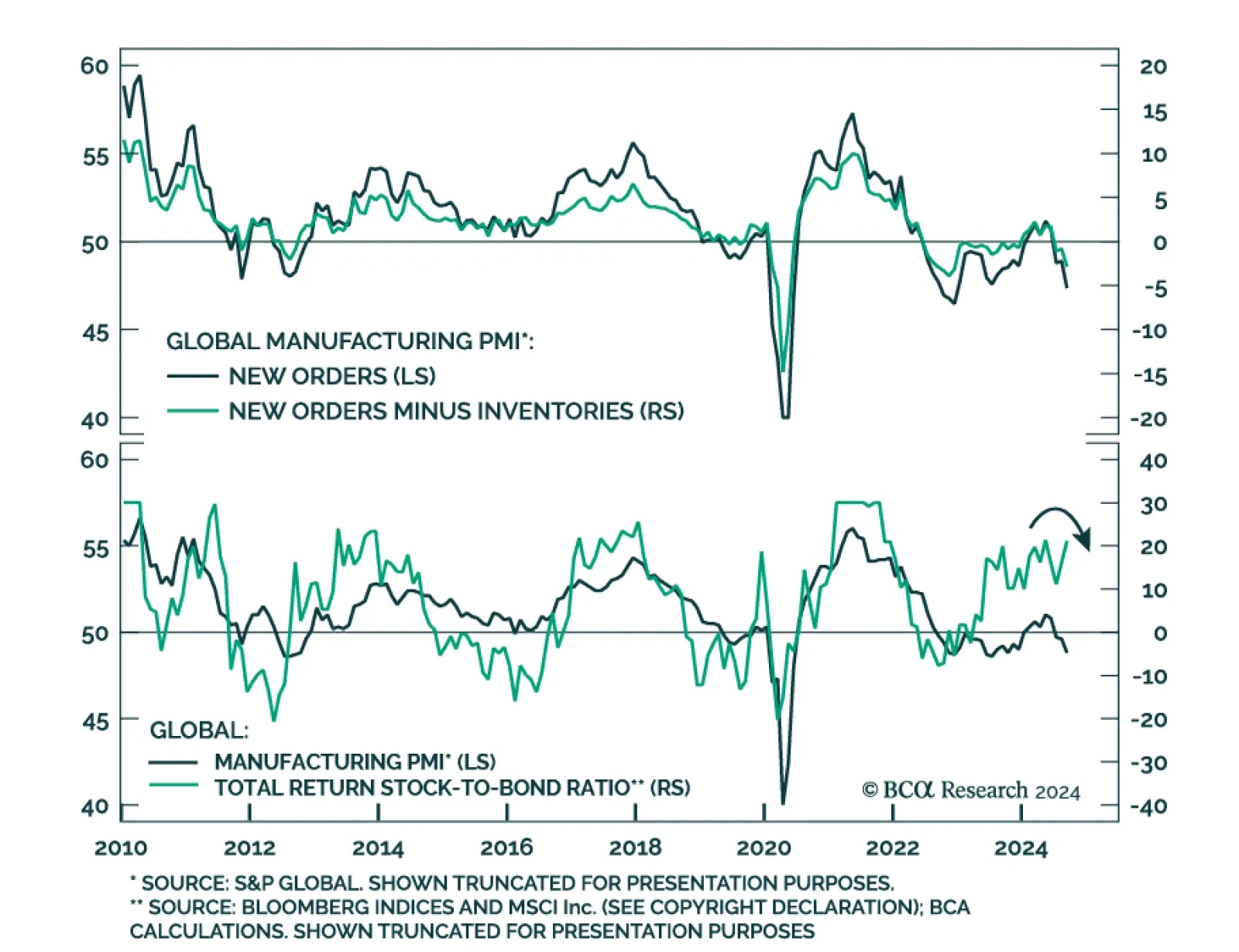

The JPM Global manufacturing PMI declined at an accelerating pace in September (49.6 to 48.8). Moreover, international trade flows deteriorated notably with the new export orders component falling from 48.4 to 47.5. A sector…

Our Portfolio Allocation Summary for October 2024.

