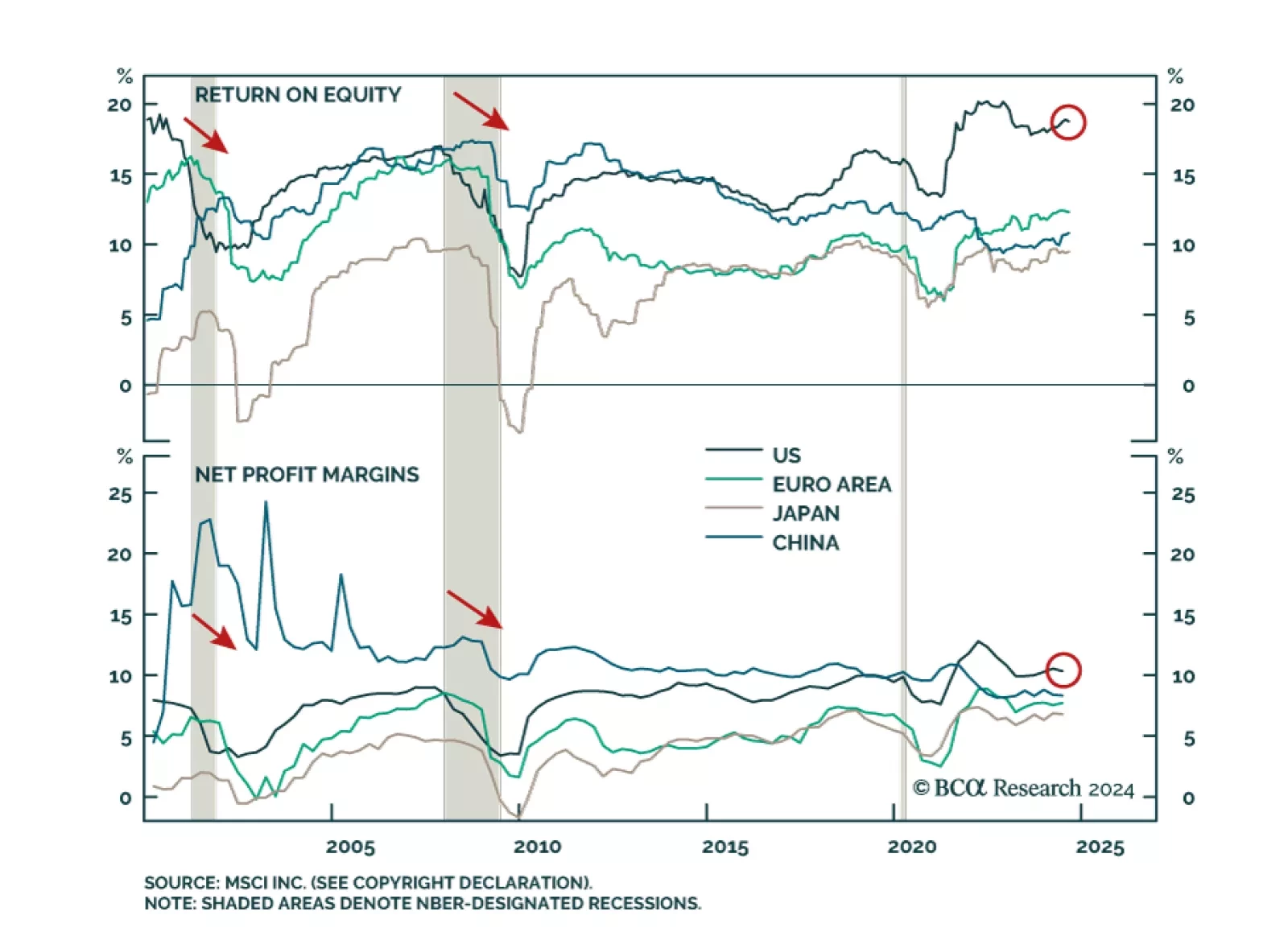

Despite the recent correction, US equity leadership remains intact. The MSCI US index has outperformed global markets by 3.8% in 2024YTD. A 7.8% expansion in forward