Highlights We are asked nearly everywhere we go about the Fed’s independence, … : The Fed’s independence is an especially popular topic overseas, and it typically takes some persuasion to bring clients around to our…

Highlights Global equities will remain rangebound for the next month or so, but should move decisively higher as economic green shoots emerge in the spring. A revival in global growth will cause the recent rally in the U.S. dollar to…

Highlights Duration: With rate hikes more likely than cuts over the next 12 months, it makes sense to maintain below-benchmark duration in U.S. bond portfolios. However, timing the next up-move in Treasury yields is difficult. We…

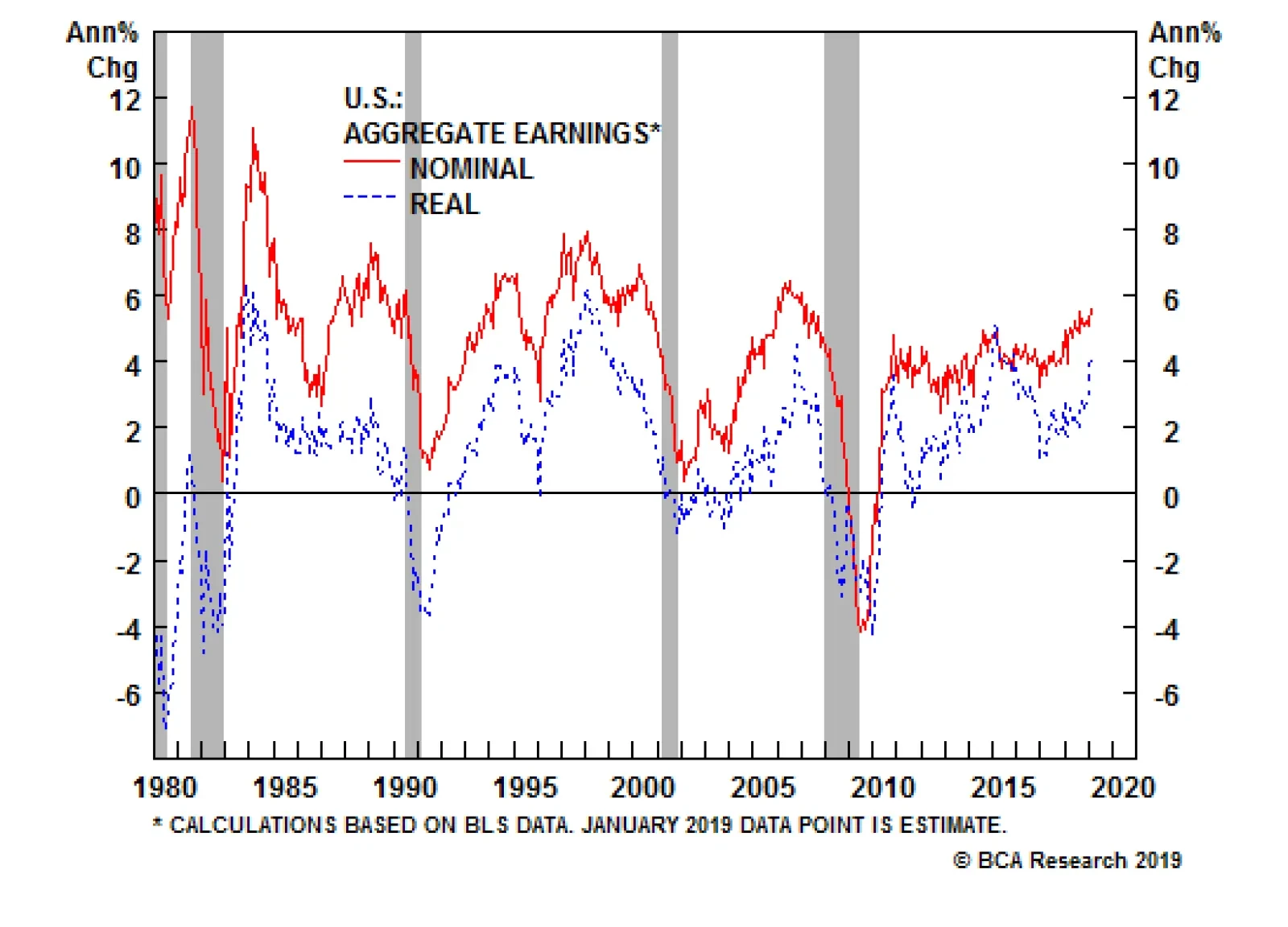

Highlights All the U.S. data look broadly similar to us, …: The data series are decelerating, one by one, but they generally remain at a fairly high level relative to history. … and we have begun sounding like a broken…