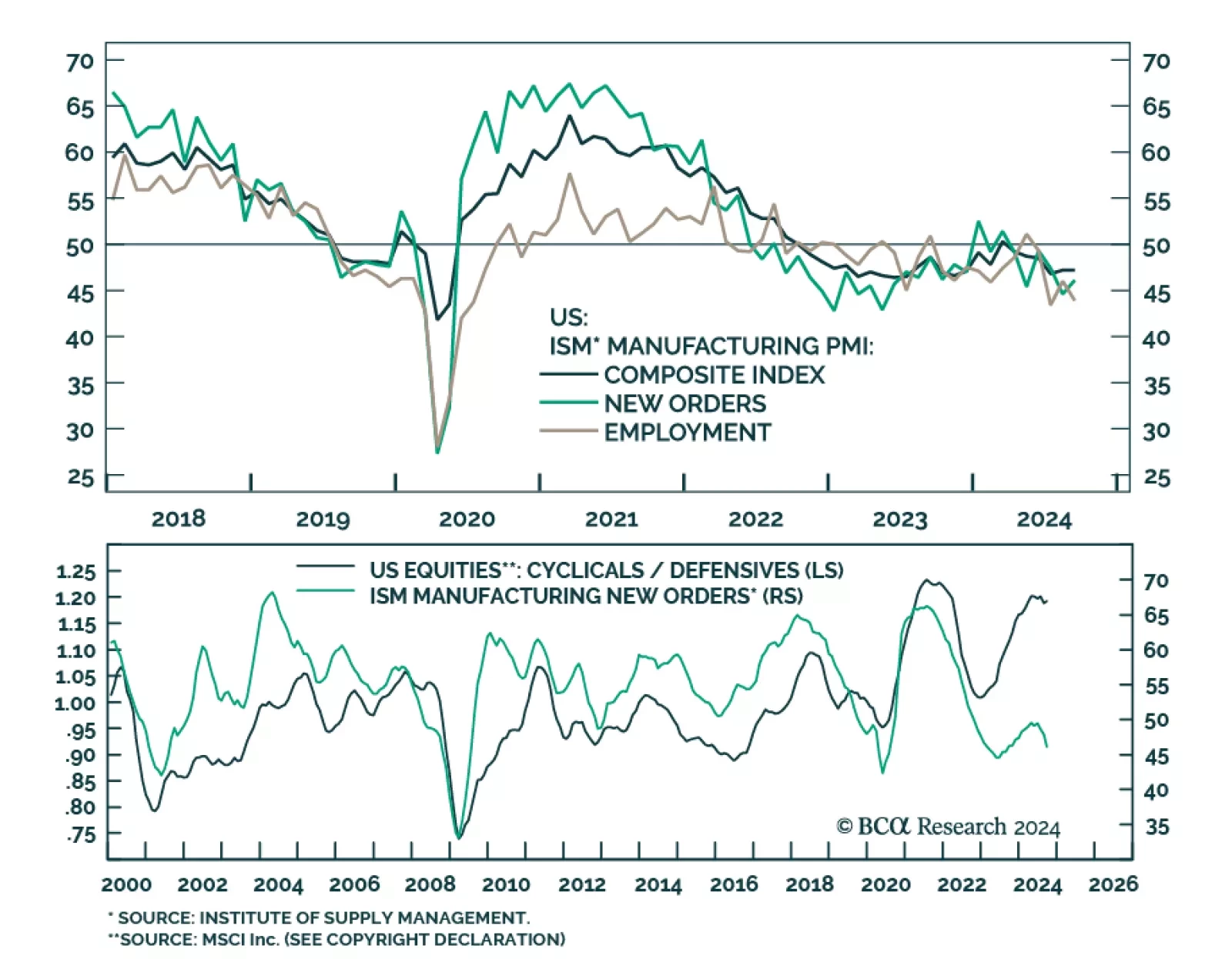

The ISM manufacturing PMI remained constant in September at 47.2, against expectations of a slower pace of decline and extending a six-month contraction streak. Measures of production and domestic demand decelerated at a…