earnings drove the MSCI US index’ 2024YTD gains which was…

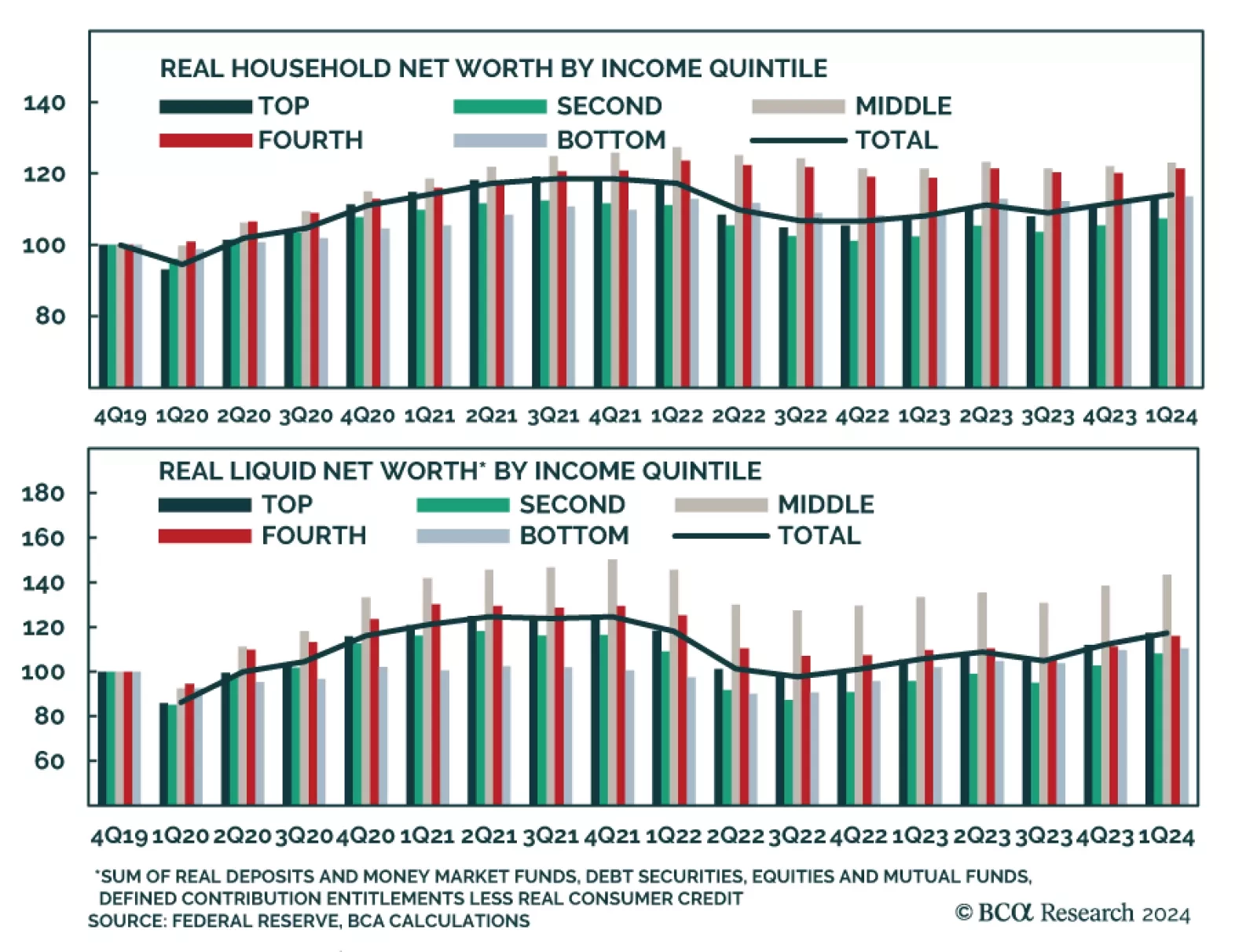

Stress among lower-income households is often cited as an early indication of deteriorating aggregate consumer