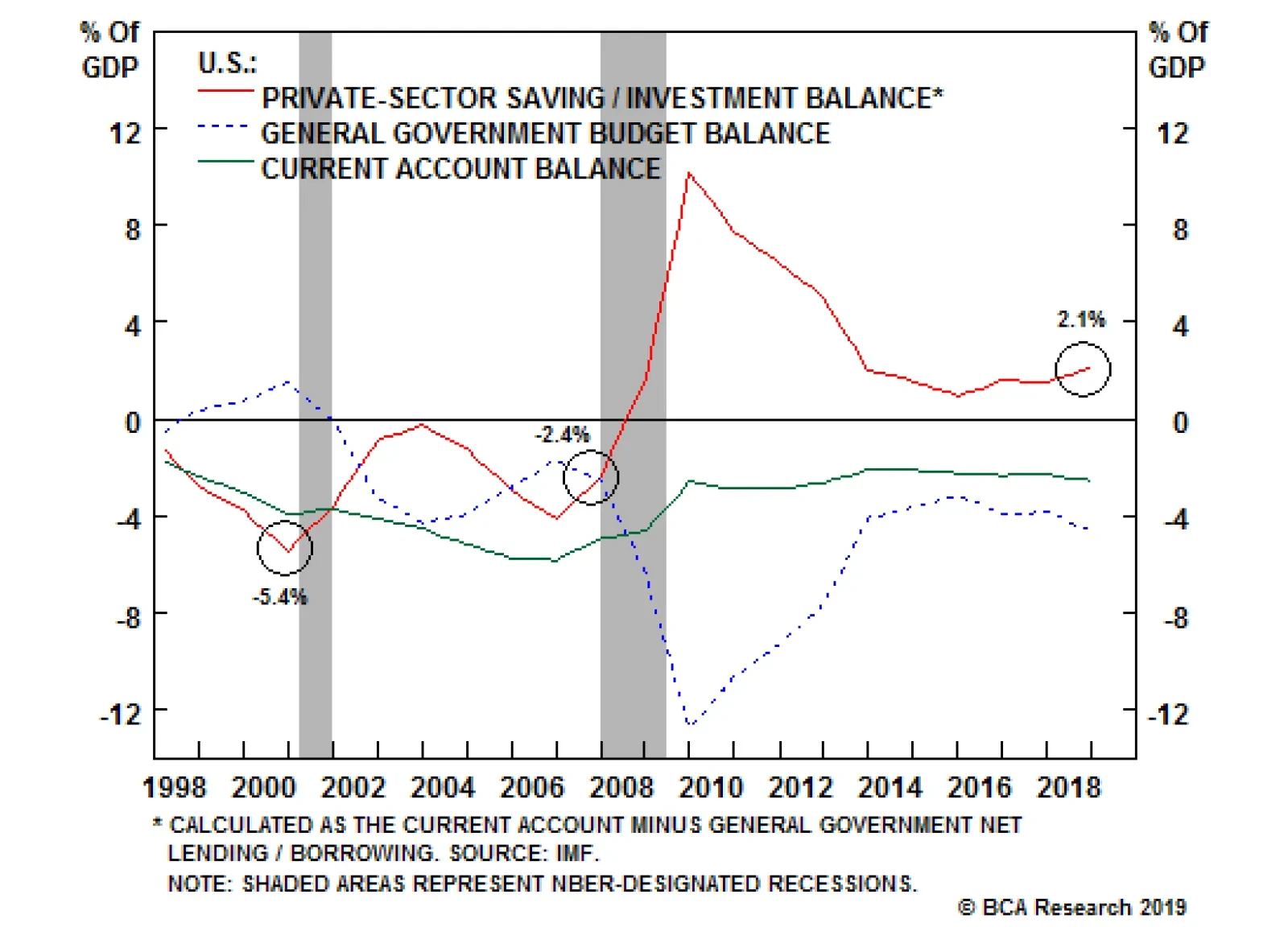

Today, the U.S. private-sector financial balance – the difference between what the private sector earns and spends – stands at a healthy surplus of 2.1% of GDP. Both of the last two recessions began when the private-…

The recent U.S. data has certainly been consistent with that thesis. The ISM manufacturing index rose 2.3 percentage points to 56.6 in January. New orders jumped by 6.9 percentage points to 58.2. Payroll growth has also…

Highlights Hyman Minsky famously said that “stability begets instability.” The converse is also true: Instability begets stability. None of the preconditions for a U.S. recession are in place yet. The Fed’s decision…

Highlights Our non-consensus inflation and Fed views just got even more non-consensus: Media and sell-side commentators were quick to speculate about an end to the tightening cycle following Wednesday’s FOMC meeting, but we don…

Highlights So What? A 70% tax on Americans with income over $10 million is not far-fetched. Why? The median U.S. voter wants higher taxes on the wealthy; Both populism and geopolitics make it impossible to cut spending; The…

Dear Client, In lieu of next week’s report, I will be hosting a webcast on Wednesday, January 9th at 10 AM EST, when I will be discussing the economic and financial market outlook for 2019 and answering your questions. Best…