Developed markets Flash PMIs estimates for October were mixed, with resilient US numbers and weakness elsewhere. The eurozone composite met expectations but remains below the 50-level expansion threshold. Germany…

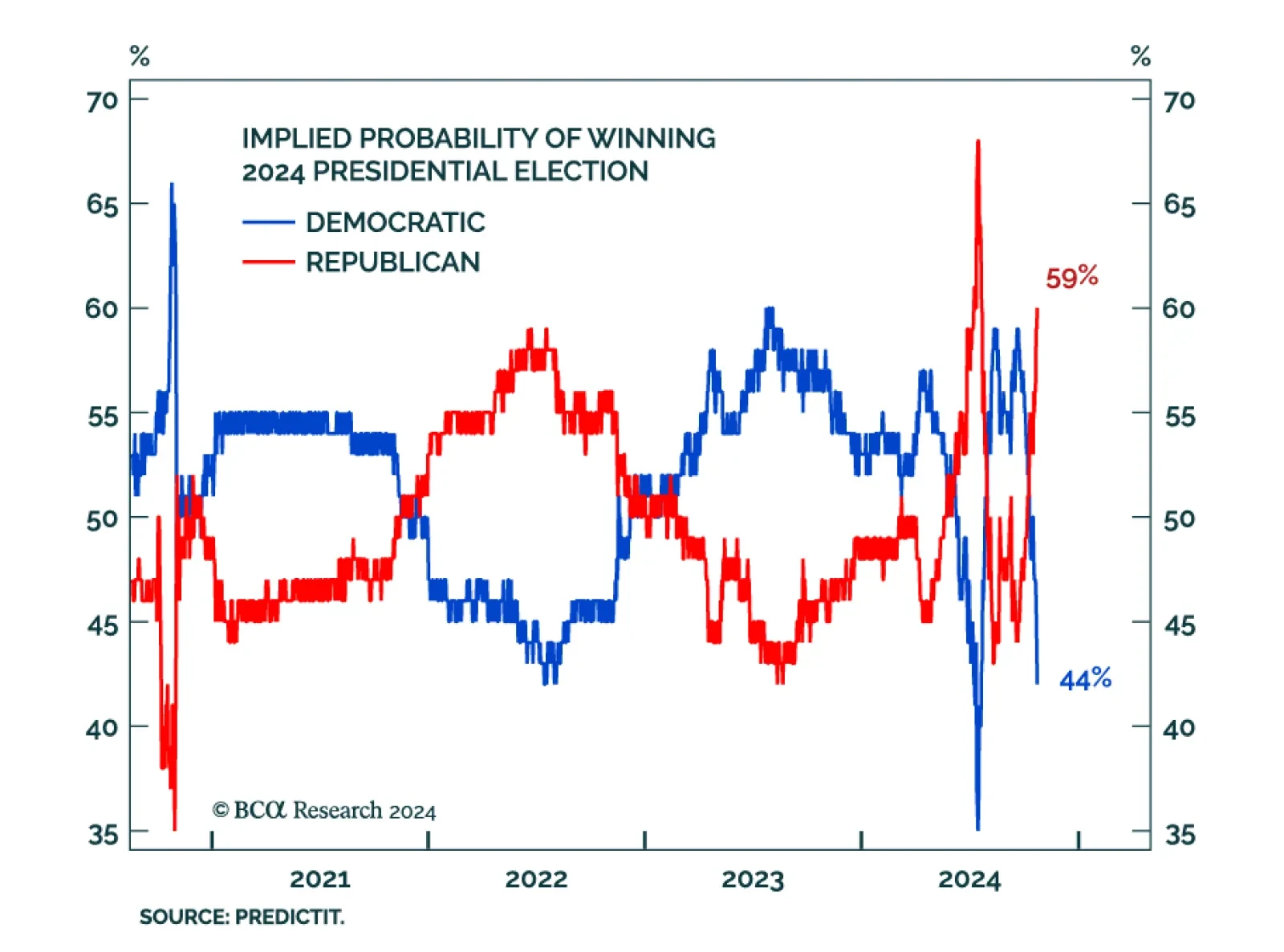

The US election is tightening in its final weeks, and the latest polls challenge our Geopolitical Strategy’s base case of a Democratic White House. The original thesis was built on the premise of a Democratic incumbent…