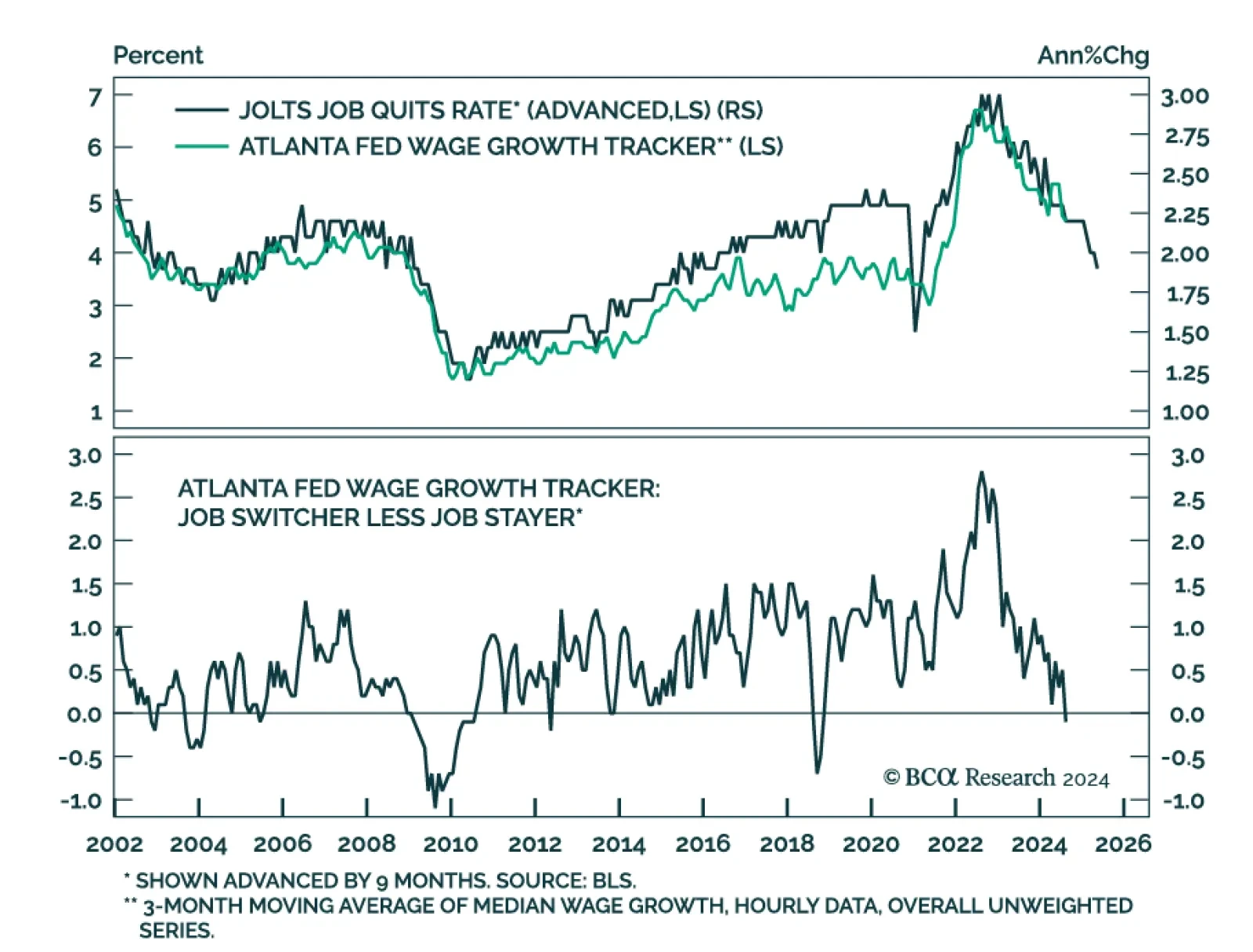

US job openings grew by a larger-than-expected 8.04 million jobs in August from 7.71 million. July’s openings were also revised 38 thousand higher. However, despite the upside surprise, the August hires rate fell to 3.3…

