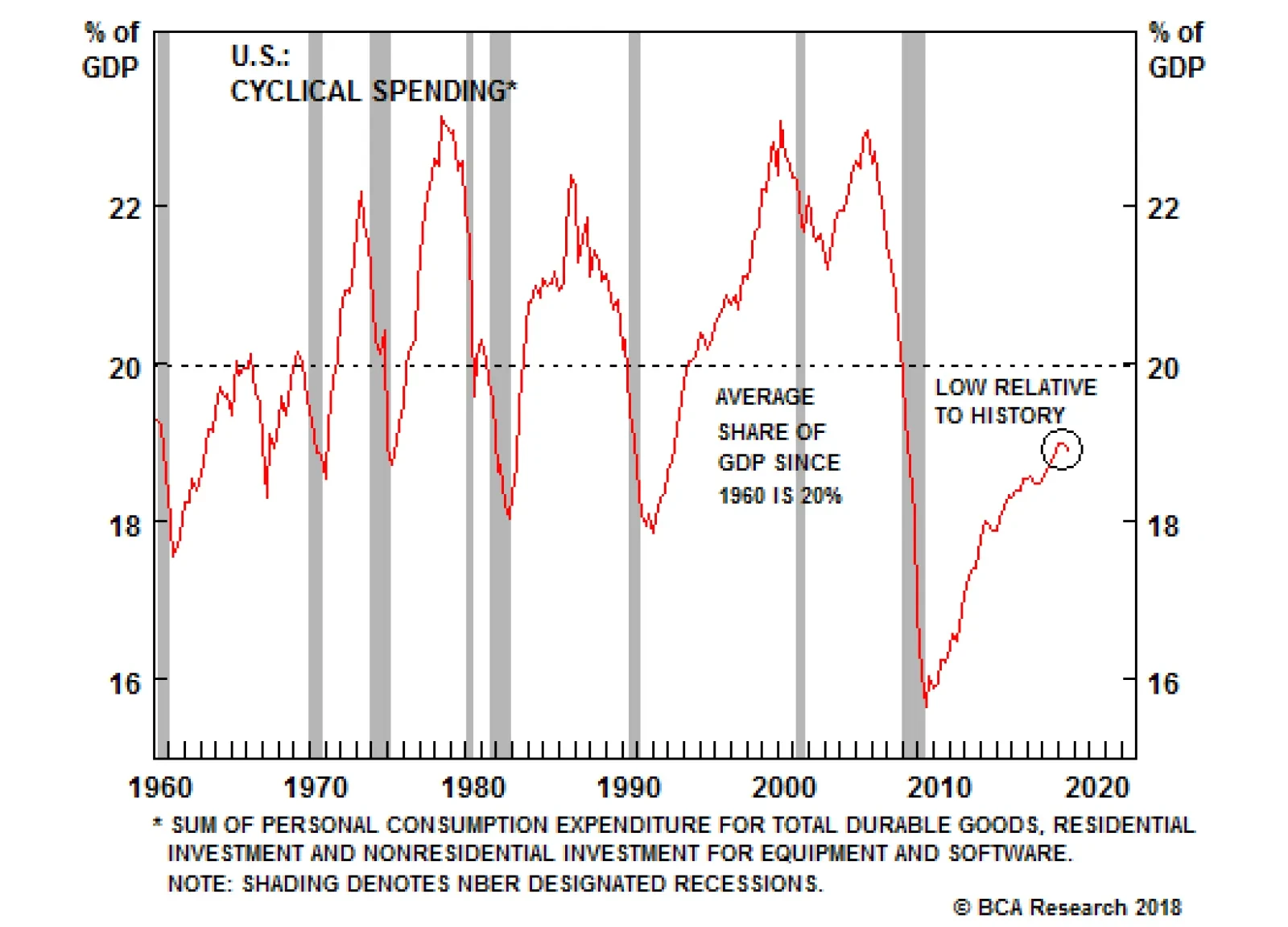

One of my favorite recession indicators is the percent of cyclical spending as a share of GDP. Cyclical spending includes corporate investment, residential investment, and consumer spending on durables. The chart above shows…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook. This report is an edited transcript of our recent conversation. Mr. X: I have…

Highlights Equities had a wild ride in October, ... : The S&P 500 has bounced smartly off of its October 29th lows, but the decline that preceded the bounce was unusually severe. ... that unsettled a lot of investors, and made us…

Highlights Investors are worrying too much about the things that caused the global financial crisis, and not enough about those that could cause the next downturn. Despite the recent patch of soft data, the U.S. housing market is in…

Highlights The combination of slower global growth, trade protectionism, Italy's budget crisis, and rising Treasury yields have made U.S. equities increasingly vulnerable to a phase transition from euphoric optimism to a more sober…

Highlights U.S. domestic demand will remain robust for the foreseeable future thanks to fiscal stimulus, stronger credit growth, a falling savings rate, and plentiful sources of pent-up demand. Economic and financial imbalances in the…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…