fundamentals. The data indeed suggests that this cohort’s cash holdings are depleting. However, the Fed…

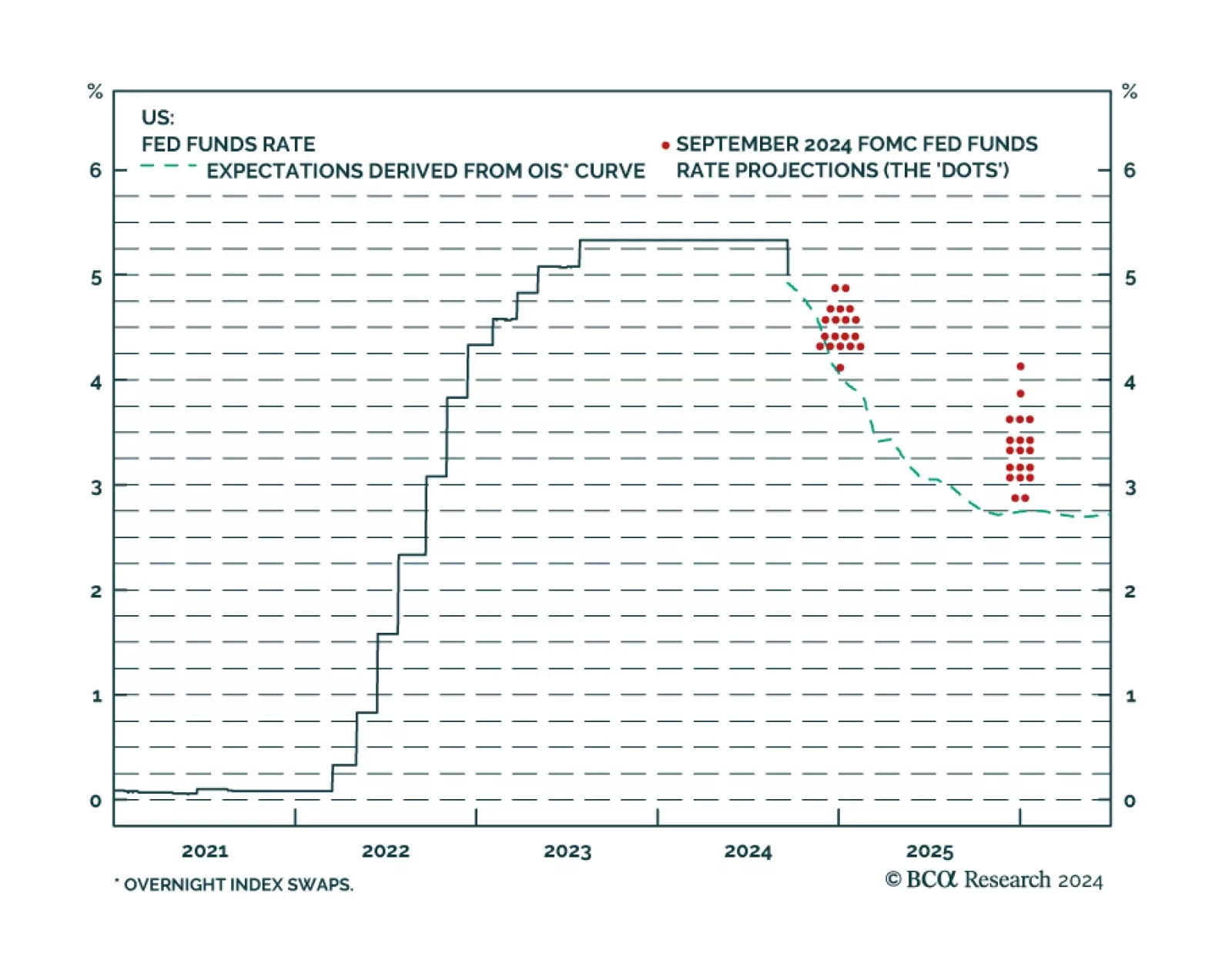

The Fed started its easing cycle with a bang, cutting the