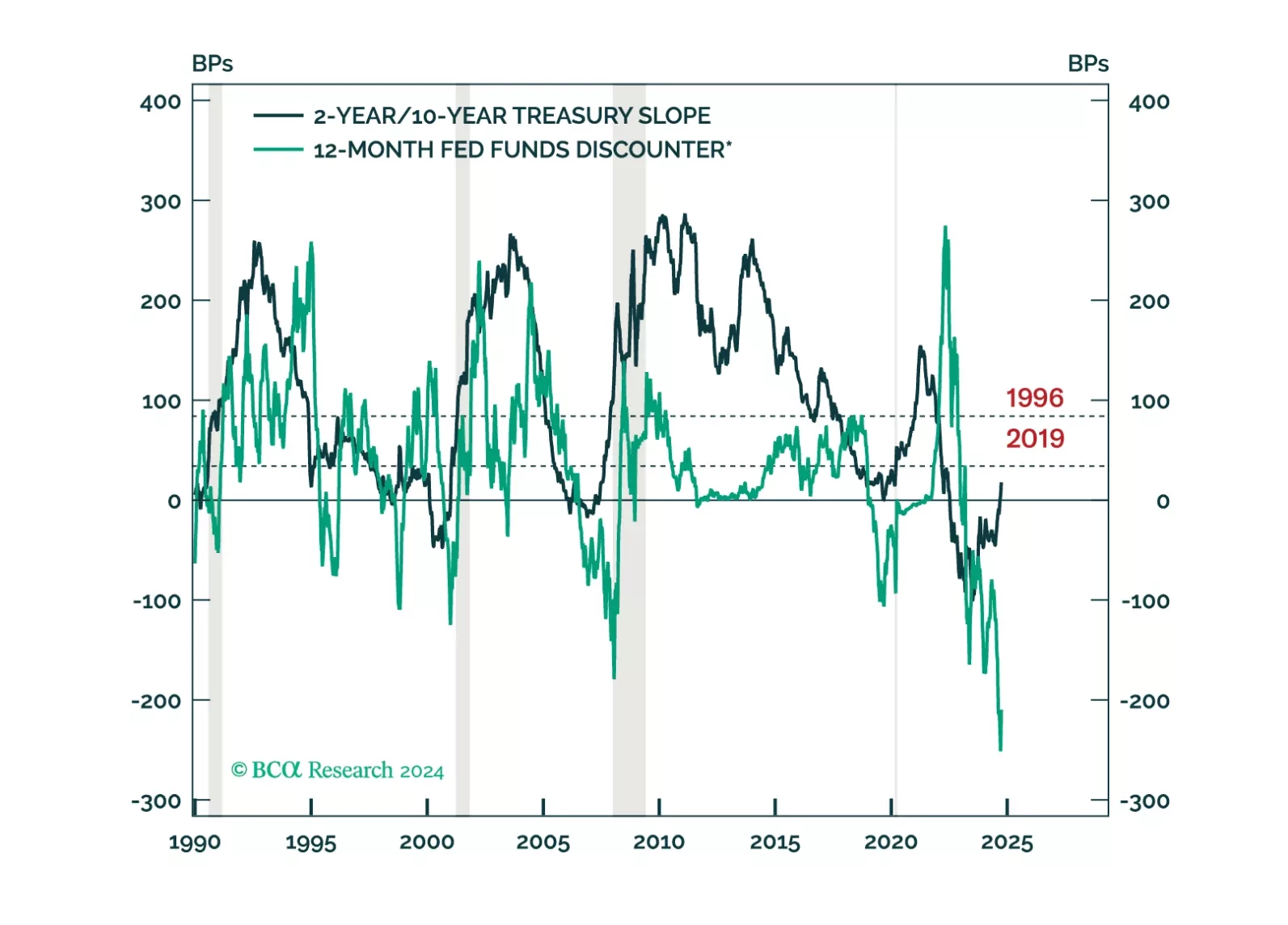

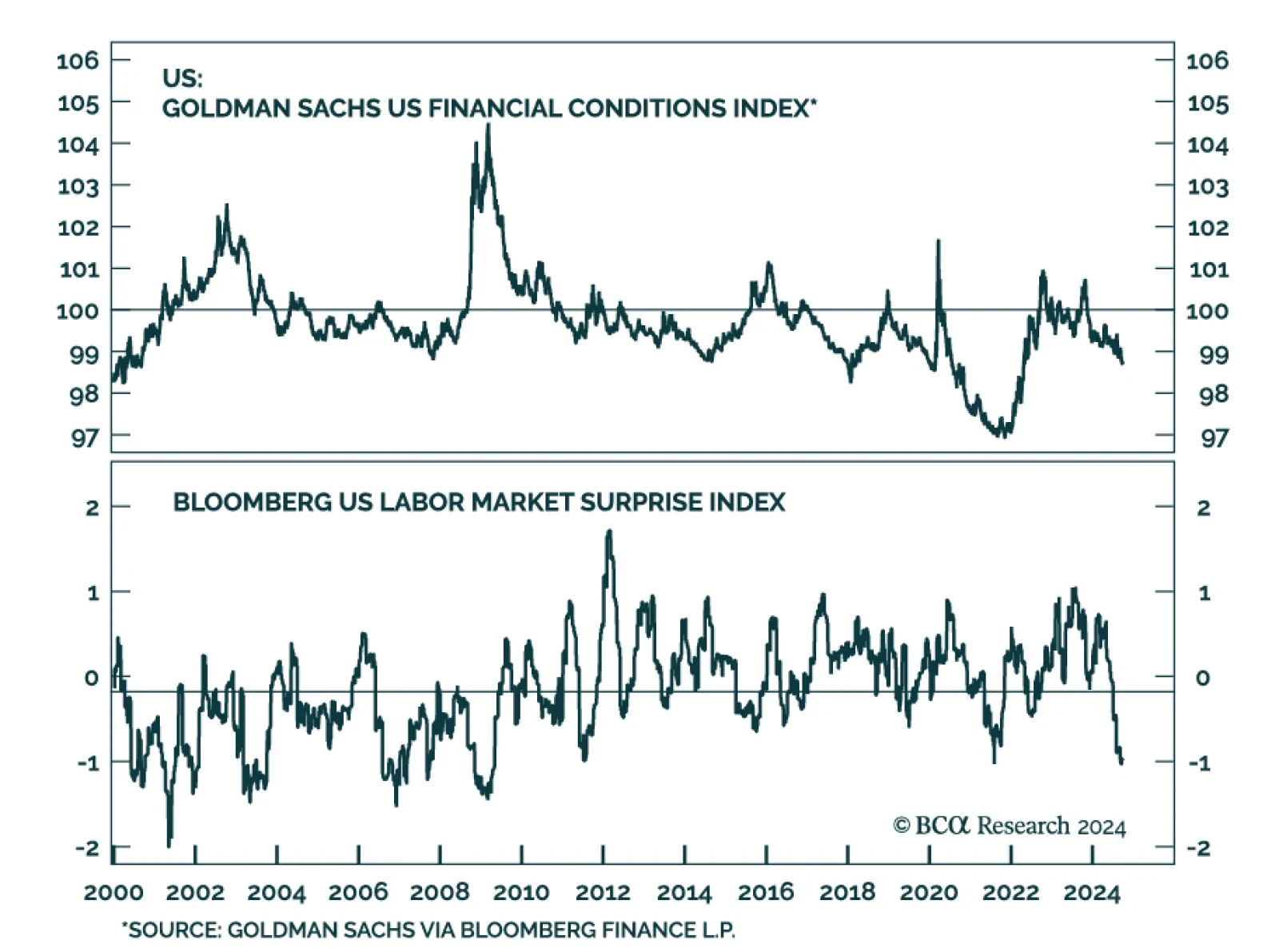

US financial conditions have become noticeably easier since August. The Fed has embarked on its easing cycle with a bang, sending equities higher and spreads lower, while the trade-weighted dollar gave back more than half of its…