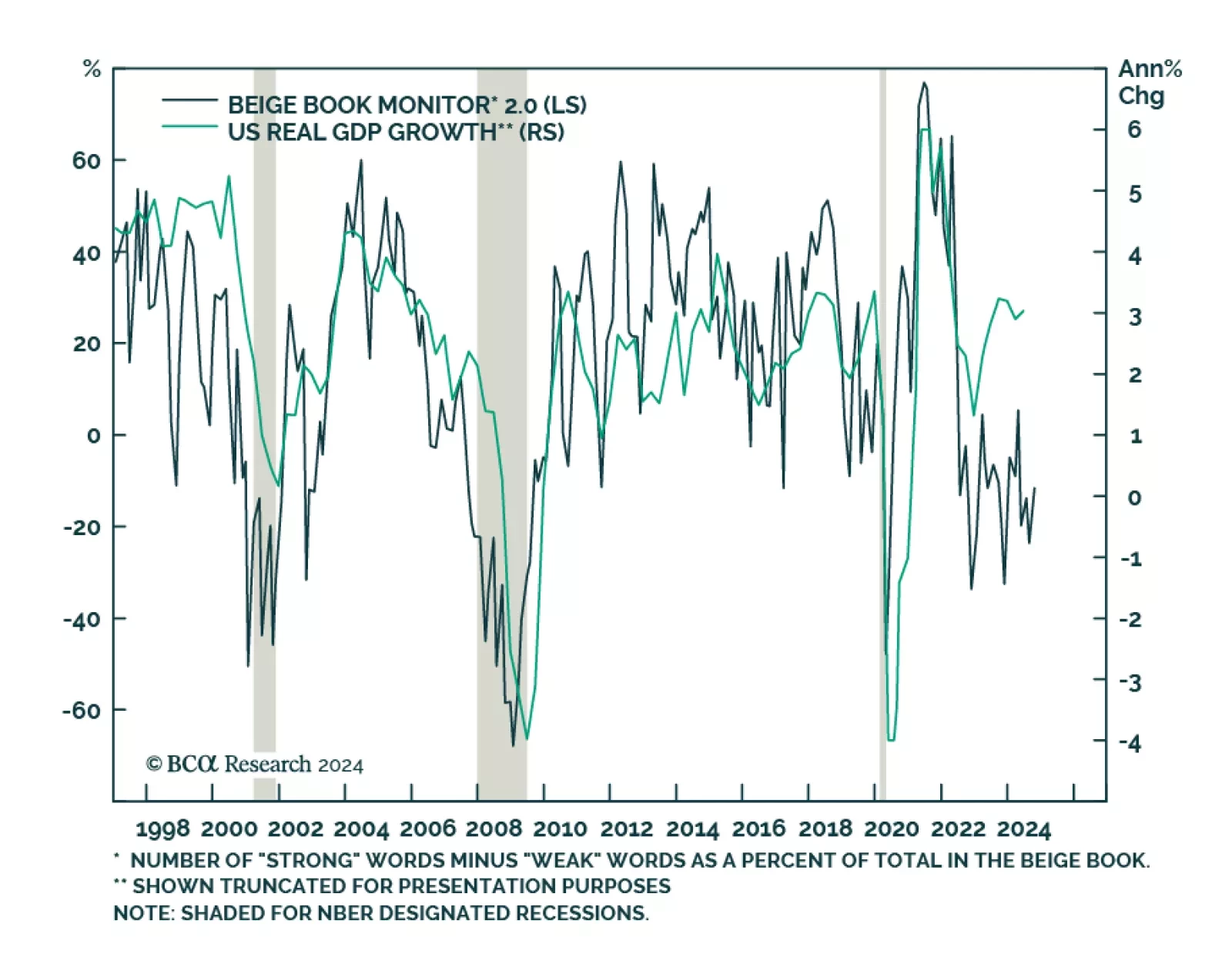

The Federal Reserve’s Beige Book, its survey of business contacts, shows an economy that has seen little growth since early September. The Fed’s contacts confirmed the manufacturing recession reflected in other…