policy rate by 50 basis points in September, above consensus expectations but in line with odds embedded in the futures and OIS curves. Our US Bond strategists had…

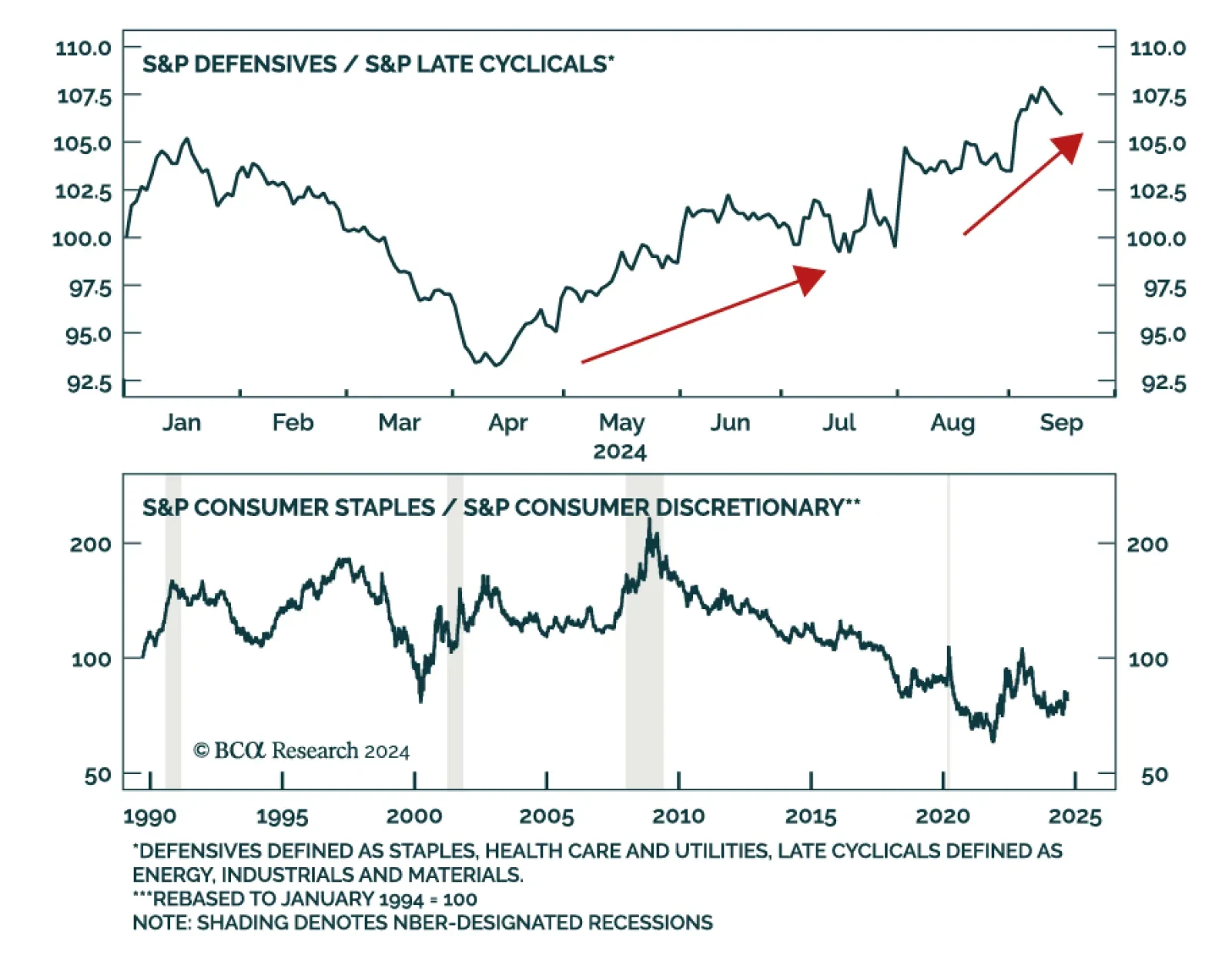