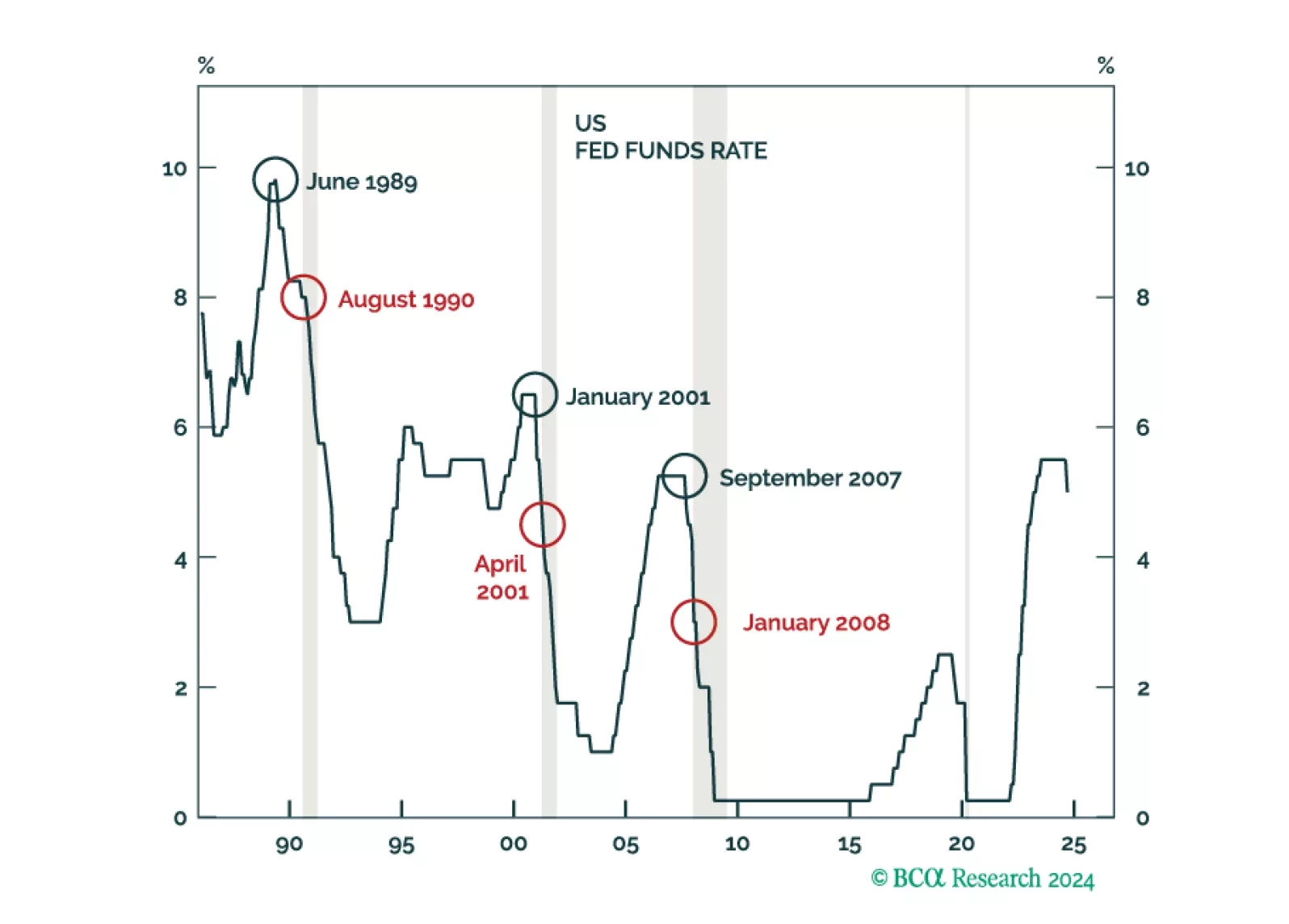

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

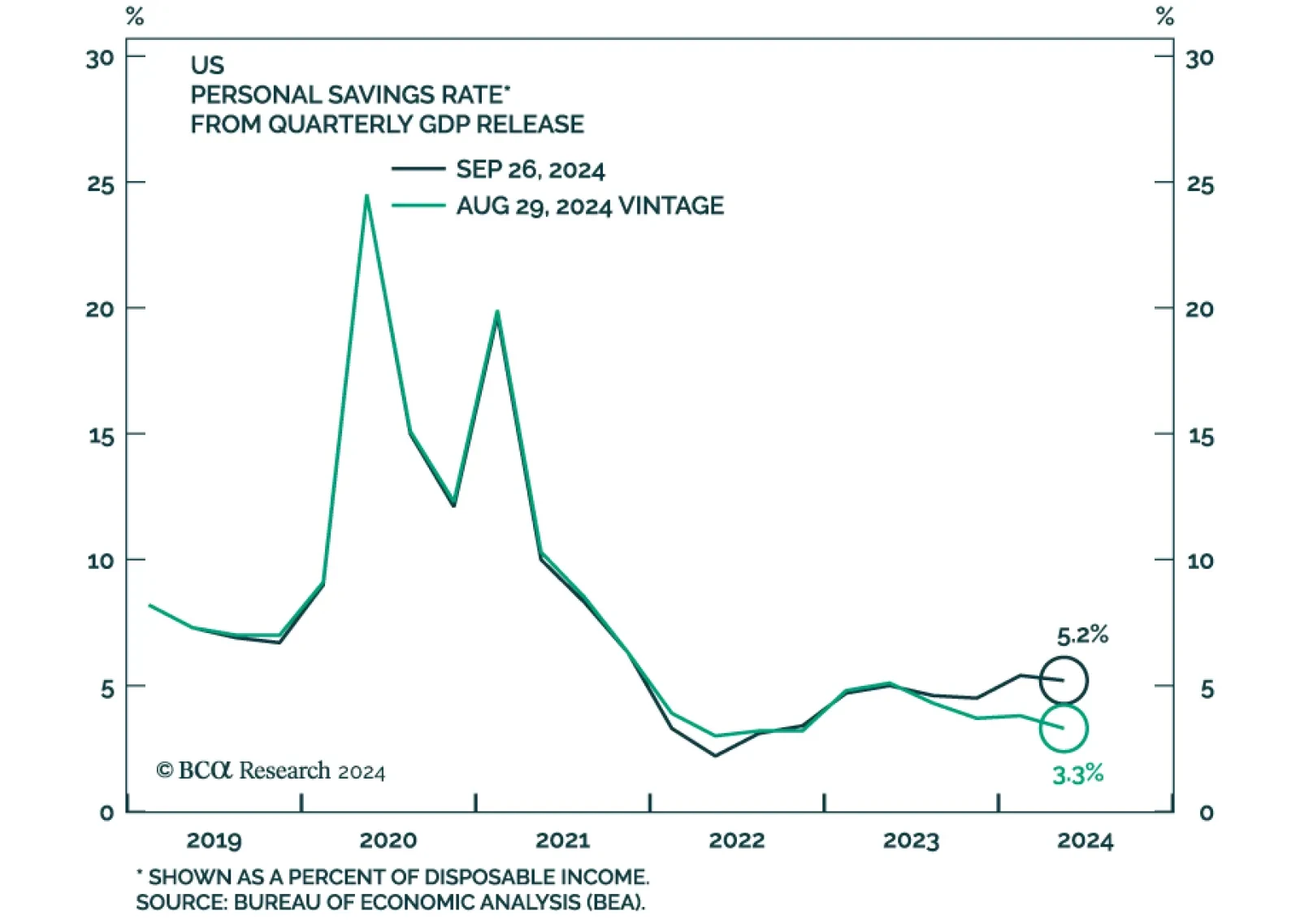

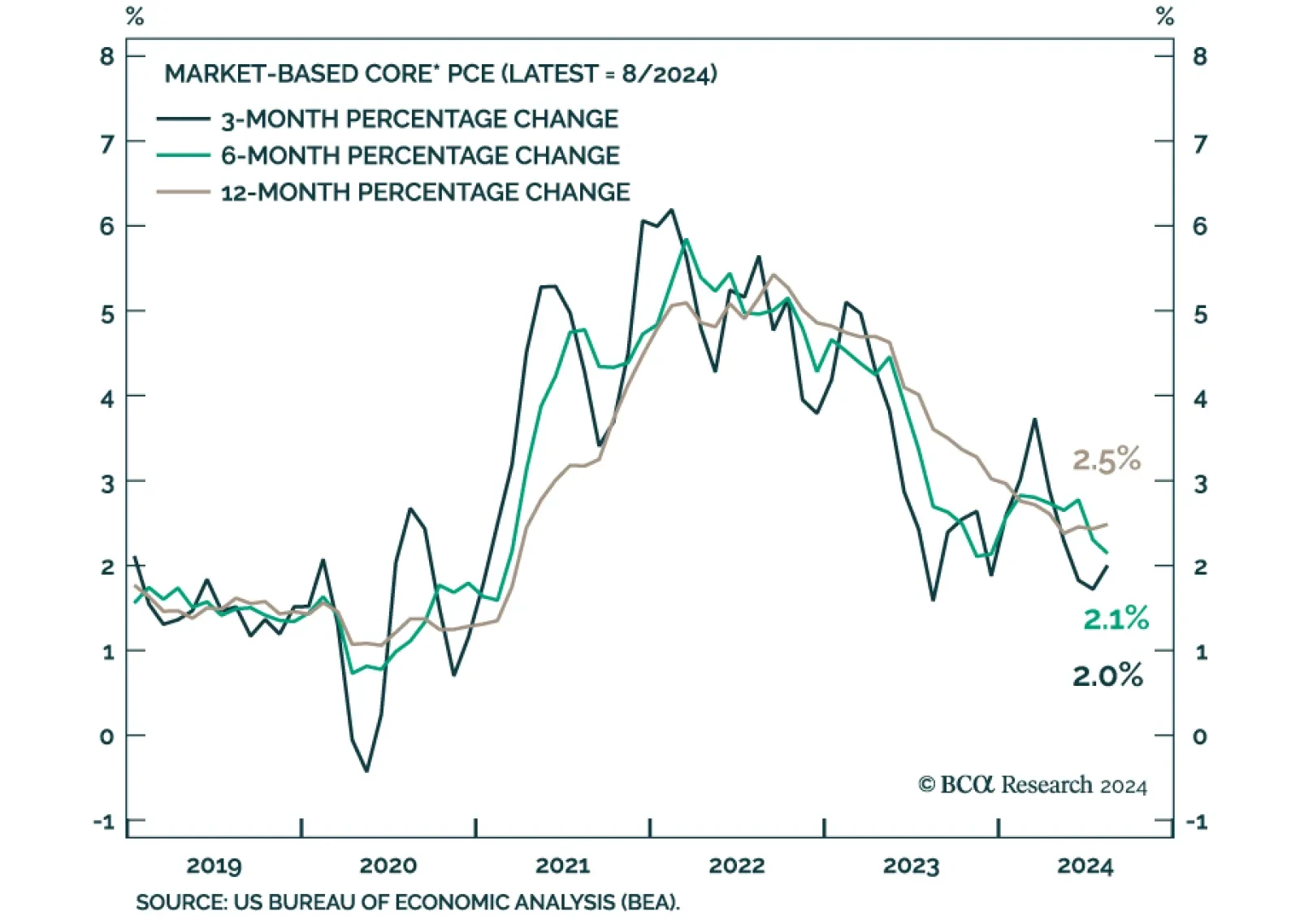