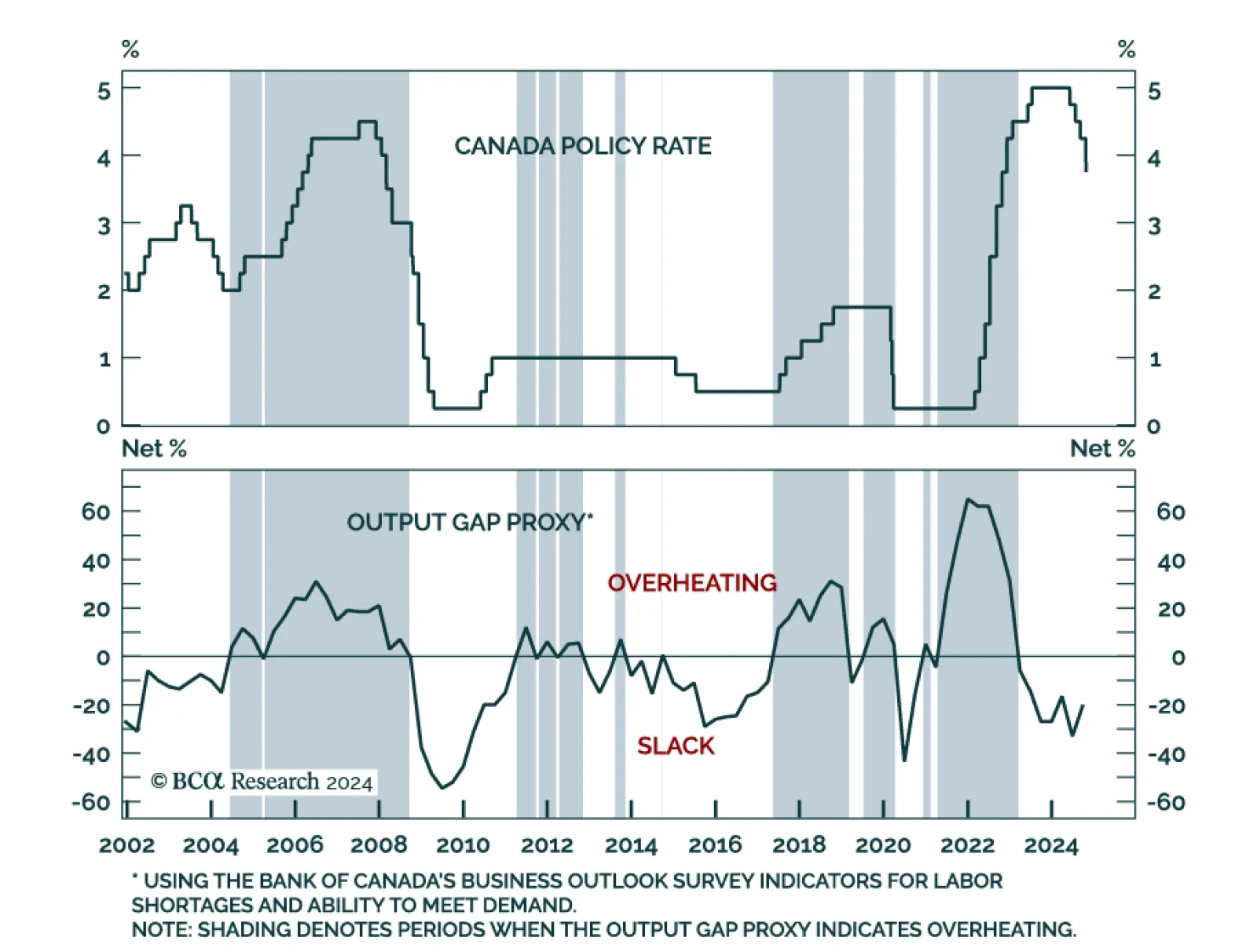

After cutting three times already since June, the Bank of Canada fulfilled market expectations and cut the overnight rate by 50 bps to 3.75%. The BoC sees risks around inflation as roughly balanced over its projection horizon,…