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

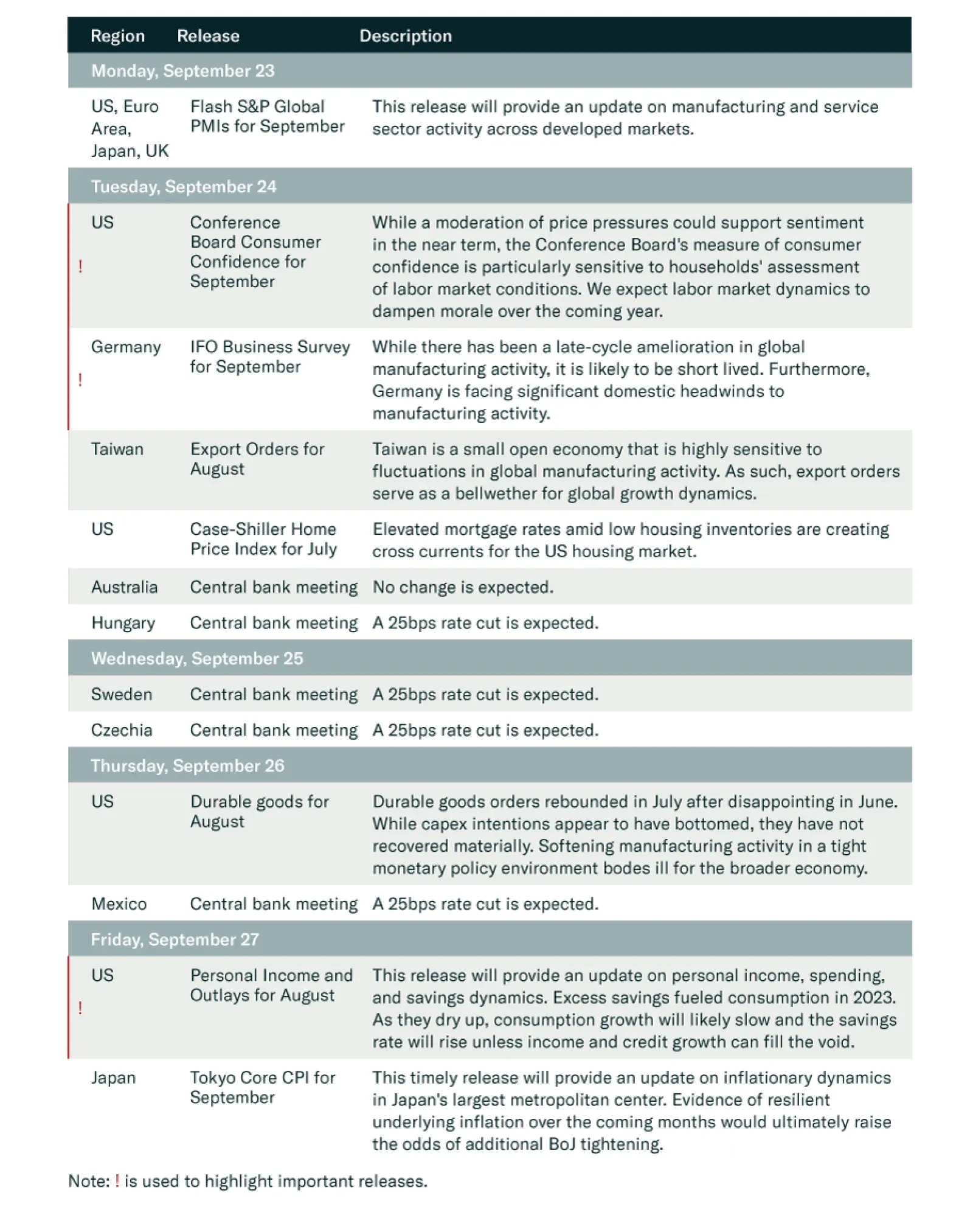

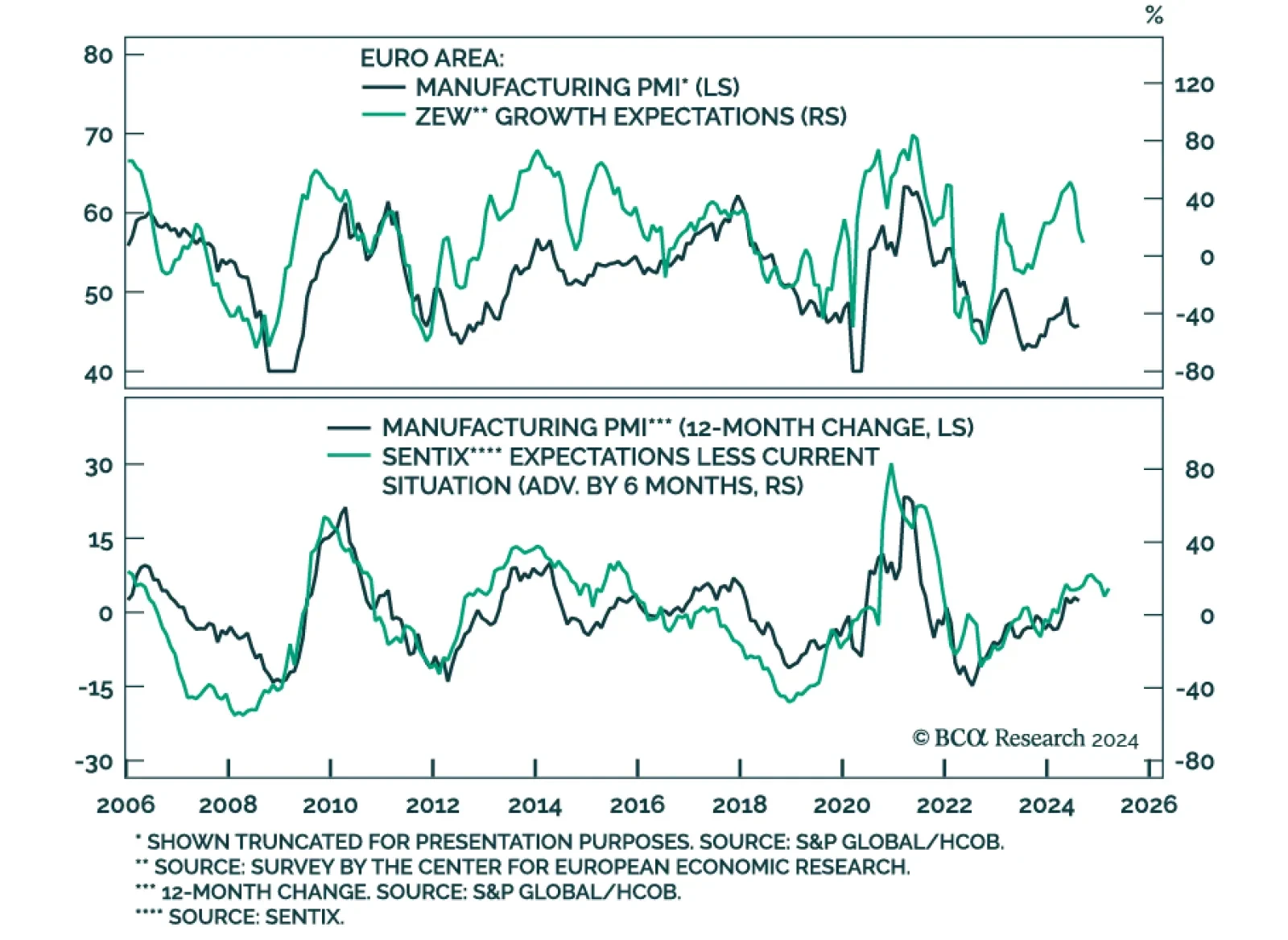

The ZEW survey of both German business expectations and current situation