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…

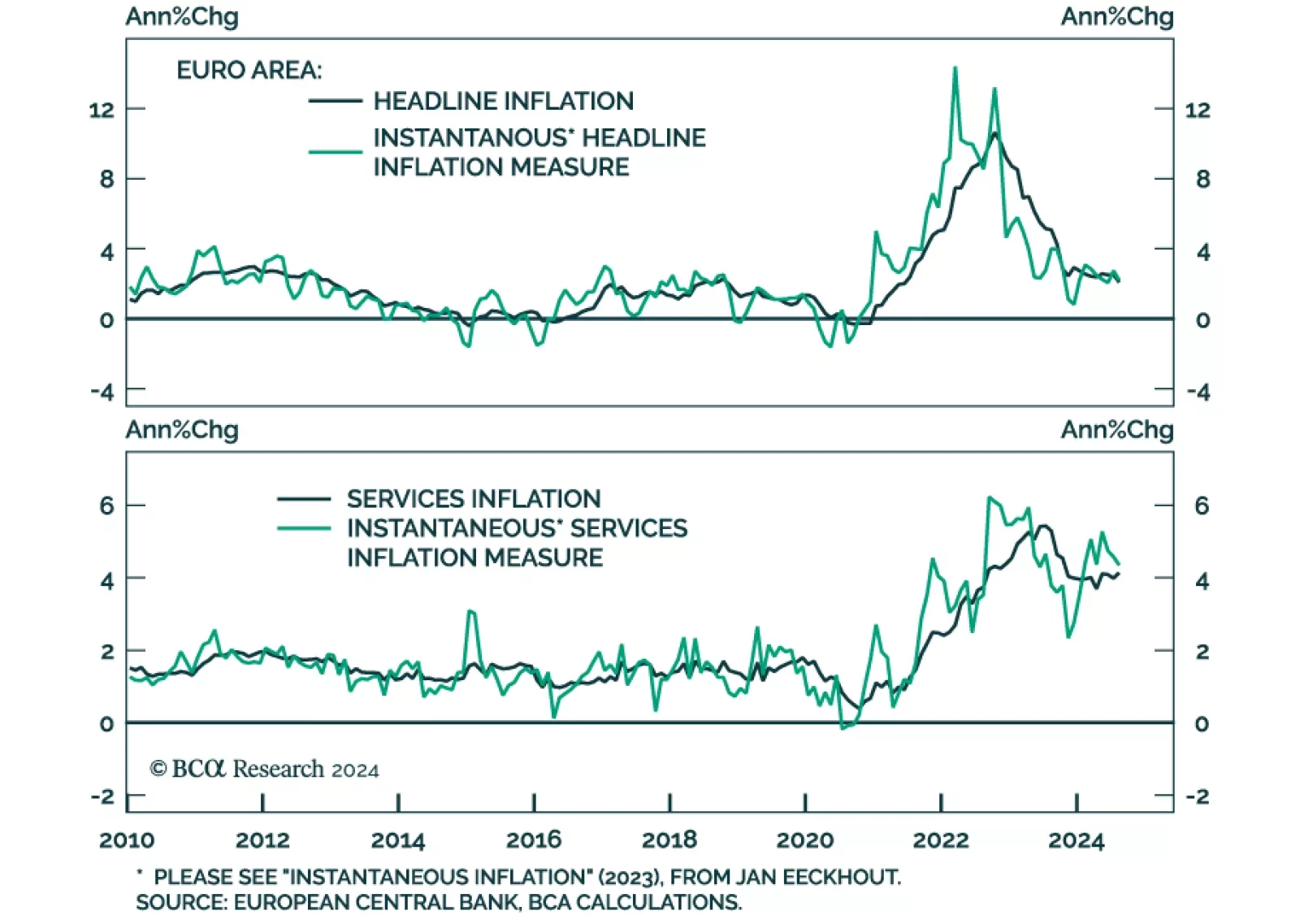

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…

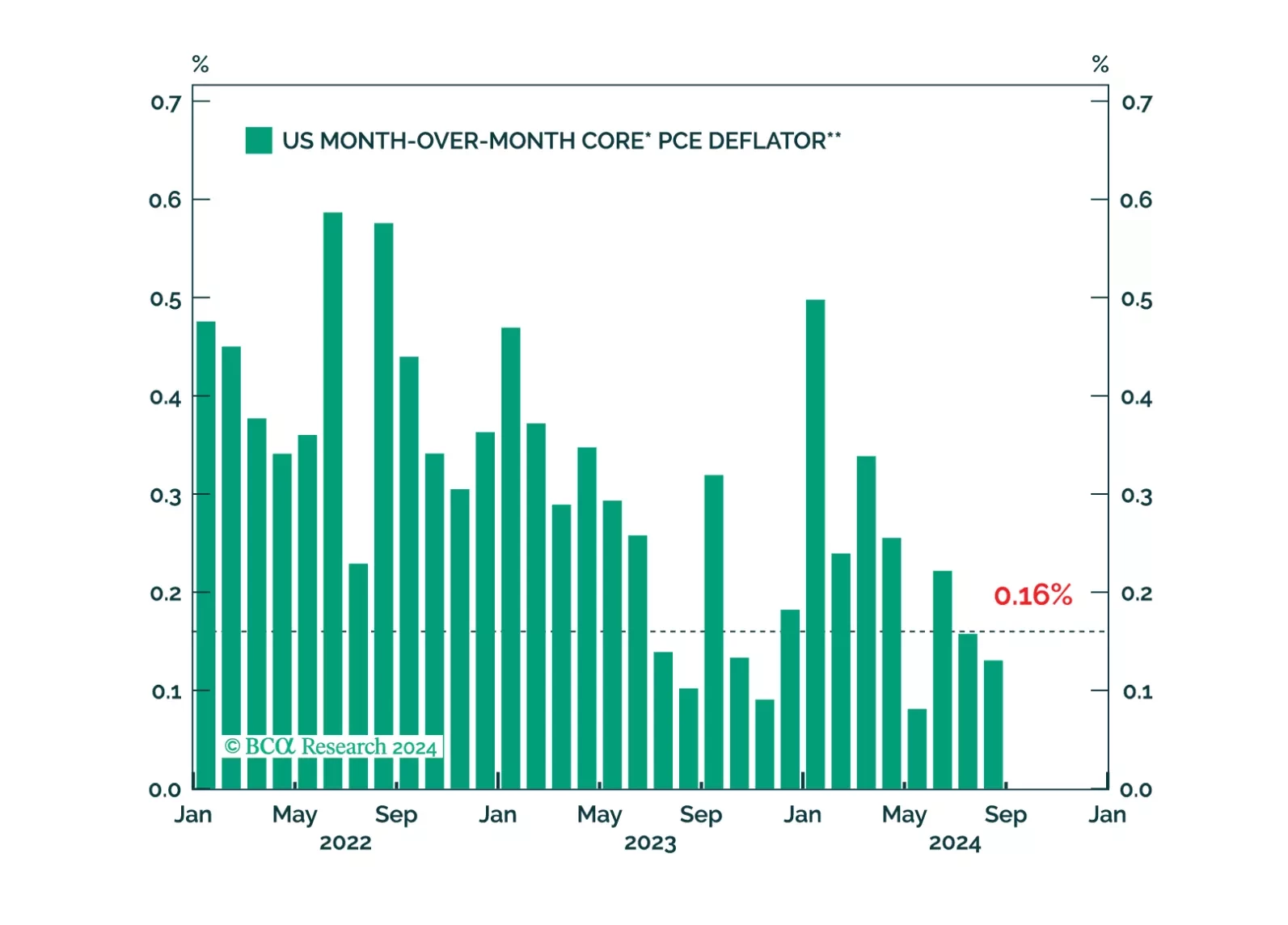

US nominal personal income growth decelerated to a 0.2% pace in August, from 0.3% in July, missing expectations that it would accelerate. Nominal personal spending also disappointed, growing at a slower 0.2% pace from 0.5%. In…

We consider the possibility that lower interest rates could lead to an increase in household borrowing, prolonging the economic recovery.