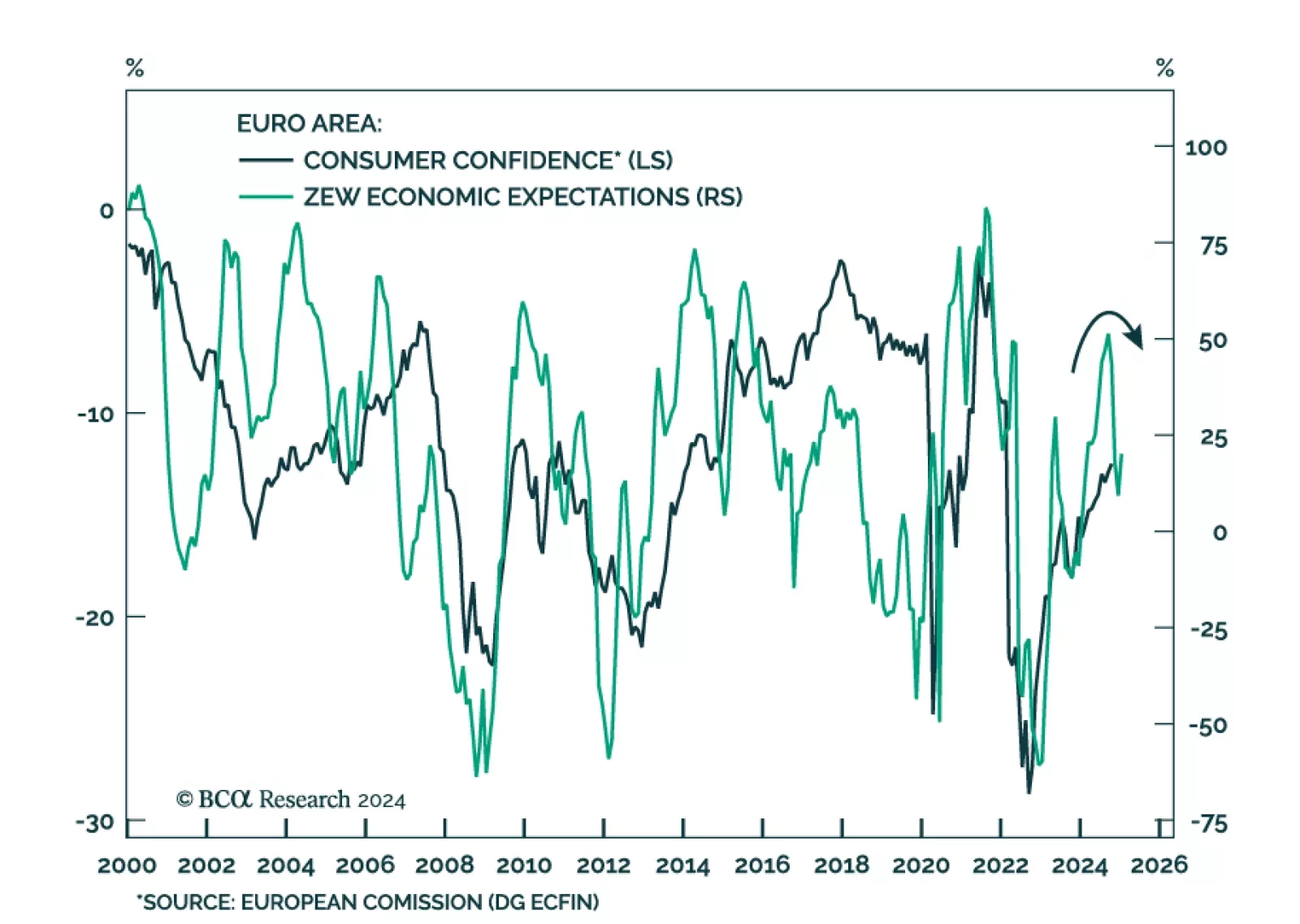

Flash estimates for European consumer confidence met expectations at -12.5 in October, rising from -12.9 in September. Despite this positive development, Euro Area sentiment remains poor. Consumer confidence remains below its…

