Highlights Our top five “black swan” risks for 2022: Social unrest in China; Russian invasion of all of Ukraine; unilateral Israeli strikes on Iran; a cyber attack that goes kinetic; and a failure of OPEC 2.0. Too early…

Highlights Global equities are poised to deliver mid-to-high single-digit returns this year, with the outlook turning bleaker in 2023 and beyond. Non-US markets are likely to outperform. We examine the four pillars that have…

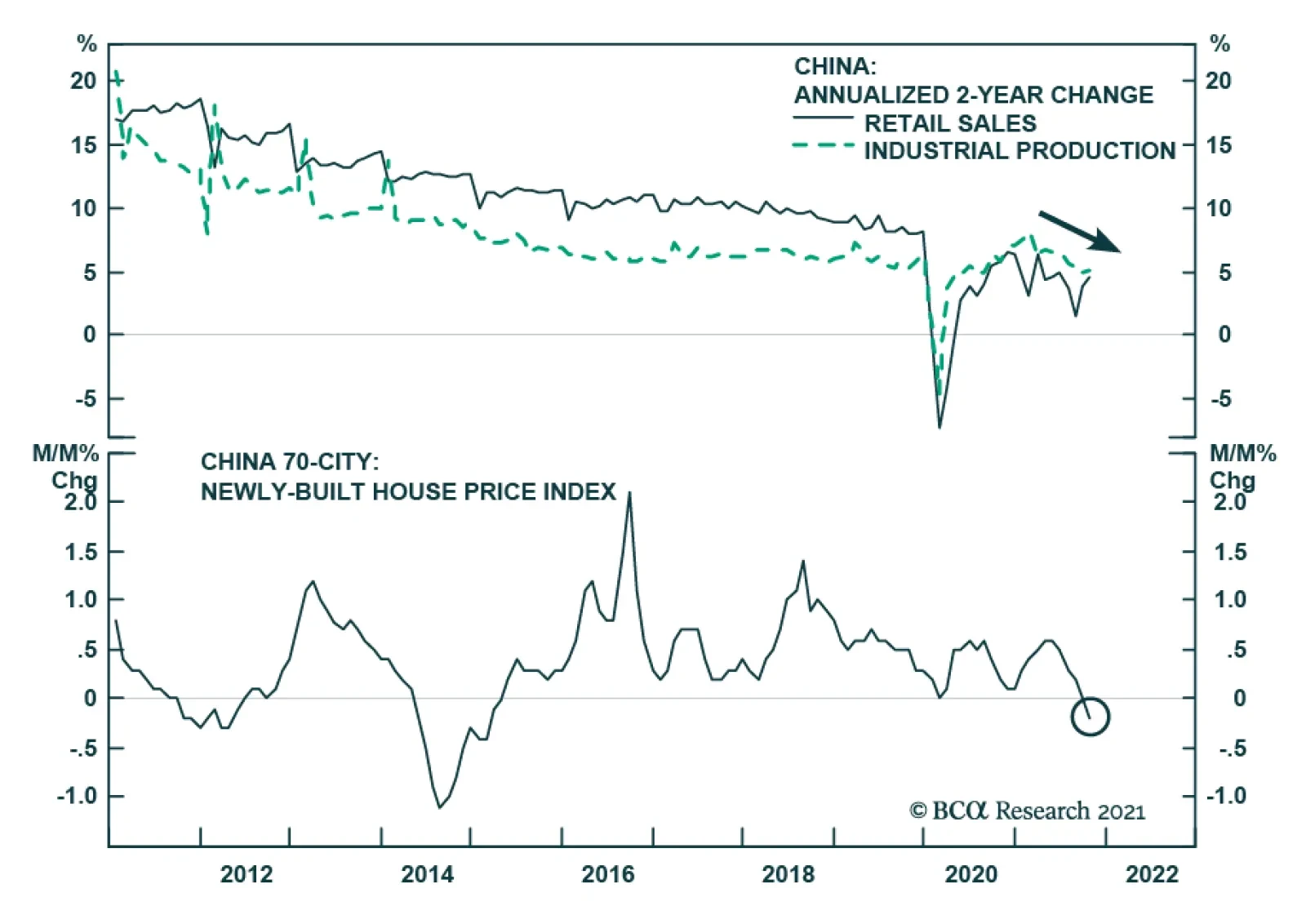

Chinese retail sales and industrial production data for October surprised to the upside. Retail sales growth accelerated slightly from 4.4% to 4.9% y/y and beat expectations of a slowdown to 3.7%. Similarly, industrial production…

Highlights We cannot predict how China will manage Evergrande precisely but we have a high conviction that it will do whatever it takes to prevent contagion across the property sector. However, China’s stimulus tools are losing…

Highlights Our willingness to spend money depends on which ‘mental account’ it occupies. Once windfall income enters our ‘savings mental account’, we will not spend it. Hence, the pandemic’s windfall…

Highlights Global growth is peaking, which makes it important to monitor the risks for signs that it is time to reduce equity exposure. We are especially focused on five risks: 1) The emergence of vaccine-resistant Covid variants; 2) a…

Highlights A first Fed funds rate hike by early 2023 is cloud cuckoo land – because it will take years to meet the Fed’s pre-condition of full employment. More likely, the first rate hike will happen after mid-2024, and…

Highlights Massive slack in the US labour market means that the current uplift in US inflation is highly likely to fade by the end of the year. On a long-term horizon, investors should own US T-bonds. Equity investors should fade the…