largely disappointed in September, decreasing by 15.6 points to 3.6 and by 7.2 points to -84.5, respectively. The ZEW survey of expectations for…

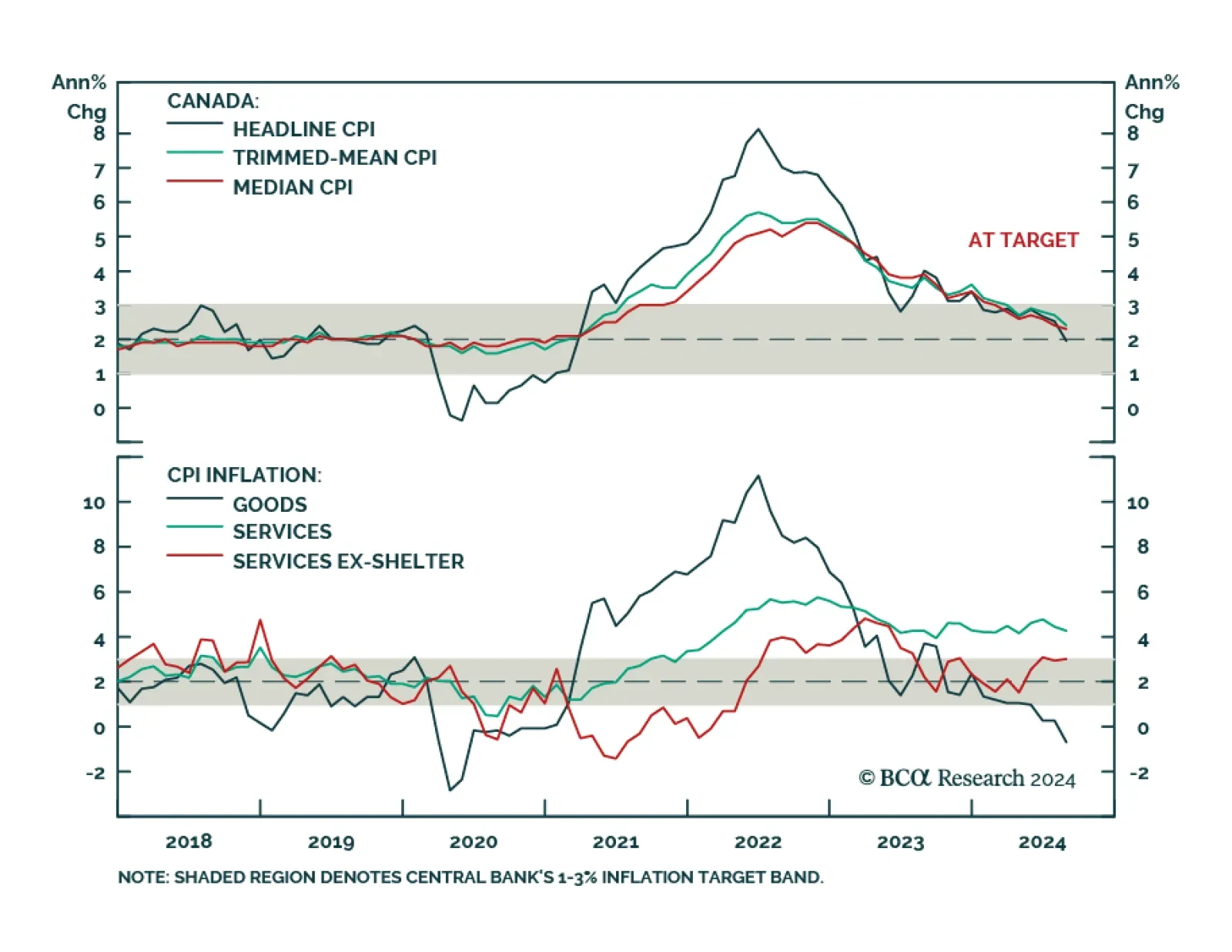

Canadian headline CPI inflation decelerated at a faster-than-anticipated pace from 2.5% y/y to 2.0% in August, the slowest since 2021. Notably, core median and trimmed-mean CPI ticked 0.1 ppt and 0.3 ppt lower to 2.3% and 2.4%,…