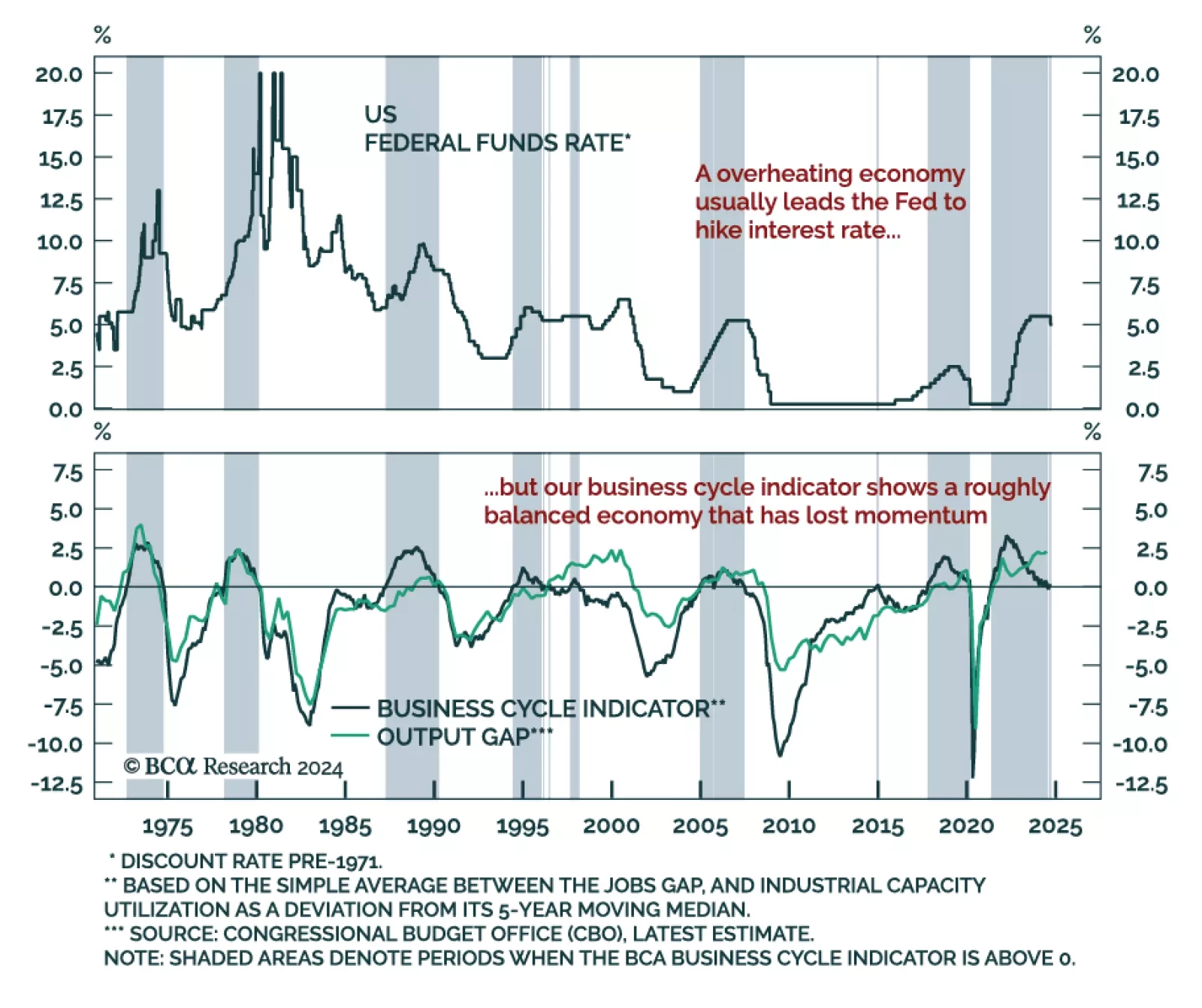

According to the latest estimate of the output gap, the US economy still operates above potential. Continued overheating – a no-landing scenario – would cause a drastic re-pricing across markets which expect a near-…

Dear client, We are launching a new type of Daily Insight titled “Cross-Asset Focus”, where we delve into the dynamics between multiple asset classes, tying them to the current macro and market regimes. The inaugural entry…

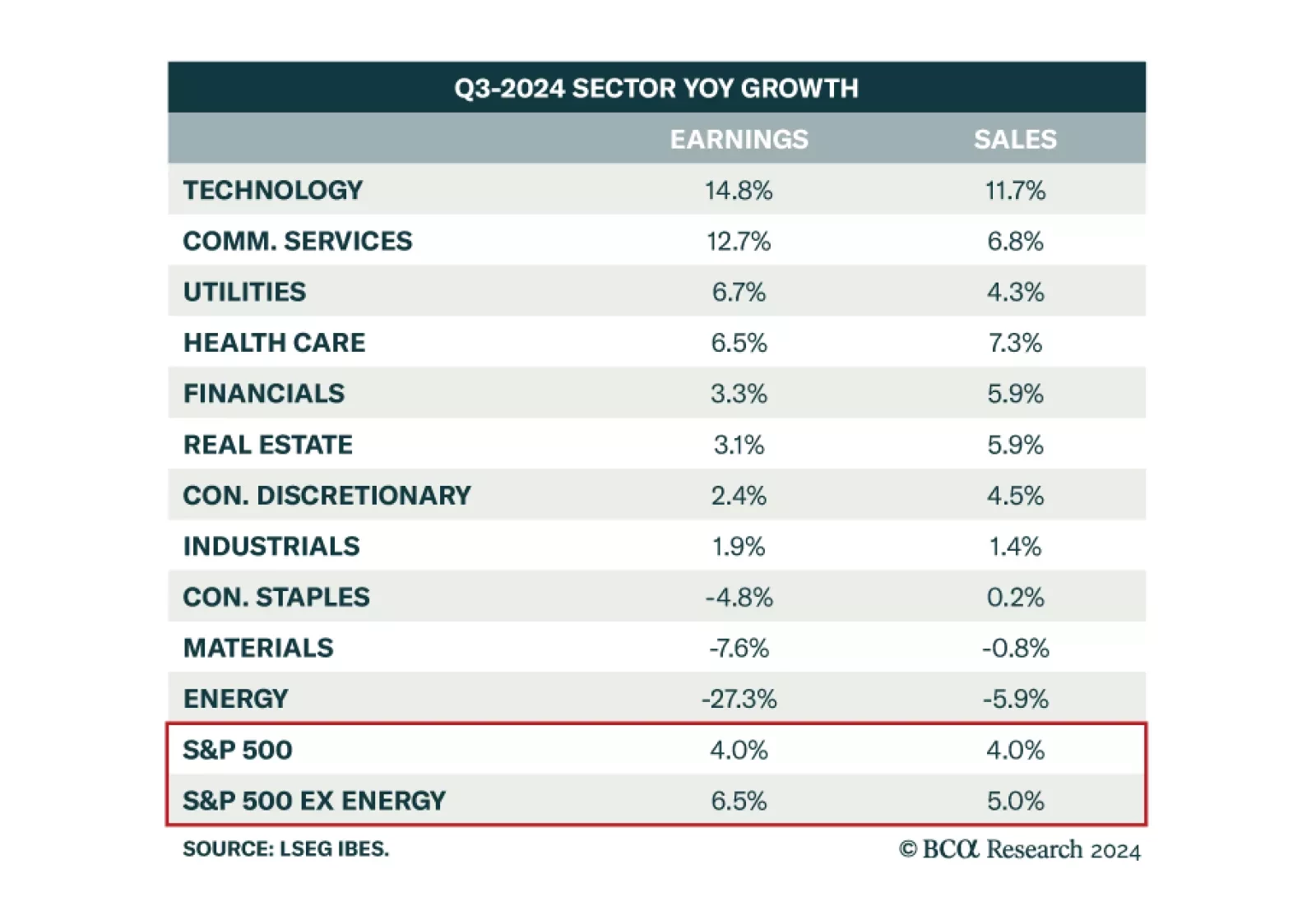

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

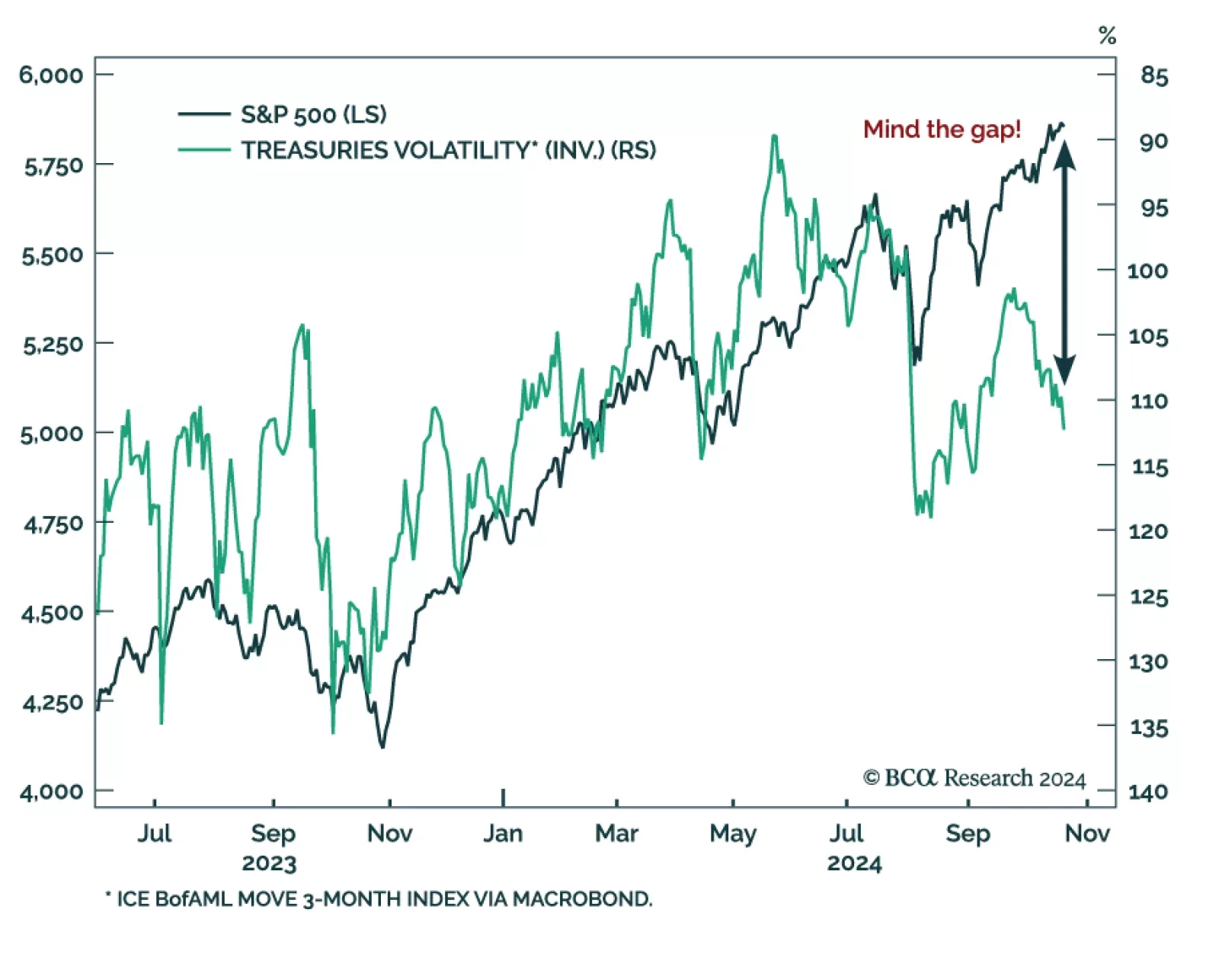

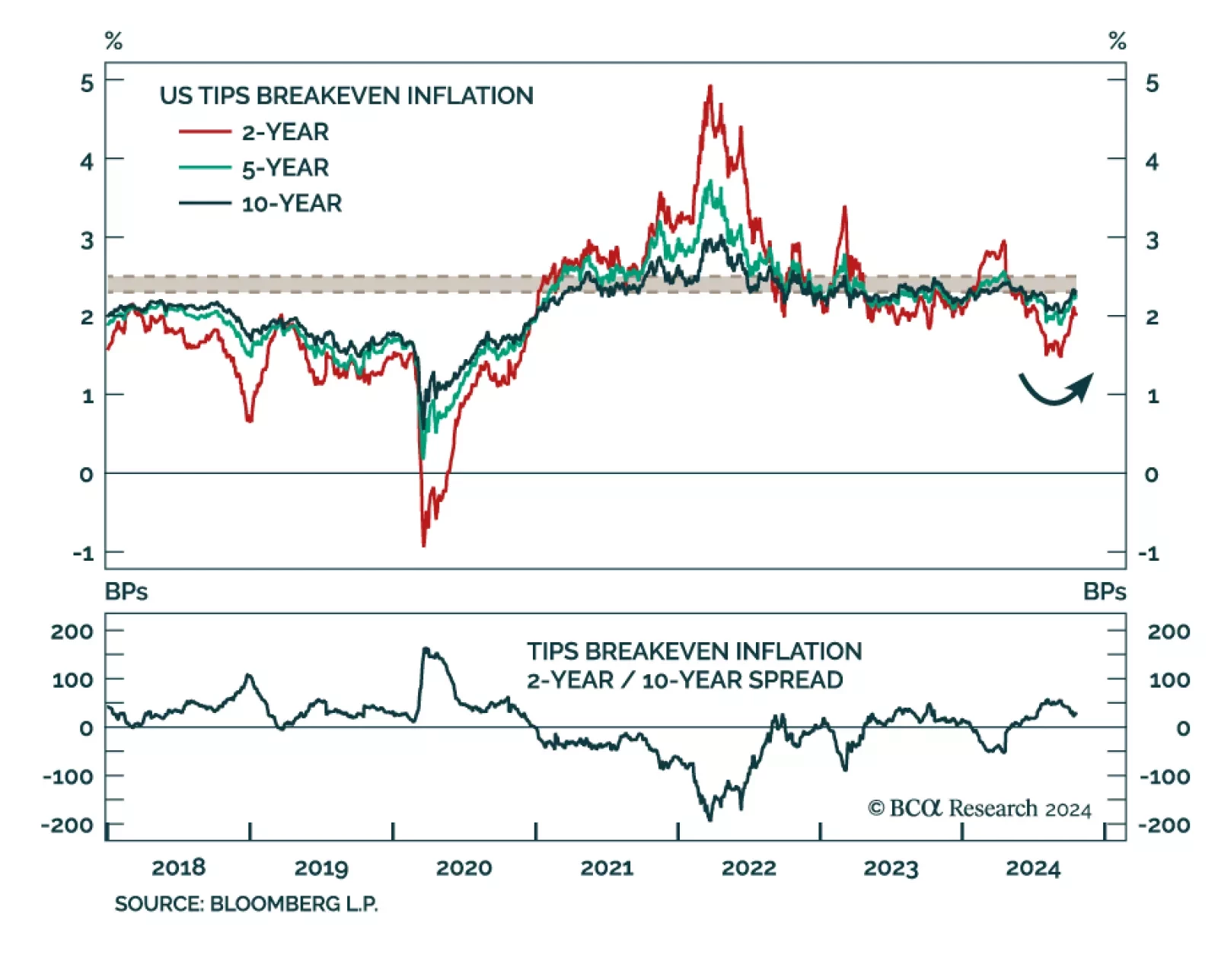

Since the August selloff in risk assets, the main cross-asset driver was the shift from inflation worries to growth worries. Some of that price action has reversed, as TIPS breakeven inflation rates swiftly rebounded since early…